Anand Saxena's Blog

July 10, 2020

The Shortest Finance Book Ever- Concluding part

THE SHORTEST FINANCE BOOK- EVER

ALL OF 87 WORDS

CONCLUDING PART

“Too many people spend the money they earn, to buy things they don’t need, to impress people they don’t like”- Dave Ramsey

First, my apologies for the long break in bringing out this second part. The delay was due to some inescapable reasons. Hereafter, the posts will be more frequent.

I am happy to inform my readers that the first part of this post was very well received and a few of my friends and my brother gave some fantastic suggestions too. To begin with, one of my dear friend, Atul, forwarded this beautiful definition of success as given by Ralph Waldo Emerson:

“To laugh often and much; to win the respect of intelligent people and the affection of children; to earn the appreciation of honest critics and endure the betrayal of false friends; to appreciate beauty; to find the beauty in others; to leave the world a bit better whether by a healthy child, a garden patch, or a redeemed social condition; to know that one life has breathed easier because you lived here. This is to have succeeded.”

Then my elder brother Ashok brought out a very valid observation keeping the frequent hacking of our social media and email accounts in mind. If you recollect, I had stressed the need of sharing all your financial details including the passwords with your spouse and children through email. The suggestion is to either share a printout or have it saved and updated regularly on your personal computer or have the document protected by a password.

The last observation was raised by at least two friends who are in a government job. They felt that since their organization was insuring them for an amount of Rs 80 lakh, additional insurance was not required. Let us do some back of the envelope calculations for the approximate corpus required should something untoward happen to the breadwinner of the family. We will assume that the couple in question has two children, both studying and liability of Rs 40 lakh (home loan, car loan, credit card dues, personal loans etc.) We will also assume that the spouse is a homemaker.

Before one gets about planning for a child’s education, it will be worth our while to look at the current costs of a UG degree in India: MBA up to Rs 25 lakhs, MBBS Rs 70 lakhs and B. Tech. Rs 20 lakhs, just to name a few mainstream and popular courses. Since parents would not know the interest of the child for quite some time, let’s work on an average cost of the three courses which comes to Rs 38 lakhs. You also need to factor education inflation @ 10 percent, that means the education cost doubles every seven years. This mental calculation is by using the wonderful rule of 72, about which we shall discuss in a later post. We are not even factoring if the children have an aspiration to study abroad but just to give a glimpse. Graduation in Canada today costs 300,000 Canadian Dollars over 4 years- nearly Rs 1.6 crore. Add rupee-dollar depreciation, which is a reality and the cost increases exponentially. Just as an aside, the rupee has fallen by around 2000% as compared to the US dollar since independence.

Even doing this basic math, of Rs 76 lakh for the education of both the children and Rs 40 lakh to settle the liabilities, one is looking at the requirement of a corpus of Rs 1.16 crore. We have not even discussed the expenditure which will be incurred in two marriages. And mind you, the family will have household expenses which the pension (if at all) will definitely not be able to fulfil and hence a decent corpus for that will also be required. The verdict, one has to look very closely at one’s liabilities and err on the positive side while taking life insurance.

So now getting back to this post, we are discussing the shortest finance book ever written, titled “Everything You Need to Know About Financial Planning”. The book is 87 words long and has been written by Scott Adams, creator of the iconic “Dilbert” comic strip. We had deconstructed the first two issues about Life Insurance and making a Will. Let’s get on with other issues. The book is here to refresh your memory.

“Make a will. Pay off your credit cards. Get term life insurance if you have a family to support. Fund your 401 (K) to the maximum. Fund your IRA to the maximum.

Buy a house if you want to live in a house and you can afford it. Put six month’s expenses in a money market fund. Take whatever money is left over and invest 70% in a stock index fund and 30% in a bond fund through any discount broker and never touch it till retirement”.

The next issue is putting six month’s of expenses in a money market fund or liquid fund. I call this a Breathing Fund because it allows you to sleep peacefully at night despite what life may throw at you financially. The financial and job destruction in the wake of ongoing CoVid 19 pandemic has brought this stark reality out in the open. In fact, along with Life Insurance, it is the second most important financial planning one has to do. This fund has to be built up fastest even if you have no other investment going on in this interim period. This six month’s expenses should include not only your household running expenses but also any EMI and SIP etc. which may be going on. It is very important to define what would constitute a financial emergency for which this Breathing Fund will be used? Your Parent’s Marriage Anniversary will not be one because that is on a fixed date and for which you should plan through regular saving nor an annual vacation in Andamans, which also should be a planned event funded out of your monthly income.

The next issue is of Credit Cards. All the authors of personal finance books that I read, and I did read nearly fifty of them, are dead against using a Credit card. One of them, Dave Ramsey, in his book “The Total Money Makeover” goes to the extent of urging the readers to just cut their Credit cards into two- yes you read that right, just cut the Credit cards off. And this advice is not without some good reasons, few of which I would elaborate and leave you to make your own judgment.

Like Investing is using today’s earnings for tomorrow’s spending, Credit or borrowing is using tomorrow’s earnings for today’s spending- fundamentally a bad concept. The biggest problem with Credit card usage is that it engenders a habit of overspending beyond one’s Needs/Wants budget. One gets tempted with the interest-free payment period of 50 odd days and may get into a vicious cycle of mounting Credit card debt.

The second problem is seemingly benign rates of Interests- only 1.5% (per month is in fine print) which can burgeon into a humongous debt within no time. Then, even one missed payment of Credit card balance or large outstanding amount adversely impacts your “Credit Score” resulting in difficulty in getting loans or getting one at competitive rates. I will not go to the extreme of proscribing the use of Credit card totally- may be having one Credit card which is used responsibly and paying off the balance in full in every billing cycle is not a bad idea.

The next advice is to fund the 401 (K) and IRA to the maximum. These instruments are specific to the US. The 401 (K) is a qualified retirement plan that allows the employees of a company to save and invest for their retirement on a tax-deferred basis. These contributions are deducted from the salary on a pre-tax basis. The IRA or Individual Retirement Account is also a retirement plan but not by the employer of the individual. These plans are offered by companies which can be invested into by the individual investor. For our context, we can replace these instruments as mandatory PF, NPS and annual investments in ELSS. The bottom line is that after Life Insurance and Breathing Fund, your retirement planning should be the next most important financial decision. The icing on the cake is the tax break you get in the process of retirement planning.

The next financial decision is of a House. Adams suggests buying a house if you have to stay in it and if you can afford it. I am in full agreement with this advice too. Buying a house is likely to be the most enduring and financially taxing commitment one will undertake. In the initial stages of one’s career, frequent movements, either in search of a better job or due to postings/transfers, are inevitable resulting in shifting bases from city to city. If this is the case, it does not make sense to take on the burden of a house in a city from where one will eventually relocate.

In any case, looking after the house for 3-4 decades including periodic maintenance and tenant management will consume a lot of your time and effort, other than tying down precious financial resources while paying the EMI. It is best to buy the house slightly later in life when you are reasonably sure of finally settling down at a particular place. In General, buying property (rental or commercial) for the purpose of investment is a lousy proposition.

