The History Book Club discussion

ECONOMICS/FINANCE/TRADING, etc.

>

ECONOMICS

date newest »

newest »

newest »

newest »

message 1:

by

Bentley, Group Founder, Leader, Chief

(last edited Mar 28, 2018 12:57PM)

(new)

Sep 02, 2017 11:36AM

Mod

Mod

reply

|

flag

Readers interested in studying the Austrian School approach to economics can read articles, journals, and ebooks, listen to audio, view videos, take online courses, and more at the Mises Institute and the Foundation for Economic Education. The number of free ebooks available at these sites is amazing.

I highly recommend starting with the following book, an introduction to the Austrian school that I downloaded and am currently finishing reading:

by Gene Callahan (no photo)

by Gene Callahan (no photo)

I highly recommend starting with the following book, an introduction to the Austrian school that I downloaded and am currently finishing reading:

by Gene Callahan (no photo)

by Gene Callahan (no photo)

Economics in One Lesson

by

by

Henry Hazlitt

Henry Hazlitt

Synopsis:

Economics in One Lesson is one of the definitive introductions to economics from the 20th Century. Henry Hazlitt shrunk down the core principles of economics into one concise lesson that one could read in a weekend.

Inspired by Ludwig von Mises and Frédérick Basiat, Hazlitt taught core principles with memorable stories, like the "broken window fallacy" for teaching what we now call opportunity cost. The book does not only focus on basic laws of economics. It explores political issues like tariffs and wage laws as well.

This book can be an effective wake-up call to readers who had made assumptions about how many aspects of economics work. More than 1 million copies have been sold. That number probably won't go up much anymore, as free editions are available online.

The 1952 edition of this book is available online free in PDF and MP3 formats from the Foundation for Economic Education. The 2008 edition is available online free in PDF format from the Mises Institute.

by

by

Henry Hazlitt

Henry HazlittSynopsis:

Economics in One Lesson is one of the definitive introductions to economics from the 20th Century. Henry Hazlitt shrunk down the core principles of economics into one concise lesson that one could read in a weekend.

Inspired by Ludwig von Mises and Frédérick Basiat, Hazlitt taught core principles with memorable stories, like the "broken window fallacy" for teaching what we now call opportunity cost. The book does not only focus on basic laws of economics. It explores political issues like tariffs and wage laws as well.

This book can be an effective wake-up call to readers who had made assumptions about how many aspects of economics work. More than 1 million copies have been sold. That number probably won't go up much anymore, as free editions are available online.

The 1952 edition of this book is available online free in PDF and MP3 formats from the Foundation for Economic Education. The 2008 edition is available online free in PDF format from the Mises Institute.

Debts, Defaults, Depression and Other Delightful Ditties from the Dismal Science

by

by

Bryan Taylor

Bryan Taylor

Synopsis:

A light-hearted look at some of the more entertaining episodes of economic history. Bryan Taylor uses his knowledge of the past to illustrate how corporations and governments have helped and harmed the economy and financial markets.

Readers will learn about the greatest counterfeiter of all time, the first publicly traded bonds, the worst inflation in history, the currency that created two countries, zombie bonds, and the New Jersey tailor who went to jail for undercutting other tailors by 5 cents. Taylor provides his insights on the gold standard, government debt, the stock market and why the Fed will keep interest rates low for years to come.

Whether looking for an amusing glimpse into the past or to learn how the economy can affect the stock market, Debt, Defaults, and Depression provides both. Even people who think calling economics the "dismal science" is being too kind enjoy this book.

by

by

Bryan Taylor

Bryan TaylorSynopsis:

A light-hearted look at some of the more entertaining episodes of economic history. Bryan Taylor uses his knowledge of the past to illustrate how corporations and governments have helped and harmed the economy and financial markets.

Readers will learn about the greatest counterfeiter of all time, the first publicly traded bonds, the worst inflation in history, the currency that created two countries, zombie bonds, and the New Jersey tailor who went to jail for undercutting other tailors by 5 cents. Taylor provides his insights on the gold standard, government debt, the stock market and why the Fed will keep interest rates low for years to come.

Whether looking for an amusing glimpse into the past or to learn how the economy can affect the stock market, Debt, Defaults, and Depression provides both. Even people who think calling economics the "dismal science" is being too kind enjoy this book.

Today's Audible Sale $2.95 -

Today's Audible Sale $2.95 -Prediction Machines: The Simple Economics of Artificial Intelligence

by Ajay Agrawal (no photo)

by Ajay Agrawal (no photo)Synopsis:

"Artificial intelligence does the seemingly impossible, magically bringing machines to life--driving cars, trading stocks, and teaching children. But facing the sea change that AI will bring can be paralyzing. How should companies set strategies, governments design policies, and people plan their lives for a world so different from what we know? In the face of such uncertainty, many analysts either cower in fear or predict an impossibly sunny future.

But in Prediction Machines, three eminent economists recast the rise of AI as a drop in the cost of prediction. With this single, masterful stroke, they lift the curtain on the AI-is-magic hype and show how basic tools from economics provide clarity about the AI revolution and a basis for action by CEOs, managers, policy makers, investors, and entrepreneurs.

