Harry Sit's Blog

November 17, 2025

Building a Bond Ladder with Individual Bonds and ETFs

Bond funds had their worst calendar-year return in several decades in 2022. The broad market index was down 13% that year, while the S&P 500 was down 18%. People were disappointed that bonds didn’t hold up when stocks were down. They’re doubly disappointed that bonds still haven’t fully recovered from the losses in 2022 as of mid-November 2025, while stocks have not only recovered but are up nearly 50% since then.

Bond Fund Performance 2022-2025

Bond Fund Performance 2022-2025Rightly or wrongly, people blame bond funds for this loss. They think they would’ve avoided the loss if they had a bond ladder, because every bond in the ladder would pay out in full at maturity. While a bond ladder is better in some cases, and not a magic bullet in other cases (see Two Types of Bond Ladder: When to Replace a Bond Fund or ETF), it’s difficult to fight the perception that a bond ladder is safer than bond funds. Psychological comfort is important. If it makes you feel better to have a ladder and avoid bond funds, then make one.

How difficult it is to implement a ladder depends on the types of bonds you invest in. It’s easier to do it with Treasuries and brokered CDs. It’s more difficult to do it with corporate bonds or munis. ETF providers have created products to help with this endeavor.

TreasuriesYou can buy Treasuries at major brokers such as Vanguard, Fidelity, and Charles Schwab with no fee. New-issue Treasuries come in these maturities:

MaturityNew Issue Frequency4-week, 6-week, 8-week, 13-week, 17-week, 26-weekWeekly52-week, 2-year, 3-year, 5-year, 7-year, 10-year, 20-year, 30-yearMonthlySee How To Buy Treasury Bills & Notes Without Fee at Online Brokers. While there’s no 4-year Treasury or 6-year Treasury as a new issue, you can fill in the missing rungs by buying on the secondary market. See How to Buy Treasury Bills & Notes On the Secondary Market.

If you don’t want to mess with individual Treasuries, iShares offers iBonds Term Treasury ETFs to help you build a ladder. Please don’t confuse these with I Bonds from TreasuryDirect. Each of these Term Treasury ETFs holds Treasuries maturing in one specific year. For example, iShares iBonds Dec 2028 Term Treasury ETF (IBTI) holds Treasuries that will mature between January 2028 and November 2028. This ETF will liquidate in December 2028 and pay out in cash.

Instead of buying one Treasury for each year, you would buy one different ETF for each year. iShares has one of these ETFs each year from the current year through the next 10 years. You would buy the 2026 ETF for 2026, the 2027 ETF for 2027, the 2028 ETF for 2028, and so on. They’ll put out new ETFs as each ETF liquidates at the end of its life.

iShares charges a 0.07% expense ratio for these Term Treasury ETFs. Treasuries trade in $1,000 increments. These iShares Term Treasury ETFs are about $25 per share. You can get more granular and buy in smaller amounts when you build and add to your ladder with these ETFs. The ETFs also make tax reporting easier than individual Treasuries when you hold them in a taxable account.

TIPSTIPS are a special type of Treasuries. You can buy them in the same way as you buy regular Treasuries, except that there are fewer new issues. You must buy most of them on the secondary market when you want a TIPS ladder. There are no TIPS maturing between 2036 and 2039, but this gap will be filled in the next few years.

The website TIPSLadder.com tells you which TIPS to buy and how many to buy when you enter the desired size and length of your ladder.

iShares also offers iBonds Term TIPS ETFs. Similar to the Term Treasury ETFs, each Term TIPS ETF holds TIPS that will mature in one specific year. For example, iShares iBonds Oct 2028 Term TIPS ETF (IBIE) holds six TIPS that will mature between January 2028 and October 2028. It will liquidate and payout in cash in October 2028. iShares has one of these ETFs each year from the current year through the next 10 years. You would buy these 10 different ETFs if you want a 10-year ladder. The expense ratio is 0.1%.

It may be more convenient to buy these Term TIPS ETFs. They also make tax reporting easier than individual TIPS when you hold them in a taxable account.

