Jimmy Song's Blog

March 7, 2025

Free Trade, like Open Borders, Doesn’t Work Under Fiat Money

Libertarians believe in open borders in theory. In practice, open borders don’t work, because, among other things, the combination with a welfare state creates a moral hazard, and the least productive of society end up within the borders of welfare states and drain resources. The social services are paid by the productive people of the country or, in the case of most fiat systems, by currency holders through inflation. Welfare states are much more likely under fiat money and the redistribution goes from native taxpayers to illegal immigrants. Thus, under fiat money, open borders end up being an open wound by which the productive lifeblood of the country bleeds out, despite the theoretical trade-efficiency benefits. As libertarians like to say, open borders and the welfare state don’t mix. In this article, we’ll examine the other sacred cow of libertarian thought: free trade.

Free Trade without Libertarian Ideals

Free trade is very similar to free movement of labor in that it works great in theory, but not in practice, especially under fiat money. In a libertarian free-market world, free trade works. But that assumes a whole host of libertarian ideals like sound money, non-interfering governments, and minimal aggression. Once those ideals are violated, such as with government intervention in the market, similar moral hazards and long-term costs come with them, making free trade about as libertarian as a fractional reserve bank.

An example will illustrate what I’m talking about. Let’s say Portugal subsidizes their wine for export to other countries. The obvious first-order effect is that it makes Portuguese wine cheaper in France, perhaps undercutting the price of French wine. Libertarians would say, that’s great! French customers get cheaper goods, so what’s the problem?

As with any government intervention, there are significant second- and third-order effects in play. Subsidization puts unsubsidized companies at risk, perhaps driving them to bankruptcy. In this case, this might be a French wine maker. Subsidized companies may become zombies instead of dying out. In this case, this might be a Portuguese wine maker that was failing domestically but survives by selling to customers abroad with government subsidies. While French customers benefit in the short run with cheaper prices for wine, they are ultimately hurt because the goods that would have existed without government intervention never come to market. Perhaps French wine makers that went bankrupt were innovating. Perhaps the resources of the zombie Portuguese wine maker would have created something better.

Further, the dependency of French people on Portuguese wine means that something going wrong in Portugal, like a war or subsidy cuts, disrupts the supply and price of wine for France. Now France must meddle in Portugal internationally if it doesn’t want the wine supply to get disrupted. The two countries get entangled in such a way as to become more interventionist internationally. A war involving Portugal now suddenly becomes France’s business and incentivizes military aid or even violence. As usual, the unseen effects of government policy are the most pernicious.

Not Really Free

In other words, what we call free trade isn’t really free trade. A country exporting to the US may subsidize their products through government intervention, making the product cheaper in the US. This hurts US companies, and they’re forced into choices they never would have had to face without the foreign government intervention. But because the good is crossing borders under the rubric of “free trade,” it’s somehow seen as fair. Of course it’s not, as government intervention distorts the market whether it’s done by our own government or a foreign government.

So why would a foreign government do this? It gets several benefits through targeted market manipulation. First, it makes its own companies’ products more popular abroad and conversely, makes US companies’ products less popular. This has the dual benefit of growing the foreign government’s firms and shrinking, perhaps bankrupting, the US ones.

Targeted subsidization like this can lead to domination under free trade. It’s not unlike the Amazon strategy of undercutting everyone first and using the monopoly pricing power at scale once everyone else has bankrupted. The global monopoly is tremendously beneficial to the country that has it. Not only is there significant tax revenue over the long term, but also a head start on innovations within that industry and an advantage in production in the adjacent industries around the product.

Second, the manufacturing centralization gives that country leverage geo-politically. A critical product that no one else manufactures means natural alliances with the countries that depend on the product, which is especially useful for smaller countries like Taiwan. Their chip manufacturing industry, holding 60% of global supply (2024), has meant that they’re a critical link for most other countries, and hence, they can use this fact to deter Chinese invasion.

Third, because of the centralization of expertise, more innovations, products, and manufacturing will tend to come within the country. This increased production has cascading benefits, including new industries and national security. China leads the world in drone technology, which undoubtedly has given it an innovation advantage for its military, should it go to war.

Fourth, the capital that flows into the country for investing in the monopolized industry will tend to stay, giving the country more wealth in the form of factories, equipment, and skills. While that capital may nominally be in the hands of foreigners, over time, the ownership of that industry will inevitably transition toward native locals, as the knowledge about how to run such industries gets dissipated within the country.

Currency Devaluation: The Universal Trade Weapon

It would be one thing if only a specific industry were singled out for government subsidies and then the products dumped into the US as a way to hurt US companies, as that would limit the scope of the damage. But with currency devaluation, a government can subsidize all of its exports at the same time. Indeed, this is something that many countries do. While short-term, this helps US consumers, it hurts US companies and forces them into decisions that aren’t good for the US.

To compete, they have to lower costs by using the same devalued currency to pay their labor as their foreign competition. That is, by relocating their capital, their manufacturing, and even their personnel to the country that’s devaluing the currency. Not only does relocating reduce labor cost, but it also often gets them benefits like tax breaks. This makes US companies de facto multinationals and not only makes them subject to other jurisdictions, but ultimately divides their loyalties. To take advantage of the reduced labor, capital must move to another country and, along with it, future innovation.

Such relocations ultimately leave the company stripped of their manufacturing capability in the US, as local competition will generally fare better over the long run. Much of the value of the industry then is captured by other governments in taxes, development, and even state-owned companies. Free trade, in other words, creates a vulnerability for domestic companies as they can be put at a significant disadvantage compared to foreign counterparts.

Hidden Effects of Foreign InterventionUnlike the multinationals, small companies have no chance as they’re not big enough to exploit the labor arbitrage. And as is usual in a fiat system, they suffer the most while the giant corporations get the benefits of the supposed “free trade”. Most small companies can’t compete, so we get mostly the bigger companies that survive.

The transition away from domestic manufacturing necessarily means significant disruption. Domestic workers are displaced and have to find new work. Factories and equipment either have to be repurposed or rot. Entire communities that depended on the manufacturing facility now have to figure out new ways to support themselves. It’s no good telling them that they can just do something else. In a currency devaluation scenario, most of the manufacturing leaves and the jobs left are service-oriented or otherwise location-based, like real estate development. There’s a natural limit to location-based industries because the market only grows with the location that you’re servicing. Put another way, you can only have so many people give haircuts or deliver packages in a geographic area. There has to be some manufacturing of goods that can be sold outside the community, or the community will face scarce labor opportunities relative to the population.

You also can’t say the displaced workers can start some other manufacturing business. Such businesses will get out-competed on labor by the currency-devaluing country, so there won’t be much investment available for such a business, and even if there were, such a business would be competing with its hands tied behind its back. So in this scenario, what you end up with are a large pool of unemployed people whom the state subsidizes with welfare.

So when a US company leaves or goes bankrupt due to a foreign government’s subsidies, the disruption alone imposes a significant short-term cost with displaced labor, unused capital goods, and devastated communities.

MitigationsSo how do countries fight back against such a devastating economic weapon? There are a few ways countries have found around this problem of currency devaluation under free trade. First, a country can prevent capital from leaving. This is called capital controls, and many countries, particularly those that manufacture a lot, have them. Try to get money, factories, or equipment out of Malaysia, for example, and you’ll find that they make it quite difficult. Getting the same capital into the country, on the other hand, faces few restrictions. Unfortunately, the US can’t put in capital controls because dollars are its main export. It is, after all, the reserve currency of the world.

Second, you can compete by devaluing your own currency. But that’s very difficult because it requires printing a lot of dollars, and that causes inflation. There’s also no guarantee that a competing country doesn’t devalue its currency again. The US is also in a precarious position as the world’s reserve currency, so devaluing the currency more than it already does will make other holders of the dollar less likely to want to hold it, threatening the reserve currency status.