When AI is framed as cheap prediction, its extraordinary potential becomes clear:

Prediction is at the heart of making decisions under uncertainty. Our businesses and personal lives are riddled with such decisions. Prediction tools increase productivity--operating machines, handling documents, communicating with customers. Uncertainty constrains strategy. Better prediction creates opportunities for new business structures and strategies to compete.

Penetrating, fun, and always insightful and practical, Prediction Machines follows its inescapable logic to explain how to navigate the changes on the horizon. The impact of AI will be profound, but the economic framework for understanding it is surprisingly simple."

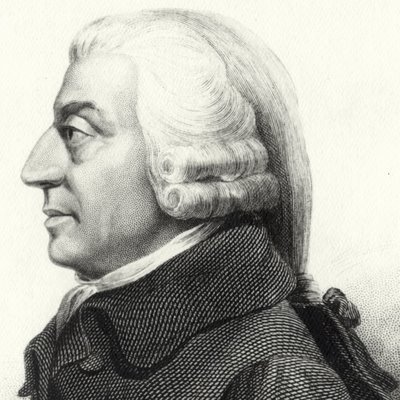

Adam Smith

“[E]very individual [who tries to maximize the value of his own capital and labour] necessarily labours to render the annual revenue of the society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it.”

Adam Smith, The Wealth Of Nations [1776] on the Invisible Hand - published the same year as our Declaration of Independence - the foundations of capitalism

by

by

Adam Smith

Adam Smith

Introduction to Economics - discussing the Scottish philosopher and economist Adam Smith (the first real economist):

https://www.khanacademy.org/economics...

Source: Khan Academy

Adam Smith's quote is combining a mix of micro-economic and macro-economic statements. Modern economists tend to divide themselves into two schools - microeconomics and macroeconomics.

Micro is focused on the people, individual actors who are acting out of their own self interest. And the macro is that it might be good for the economy, or the nation as a whole.

And so, now, modern economists tend to divide themselves into these two schools, or into these two subjects: microeconomics, which is the study of individual actors. And those actors could be firms, could be people, it could be households.

And you have macro-economics which is the study of the economy in aggregate. This shows what happens at the aggregate level to an economy - from the millions of individual actors.

Often it focuses on policy-related questions. So do you raise taxes or not and what is going to happen if you do. Do you regulate or not and what affect will it have. Macro economics often concerns policy - or top down kind of questions.

In macro economics there is alway all sorts of predictions about the state of the economy, about what needs to be done, about how long the recession will last, about what will be the economic growth next year, about what will inflation do and often they are proven wrong.

And it may seem to be a science like physics - but it is not - it is open and very much open to subjectivity.

Macro-economics concerns itself with the (bigger picture).

Micro-economics concerns itself with the actors who make decisions, different allocations, allocation of scarce resources and how do people decide where to put these scarce resources and how to deploy them. And how does that affect prices and markets.

Micro-economics deals with the decision making and the assumptions you make about those decisions. In Micro-economics you are taking complicated things that deal with how people act and respond to each other - and you are aggregating over millions of people

https://www.khanacademy.org/economics...

Source: Khan Academy

Adam Smith's quote is combining a mix of micro-economic and macro-economic statements. Modern economists tend to divide themselves into two schools - microeconomics and macroeconomics.

Micro is focused on the people, individual actors who are acting out of their own self interest. And the macro is that it might be good for the economy, or the nation as a whole.

And so, now, modern economists tend to divide themselves into these two schools, or into these two subjects: microeconomics, which is the study of individual actors. And those actors could be firms, could be people, it could be households.

And you have macro-economics which is the study of the economy in aggregate. This shows what happens at the aggregate level to an economy - from the millions of individual actors.

Often it focuses on policy-related questions. So do you raise taxes or not and what is going to happen if you do. Do you regulate or not and what affect will it have. Macro economics often concerns policy - or top down kind of questions.

In macro economics there is alway all sorts of predictions about the state of the economy, about what needs to be done, about how long the recession will last, about what will be the economic growth next year, about what will inflation do and often they are proven wrong.

And it may seem to be a science like physics - but it is not - it is open and very much open to subjectivity.

Macro-economics concerns itself with the (bigger picture).

Micro-economics concerns itself with the actors who make decisions, different allocations, allocation of scarce resources and how do people decide where to put these scarce resources and how to deploy them. And how does that affect prices and markets.

Micro-economics deals with the decision making and the assumptions you make about those decisions. In Micro-economics you are taking complicated things that deal with how people act and respond to each other - and you are aggregating over millions of people

Basic Economics 5th Edition, Kindle Edition - also available in hardcover and other formats

by

by

Thomas Sowell

Thomas Sowell

Synopsis:

If you're looking for a general overview of economics and how different economic systems work, this book is your guide. Thomas Sowell's bestseller covers the basics of capitalism, socialism, feudalism and the like with a concise explanation of the underlying principles of each. It's very much a common sense approach to high-level economic concepts explained for the everyday person.

The book is designed to reinforce the basic relationships between the entities that own or control resources and those that need or purchase them. It incorporates real-life examples along the way, offering a relatable context for how the economy operates and how it affects the people who live within it.

