Michael C. Taylor's Blog

November 6, 2024

The FAFO Election

A certain type of voter has a set of issues they care about, and seeks the candidate who most represents their view on the issue(s.) That’s probably true of some segment that cares most about abortion, for example, both from the pro-life and pro-choice sides.

Brave enough, angry enough for the Fuck Around and Find Out voters

Brave enough, angry enough for the Fuck Around and Find Out votersAnother type of voter has some agnosticism about a wide variety of issues, but feels a personal affinity – a vibe, a cultural fit, a style – with a candidate, and votes accordingly. Honestly, that probably describes me and my voting patterns more than I would care to admit. I’m part of various tribes, and I seek people who best represent my varying identities.

A third type of voter feels that their society – as they experience it day to day – has gone seriously wrong. The wrong people are in charge. The rules are stacked against them. Their economic prospects are at risk. Multiple threats exist near and far, and there are not enough strong leaders concerned with punching back against those threats.

I don’t honestly hang out with this third group much. I feel their presence in the rhetorical outreach of Donald Trump. He seems to know these people. And he offers them hope.

Fuck Around

I think if you’re in that third group, there’s no specific policy that matters much. What matters is that your leader is mad as hell, a little bit crazy enough to try to shake up the status quo, and has proven fearless in the face of adversity. I think you want someone who can fuck around with the existing elites, the failed structures, the scary direction that things seem to be trending.

If you’re wrong, well, at least you tried. The status quo was so terrible, so scary, that you needed a brave, angry, give-zero-fucks leader.

I think, unfortunately, the Fuck Around and Find Out voters – a majority it turns out of my fellow voting citizens – has made a serious category error.

He’s angry enough, it’s true. But not about any particular issue. He’s angry at the gnawing void in his soul that can’t ever be filled.

He’s willing to poke at the existing elites, that’s true. But not because of any true democratic, everyman-loving, impulse. He loves nobody. It stems from a will to dominance, which doesn’t have any ultimate agenda behind it, beyond the hedonic.

He will tear down what he can. He will corrupt what is corruptible. There are no moral limits within his sphere. I don’t know how much damage can be done in 4 years. But there’s no specific “find out” consequence that should be taken off the table.

Find Out

Jail or shoot opponents? I mean, it’s certainly on his mind a lot and gets ideated out loud.

Shut down newspapers, broadcasters, online media companies insufficiently compliant to his ends? He’s pre-announced that one.

Use the military against civilian protesters? He wanted that done the first time around.

Cut military and trade ties with our closest allies over financial disagreements? That’s the plan.

Forge closer ties with “strongman” autocrats in China, Russian, Hungary, and Saudi Arabia? Also announced.

Use paramilitary groups – Proud Boys, self-appointed militia, gun-rights supporters – to achieve violent political ends, with plausible deniability? That was the Jan 6 playbook, and he didn’t suffer any consequences for trying it before. The fucking Senate caved in the face of an obvious, albeit clumsy, coup attempt.

Demonize already marginalized group – immigrants, trans kids, single-mothers – for problems in America, a punching-down strategy that not only launched his campaign in 2015 but formed the core of his two election wins in 2016 and 2024.

Take the best economy in the world – lowest unemployment, highest stock market, fastest-growth, and tamed inflation – and fuck around by starting unilateral trade wars with tariffs against everybody? That’s his entire campaign promise in a nutshell.

No Limits This Time

Half of the people around him the last time around had moral limits. Which is why more than half of his top cabinet members denounced him in extreme, apocalyptic, terms. It was obvious before the first time that everything Trump touches dies, and so it made no sense (to me) that honest people would agree to hitch their reputations to his. But they did. They fucked around and they found it. But they also, reportedly, kept the country from lurching impulsive disasters, for which I am grateful in retrospect.

I cannot imagine a person who has moral limits would agree to join this incoming administration. Nobody could be that blind a second time.

There will be no shortage of grifters and fascists willing to join this time. There will be a severe shortage of qualified, moral, people around him.

The elected officials in his party in the House and Senate have also self-sorted since 2016. The strong and moral ones resigned or were drummed out of office over the last 8 years. The ambitious, the corrupt, and the compliant have stayed.

I don’t know what we’ll find out. I think if you’re not at least considering the worst case scenarios, that’s a failure of imagination. I do not take comfort in the fact that his own voter will find out, soon enough, how horribly wrong they have calculated this man’s ability to improve their situations.

Post read (2) times.

The post The FAFO Election appeared first on Bankers Anonymous.

September 25, 2024

One Word For You: Lithium

A very cool story in the October 2024 issue of Texas Monthly hit me personally as a modern version of that memorable moment in the movie The Graduate, like a quiet investing tip given out by the pool during a cocktail party:

Texas Monthly Article: “I just want to say one word to you. Just one word.”

Me: “Yes, sir.”

TMA: “Lithium.”

Me: “Exactly how do you mean?”

TMA: “There’s a great future in Lithium. Think about it. Will you think about it?”

I thought about it.

The Bull Case For Lithium

Oil and gas isn’t going away any time soon, but we are in the early years of rapidly ramping up alternative energy sources, including especially here in Texas.

To get from here to there in the energy transition, we’re on a path to use a lot more lithium, a central ingredient in the lithium-ion battery powering your utility scale batteries for renewable-energy storage, your Tesla, and also your iPhone.

The chart showing demand for lithium is a one-way line, straight up.

A McKinsey study from 2023 expects 27% annual growth of demand for lithium-ion batteries between 2022 and 2030.

The growth of batteries is closely linked to the growing demand for lithium, of which 90 percent is for electric vehicles and battery storage. As a result, the International Energy Association foresees an eight-fold increase in demand for lithium between 2023 and 2040.

The three largest sources of lithium mining are in Australia (33 percent), China (23 percent), and Chile (12 percent.)

The US hasn’t opened a lithium mine since the 1960s, and for a variety of good environmental reasons maybe we shouldn’t. Current techniques may make it impossible to onshore lithium mining to the United States – due to environmental concerns such as water contamination and injury to the landscape.

China currently dominates the lithium-ion battery industry, supplying 80 percent of batteries worldwide. It is also the largest lithium refiner in the world. Average prices for lithium were five times higher in 2022 than 2021.

Texas Monthly article

So, back to the Texas Monthly article, which is excitingly titled “The Lone Star Lithium Boom,” and the story is quite cool as well. A Baylor-trained chemist living in northeastern Texas developed a process – a while ago – for extracting lithium from briny water. He set up a company called International Battery Metals (IBAT) to commercialize his patented process.

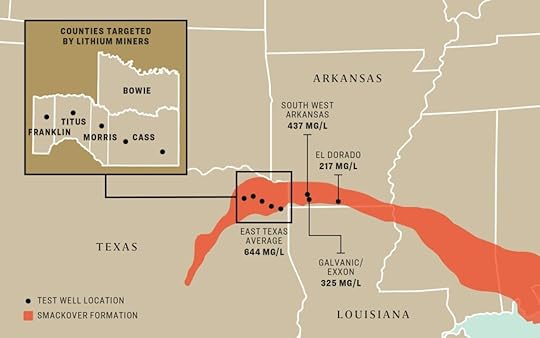

Map from Texas Monthly: Shows area of high lithium concentration in briny water in these areas in red

Map from Texas Monthly: Shows area of high lithium concentration in briny water in these areas in redThe other weirdly exciting Texas angle is that a large southern swathe of Arkansas and northeastern Texas is unusually rich in the briny water that makes for concentrated lithium extraction using his technique.

