Simon Constable's Blog

December 27, 2025

Briefigns Magazine: UK’s Magical Ride to AI Superpower

By SIMON CONSTABLE

When people think about mega-sized tech companies, they are likely to think of corporations that were created and grew huge in the US or China. Those have dominated the sector in ways that no other country has achieved. That is, until recently.

As if by magic, the UK now ranks third globally in artificial intelligence. Private investments in British AI totaled $28 billion from 2013 through 2024, trailing only China at $119 billion and the US at $471 billion, according to Visual Capitalist data. On the face of it, there’s no reason for the UK to be a magnet for artificial intelligence. But like it or not, much of it comes down to the government understanding that AI is the future. “It understands where things are going and is being proactive,” says Ted Mortonson, managing director and technology desk sector strategist at Baird, the investment firm. READ MORE HERE.

KORN FERRY: Are UK CEOs ‘Job Hugging’ Now Too?

The number of CEOs quitting FTSE 100 companies dropped to its lowest level in four years.

By SIMON CONSTABLE

It’s been all the rage across the pond: CEOs are exiting at record levels. A similar exodus in the UK appears to be over.

For CEOs of companies in the FTSE 100 index of the UK’s largest stocks, turnover hit a four-year low of just 7% over the first nine months of 2025. It was the continuation of a slowdown that started last year, with the country’s firms focused increasingly on leadership stability. “There is just more reluctance to rapid change in the UK versus the US,” says Dominic Schofield, Korn Ferry’s chair of board and CEO services for the UK.

At public companies, some level of CEO turnover is normal. Over the five years through September, more than half of FTSE 100 companies (53) have seen their CEOs leave. Slow growth and post-pandemic burnout have led to a wave of voluntary and involuntary departures. “It’s probably a good thing they were moved on,” says Olivier Boulard, Korn Ferry senior client partner for board and CEO services. “When the board needs to replace the CEO, they do.” READ MORE HERE.

CBS Eye On The World: @REALConstable discusses the political troubles of UK Prime Minister Keir Starmer and the suspension of a US-UK tech deal due to clashes over AI regulation.

By SIMON CONSTABLE

The Blitz, Australian armed forces, Public domain, via Wikimedia Commons

The Blitz, Australian armed forces, Public domain, via Wikimedia CommonsSimon Constable discusses the political troubles of UK Prime Minister Keir Starmer and the suspension of a US-UKtech deal due to clashes over AI regulation. He explains that Britain’s “Online Safety Act” aims to tax and regulate tech giants, which threatens to stifle American AI companies operating there.

CBS EYE ON THE WORLD: @REALConstable reports from France on high copper prices and slowing European energy demand.

By SIMON CONSTABLE

LISTEN HERE.

Bibliothèque nationale de France , Public domain, via Wikimedia Commons

Bibliothèque nationale de France , Public domain, via Wikimedia CommonsSimon Constable reports from France on high copper prices and slowing European energy demand. He describes protests by French farmers burning hay to oppose government orders to cull cattle exposed to disease and notes a significant rise in electric vehicle sales across the European Union.

Press enter or click to view image in full size

December 8, 2025

WSJ: President Johnson takes on the Fed Six decades Ago

By SIMON CONSTABLE

Inflation is elevated. Tax cuts have energized the economy. And the president and Federal Reserve chief are locked in battle over interest rates.

Sound familiar?

While the challenge to the Fed’s independence isn’t an exact analog of today, where President Trump has repeatedly called on Fed Chief Jerome Powell and others to cut interest rates, it's what happened in 1965 as President Lyndon Johnson made an “unusual public expression of disapproval of the board’s action to increase interest rates by 0.5% point to 4.5%.

LBJ called the Fed Chairman and other top economic officials and laid into them. “You’ve got me in a position where you can run a rapier into me,” charged Johnson.

Many business leaders of the time seemed worried about inflation. “I approve of the increase” because “all signs indicate we are in a spiral of inflation,” one business leader said.

Others saw the president’s comments as simply political. “This [criticism] is just what you’d expect him to say,” said another business leader. “If the economy turns down, he can blame it on the Fed. If the economy continues doing well, everyone will forget.”

Ultimately, neither the Fed nor inflation backed down. READ MORE HERE.

Arnold Newman, Public domain, via Wikimedia Commons

Arnold Newman, Public domain, via Wikimedia Commons

November 28, 2025

WSJ: How Much Do You Know About Black Friday and Cyber Monday? Take Our Quiz.

By SIMON CONSTABLE

Black Friday is almost here. But how much do you know about it?

For decades, the day after Thanksgiving has marked the start of the shopping rush for the holiday season. What was once a single-day event has now grown to include Thanksgiving Day, Small Business Saturday and Cyber Monday.

Over the years, Black Friday has been surrounded by little-known details—and common misperceptions. Take our quiz and find out how much you really know.