Source: the Balance

by

by

Thomas Sowell

Thomas SowellSynopsis:

If you're looking for a general overview of economics and how different economic systems work, this book is your guide. Thomas Sowell's bestseller covers the basics of capitalism, socialism, feudalism and the like with a concise explanation of the underlying principles of each. It's very much a common sense approach to high-level economic concepts explained for the everyday person.

The book is designed to reinforce the basic relationships between the entities that own or control resources and those that need or purchase them. It incorporates real-life examples along the way, offering a relatable context for how the economy operates and how it affects the people who live within it.

Source: the Balance

Economics in One Lesson: The Shortest and Surest Way to Understand Basic Economics

by

by

Henry Hazlitt

Henry Hazlitt

Synopsis:

This book, first published in 1946, is a good starting point for anyone who needs a thorough but not overly technical explanation of economics and how economies work. While the book does use some dated examples, the underlying message remains relevant today. And that message is that economics is best viewed as a long game that factors in both known and unknown elements that can influence outcomes.

The book applies that principle to common scenarios that are easy to understand, such as minimum wage and government spending initiatives. It challenges the notion that economics is best interpreted as a series of short-term scenarios, events, and trends. Overall "Economics in One Lesson" is a solid choice for building your economics knowledge base if you want something that's easy to digest.

Source: the Balance

by

by

Henry Hazlitt

Henry HazlittSynopsis:

This book, first published in 1946, is a good starting point for anyone who needs a thorough but not overly technical explanation of economics and how economies work. While the book does use some dated examples, the underlying message remains relevant today. And that message is that economics is best viewed as a long game that factors in both known and unknown elements that can influence outcomes.

The book applies that principle to common scenarios that are easy to understand, such as minimum wage and government spending initiatives. It challenges the notion that economics is best interpreted as a series of short-term scenarios, events, and trends. Overall "Economics in One Lesson" is a solid choice for building your economics knowledge base if you want something that's easy to digest.

Source: the Balance

Freakonomics: A Rogue Economist Explores the Hidden Side of Everything (P.S.)

by

by

Steven D. Levitt

Steven D. Levitt

Synopsis:

Microeconomics is a branch of economics that focuses on single drivers of economic change and the impacts of individual decision-making. In other words, it's largely about cause-and-effect. Sounds simple enough but "Freakonomics" doesn't take the traditional approach to understanding microeconomics and its impacts on the broader economy. Instead, authors Steven Levitt and Stephen Dubner analyze the links between seemingly unrelated concepts, such as how crime rates coincide with abortion rates.

The book is a fun and thought-provoking read that's designed to spur armchair economists to take a closer look at how things that may not seem important at all can have a ripple effect where the economy is concerned. After its publication in 2005, the authors have continued expanding on their microeconomics theories in two other books, "SuperFreakonomics" and "Think Like a Freak".

Source: the Balance

by

by

Steven D. Levitt

Steven D. LevittSynopsis:

Microeconomics is a branch of economics that focuses on single drivers of economic change and the impacts of individual decision-making. In other words, it's largely about cause-and-effect. Sounds simple enough but "Freakonomics" doesn't take the traditional approach to understanding microeconomics and its impacts on the broader economy. Instead, authors Steven Levitt and Stephen Dubner analyze the links between seemingly unrelated concepts, such as how crime rates coincide with abortion rates.

The book is a fun and thought-provoking read that's designed to spur armchair economists to take a closer look at how things that may not seem important at all can have a ripple effect where the economy is concerned. After its publication in 2005, the authors have continued expanding on their microeconomics theories in two other books, "SuperFreakonomics" and "Think Like a Freak".

Source: the Balance

SuperFreakonomics

by

by

Steven D. Levitt

Steven D. Levitt

Synopsis:

The New York Times best-selling Freakonomics was a worldwide sensation, selling over four million copies in thirty-five languages and changing the way we look at the world. Now, Steven D. Levitt and Stephen J. Dubner return with SuperFreakonomics, and fans and newcomers alike will find that the freakquel is even bolder, funnier, and more surprising than the first.

Four years in the making, SuperFreakonomics asks not only the tough questions, but the unexpected ones: What's more dangerous, driving drunk or walking drunk? Why is chemotherapy prescribed so often if it's so ineffective? Can a sex change boost your salary?

SuperFreakonomics challenges the way we think all over again, exploring the hidden side of everything with such questions as:

How is a street prostitute like a department-store Santa?

Why are doctors so bad at washing their hands?

How much good do car seats do?

What's the best way to catch a terrorist?

Did TV cause a rise in crime?

What do hurricanes, heart attacks, and highway deaths have in common?

Are people hard-wired for altruism or selfishness?

Can eating kangaroo save the planet?

Which adds more value: a pimp or a Realtor?

Levitt and Dubner mix smart thinking and great storytelling like no one else, whether investigating a solution to global warming or explaining why the price of oral sex has fallen so drastically. By examining how people respond to incentives, they show the world for what it really is – good, bad, ugly, and, in the final analysis, super freaky.

Freakonomics has been imitated many times over – but only now, with SuperFreakonomics, has it met its match.

