Nik Patel's Blog

August 11, 2018

#9. Interviews on LedgerCast and Ultimate Money

Last month I was interviewed on a couple of podcasts, both of which I thoroughly enjoyed. Here are the links to both interviews:

LedgerCast: https://ledgerstatus.com/trading-alt-coins-with-nik-patel/

Ultimate Money: https://www.ultimatemoney.com.au/bitcoin-podcast-13/

July 9, 2018

#8. Two Recent Interviews

I was recently interviewed by a couple of crypto-related blogs and websites, so I've included links to both of those below, for anyone interested:

https://cryptomenow.com/interview-nik-patel-author-altcoin-traders-handbook-icos-many/https://cryptoiscoming.com/nik-patel-on-crypto-twitter-technical-analysis-and-the-future-of-crypto/Enjoy!

#8. Two Recent Interviews: 05/07/2018

I was recently interviewed by a couple of crypto-related blogs and websites, so I've included links to both of those below, for anyone interested:

https://cryptomenow.com/interview-nik-patel-author-altcoin-traders-handbook-icos-many/https://cryptoiscoming.com/nik-patel-on-crypto-twitter-technical-analysis-and-the-future-of-crypto/Enjoy!

July 5, 2018

#7. Ask Me Anything #1

1. What do you think current exchanges and financial platforms lack? Where do you personally see the industry heading?

Adequate charting tools. The vast majority of exchanges have poor integrated charting. Coinigy and TradingView make up for this, but there are still many unsupported exchanges on those platforms, and I’d prefer being able to chart natively. Also, the major exchanges are definitely lacking in high-quality listings; most, if not all, coin additions of late are ICOs.

As for the industry, I think we’ll see it move in the same direction that traditional markets have moved, with a far greater range of alts being exposed to high leverage, as the space grows in liquidity over the coming years. Right now, hardly any alts at all can be traded with leverage, but I think that will change, though probably not soon. I don’t think it’s a good change either, as it’ll mean far more retail pain, but it’s the natural progression. I also think we’ll see a large division of exchanges; some will become heavily compliant to regulation and go down that route, with all that comes with it; some will probably neglect to do so and perhaps shut up shop entirely to regulation-heavy countries (I.e. pretty much just the US). We’re already seeing this unfold with several exchanges.

2. Do you still practice speculative mining? If so, what is your approach to finding the newest coins? I saw on your blog post you may have a guest post about this. That would be dope!

I haven’t speculatively mined anything since Arto, a couple of months back. I decreased my exposure to spec-mining plays dramatically after the hack, purely for my own comfort. I’m missing out on a lot, but it’s rare that I’ll consider spec-mining now. I will definitely do my best to get someone to write a guest post on the topic, though!

3. Do you do anything outside of the markets that you have found helps you with your trading ability? e.g. meditation, reading etc... (directly or indirectly). Also, other book suggestions if you have any and why?

I was very much into meditation for about six months, and found that it helped with mental clarity, but I’ve fallen out of practice recently, though I do recommend it. Even just 10 minutes in the morning would be useful. I read pretty much all day because that’s how I best absorb information, and because I enjoy it! Exercise certainly helps, indirectly though it might be – I tend to feel energised after a workout, so productivity will increase in the immediate period following one. I think another thing that indirectly assists in trading is one’s sleeping pattern. There is always a tendency, at least when you’re new to the space, to cut down on sleep to maximise hours in front of charts or poring over research (I used to do this a lot in my first year, and would sleep a few hours a day at best), but this is unimaginably detrimental to decision-making, which, in turn, negatively affects trading. I sleep 7 and a half hours every day, no matter what, and tend to be asleep by 11pm. I’ve had this routine for a year now and the benefits come across the board, and I feel that I can concentrate on research and analysis for longer periods without needing a break, relative to my concentration span when I had a broken sleeping pattern. Read Matthew Walker’s Why We Sleep or watch this podcast with him for more on that.

As for other book suggestions, I’ve only read a handful of trading-related books, and these three are the ones that stood out, particularly on the topic of market psychology:

• Trading In The Zone – Mark Douglas

• Trading For A Living – Alexander Elder

• Reminiscences of a Stock Operator – Edwin Lefevre

4. I found out that learning how to chart is one thing, but executing trades and shutting out your emotions is another thing which is hard to do. Please share how you overcame the emotional obstacle and tell me how I can improve.

Ah, this is definitely the most difficult thing to provide an answer for – at least to provide a satisfying answer for… the short answer is simply experience; it takes making numerous, poor, emotion-based decisions before it begins to click that you should often be doing the opposite to what your limbic system seems to compel.

There is definitely a mind-hack that you can take to shorten the learning curve and get a firmer grasp of your emotions, but it often isn’t one that people like to take: from the outset, only invest what you can afford to lose. And I mean it in the strictest sense. Everything that comprises your altcoin portfolio should be disposable income, in the same way that you wouldn’t use money you need for rent to buy a Michelin-starred meal. Emotions, naturally, become heightened when we are deeply attached to something, and this is even more true of money. Money that we require to live is inextricably linked to our emotions, so, by using even a fraction of that capital to invest and speculate, you are beginning the marathon five miles behind. By simply taking what you can comfortably afford to lose, you eradicate much of the emotional attachment to your trades.

Otherwise, you can also implement meditation into your daily routine for five to ten minutes each morning, and, trust me, it will help you make better decisions. It’s incredible how simple breathing techniques can alter one’s perspective for the rest of the day. Finally, try to minimise your screen-time and exposure to the markets and news; crypto is intensely fast-paced, and the attempt to keep up-to-date with everything can backfire massively by putting unnecessary stress on yourself, which manifests later in trading decisions. I have found my decision-making to improve dramatically since I stopped day-trading and began spending more time away from the market, focusing on longer-term positions with high growth potential.

5. How do you protect yourself from risky wallets / staking purpose?

My security process is fairly straightforward for wallets: firstly, make sure you have the best computer security software (BitDefender is a good starting point). Make sure you scan all wallets prior to download using VirusTotal or something similar, and then scan the file again post-download. If it’s all okay, run the wallet within your security software’s Sandbox to prevent any potential spillage of malware that bypassed the two original scans. Alternatively, use Virtual Machines to run wallets on, though this is a little more technical. Keep your wallets encrypted and only unlocked for staking, as opposed to fully unlocked. Don’t store encryption passwords anywhere on your computer.

6. Have you ever liked a coin/project so much that you wanted to join its team and contribute somehow? Or is it always strictly business for you?