So the main two mitigations against currency devaluation in a free trade scenario are not available to the US. So what else is there? The remaining option is to drop free trade. The solution, in other words, is to add tariffs. This is how you can nullify the effects of foreign government intervention, by leveling the playing field for US manufacturers.

Tariffs

One major industry that’s managed to continue being manufactured in the US despite significant foreign competition is cars. Notably, cars have a tariff, which incentivizes their manufacture in the US, even for foreign car makers. The tariff has acted as a way to offset foreign government subsidies and currency debasement.

The scope of this one industry for the US is huge. There are around 300,000 direct jobs in auto assembly within the US (USTR) and there are an additional 3 million jobs supplying these manufacturers within the US. But the benefits don’t end there. The US is also creating a lot of innovation around cars, such as self-driving and plug-in electric cars. There are many countries that would love to have this industry for themselves, but because of tariffs, auto manufacturing continues in the US.

And though tariffs are seen as a tax on consumers, US car prices are cheap relative to the rest of the world. What surprises a lot of people when they move from the US to other countries is finding out that the same car often costs more abroad (e.g. 25% tariffs keep U.S. prices 20% below Europe’s $40K average, 2024). The downside of tariffs pales next to the downsides of “free trade.”

Free Trade Doesn’t Work with Fiat MoneyThe sad reality is that while we would love for free trade to work in the ideal libertarian paradise, it won’t in our current fiat-based system. The subsidization by foreign governments to bankrupt US companies or to make them multinational, combined with the unfortunate reality of the US dollar being the world reserve currency, means that free trade guts the US of manufacturing. Tariffs are a reasonable way to protect US manufacturers, particularly smaller ones that can’t go multinational.

What’s more, tariffs make the US less fragile and less dependent on international supply chains. Many of the wars in the past 60 years have been waged because of the entanglements the US has with other countries due to the reliance on international supply chains. Lessening this dependency, if only to prevent a war, has clear value.

Lastly, labor has been devalued significantly by fiat monetary expansion, but at least some of that can be recovered if tariffs create more manufacturing, which in turn adds to the demand for labor. This should reduce the welfare state as more opportunities are made available and fewer unemployed people will be on the rolls.

ConclusionFiat money produces a welfare state, which makes open borders unworkable. Fiat money also gives foreign governments a potent economic weapon to use against US companies, and by extension the labor force that powers them. Though currency debasement and capital controls are available to other countries as a defense, for the US, neither of these tools is available due to the fact that the dollar is the world reserve currency. As such, tariffs are a reasonable defense against the fiat subsidization of foreign governments.

[image error]May 8, 2024

On Memecoins

The VC token industry is not what it was in 2017 or even 2021. Back then the newbies to the “crypto” space trusted them to give recommendations on what to buy and what to not buy. Fortunes were made by crypto VCs as almost anything they promoted would be bought by the gullible public and subsequently pump. They made money on all kinds of tokens, from EOS, to IOTA, WAX and STEEM. Those were the golden days when they had influence in the market.

The crypto VC influence has significantly waned the last few years and the days of making 30x on an ICO are long over. Their reputation since has been sinking faster than Bill Cosby’s, as the market that they built their funds on got away from them. In a sense, though, they deserved it, as pretty much everything they pumped did horribly, and the promises of these tokens about as likely to be fulfilled as a Kardashian wedding vow. The run they had was unbelievable, fueled by a ZIRP environment and insane FOMO, but when the altcoin market started going south, their prospects crashed along with them.

The Demise of VC TokensDespite their struggles, Venture Capital benefit from the fact that it’s a lagging industry. They typically raise the next fund while the iron is hot, and can raise crazy amounts during these bull cycles. They can survive a long time on their 2% yearly management fee, even as their 20% of profit looks increasingly unlikely. Crypto funds have all done terrible the last few years and most of them are deeply underwater.

The few coin pumps that they’ve tried have more or less died before they had any chance to pump, BitClout and WorldCoin being two notable examples. VCs poured a lot of money into these things, hoping to bring back the good old days, only to find that the market no longer trusted them. And who could blame the market? The coins they pumped previously were down significantly in USD terms, and in BTC terms, they looked like the Venezuelan Bolivar.

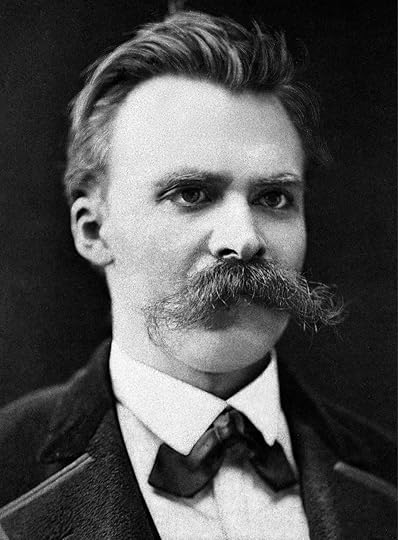

The Rise of MemecoinsBut that doesn’t mean altcoins went away. Memecoins obsoleted the VCs and ultimately brought some more honesty to the Neitzchean will-to-power games that were always being played. The original memecoin, of course, was Dogecoin, and Elon Musk pumped that thing like a hot air balloon, and surprisingly, the market followed. What Dogecoin did was to lay bare what was actually going on in the altcoin markets. The narrative didn’t matter and it was all a power game, a Keynesian Beauty Contest, and mob rule. These “blockchain” use-cases were about as realistic as a Milli Vanilli comeback, so in a sense, the altcoin market reduced to its essence.

Dogecoin was also notable because it cut out VCs. It was a retail phenomenon and VCs for the most part, didn’t get into it. How could they? These are people that supposedly figure out what the future is going to look like and invest accordingly. There’s no expertise, no due diligence and no market research needed in a memecoin pump. VCs don’t have any special access or insight in the memecoin market and they didn’t provide anything of value to the pumpers. They got cut out as middlemen.

Doge was followed by Shibu Inu and its success rapidly rendered VCs completely unnecessary. The game that was being played didn’t require large injections of capital, just the appropriate buzz and enough marketing to achieve escape velocity. Shibu pumped purely as a meme, copying Dogecoin and it similarly required no VC pumping to succeed. And with that, VCs became the cable news of the altcoin industrial complex, where the only attention they garnered was from their deluded peers.

A New CycleWe’re now in an environment where memecoins have become the altcoin pump and dump of choice. Indeed, just about the only coins this cycle that are pumping are either memecoins or platforms for memecoins.

For what it’s worth, memecoins seem to have a similar dynamic as other altcoins, in that a few mainstays seem to hold significant mind share while everything else dies a quick death. What’s different is that because these memecoins don’t have large marketing budgets, they get to their dump phase much quicker.

All this is good. The altcoiners are in a sense a lot more honest this time around. There’s no grand promises of crazy applications using blockchain, or disrupting some industry. The people that are getting into memecoins know that it’s a gambling vehicle and that they’re playing a greater fool game. There’s little deception in PepeCoin or DogWifHat because they’re not claiming any utility or even a future.

And don’t feel sorry for the VCs. They are reaping the rotten fruit of hype and fraud that they’ve sowed. Many have destroyed their reputations pumping useless stuff and the fact that no one is listening to them is the market functioning properly.

There’s also a lot less waste of developer time. Instead of altcoin platforms wasting developer time on barely working, insecure projects, they’re eschewing utility altogether for “fun.” The entire altcoin industry has been about gambling and now, everyone knows.

In the end, memecoins make Bitcoin look better and better.

[image error]April 19, 2024

Halving Fee Chaos

The Bitcoin halving is an anticipated event, one of those Bitcoin holidays that happen every once in a while. Along with Soft Fork Activation and various financial instrument introduction days, it’s one of those not-quite-predictable days that occur every few years which give Bitcoiners reason to pay attention and mainstream media to speculate.