Source: the Balance

by

by

Steven D. Levitt

Steven D. LevittSynopsis:

The New York Times best-selling Freakonomics was a worldwide sensation, selling over four million copies in thirty-five languages and changing the way we look at the world. Now, Steven D. Levitt and Stephen J. Dubner return with SuperFreakonomics, and fans and newcomers alike will find that the freakquel is even bolder, funnier, and more surprising than the first.

Four years in the making, SuperFreakonomics asks not only the tough questions, but the unexpected ones: What's more dangerous, driving drunk or walking drunk? Why is chemotherapy prescribed so often if it's so ineffective? Can a sex change boost your salary?

SuperFreakonomics challenges the way we think all over again, exploring the hidden side of everything with such questions as:

How is a street prostitute like a department-store Santa?

Why are doctors so bad at washing their hands?

How much good do car seats do?

What's the best way to catch a terrorist?

Did TV cause a rise in crime?

What do hurricanes, heart attacks, and highway deaths have in common?

Are people hard-wired for altruism or selfishness?

Can eating kangaroo save the planet?

Which adds more value: a pimp or a Realtor?

Levitt and Dubner mix smart thinking and great storytelling like no one else, whether investigating a solution to global warming or explaining why the price of oral sex has fallen so drastically. By examining how people respond to incentives, they show the world for what it really is – good, bad, ugly, and, in the final analysis, super freaky.

Freakonomics has been imitated many times over – but only now, with SuperFreakonomics, has it met its match.

Source: the Balance

Think Like a Freak

by

by

Steven D. Levitt

Steven D. Levitt

Synopsis:

The New York Times bestselling Freakonomics changed the way we see the world, exposing the hidden side of just about everything. Then came SuperFreakonomics, a documentary film, an award-winning podcast, and more.

Now, with Think Like a Freak, Steven D. Levitt and Stephen J. Dubner have written their most revolutionary book yet. With their trademark blend of captivating storytelling and unconventional analysis, they take us inside their thought process and teach us all to think a bit more productively, more creatively, more rationally—to think, that is, like a Freak.

Levitt and Dubner offer a blueprint for an entirely new way to solve problems, whether your interest lies in minor lifehacks or major global reforms. As always, no topic is off-limits. They range from business to philanthropy to sports to politics, all with the goal of retraining your brain. Along the way, you’ll learn the secrets of a Japanese hot-dog-eating champion, the reason an Australian doctor swallowed a batch of dangerous bacteria, and why Nigerian e-mail scammers make a point of saying they’re from Nigeria.

Some of the steps toward thinking like a Freak:

First, put away your moral compass—because it’s hard to see a problem clearly if you’ve already decided what to do about it.

Learn to say “I don’t know”—for until you can admit what you don’t yet know, it’s virtually impossible to learn what you need to.

Think like a child—because you’ll come up with better ideas and ask better questions.

Take a master class in incentives—because for better or worse, incentives rule our world.

Learn to persuade people who don’t want to be persuaded—because being right is rarely enough to carry the day.

Learn to appreciate the upside of quitting—because you can’t solve tomorrow’s problem if you aren’t willing to abandon today’s dud.

Levitt and Dubner plainly see the world like no one else. Now you can too. Never before have such iconoclastic thinkers been so revealing—and so much fun to read.

Source: the Balance

by

by

Steven D. Levitt

Steven D. LevittSynopsis:

The New York Times bestselling Freakonomics changed the way we see the world, exposing the hidden side of just about everything. Then came SuperFreakonomics, a documentary film, an award-winning podcast, and more.

Now, with Think Like a Freak, Steven D. Levitt and Stephen J. Dubner have written their most revolutionary book yet. With their trademark blend of captivating storytelling and unconventional analysis, they take us inside their thought process and teach us all to think a bit more productively, more creatively, more rationally—to think, that is, like a Freak.

Levitt and Dubner offer a blueprint for an entirely new way to solve problems, whether your interest lies in minor lifehacks or major global reforms. As always, no topic is off-limits. They range from business to philanthropy to sports to politics, all with the goal of retraining your brain. Along the way, you’ll learn the secrets of a Japanese hot-dog-eating champion, the reason an Australian doctor swallowed a batch of dangerous bacteria, and why Nigerian e-mail scammers make a point of saying they’re from Nigeria.

Some of the steps toward thinking like a Freak:

First, put away your moral compass—because it’s hard to see a problem clearly if you’ve already decided what to do about it.

Learn to say “I don’t know”—for until you can admit what you don’t yet know, it’s virtually impossible to learn what you need to.

Think like a child—because you’ll come up with better ideas and ask better questions.

Take a master class in incentives—because for better or worse, incentives rule our world.

Learn to persuade people who don’t want to be persuaded—because being right is rarely enough to carry the day.

Learn to appreciate the upside of quitting—because you can’t solve tomorrow’s problem if you aren’t willing to abandon today’s dud.

Levitt and Dubner plainly see the world like no one else. Now you can too. Never before have such iconoclastic thinkers been so revealing—and so much fun to read.

Source: the Balance

Capitalism and Freedom: Fortieth Anniversary Edition

by

by

Milton Friedman

Milton Friedman

Synopsis:

There are different approaches that tend to dominate world economies and capitalism is one of them. In a capitalist economy, or in a mixed economy that incorporates capitalist principles alongside something else, such as socialism, the markets and market transactions are the main movers and shakers of economic activity.