The last financial advice by Adams is to invest the balance of your investible surplus in Index Funds- 70% in equity and 30% in bond (debt) funds. The Mutual Funds that seek to track a given Index (e.g. Sensex or Nifty) by owning all or nearly all of the Stocks in that Index with no attempt to pick Stocks with superior performance (thus the fund buys or sells the stocks contained within the fund only when they move out of the Index, which is rare), are called Index Funds. Since these funds are not trying to chase the market or generate Alpha but only give returns as close to the chosen market Index as possible they are not under pressure to buy and sell frequently and can follow a Buy and Hold strategy, a winner in all market conditions. Of late, new offerings in Index mutual funds have been launched and which are worth having a look. These include- Nifty 50 and Next 50 funds, Nifty Midcap and Smallcap Index funds, Nifty 500 Index funds (funds which give you exposure to virtually the entire Indian Stock Market) at very low costs.

In India, Index funds are yet to catch public fancy but in the Large Cap universe, it is empirically proven that indexing works better than active investing. We don’t yet have bond index funds though recently Bharat Bond ETF has been launched which is a good option. I would recommend investing around 25% of your equity money through Index Funds. Balance 75% could still be invested through active Multi-Cap mutual funds. This issue has been dealt with in detail in both of my books.

This is it- the most important 87 words you will ever read so far as your personal finances are concerned. Mull over this book and its recommendations over the week.

We have many wannabe authors who will be reading this post and for those, I will be writing my next- How to go about publishing your book as a debut author. I hope that my experience of writing and publishing two books will help those who aspire to become published authors.

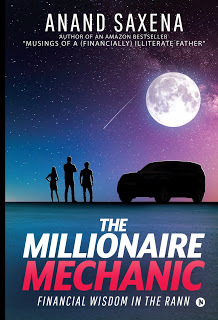

I am eagerly looking forward to your feedback of my books, “The Millionaire Mechanic” and “Musings of a Financially Illiterate Father”.

The Millionaire Mechanic: Financial Wisdom in the Rann https://www.amazon.in/dp/1646787404/ref=cm_sw_r_em_apa_i_-ZU9EbFWMC05T

January 25, 2020

MUSING 43 THE SHORTEST BOOK ON FINANCE - EVER: ALL OF 87 WORDS PART 1

MUSING 43 THE SHORTEST BOOK ON FINANCE - EVER ALL OF 87 WORDS PART 1

Good morning and a happy Republic Day to all. We all have read a number of finance or investment related books. While writing my books, I must have read more than 50 of them, a shortlist of the recommended ones I will share in this post. Every book requires an investment of your time and money and may or may not give you the “bang for the buck”. In this post, I will introduce you to the shortest finance book ever written- all of 87 words. The book has been written by the famous cartoonist, Scott Adams, the creator of the iconic Dilbert comic strip.

Some trivia before I lay out the book before you. Adams titled his book as, “Everything You Need to Know About Financial Planning” but when he went for publishing his book to the publishers, they declined, not because the contents of the book were not juicy enough but because it was too short to be published as a book. Be that as it may, Adams still calls his 87 words treatise a “book” and here is it for your reading pleasure.

“Make a will. Pay off your credit cards. Get term life insurance if you have a family to support. Fund your 401 (K) to the maximum. Fund your IRA to the maximum. Buy a house if you want to live in a house and you can afford it. Put six month’s expenses in a money market fund. Take whatever money is leftover and invest 70% in a stock index fund and 30% in a bond fund through any discount broker and never touch it till retirement”.

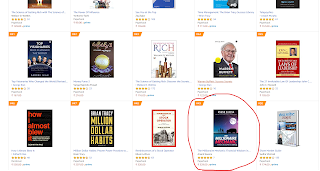

That’s it. 87 words of sane personal finance advice which is jargon-free and contains the essentials that any investor need to know and do. I will deconstruct these 87 words to you shortly as few of the terms may not be familiar to you being part of the USA lexicon. But before that, my second book, “The Millionaire Mechanic” is showing some very impressive initial sales figures and is globally ranked 49 as of yesterday. I am sure it is because of your support to the book in the form of its purchase by you and sharing the link with your family, friends and social circles. Please keep blessing my endeavour.

Returning to our topic- Adams is well-qualified to talk about finance. He has a bachelor’s degree in economics. He is an MBA and has worked in the banks for more than eight years. So, let’s demystify this book, in the order of financial priorities of a common investor.

Firstly, take Term Insurance if you have dependents. For effective and efficient financial management, a regular income stream is a prerequisite. If the sole source of income is the breadwinner of the family, his/her wellbeing becomes absolutely vital for the financial security and indeed survivability of the family. The first and the most important form of insurance is Life insurance which protects against loss of the life of the breadwinner.

A good thumb rule figure is ten times the annual income. “The ten-time rule of thumb is not an arbitrary number. Remember, life insurance is designed to replace your income. If your surviving spouse invests that $400,000 (assuming an annual salary of $40,000) in good mutual funds at an average 10–12 percent return, he or she could peel off $40,000 a year from that investment to replace your income without ever cutting into the principal.We also need to factor in other liabilities of the breadwinner. Let’s say he has taken a home loan of Rs 20 lakh and a car loan of Rs 8 lakh. In case of a mishap, paying off these two liabilities itself will polish off most of the coverage amount. This amount of Rs 28 lakh (Rs 20 lakh+ 8 lakh) must, therefore, be added in the required coverage amount. If the breadwinner has children, their expenses, as they grow up and settle down in life also need to be catered for (education, marriage etc.).

The next issue to be tackled is which kind of life insurance one should opt for? There are a whole lot of options out there- Endowment plans, whole life policy plans, unit-linked insurance plans, and money-back plans. All are avoidable. The only plan one should go for is a pure term insurance plan. A term insurance plan is for a predesignated term, say 40 years. So, if you buy a 1 crore term insurance plan for 40 years and pass away in this period, the insurance company will pay your next of kin, Rs 1 crore. If you survive 40 years, you get nothing. Always go for a term insurance plan even if you are taking insurance to cover your house mortgage, car loan, personal loan and so on. It works out the cheapest and most effective.

Secondly, Make a will. We all keep postponing this important aspect for our older age thinking that no mishap can occur to us in our younger days. This is a folly as life is uncertain and accidents do happen. A will is a legal document that names individual/ individuals who would receive the property and possessions of a person after his/ her death. It can always be modified by the person executing his/ her will.

A will can be made on a plain paper and remains functional even if it is unregistered. However, it is always better to register a will by going to the sub- registrar’s office along with the witnesses- at least two. Remember that a beneficiary under the will can’t be a witness. The will can be kept in safe custody in a sealed cover with any registrar.

