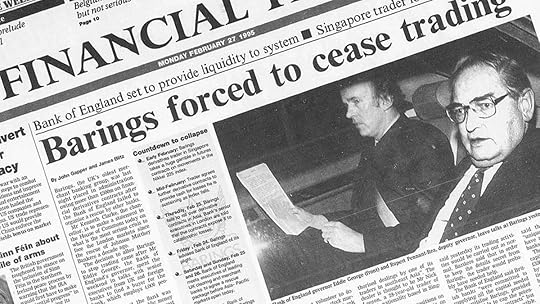

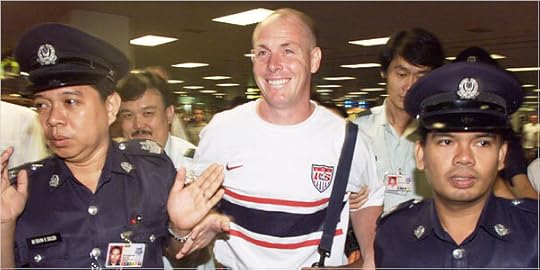

Rogue Trader is quite an exciting book and it reads like a thriller. It's a true account of a well documented crime. Nick Leeson, a young broker with Barings Bank, was sent to work as general-manager at the Singapore International Monetary Exchange. At first he made large profits. His problems began when he covered-up a mistake by one of his colleagues, and hid the financial loss in an error account referred to as 88888. Nick then tried to recoup that loss, only to make losses of his own. In the beginning he was confident he would eventually recover from his devastating bad-luck, but he just got deeper and deeper into the quagmire. Nick continuously requested large amounts of funds from London, hoping that his trading would eventually make profits to balance his losses, but the financial market was against him. Then an earth quake exacerbated his problems by negatively affecting the flow of financial trading.

The biography is full of jargon, such as futures, options and derivatives, which just went over my head, but there is no need to understand those terms to enjoy the book.

Nick’s request for millions of pounds of funding from London was interpreted by the Barings Bank bosses, as having a whiz- kid trader, who was making millions of pounds of profit for them. Therefore, Nick became a legend among his social circle. Nick was dealing in unauthorised speculative trading and he suffered a particularly heavy loss, which he tried to hide. There was evidence of discrepancies that should have been obvious to anyone who compared the figures. When awkward questions arose, Nick just blinded his superiors with jargon, but they were too proud to admit they had no idea what he was talking about. I'm sure readers would find this amusing, because, to me, there was an element of black comedy.

Nick Leeson, although not a polished writer, successfully conveys how his prolonged duplicity culminated in his ever deepening nightmare. I felt his raw emotions: considerable stress, constant anxiety and literally sick with fright. His feeling of solitude was evident, as he hadn't even confided in his wife. I felt it was written with honesty. At first, I really didn’t like the impression Nick gave of himself, as a cocky, confident trader, who was arrogant, self-absorbed and prone to boorish behaviour. But I eventually began to empathise with his predicament. The book is an unbelievable page turner.