The idea behind capitalism is that capital goods are owned privately, by either individuals or businesses, while the public (i.e. consumers) supplies the labor to produce them. The pace at which those goods and/or services are produced is based on the laws of supply and demand.

In "Capitalism and Freedom", author Milton Friedman examines how capitalism paves the way for economic progress. He makes a strong argument for the merits of capitalism in its purest form and its role in promoting individual economic freedom

Source: the Balance

by

by

Milton Friedman

Milton FriedmanSynopsis:

There are different approaches that tend to dominate world economies and capitalism is one of them. In a capitalist economy, or in a mixed economy that incorporates capitalist principles alongside something else, such as socialism, the markets and market transactions are the main movers and shakers of economic activity.

The idea behind capitalism is that capital goods are owned privately, by either individuals or businesses, while the public (i.e. consumers) supplies the labor to produce them. The pace at which those goods and/or services are produced is based on the laws of supply and demand.

In "Capitalism and Freedom", author Milton Friedman examines how capitalism paves the way for economic progress. He makes a strong argument for the merits of capitalism in its purest form and its role in promoting individual economic freedom

Source: the Balance

Capitalism in America

by

by

Alan Greenspan

Alan Greenspan

Synopsis:

From the legendary former Fed Chairman and the acclaimed Economist writer and historian, the full, epic story of America's evolution from a small patchwork of threadbare colonies to the most powerful engine of wealth and innovation the world has ever seen.

Shortlisted for the 2018 Financial Times and McKinsey Business Book of the Year Award

From even the start of his fabled career, Alan Greenspan was duly famous for his deep understanding of even the most arcane corners of the American economy, and his restless curiosity to know even more. To the extent possible, he has made a science of understanding how the US economy works almost as a living organism--how it grows and changes, surges and stalls. He has made a particular study of the question of productivity growth, at the heart of which is the riddle of innovation. Where does innovation come from, and how does it spread through a society? And why do some eras see the fruits of innovation spread more democratically, and others, including our own, see the opposite?

In Capitalism in America, Greenspan distills a lifetime of grappling with these questions into a thrilling and profound master reckoning with the decisive drivers of the US economy over the course of its history. In partnership with the celebrated Economist journalist and historian Adrian Wooldridge, he unfolds a tale involving vast landscapes, titanic figures, triumphant breakthroughs, enlightenment ideals as well as terrible moral failings. Every crucial debate is here--from the role of slavery in the antebellum Southern economy to the real impact of FDR's New Deal to America's violent mood swings in its openness to global trade and its impact. But to read Capitalism in America is above all to be stirred deeply by the extraordinary productive energies unleashed by millions of ordinary Americans that have driven this country to unprecedented heights of power and prosperity.

At heart, the authors argue, America's genius has been its unique tolerance for the effects of creative destruction, the ceaseless churn of the old giving way to the new, driven by new people and new ideas. Often messy and painful, creative destruction has also lifted almost all Americans to standards of living unimaginable to even the wealthiest citizens of the world a few generations past. A sense of justice and human decency demands that those who bear the brunt of the pain of change be protected, but America has always accepted more pain for more gain, and its vaunted rise cannot otherwise be understood, or its challenges faced, without recognizing this legacy. For now, in our time, productivity growth has stalled again, stirring up the populist furies. There's no better moment to apply the lessons of history to the most pressing question we face, that of whether the United States will preserve its preeminence, or see its leadership pass to other, inevitably less democratic powers.

Source: the Balance

by

by

Alan Greenspan

Alan GreenspanSynopsis:

From the legendary former Fed Chairman and the acclaimed Economist writer and historian, the full, epic story of America's evolution from a small patchwork of threadbare colonies to the most powerful engine of wealth and innovation the world has ever seen.

Shortlisted for the 2018 Financial Times and McKinsey Business Book of the Year Award

From even the start of his fabled career, Alan Greenspan was duly famous for his deep understanding of even the most arcane corners of the American economy, and his restless curiosity to know even more. To the extent possible, he has made a science of understanding how the US economy works almost as a living organism--how it grows and changes, surges and stalls. He has made a particular study of the question of productivity growth, at the heart of which is the riddle of innovation. Where does innovation come from, and how does it spread through a society? And why do some eras see the fruits of innovation spread more democratically, and others, including our own, see the opposite?

In Capitalism in America, Greenspan distills a lifetime of grappling with these questions into a thrilling and profound master reckoning with the decisive drivers of the US economy over the course of its history. In partnership with the celebrated Economist journalist and historian Adrian Wooldridge, he unfolds a tale involving vast landscapes, titanic figures, triumphant breakthroughs, enlightenment ideals as well as terrible moral failings. Every crucial debate is here--from the role of slavery in the antebellum Southern economy to the real impact of FDR's New Deal to America's violent mood swings in its openness to global trade and its impact. But to read Capitalism in America is above all to be stirred deeply by the extraordinary productive energies unleashed by millions of ordinary Americans that have driven this country to unprecedented heights of power and prosperity.