I have had many offers from projects asking me to join their team (usually awful ICOs). Every single one of them I turned down, except one. I joined the Neutron team as an advisor – and I remain one to this day – about five or six months ago. I accepted their proposal because it was one of the very few coins that I actually liked a lot; that had no premine or ICO; that I followed the developments of; and that I had been trading for over a year prior to the offer. This was a one-time deal, though. I won’t be advising any other projects in the foreseeable future. In general, it’s strictly business, but with Neutron I was very much happy to join them and assist in growing their presence in the space.

7. For you, what are the next innovations/features/sectors that will be valued by the market?

I believe privacy will always remain supreme with regards to ‘features’ that a coin might have, simply because it is the most universally-useful one, so whichever projects continue to innovate within that domain will grow exponentially over the coming years. I also think atomic swaps will be a key innovation, if only to increase ease-of-use and ease-of-exchange.

8. When will your book be available in audio format on Audible?

I don’t currently have any plans to release the book in audio format, primarily because there is so much in the book that relies on the data and images to make any sense that it’ll sound nonsensical when listened to without it all.

9. What impact do you think derivatives will have on the crypto space?

I think anything that allows for a greater number of market participants is a good thing for crypto, in terms of growth potential. Though not strictly a derivative (though it resides among the same range of products), I believe a Bitcoin ETF will be huge for the industry as a whole, so I look forward to that.

10. Have you (or someone) tried to automate your process of analysing coins? Thoughts on it?

I’ve had lots of people create their own automated versions of my process for coin selection and analysis, and it’s great that it works for them, but I have a weird thing about automation. When researching and analysing coins, particularly in the pre-accumulation stage, where I need to figure out the fundamental and technical quality and promise of a project, I like to be very much hands-on. By doing things manually, you get a firmer grasp of all of the different variables. Automated processes are generally useful except that they lack in showing you how data came to be, so you have all the information without knowing the process. It’s similar to having answers to a mathematical problem without any of the working out.

If you've enjoyed this post and want to receive new posts straight to your inbox, I've set up a RSS-to-Email feed that will be sent out weekly; every Monday, 12pm. Just submit your email and I'll make sure you're included in the list. Cheers.

Email Address *

Thank you!

Disclaimer: This post references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

June 30, 2018

#6. Rich-List Case Study: Blackcoin

Rich-List: an index of the largest individual addresses on a blockchain, and thereby a spyhole into the activity of the wealthiest holders of any given coin.

When I was writing An Altcoin Trader’s Handbook, I figured that one of the most well-received sections would be the one that delved into block explorers (particularly rich-lists) and the extent to which their transparency can be exploited. Whilst I will refrain from detailing the theory and the process in this post, as that is all laid out in the book, I thought that it would make for an insightful extension to that section to run through a case study in near enough real-time. In doing so, I hope much shall be illuminated on the application of this particular approach, though I cannot guarantee a satisfying conclusion, as the case study will unfold over the following week. I begin writing this on June 19th, and will write up the conclusion to this post in eight or nine days time. Over that time-period, I will collect data on the Blackcoin rich-list at regular intervals, exhibiting all of it within this post and annotating the data with various thoughts and calculations. Those familiar with the process from the book should, with a little luck, garner a clearer understanding of how it all unfolds. I invite you to form your own conclusions in the Comments section when you are done with the read.

For reference, the Blackcoin rich-list I am using for this study can be found at https://chainz.cryptoid.info/blk/#!rich.

Day One: 11:30AM 20th June 2018

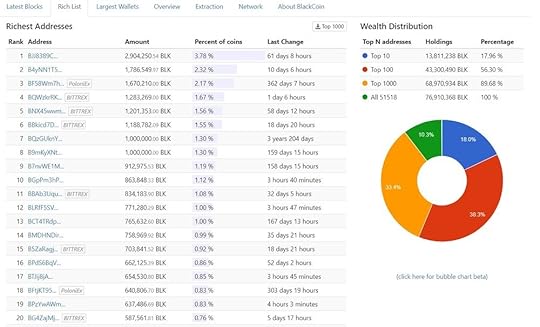

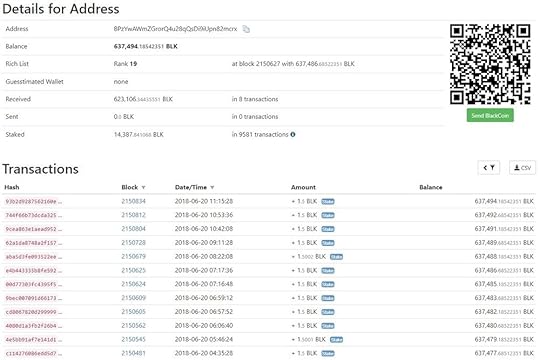

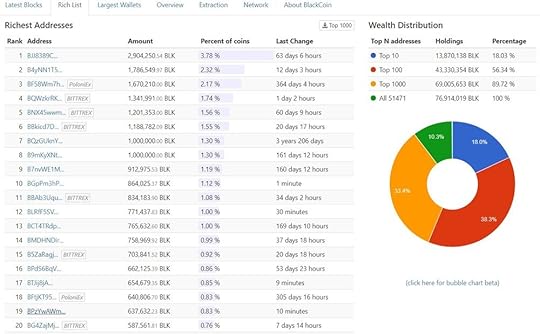

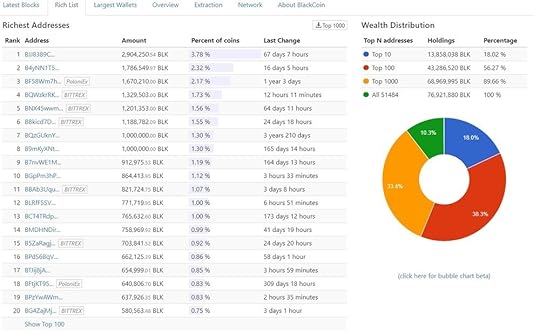

The first screenshot is that of the Top 20 richest Blackcoin addresses, taken at 11:30AM on 20th June. This is the starting point for our case study, and it depicts the following things:

Only a handful of the addresses listed are those of an exchange. This does not mean the coins are owned by that exchange, but rather that they are stored on the exchange by the holder. Thus, the majority of BLK in this Top 20 is likely stored locally.Only 9 of the 20 addresses have had any activity within the last 30 days; the rest have been left untouched for a relatively long time.Of those 9, 6 addresses have had activity over the previous week.The richest single address holds almost 3 million Blackcoin (nearly 4% of the supply); an amount roughly equivalent to 60BTC ($360,000).