A related issue is to acquaint your spouse and children with all your investments- insurances, mutual funds, stocks, FD etc. Most of our transactions are online and require passwords to log in. Please make a list of all the passwords, login ID etc and create a folder. It should contain a list of all your bank accounts, investments, loans and any other related issues. I recommend updating this list every quarter. Mail this document to your spouse and take a printout and hand over to her/ him. In the case of a mishap, your spouse will not be left floundering.

I will stop here and continue to demystify the shortest personal finance book ever written next week. In the interim, please complete these first two steps for financial planning. Also, please read my books and provide feedback. I will also request you to put in a review on Amazon.

Enjoy your weekend.

January 4, 2020

Musing 42- My Second Baby is Born

MUSING 42

MY SECOND BABY IS BORN

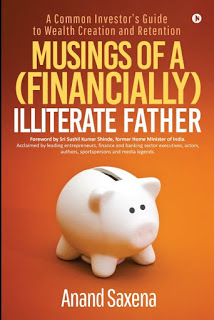

It gives me immense pleasure to announce the publishing of my second book, “The Millionaire Mechanic”. It has been around 20 months since my first book, “Musings of a Financially Illiterate Father” got published which is already an Amazon Bestseller and has been in global top 20 for the last 4 months. I hope and pray that my second book also receives your love and patronage. In fact, the book has had a promising debut- breaking into top 100 in its genre of “Business and Finance” within first one week of being published. It is ranked # 93 as of yesterday. Of course, “Musings of a Financially Illiterate Father” continues its relentless successful march in top- 20. It was ranked # 16 on 04 Jan 2020.

With “The Millionaire Mechanic”, I have attempted a new genre in Indian writing- a Financial Travelogue.The story narrates the road trip of two friends, HoneyCool and Anshreya (the protagonists of my first book) to Kutch. During the trip, they come across a mysterious man, called Aman, who calls himself a mechanic but appears too sophisticated and well-read for the same. The book traces the road journey of these three protagonists which brings alive the history, geography, anthropology, culture and traditions of Kutch. Of course, you will keep getting the nuggets of personal finance too, which are a natural progression from my first book.

In this book I have invested a lot of space to the aspects of behavioural finance. I firmly believe that wealth creation and retention is only 20% knowledge and 80% behaviour. All wealthy persons have an inherently disciplined and frugal mindset which I have tried to put forth through empirical data and examples.

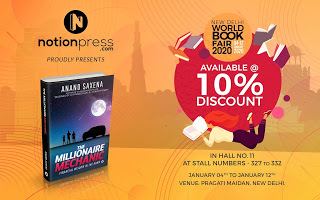

My publishers have displayed both my books at the World Book Trade Fair, New Delhi from 04 t0 12 Jan 2020. It is indeed a big honour and I will request you to please find time to visit Hall number 11, Stalls 327 to 332 and where my books are displayed. A photograph of my friends with my book will be a great morale- booster. I will stop here and let the heavyweights speak about my book- both from the literary and financial fields. Looking forward to your esteemed feedback.

“A wonderful financial travelogue which is a must-read for all those who are interested in this topic.” Yashwant Sinha Former Union Finance and External Affairs Minister

“It is not every day that you are called upon to hold a conversation with an author who is a maverick in terms of what he does for a living and blends it effortlessly with what he aspires to be. I was conferred with the honour to hold a talk with Anand Saxena on his debut endeavour ‘Musings of a financially illiterate father ‘at a Literature Festival. The title was thought-provoking and the pages I turned were the best ever in the genre of financial guidance and sharp insight into what can grow in our coffers if we apply our mind to it. An incisive, insightful and simple-to-understand writing that could turn you an alchemist to watch out for.

Anand’s second book, ‘A Millionaire Mechanic’ is another page-turner in sequence. He connects meaningfully with the reader, right at the start and effortlessly weaves story of Anshreya and HoneyCool around the concepts he wants to hold forth, thus turning the intimidating financial jargons into relatable concepts.

Anand truly is an exceptional writer, as they say of the first water and flowing forward with sequels surpassing his original. The book is an eclectic mix of adventure, history and anthropology thus making it a novel attempt to educate and show the ropes to the financially unacquainted.

An engaging read with practical applications which make you richer, both as a reader and investor.”

Mona Verma Poet, Corporate Trainer Author of books- A Bridge to Nowhere; God is a River; The White Shadow; The Clown of Whitefields & Other Stories; The Other & Lost and Found in Banaras.

“The book “Musings of a Financially Illiterate Father”, written so lucidly by Anand Saxena gave a clear glimpse into how seemingly difficult financial issues can be presented in an uncluttered manner to be easily understood and implemented by a common man.

Continuing with the same tradition of simple and easy presentation, Anand has again tackled this subject of personal finance by writing a unique Financial Travelogue, “The Millionaire Mechanic” traversing the colourful expanse of Bhuj and Rann of Kutch. The lessons driven home are as exciting as the travelogue.

I’m sure, this unconventional treatise of financial learning while travelling will bring delight and knowledge to its readers.

A strongly recommended book for the novices and experts alike.” Col Sanjeev Govila (Retd) SEBI Certified Registered Investment Advisor CEO, Hum Fauji Initiatives

“While going through the very first few chapters of the book, “The Millionaire Mechanic” written by Anand Saxena, I was struck with a deep sense of déjà vu. Firstly, I was amazed at the simplicity of the language of the author which was bereft of any high-sounding financial jargon and yet made personal finance look so easy. It grabbed my attention from the first page itself. And secondly, the déjà vu part- coming from an engineering background myself with no formal degree in finance, I can understand how interesting & important it would have been for Anand to gain knowledge of finance while researching for his book. What started as a fledgeling organisation just a few years back, my firm, Singhi Advisors today is amongst the top 5 Investment Banking firm in India and the largest homegrown “Midmarket Focussed” M&A advisory firm. That would not have been possible without gaining knowledge of finance and adapting to numbers-crunching skills. How I wish that I had recourse to such an interesting and enlightening book in my initial studies of finance.

Anand, however, is in a different zone in the book. His honest desire to impart personal finance education to the common investor comes out loud and clear throughout the book. He has also managed to put together a new genre in Indian writing- a financial travelogue, with great finesse. He has woven a colourful and rich landscape of Bhuj and the Rann of Kutch which the protagonists of the book travel through. The history, geography, anthropology, culture and traditions of this fascinating part of India come alive against which the nuggets of financial wisdom seem so easy and delightful to follow.

The book covers every part of personal finance that a common man is interested in and indeed concerned about- saving/investment, debt and credit management, asset allocation, planning for retirement, child education or buying a house, you name a need and Anand has provided a solution. He has also backed up his findings and deductions with rich empirical data which is logically laid out in the book.I would very strongly urge all the investors- financially wise or otherwise, to grab a copy of this book to keep referring to whenever a doubt about personal finance arises. It is a veritable treatise on personal finance masterfully narrated by Anand through the characters you will fall in love with. A winner for sure.”

Mahesh Singhi Founder and MD Singhi Advisors

Please do order the book now and enjoy it over the weekend.