At heart, the authors argue, America's genius has been its unique tolerance for the effects of creative destruction, the ceaseless churn of the old giving way to the new, driven by new people and new ideas. Often messy and painful, creative destruction has also lifted almost all Americans to standards of living unimaginable to even the wealthiest citizens of the world a few generations past. A sense of justice and human decency demands that those who bear the brunt of the pain of change be protected, but America has always accepted more pain for more gain, and its vaunted rise cannot otherwise be understood, or its challenges faced, without recognizing this legacy. For now, in our time, productivity growth has stalled again, stirring up the populist furies. There's no better moment to apply the lessons of history to the most pressing question we face, that of whether the United States will preserve its preeminence, or see its leadership pass to other, inevitably less democratic powers.

Source: the Balance

A Crisis of Beliefs: Investor Psychology and Financial Fragility

by Nicola Gennaioli (no photo)

by Nicola Gennaioli (no photo)

Synopsis:

The 2008 financial crisis took many average Americans by surprise and it serves as the starting point for "A Crisis of Beliefs". Specifically, the authors look at how the collapse of Lehman Brothers was a catalyst for government financial bailouts and ensuing recession. They hone in on how the beliefs and behaviors of individual investors, home buyers, and federal regulators played a part in moving the financial tide of those immediate months and years following the crisis.

It's really a guide to understanding risk within economies and how that risk can be minimized or amplified by the behavior of the individual players within an economy. This book is a little more complex in terms of the ideas and concepts discussed but if you're looking for an in-depth look at how psychology and behavior drive the market it's well worth your time.

Source: the Balance

by Nicola Gennaioli (no photo)

by Nicola Gennaioli (no photo)Synopsis:

The 2008 financial crisis took many average Americans by surprise and it serves as the starting point for "A Crisis of Beliefs". Specifically, the authors look at how the collapse of Lehman Brothers was a catalyst for government financial bailouts and ensuing recession. They hone in on how the beliefs and behaviors of individual investors, home buyers, and federal regulators played a part in moving the financial tide of those immediate months and years following the crisis.

It's really a guide to understanding risk within economies and how that risk can be minimized or amplified by the behavior of the individual players within an economy. This book is a little more complex in terms of the ideas and concepts discussed but if you're looking for an in-depth look at how psychology and behavior drive the market it's well worth your time.

Source: the Balance

Gigged: The End of the Job and the Future of Work

Sarah Kessler (no photo)

Sarah Kessler (no photo)

Synopsis:

Traditionally, the U.S. economy has been based on the idea that you go to college and get a full-time job working for a company. You might change jobs a few times over the course of your career but otherwise, you put in your 40 hours a week for 40 years, then retire. The rise of the gig economy is changing the norm about how people work and earn, a topic that Sarah Kessler explores in her book.

She puts forth the idea that the full-time job is in danger of becoming extinct as more Americans are drawn to gig work — such as freelancing or driving an Uber. Her book explores the implications of that on an individual financial level and how it may transform local economies in cities small and large, as well as the broader U.S. economy.

If you're a gig worker or thinking of becoming one, this is one to bookmark if you're curious about where gig work fits in the long-term economic outlook.

Source: the Balance

Sarah Kessler (no photo)

Sarah Kessler (no photo)Synopsis:

Traditionally, the U.S. economy has been based on the idea that you go to college and get a full-time job working for a company. You might change jobs a few times over the course of your career but otherwise, you put in your 40 hours a week for 40 years, then retire. The rise of the gig economy is changing the norm about how people work and earn, a topic that Sarah Kessler explores in her book.

She puts forth the idea that the full-time job is in danger of becoming extinct as more Americans are drawn to gig work — such as freelancing or driving an Uber. Her book explores the implications of that on an individual financial level and how it may transform local economies in cities small and large, as well as the broader U.S. economy.

If you're a gig worker or thinking of becoming one, this is one to bookmark if you're curious about where gig work fits in the long-term economic outlook.

Source: the Balance

Doughnut Economics: Seven Ways to Think Like a 21st Century Economist

by

by

Kate Raworth

Kate Raworth

A lot of what happens in economic policy, in the U.S. and in other countries, is a repetition of things that have been tried before. And while history often repeats itself, author Kate Raworth challenges the idea that it has to in her book, "Doughnut Economics." She offers some alternative ways to think about how to shape economic policy now and in the coming decades to benefit current and future generations.

Specifically, she highlights seven focuses for re-envisioning the economy against a backdrop of encouraging both financial and environmental sustainability on a global scale. Raworth's end goal is to promote the idea that economic prosperity and a healthy Earth don't have to be mutually exclusive of one another.

Source: the Balance

by

by

Kate Raworth

Kate RaworthA lot of what happens in economic policy, in the U.S. and in other countries, is a repetition of things that have been tried before. And while history often repeats itself, author Kate Raworth challenges the idea that it has to in her book, "Doughnut Economics." She offers some alternative ways to think about how to shape economic policy now and in the coming decades to benefit current and future generations.

Specifically, she highlights seven focuses for re-envisioning the economy against a backdrop of encouraging both financial and environmental sustainability on a global scale. Raworth's end goal is to promote the idea that economic prosperity and a healthy Earth don't have to be mutually exclusive of one another.