The following screenshots (up until we begin a new day) are all of individual addresses of particular significance. For the purposes of this case study, I am looking only at those 9 addresses that have had transactional activity within the last 30 days.

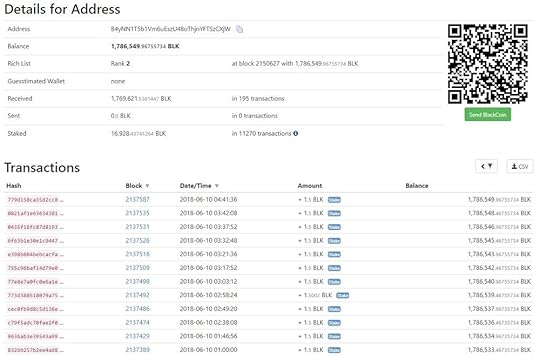

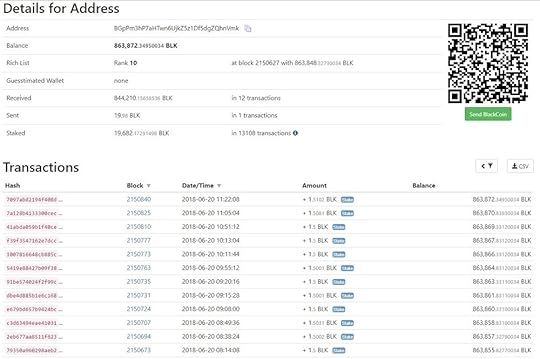

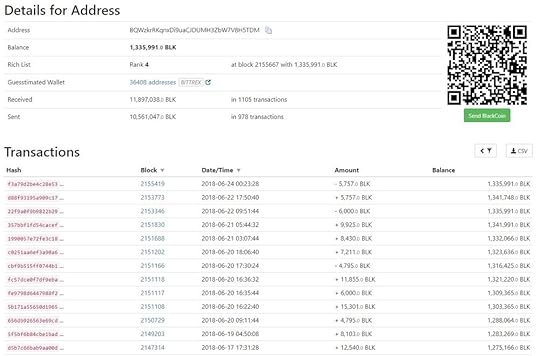

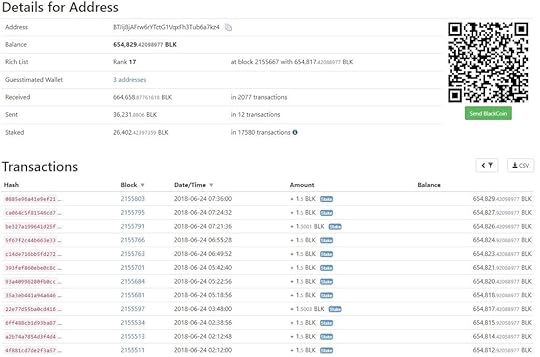

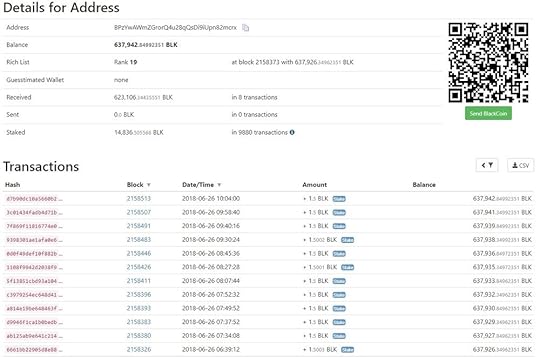

The first of these screenshots is the 2nd-richest Blackcoin address:

From the transaction data, it is clear to see that this address is being staked. We can also see that there has been 0 Blackcoin sent out from this address over its entire history, thus this address has been in accumulation mode since its origination.

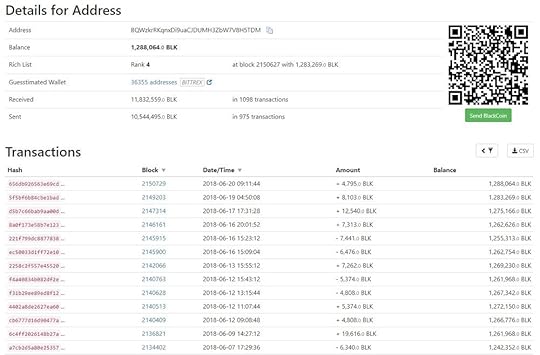

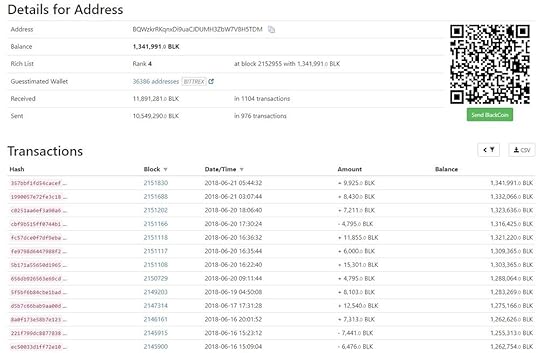

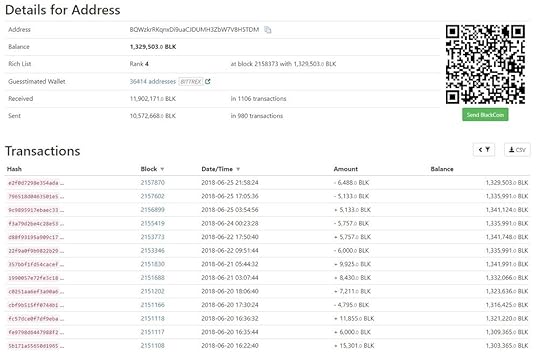

Below is a screenshot of the 4th-richest address:

We can see that this address exists on Bittrex, and, as such, it is no surprise that there are a large number of transactions to and from the address over its history. Furthermore, we can see that, despite some distribution since the 7th June, on balance the address is currently in accumulation, as evident by the 46,000 BLK increase in position size since that date. That's now 2/2 addresses in apparent accumulation.