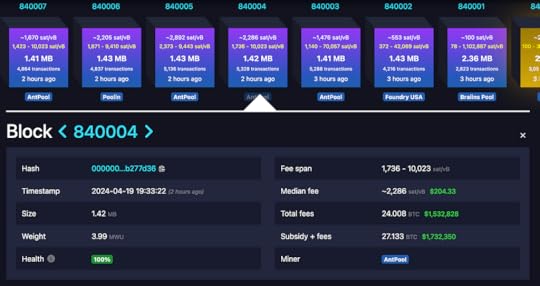

This year’s halving was much anticipated, as halvings usually are, but we had a bit of an incident that requires some further explanation. The block subsidy decreased from 6.25 BTC to 3.125 BTC on block 840,000 as expected, but what wasn’t expected was the 37.626 BTC in fees that came along with it. To give some context, that’s easily the highest ratio of fees to block subsidy that Bitcoin has ever had. One transaction paid nearly 8 BTC in fees by itself.

More FeesIt wasn’t just block 840,000 that had high fees, over the next 5 blocks, we had fees of 4.486, 6.99, 16.068, 24.008 and 29.821 BTC respectively. The fees are the highest it’s ever been. This situation in Bitcoin is unprecedented.

Up to this point in Bitcoin’s history a block whose fees were higher than block subsidy were pretty rare. There were a few in the 50 and 25 BTC eras, but these were mistakes by the user (usually forgetting to put in a change address) and almost all of the fee came from a single error transaction. In the 12.5 BTC subsidy era, there were a few transactions toward the end of 2017 when the cumulative fees exceeded the 12.5 subsidy. In the just-ended 6.25 BTC subsidy era, there were many blocks during the ordinals craze which exceeded the 6.25 BTC subsidy.

Still, these were relatively rare, and most blocks even in the most recently completed era mostly didn’t exceeded 1.5 BTC. Yet in this new era of 3.125 BTC subsidy, every single block as of this writing (block 840018) has had fees exceed the subsidy, some by many multiples. So what happened? Why was the halving block getting so much in fees?

RunesThe reason has to do with a new protocol called Runes. It’s yet another colored coins protocol on top of Bitcoin that Casey Rodarmor designed back in September of 2023. The main idea is to allow coin issuance on Bitcoin that uses the UTXO set natively.

Now to back up a bit, colored coins have been around for a long time. The main idea is that you can “color” certain Bitcoin transaction outputs as meaning something in addition to the Bitcoin amount in the output. It could be another “asset” and issued as a token. The first implementation of such a protocol happened 11 years ago in 2013 and there have been many attempts since, including MasterCoin (renamed Omni), CounterParty, and more recently, RGB, Taro Assets and BRC-20.

As Rodarmor states in his blog, his motivation for making another protocol is to bring some of the asset issuing from other chains to Bitcoin. To make the launch of this protocol more interesting, Rodarmor decided to start the issuance on block 840,000, leading to the chaos we saw.

Simplification vs Game TheoryCasey Rodarmor is also the creator of ordinals, and he took one of the concepts, which was to name assets using the capital latin alphabet on Runes. This is a normal fine choice, but what happens when there’s a conflict? If two assets have the same name, how do we distinguish between them?

To simplify things, the protocol just looks up what assets exist already and if the name conflicts with something that exists, then the new asset isn’t issued. This indeed simplifies the client and gives a global unique name to each asset. Unfortunately, it also makes for some terrible incentives.

Sniping Asset IssuanceThe first incentive problem is that if the transaction issuing the asset is sent out to the Bitcoin mempool, then as that transaction is gossiped to nodes around the network, other observers can snipe the name by getting the transaction in earlier.

Now “earlier” in Bitcoin is a strict concept. Blocks are ordered and transactions within a block are ordered. Whichever comes first gets the symbol and the asset issuance. But if you want to squat on a good symbol name, you can just look for mempool transactions that are attempting to create a new asset and create your own with a bigger fee. That’s the essence of sniping.

What’s really terrible about a situation like this is that both transactions will likely go into the block, but only the first will successfully issue the asset. The second will not issue the asset but still pay the fee.

Miners generally order transactions by fee rate, so a higher fee likely means that they’ll get to issue the asset. I say likely, because there’s a second incentive problem here I’ll discuss later. But game-theoretically, both participants are incentivized to increase fees continually to one-up each other. The dynamic is similar to the One Dollar Auction, where participants end up making rational choices, but end up with an irrational result (like paying $1.50 for $1). Every loser pays lots in fees for nothing.

Second order Game TheoryNow given this first-order incentive playing out, it’s not a surprise that a lot of issuers purposefully put in a very high fee initially to discourage anyone from trying to snipe the symbol. After all, if your sniping attempt fails, then you lose out on the fees you tried to snipe with. There’s also a significant uptick in the usage of RBF for this reason, so that you have the option to one-up the sniper and the sniper to do the same to the issuer.

Note that RBF isn’t useful here to get out of paying the fee, as a replacement transaction has to pay more than the previous transaction in fees. Either way, the miner ends up with the fees.

Now back to the miner’s role. The miner can, if it so desires, give preference to the lower fee transaction by including it earlier in the block. Indeed, the incentive is to give miners off-band fees if possible to order transactions in such a way as to win by not revealing how much you’ve paid. Miners in this protocol have a lot of leverage.

ConclusionRunes have resulted in some really high fees, though it’s hard to know if the design was intentional or unintentional. What we do know is that Runes have been hyped up for the last few months and have been anticipated for a while, and certainly being one of the first assets issued under the protocol has some marketing value for the eventual goal of getting them listed on an exchange.

Sadly, in addition to the normal scamming of altcoins being completely centralized, there is a deeper cost in terms of block space congestion, where fees of 1000 sats/vbyte are currently not enough to get into certain blocks. The Runes asset issuance has overridden almost every other use case at the moment.

That said, the current rate of Runes issuance is completely unsustainable. Just in the first 18 blocks, there’s been over $20M in fees spent, most of that in Runes issuance. At this rate, Runes issuers would be spending $150M a day or $1B a week. I honestly can’t see them doing this for much longer than a month or two. In the meantime, it must be great to be a miner finding these blocks.

[image error]April 11, 2024

Privacy is a Social Good

When we think about privacy, it’s usually in the context of an individual being able to hide something, usually from the government, but also from lots of other entities. It’s a security issue in the greater discourse because there are bad people that can and will use information about you to reveal embarrassing information, blackmail, or even steal from you.

This is not just true of criminals, but also of companies and even governments. They can and do use information about you to propagandize you or demand taxes from you. These are, of course, understandable concerns and good reasons to want privacy.

Status GamesBut there’s another aspect of privacy which is just as important, perhaps more important than these and it’s the social dynamic at play.

Privacy, you see, is a necessary buffer between people to keep order. This is because people are, in the end social creatures and in every social group, there is a constant jockeying about for position, what I would call status games being played.

The problem with status games is that they are by nature zero-sum. Whoever is at the top is usually both admired and envied, while whoever is at the bottom is generally pitied. This is especially true when the participants can change their position, whether through achievement, violence or politics.

Envy and ResentmentToo much clarity on the status of individuals in the group causes strife in the form of envy. This is not just for people at the bottom, whose envy of everyone above them is understandable, but also for those near the top, who likewise will envy people above them. A big enough group of disaffected people in a status game will cause some form of revolution. In other words, strictly ordered status games are not stable.

Thus, too much information sharing is bound to cause bitterness and resentment which in turn causes unstable organizations because humans are very status-aware. Marxism tries to solve this by making everyone equal, but of course, this doesn’t work because the entity which controls this equality ends up being higher status than everyone else. You cannot have full transparency and social order. There will be too many dissatisfied people.

This is where privacy is important because it gives groups ambiguity about where each individuals stand. For example, most social groups in the US have as a default, social standing that corresponds with their level of wealth. The richer you are, the higher on the status ladder you are and the poorer, the lower. A very strict pecking order where everyone knew exactly how many assets everyone had would breed a significant amount of envy and resentment. Any group where this level of transparency was required would be unpleasant to be in strictly for that reason. We need a level of ambiguity to socially interact in a reasonable way.