December 28, 2019

MUSING 41- BHARAT BOND ETF: WORTH YOUR INVESTMENT?

MUSING 41

BHARAT BOND ETF: WORTH YOUR INVESTMENT?

The New Fund Offer (NFO) of Bharat Central Public Sector Enterprises (CPSE) Bond ETF was launched a few days back by the Government. The intention of the government is to raise about Rs 10,000 crore through this ETF. The ETF is mandated to invest in the bonds issued by the CPSU, CPSE, Central Public Financial Institutions (CPFI) or other government organisations. We have seen the crisis in the debt market over the last 18 months or so which still continues unabated. Forget about the coupons, the investors are finding that even their principal protection is at risk. At this juncture, the launch of this bond ETF is an interesting phenomenon which the common investors like you and me should watch closely. This post is meant to provide you with necessary inputs pertaining to this ETF for you to make a considered investing decision.

But before we do that a bit of update on my both the books. Musings of a Financially Illiterate Father continues its relentless march on Amazon Bestsellers list. It was ranked #12 on Kindle as on yesterday, 28 December 2019. The book has been in the top 20 for over last three months. My second book, The Millionaire Mechanic, is now in the absolute final stages of publishing and should be in your hands by the end of this month.

So, let’s first begin with the question- what is an ETF? As per Investopedia, “An ETF is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. To put it in layman’s terms, an ETF is akin to a mutual fund (MF) which is traded on the index like stocks. So far there was this myth in the Indian context that ETF and passive investing is only about equity investing. The western developed markets already have a huge investment in bond ETFs, but it is a brand-new phenomenon for India. In fact, the equity ETFs themselves have not done too well against equity MF so far. The Bharat ETF will compete against the traditional fixed income instruments like FD, FMP, debt MF and so on. Let’s start this comparison one by one.

Individual bonds- It is extremely difficult and cumbersome for the individual investor to buy bonds. The ticket size to buy individual bonds is quite big, to the tune of Rs 10 lakh or so. Secondly, with the individual bond, you carry the concentration risk because your money is invested in only 1 or 2 bonds whereas a bond ETF is a basket of many bonds which reduces the risk due to its inherent diversification. Thirdly, the taxation of individual bonds is also adverse where the interest accrued is fully taxable while the ETF offer the same tax advantages as debt MF. The last issue is of liquidity. When you want to sell your bond, a buyer may not be readily available or not at the price at which you wish to sell. In bond ETF, since they are being traded on the index, one can buy or sell any time.

Debt MF- The biggest advantage that ETF has over debt MF is of low cost. Normal debt MF has nearly 1% of Total Expense Ratio (TER), whereas in ETF it is only 0.0005%, virtually no expense. If you recollect my previous post of 11 Nov 2018, you will gauge the pernicious impact. I am giving the link below. The second issue is of transparency. It is difficult to track the performance of your bonds (say in debt mutual funds) but with the bond ETF, it can be done in real-time since the bond ETF is traded on the exchange and its NAV can be compared against the relevant benchmark index. Thirdly, with debt MF, the investor doesn’t know the exact type of bonds (duration or credit risk) in which the fund manager is investing whereas, in bond ETF, the structure of investing is clearly defined.

http://andysfinancial.blogspot.com/2018/11/personal-finance-musing-32-all-about.html?m=1

FD- As we have already seen that Bharat ETF can be traded on a daily basis since they are being traded on the exchange. This is a great advantage over other fixed income products like FD or FMP where your money gets locked for the fixed time. Secondly, FD interests are fully taxable unlike ETF which have taxation akin to debt Mutual funds with indexation benefits (after 3 years holding) hence taxation on ETF is lower than debt MF and bonds.

So, is it all hunky-dory with the Bharat ETF with no disadvantages? As of now the only major problem that I see is that of liquidity. Any investment must have easy liquidity, meaning if one has to sell it for some need or to get out of that investment, there should be buyers readily available. If Bharat ETF remains thinly traded it may suffer from this problem.

The second issue, not really a problem, is that one has to open a Demat account for investing and trading in Bharat ETF. For those not having a Demat account, it may be a restriction.

The Bharat ETF has been launched for two sets of maturity, 3- and 10-year series. It thus gives a wonderful combination of lock- in (if you decide to hold it till maturity) and liquidity (if you wish to trade on the exchange). However, if trading on the exchange, relevant brokerage charges will be applicable. As per the initial estimates, the likely yields are going to be as follows- 3-year ETF: 6-6.5%; 10-year ETF: 7-8%. Good option. Of course, these are indicative yields and the actual ones may be marginally different.

Debt MF is mainly being subscribed by the institutional investors and not by the retail investors. Bharat ETF are suited a common investor for a variety of reasons. Someone who has a long-term horizon of a minimum of 3 years and looking for safe, inflation plus returns would be interested in this ETF. In the era of crisis of debt funds, the sovereign backing of Bharat ETF is a Godsend as the principal is more or less protected.

Hope I have been able to provide you with the necessary information to make an educated decision about your debt ETF investing. Watch out my blog for future developments as they happen.

We were on a trip to Southern India over last week where I was invited to speak on “Personal Finance Management” at Trivandrum. The audience consisted of educated and erudite officers and ladies. My talk, on 27 Dec 2019, was received very well which included a riveting Q & A session. A glimpse of the event.

In the meanwhile, please enjoy my book, “Musings of a Financially Illiterate father”. Please share this post with your family, friends and social circles.

https://www.amazon.in/Musings-Financially-Illiterate-Father-Investors-ebook/dp/B07GDNFNMQ

December 13, 2019

MUSING 40- FINANCIAL LESSONS FROM SENSEX HISTORY: PART 2

MUSING 40

FINANCIAL LESSONS FROM SENSEX HISTORY

PART 2

Good morning friends. In the last post, we had discussed a few interesting facts and financial lessons from the 40 years old history of Sensex. This week we will track the entire journey of Sensex and draw out relevant investing/ financial lessons. But first, let us recount the three financial lessons from the last week’s blog post.

Financial Lesson 1. It is very difficult to bet on individual stocks and had we done so for the Sensex companies (the real blue- chip companies), in the last six months, there was a 50% chance of a loss/gain.

Financial Lesson 2. It is better to invest in broad market indices like Sensex or Nifty 50, at least 50% of your equity component, for steady and safe returns.

Financial Lesson 3. Though your equity investments will give good returns over the long term (Sensex has given nearly 17% returns since inception), but they will be full of volatility.

This blog post in fact takes off from where we left last week- tracking the journey of Sensex over the last 40 years. But before we do that a bit of update on my both the books. Musings of a Financially Illiterate Father continues its relentless march on Amazon Bestsellers list. My second book, The Millionaire Mechanic, has gone through two rounds of editing and should be in your hands by the end of this month.

Let me first show you the entire journey of the Sensex over the last 40 years.

