Tadas Talaikis's Blog

August 9, 2020

July, 2020 Bitcoin trading signals results

One 2.0 17.2%

F 3.96%

S 4.98%

Pi 0%

Pi 2.0 6%

V 15.1%

Portfolio 6%

July was 100% profitable, majority of the strategies, except the ���S��� and ���V���, earned 3x+ more than the losses of the June. ���Pi 2.0��� was not at record, it is expected, because it works better in a bit more troubled times. ���One 2.0��� was the record for this month with the 17.2%.

Introducing stock market strategies, a sample

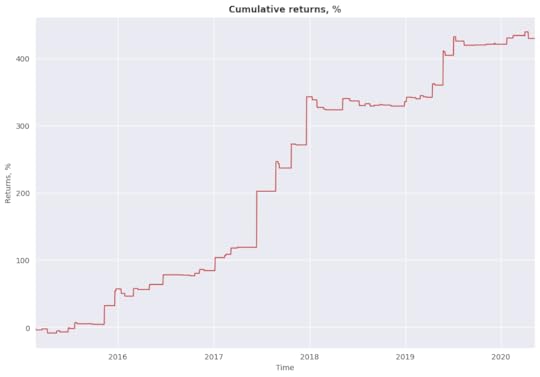

I have long running various stock market strategies, for example, complex ones that are using BlueBlood Engine, which is completely outdated now and is partially public.

First mention of the ���engine��� strategies was the article in Medium: Introducing BlueBlood Quantitative Trading Strategies Index, but also there were a lot of single-shot strategies targeting one or few of the simple trading ideas.

For all of them I had the plans to make them public as the Bitcoin signals, listed in this blog...

July 9, 2020

May 31, 2020

May, 2020 Bitcoin trading performance overview

This months experienced the Bitcoin crash and results are mixed - most of the strategies performed above the zero, except most volatile - V -4.87 and most previously profitable - Pi 2.0 -10.59. This is as expected.

One strategy was a record (One - 15.96), all others, except weekly (I don���t take them into account in reviews) - from 0.44% (portfolio) to 8.69%.

So, indexing clearly shows it can protect from crashes.

Future plans. I am working on hourly ar minute Bitcoin bots when I can, but this ...

May 5, 2020

April, 2020 Bitcoin trading performance overview

I told March was one of the best of this year, then April is a record month for 5 out of the 10 strategies! Bitcoin Pi 2.0 is totally crazy here, almost 70% over just 4 months (of course, it has higher inherent risk).

Bitcoin V, volatility based, new, just first month in operation generated record for the year too.

For the portfolio of the strategies month was also the record.

Returns ranged from 0 (weekly ones are no match for higher frequency trading) to 17.1% in just a month.

Also, I have...

April 17, 2020

Modified pricing model for arbitrage strategies

April 14, 2020

Bitcoin V trading strategy

Bitcoin V is quantitative trading strategy in Bitcoin, which uses quantitative trading models for trading decisions making.

Trading decision making model (alpha) of this strategy is based on volatility model.

There are many reasons:

Don���t stare at the screen all day, don���t waste time, just watch for our signals once a day Don���t overthink your decisions - with manual trading, you can enter and exit long trades several...