According to the article, IBAT recently opened its first commercial lithium-extraction operation in Utah this summer. Meanwhile a Norwegian oil company has partnered with an Arkansas-based company that has a similar lithium extraction method. They are aggressively leasing briny water acreage in East Texas. Reuters reports that Exxon Mobil also has big plans in a section of Arkansas to begin lithium extraction.

Houston-based companies SLB and Occidental, plus Saudi Aramco and the Abu Dhabi National Oil Company all have indicated interest in lithium extraction, giving further credence to the large scope of the opportunity. A further hope and claim of lithium-extraction from briny water is that it avoids the high environmental impact of traditional mining.

As a hot tip, Is this a good investment?

In the specific sense of one man’s entrepreneurial quest to invent and perfect a process to respond to a global market opportunity – it’s undoubtedly super risky as a standalone investment. IBAT in particular is a penny-stock company listed on the Canadian Securities Exchange, a situation which always gives me the ick.

On the other hand, you can’t help but cheer for a guy who was super early in developing a process that might respond to a megatrend of the next decade, and has many giant companies looking to get in the game.

Malthus versus reality

My biggest takeaway from this story is renewed optimism. A few years ago a frequent complaint about the energy transition was that the rare metals required to make large-scale batteries and other high-tech hardware were located in dangerous or unfriendly countries, creating a choke point against progress.

But you know what? When the demand gets high enough and prices respond, entrepreneurs get busy finding new ways to solve most any choke point.

In the late 18th Century, economist Thomas Malthus proposed a view – totally wrong as it turns out – that scarcity and increasing shortages of vital goods would be the fate of humanity as our population grew. The Malthusian worldview – proven wrong over and over again – often dominates our expectations for the future.

“Peak Oil” has been declared numerous times since the 1970s. Decelerationists and anti-growth people often adopt a Malthusian mindset – this idea that the world is running precipitously towards a commodities cliff, after which declining living standards will follow scarcity and shortages. Instead, our actual lived experience – decade after decade, century after century – has been one of increasing abundance since Malthus. Abundance not just of food but also fresh water and sources of electricity and all the things that make humanity materially better off generation after generation.

This is the right framing of the lithium story. Step 1: Demand explodes for lithium due to the innovative roll-out of batteries to solve a huge number of human problems in the twenty-first century. Step 2: Prices of lithium rise fivefold in response to the demand. Step 3: Some clever chemistry PhD develops novel extraction techniques. Step 4: If prices get high enough and the technology gets good enough, he could be rewarded handsomely. Step 5: In the meanwhile, others will follow his lead, improve upon the technology, provide massive amounts of capital if the price is right and the need is there, and discover commercially profitable ways to get the thing we need.

Incidentally, after a huge spike in price and demand for lithium in 2022, prices actually dropped 75 percent since the beginning of 2024. Commodity prices are notoriously volatile. As exciting as the future opportunity for lithium is, don’t go investing everything just yet based on the “one word” whispered to you at a cocktail party.

A version of this post ran in the San Antonio Express-News and Houston Chronicle.

Please see related posts

Solar I – The energy of the future (and always will be?)

Solar II – Tracking the rise of battery storage to see the future

Post read (0) times.

The post One Word For You: Lithium appeared first on Bankers Anonymous.

September 19, 2024

Ask an Ex-Banker: One Day Options Trading

Hey Michael!

I wanted to fill you in on something I have been playing with recently.

In February I used my margin account to buy 100 shares of ETF QQQ. [Ed note: This ETF tracks the tech-heavy Nasdaq 100 index.] Then immediately I sold a 1-day call at the next dollar value up and a 1-day put at the next dollar down price. If forced to buy, I immediately turn around and sell a 1-day call at what I think is a reasonable price. If all my shares were “called away”, I would simply sell puts. I have made $14,784 (cash, not paper profits) in just over 6 months without using a penny of my own money. This total includes capital gains/losses, put premiums, call premiums, and margin interest charged. I understand that if I had just bought and held the original 100 shares, I would have made $6,200 profit on paper. That pales when compared with what I have done. And also, I don’t research or try to outsmart anything. It takes about 3 minutes a day and is pretty mindless.

Obviously, it has been a wonderful market for 6 months, and I’m not suggesting you write about this for the general public. I just thought you might find it interesting and would welcome your thoughts. Even in a down market, it would create an income stream of about $100 a day in cash (even with paper losses) to pay bills etc.

If I ever got overloaded with too much QQQ due to exercised puts (i set my limit at 300 shares or about $135,000 on margin), I would stop selling puts.

I would love to see an article about my basic investing strategy of using put and call ladders on strong ETFs to force me to sell at high prices and buy at low, while creating an income stream and boosting yields.

Gerard van den Dries, San Antonio, TX

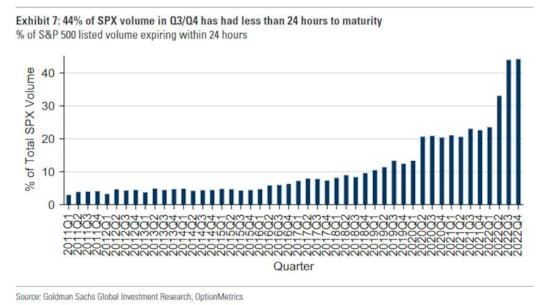

Thanks for staying in touch Gerard, and for your most recent idea, writing about short-dated options. I am particularly grateful because since early 2023 1-day option trading – also known as 0dte (short for “zero days to expiration”) – has dramatically surged among retail traders. Whereas short-dated options were only about 20 percent of options trading volume until 2022, it now makes up 45 to 50 percent of the options trading on stocks. Regulators have taken notice, and frankly they are worried. The former SEC Chairman Jay Clayton has called “0dte options” gambling, and thinks they should not be allowed.

To briefly review options terms: When you sell a 1-day put, that means your broker has the right to sell you that ETF, which they only do if it drops in value over that day. When you sell a 1-day call, that means your broker has the right to buy the ETF from you, which they only do if it goes up in value over that day.

0Day-to-expiry Options trading has soared, as % of all options trading

0Day-to-expiry Options trading has soared, as % of all options tradingI have lots of thoughts on options-trading as a strategy, a business I used to be involved in on the brokerage side as an institutional bond salesman.

Before I get into my actual reaction, it’s worth acknowledging the advantages you cite:

1. You are only spending 3 minutes a day on it and not doing any research, which implies many could use this same strategy to profit.

2. Your investment returns have been well over twice what they would have been if you just bought and held the same ETF.

3. You have created a system by which, because of the forced buying and selling, you will automatically buy low and sell high, which is highly enviable.

4. Finally, you are using borrowed money, so you don’t have to put up money in advance, an attractive feature as well.

Ok, on to my views of this as a strategy, both for you in particular and for the people who are participating in this massive surge in 0dte trading we’ve witnessed in recent years.

Your experience has been very positive and profitable. But in no way would I endorse this.

Risk Profile

I think the risk you are taking when you sell options has the profile of an insurance company. That is to say, you take in small premiums most days, earning the steady income you like. Then, every once in a while, a big move happens and you have the potential to lose big.

This works in the insurance industry best (and is ultimately survivable only) with unlimited funds relative to the size of the bets.

