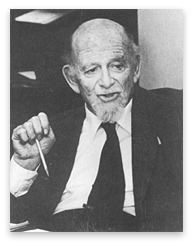

Ludwig Lachmann

Born

in Berlin, Germany

February 01, 1906

Died

December 17, 1990

|

Capital and Its Structure

—

published

1956

—

8 editions

|

|

|

The Legacy of Max Weber

—

published

1970

—

8 editions

|

|

|

Capital, Expectations, and the Market Process: Essays on the Theory of the Market Econony (Studies in Economic Theory)

—

published

1977

—

4 editions

|

|

|

New Directions in Austrian Economics

by

—

published

1978

—

4 editions

|

|

|

Macro-economic Thinking and the Market Economy

—

published

1973

—

4 editions

|

|

|

Expectations and the Meaning of Institutions: Essays in Economics by Ludwig M. Lachmann (Routledge Foundations of the Market Economy)

by

—

published

1994

—

8 editions

|

|

|

The Market As an Economic Process

—

published

1986

—

2 editions

|

|

|

Subjectivism and Economic Analysis (Routledge Frontiers of Political Economy)

—

published

1998

|

|

|

Wstęp do austriackiej szkoły ekonomii

by

—

published

2019

|

|

|

Il mercato e la distribuzione della ricchezza (FREEdom Vol. 1) (Italian Edition)

—

published

2012

|

|

“The generic concept of capital without which economists cannot do their work has no measurable counterpart among material objects; it reflects the entrepreneurial appraisal of such objects. Beer barrels and blast furnaces, harbour installations and hotel-room furniture are capital not by virtue of their physical properties but by virtue of their economic functions. Something is capital because the market, the consensus of entrepreneurial minds, regards it as capable of yielding an income. This does not mean that the phenomena of capital cannot be comprehended by clear and unambiguous concepts. The stock of capital used by society does not present a picture of chaos. Its arrangement is not arbitrary. There is some order in it.”

― Capital and Its Structure

― Capital and Its Structure

“A progressive economy is not an economy in which no capital is ever lost, but an economy which can afford to lose capital because the productive opportunities revealed by the loss are vigorously exploited.”

― Capital and Its Structure

― Capital and Its Structure

“Both, business expectation and scientific hypothesis serve the same purpose; both reflect an attempt at cognition and orientation in an imperfectly known world, both embody imperfect knowledge to be tested and improved by later experience. Each expectation does not stand by itself but is the cumulative result of a series of former expectations which have been revised in the light of later experience, and these past revisions are the source of whatever present knowledge we have”

―

―