Goodreads helps you follow your favorite authors. Be the first to learn about new releases!

Start by following Guy Lawson.

Showing 1-11 of 11

“Justice Oliver Wendell Holmes reminded us, it is a ‘less evil that some criminals should escape than that the government should play an ignoble part.”

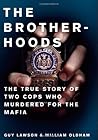

― The Brotherhoods: The True Story of Two Cops Who Murdered for the Mafia

― The Brotherhoods: The True Story of Two Cops Who Murdered for the Mafia

“Over the years, Ellis had dealt with many eccentric hedge fund traders. A shockingly large number were given to wild mood swings and nutty investment theories.”

― Octopus: Sam Israel, the Secret Market, and Wall Street's Wildest Con

― Octopus: Sam Israel, the Secret Market, and Wall Street's Wildest Con

“A trader named Chuck Zion took an interest in Sam. Known as Brown Bear, Zion showed Israel how to be a “paper trader.” Following a matrix of three hundred companies, Israel learned to track the price movement of shares so that he could recognize characteristics. “Brown Bear made sure I was doing it every day, not being lazy and wasting his time,” Sam recalled. “He was giving me a gift. Once you know the price range of a share, you get a chart in your head. You know if the stock is streaking. You know if it is tanking. Each stock has characteristics in the way it trades. Knowing the price of a stock was like dating a girl. How well do you know her? What does she like to do? What’s her mood today?”

― Octopus: Sam Israel, the Secret Market, and Wall Street's Wildest Con

― Octopus: Sam Israel, the Secret Market, and Wall Street's Wildest Con

“The Rise, Decline, and Resurgence of America’s Most Powerful Mafia Empires,”

― The Brotherhoods: The True Story of Two Cops Who Murdered for the Mafia

― The Brotherhoods: The True Story of Two Cops Who Murdered for the Mafia

“Consciously harming others and giving himself the moral permission to do so tested Blazer’s interior monologue; he wasn’t a sociopath, and his mother hadn’t raised a liar and a cheat, but he’d developed a toxic unwillingness to admit failure. The blend of arrogance and ease of deception, coupled with Blazer’s knowledge of his players’ lack of financial sophistication, proved too much to resist.”

― Hot Dog Money: Inside the Biggest Scandal in the History of College Sports

― Hot Dog Money: Inside the Biggest Scandal in the History of College Sports

“I am agnostic on the shadow market. I went deep into the rabbit hole of global finance, with a legal background and experience on Wall Street, and I decided it wasn't my role to decide--that was for readers.”

― Octopus: Sam Israel, the Secret Market, and Wall Street's Wildest Con

― Octopus: Sam Israel, the Secret Market, and Wall Street's Wildest Con

“He was my ticket into the Alabama gold mine, reeking with corruption but also overflowing with riches. It was yet another of the worst-kept secrets of college football, how massive the corruption was in Alabama. Not only were players taking money from boosters and financial advisers and agents, but they were doing so in many instances with the blessing of the university and the football program.”

― Hot Dog Money: Inside the Biggest Scandal in the History of College Sports

― Hot Dog Money: Inside the Biggest Scandal in the History of College Sports

“Byron Wien, for decades one of the most influential voices on Wall Street, taught Israel how to understand macroeconomic questions like the difference between gross national product and gross domestic product. The government had switched the leading economic indicator from GNP to GDP, Wien explained to Israel, as a way to make it seem that the economy was growing faster—official sleight of hand understood by very few.”

― Octopus: Sam Israel, the Secret Market, and Wall Street's Wildest Con

― Octopus: Sam Israel, the Secret Market, and Wall Street's Wildest Con

“Many scholars understand the NCAA as a cartel,” court of appeals judge Frank Easterbrook wrote, allowing that Walters was a “nasty and untrustworthy fellow” but pointing out that reality didn’t exempt college sports from legal scrutiny. “The NCAA depresses athletes’ income—restricting payments to the value of tuition, room, and board, while receiving services of substantially greater worth. The NCAA treats this as desirable preservation of amateur sports; a more jaundiced eye would see it as the use of monopsony power to obtain athletes’ services for less than their competitive value.” The word monopsony said it all: the term describes monopoly powers on the buyer side of the market. In this case, the NCAA was the lone competitor for the purchase of the players’ services, contriving to leave young athletes—many of them Black—like sharecroppers on a plantation, only able to sell their yields to the landowner and compensated in goods sold at the landowner’s store in the form of scholarships.”

― Hot Dog Money: Inside the Biggest Scandal in the History of College Sports

― Hot Dog Money: Inside the Biggest Scandal in the History of College Sports

“If the other guy’s happy, then there’s still money left on the table.’ ” A”

― Arms and the Dudes: How Three Stoners from Miami Beach Became the Most Unlikely Gunrunners in History

― Arms and the Dudes: How Three Stoners from Miami Beach Became the Most Unlikely Gunrunners in History