A sudden downward move, or multiple down days, could leave you owning a lot of QQQ with losses on your ownership. It is good that you have a limited size of QQQ beyond which you wouldn’t purchase more or write additional put options. Investment returns will also be magnified, for good and evil, when you buy on margin.

A structural problem of you earning premiums like an insurance company is that your broker is buying the insurance from you. They have the computing power to price this attractively for them, over the long run. You should not assume they are mispricing the insurance they are buying from you.

I’m not saying you should never do this. Based on our previous conversations, I know you have a very conservative approach to spending, and you’ve very likely accumulated sufficient investment capital that allows you to take a gamble. I would just say emphatically that this is a gamble, in a way that boring old buy-and-hold can feel like a gamble in the short run but in the long run is an investment. With options trading, there is no long run. It’s only a series of short-run gambles. I believe that in the long run and on average, options trading like this will not lead to gains. The primary winner will be the firm that bought insurance from you.

I acknowledge that has not been your experience so my advice doesn’t match up with your observed profits.

Market environment

I fear that this strategy works well in particular market environments, and not others. The ideal environment for covered-options selling is steady and upward trending. Which is mostly what we’ve had in 2024.

The first two days of August however started with the Nasdaq 100 down about 5 percent. It’s that kind of action, especially if it continues, which can lead someone to get wrecked.

We generally won’t know when we’ve shifted from one phase (steady and upward trending) to the other phase (volatile and downward trending) until it’s already happened to us.

Options trading in general

As a general rule, I can’t endorse retail – meaning non-professional – options trading.

Certain options strategies, like selling uncovered calls, have unlimited losses as a possibility. You have limited your risk there by owning the underlying QQQ before you sell a call, which is good. Other options strategies, like selling puts, also have nearly 100% loss-of-principal possibilities. You limit your risk there by keeping your bet sized appropriately. Purchasing calls and puts that expire worthless also have the possibility of 100% loss of investment. Unlike buy and hold investing, options trading is always a short-term and zero-sum gamble.

Short-term gambles can be fun. I play poker with the neighborhood dads. I even periodically make a pilgrimage to Las Vegas to lose sums larger than I can efficiently lose to the neighborhood dads. But I distinguish my fun gambles from good investment strategies.

From other conversations we have had, and since you personally limit the size of your gambles, I think you will be fine. I just would not recommend this as a general strategy for most people to pursue.

A version of this ran in the San Antonio Express News and Houston Chronicle.

Please see related post

Post read (0) times.

The post Ask an Ex-Banker: One Day Options Trading appeared first on Bankers Anonymous.

September 18, 2024

Book Review: On The Edge, by Nate Silver

Nate Silver published On The Edge: The Art of Risking Everything on August 13th and, well, I knew I had to jump it on the top of my reading list.

Silver is best known for creating the election-forecasting blog FiveThirtyEight, which he reconstituted on Substack in 2024 as The Silver Bulletin.

For newspaper-reading political obsessives like me, it’s Nate Silver’s world between now and November 5th, and we’re all just living in it. He aggregates and weights polling data, inputs other calibrated factors into his model, and suggests a probabilistic approach to electoral college results.

In his new book, Silver gives coherence – and the name “The River” – to a community of practitioners and thinkers who I admire, and who I try to channel in my own writing.

Silver’s thesis is that there is a particularly successful and newly salient group of people from a variety of walks of life who share a common epistemology.

Epistemology is the 50-cent word for a theory of knowledge or a way of thinking.

The River

So this group, the River, primarily shares a way of thinking about risk.

Among other things, they think probabilistically about risks in rational and objective ways, rather than emotional or traditional ways. They compare the probability of success versus the size of the rewards. They specifically seek to take risks when there is positive expected value – where the size of the reward is big enough to overcompensate for the probability of failure. They are competitive. They are strategically empathetic, by which he means they try to see how the other side of a contest is thinking. They update their views when new data comes in. They try to not be overly wedded to one world-view or one model of how things work. They can be contrarian in the face of societal consensus.

The meat of the book is derived from interviews and observations of people who share this epistemology from the worlds of technology, private equity, trading, gambling, cryptocurrency and artificial intelligence. Silver is a member of The River, so he’s eager to explain the advantages of this method, as it serves him and others well when investing, gambling, sports-betting, election-model building or other risky endeavors. He’s also a careful journalist and writer, so he sifts through – especially in later chapters – how this type of thought can go wrong for individuals or the world.

Nate Silver

Nate SilverFor an example of the latter, you get in this book very close-up conversations with Sam Bankman-Fried before, during and after his spectacular cryptocurrency rise with FTX, and his subsequent fall and fraud conviction.

You also get the most in-depth explanation of the rise of artificial intelligence I have read to date, including an attempt at a technical explanation of how large language models (LLMs) like ChatGPT work for a non-technical reader like myself. You’ll get far more poker history and lore and strategy than you’ll ever need, as well as the methods and thought process of a sports better.

My Own Retrospective Guide

Narrative, connectivity, identity, justice, and status-quo pattern recognition, are examples of other useful intellectual techniques common in academia, government, and journalism. They also may be at odds with the hyper-rational, probabilistic, contrarian risk-orientation of The River.

What I hadn’t expected is that Silver’s new book would provide a kind of retrospective guide to my own mental aspirations when writing this column. I naturally gravitate to stories about practitioners from The River, probably because I think it’s a great corrective to the typical epistemology of traditional journalism.

While there are quite a few members of The River and an extensive philosophical tradition – as explained in detail throughout On The Edge – the vast majority of us do not apply enough of these thought processes.

Silver dedicates two chapters to the rise of artificial intelligence, and especially the worries of leading rationalists like Eliezer Yudkowsky who see an existential threat from AI, something I became alarmed about last year.

Silver is a major advocate for prediction markets like Manifold, Polymarket and PredictIt, which allow the collective bets of crowds on outcomes in a probabilistic manner, and with which I’ve become obsessed in the past few months.

The River’s way of thinking informs my view of why retail options trading is not likely to be profitable in the long run.

My views on the organization GiveDirectly – which attempts to bring a rational and probabilistic mindset to philanthropy – stems from this same impulse.

The Recent Texas Lotto Example

This one didn’t come from Silver’s book, but an excellent Hearst investigation of a lottery scheme in Texas is one of the best recent examples of River vs. non-River thinking from the Lone Star State.

The most commonplace piece of personal finance wisdom is to never buy lottery tickets. And this is true, you should not, precisely because the “expected value” of every lottery ticket you’ve ever bought is less than the price you pay. The more tickets you buy, the more you will lose over time, like any other game of chance at the casino. This is Expected Value 101.

On the other hand, if there were a theoretical lottery game in which the payout had a positive expected value, then you should play that lotto. In the real world this is extremely rare, and requires specific circumstances and some sophisticated techniques.

The investors and implementers behind a lottery scheme in 2023 are an example of people from The River who know how to calculate and exploit expected value opportunities, even with lottery tickets. You should look up the Hearst investigation yourself as its quite interesting, but the short version is this:

For the April 22, 2023 Texas Lotto drawing, an investment group managed to spend an estimated $25.8 million to purchase every numerical combination possible in order to guarantee a win of the $57.8 million lump sum offered by the Texas Lotto, plus smaller prizes as well. Their expected value calculation depended upon the payout getting very large over many months without a jackpot, plus their confidence they had solved the technological and logistical problem of buying up every number combination over the course of two days. They basically brought an Oceans 11 approach to winning the Texas Lotto, and it was all legal.

If you don’t know how to do that, you should not ever be buying lottery tickets.