CDsIt’s more difficult to build a ladder with direct CDs. You’d have to open accounts with multiple banks to get the best rates for each maturity. It’s easier to buy brokered CDs in a brokerage account, but watch out for callable CDs. The rates on non-callable CDs aren’t that much better than Treasuries, and CDs don’t have state and local tax exemptions. See Buying CD in a Brokerage Account vs Bank CD or Treasury.

Corporate BondsThe yields on investment-grade corporate bonds are higher than yields on Treasuries of comparable maturities because corporate bonds have a higher risk. There are no state or local tax exemptions on corporate bonds in a taxable account.

It’s better to use ETFs when you want a corporate bond ladder because it’s difficult to diversify in individual corporate bonds.

iShares offers iBonds Term Corporate ETFs. Invesco offers BulletShares Corporate Bond ETFs. They work similarly to the Treasury and TIPS counterparts. Each ETF holds hundreds of bonds from different corporations, all maturing in the designated year. Both series have one of these ETFs each year from the current year through the next 10 years. Each ETF will liquidate and pay out in cash in December of the designated year. You would buy 10 ETFs if you want a 10-year ladder. Both the iShares series and the Invesco series charge a 0.1% expense ratio.

MunisIt’s the same story with municipal bonds. It’s better to use ETFs when you want a muni bond ladder because it’s difficult to diversify in individual muni bonds.

iShares offers iBonds Term Muni Bond ETFs. Invesco offers BulletShares Municipal Bond ETFs. Each ETF holds over 1,000 muni bonds from different municipalities, all maturing in the designated year. iShares has an ETF each year from the current year through the next 6 years. Invesco has one each year from the current year through the next 10 years. Each ETF will liquidate and pay out in cash in December of the designated year. Both the iShares series and the Invesco series charge a 0.18% expense ratio.

Because muni bond yields are lower than taxable bond yields, the 0.18% expense ratio takes a bigger bite out of the muni bond yields than the more reasonable 0.07% and 0.10% expense ratios on the Treasury, TIPS, and corporate bond ETFs. If I were to build a bond ladder with these ETFs, I would first consider doing one with Treasury, TIPS, or corporate bond ETFs in a pre-tax account.

Rolling Ladder ETFsiShares also offers four ladder ETFs that invest in the Term ETFs as a rolling ladder. It has one ETF for Treasury (LDRT), one for TIPS (LDRI), one for investment-grade corporate bonds (LDRC), and one for high-yield (junk) bonds (LDRH). For example, LDRT invests 1/5 of its assets in each of the 2026 through 2030 Term Treasury ETFs. When the 2026 ETF liquidates and pays out, it will put the money in the 2031 ETF and keep it going.

These rolling ladder ETFs aren’t that interesting. You might as well invest in a normal bond mutual fund or ETFs that invest in bonds with a target range of maturities. The market has realized this as well. The rolling ladder ETF LDRT has $21 million in assets. The regular short-term Treasury ETF SHY is 1,000 times larger with $24 billion in assets.

Distributing Ladder ETFsNorthern Trust offers an interesting product called distributing ladder ETFs. Instead of buying 10 ETFs for a 10-year ladder, you just buy one ETF, which holds a ladder inside the ETF and distributes the principal when the bond matures.

For example, Northern Trust 2035 Inflation-Linked Distributing Ladder ETF (TIPB) holds 10 TIPS, one maturing each year from 2026 through 2035. It distributes the interest earned on these TIPS, plus the principal from each TIPS as it matures. It’s a 10-year TIPS ladder managed for you in one ETF. Northern Trust currently has four of these TIPS distributing ladder ETFs running through 2030, 2035, 2045, and 2055. The expense ratio is 0.1%.

These TIPS distributing ladder ETFs have a great design, but the market hasn’t recognized them yet because they only started in August 2025. Each ETF only has about $5 million in assets as of mid-November 2025. I hope they will get more traction in the marketplace; otherwise, they run the risk of not surviving the ETF market competition.

***

A ladder is helpful when you want to spend a preset amount on a preset schedule. Although I don’t hold a ladder because I don’t need to spend a preset amount on a preset schedule, some find a ladder psychologically beneficial, even if it doesn’t make much financial difference.