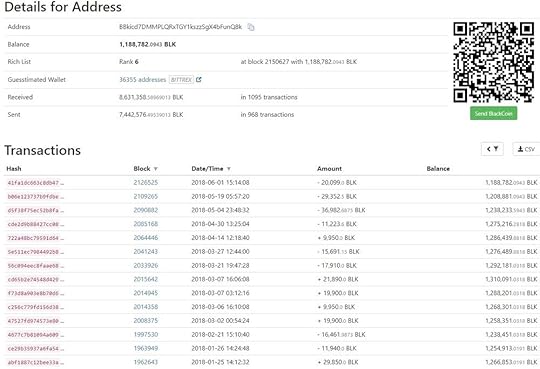

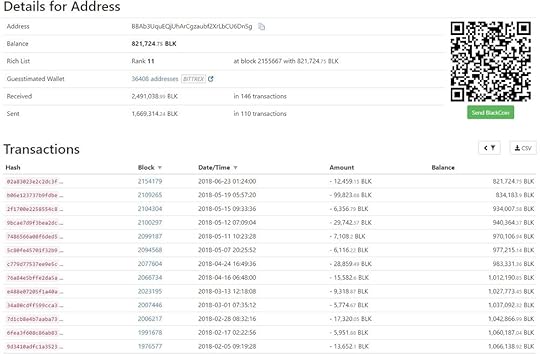

Here we can see the data for the 6th-richest address:

This is another Bittrex address, again with a large number of transactions in and out. Relative to the previous address, however, we can see that there is less transactional data for the last month, with only one transaction in June and two in May. On balance, the address seems to be in a period of distribution, as, since January 25th, the position size has decreased from 1,266,853 BLK to 1,188,782 BLK. Relatively-speaking, this is a minor change, given that the time-frame for this distribution has been around half a year.

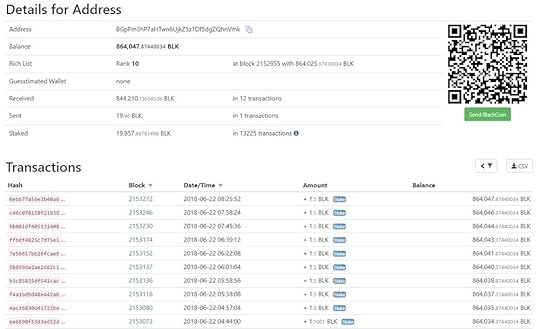

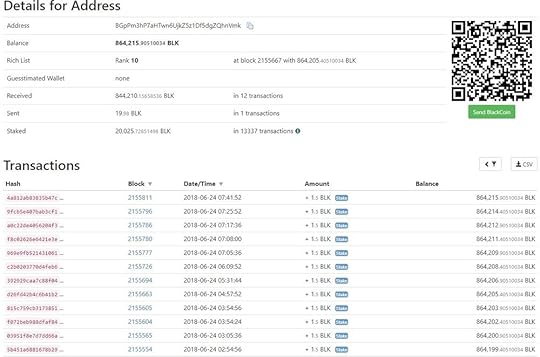

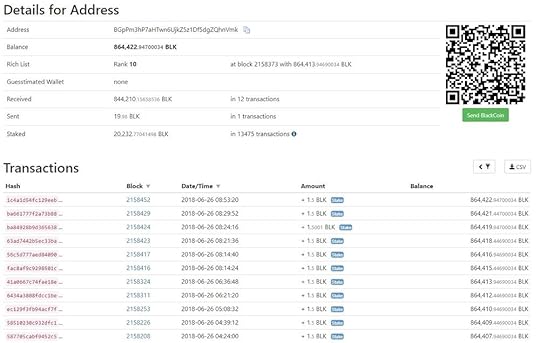

Below is a screenshot of the 10th-richest address:

Here we have another example of an address being exclusively staked, with only 1 transaction out in its history. As it stands, 3/4 addresses in accumulation mode.

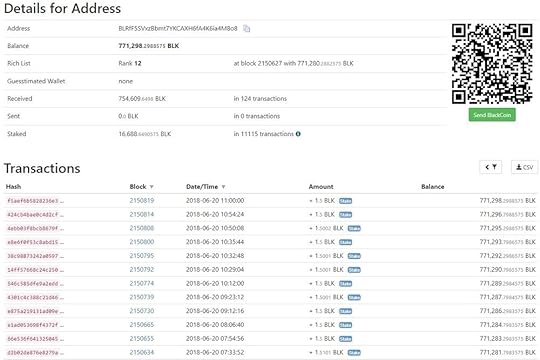

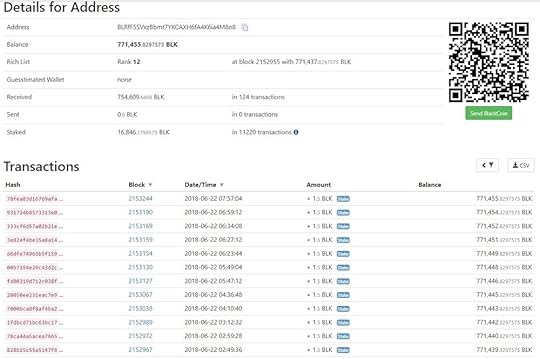

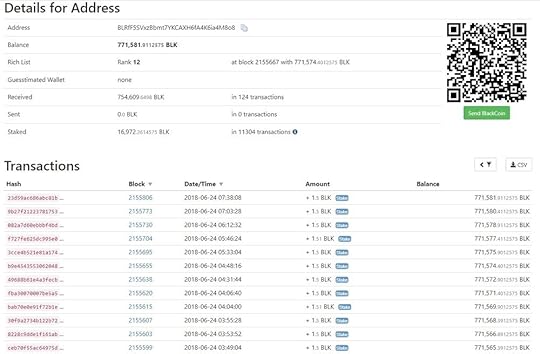

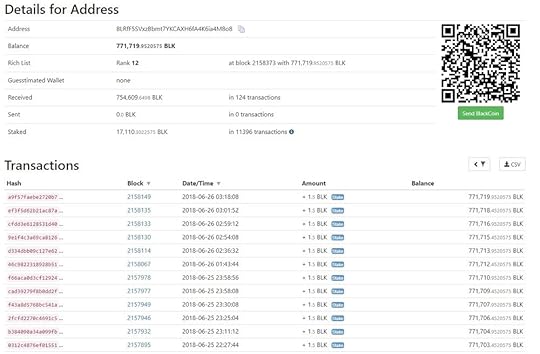

Alas, another Top 20 address being exclusively staked; this time, the 12th-richest.

Also, there have been no transactions out since its origination. 4/5 addresses in accumulation.