Source: the Balance

Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty

by

by

Abhijit V. Banerjee

Abhijit V. Banerjee

Synopsis:

Winner of the 2011 Financial Times/Goldman Sachs Best Business Book of the Year Award

Billions of government dollars, and thousands of charitable organizations and NGOs, are dedicated to helping the world's poor. But much of their work is based on assumptions that are untested generalizations at best, harmful misperceptions at worst.

Abhijit Banerjee and Esther Duflo have pioneered the use of randomized control trials in development economics. Work based on these principles, supervised by the Poverty Action Lab, is being carried out in dozens of countries. Drawing on this and their 15 years of research from Chile to India, Kenya to Indonesia, they have identified wholly new aspects of the behavior of poor people, their needs, and the way that aid or financial investment can affect their lives. Their work defies certain presumptions: that microfinance is a cure-all, that schooling equals learning, that poverty at the level of 99 cents a day is just a more extreme version of the experience any of us have when our income falls uncomfortably low.

This important book illuminates how the poor live, and offers all of us an opportunity to think of a world beyond poverty.

My Review:

Winners of the 2019 Nobel Prize in Economics, Abhijit Banerjee and Esther Duflo have spent their careers using economics to study poverty and find solutions to some of the world’s biggest problems. Poor Economics compiles their research and the research of other economists—always well-cited—about why problems exist and how effective or ineffective various solutions are. They discuss health, nutrition, education, political involvement, and many other issues in this book. They compare the impacts of interventions like foreign aid, micro-finance, nudges, and more. There are many interesting conclusions, but, as expected, no magic panacea to solve all our world’s complex problems. This is a great book for people interested in helping people or interested in economics, especially behavioral economics.

by

by

Abhijit V. Banerjee

Abhijit V. BanerjeeSynopsis:

Winner of the 2011 Financial Times/Goldman Sachs Best Business Book of the Year Award

Billions of government dollars, and thousands of charitable organizations and NGOs, are dedicated to helping the world's poor. But much of their work is based on assumptions that are untested generalizations at best, harmful misperceptions at worst.

Abhijit Banerjee and Esther Duflo have pioneered the use of randomized control trials in development economics. Work based on these principles, supervised by the Poverty Action Lab, is being carried out in dozens of countries. Drawing on this and their 15 years of research from Chile to India, Kenya to Indonesia, they have identified wholly new aspects of the behavior of poor people, their needs, and the way that aid or financial investment can affect their lives. Their work defies certain presumptions: that microfinance is a cure-all, that schooling equals learning, that poverty at the level of 99 cents a day is just a more extreme version of the experience any of us have when our income falls uncomfortably low.

This important book illuminates how the poor live, and offers all of us an opportunity to think of a world beyond poverty.

My Review:

Winners of the 2019 Nobel Prize in Economics, Abhijit Banerjee and Esther Duflo have spent their careers using economics to study poverty and find solutions to some of the world’s biggest problems. Poor Economics compiles their research and the research of other economists—always well-cited—about why problems exist and how effective or ineffective various solutions are. They discuss health, nutrition, education, political involvement, and many other issues in this book. They compare the impacts of interventions like foreign aid, micro-finance, nudges, and more. There are many interesting conclusions, but, as expected, no magic panacea to solve all our world’s complex problems. This is a great book for people interested in helping people or interested in economics, especially behavioral economics.

Advanced Macroeconomics

by David Romer (no photo)

by David Romer (no photo)

Synopsis:

The fifth edition of Romer's Advanced Macroeconomics continues its tradition as the standard text and the starting point for graduate macroeconomics courses and helps lay the groundwork for students to begin doing research in macroeconomics and monetary economics. Romer presents the major theories concerning the central questions of macroeconomics. The theoretical analysis is supplemented by examples of relevant empirical work, illustrating the ways that theories can be applied and tested. In areas ranging from economic growth and short-run fluctuations to the natural rate of unemployment and monetary policy, formal models are used to present and analyze key ideas and issues. The book has been extensively revised to incorporate important new topics and new research, eliminate inessential material, and further improve the presentation.

My Review:

The title doesn't lie. This is a high-level text that covers macroeconomic models for economic growth and fiscal and monetary policy. Romer has a background in physics and focuses primarily on mathematical models. A solid background in algebra, calculus, probability, and statistics is necessary to grasp about 80% of the text. Romer assumes a great deal of prior knowledge of both the mathematical and economic concepts. This text is extremely comprehensive and incorporates research from various schools of economic thought, including new Keynesian, neoclassical, and monetarist perspectives. This recently released 5th edition covers new concepts, such as how economists' perspectives of the zero lower bound have changed, and cites many recent studies that challenge and expand on more fundamental concepts. Romer is extremely thorough with each concept and includes copious references to papers, making this an excellent research tool. My only criticism of the text is that the assumptions of prior knowledge result in a disconnect between the text and the problems at the end of each chapter, making this very challenging to use as a textbook, especially for online courses or independent learning.

by David Romer (no photo)

by David Romer (no photo)Synopsis:

The fifth edition of Romer's Advanced Macroeconomics continues its tradition as the standard text and the starting point for graduate macroeconomics courses and helps lay the groundwork for students to begin doing research in macroeconomics and monetary economics. Romer presents the major theories concerning the central questions of macroeconomics. The theoretical analysis is supplemented by examples of relevant empirical work, illustrating the ways that theories can be applied and tested. In areas ranging from economic growth and short-run fluctuations to the natural rate of unemployment and monetary policy, formal models are used to present and analyze key ideas and issues. The book has been extensively revised to incorporate important new topics and new research, eliminate inessential material, and further improve the presentation.