Serial Year Sensex Milestone 1 Jul 1990 1000 2 Dec1999 5000 3 Feb 2006 10000 4 Oct 2007 20000 5 Jun 2014 25000 6 Mar 2015 30000 7 Jan 2018 36000 8 Aug 2018 38000 9 Apr 2019 39000 10 Jun 2019 40000 11 Nov 2019 41000

Remember that we discussed in the last post that though the Sensex was launched in 1986 but its base year to set the index to 100, was decided as 1979. Hence, Sensex took 11 years to reach the mark of 1000 from the initial 100 but then accelerated to next 3000 points within next one year. It reached the mark of 4000 by 1992. The notorious Harshad Mehta scam was also partly responsible for this bull run. Once this bubble burst, the consciousness to tighten the regulations came about. This was also the time when India, on the brink of a debt payment default and about to pledge its sovereign gold, liberalised its markets. This increased the competitiveness and efficiency of the market manifold.

Financial Lesson 4. What seems too good to be true in investments or indeed in life, is generally spurious and should be guarded against.

The journey of the Sensex from 4000 to 5000 was torturous and took nearly eight years and this milestone was reached in 1999 (a historical year; remember Operation Vijay in the Kargil Sector?) This was the phase of the Dot- Com boom and the internet gaining centre stage. Consequently, IT companies like Infosys and TCS made their stockholders rich and replaced old economy stocks.

Financial Lesson 5. Despite all the investing skills and prudence, disruptive technologies and inventions can bring shockwaves, both good and bad. No one can predict the next Infosys, TCS or Apple.

The Sensex journey from 5000 to 10000 took all of nine years and this milestone was reached in 2006 due to global markets booming on the back of the Chinese miracle. The journey from 100 to 5000 had taken 20 years but the next 5000 points took only seven years. The next 10000 points were reached in a record one year with the Sensex reaching 20000 mark in October 2007. The equity boom had set in in the right earnest mainly due to infusion of funds by the FIIs.

Financial Lesson 6. This further reinforces the previous financial lesson. Global markets are interlinked today and happenings in one part of the world can bring untold riches to the investors in the other part. Serendipity, as they say. But the reverse is equally true as we shall shortly see.

The Global markets went in a recession from early 2008 and by October 2008, Sensex had lost 64% of its value and sunk to 8500 points.

Financial Lesson 7. This lesson is a corollary to the previous lesson. The proverbial butterfly fluttering its wings in one part of the world can cause hurricanes in the other part. In this case, the Sensex hit a financial hurricane called the Sub- Prime Crisis.

The investors who were riding the equity bull deserted it for the safe comfort of debt, gold and real estate. A bad move in the long run as we will see. Those who were brave enough to stay put soon reaped handsome rewards.

Over the next five years, the market consolidated and grew steadily on the back of a recovering Indian economy and the second round of reforms in 2012. The Sensex regained 15000 points by July 2009. So, the investors who showed courage to not only hold on to their equity investments but in fact add to it in this bloodbath gained hugely- 8500 to 15000 in a mere nine months. In the five years following the 2008 global financial crisis, the Sensex went up 150%, a CAGR of 20%. It was a bonanza for the braves who chose to show faith in equity markets.

Financial Lesson 8. In Warren Buffet’s words, “Invest in equity when there is blood on the streets.”

Sensex rose to 21000 in November 2010 but could not sustain itself and slid to 15000 again by December 2011 due to global factors. This time the culprits were the European debt crisis due to which FIIs pulled out money and rupee depreciated. The financial lessons we have learnt so far were reinforced in a big way. However, the investors again panicked and exited the equity markets in droves.

Sensex rose to the levels of 20000 again by December 2012 due to the worldwide economic reforms. The FIIs came back to the Indian markets and their buying pushed the Sensex to new heights in the year 2013. Sensex touched the mark of 25000 in Jun 2014 and 30000 in Mar 2015.

In fact, from the year 2014 onwards, the market has been tracking Indian economic reforms and has been aided by abundant global liquidity as central banks around the world maintained an accommodative stance. Over this period, the Sensex has been moving to new heights touching 41000 in November 2019. However, as we saw in the last week’s post, its not that all the 30 stocks of the Sensex are moving up. In fact, about half of them are losing money. The bull run of the Sensex is due to just 4- 5 stocks.

Financial Lesson 9 We must understand the volatile nature of the equity market as well as its ability to appreciate over time as economic cycles turn. Also, that equity is a long- term wealth creator and any period less than five years is likely to give you volatile returns.

Hope you have enjoyed this roller-coaster journey of Sensex with its attendant financial lessons. Sensex or Nifty investing also called Passive Investing, already hugely popular in the developed western markets, is the future of equity investing. So, keep in touch with the emerging trends.

Enjoy your weekend with my book.

https://www.amazon.in/Musings-Financially-Illiterate-Father-Investors-ebook/dp/B07GDNFNMQ

November 29, 2019

MUSING 39- INVESTING LESSONS FROM THE JOURNEY OF SENSEX: PART 1

MUSING 39

FINANCIAL LESSONS FROM SENSEX HISTORY

PART 1

Good morning friends. For the equity enthusiasts, the day of 26 November 2019 would have been a special one. On that day, the Sensex crossed a new milestone- of closing at its highest ever, 41000 mark. It is an interesting journey which along the way has taught us so many investing lessons. I thought of writing a series of blogposts on Sensex, and some key issues which may help us in our future investment journey.

But before that, a bit of update on both my books. Musings of a Financially Illiterate Father continues its relentless march on Amazon Bestsellers list. The book was ranked #9 on Kindle on 27 November. My second book, The Millionaire Mechanic, has gone through two rounds of editing and should be in your hands by end-December.

Bombay Stock Exchange (BSE), established in 1986, is the world’s 11thbiggest stock exchange with more than 5500 publicly listed companies on it. All the trading for the stocks of these companies takes place on BSE. The Sensex or the Sensitive Index or BSE 30, was launched in 1986 but it's base- year to set the index to 100, was decided as 1979. Thus, the Sensex is now 40 years old and has risen from 100 to 41,000 in these 40 years. Sensexor BSE 30 is the market index for BSE consisting of 30 well established and financially sound companies belonging to different sectors of the economy. The movement of the Sensex reflects the general movement of the companies listed on the BSE. Please understand that the upward/downward movement of Sensex doesn’t reflect the similar movement of all the companies contained in it much less of all the 5500 listed companies. We will see this point as we move along.

As on date, the sectors contained in the Sensex are- Banks Private, Banks Public (only SBI), Paints, Automobiles, Finance NBFC, Telcom, IT Services and consulting, Finance- housing sector, Household and Personal Products, Cigarettes/Tobacco, Engineering and Construction, Power generation, Oil exploration and Production, Pharma and drugs, Iron and Steel, and Metals- Non-Ferrous.