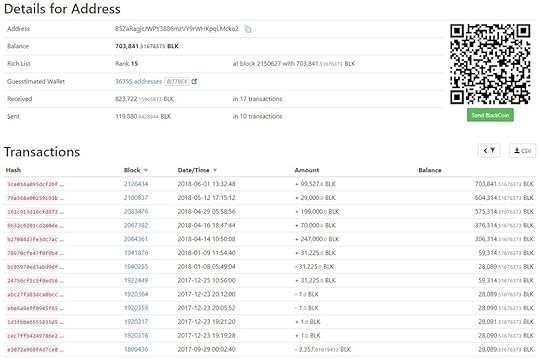

Here we have a very interesting address - the 15th-richest:

This address exists on Bittrex, but has had far fewer transactions than the previous two Bittrex-based addresses we have so far observed. There have also only been a handful of transactions since September last year. The interesting thing about this address, however, is that it has grown from 28,089 BLK at the end of 2017 to 703,841 BLK as of 1st June. That is a heavy but sporadic period of accumulation. 5/6 addresses in accumulation, as it stands.

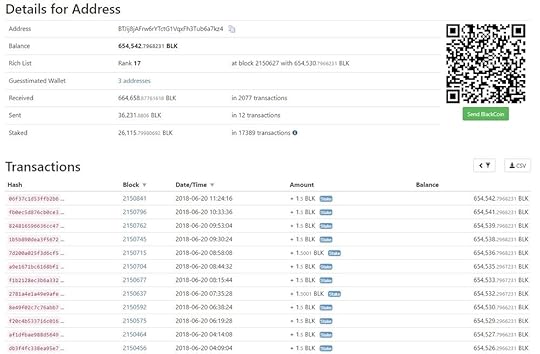

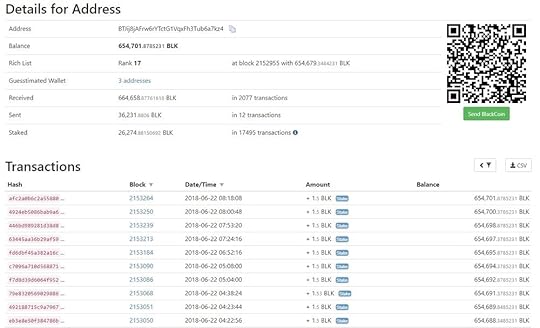

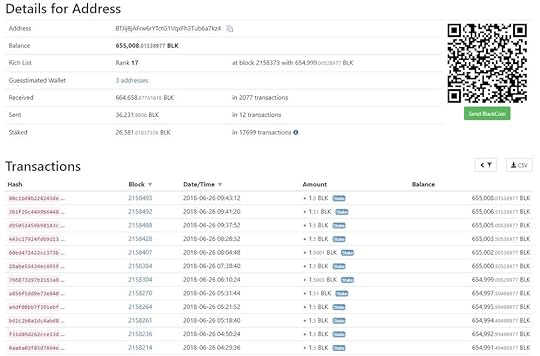

Below, we have the 17th-richest address:

This seems to be another staking address, having only sent out 36,231 BLK of the 664,658 BLK it has received. However, having staked only 26,115 BLK suggests that this holder may simply be selling his staking rewards, rather than accumulating them. I'd call this neutral; neither in accumulation nor distribution of any significance. 5/7 addresses in accumulation.

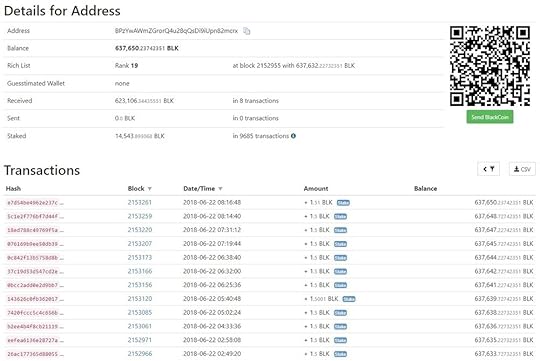

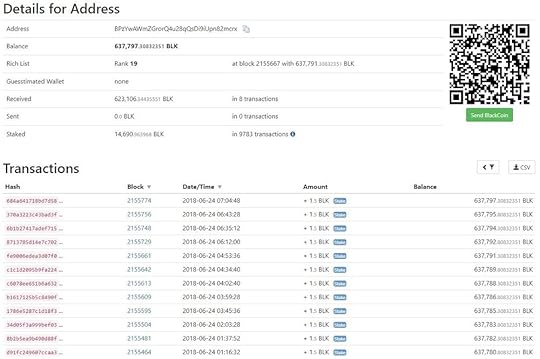

Surprise, surprise: another staking address. This time, it's the 19th-richest:

0 transactions out in its history. 6/8 addresses in accumulation.

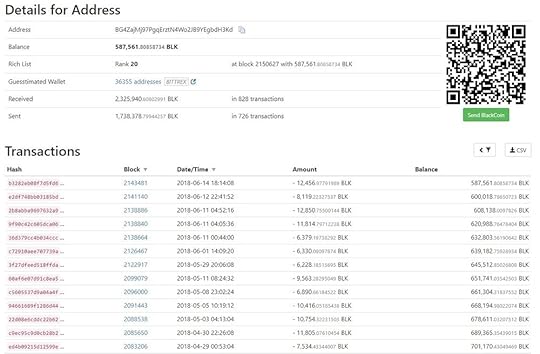

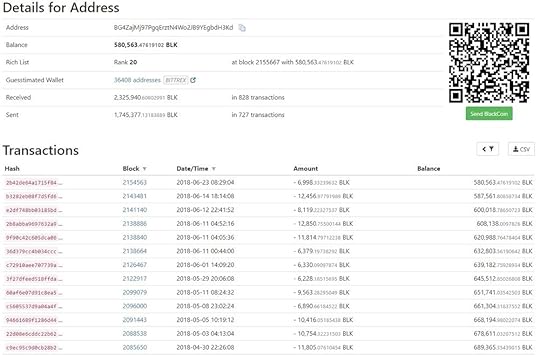

To conclude our 9 addresses, we have another Bittrex address - the 20th-richest:

This address has had a fair amount of transactional activity over the previous couple of months, with its position size decreasing from 701,170 BLK at the end of April to 587,561 BLK as of 14th June. A fairly large decrease in a relatively short span of time.

So, of the 9 addresses I have examined with activity in the last 30 days, 6 of them appear to be in accumulation, making it a majority.

Day Three: 8.30AM 22nd June 2018

I have skipped a day, opting instead to collect data every two days. It is 8.30AM, 22nd June, and below you can see a screenshot of the Top 20 richest addresses as it now stands. As can be observed, only 5 addresses have had any activity since the previous date of data collection, so these will be the focus of the following screenshots.

The 4th-richest address has increased position size by around 54,000 BLK since the first screenshot; a very large increase given that it has only been 48 hours or so.

The 10th-richest address remains staking.

The 12th-richest address also remains staking.

As does the 17th-richest address.

And the 19th-richest address.