As a p.s. to the story, the Texas Lottery Commission will probably change the rules to prevent this kind of exploit in the future.

Texas Lotto changes rules after a Houston Chronicle investigation

Improve Our Thinking

I’m not claiming to be particularly great at The River’s mode of thinking, but I am naturally attracted to it. I aspire to it.

My interest began as a childhood board game player, was enhanced by years working on Wall Street, and is kept percolating through hobbies like dabbling in poker, investing, and prediction markets.

I’ve been exposed enough to it throughout the years to see it as something that can give me, and other people, a possible edge in understanding the world. Whether you’re a member of The River already, or just want to avoid the pitfalls of conventional thinking, I recommend Nate Silver as your guide.

A version of this post ran in the San Antonio Express-News and Houston Chronicle.

Post read (0) times.

The post Book Review: On The Edge, by Nate Silver appeared first on Bankers Anonymous.

The Best Presidential Economic Policies

Last week I mentioned the worst economic proposal of the candidates, so in contrast today I’ll mention the best.

Democratic presidential nominee Kamala Harris’ plan to support the building of 3 million new housing units is it.

YIMBYism and Texas

One of my strongest held economic growth views, solidified over the last 15 years in Texas, is about housing.

My theory is entirely too reductive, but I have come to believe that the key to Texas’ astonishing economic strength is housing, and specifically the ease with which it can be built. This keeps housing affordable relative to other places, which attracts newcomers, which in turn spurs growth, in a virtuous cycle of economic development.

By contrast, I moved here from New York City 15 years ago. A big reason why housing is so expensive in New York, and California, and my hometown in Massachusetts, is that it’s too darn difficult to build new housing. There is something about all the zoning, the regulations, the permitting, and the scope for local objections that all adds up. A culture of NIMBY (Not In My Back Yard), expressed by both local government and by neighbors able to block new projects, prevails. The local administrative state raises the cost of new construction to the point where housing is chronically underbuilt in those areas. Which leads to unaffordable housing.

The backlash movement to this chronic problem, whose worldview I have come to adopt, is known as YIMBY (Yes In My Back Yard).

Texas, in contrast to these high-cost-of-housing places, seems highly capable of increasing housing supply as the demand increases. I think the state’s YIMBY approach is really working here. Sometimes (again, I know this is too simple, but I like simple) I think efficient home building is the single greatest comparative advantage of Texas versus slower-growth places.

Harris’ housing policy

So that’s the background to my excitement over Democratic candidate Harris’ policy announcement this month of a plan to encourage 3 million more housing units to be built.

She got this one right

She got this one rightAs a former Democratic Senator from California, the epicenter of NIMBY, Harris was not necessarily an expected advocate for YIMBY zoning reform. Which, from a messaging perspective, might make it even more important. Democrats at the national level seem to be getting the message.

In 2022, the Biden administration announced a federal focus on affordable housing as a mechanism for making housing more, well, affordable.

Reading that laundry list of 2022 “pro-housing” policies feels extremely on-brand for traditional Democratic thinking, which is to say, the proposal and implementation of 33 distinct well-meaning, micro-targeted programs across the federal bureaucracy and throughout different parts of the country, each of which might do something positive but none of which trust anything could happen without creating a new governmental carrot or stick to make that very specific thing happen.

[Note to Ric/Editor: I know that previous sentence is ridiculously run-on, but it’s my attempt at having the sentence style match the content point, if that makes sense?]

Policies like new incentive grants to rehab outdated affordable housing. Help for rural counties to build multi-family units. Promotion of R&D in modular housing. Finalization of rules about “income averages.” The eyes glaze over. I hope that all did something positive? I don’t know.

The Harris announcement in August 2024 is much better.

It starts with the correct big idea, which puts “building more homes at the center of their economic agenda because rents are lower and homes are more affordable when we build more housing.”

Yes.

Compared to 2022, the Harris campaign proposes a far more markets-based solution to building millions more housing units. Their new message is a classic YIMBY agenda: lower the costs and time to build by dropping zoning, permitting, and review processes. If you increase the supply of the thing (Yes! Wow! Amazing!) prices stay low. Also, how to do this?

Specifically, her campaign proposes to incentivize regional and local authorities to lower many of the barriers to building. Exempt projects from very slow environmental review. Change HUD codes to expand the types of houses that can be built. Streamline permitting to speed up construction. Accelerate historical preservation processes that often trip up rehabilitation of properties.

Each of these is thematically linked to pro-growth YIMBYism and just actually better than the 2022 ideas. It’s about getting the regulatory state out of the way to allow the construction sector to do its thing, faster and cheaper.

Housing policy wonks have responded very positively to the Harris proposal, and are somewhat shocked that it has become a key plank of her campaign.

Trump, by contrast, is no YIMBY. He has made “protecting suburbs from apartment buildings” a talking point of his campaign, which is a classic NIMBY move. Trump is on the wrong side of this, choosing to use fear-based language aimed at suburban voters. The way you “protect suburbs from apartment buildings” is you impose NIMBY regulations.

Directionally, the GOP has been committed to the idea that the government is best when it does the least, which should have a YIMBY flavor to it when applied to local zoning and permitting rules around new construction and property rehabilitation. So you might have expected the Trump campaign to be better on this than the Harris campaign. But it’s not.

To be clear, I don’t endorse the view that local government regulation has to be minimized in all or even most situations. I’m just saying that in the case of housing we have a notion about what smaller-government GOP plans ought to be, or could be. It’s what has been going on in GOP-led Texas. The Texas model – pro-growth, pro-development, light regulatory-touch, light zoning – gives us a hint of what could be.

But as far as I can tell, Trump has no “build baby build!” plans when it comes to housing in America, just a nod at NIMBYism.

Harris’ centering of this pro-growth housing approach has the potential to signal to Democratic-led areas – like California, New York, and my hometown in Massachusetts – a better way.

It’s not like we have lost the knowledge or willingness to build housing. It’s just that we have allowed a NIMBY set of policies to get in the way of lower-cost housing and therefore national economic well-being.

A version of this ran in the San Antonio Express News and Houston Chronicle

Please see related posts:

The 2024 Presidential Candidates’ worst economic ideas

Post read (0) times.

The post The Best Presidential Economic Policies appeared first on Bankers Anonymous.

September 12, 2024

The Worst Presidential Economic Policies

Let’s talk about the Presidential candidates’ worst economic ideas.

My preference when reading about presidential candidates is to focus less on the name-calling and memes, and more on their stated plans for improving the odds of positive economic outcomes for Americans during and after their administration.

When candidates propose something new, they should figure out if the policies would do more harm than good. Trump’s tariff plan, and Harris’ plan to fight food prices, each land somewhere between bad and catastrophic.

Trump’s Tariffs

Republican nominee for President Donald Trump has proposed a 10 percent tariff on all important goods from outside of the country, and a 60 percent tariff on all goods from China.

The stated purpose of these tariffs is to raise revenue that could replace other taxes such as income tax, plus protect domestic businesses and address a trade imbalance with China.

There is near-universal agreement among economists that even before a trade war – and indeed this would prompt a response from all trading partners and trading rivals – the tariffs would effectively raise prices on US consumers. This would kick off an immediate round of inflation and impose a $300 billion tax on the US economy, according to the Tax Foundation.

To the extent that tariffs boost domestic production, they would fail to raise revenue. To the extent they raised revenue, the price hikes would be felt by consumers as inflation. Domestic manufacturers that depend on intermediate goods produced outside the country would also pay higher prices and feel that same inflation.