You can buy individual Treasuries and TIPS when you want a Treasury or TIPS ladder. The iShares iBonds Term Treasury and Term TIPS ETFs offer convenience at a reasonable price. It’ll be easier still if the Northern Trust distributing ladder ETFs become more popular. Building a ladder with the iShares and Invesco ETFs makes more sense when you want a corporate or a muni bond ladder because the ETFs provide diversification.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Building a Bond Ladder with Individual Bonds and ETFs appeared first on The Finance Buff.

November 10, 2025

ACA Health Plan Premiums When One Spouse Starts Medicare

When both spouses in a married couple retire before 65, they most likely will buy health insurance from the ACA marketplace unless they have retiree health insurance coverage or they only have a short gap that can be covered by COBRA. When there’s an age difference between the two spouses, the older spouse will start Medicare at 65, leaving the younger spouse in ACA health insurance.

Reader Charlie brought up this exact scenario. Both Charlie and his wife have ACA health insurance now. After Charlie becomes eligible for Medicare next year, his 58-year-old wife will continue on the ACA plan. Now, when they switch from covering both of them on the ACA plan to covering just one person, how will their ACA health insurance premiums change?

Will their premiums drop 50%, because they will cover just one person instead of two? Or actually more than 50%, because the person coming off the plan, Charlie, is older and more expensive to insure?

Will their premiums stay the same, because ACA premiums are tied to income, and their income won’t change?

Will their premiums actually increase, or drop, but by less than half, because if it isn’t weird and counterintuitive, it wouldn’t make an interesting subject for a blog post?

The answer is — all of the above, depending on whether they receive a subsidy and what plan they have.

We’re not talking about premium increases from the insurance company or changes to the premium tax credit from changes in income. Just changing the number of people covered by an ACA health plan will have weird and unexpected effects.

No SubsidyThe ACA premium subsidy cliff is scheduled to return in 2026. The recent government shutdown didn’t push it out. You won’t receive any premium subsidy if your income is above 400% of the Federal Poverty Level (FPL), which is $84,600 in 2026 for a two-person household in the lower 48 states.

It’s more intuitive when you don’t qualify for a premium subsidy. When you pay the full price, insuring two people sure costs more than insuring just one person. When the older spouse starts Medicare, your ACA health insurance premiums will drop by half. Because it usually costs more to insure an older person, it’ll fall by slightly more than half.

Subsidy – 2nd Lowest Cost Silver PlanIf your income qualifies you for a subsidy, the subsidy is calculated from the premiums for the Second Lowest Cost Silver Plan (SLCSP) in your area. If it happens to be the plan you choose, you will be asked to pay a set percentage of your household income for that plan. The government will pay the remainder with a premium subsidy. See ACA Health Insurance Premium Tax Credit Percentages.

The amount you’re expected to pay toward a second lowest cost Silver plan goes by the household size and household income. It doesn’t matter how many people in the household are on the policy. When one person goes on Medicare, your household size doesn’t change. Nor does your household income. Therefore, you’re still expected to pay the same amount.

Suppose your household income is just below the maximum that qualifies for the premium tax credit for a two-person household, and you choose the second lowest cost Silver plan in your area. Your net premiums after the subsidy will be the same whether you cover both of you or only one person. The only difference is that the premium subsidy becomes smaller when the total premiums before the subsidy drop by half.

After the older spouse starts Medicare, you will also have to pay for Medicare Part B and Part D, and possibly a Medicare Supplement policy. Your total spending on health insurance will increase. But, because the deductible and co-pay on Medicare are lower than those on an ACA plan, your total healthcare spending may decrease. And because you will still receive a subsidy when you cover just one person, albeit a smaller subsidy than when you cover two people, a subsidy is still a subsidy. You’re better off with a subsidy and not seeing a premium drop than if you must pay the full price.