Thus, of the 5 addresses with activity since the first day of data collection, 4 are still staking and 1 has heavily increased position size.

Day Five: 8AM 24th June 2018

Two more days have passed, and below is a screenshot of the Top 20, as it stands. This time, 7 addresses have had activity since the previous data collection.

The 4th-richest address has decreased position size by 6,000 BLK or so. On balance, it is still up 48,000 BLK since the first day.

Well, what do you know? The 10th-richest address is still staking away.

The 11th-richest address has recorded its first transaction since May, decreasing position size by 12,459 BLK. Since February, it has decreased its position size by around 244,000 BLK. Clear distribution.

Keep staking, mate.

And you, 17.

19th-richest remains a staker.

The bottom of the Top 20 has decreased position size by around 7,000 BLK.

Day Seven: 10AM 26th June 2018

The final day of screenshots is upon us. 5 addresses have had activity since the previous day of data collection.

To save you a little time, of the 5 addresses, only this one (the 4th-richest) isn't due to a continuation of staking rewards. This address has decreased position size by around 12,000 BLK. That being said, it remains in the positive since the first day of data collection.

So, as can be observed, some interesting transactional activity takes place within a week of observation (along with some less-than-interesting activity). I hope that this case study in near enough real-time has proved useful for those tackling the Block Explorers and Rich-Lists section from the book. I'd love to hear what conclusions you have drawn from this data, and how the process is working for you in your own research. Feel free to leave your thoughts in the Comments, and I'll make sure to reply to any questions as best I can.

If you've enjoyed this post and want to receive new posts straight to your inbox, I've set up a RSS-to-Email feed that will be sent out weekly; every Monday, 12pm. Just submit your email and I'll make sure you're included in the list. Cheers.

Email Address *

Thank you!

Disclaimer: This post references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

June 25, 2018

#5. The Speculator’s Guide To Masternodes and Masternode Network Value

Given the fervour that began with DASH announcing the release of its initial masternode system and that continues to surround the plethora of projects now offering their own versions of one, what exactly is the incentive for a speculator to run a masternode, and how can one navigate the oversaturated space to find the most promising opportunities? One brief glance at a masternode directory, such as www.masternodes.online, will suffice to show just how daunting a task this can seem to those unfamiliar with the territory; with well over 300 masternode coins listed on that website alone, what should you really be looking for?

Masternode Network Value (MNV), as I like to call it, is the calculation that I consider the key to unlocking the most dependable opportunities in the masternode space. Note that I do not say ‘most profitable’, but rather ‘most dependable’. There is a critical difference between the two, but we will get into that a little later. By the end of this post, you will have a comprehensive take on my approach to masternodes: how I research and analyse them; the distinction between profitability and dependability; why I believe that MNV is the most informative calculation one can make regarding masternode speculation; and how the common pitfalls can be avoided.

But first, we must first define what a masternode is and why they can be a profitable addition to an altcoin portfolio. Forgive me if I butcher the definition, though I write from the perspective of a speculator, and, as such, much of the (irrelevant) technical information has been omitted:

A masternode is simply collateral, in the form of a predetermined amount of a given coin, that fulfils certain tasks on the blockchain and is rewarded for these tasks, often with a fixed portion of the block reward.

Thus, running a masternode is financially incentivised, and one can begin to accrue a steady passive income given an appropriate strategy. Needless to say, it is a space rife with opportunity but also pitfalls, and rarely is it ever as easy as simply selecting a masternode coin, buying the collateral and watching the income pour in. I first began to utilise masternodes in my own altcoin portfolio around twelve months ago, being aware of the potential rewards but anxious about the technology and all that goes with it prior to that. Since then, they have become integral to my strategy, and some of the greatest returns-on-investment that I have gained have stemmed from such projects.

Without further ado, let’s get stuck in.

Tools and Resources:To begin with, we need to identify the tools and resources available to us to search out – with some luck – promising masternode projects. As far as I am aware, there are five useful masternode directories or ranking websites:

https://masternodes.online/https://masternodes.pro/statisticshttp://mnrank.com/https://masternodes.directory/https://masternode-stats.com/These should suffice for the research process, though I often also scour the Bitcointalk threads – using a simple search for ‘masternode’ – to bolster the list of potentials.

Masternode Network Value:Now, we must define what I deem to be the most important calculation (for a speculator) concerning masternodes: Masternode Network Value, or MNV. Masternode Network Value is as follows:

(cost of one masternode x number of masternodes online) / circulating market cap

To clarify, let’s take DASH as an example. The MNV of DASH would be:

(39.04BTC x 4656) / 318,233BTC = 0.571 or 57.1%

For comparison, let’s take MANO as an example. The MNV of MANO would be:

(1.8BTC x 186) / 937BTC = 0.357 or 35.7%

And finally, let’s take MEDIC as an example. The MNV of MEDIC would be:

(2.31BTC x 144) / 2202BTC = 0.151 or 15.1%

This is essentially just an equivalent calculation to that of the Coins Locked figure that can be found on some masternode directories, which shows the supply that is currently locked in masternodes as a percentage of the circulating supply, except that I prefer working it out as an MNV figure because I get to know the strength of the underlying masternode network. This leads us on to the next question; what exactly am I looking at with this calculation, and why is it helpful?

MNV is a figure that shows you how much of the market cap of any given masternode coin has actually been bought up and locked into running masternodes. Therein lies its utility; market caps can be useless, artificial figures, but MNV cannot feasibly be faked. It is indicative of true demand and value for a masternode project, as it illuminates the amount of buying that has taken place to accrue those masternodes. The first part of the calculation is itself the masternode network value, as it is a sum of the cost of all masternodes currently online, and we use the circulating market cap to assess how much of a coin’s perceived value is actually in use. It’s all well and good having a billion-dollar market cap for a masternode coin, but if only 10% of that is being used to run masternodes, it speaks volumes as to the dependability of that masternode network.

With regards to how this calculation becomes useful in our analysis, it differs based on the following section.

Masternode Selection:The selection process from this point is dependent upon one’s aim; is it to find the most profitable masternodes or the most dependable? As I mentioned in the opening paragraphs, there is a critical difference here, and this is where Masternode Network Value comes in. Before elaborating on the most dependable, I’ll first run through the most profitable.