Decentralized Status GamesThat’s not to say that everything is completely obscured. Most people that have money signal in various ways, with their clothing, car, topics of conversation and so on. They signal with various levels of loudness and reveal status information to the people that they’re targeted at. One of the features of “old money” people is that they’re very good at identifying other “old money” people while simultaneously hiding their wealth from people that are not as rich as they are. In a sense, this is a survival mechanism because envy, bitterness and resentment are not pleasant to deal with and oftentimes dangerous.

Privacy is the ability to disclose information at our discretion, not someone else’s and that’s exactly what happens in groups to keep the peace. Privacy has deep social value because it gives individuals the discretion to reveal where they are relatively in status. That protects not just them from attack, but also protects the group from upheaval. The less envy, bitterness and resentment there is, the more cohesive the group can be.

ConclusionPrivacy is a necessary part of civilization because cooperation is hard and nothing destroys cooperation like bitterness and envy. And those two in turn are caused by too much clarity on status. Privacy is what adds ambiguity and empowers individuals to calibrate group dynamics.

Privacy: it’s not just for cypherpunks anymore.

[image error]April 6, 2024

BTC Investing vs. BTC Standard

There’s a difference between investing in Bitcoin and being on a Bitcoin standard. It may seem like semantic hair-splitting, but it’s not, because the behavior of these two groups is very different, as is their mental model. In this article, I aim to explain what it means to be on a Bitcoin standard.

The Bitcoin InvestorsThe Bitcoin investors are the people that are looking for a dollar (or some other fiat money without loss of generality) return. Their base money is the dollar and that’s how they measure their wealth. That’s understandable, since that’s how they’ve been indoctrinated, but such a mentality is rigged from the start.

First, it’s hard to measure how much value your assets are increasing by. If you use strict dollar terms, you may have gained some percentage (say 30%), but over what time frame? If the asset is something like real estate, that may be over 10 years or 10 months. Obviously, the 10 months is better, but exactly how much of that value is real? How much can you buy with the returns and is the money you got back the same as the money you put in?

InflationBecause, of course, there’s inflation to consider. Investing with the dollar as the base asset means you have to account for it. If you have an investment that goes up 30% at the same time that inflation is 30%, you haven’t actually gained anything. In fact, due to capital gains taxes, you likely have lost value.

Then there’s the question of what measure of inflation to use. Many investors use the CPI-indexed dollar to measure how much they’ve gained. But this too is flawed because the CPI is a gamed metric. There are hedonic adjustments that the Bureau of Labor Statistics puts in almost arbitrarily to output a CPI to be lower than the actual prices. So if your investment merely kept up with CPI, you again probably lost ground in terms of purchasing power. It’s not a good measure.

Monetary ExpansionThe classical definition of inflation is monetary expansion and the M2 money supply is a popular metric to measure that. It was $287B in 1959 and was $19.4T in 2021 (more on that in a bit), so annualized, that’s about 7% per year. If you use that metric, most investments look pretty terrible. You’re most likely losing ground because it’s hard to get 7% every year consistently, even on average. Financial advisors use that 7% number to measure themselves and most don’t meet that mark. So if your investment keeps up with M2 monetary expansion, you have merely kept the numerator up in proportion to the denominator. Again, because of capital gains taxes, you’ve probably lost ground in terms of percentage of money supply.

But even here, the stats are not great. The Fed discontinued the M2 in 2021 and came up with something called the M2SL, likely to add more fudge factors that they can use for gaming the metric. Why would they do that? Because investors started measuring their returns against the M2. Especially during the pandemic, the M2 was going up so fast that most of the investment gains were known to be non-existent in M2 terms. So now, we have their modified measure of money supply called the M2SL. There are all sorts of problems with the M2 measurement, and aggregate statistics are notoriously unreliable. Hence, for investors, even this harsh measure is likely being gamed to make their gains look better.

The Bitcoin StandardSo what’s left? You can use gold or a cow or a custom men’s suit or even a big mac as a way to measure how you’re doing with your investments. They’re all useful ways to see how much purchasing power you have relative to points in the past, but all of them have flaws, are lagging indicators and are relatively easy to manipulate.

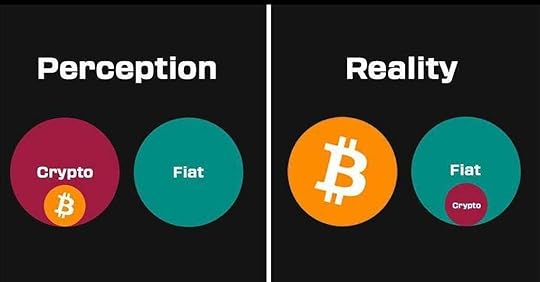

For the red-pilled investor, the real measure of wealth becomes Bitcoin because that’s the most difficult to manipulate. When you accept this, that’s when you are on a Bitcoin standard. In other words, Bitcoin becomes how you measure your investment gains, not the dollar, not the CPI-adjusted dollar or the M2-indexed dollar.

ConclusionThere are undoubtedly a lot of Bitcoin investors. Between exchanges, ETFs, even apps like Robinhood, Venmo and CashApp, there are a lot of people that own Bitcoin. But that’s not the same thing as being on the Bitcoin standard. The people that are most likely to hold for the long term are the people on the Bitcoin standard.

I know for myself that I finally flipped when I read Saifedean’s book by the same name. I have had a very different mentality about money since then and think of the dollar as the depreciating asset that it is. The measuring stick for me has changed. In economics, we would call that function of money the unit of account.

It’s been amazingly freeing because I don’t worry about my investments, mostly because I don’t have very many. I’m on a Bitcoin standard and I keep my value in my unit of account. We’re so used to being stolen from through the fiat system that we’ve learned to live with the debasement. Debasement is a continual and never ending burden.

The Bitcoin standard frees us from this investing burden. And it’s the game-theoretical end state of money. Hardest money wins. You can get there now or get there later.

[image error]March 29, 2024

“Free” is Slavery

Thae Young Ho is the highest ranking defector to ever have come out of North Korea. He was an ambassador to Sweden and then to England. At the Oslo Freedom Forum back in 2019, I got to talk to him for a few hours, and it’s a conversation I’ll never forget.

It’s rare that we get such a high ranking official to come out of the country to tell us how they operate, but Mr. Thae is one of those people. He was able to enlighten many of us what North Korea’s process for the currency revaluation was and why they backtracked. He also told us about how they had to execute someone so that the regime wouldn’t get blamed. If you read any works of Rene Girard, that shouldn’t surprise you, especially given that it’s an atheist country.

Kim’s Rise to PowerBut the story that struck me the most was about Kim Il Sung’s rise to power. Mr. Thae explained that after being installed as the hand-picked leader of North Korea in 1945, he wasn’t that popular. His Korean was marginal as he had grown up mostly in China. His education was a scant 8 years, all of it in Chinese and communist guerrilla tactics weren’t exactly beloved by the people. Yet if we look at how he’s looked at in North Korea today, he’s essentially viewed as a divinity. Somehow, this poorly educated, barely comprehensible puppet of the Soviet Union became the god of North Korea.

So what happened? How did he gain all that power? What did he do to take control? You would think that given what we’re generally told about communism that it would be based completely on fear and ruthlessness that consolidated his power. And certainly, there was plenty of that. But according to Mr. Thae, Kim Il Sung relied on something else: free stuff.

The Cult of FreeEveryone loves free stuff. Think about how popular the free stuff section on your local craigslist is. I’ll bet you anything it’s the most visited and monitored part of the site and rarely will you find stuff that’s that valuable that someone hasn’t taken already. It’s part of the human instinct to try to get something for nothing and Kim Il Sung exploited it.

As with most socialist/communist programs, the way he won over the North Korean people was with lots of entitlements. They got free health care, free food, free housing, a guaranteed job. They got everything they needed. And with Soviet subsidization, it worked great. People supported him and for a time, a lot of international observers thought that North Korea was doing better than the South.