That’s all very predictable even before we get to the secondary effects, such as the offshoring that our domestic manufacturers would do to avoid the 10 percent tariff. And the tertiary effects, which would be a Trump administration poised to “cut deals” and grant tariff exceptions to companies and industries that it favors for whatever reason, legitimate, political, or nefarious. The opportunities for corruption would multiply along with the bureaucratic barriers to trade.

To lend some nuance to my critique of Trump’s plan and the role of tariffs: Certain specific industries should get tariff protections or outright trade restrictions, plus domestic subsidies, if it is truly a matter of national security or the industry represents a key strategic chokepoint.

A consensus among economists has shifted over the past decade to recognize that protecting a domestic computer chip industry for example, or protecting our capacity for domestic military manufacturing, is necessary for national defense. But these industries are rare and strategic.

Trump’s impulse toward national strength and bolstering domestic manufacturing has led him too far and is deeply misguided. The effects of blanket 10 percent tariffs on importations would be catastrophic for consumers and for practically every medium and large business in the country. The inflation effects would be massive and permanent.

Harris’ War on Food Prices

In mid-August Democratic presidential candidate Kamala Harris unveiled a series of economic plans, the worst of which is an intention to fight “corporate price gouging” on food and groceries. Her plan did not come with specifics, but it’s nonsensical on its face.

To fight “price gouging” you have to be willing to impose “price controls.” And price controls will do more harm than good when it comes to food and groceries.

I don’t doubt Harris’ team poll-tested this idea and found it a winning argument among their likely or persuadable voters. But if so, their electorate is wrong.

Price controls involve monitoring for rule breaking. Price controls means regulators have to weigh in on the fairness of prices. Did the company raise its prices – on any number of (hundreds? thousands?) of grocery items for a legitimate or a non-legitimate reason? Who is to decide and how? You will need a massive and intrusive bureaucracy to police this.

Companies will then anticipate government intrusion, probably err on keeping prices artificially low in the short run to avoid penalties, and then pretty soon you would see scarcity on the shelves because keeping that grocery item stocked is a money loser. Consumers – all of us – could be catastrophically affected.

The goal of announcing a plan to fight “price gouging” is presumably to be seen as responsive to the very unpopular bout of inflation we experienced in 2022 and 2023. But there is literally no evidence that inflation is caused by mythical “greedflation” by corporations, and instead is caused by loose monetary policy, expansive fiscal policy, and corporations trying to adjust, survive, and thrive in a changing environment.

To take one salient example of price rises for a grocery item:

Two years ago the price of a dozen eggs briefly became an economic meme and supposed evidence for inflation and/or greedflation. It was a classic gross misunderstanding, or purposeful manipulation, of the story of how supply and demand works. An avian flu wiped out about 100 million egg-laying hens since early 2022. Once the flu receded, prices dropped in late 2023. They have recently risen again as avian flu outbreaks have recurred. But at no point in this fluctuating supply story would price controls have helped the situation. Lower prices for eggs imposed on grocery stores would simply discourage chicken farmers from reinvesting in rebuilding their flocks. Eggs will be plentiful and affordable again when the market gets back to equilibrium.

If you take the price-gouging idea and start believing price controls on consumer goods are the answer to the problem, then you’ve lost the thread. Slippery slope arguments are usually mistakes, but I’m going to acknowledge where our brains go with the slippery slope logic. You’ve already thought of the words “Venezuela” and “Cuba” before you read them here. Those countries have a lot of price controls and it’s not helping the average person’s standard of living.

Harris further offered support for “smaller food businesses” as part of a plan to bring down prices. The instinct for smaller obviously codes as a populist appeal against big business, but defies common sense. Any consumer knows that if you want the lowest prices, you’re going to Costco, Wal-Mart, or in Texas specifically, an HEB Plus-type store. Basically as big box as it gets. The Harris campaign probably knows that “Support your big box store!” is not an appealing electoral pitch, but is usually how we get lower prices in reality.

Smaller food suppliers usually correlates with higher prices. Micro suppliers like farmers markets will happily sell you a delicious $6 tomato – and that has its own aesthetic and ethical appeal – but most of us cannot afford buying in bulk at that kind of smaller-food business more than once in a while. I can’t really see how the federal government supporting smaller food businesses is moving us in the direction of lower food prices.

Like Trump’s tariffs, Harris’ focus on lowering food prices has a gut appeal (pardon the pun) but an obvious misunderstanding of how markets work in reality.

To return to the idea of price controls and to moderate my critique for a specific consumer sector, price-regulating of medications (by contrast with groceries) can be extremely important because

1. Pharmaceutical companies do hold legal monopolies (in the form of patents) so price-gouging in those markets can be a real thing, and

2. People buying life-saving drugs are truly vulnerable. Insulin is not a luxury good. Your expensive cancer treatment is not your consumer choice, it’s a life-saving necessity. These are complicated trade-offs but pharma is in a different category than highly competitive and substitutable markets like food and other groceries.

I hope the sophisticated advisors for our main Presidential candidates realize the folly of these populist proposals which defy common economic sense.

A version of this ran in the San Antonio Express News and Houston Chronicle

Post read (0) times.

The post The Worst Presidential Economic Policies appeared first on Bankers Anonymous.

September 6, 2024

Break Up Google

August was a busy news month.

The most impactful story for all of our lives is that the federal government won its landmark case against Google, with a district court declaring the company a monopoly. We don’t know yet what the court will order Google to do, nor how Google plans to fight the ruling in coming years. Still, this case may change everything about our tech landscape in the coming decades.

GOOGLE! Too Big!

GOOGLE! Too Big!The federal government also has ongoing anti-competitive lawsuits pending against mega-tech companies Apple, Amazon, and Meta (the parent of Facebook, Instagram and WhatsApp). These cases potentially build on one another. The Google ruling depended for precedent on a Microsoft ruling from 2000. The government’s win against Google strengthens its cases against Apple, Amazon, and Meta.

Implications

I believe this will be very good for markets in the long run, in the sense that successful capitalism requires innovation, which may itself require forcibly busting up giant companies every once in a while. It could be bad for US stock market investors in the short run, with its extraordinary top-heavy reliance on a few monopolistic tech giants.

My beliefs are based on past reading on the regulation of monopolies and technology innovation, which provides historical context.

The Microsoft precedent

The previous tech bubble of 1999/2000 was kicked off by the IPO for Netscape and the subsequent “browser wars.” That era concluded with Microsoft being sued by the federal government, found to be a monopolist in April 2000, and ordered to break up in June 2000.

MICROSOFT! Avoided break-up for being too big in 2020

MICROSOFT! Avoided break-up for being too big in 2020In the end, Microsoft appealed the ruling and was not ultimately broken into two companies as it had been originally ordered to do. There are many steps still to come before Google is broken up. Still, observers believe that, because of its loss in court, Microsoft moderated its behavior and did not come to dominate the nascent internet in 2000. Remember Internet Explorer? Yeah, me neither. The rise of Amazon, Apple, Facebook and Google themselves may be owed to the fact that Microsoft did not successfully win the browser wars and manage to shut down internet innovation with its own dominance.

Regardless of the future for Google, an optimistic view on the recent monopoly ruling is that this loss in court will open up pathways for competitors to grow and compete in search, advertising, and possibly AI services.