I must preface this by mentioning that there is a more imminent danger when seeking out profitability as the deal-breaker on your masternode hunt: inflation. With a swift glance at the masternode directories I have provided, you will see an abundance of coins seemingly offering upwards of 1000% annual ROI, and at least a handful offering upwards of ten times this. This is a death trap. Do not fall for the false glisten of such rewards; with immense profitability comes immense inflation. The cause of such rewards is as follows, and it is simply a marketing trick:

Project Z announces its launch and states that its masternodes will be providing 1000% annual ROI by offering the vast majority of their block rewards to masternode holders → This attracts a large number of speculators and miners → The collateral required is high and the project has a premine that allows for a handful of masternodes to be set up by the developers to ‘get the masternode network running and stable’ → The developers use part of the premine as a listing fee to index their projects on the popular masternode directories → Meanwhile, the early masternodes are reaping far greater than the specified 1000% annual ROI as there are so few up and running, so block rewards are disproportionately being accrued to those early few → The masternode directories now show the project to currently offer far greater than 1000% annual ROI, which in turn attracts more speculators and miners → This creates artificial demand for the coin, as the collateral amount is often so excessive that it is impractical to simply mine the amount in short enough a time-period to reap the current rewards → The early masternode holders can sell their rewards because of such high demand → More and more masternodes come online and the annual ROI greatly decreases to accommodate this but supply emission does not change as the block rewards remain the same → The price of the coin decreases as demand is no longer sufficient to maintain the supply emission, to the woe of anyone who bought their masternode collateral after the early few.

This may be a simple trick, but it has been used and re-used by so many projects that there is now a graveyard of tens, if not hundreds, of coins that will never recover. The allure of high profitability is too great for the trick to stop working. It is partly the reason why I was hacked back in October 2017, as I scoured the crevices of the cryptosphere for early entry into the most profitable masternodes, unwittingly downloading an unsafe wallet with a hidden RAT that later devoured the majority of my altcoin portfolio. There can only be a few winners (at least at the highest levels of profitability) for such coins, and these are all too often the developers and the very earliest (and luckiest) miners. I myself was lucky enough to be perhaps one of the first five miners on Magnet, securing myself three or four of the first twenty or so masternodes, and, as such, reaping since-unparalleled profitability. But this is a rarity and not one I suggest seeking out. (That being said, I may find someone more experienced in speculative mining to write a guest post on the subject of early masternode mining, at some point.)

However, for those I cannot convince, there is still somewhat of a process for picking profitable masternodes that won’t have you weeping after a week:

All of the selection criteria highlighted in the book and in my post on Picking Out Microcaps remains valid, and should be the first port-of-call for separating the wheat from the chaff.After that, ignore any masternode offering over 1000% annual ROI. This is too great a level of inflation for it to be worth the additional stress.It is at this point that MNV comes into play. For higher profitability masternodes, you want a higher-than-usual MNV. This is because the higher profitability means that more supply will potentially be coming onto the market, thus likely devaluing the coin and thereby our masternodes. By having a high MNV, we can be assured that a high percentage of the coin supply is locked up in masternodes. (Note: of course, this figure is dynamic rather than static, and thus must be monitored closely to assure there is a constant demand for masternodes on this network.)For masternodes with greater than 100% and less than 1000% annual ROI (the range I consider ‘high profitability’), I would suggest filtering for at least a 0.66 or higher MNV (66%). Two-thirds or more of the market cap being used to run masternodes is rare but I believe it is a necessary filter to prevent falling into the liquidity trap, wherein demand for masternodes is too low to accommodate the immense supply emission.From this point, the usual technical analysis comes into play, where I make sure that the chart aligns well with MNV. What I mean by this is simply that the ideal scenario is one in which a high MNV is complemented by price being at the lows on the chart. This ensures that:High profitability masternodes are still in heavy demand despite price being low.One is hedged against the likelihood of the value of the masternode itself decreasing by much, as it is already cheap, relative to its price-history.And then, once you’ve filtered for all of the above, the accumulation process can begin and you can set up your high profitability masternode. One word of final warning would be to consider making high profitability masternodes a shorter-term component of your strategies and portfolios. The longer you run them, the longer you run the risk of supply emission beating out demand and your masternodes (and their rewards) becoming relatively worthless.Now, if, like me, you prefer dependable, longer-term masternodes to add to your portfolio, the bar is considerably lower for MNV and the range narrower for profitability (and that is where the sole distinction lies in the selection process, as the rest of the above outline can be used across-the-board). Dependable masternodes are so because of their low inflation, historically sustained demand and stable networks. This kind of masternode is most suitable for passive income purposes.

How do we find them? Well, aside from the filtering process above:

Look for coins with an annual ROI between 10-100%. This is a stable range of inflation and still very profitable for a passive income model.Filter for a MNV of 0.25 (25%) or greater. The reason the required MNV is lower for these is because we are contending with far less supply emission than in the ‘high profitability’ category. Of course, the higher the MNV, the better, regardless of the profitability of the coin. We want more masternodes online.Whilst you are scouring the masternode directories, keep in mind that a few of them (masternodes.online and masternodes.pro come to mind) display graphs for the coins listed that depict the history of masternode cost, masternode count and other useful data. The masternode count data is especially useful, as it allows us to visualise how the network has grown over time. Ideally, we want to see steady, linear growth in the number of masternodes online. This ties in to the idea of historically sustained demand; long-term demand indicates that a potential passive income model may be sustainable.Common Mistakes and Pitfalls:

For the final section of this post, I’d like to run through a number of common mistakes that inexperienced (or even experienced) speculators may make when approaching masternodes:

Buying high: The most common pitfall of all is buying a masternode when it is extremely costly to do so, often due to the allure of the rewards but not exclusively so. Technical analysis remains paramount, and by neglecting to cross-compare other analysis with the price-chart, one can fall into the all-too-common trap of buying an overvalued masternode. The closer to the lows you buy your masternode, the better you are hedged against potential devaluation, which protects your initial investment. Ignoring inflation: It might seem lucrative to disregard basic economics in the pursuit of high rewards, but five-digit percentage annual ROI is almost always likely to end up a loser, despite any early gains. The masternodes are usually incredibly expensive and devalue exponentially due to the immense, incessant increase in supply.Downloading unsafe wallets: This one hits home, as it is a mistake I also made in the pursuit of high profitability, to my despair. There will be times when new or less-established coins will come into your cross-hairs, and those unfamiliar with security procedures will unwittingly download potentially dangerous wallets. Refrain from this as much as you can, but if you must download a wallet for a lesser-known project, make sure to scan the file for viruses prior to downloading and post-download, as well as running them in sandboxes or on Virtual Machines where possible. For further security advice, consult @notsofast’s article here.I hope this post has been somewhat insightful, and I am happy to answer any questions you may have in the Comments section. Further, what has worked for you in your own masternode strategies? I’d love to hear any thoughts and ideas.