Subsidy – More Expensive PlanWhen you qualify for a premium subsidy and you choose a more expensive plan than the second lowest cost Silver plan in your area, you pay 100% of the price difference in addition to your normal net premium. The formula for your net premiums is:

Income * Applicable Percentage + (full price for your selected plan – full price for the Second Lowest Cost Silver Plan)

When one person goes off the ACA plan, the price difference also drops by half. Your premiums after the subsidy will go down by the decrease in the price difference.

Suppose you choose a Gold plan, and it’s more expensive than the second lowest cost Silver plan by $500 per month for two people. You pay 100% of this $500 price difference. The price difference may become $240 per month when you cover just one person. Therefore you save $260 per month when the older spouse starts Medicare.

Subsidy – Less Expensive PlanThe opposite happens when you choose a less expensive plan. You receive 100% of the price difference as your cost savings to reduce your normal net premiums. Your net premiums after the subsidy are:

Income * Applicable Percentage – (full price for the Second Lowest Cost Silver Plan – full price for your selected plan)

When one person goes off the ACA plan, your cost savings drop by half. Your premiums after the subsidy will go up by the decrease in the price difference.

Suppose you choose a Bronze plan, and it’s less expensive than the second lowest cost Silver plan by $400 per month for two people. You receive 100% of this $400 price difference. The price difference may become $180 per month when you cover just one person. Therefore you lose $220 per month in cost savings when the older spouse starts Medicare, and your net premiums will rise by $220 per month.

You pay more to cover one person in a less expensive plan than to cover two people. Such is the punishment for choosing a less expensive plan.

Effect on HSA ContributionsAll Bronze ACA plans are eligible for HSA contributions starting in 2026. When you choose a Bronze plan, you go from family coverage to single coverage for HSA after one spouse starts Medicare, and you’ll have a lower HSA contribution limit. Because HSA contributions lower your Modified Adjusted Gross Income (MAGI) for ACA health insurance, your MAGI will increase when you contribute less to the HSA. A higher MAGI means a lower subsidy, or possibly losing the subsidy altogether when your MAGI goes over the 400% FPL cliff.

***

Here’s a summary of all the scenarios:

Change in Net PremiumsNo SubsidyDecrease by 50% or moreSubsidy – 2nd Lowest Silver PlanNo changeSubsidy – more expensive planDecrease by 50%+ of the price difference between your plan and the SLCSPSubsidy – less expensive planIncrease by 50%+ of the price difference between the SLCSP and your plan, plus the effect from HSA contributions and MAGICharlie and his wife qualify for a premium subsidy, and they want a Bronze plan. Their net ACA plan premiums will go up substantially when Charlie starts Medicare. It’s counterintuitive, but that’s how it works.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post ACA Health Plan Premiums When One Spouse Starts Medicare appeared first on The Finance Buff.

October 25, 2025

How Does Claiming Social Security Affect ACA Health Insurance?

I mentioned in the previous post When to Claim Social Security: How Much Does It Matter, Anyway? that a common recommendation for a married couple is for the lower-earning spouse to claim Social Security early at 62, and for the higher-earning spouse to delay claiming until age 70. Several readers raised a concern that claiming Social Security at 62 may raise the ACA health insurance premiums. The same concern also applies to a single person considering claiming at 62.

We’re assuming that you’re not working when you’re considering claiming Social Security at 62. Otherwise, the Social Security earnings test may apply, which defeats the purpose of claiming at 62. When you’re not eligible for Medicare yet, you’ll most likely buy health insurance from the ACA marketplace unless you have retiree health insurance or you’re covered through your spouse.