So, the entire spectrum of the economy is represented in Sensex and hence the movement of it truly reflects the general health of the country’s economy. I made the point that the movement of the Sensex does not reflect the movement of all the constituent of it- let me give a few examples. In the last 6 months (the reason for taking a six-month period will be covered subsequently), 15 out of 30 constituent companies have lost money, the severest being Yes Bank at minus 52.23% If we turn to good news, Asian Paint has given returns of plus 25.94% followed by Bharti Airtel at plus 24.77%.

The Sensex overall has risen from 39,765 (28 May 2019) to 41,130 (28 Nov 2019), thus giving a gain of 3.43% over 6 months or nearly 7% per annum- a very good return in these choppy markets. The first lesson here is that it is very difficult to bet on individual stocks and had we done so for the Sensex companies (the real blue-chip companies), there was a 50% chance of a loss/gain. This fact, of course, could not have been known in advance. However, by investing in Sensex, we would have avoided all the palpitations and yet gained handsome returns. One could argue that while we would have got 7% returns, but that would have been at the cost of 25% returns (Asian Paints). I would humbly respond that actually, one would have avoided minus 52% returns (Yes Bank) as it is only the hindsight which is telling us which company did well.

This brings us to our second lesson- it is better to invest in broad market indices like Sensex or Nifty 50, at least 50% of your equity component for steady and safe returns. This obviates the need for churning your stock picks and keeping a constant track of their performance. You have a life to live and enjoy and it is better not to become a slave to the stock market. Today, mutual funds provide readymade solutions to invest in these indices. The details I will cover in one of my subsequent posts.

The methodology of inclusion and exclusion of these 30 companies that form the Sensex is also very interesting. The exercise is done every Jun and December, and the next one is due on 23 December. However, it is already known that three companies are being moved out of Sensex and consequently three being moved in. The companies exiting are Tata Motors, which is not doing well for a long time now, Vedanta Ltd, and Yes Bank, which, as I already covered, is down by about 52% in the last six months.

The three companies which are being added are- Nestle Ltd, Titan Industries and Ultratech Cement, which have been good performers over the last six months.

The third lesson here is that though your equity investments will give good returns over the long term (Sensex has given nearly 17% returns since inception), but they will be full of volatility. This fact can be validated by following the Sensex journey since inception which has been anything but smooth. It has had its share of rise and fall. We will cover the same on our next week’s post, where we will track the Sensex journey since its inception, which is quite fascinating, and learn our financial lessons from it.

I would leave you to mull over these three financial lessons from Sensex journey and work out your methodology to invest in equity. Next week I will follow up this Sensex journey in detail while bringing out the investing lessons.One of the readers, Sunil, has this to say about “Musings of a Financially Illiterate Father” on Amazon, on 18 November- “An eye-opener. While one will feel enriched after reading the book, the other feeling which is hard to suppress is, “WHY DID I NOT READ IT EARLIER? Not only a MUST-READ, but an ASAP READ.” Thanks for your encouraging words, Sunil. A screenshot is below.

https://www.amazon.in/Musings-Financially-Illiterate-Father-Investors-ebook/dp/B07GDNFNMQ

November 22, 2019

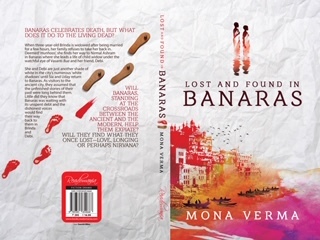

Musing 38- Meet the Author: Mona Verma

MUSING 38- MEET THE AUTHOR

MONA VERMA

A bit of update on my books. “Musings of a Financially Illiterate Father” is continuously trending in top 20 on Amazon and is an Amazon bestseller now. My second book, “The Millionaire Mechanic” is in advanced stages of editing and should be in your hands by next month. I am also launching my website soon, the details of which I will share next week.

How does time fly? It has been one full year since my book, “Musings of a Financially Illiterate Father”, debuted at the lit fest “Valley of Words” at Dehradun. It was my first appearance as an author at a lit fest and not surprisingly, there was a swarm of butterflies in my stomach. I was to do an hour’s interview anchored by a famed author followed by Q&A by the audience. I was nervous on two counts- firstly, my book was on a non-core subject and I was apprehensive of being bombarded with questions which I may not be able to answer. And secondly, facing intellectual and cerebral audience who may ask no-holds-barred questions without the political correctness as encountered in my profession.

To cut a long story short, the session went off exceedingly well, and no thanks to me. It happened because I was guided so beautifully by the anchor, Mona Verma, the famed author, who soothed my nerves by meeting me an hour before the interview, telling me what to expect and how to handle the Q&A. Her charm, grace and poise and the fact that she was such a celebrated author had a salutary effect on me. On this first anniversary of my debut lit fest, I thought it fit to introduce Mona and her books to you. This musing thus is not about personal finance but a fellow author and dear friend.

Mona incidentally is not only an author of 6 acclaimed books but also a poet, Academician, Soft Skills Consultant and Corporate Trainer. How she finds time and energy to do so many things together beats me and whenever I ask her, she very gracefully sidesteps the question. I though am resolute to find the answer one of these days as I find it so tough to even don a double hat- of a working professional and an author.

Mona is an award-winning author of 6 works of fiction, A Bridge to Nowhere, God is a River, The White Shadow, The Clown of Whitefields & other stories, The Other and Lost & Found in Banaras. She has edited various science journals, self -help books, biographies and is a regular feature writer for online newspapers. She is on board of various Universities as an advisory expert and is much sought as visiting faculty for Creative writing, Haiku and Limericks. She is a regular invitee to Writers' meet called for by Governor of Uttarakhand, at Rajbhawan Dehradun.

Presently, she co-owns and runs her firm DISHA, which deals with corporate, organizational and faculty/student training in Universities and Corporate houses. She is a visiting faculty at Mahindra & Mahindra, American Express, DRDO, ONGC, THDC and IITs across the country. Apart from the above, she has a keen interest in classical music, charcoal sketching, oil painting, photography and travel.

If I cover her credentials in full, I will run out of space in this blog and hence tell you a bit about her latest book, “Lost and Found in Banaras”, which is not only setting new records in sales but also winning critical acclaim. The words describing her work are of the author herself- Mona.

“Lost and Found in Banaras is entirely a work of fiction, which is based on the predicaments of the forlorn child widows in Banaras. These women are a plaintive sight with no dearth to the plethora of the adversities they face in this obsolete culture. At the receiving end of the misgivings of an abrasive society, the dichotomy between religion and spirituality further ostracises them from the life they ought to be living. The protagonists, Brinda and Debi fight a valiant battle against these acrimonious oddities and stave off the call of the flesh that they could be pushed into; their hearts waging a war against the sensibilities of the society that are so severely sedimented into its culture.

While writing this book, I was gripped by a vexed question: What is the Law of karma, and whether there is a good reason to believe in expiating, the longing for salvation and its significance in this hedonistic age. The story is set around Banaras, the most ancient city in the world; still shrouded in the mysteries, the myths and the legends that surround it. Pilgrims and tourists throng this place to attain nirvana. The want of peace in afterlife puzzled me all the more. Would we want to be born again?