Disclaimer: This post references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.

June 20, 2018

#4. Interview on The Crypto Sky Podcast: 19/06/2018

On 19th June, 2017, I was interviewed for The Crypto Sky Podcast.

Here is a link to that podcast, for anyone interested:

http://thecryptosky.com/2018/06/ep-018-interview-with-nik-patel/

June 12, 2018

#3. Picking Out Microcaps 101 (Revised)

N.B: This is a revised edition of the post I published in July 2017, which featured a framework for filtering for microcap coins. Since that post was published almost twelve months ago, much has changed in the space, not least of which being the price of Bitcoin. Thus, many of the more minute details and figures in the original post are now invalid or ineffective, and a revision of said post feels necessary. I have refrained from changing the style or structure of the post, and have instead simply opted to update whatever information feels out-dated. I hope that you will find it useful.

Microcap: A coin that has a market cap between 0-25BTC ($0-170,000, at the time of writing this).

Microcaps have long-proved to be the most profitable coins for me, and the process by which I pick them out is rather simple:

1. Direct your browser to www.coinmarketcap.com: Click view all. Filter the list using the 'Market Cap' option for $0-100k. Open a new tab and repeat this for $100k-1mn. Click on the button that says 'USD' and change to BTC, so that the market cap figures are displayed in Bitcoin. Note down all of the coins below 25BTC that show a circulating supply below 1 billion coins. For all of these, also note down their 24H volume in BTC. Cross out the coins with a lower than 2% market cap to volume ratio: if X has a market cap of 25BTC, its 24H volume should be 0.5BTC or more. This is simply to filter for the microcaps that are getting a decent amount of attention. Now open up a separate tab for each remaining coin. From these remaining coins, cross out all the coins that have a total supply that is more than twice the size of their circulating supply (this is usually indicative of a large premine, and that is unnecessary added liability). Make sure that the figure you are looking at is the 'total supply', not the 'maximum supply'. Total supply means the total amount of coins currently in existence. Maximum supply means the maximum possible amount of coins that can come into existence. The ones you’re left with (there’s usually quite a few) are the ones you need to do further research on.

2. Head over to Bitcointalk and read through the announcement threads of every single coin that you have left on your list. Make a note of the level of activity in the thread, the number of pages it contains, the last time there actually was communication on there (some coins will be dead), and get a general feel for the community of each coin. Read through the announcement itself to find out where the coin has come from and where it is heading — look for roadmaps, Slack and Telegram channels, and active, communicative developers. Have a look at their websites and block explorers. Remove coins from the list of remaining ones that do not have at least a decent standard for all of the above (room for improvement can be profitable).

3. You should now have a small-ish number of coins on your list. These are the ones you’re looking to pick up, but whittle the number down even further by doing more meticulous research on how they are currently trading. Remove anything that trades only on Yobit - remove it immediately. Of the other exchanges, CoinExchange, CryptoBridge, TradeOgre and Cryptopia can be great for microcaps. Look at the charts for each of these coins, and spot accumulation patterns: constricted ranges; spikes of high buying volume etc.

Another research tool is the block explorer for these coins. Some may have rich-lists or largest address tabs. Monitor movements within these addresses. Are the largest addresses getting larger over time or are they being depleted? Screenshot the top 25 richest addresses and then screenshot the top 25 again a few days later. Compare your lists. Are these coins being accumulated?

4. Take the plunge and buy the ones you’re most confident in. It may even take you weeks to accumulate a decent amount of any single microcap project. And it most likely will take months before you start seeing serious returns on them, but it’s worth it if you have the patience.

I hope this article helps with your research.

#2. Interview on What Bitcoin Did: 30/11/2017

On 30th November, 2017, I was interviewed for the What Bitcoin Did podcast.

Here is the link to that podcast, for anyone interested:

https://www.whatbitcoindid.com/podcast/2017/11/30/wbd-002-interview-with-daytradernik

June 3, 2018

#1. Picking Out Microcaps 101: 25/07/2017

N.B: This article was written on July 25th, 2017, and, as such, contains a number of small errors and details that are, at present, inaccurate. A revised version will be published soon, but the framework will remain largely the same.

Microcaps have proved to be the most profitable coins for me, and the process by which I pick them out is pretty simple:

1. www.coinmarketcap.com: Click view all. Order by market cap in $. Scroll all the way down to the coins with a smaller market cap than $250,000, or 50btc, (these are the ones that can be the mega-winners over time). Note down all the coins below this mark with a low to medium coin supply i.e less than 50m. For all of these, also note down their 24H volume in $. Cross out the coins with a lower than 2% market cap to volume ratio (if X has a market cap of $100k, it’s 24H volume should be $2000 or more). This is simply to filter the microcaps that are getting a decent amount of attention. From these remaining coins, cross out all the coins that have a far greater total supply than their circulating supply (this is usually indicative of a large premine, and fuck that noise — there’s plenty of coins to pick up without this added liability). The ones you’re left with (there’s usually quite a few) are the ones you need to do further research on.

2. Head over to Bitcointalk, and read through the announcement threads of every single coin that you have left on your list. Make a note of the level of activity in the thread, the number of pages it contains, the last time there actually was communication on there (some coins will be dead ones), and get a general feel for the community of each coin. Read through the announcement itself to find out where the coin has come from and where it is heading — look for roadmaps, Slack and telegram channels, and active devs. Have a look at their websites and explorers. Remove coins from the list of remaining ones that do not have at least a decent standard for all of the above (room for improvement can be a profitable thing).

3. You should now have a smallish number of coins on your list. These are the ones you’re looking to pick up, but whittle the number down even further by doing further research on how they are currently trading. Fuck anything that trades only on Yobit, remove it immediately. Of the other exchanges, CoinExchange, NovaExchange and Cryptopia are great for microcaps. Look at the charts for each of these coins, and spot accumulation patterns: contricted ranges with mid to high volume; spikes of high buying volume etc.

Another research tool is the Block Explorer for these coins. Some may have rich lists or largest wallet tabs. Keep tabs on movements within these addresses. Are the largest wallets getting larger over time or are they being depleted? Screenshot the top 25 richest addresses and then screenshot the top 25 again a few days later. Compare your lists. Are these coins being accumulated?

4. Take the plunge and buy the ones you’re most confident in. It may take you weeks to accumulate a decent amount of any single coin. And it most likely will take months before you start seeing serious returns on them, but it’s worth it if you have the patience.

Thanks. Hope this article helps with your search.

Tips: 1NA9AWApB1EGZUQo2HNp94TQjQoPMJh6i5