But there’s a darker side to “free stuff.” What happens when they run out of a scarce resource? How do you determine who gets it? Say there’s medicine that will help two different people, but there’s only enough for one. Who gets it?

In a free market, prices help you decide that, and a high price spurs greater production of the scarce resource so that the prices come down. But if it’s free, what do you do? When you have a central controller of everything, the answer is obvious. You reward those that are loyal and punish those that are not. Instead of money being your currency, it was loyalty to the regime that was your currency.

Markets Build CommunitySoon, the only people that really got the free stuff were near the top of the ideological hierarchy. Instead of prices determining what you got, it was your perceived compliance and loyalty to the regime that determined it.

In the absence of a market, compliance was what determined who got what. Mr. Thae’s point of the story was that there’s something sacred about market transactions. Market transactions cause both parties to have obligations to the other. There’s a mutual desire to satisfy the other party and it binds us together in a community. That’s precisely what they lacked in North Korea and why the regime was so powerful.

It’s easy to listen to these stories and think of it as “out” there, that it’s got nothing to do with us. But after listening to this story, I started thinking about what stuff I got for free from centralized entities. I get GMail for free. I get Facebook for free. I get YouTube for free. I realized that the cost of getting these things was indeed compliance. In these walled gardens, they can kick you out at any time and that is indeed what they do. The reason why these companies have so much power is because they give you this stuff in exchange for compliance. They give you this stuff to enslave you.

Western GovernmentsFact is, there’s way more of the communist/socialist system of free embedded in our supposed democracies than we think. Remember during the pandemic how you had to get a vax to keep your job, visit your sick relatives or travel? There were people in the US suggesting that unvaxxed people should be denied health care services. Such tactics really only work when the service is “free.” The central controller of the resource extracts its pound of flesh, just not in money. Many governments have gone down this route. We’re much closer to communism in western societies than we’d like to believe.

Prices and paying for things are a good thing. They obligate both parties to the trade to satisfy the other. The instinct to get something for nothing is not one that builds civilization. The reason communism has led to tyranny every single time is because the central government ends up with all the resources and wields absolute power through “free” stuff.

Reject free. Pay for value.

[image error]March 21, 2024

Ordinals are a Fiat Scam

The past two years have seen a flurry of productive activity in the Bitcoin space. Taproot has brought in lots of new interesting possibilities from Schnorr Signatures enabling smaller on-chain lightning channel transactions to TapScript Merkle Trees bringing the innovative way to prove the execution of a program through BitVM. These are truly new and novel things in Bitcoin and they have been genuinely good for the Bitcoin ecosystem.

But that’s not the full story of the last two years in Bitcoin, and as much as I’d love to write about the actual innovation, I have to deal with the fake, stupid, immoral and fiat scam that is ordinals. It’s not a job that I enjoy, but given the asymmetry of the arguments, one side that’s incentivized to pump it against an unfunded debunkers who talk about it objectively, there’s some much-needed cold water that needs to be poured on their prospects and I’m here to deliver.

For most normal people, the idea of NFTs, unique digital property seems pretty dumb on its face. Whether it’s a jpeg or a short video clip or whatever, they rightly ask after having the whole concept explained to them, “wait, that’s it? I’m not missing something here?” I’ve written about them in the past, how they’re a vehicle for scams in much the same way altcoins are. I’d go so far as to call NFTs altcoins, as they’re an alternative and the T in NFT marks them as a coin. What’s especially confusing for normies is this concept of a bitcoin NFT or ordinals. Does that mean that somehow it’s better or purer than the ones on Ethereum or Solana? They’re not, but we’re getting ahead of ourselves. Let’s start at the beginning.

Trolls Gonna TrollThe whole “fad” started with Rod Armor, who inscribed a skull in using the witness discount in late 2022. It wasn’t really even noticed by the network as it was a mere 793 bytes, well within the normal range of transaction sizes.

What really got it going was Taproot Wizards group, who are a disaffected group of “former” Bitcoin Maximalists that wanted revenge after getting humiliated supporting a whole bunch of affinity scams like BlockFi, Celsius and of course, FTX. Their intent wasn’t to create a new asset class, they realized that inscriptions were the perfect vehicle to fill certain blocks with noise for the sake of making Bitcoiners angry. So they inscribed a 4MB jpeg in early 2023 and a new market to make Bitcoin Maximalists angry began, which by August 2023 was an insane 21 million inscriptions on the Bitcoin blockchain. Though the rhetoric now is that inscriptions were some sort of new thing being “built on Bitcoin,” nobody really noticed until this very obvious and continuous troll.

Also in early 2023, ordinals began, and given that there were a lot of degenerate altcoiners that would buy and sell pretty much anything, what got attention as a troll quickly pivoted to a business. BRC-20 tokens started soon after and stamps not much longer after that. Trading activity picked up and soon, they traded in various exchanges. And these trolls have definitely made some money, especially from VCs who are all too willing to sacrifice their Bitcoin bona-fides for the prospect of some ROI.

The troll put on a business suit and began arguing with Bitcoiners that they were a legitimate part of the Bitcoin ecosystem.

Ordinals, the argumentAsk any ordinals supporter why they think ordinals are good for Bitcoin and they immediately change the topic to “rights” and “you can’t stop it” and so on. Instead of telling Bitcoiners what they bring to the table, they focus on why the protocol doesn’t stop them. Like shop lifters in San Francisco, they don’t bring anything good to the table, so they focus the discussion on how there’s nobody that’s going to stop them from doing what they want. But of course, just because you can do something doesn’t mean you should. To paraphrase Chris Rock, you can drive with your feet, but that doesn’t make it a good idea.

In other words, they don’t have a good answer. They have bad ones, though, if you press them. Somehow it supports miners by giving them money. Or it undermines other altcoin launching platforms. Or making Bitcoin “fun.” All these are very weak arguments and they don’t talk about how their projects change the incentives or undermine the monetary use-case, which is why they don’t make them that often. The discussion they want to have is that they “can” inscribe or put ordinals or stamps on the Bitcoin blockchain, which as stated above is confusing could and should.

Why Are They on Bitcoin?My gripe with NFTs in general have been that there’s no technical reason for them to be on a blockchain. They’re already clearly centralized. They have an issuer. You can’t look at the ordinal without some other software which decides what it represents. Some other trusted entity decides whether you have the ordinal or not. If they change the rules in the future and you get the short end of the stick? Tough luck for you. They’re no different in centralization than the run-of-the-mill forgotten altcoin from 2011.

So if they’re centralized, why are they on a blockchain? A blockchain is a horribly cumbersome database to hold digital data. It’s hard to develop, hard to scale, costly to maintain, and difficult to upgrade because they’re voluntary. So from a purely technical point of view, a centralized project on any blockchain, let alone the decentralized one in Bitcoin, doesn’t make any sense. It’s much easier, faster, cheaper and more maintainable in a centralized database.

Technically speaking, a centralized project becomes more difficult in every way on the Bitcoin blockchain.

So what’s the real reason why ordinals are on the Bitcoin blockchain? Because there’s a large market of people to market to. Because it’s easy to hype by associating it with Bitcoin’s historical success. Bitcoin represents, hope, freedom, self-sovereignty, sound money, and a better world. It’s an amazing thing and to even be slightly associated with it, as altcoins have over the past 13 years. But altcoins have a long history of going comatose, so ordinals are the new argument, a new way to sell old, outdated, failed ideas. In other words, ordinals are on Bitcoin because it’s a new way to scam a market that has wised up a bit.

Anticipating the VC-funded ResponsesNow the ordinals people will undoubtedly make excuses for why it needs to be on Bitcoin. You can’t manipulate it! It’s less work and requires real payments! Both of which are true. Bitcoin is secured by proof-of-work and that means anything embedded in it requires astronomical amounts of hashing power to change. But you don’t need to use Bitcoin to do that. There are timestamp servers and receipts and backup services all of which are way cheaper and provide the same service without bloating the Bitcoin blockchain. And Bitcoin’s blockchain is no real protection. You have to use other software to figure out whether you own an ordinal or an inscription or whatever. That software can change the rules anytime they want, just like any altcoin software. And these things aren’t generally backwards compatible. So if you’re running something old? You’re not following the centralized “consensus.”