Monopoly theory evolved

The big thing to know about the Google ruling is that the Department of Justice and Federal Trade Commission are working on a relatively novel theory of monopolies. This is the biggest win for their novel approach in 25 years.

Interestingly, in a society increasingly inclined to view everything under a partisan lens, all of the federal investigations of Big Tech for monopolistic practices began under the Trump administration’s Department of Justice and Federal Trade Commission. The Biden administration continued the investigations and launched each of the lawsuits, except for the one against Meta, which began in December 2020 under Trump.

A simple version of the novel theory of monopolies – laid out in a book I have previously recommended called “The Curse of Bigness” by Timothy Wu – is that sheer size is its own problem when it comes to tech companies.

[LINK to October 2021 column on Tim Wu’s book: https://www.expressnews.com/business/business_columnists/michael_taylor/article/Taylor-Antitrust-action-is-not-anti-business-16528601.php]

For decades prior to this argument, the FTC generally didn’t pursue this type of monopoly case. Instead, the bar for proving monopolistic behavior was that consumers were being harmed, usually through higher prices. Companies like Amazon and Google seem to bring lower prices, so have long fought off the idea that they are monopolies.

AMAZON! Too Big!

AMAZON! Too Big!Lina Khan, the Chairman of the Federal Trade Commission, was brought aboard in 2021 specifically to pursue these anti-trust cases against big tech companies.

Khan made her reputation as a law student in 2017 initially by arguing that Amazon was a monopolistic threat to businesses, despite the fact that

1. Amazon probably reduces consumer prices overall and

2. Amazon faces extraordinary competition in each of its market segments.

So why is sheer size its own problem? A monopolist we assume will act in its own interest. Its interest is sometimes to destroy competitors and squash any threats from innovation, which big companies can typically do successfully against small and medium-size companies. And that’s pretty much it.

We can’t reliably know what innovations come next. But certainly telecommunications, software, retail, and artificial intelligence should continue to evolve and improve in the coming decades. Breaking up overly large companies that have formed tech monopolies is a way to shape the commercial landscape so that innovation can happen.

Lina Khan heads up the FTC

Lina Khan heads up the FTCNo business likes to be attacked by the federal government, and no monopolistic company will take this lying down. They will all fight vigorously against accusations of monopoly power.

Even while I cheer the break-up of Google, and possibly the other giants, I have no ill-will toward them.

I’m typing this column into my Google Docs account, saving it to my Google Drive while checking my Google Calendar and using Google Search continuously throughout the day, before I Gmail the column over to my editor or go on YouTube to watch some important video.

Google is convenient, excellent, universal, and mostly free. But if Google’s current dominance prevents the emergence of the next world-beating technology – as monopolies typically have the power to do – then this ruling is good news.

I’m also cheering this news knowing that it could cause rocky times for the stock market.

Implications for the Magnificent 7

The other three companies being sued – Amazon, Apple, and Meta, along with Google parent Alphabet, NVIDIA, Microsoft and Tesla – constitute the so-called Magnificent 7 stocks that have absolutely determined and dominated returns of the S&P500 and Nasdaq 100 over the past three years.

The last time the government found the most important tech company of the time – Microsoft – a monopolist in the Spring of 2000, things got volatile and scary. The Nasdaq dropped more than 36 percent in 2000, 32 percent in 2001, and 37 percent in 2002. Obviously the Microsoft story was not the only thing going on then. But the volatility of early August 2024 is a reminder that markets do not like uncertainty and they generally do not like governmental attacks on highly successful companies. So maybe we are in for some rocky days with respect to these court cases.

A version of this post ran in the San Antonio Express-News and Houston Chronicle.

Please see related post:

Book Review: The Curse of Bigness by Timothy Wu

Post read (0) times.

The post Break Up Google appeared first on Bankers Anonymous.

August 14, 2024

Averting College Financial Disaster – Barely

My family dodged a major financial catastrophe this Spring.

I have one large point to make about the difficulty of making optimal personal finance choices within one’s own family. In the telling of the story, I slip in some small points about paying for college and updates to 529 education savings accounts.

This story ends well, but for a while it looked like we were totally cooked, financially.

Pursuing one’s dream

In November 2021 we did an official campus tour of highly selective out-of-state private University A. Old buildings, beautiful weather. Incredible foliage. Everything you’d want based on the brochures. My daughter, early in her high school career then, fell in love. I think it was the foliage. University A became her top choice from then on.

You might think allowing her first to fall in love with, and then second to apply to, a private out-of-state university was the original sin we committed. You wouldn’t be wrong. On the other hand, she has told us for at least the past four years that going to college out of state was a primary criterion. We respected that. Also in our defense we had not been totally irresponsible with funding her 529 account, which we started when she was 1.5 years old. The account had grown to something substantial.

A gorgeous building at University A

A gorgeous building at University AUnfortunately, the sticker price of higher education for private universities has also grown, but to absurd heights, over the last 20 years. What normal family can afford this? If you haven’t checked lately, the all-in cost (tuition, room & board, books, fees, insurance and transportation) is about $90 thousand per year. Multiplying that by 4 years gets you to $360 thousand for an undergraduate degree. What even? Huh?

Briefly about 529 Accounts

529 accounts are merely fine investment vehicles. They are better than nothing. They are inferior to retirement accounts like 401Ks or IRAs.

I advise parents who have to choose which bucket to place their scarce investment dollars to fund their own retirement accounts more generously than their child’s 529 account. The tax advantages, opportunity for employer-matching, and long-term growth are all superior in retirement accounts as compared to a 529 account.

Another long-time knock on – or at least fear about – 529 accounts was that overfunding these accounts could leave dollars stranded, unusable for education purposes. I know that’s possible because two different families I am close to – relatives of mine – have overfunded their kids’ 529 accounts.

A 2024 change in 529 rules has made these accounts somewhat better and reduced the risk of “stranded money.” I’ll describe the rule change below.

But first, back to my daughter’s college journey.

She received a number of college acceptances this Spring, including her dream school, University A. Yay!

Because of its prestige, it has a policy of not offering merit scholarships. This is typical of highly selective universities in which the admission office essentially says “all of our accepted students have extraordinary merit,” so nobody gets money on that basis. Boo!

University B – With a generous merit scholarship!

University B – With a generous merit scholarship!She also got into University B with a very generous merit scholarship. For social and sporting reasons she also strongly considered University C, which offered a decent scholarship. In April of this year she had narrowed down her choice to A, B, or C. All three out of state, and private. The sticker prices for each is wildly high, but because of the three different merit scholarships, A, B, and C had totally different actual costs for our family.

The difference between finance rules and real life

With my finance-guy hat on, I know the cost of private out of state college is utterly ridiculous. Unconscionable. Absurd. Specifically, University A would cost us more than twice the amount that we had saved up over 17 years.

University C was also in the mix as an attractive option

University C was also in the mix as an attractive optionBut I am not only a finance guy. I am also a dad and a husband. And something strange happens when you try to apply finance-guy rules to real life choices for people who you love more than anything in the world. The rules melt away in the face of your most precious relationships.

[A reader recently wrote in to chastise me for making certain choices with respect to home equity line of credit debt, which isn’t in line with theoretical best practices. That’s right, I have done that. I will continue to deviate from best practices at times. Other criteria are sometimes preferable to the finance theory.

I know deep in my bones the personal finance rule that for a student – and her parents – going into extraordinary debt for undergraduate education is not a wise idea. And yet, when it came to the moment for my daughter to decide on college before May 1st, 2024, we did not insist on her choosing the optimal financial strategy.