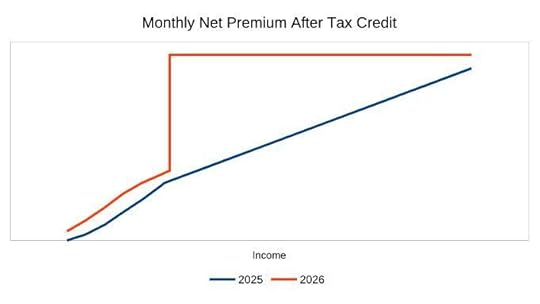

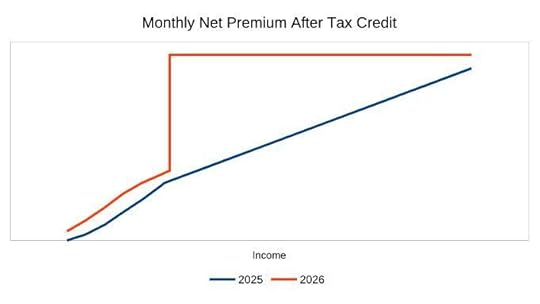

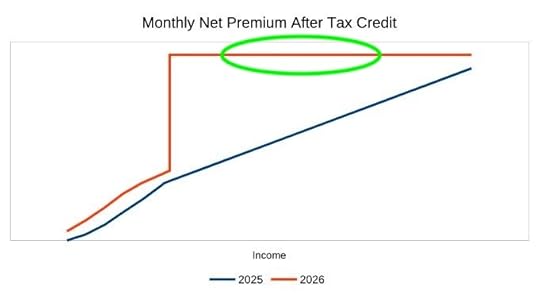

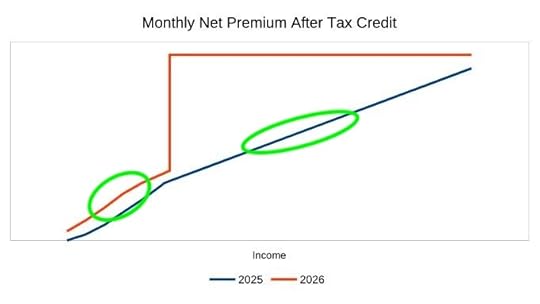

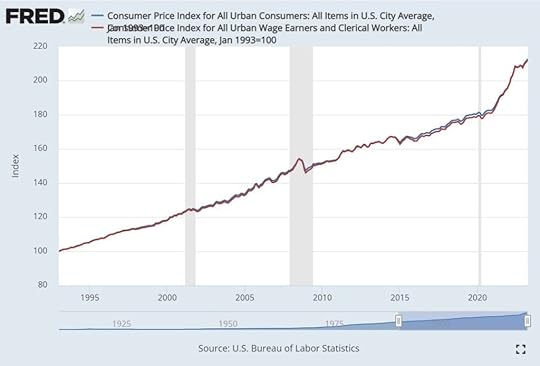

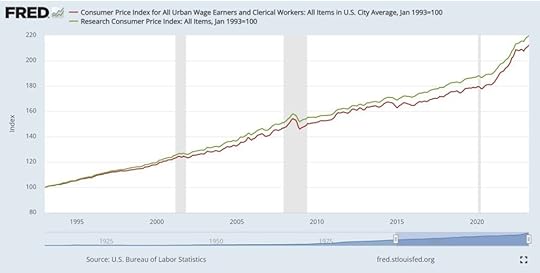

ACA Premium Subsidy, Cliff or Ramp?How does claiming Social Security affect the ACA health insurance premiums? It depends on your household income. I had this chart in my post The ACA Premium Subsidy Cliff After the 2025 Trump Tax Law:

The federal government is currently shut down due to disagreements in how ACA health insurance premiums will be structured in 2026 and beyond. The blue line in the chart represents the law in effect in 2025. As your household income increases, your ACA health insurance premiums also increase on a ramp. The orange line represents what will happen in 2026 and beyond if Congress doesn’t pass a new law to stop it. The ACA health insurance premiums will be higher at all income levels, and then suddenly jump up a cliff when your household income exceeds 400% of the Federal Poverty Level (FPL), which is $62,600 for a single-person household, and $84,600 for a two-person household, in 2026.

The first question is whether there will be a cliff.

Suppose there is a cliff (the orange line), and your household income is already over the cliff before claiming Social Security (the flat part of the orange line). In that case, you’re already paying the full price without any premium tax credit. Receiving additional income from Social Security will NOT affect your ACA health insurance premiums.

Suppose there’s no cliff (the blue line), or suppose there’s a cliff, but your household income will still be below 400% of FPL after claiming Social Security (the left part of the orange line). In that case, each $100 of incremental income from Social Security will increase your ACA health insurance premiums by $10 – $20.