Ordinals, like NFTs and really every altcoin, are a glorified spreadsheet that can just as easily be run on a $500 website while providing cryptographic proof that it hasn’t been manipulated. Again, the only reason ordinals are on Bitcoin is to create more demand through marketing it as something that “helps” Bitcoin, which is like saying that spam helps email adoption.

ConclusionFor many years, altcoins have ridden the coattails of Bitcoin to scam lots of people. It’s getting harder to scam the same people and indeed there are currently only two paths left. There’s the post-modern nihilistic tactics most fully realized in memecoins. Altcoins no longer purport to have real-world utility anymore. That ship sailed back in 2019. They are forced to go to memecoins because the market doesn’t appreciate being lied to. Memecoins have no utility, no disruption of any industry, no innovation and no prospects, but at least they’re honest about it.

The other way is to associate closer with Bitcoin than altcoins have been. It’s not enough to be a “cryptocurrency” anymore, to affinity scam now, you have to pretend you’re a Bitcoin Maximalist.

The actual technical reality of these projects is not new. Colored coins were live back in 2013, as were MasterCoin and Counterparty. But the cultural pivot is. Ordinals, inscriptions, BRC-20, stamps are all trying to clothe themselves with Bitcoin so the general public associates the benefits of Bitcoin with these projects. But of course, the values of these projects are antithetical to Bitcoin. There’s no self-sovereignty, financial freedom, decentralization or really any hope for the future in these projects, just straight gambling. So they borrow the good values as much as they can from Bitcoin.

Fiat in English literally means creating something by decree. And these new types of altcoins are fiat in that strict sense. They’re decrees by a centralized authority masquerading as a decentralized project by associating with Bitcoin.

Meet the new altcoins. Same as the old altcoins.

[image error]December 30, 2021

What is money, really?

One of my favorite stories in the Bible is in Acts 1. Jesus has been with the apostles for over 3 years. He’s also spent about 40 days with them after rising from the dead. He’s about to go up to heaven and leave them. They have one question they ask and the question is:

So when they had come together, they asked him, “Lord, will you at this time restore the kingdom to Israel?” — Acts 1:6

After three years of miracles, direct teaching and witnessing Jesus rise from the dead, they still didn’t quite get what the kingdom of God was all about. For them, establishment of Israel was the Old Testament prophesy that He had not yet fulfilled. The Messiah was supposed to restore Israel and while they’d all seen the miracles, they hadn’t gotten the message that Jesus fulfilled that prophesy in a way that they didn’t expect. The kingdom He restored was one that was much broader than a political kingdom. His kingdom would be a restoration of humanity as a whole.

Blind Spots in our EducationYou can forgive them for their ignorance in this matter. Jewish teaching at the time, and to some degree today, believed that a Messiah would restore the nation of Israel and that’s what these Jewish followers of Jesus grew up learning. They didn’t have the benefit of the perspective we have today of seeing Christ change civilization forever.

I bring this story up not to make fun of the apostles, but as a reminder that everyone has blind spots. Like those apostles, there are certain ways of thinking about things that are entrenched in us. Some of those perspectives are just wrong, and to correct them is often a Herculean effort.

One of those things is money and the economy. Our tendency is to think that we understand them based on what we’ve been told. Money is what the government decides. The economy must be managed centrally. The people in charge know what’s likely to happen and we must do what they say to avoid disaster.

We think we understand because we work with money all the time. We use it to buy stuff, we earn it by working, we invest it and have lots of interactions with money, which makes us think that we understand it. Much like the apostles and Jesus, we’ve spent a lot of time with money, but that does not necessarily mean we really understand it.

Conviction ConflationWhat’s particularly dangerous is that many assumptions about money and economics sneak into our worldview and get conflated with our Christian convictions. We think that our convictions on how the economy works has the same moral force as the law written on our hearts or the convictions we have as Christians.

This is particularly dangerous with money because money is where the rubber meets the road as far as actual expression of Christian convictions is concerned. We don’t just love others. Loving others often requires sacrifice, or allocation of resources we are put in charge of.

How we view money has infected how we look at the gospel.

Worse, many people use the gospel as a way to convince others of non-gospel convictions. Just about everything has used Christianity as a justification for behavior or beliefs that simply aren’t the gospel. Chattel slavery, socialism and wars of conquest were all argued as Christian when they clearly were not.

Money and EconomicsThat’s unfortunately the position we’re finding ourselves in the money and economics realm. There are those that tell us what Christians should believe, not from critical examination of the Bible, but from convictions from an ideology outside the gospel.

This is false teaching and we must be very careful about such claims.

In particular, there’s a tendency to view current norms as somehow right or correct. There have been many norms throughout history that we would find horrifying today and vice versa. One of those things is our current monetary system.

Our church forefathers would be horrified by the current system and their analysis morally of monetary systems, particularly ones controlled by a central authority, is well documented.

The current monetary system is a cesspool of theft, corruption and cronyism. I’m not exaggerating. I’ve made the argument in my book about how the system of central bank backed fiat money is theft at its core. The ability of Central Banks, and really all the member banks of a central bank to issue credit without anything backing it, is ultimately theft from all other holders of the currency.

But if you doubt me, start with this. What is money supposed to be? What is it supposed to represent? What is inflation? Exploring any of these topics in depth will naturally lead to questioning the morality of the current system. Much of the wealth of the United States, for example, is based on a dollar dominance that’s neither earned nor fair.

Getting Out of the CesspoolSo what are Christians to do? How should we think about not just the money, but the very monetary system that we were born into?

If the current system is morally wrong, it is our moral duty to work to change it. William Wilberforce did this with chattel slavery by fighting against it until England abolished slavery. Perhaps we’re not quite ready to go on a moral crusade just yet, but there is a way to start exploring alternatives.

Much like the apostles who thought the Messiah would politically restore Israel, we find ourselves in the position of finding that our money isn’t anything like what we thought it was. Our assumptions around the current monetary system are being proven wrong, so we should be looking at alternate explanations. There’s a digital alternative in Bitcoin. As Christians and as investors, exploring this alternative is a good thing.

[image error]October 28, 2021

On Christians Investing in Bitcoin

The article by Greg Phelan published in The Gospel Coalition titled Ask the Economist: Should Christians Invest in Bitcoin? was one I looked at with great interest. I’m a Christian and a Bitcoiner. I’ve been teaching the technical and economic details of Bitcoin for over 5 years and have written 3 books on the topic. The latest book is Thank God for Bitcoin, which makes the moral argument for Bitcoin from a Christian perspective.

To say that I was disappointed would not do my feelings justice. Greg Phelan claims to be focusing on “higher level ideas,” but what comes through loudly and clearly is that he doesn’t understand what Bitcoin is or what problem it’s solving. This article is a rebuttal, but also a different perspective. I hope to show a view that is a lot more expansive, which critically compares our current monetary system to Bitcoin, rather than dismissing Bitcoin in isolation as Phelan does.

Denigrating BitcoinersThe strategy of the article is made clear in the first subheading: “There Are No Dividends Here.” Phelan’s argument starts by classifying Bitcoin into known categories like stocks, bonds, assets or currencies and then analyzing whether Christians should invest based on the norms of that category. While this sounds reasonable, it’s a very narrow view of what Bitcoin is and reveals a lack of understanding of what Bitcoin is trying to do. I’ll have more to say about this later.

Phelan notes that there are no dividends in Bitcoin, eliminating it as an asset. He reveals his lack of knowledge about Bitcoin as he gets even basic facts wrong when he writes:

Bitcoin and other cryptocurrencies produce no dividends. They will never provide a place to stay or earned income or even interest.