We said she could choose University A.

My wife and I were those parents who did not enforce the right thing financially. Because of the crazy cost of private higher education, we faced taking on six-figure debt to make her dream come true. To paint a slightly fuller picture of the University A scenario, we also would have required our daughter to borrow the full amount of Federal unsubsidized loans under her own name, which adds up to $27,000 over four years. Which is also not optimal.

Financially, this was nuts. Emotionally, however, we were not willing to deny her a chance to pursue her dream.

The new 529 to Roth IRA rules

As I promised, I also have a small point to make about paying for education. That is, while 529 accounts aren’t amazing, they just got incrementally more flexible in 2024. That’s a good thing. Beginning in 2024, surplus funds – by which I mean money in a 529 account that will not ultimately be spent on the beneficiary’s education – can now be repurposed in a very advantageous way.

Surplus 529 account funds can be contributed to a beneficiary’s Roth IRA, with certain restrictions in the fine print, as follows.

First, the 529 account must have been open for a minimum of 15 years. Next, the lifetime limit for moving surplus 529 funds to a Roth IRA is $35,000. At the current annual individual contribution limit of $7,000, it would take at least 5 years to max out this 529 to Roth IRA conversion opportunity. In addition, the IRA beneficiary must have earned at least the contributed amount of income in the year it was contributed. So for example, a student earning $3,000 in income during a calendar year could only contribute up to $3,000 to her IRA that year. Finally, funds in the 529 have to have been in the account for more than 5 years before turning them over to the beneficiary’s Roth IRA.

These are a lot of conditions to satisfy. The purpose of all these persnickety rules is to make sure the 529 account is not being used as a backdoor Roth IRA funding loophole.

This 529 to Roth IRA rule is available this year for the first time in 2024.

Which is very very good! Because we got lucky and our daughter decided to give up her dream of University A in favor of University B. With University B, because of their generous merit scholarship, we will have funds left over in her 529 account at the end of 4 years.

In my family’s particular case, we satisfy all the persnickety conditions, so we are eligible to help fund our daughter’s Roth IRA, up to $35 thousand dollars, in her early working years.

This is all subject to change if she chooses instead to go to graduate school or some other educational opportunity that is more attractive than funding her Roth IRA. She starts University B in a few weeks. Hopefully she’ll have a Roth IRA funded after her first 5 working years as well. We got lucky and it was a very close thing.

A version of this post ran in the San Antonio Express News and Houston Chronicle

Post read (0) times.

The post Averting College Financial Disaster – Barely appeared first on Bankers Anonymous.

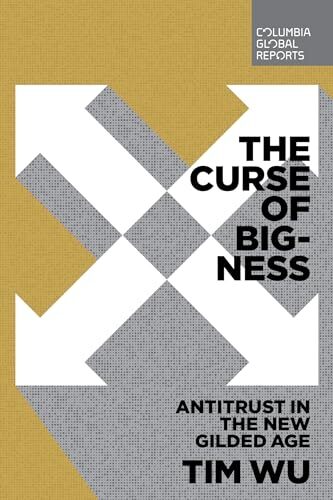

Book Review: The Curse of Bigness by Timothy Wu

Editors’ Note: I wrote this for my column in the San Antonio Express-News back in October 2021. After the ruling of Google as a monopolist in August 2024, I realized I hadn’t posted it here yet. Whoops.

Prior to a few weeks ago, I was not overburdened with any particular bias or knowledge when it came to antitrust law and how it affected US businesses. If anything, I start with a bias that regulators should butt out of markets whenever possible.

Then I read a short book.

Version 1https://amzn.to/3WNHgWK.0.0

Version 1https://amzn.to/3WNHgWK.0.0And now I recommend you read this small book, weighing in at a slim 139 pages, Tim Wu’s The Curse Of Bigness: Antitrust in the New Gilded Age.

This book not only has changed my mind about what is likely to happen during the Biden Administration. It also has changed my mind about what ought to happen.

Antitrust, I see from Wu’s history, is something that enhances markets. It improves competition. It’s usually fought tooth and nail by the target company but it can be something necessary for an industry as well as for consumers. I had not expected to come to this conclusion.

We sort of, kind of, remember that the first wave of trust busting involved the dismemberment of John D. Rockefeller’s Standard Oil into 34 regional oil companies. Far from wrecking the oil industry, the break-up in 1911 of Standard Oil kicked off a robust national oil industry of competitive and innovative firms in the US.

Exxon, Amoco, Marathon Oil, and Chevron among others thrived in the over one hundred years since. Compare those to the lumbering national giants like Mexico’s Pemex, Venezuela’s PDVSA, or Saudi Arabia’s Aramco and you would always choose our market structure over theirs. You can see in them what a problem leaving Standard Oil’s monopoly would have been.

Or take the case of AT&T, the last great antitrust break-up, in 1982. This is the most convincing part of Wu’s book, in which he connects the dots between monopoly power, innovation, and the need for antitrust regulation to improve markets. AT&T never would have chosen the path of breakup if President Nixon hadn’t initially brought antitrust action against the company in 1974.

Before its breakup, AT&T had a monopoly on long distance telephony, local distance, and all equipment that could be plugged into a phone jack. It jealously killed off innovators that threatened any of its control, like tiny MCI trying to innovate with microwave towers. As Wu tells it, cutting-edge technologies of the early 1980s – like answering machines and fax machines! – would have been quashed or controlled by AT&T. The ability to innovate with modems, to eventually allow home computers to connect to “online service providers” like Compuserve and AOL, was only made possible by breaking up AT&T’s monopoly power.

Timothy Wu. Law Professor and author

Timothy Wu. Law Professor and authorHaving read Wu’s book, however, I’m jumping on the antitrust train.

Wu argues that Europe and Japan in the 1980s largely left their national telephone monopolies in place. Japan – a tech innovator in the 70s and 80s – suddenly found itself leapfrogged by independent US telephone, and then computer, companies. Nippon Telephone and Telegraph retained its size and monopoly power for too long. As Wu writes “There is, after all, only so much you can do when your innovations need to be engineered not to disturb the mother ship.”

It’s hard to imagine counterfactuals, but the sheer size and control that AT&T had over telecommunications until 1982 meant that all the innovation that followed in the United States might never have happened, were it not for antitrust actions begun by Nixon.

Fast forward to the late-1990s. Microsoft nearly established monopoly control over the internet and search engines by crushing the startup Netscape, and bullying its way to 90 percent share of browser usage with Internet Explorer. Google and Amazon and Apple too at that point were merely scrappy medium-sized companies. After years of antitrust litigation, and an ultimately rescinded order to break up, Microsoft ceded space in the browser and search wars. (Just imagine if Microsoft hadn’t backed down. We’d all be using Bing today for search. Ugh. Bing is awful.)

Now we have today’s Big Tech monopolists. Like Amazon, Apple, Alphabet (aka Google), and Facebook.

Don’t get me wrong, I love these companies. They are extremely customer-friendly. I use their products every day. I am grateful for the convenience and services they provide.

I am convinced by Wu that their size alone justifies their breakup. Notice, I did not say “destruction.” Just separation into smaller, non-monopolistic parts, like what happened to AT&T and Standard Oil.

Currently, the antitrust train against the sheer size of Big Tech is gathering steam in state capitals and Washington DC.