1 OF 10

When was the term “Black Friday” first coined in reference to the retail industry?A. 1930sB. 1940sC. 1950sD. 1960sE. 1970s2 OF 10

What company popularized the day after Thanksgiving as the start of the holiday shopping season?A. Macy’sB. AlexandersC. Barneys New YorkD. WoolworthsE. Lowe’s3 OF 10

Shopping on the day after Thanksgiving has become a global event. How much money did people spend globally from Thanksgiving through Cyber Monday last year?A. Around $50 billionB. Around $110 billionC. Around $160 billionD. Around $270 billionE. Around $500 billion

November 26, 2025

Korn Ferry: Where Did This Bounce Back Come From?

Figures suggest there may be a light at the end of the tunnel for Britain’s manufacturing sector, which has faced years of struggles.

By SIMON CONSTABLE

It’s a sector that has been blindsided again and again. First, manufacturing firms were hit with COVID-19 lockdowns. Then came a surge in energy prices after Russia invaded Ukraine. Supply chain-issues followed, along with higher interest rates and ultimately inflation. What else could go wrong?

Perhaps the sector has found a way to bounce back. One measure of its health, the Purchasing Managers Index (PMI), has steadily improved over the last 12 months, according to new data. As of October, the PMI was at 49.7, up from around 45 in March. While manufacturing slumped, executives were less willing to invest in new projects, says Ben Frost, a Korn Ferry senior client partner, EMEA. “There hasn’t been a positive outlook for a while,” he says. “But many executives are currently saying we need to activate these plans, and the time is now.”

Part of the turnaround has come from an increase in passenger-vehicle production following an interruption at one UK automaker. Still, experts forecast that the PMI is ripe to surpass 50 before year’s end. A PMI reading of 50+ indicates economic growth in the sector. The UK’s defense and aerospace subsector is also a bright spot, says Rory Singleton, a Korn Ferry senior client partner for the global industrial market. “We have world-leading companies in the subsector that should be seeing investment,” he observes. READ MORE HERE.

November 25, 2025

Majority of UK entrepreneurs say British government is ‘anti-business,’ new survey shows

By SIMON CONSTABLE

Britain’s reputation as a country full of get-up-and-go seems to have got up and left the kingdom. Much of the blame for that falls on British Prime Minister Keir Starmer and his colleagues, who led the left-leaning Labor Party to an epic victory in the middle of last year, but the landslide win hasn’t been good for the British economy.

The truth is that Britain’s primary income deficit — the difference between what the government raises from taxpayers compared to what it spends, excluding debt payments — has deteriorated rapidly over the last few years. In this year’s second quarter, the primary deficit totaled 16.8%, more than double the deficit in the fourth quarter of last year and the worst showing since the second quarter of 2023, according to government dat

"The biggest problem is the current British government is remorselessly negative," said Alan Mendoza, executive director of the Henry Jackson Society, a London-based think tank. "That’s not an environment to encourage investment." READ MORE HERE

Vaughan Leiberum from Cape Town, South Africa, CC BY 2.0, via Wikimedia CommonsPress enter or click to view image in full size

Vaughan Leiberum from Cape Town, South Africa, CC BY 2.0, via Wikimedia CommonsPress enter or click to view image in full size

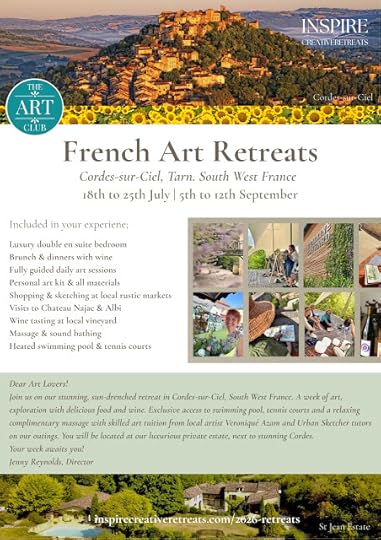

Inspire Creative Retreats 2026

Inspire Creative Retreats2026Art Retreats in Southern FranceHello! Just to let you know, following the success of my wife's art retreat earlier this year, she's now offering two retreats in Southern France.Hosted at a luxurious private villa in the medieval town of Cordes-sur-Ciel. You will be treated to a wonderful week of art, gourmet French food, and wine. Check out the retreats and book here: https://www.inspirecreativeretreats.com/2026-retreats

November 21, 2025

What Made Warren Buffett's Career So Remarkable who could be next as king or queen of investing?

By SIMON CONSTABLE

Warren Buffett, 95, the so-called Oracle of Omaha, is set to step down by year-end as CEO of investment company Berkshire Hathaway. Over 60 years, he and his deputy, Charlie Munger, who died in 2023 at the age of 99, produced outstanding investment returns that made other investors’ returns pale in comparison.

Look at the numbers: From 1965, the year Buffett took over a struggling textile company, through the end of 2024, Berkshire’s shares rose 5,502,284%. That’s an annual compounded return of 19.9%. Over the same six decades, the S&P 500 index rose just 39,054% or 10.4% annually.

“Buffett is the most legendary investor in the history of investing,” says Adam Patti, CEO of exchange-traded fund company VistaShares. “And he has changed the way people invest.” Read more here.

USA International Trade Administration, Public domain, via Wikimedia CommonsPress enter or click to view image in full size

USA International Trade Administration, Public domain, via Wikimedia CommonsPress enter or click to view image in full size