His claim that there will never be a place to earn interest is demonstrably false as there are multiple such places that operate right now, including locking up Bitcoin in lightning liquidity pools. There are also multiple services with varying levels of risk that offer interest as well. Given Phelan’s apparent lack of knowledge about the Bitcoin ecosystem, his confidence in his analysis is a bit strange.

What’s stranger is his conclusion from the premise that Bitcoin does not produce dividends. He concludes:

So why do people invest in crypto? Because they expect the price to rise.

We have a word in finance for an investment like this — a bubble. An asset that never pays a dividend but has a price that keeps rising is a bubble. An investor can believe Bitcoin is a bubble and rationally invest so long as she expects to sell out before the bubble pops. But that isn’t investing; that’s gambling, and it’s a zero-sum game.

His argument here amounts to saying that because there is no dividend, Bitcoin must be a speculative gambling vehicle. By his logic, gold jewelry and artwork do not qualify as assets and must be gambling vehicles since, strictly speaking, they don’t produce dividends.

More charitably, perhaps he’s talking about utility since he gives an example of a house where you get “the value that you receive from having a place to stay.” Using that definition, jewelry provides a dividend from the value that you receive from wearing it and artwork provides a dividend from the value you receive displaying it in your home. Even by this rather strange definition of dividend, Bitcoin certainly qualifies. You can timestamp documents using proof-of-existence. You can create a decentralized identity on Bitcoin using ION. If “dividend” is defined as “value you receive,” then it’s really no different than utility you can get for an item.

The conclusion is a non sequitur, or more accurately, an accusation: Bitcoiners are a bunch of gamblers! This is not only uncharitable, but startlingly ignorant. Even a modicum of research into the topic would show that the most popular use of Bitcoin is what he accuses Bitcoin not being useful for: storing value.

Bitcoin is for Saving…you don’t “buy” money because you intend to hold it forever. The point of holding money is to “sell it” in the future

This is what economists call salability across time and what normal people call saving. Saving is the main reason people hold Bitcoin. Bitcoin stores value really, really well (+150%/yr) as the last 10 years have shown. This is in stark contrast to USD, which has depreciated considerably in the last 10 years. Even by using the heavily manipulated CPI metric, a dollar from 10 years ago has lost 20% of its purchasing power. This is obvious when shopping at the grocery store as some items have gone up 20% just in the past 6 months. Using his definition of what money is for, the dollar has performed poorly while Bitcoin has performed spectacularly.

Yet he comes to an odd conclusion:

The value of currency comes from people’s willingness to accept it as a means of payment.

But Bitcoin is a much less robust means of payment than other currencies. While there is a black-market demand for Bitcoin transactions because of anonymity, the current level of payments can’t explain the price. The number of Bitcoin transactions slowed down starting in 2012 and hasn’t increased at all since 2017. But the price has soared since then.

There are a couple of demonstrably false statements in the second paragraph. First, the black-market demand for bitcoin is a very small amount of transactions as compared to USD. Second, Bitcoin transactions have increased significantly since 2017 through the lightning network.

The bigger error here is the argument which starts with the utility of money being savings somehow leading to the opposite, which is that payment volume should be the only factor in its price. The Venezuelan Bolivar has tremendous payment volume, mostly due to people wanting to get rid of it, but that hasn’t helped its price in USD terms at all. In other words, price doesn’t reflect payment volume. The market value of one currency relative to others comes from the opposite of spending: it comes from people’s willingness to hold savings in it.

As a currency, Bitcoin is not as good as dollars or any other currency.

As savings over the long term, Bitcoin has been quantifiably better and that’s easily proven. Charitably, his definition of “good” here could mean “more accepted worldwide as payment,” in which case, I’d agree. This would then be an argument from authority based on his false conclusion that currencies are only useful for payments. But as I’ll argue below, that’s not the only reason Bitcoin is useful nor the only problem that Bitcoin is solving.

All economists agree that a stable price is highly desirable for a currency.

This is another argument from authority with no justification. Stable to what? And desirable for whom? I strongly suspect he means stable to the dollar, which then would mean that no currency, even in principle, can ever be better than the dollar, a ridiculous conclusion. More charitably, perhaps he means staple basket of goods used to calculate CPI. On that metric, too, the dollar is very stable as it’s consistently suffered 2% or 3% debasement every year.

Is that really how we measure whether a currency is useful? A macro-economist may find that useful, but certainly not the average person. To normal people, a way to save over the long term is much more useful than stability to a basket of goods. For an asset you’re going to purchase and hold for 5 years would you rather have a 2% decrease every year in a perfectly stable way or a net 100% increase over 5 years with instability (say, -20%, +70%, +10%, -5%, +41%) along the way?

That is the big utility of Bitcoin that Phelan doesn’t acknowledge. Bitcoin is extremely useful as a savings vehicle. This is because there really aren’t many good stores of value in the market. Traditional stores of value like real estate and stocks are in an asset bubble because so much money is flowing into both as a result of the monetary expansion of the last 20 months.

Bitcoin is a Hedge Against InflationSpeaking of which, inflation is the big elephant in the room that Phelan does not mention. Monetary expansion is the reason that people are opting out of the dollar and into other assets like Bitcoin. And this is where I think Phelan’s analysis falls woefully short.

Christians should be excited to invest in ways that serve the common good, whether by using their retirement funds to align values and investments or by providing funding for a car wash to provide jobs or in any number of other ways. Investing creates and serves.

I agree wholeheartedly with his statement. What Phelan doesn’t realize is that Bitcoin is far more aligned with Biblical principles than the US dollar. He doesn’t question the US dollar system at all, which is why his article comes off as ignorant and dismissive. In reality, the current monetary system is one of theft, corruption and cronyism running on debt.

The US Dollar System is CorruptNew money is constantly created for the benefit of the people closest to the money printer in the form of loans. These not only include central banks, but also commercial and retail banks who lend out money that they create ex nihilo. Dollars created ex nihilo means that all other dollars in existence are diluted. In the case of the dollar, the supply has increased by over 70x in the past 62 years, meaning that the dollar has been diluted to 1.4% of its original value. This not only affects people in the United States, but people all over the world. The dollar is sadly the most accessible store of value for billions of people, especially those in fast-inflating economies.

Put another way, the monetary expansion is unjust to the poorest of the poor. People as far away as Nigeria, Turkey, Argentina, Lebanon and North Korea all use the dollar as their savings. Dollar expansion necessarily means that their savings get diluted. When the dollar expands through large government programs like PPP loans or stimulus checks, the poorest lose out. When banks loan money ex nihilo to buy corporate bonds or fund a residential mortgage, the poorest lose out. When hedge funds use 100x leverage and lose and are bailed out through repo loans, the poorest lose out.

Bitcoin is a way to opt out of this corrupt, US-centric system which takes value from the poor and gives to the rich. Because Bitcoin is decentralized, it is an apolitical money, meaning that it serves no one’s agenda. Because Bitcoin is digital, it’s convenient and individuals can obtain banking services without the need of a bank. This is by no means theoretical. The Bitcoin Beach movement in El Zonte, El Salvador is proof of that and many people are benefiting tremendously. Many people in El Zonte are starting their own businesses and providing goods and services to the market.

ConclusionIn Bitcoin, we have the concept of financial privilege. Financial privilege is people in first-world countries dismissing and ignoring the financial suffering they have inflicted on people in the third world. Greg Phelan’s attitude is an all-too-common example. His dismissal of Bitcoin as a gambling vehicle while saying nothing of Bitcoin’s benefits is not only factually wrong, but deeply uncharitable. His failure to acknowledge the corruption and shortcomings of the US dollar is even more telling.

Bitcoin allows Christians to opt out of the corrupt system of central banking which has done immeasurable harm to people around the world. Should Christians invest in Bitcoin? That’s something Christians should ponder while checking their financial privilege.

[image error]July 15, 2021

The Triumph of Post-Modern Investing

“The market can stay irrational longer than you can stay solvent.”