My Review:

The title doesn't lie. This is a high-level text that covers macroeconomic models for economic growth and fiscal and monetary policy. Romer has a background in physics and focuses primarily on mathematical models. A solid background in algebra, calculus, probability, and statistics is necessary to grasp about 80% of the text. Romer assumes a great deal of prior knowledge of both the mathematical and economic concepts. This text is extremely comprehensive and incorporates research from various schools of economic thought, including new Keynesian, neoclassical, and monetarist perspectives. This recently released 5th edition covers new concepts, such as how economists' perspectives of the zero lower bound have changed, and cites many recent studies that challenge and expand on more fundamental concepts. Romer is extremely thorough with each concept and includes copious references to papers, making this an excellent research tool. My only criticism of the text is that the assumptions of prior knowledge result in a disconnect between the text and the problems at the end of each chapter, making this very challenging to use as a textbook, especially for online courses or independent learning.

In economics, we often talk about government spending "crowding out" private investment. Warren Buffett said at Saturday's Berkshire Hathaway annual shareholder's meeting that that is exactly what happened last month. The federal government quickly responded to Covid-19 with bailout packages for businesses, while the Federal Reserve lowered rates and dramatically increased its balance sheet, propping up various asset valuations. This effectively left Berkshire Hathaway with no opportunity to make a "blockbuster deal" like it did during the 2008 financial crisis. This is a great anecdotal example of the economic theory that government spending crowds out private investment.

Warren Buffett

Warren Buffett

Warren Buffett

Warren Buffett

Excellent post

Note - I will delete this part - you may want to add at the bottom of the comment post the author citation for Buffet - we cite all authors

Warren Buffett

Warren Buffett

Note - I will delete this part - you may want to add at the bottom of the comment post the author citation for Buffet - we cite all authors

Warren Buffett

Warren Buffett

Hernando de Soto Polar (or Hernando de Soto /dəˈsoʊtoʊ/; born 1941) is a Peruvian economist known for his work on the informal economy and on the importance of business and property rights. He is the president of the Institute for Liberty and Democracy (ILD), located in Lima, Peru.

Remainder of article:

Link: https://en.wikipedia.org/wiki/Hernand...

The Other Path:

Link: https://en.wikipedia.org/wiki/The_Oth...

More:

https://www.newsweek.com/economy-slum...

https://www.justiceinitiative.org/pub...

Hernando de Soto Knows How To Make the Third World Richer than the First

Link to video: https://youtu.be/Dkgc5Jo-Ft8

Poor People Also Have the Right to Buy and Sell - Hernando de Soto

Link to video: https://youtu.be/6RXdLYP-dxM

Summary: Influential economist and president of the Institute for Liberty and Democracy Hernando de Soto explores the economic roots of the Arab Spring.

An Interview with Hernando de Soto Polar - McKinsey and Company

Link: https://www.mckinsey.com/industries/p...#

Building a nation of owners - October 1, 2012 | Interview- McKinsey and Company

Link: https://www.mckinsey.com/industries/p...

Globalization at the Crossroads - Full Video

Link: https://youtu.be/Gnh5MIiG4gQ

Summary: Globalization at the Crossroads features renowned Peruvian economist and author, Hernando de Soto. His twenty years of research show that economies prosper only in places where widespread personal property ownership exists—coupled with inclusive, efficient, and transparent business and property law.

This program demonstrates how the West successfully revolutionized its legal systems, property laws, and developed the modern corporation. Other nations that have instituted private property and business reforms, such as post-WWII Japan and present-day China, have seen their economies take off and their middle classes grow. Globalization is the new civilization. But unless we include the 80% of humanity currently excluded from the system, they will bring civilization down, as they have brought down other civilizations in the past.

by

by

Hernando de Soto

Hernando de Soto by

by

Hernando de Soto

Hernando de SotoSources: ReasonTV, Youtube, Wikipedia, Newsweek, Wikimedia, The RSA

I am interested in de Soto's thesis in The Mystery of Capital that capitalism's success is based on a country's or culture's conception of property and property rights. I am going to check that book out.

by

by

Hernando de Soto

Hernando de Soto

by

by

Hernando de Soto

Hernando de Soto

Yes, very interesting ideas that others have thought had a lot of merit. Lawrence H. Summers of Harvard said - "Nobody washes a rental car."

Lawrence H. Summers

Lawrence H. Summers

Lawrence H. Summers

Lawrence H. Summers

Books mentioned in this topic

The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else (other topics)The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else (other topics)

The Other Path: The Economic Answer to Terrorism (other topics)

Advanced Macroeconomics (other topics)

Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty (other topics)

More...

Authors mentioned in this topic

Lawrence H. Summers (other topics)Hernando de Soto (other topics)

Hernando de Soto (other topics)

Warren Buffett (other topics)

Warren Buffett (other topics)

More...