And what is salvation to us?

Banaras has infinite etymologies surrounding it, the myths, the tryst for redemption and expiation from the cycle of life and death but what sense does it make to the common man of today? Do we still want it?

What fascinated me further was that where death is feared in other parts of the world, it is Banaras's currency. It is welcomed like a lucrative business. As the story wove on, I felt that Banaras fights the stereotypes in more ways than one. That is when I had Sia and Uday visit Banaras for reasons entirely different from the traditional. The former to her parental home, long left. And, Uday to relive his atavistic fears but in the name of a professional venture. But unbeknownst to them, they both had a punishing past, waiting to be unfolded. Does their sojourn help them find a cogent emotional fix? Does Kashi still render nirvana to the empathy starved and what significance does the law of karma hold for the contemporary debauched world to which Sia and Uday belong?

Lost & Found in Banaras draws its inspiration from reality, albeit it is entirely a work of fiction, yet it does not circumvent the enormity of these remissive subjects and breaks the paradox. The aphorisms from the Bhagwad Gita, further reinstate the law of karma. There is an unexpected denouement to the storyline as a new season is uncorked into the characters’ lives, which never seemed quite as possible when they had set off on their journey.

The title Lost & Found In Banaras, applies to the answers to the vexed questions that life raises again and again and a discovery that freedom from the corroding past is what salvation is. Sia and Uday and all those who tread this journey with them find their answers through each other, as entwined destinies come undone in the face of adversities and realisations and fate offer them a chance to expiate, not by death but by life.

And what do the child widows discover as they in their irrelevant existence just treaded their lives as mere white shadows in clear darkness? Conveniently unseen and forgotten but ubiquitously ambient, just like the white shadow of karma, something that we are never a moment without…

And it led them to find what they had lost, in Banaras.”

Hope you enjoyed reading it? I definitely did. Mona truly is a wordsmith and mesmerises the readers with her subtle play of words. Do read "Lost and Found in Banaras", it's available on Amazon. I am sharing the link.

https://www.amazon.in/Lost-Found-Banaras-Mona-Verma/dp/9385854666

November 16, 2019

Musing 37- Essential Five Insurances: The Concluding Part

MUSING 37

INSURANCE: THE ESSENTIAL FIVE

OTHER INSURANCES

It is a matter of great honour and privilege for me to unveil the cover of my new book, “The Millionaire Mechanic- Financial Wisdom in The Rann”, to my friends. With this book, I am attempting a new genre in writing- a Financial Travelogue. The book is set in beautiful Kutch and will give you the thrill of travelling as you also gain financial wisdom through the protagonists- Anshreya, HoneyCool and Aman. I will await your reactions to the book cover with bated breath. I will also request you to share the book cover with your family, friends and social circles to give it wide publicity. The book should be in your hands by December.

In the last three posts we have discussed two out of the five essential five insurances- Life and Health insurances. In this final post of this series, we will tackle the balance three essential insurances.

Accident and Disability Cover

The number of road accidents are rising by the day in our country. Despite enhanced safety features in the vehicles, many of these accidents result in serious injuries to the persons involved in them. Many of these injuries could be potentially debilitating and may result in short/long term hospitalisation which in turn may impact the earning capacity of the victim. This could have a serious financial effect on the family of the victim.

It is thus axiomatic to protect you and your family against such mishaps by an appropriate insurance. This cover will protect you against a temporary or permanent disability which results in your loss of job or reduction in earning capacity. The thing to note is that one should not go for a ‘short-term disability plan’ meaning a plan that covers less than five years of disability. Instead, go for a longer duration disability plan, we see the mishaps resulting in persons being even paraplegic for life.

The important issue is to look at all the financial liabilities that one has including the EMI being paid and the investments that are ongoing in terms of SIP. The annual financial requirements must be diligently worked out and a cover of 6 to 8 times could be considered. This amount (sum insured) could be reviewed every five years or so as one’s financial obligations will undergo a change with children and their education and marriage requirements looming.There are policies that pay out a lump sum to one’s nominee in case of death due to accident and pay a monthly sum in case of a disability due to an accident. Take a call as per your needs and financial status.

Home and Content’s Insurance

Your home and its contents are invariably your most precious possessions which you can’t afford to lose in a natural or manmade catastrophe. Yes, earthquakes, fires, cyclones, floods and burglary can occur with no notice and cause the devastation to your home- remember the recent floods in Chennai? This is one kind of insurance that people shy away from and this could be a big mistake in case of a mishap.

You don’t have to insure the house for the "value of the property" which includes the cost of the land, locality and construction costs but only for the reconstruction cost in case of a mishap.

Even if you are living in the house as a tenant, do insure the contents of the house against any mishap.

Vehicle Insurance

Your vehicle insurance should not only cover the cost of repairing or replacing the vehicle but also have a ‘third party insurance’ clause which protects you against claims made by the accident victims. Also, go for the cashless repair clause wherein your vehicle gets repaired in the designated workshops without you paying for it.

You may consider a zero-depreciation rider meaning that year-on-year the value of the car will not be deemed to be depreciating by the insurance company. The pros are that in case of an accident, you get almost the full settlement without considering any depreciation in the cost of the vehicle. The cons are a slightly higher premium. You may also consider covering your valuable car accessories.

Do not claim the cost of minor repairs to the car as that is construed as a claim and takes away the No Claim Bonus on renewal of the policy. This bonus could be as high as 20-60% of the premium amount.

Also remember, never to let your vehicle insurance policy lapse. It is taken as a sign of reckless behaviour by the insurance companies with a corresponding higher premium.

Key Takeaways

• The ‘essential five’ insurance policies discussed in the last four posts (Life, Health, Accident and Disability, Home and Content and Vehicle Insurance) along with your breathing fund (please read Musing 33 dated 16 October in the blog. The link is provided below.) will give you a solid foundation to build your financial future without worrying about emergencies and mishaps. Most importantly, peace of mind will follow you and your family.

https://andysfinancial.blogspot.com/2019/10/personal-finance-musing-33-breathing.html

• Never mix insurance with investment. Don’t look for returns from your insurance policies.

See you next week with more information on my new book. Till that time enjoy my book, “Musings of a Financially Illiterate Father”, still ruling the global rankings in top 10. the link is below.

https://www.amazon.in/Musings-Financially-Illiterate-Father-Investors-ebook/dp/B07GDNFNMQ

November 9, 2019

Musing 36- The Essential Five: Health Insurance- The Latest Rules

MUSING 36

INSURANCE: THE ESSENTIAL FIVE

HEALTH INSURANCE- LATEST RULES

Morningstar is a global financial services firm based in Chicago, USA. It is considered to be the gold-standard in investment research and management services. Naturally, any reference of any product or services quoted or referred to by the Morningstar assumes utmost importance.