— John Maynard Keynes

To say that the current market is irrational would be an understatement. Stock prices are at historically high multiples of revenue. Bonds return almost nothing in the US and have negative rates in Europe. Real estate is reaching all time highs with such high demand that prices are going up 10% in a single month.

These are not even the craziest thing going on in the market. With unprofitable companies, such as WeWork, there’s at least some prospect for future growth to make up for the large premium, but with the asset bubbles going on today, there’s not even that.

We’ve seen assets pump with little to no fundamental underlying value, including companies with little prospects for growth (AMC, GameStop), bankrupt companies (Hertz), and of course, negative rate bonds.

The past decade has shown a rise in this seemingly irrational market behavior. Specifically, that of investments being based on popularity rather than fundamentals such as cash flows or earning potential. In this article, I’m going to explain the reasons behind the current irrationality, the philosophical worldview led us here and the spiritual implications going forward.

No YieldThere is little to no yield to be found anywhere in the market today, especially when inflation is taken into account. Bonds aren’t returning very much and few stocks even have dividends. When it comes to housing, rental income is a pittance compared to the cost.

Why is this the case? The reason the yields are so low is because the asset prices are really high. Historically, it was common for stocks to pay 10% dividends, back when we were on the gold standard, for example. Yield is correlated with the cost of capital and under the gold standard, the cost of capital was high and so was yield. Currently, there is much more money available than it was then. This shows up as very low interest rates and more money is chasing the same amount of assets than when yields were higher. In other words, as assets get bid up, the yields go down.

So how did we get here? The reason why the cost of capital is so low is due to the actions of the central bank (aka The Fed). The money supply in every country has expanded significantly since 2008 and has accelerated in the past year. The additional money that comes into existence go to people who would rather store that value than spend it, which leads to investment in assets, driving yields lower and lower.

Another way to look at the current market is that central banks have attempted to de-risk everything through a policy of rescuing anything close to bankruptcy by providing liquidity. There is no yield because these assets are supposedly de-risked.

The Nietzschean InvestorAt some point, yields become so low that they don’t factor into the decision to buy an asset. The price increase of the asset itself becomes the only consideration. A difference between a 1% yield or a 2% yield is trivial compared to the price increases in the assets themselves (many 30%+ per year). The investor then has to ask, what drives the price increase?

If enough people still invest based on yield, asset appreciation should still stay somewhat rational. Much like Enlightenment thinkers who rejected God but still clung to Christian morality, if there’s a critical threshold of people who believe one thing, the rest of the market is rational in following it. But what happens when there is no critical threshold? What happens when most of the market doesn’t make investment decisions based on fundamentals and instead just cares about what everyone else is buying?

This is reminiscent of what Nietzsche asked about: what is morality without God? The Enlightenment thinkers before him tried to hold onto Christian morality without Christ. As Nietzsche pointed out, this was inconsistent and moreover, wimpy. If God doesn’t exist, then morals based on God need to be thrown out with it.

In the investing world, what we’re seeing is that fundamentals like yield and profit are being thrown out and replaced with popularity. The fundamentals matter less and less in a world where anything too big to fail gets rescued. So what’s left?

Investing based on popularity is much like asking what is morality without God. As Nietzsche argued, when you remove God from the morality equation, you’re left only with the human will. As a Godless philosophy took hold, we found that culture went to post-modernism, or radical relativism. In the same way, as money has been diluted over the past 100 years, it’s taken out fundamentals and civilization building with it. The market has removed fundamentals like yield and profit, and the only thing left is popularity, or collective will.

In other words, just as we’ve gone from morality based on God to morality based on will, we’ve gone from investment based on merit to investment based on popularity. Nothing quite captures this phenomenon like Dogecoin.

AltcoinsFor the uninitiated, altcoins are digital tokens put into existence by a development team with promises of some vague future utility using some mentally tortured justification for a token. Think bad dot-com idea but with tokens that are sold beforehand. This is in stark contrast to Bitcoin, which has a very clear use case and has no central controller.

The spirit of post-modern investing is most obvious in the Elon Musk-pumped Dogecoin. It’s in the purest sense, a memecoin. Dogecoin has no purported usage and it does nothing technically better than any other token.

Post-modernism, of course, is the philosophy of complete relativism, where there are no absolutes and everything is relative. There’s certainly some truth to relative value. As any Austrian economist will tell you, value is subjective, and can be seen in the daily price fluctuations of nearly every commodity in the market.

Post-modernist investors take it a step further and decide that value is not just subjective, but can be controlled. Instead of a critical threshold of people that invest based on fundamentals, post-modern investors are a critical threshold of people that invest based on will-to-power. Essentially, they believe they can change asset prices as if it’s a vote. These are purposefully irrational actors imposing their irrationality on the market.

Irrational Behavior?Yet we have to wonder, are they being that irrational? When the dollar supply continuously expands, it removes the basis by which we can measure anything else. The dollar expansion has made the cost of capital cheaper, destroying yield, making measurement of stocks particularly difficult.

Companies that return zero dividends in perpetuity should be worth zero, yet companies like Amazon have some of the largest market caps in the world. What is the fundamental value here? The potential to get dividends 20 years from now? That hardly seems worthwhile and the discount on such future dividends should make such stocks worth much less, yet they continue to soar. The reason for the large market cap is because of a shared belief in its value. In other words, it’s based on popularity. The stock market without dividends really is a Keynesian Beauty contest.

Which leads us to the question. What’s the difference between Amazon and Dogecoin? At a fundamental level, the investor isn’t getting a dividend from either one so the only reason for buying is a potential price increase. If it’s going up, doesn’t that accomplish the goals of the investment? From a post-modern perspective, this is a compelling argument. Yet, from a moral investor’s perspective, this is a horrifying conclusion and literally de-civilizing.

Nietzche argued for a will-to-power morality. That is, a morality where anything was permissible in order to get more power. Will-to-power is a might makes right philosophy in a Godless world. Power trumps morals.

Similarly, popularity of any kind, which makes the price go up without any regard to whether anything is being built is the only consideration in a yieldless investment world. Popularity trumps merit.

A Post-Modern WorldPopularity trumping merit is not an unknown pattern. Our democracies are not run by the most qualified, and wisest leaders, but the most popular. Bureaucracies of all types promote those who are least objectionable, not the most capable. Popularity trumping merit is a recipe for poorer quality and we’re seeing that in droves. This way lies the slow decline of civilization.

Much as morals have declined with the rejection of God, civilization itself has declined with the rejection of merit. This is no small matter as investment in the wrong things is slowly breaking down civilization into a sort of nihilistic, valueless state.

The question for the moral investor is, what do we do? An investment without yield is not strictly an investment, it is speculation, or less charitably, gambling. Are we investing in something that’s being built that’s good for civilization or just speculating? If you view speculation/gambling as immoral, what alternatives are there? Do we participate in post-modern/popularity-based/de-civilizing speculation? Or do we do something else?

ConclusionThe continuous money printing has put us in a position where yield matters less and less and that is simply not sustainable. Companies that don’t make money have to be continuously subsidized. That subsidization comes through monetary expansion, which works until it doesn’t. Unsustainable debt doesn’t simply go away. Furthermore, investment based on popularity disincentivizes building that which is useful for that which is popular. Merit is being thrown out by the wayside.

There’s a reckoning coming that every Christian should be familiar with. The rejection of merit is much like the rejection of God. Both lead to destruction.

The current moral landscape is dominated by post-modern values. The various -isms are the new commandments of a fickle and arbitrary post-modern god. The way to fight post-modern values is to hold onto a God-based morality, not to submit to the post-modern hegemony. In the same way, the way to fight post-modern investment strategies dominating is to hold onto merit-based investment strategies.

This seems counterintuitive since the goal of investment, we are told, is to make money. But that’s not what Christianity is all about. We should care deeply about how we affect the world through our investments and if the investments we make bring about the discrediting of merit and ultimately the collapse of civilization, we need to take that into account.

After all, holding Christian values in a post-modern world causes us to suffer. Why are investments excluded from such calculations?