Their size is why Texas Republican legislators teamed up with Governor Abbott to warn large social media companies that any perceived political biases will be punished and regulated. Their size is what made the recent “60 Minutes” whistleblower story resonate, in which a former employee said Facebook purposefully emphasizes hateful and anger-inducing content, because it’s better for increasing engagement with the platform. Their size is why, when Facebook and Instagram suffered an unexpected outage recently, the schadenfreude was palpable. Many of us use these companies but we also rightly fear – and truth be told – loathe them a little bit.

Their extraordinary control over speech and media is what so angered President Trump and conservative supporters when Trump was de-platformed following the January 6th riots.

Sen. Josh Hawley goes after Big Tech

Sen. Josh Hawley goes after Big TechConservative Senator Josh Hawley (R-Missouri) pushes his “Trust-Busting Agenda For the 21st Century.”

The language on his website, calling out Google and Amazon in particular, seems straight from Wu’s book. On September 30th he introduced legislation to allow parents to sue social media companies if their children were harmed.

In the wake of the temporary Facebook/Instagram outage, progressive Representative Alexandra Ocasio-Cortez (D-New York) took to Instagram to call for breaking up Facebook, Instagram, and WhatsApp, due to their size.

Rep. AOC calls for Meta break-up

Rep. AOC calls for Meta break-upYou could almost ignore these calls as fringe political voices. But you shouldn’t. The antitrust calls will soon be coming from inside the White House. Tim Wu joined Biden’s National Economic Council as Special Assistant for the President for Technology and Competition Policy. I don’t believe Wu joined just to have a job. Stuff’s going to happen.

Having read Wu’s book, The Curse of Bigness, I want stuff to happen. Bigness is its own threat. Bigness ultimately quashes innovation. A better society, and a better market, requires governments to at times check the ambition, size, and voracious appetites of our biggest, and yes, most successful companies.

Don’t fear the trustbusters. We don’t know yet what tech marvels would be possible from the broken-up pieces of Google. Those software engineers don’t just go away. They probably just continue to invent, but without the innovation-squashing that incumbency and monopoly create.

Chop down the tallest tree and let the forest grow.

This post ran as a column in 2021 in the San Antonio Express News and Houston Chronicle.

Please see other Bankers Anonymous book Reviews – They’re all here!

Post read (0) times.

The post Book Review: The Curse of Bigness by Timothy Wu appeared first on Bankers Anonymous.

August 8, 2024

Solar II – When Energy Prices Go Negative

Texans should understand that we – despite our reputation for gas guzzling and oil drilling – are at the leading edge of the renewables-plus-battery-storage energy market in the country. We are likely to get to energy abundance here before anywhere else does.

How do we know we are at the leading edge? A few facts.

About half of the new battery storage capacity currently being built in the US is happening in Texas. Texas has 3.5 Gigawatts (GW) of storage capacity now, with the potential for about 10 GW installed by the end of 2024, or soon after.

The Electric Reliability Council of Texas (ERCOT) manages the flow of electricity in the state and tracks certain records over time. If you’d like to feel optimistic about the energy transition and energy abundance, you can see all that data regarding these records online.

Literally in mid-July ERCOT recorded its all-time record for solar energy generation.

Also June set the record for maximum wind energy generation.

Meanwhile power storage usage hit a record in May.

Below I explain a bit about why utility-scale battery storage capacity is the key to tracking and understanding the growth and potential future impact of renewables.

Texas’ Future Electricity Market – Look to Europe

European markets are ahead of the US in terms of electricity available from utility-scale batteries, with an estimated 36 GW compared to about 15 GW total in the United States at the end of 2023.

European markets have some lessons to teach us about what may happen with pricing and availability of electricity as solar and storage get built. It’s pretty exciting, although it comes with hiccups.

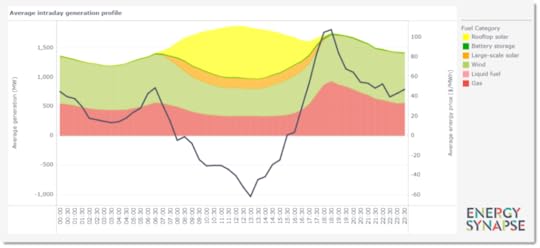

Electricity Prices Go Negative in South Australia when the sun shines brightly

Electricity Prices Go Negative in South Australia when the sun shines brightlyOne fact to know is that wholesale energy prices fluctuate throughout the day.

A second fact to know is that already-installed solar has close to zero marginal cost to generate additional power. You can’t turn off the sun, and electricity produced on bright days has to go somewhere. So producers have a need to offload electricity generated, somehow, into the grid.

Because of this need to offload power, In the middle of the day wholesale electricity prices approach zero or actually frequently turn negative, in certain markets where solar capacity has outstripped storage capacity. The number of observed “negative wholesale energy prices” days is rapidly increasing in Europe as well as in Australia.

This has been happening in Germany – the country with the most solar capacity in Europe – for a few years. It started happening in Spain in 2024. The country had prioritized solar production, but not battery storage. It actually kind of freaks them out.

A negative wholesale electricity price literally means the producer will offer electricity for free or pay to offload energy.

Utility-scale Battery Storage: A key to energy abundance

Utility-scale Battery Storage: A key to energy abundanceEnergy market observers may remember the day on April 21 2020 – early COVID 19 pandemic days – when demand for fuel got so low that a refinery in Oklahoma was paying people to remove their physical oil in barrels. That’s sort of the analogy of negative electricity prices for solar. Somebody’s got to take the energy off the hands of the producer when there’s too much of it.

To be clear, extremely low or negative energy prices for solar producers are not great for the system. If you’ve built a solar plant but then spend many days of the year giving away your electricity for free – or worse, paying others to take it – that’s not good. In the long run this removes incentives to build more solar power generation and it could bankrupt producers.

In the short run, negative wholesale electricity prices are a big problem. In the long run, it’s a huge opportunity. In the long run there’s the possibility of extraordinary energy abundance.

So who might be willing to be paid to take energy, or can receive free electricity during the middle of the day? Utility-scale battery storage operators. A low or negative wholesale electricity price for battery storage operators is amazing, as long as storage providers can resell that electricity into the grid a few hours later when the sun goes down.

Currently, Spain is scrambling to invest in battery storage. Texas seems to have already figured out the future need, and the buildout is happening now.

So what happens when utilities can access very affordable energy for significant hours of the day during a significant number of days of the year? It can’t help but keep demand and therefore prices for other energy sources in check. Solar and wind plus battery storage is nowhere near sufficient yet in Texas, but rapid growth means we should see some effects soon.

When we learn about this price-arbitrage trade of battery storage operators – store free energy from the sun and sell it a few hours later at a markup – we might be tempted to object: Profiteering!

That’s probably the wrong response. Our best response is to celebrate those early profits, as they will lead to further solar and battery investment and further downward pressure on wholesale energy prices. Which eventually links to energy abundance as well as dampened consumer energy prices to keep our utility bills manageable.

“Energy transition” in 2024 has more to do with renewables making up a larger portion of the energy mix, even while both fossil fuel supply and demand continue to grow. The rapid growth of solar and battery storage is largely a move toward energy abundance and keeping prices low, more than reducing fossil fuel usage outright.

A version of this post ran in the San Antonio Express-News and Houston Chronicle

Please see related post

Solar I – Energy of the Future (and Always Will Be?)

Post read (4) times.

The post Solar II – When Energy Prices Go Negative appeared first on Bankers Anonymous.