If there’s a cliff (the orange line), and claiming Social Security will push your household income from below the 400% of FPL cliff to above it, your ACA health insurance premiums will jump a lot. That’ll make it not worth claiming Social Security at 62.

Household IncomeCliffNo Cliff> 400% FPL before SSNo EffectIncrease by 10% of the incremental income< 400% FPL after SSIncrease by 10-20% of the incremental incomeIncrease by 15-20% of the incremental incomeCross 400% FPL with SSHuge JumpIncrease by 10-20% of the incremental incomeEffect on ACA Health Insurance PremiumsReplacing or Increasing Income?Note that the table above says “incremental income.” The incremental income isn’t necessarily 100% of the Social Security benefits you’ll receive. The incremental income can be zero or negative if receiving Social Security will only replace other income.

Where does your household income come from before claiming Social Security?

Case 1. Suppose you’re withdrawing from a pre-tax account, such as a Traditional IRA, to cover living expenses before claiming Social Security. A $20,000 withdrawal counts as $20,000 of income for ACA health insurance. You don’t need to withdraw as much to cover living expenses now after you claim Social Security. $20,000 in Social Security benefits also counts as $20,000 of income for ACA health insurance. Your income stays the same when you replace the same amount of withdrawals from a pre-tax account with Social Security.

The IRS taxes at most 85% of Social Security benefits, while many states don’t tax Social Security. In contrast, pre-tax account withdrawals are fully taxable by the IRS and most states. When you receive $20,000 in Social Security benefits, it can replace maybe $22,000 in pre-tax account withdrawals to cover the same amount of living expenses.

Your incremental income will be negative, and your ACA health insurance premiums will decrease if you replace a larger amount in pre-tax withdrawals with Social Security benefits.

Case 2. Suppose you’re selling appreciated investments in a taxable account to cover living expenses before claiming Social Security. Only the capital gains portion counts as income for ACA health insurance. Suppose your investments comprise 30% as cost basis and 70% as capital gains. $14,000 from selling $20,000 worth of investments counts as your income for ACA health insurance.

You don’t need to sell much to cover living expenses now after you claim Social Security. $20,000 in Social Security benefits counts as $20,000 in your income for ACA health insurance. Replacing investment sales with Social Security will increase your income for ACA health insurance, but by only 30% of the Social Security benefits in this example.

Case 3. Suppose your current household income comes from a pension, rental income, interest and dividends, and other income that can’t be stopped after claiming Social Security. In this case, 100% of the Social Security benefits will be incremental income.

Source of Income Before SSIncremental IncomePre-tax account withdrawalsZero or negative, after reducing withdrawalsSelling investments in a taxable accountPartial, after reducing investment salesUnstoppable incomeFullCost-Sharing ReductionsAt the low end of the income spectrum, ACA health insurance also includes something called Cost-Sharing Reductions (CSR). CSR lowers the deductible, co-pays, and the out-of-pocket maximum only when you buy a Silver plan.

There are three tiers in CSR. The income to qualify for the three tiers caps out at 150%, 200%, and 250% of FPL. Here are the maximum incomes that qualify for CSR in 2026:

1-Person Household2-Person HouseholdCSR tier 1 (150% of FPL)$23,475$31,725CSR tier 2 (200% of FPL)$31,300$42,300CSR tier 3 (250% of FPL)$39,125$52,875Maximum Income in 2026 to Qualify for CSRMany people choose to forego CSR even when their income qualifies, because they’re healthy and a Bronze plan is less expensive than a Silver plan.

How claiming Social Security at 62 affects your eligibility for CSR again depends on the “incremental income” from claiming Social Security. If the incremental income is zero or negative, it will have no effect, or it will make it easier for you to qualify for CSR or a better tier of CSR. If the incremental income is positive, and you qualify for CSR before claiming Social Security, it can disqualify you from CSR or drop you to a worse tier.

How Many Years on ACA Health Insurance?Claiming Social Security at 62 versus claiming at 65 when you qualify for Medicare will potentially affect your ACA health insurance premiums for 3 years. If you have a younger spouse who’s also on ACA health insurance, claiming early could affect your ACA health insurance premiums until the younger spouse is also 65. The more years you’ll use ACA health insurance, the more impact there may be from claiming Social Security at 62.