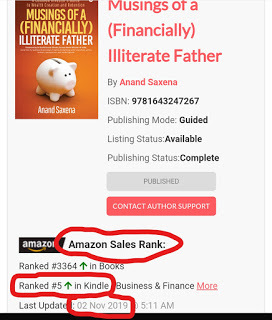

It is a matter of great pride and privilege for me that my book, “Musings of a Financially Illiterate Father”- an Amazon Bestseller and ranked # 5 globally, has been referred to by Morningstar in their article “Saving for Your Child’s Education”. As a debut author, it is indeed a great honour for me, and I thank Morningstar for the same. The link is provided below for your perusal.

https://www.morningstar.in/posts/52584/saving-childs-education.aspx

IRDAI has recently brought out its new draft policy on guidelines pertaining to health insurance. Most, if not all the proposed changes are consumer-friendly and will benefit all of us. So far, when one had gone out to buy a health insurance policy, many issues were left ambiguous to the customer which resulted in the rejection of claims when the need arose. This post is an effort to highlight important aspects of the new draft policy to you.

The most important point is pertaining to exclusions in the policy. This means certain diseases which thus far were not covered by the insurer. In fact, if one had these diseases say a heart ailment or diabetes, the insurer would not cover the customer by health policy. Now, IRDAI has listed out certain health conditions which even if the customer is suffering from, can’t result in non-granting the policy by the insurer. What will instead be done is that the insurer will cover you for all diseases and illness except for those which the customer is already suffering from. So, if the customer is suffering from diabetes, he will be given a health insurance cover which will cover him/her from all diseases/illness/ailments except related to diabetes.

Be careful of the correct declaration of pre-existing diseases and be truthful. Any treatment/diagnosis of a disease done within a period 24 months prior to the date of the policy has to be declared and construed as a pre-existing disease. Similarly, if after signing the policy, you are detected with a disease, say hypertension, within a specified period, it is also construed as a pre-existing disease.

A related issue is that if a disease comes to light about which the customer was not aware of at the time of going for the policy, his claim can’t be rejected on the ground of it being pre-existing.

Another important issue is that patients suffering from mental illness and other psychological disorders can’t be denied being covered under a health insurance policy. The caveat is that the customer should not have had this illness when he/she took the policy. This disease was a taboo for health insurance thus far.

However, there is a standard 30 days period after you take a policy, in which you are not covered even if you contact a disease/illness. This clause is not applicable in case of an accident.

There are few standard exclusions though which will not be covered by insurance company like surgery related to obesity, sex-change surgery, HIV/AIDS, epilepsy etc. Also, treatments related to alcoholism and drug abuse are also excluded. Do discuss these standard exclusions- 16 in total, in detail with your insurer before signing on the dotted line.

Earlier, an ambiguous clause existed which talked of exclusion if one indulged in hazardous activities, which were as such not defined. Hence, the insurer could reject the claim on flimsy ground. Now, if the so-called hazardous activities are part and parcel of your job/occupation your claim can’t be rejected. So, the persons working in say mining industry will get covered by health insurance. However, if you decide to go for bungee jumping and get hurt in the process, you are not covered by the policy as this activity is not intrinsic to your job.

The premiums of these health policies, with the additional exclusions, may marginally rise- may be in the range of 10-15%. However, the exact impact will have to be seen.

These changes come fully into effect with effect from 01 October 2020. However, any health policy which has been issued from 01 October 2019 onwards, has to also conform to these guidelines. In addition, any health policies purchased before 01 October 2019, will have to gradually change to be compliant with these new guidelines by 01 October 2020.

I will stop here for you to mull over your status of health insurance and take corrective actions if required. We will discuss the remaining three essential insurances next week. See you next week with more information on my new book. Till that time enjoy my book, the link is below.

https://www.amazon.in/Musings-Financially-Illiterate-Father-Investors-ebook/dp/B07GDNFNMQ

November 1, 2019

Musing 35- Insurance The Essential Five: Health Insurance part 1

INSURANCE: THE ESSENTIAL FIVE- PART 2

The festival of lights- Diwali is over and I am sure you enjoyed the same with your family and friends. In my case though, Diwali continues unabated with my book, “Musings of a Financially Illiterate Father”, reaching new heights every day.

As on 02 Nov 2019, i.e. today, the book is ranked #2 globally on Kindle (Business and Finance) and #12 on Amazon Books (Business Self-Help). It is an amazing and humbling feat considering that there are nearly 1.5 million books published each year and my book is now nearly 17 months old.Very clearly, common investors like me have found resonance with the book and have given it a thumbs-up. Thank you all for your love, support and blessings.

We had discussed the first of the essential five insurances- the life insurance, in my last post. Let’s commence with our discussion on the remaining four insurances.

2. Health Insurance.

This is the second most important insurance that one needs. In India, there are various kinds of health insurance plans: individual plans, family floater plans, maternity insurance plans, personal accident cover plans, critical illness insurance plans and senior citizen plans. The thing to be remembered is that as you age, you will be paying more and more for a health plan. In general, buying a health cover after 40 years of age will be costlier. For a family of six including two senior citizens, two adults under 40 and two children, a 10-lakh health cover will cost around ₹25,000 per annum today.

The factors to be considered for a health insurance plan follow.

• How much should be the ‘sum insured?’ In a small town, an amount of 3-5 lakhs may suffice but, in a metro, 5-10 lakhs may be a better figure to plan. Corporate health insurance is being offered by many companies today. Its coverage must be factored in the calculations.

• The insurance plan must offer ‘lifetime renewability’ as health-related expenses tend to rise with age and buying a new plan will be prohibitive in terms of premium in middle or old age. This simply means that you can keep renewing your health insurance coverage each year irrespective of your age or ailments. This is mandated by the Insurance Regulatory and Development Authority of India (IRDAI) and can’t be denied by the insurance companies.

• Your policy must have a ‘top-up’ or ‘restore limit’ meaning that if you are afflicted with a critical illness which requires an expenditure beyond the sum insured, that can be topped up by paying an additional premium.

• Critically look for ‘sub-limits’ and ‘co-payment’ options in the plan which should be none or minimum. Sub-limits mean that your insurer specifies a limit for an expense and anything above that needs to be borne by you (co-payment). Room rent, diagnostics and doctor’s fees are the most commonly introduced sub-limits.”

• Pre-existing diseases must be honestly declared. Most Insurance companies have a waiting period for starting coverage for pre-existing diseases, which may be between 2 and 5 years. Look for the minimum waiting period and do disclose your existing ailments or else the insurance company will retain the right to reject your claim.

• Day-care and OPD expenses must be covered in the policy. Most insurance plans cater for only overnight admission or minimum hospital admission of 24 hours. Many medical and surgical procedures, however, require an admission of fewer than 24 hours, which will be excluded by default by the insurance company.

I will stop here for you to mull over this post and review your health cover. But, hold your horses till next week when I update you on the latest changes brought about by IRDA in the field of health insurance.Till that time enjoy my book, the link is below.

https://www.amazon.in/Musings-Financially-Illiterate-Father-Investors-ebook/dp/B07GDNFNMQ