Compare with Delaying Social SecurityI ran a test case in Open Social Security for a married couple, both born in 1964 (will be 62 in 2026). One spouse has a Primary Insurance Amount of $2,000 per month, and the other has $3,000 per month. The recommendation from Open Social Security is for the lower-earning spouse to claim at 62 and for the higher-earning spouse to wait until 70.

Example From Open Social Security

Example From Open Social SecurityIf the lower-earning spouse waits until 65, this couple would still receive 98.7% of the maximum present value from Social Security. The difference in the total present value is $9,470 over their lifetime. See more on how to use Open Social Security in When to Claim Social Security: How Much Does It Matter, Anyway?

Suppose their incremental income from claiming Social Security falls into the “partial” category, and the effect on their ACA health insurance premium isn’t a big jump, but 10-20% of the incremental income. Then they need to balance the increase in ACA health insurance premiums against the loss in the present value of Social Security benefits if the lower-earning spouse waits until age 65.

$2,000 per month at Full Retirement Age translates to $16,900 per year when the benefits are claimed early at age 62. Suppose receiving $16,900 in Social Security benefits brings 30% of the benefits as incremental income, and it increases their ACA health insurance premiums by 15% of the incremental income. The increase in the ACA health insurance premiums for 3 years is:

$16,900 * 30% * 15% * 3 = $2,282

That’s much less than the $9,470 loss of total present value from delaying claiming until age 65. The lower-earning spouse should claim at 62 despite the increase in ACA health insurance premiums.

On the other hand, if 100% of the $16,900 in Social Security benefits will be incremental income, and it’ll push their income over a cliff, which will increase their ACA health insurance premiums by $2,000 a month, then clearly they should hold off claiming Social Security until they no longer use ACA health insurance.

It All DependsClaiming Social Security at 62 doesn’t necessarily increase your income for ACA health insurance. In some cases, it can decrease your income and lower your premiums. If it does increase your income, the incremental income isn’t necessarily 100% of the Social Security benefits. It can be only a small percentage of the benefits. The premium increase from the incremental income can be less than the loss in the total present value of Social Security benefits if you choose to delay claiming until 65. Don’t be afraid to claim Social Security at 62 only because it may raise your ACA health insurance premiums.

In some other cases, claiming Social Security at 62 will increase your income by a large percentage of the benefits, which will push it over a cliff and raise your ACA health insurance premiums by a huge amount, possibly more than the Social Security benefits received.

It all depends on whether there’s a cliff, and if so, where your household income is relative to the cliff before and after claiming Social Security. A ramp is much easier to deal with than a cliff.

You should calculate your incremental income based on the income composition before claiming Social Security. Wait to see how the cliff situation will be resolved. Then calculate the effect on your ACA health insurance premiums and compare with delaying Social Security.

Manage RiskFinally, laws can change, and your financial situation can change. If you think it’s too risky and you want to avoid any complications, it’s OK to delay claiming Social Security until you no longer use ACA health insurance.

It comes down to “What if I’m wrong?” What if you think you’ll go over a cliff, but you don’t? You delay claiming and unnecessarily lose 1.3% of your Social Security benefits in my example. What if you think you’re safely under the cliff, and you’re suddenly over? You pay a huge amount in ACA health insurance premiums. Losing 1.3% of the lifetime Social Security benefits may be a small price to pay for the peace of mind that your ACA health insurance premiums won’t blow up in your face. See Use Pascal’s Wager When You’re Not Sure About Tax Rules.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post How Does Claiming Social Security Affect ACA Health Insurance? appeared first on The Finance Buff.

October 16, 2025

When to Claim Social Security: How Much Does It Matter, Anyway?

Social Security gives everyone an official “Full Retirement Age.” It’s 67 for those born in 1960 or later, but you can claim as early as age 62, as late as age 70, or anywhere in between. The tradeoff is between a lower monthly benefit for more years and a higher monthly benefit for fewer years. The uncertainty lies in how long you’ll live.

Whenever there are choices and uncertainty, people try to optimize. Everyone is looking for the holy grail — when to claim Social Security to maximize the benefits. But how much does it matter, anyway?

Open Social SecurityIf you’ve paid attention to this matter, you’d know Open Social Security. It’s the best tool for a Social Security claiming strategy, and it’s completely free.

The primary input in Open Social Security is your Primary Insurance Amount (PIA), which you obtain by creating an account with the Social Security Administration, copying your earnings history, and pasting it into ssa.tools. See more detailed steps in Retiring Early: Effect on Social Security Benefits. If you’re married, both of you should go through this process to get your separate PIAs.

Open Social Security uses your PIA, marital status, gender, and date of birth — and the same for your spouse if you’re married — to calculate a recommended strategy. For example, it produced this output for someone single, male, born on 4/15/1960, with a $3,000 PIA:

You file for your retirement benefit to begin 10/2025, at age 65 and 6 months.

The present value of this proposed solution would be $416,562.

Open Social Security tells you exactly when to claim Social Security, which is great, but don’t stop there. Otherwise, you’ll miss this calculator’s best feature.

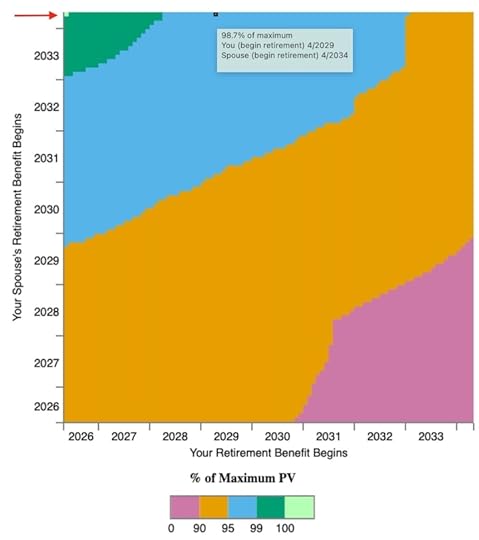

Spectrum Chart

Scroll down to the bottom of the page. You see a spectrum chart showing how much the present value of the benefits would change if you start your Social Security on other dates. As you move the mouse along the spectrum chart, the tooltip shows a percentage of the maximum for that start date.

Open Social Security recommends claiming immediately in this example, but the spectrum chart shows that this person would still get 99.3% of the maximum present value if they wait another year. And the worst case for this person? Claiming at age 70 gets 95.2% of the maximum present value.

The spectrum chart and the total present value answer this critical question:

How much does when to claim Social Security matter?

The total present value of Social Security benefits claimed at the most optimal time is $416,562 for this person in the example. This tells them how much Social Security plays a role in their retirement finances. If this person has a $1 million net worth, Social Security represents close to 30% of the total. Claiming at the worst time and getting 95% of the maximum present value decreases the total by 1.5%. I’m not suggesting that one should throw away 1.5% willy-nilly, but I would say it’s well within the margin of error.

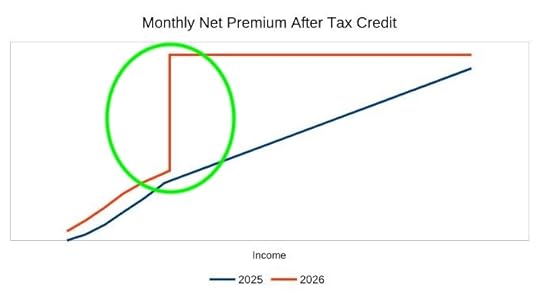

Heat MapIt’s more complicated for a married couple. The one-dimensional spectrum chart for a single person turns into a 2D heat map for a married couple. I ran another case as an example, which produced this chart:

The horizontal axis represents one spouse, and the vertical axis represents the other spouse. The recommended strategy is at the bottom right. One person should delay until age 70, and the other person should claim as soon as possible, which is a common strategy for many married couples. The maximum net present value of their benefits is about $800,000.

The green and blue zones at the lower right of the heat map indicate that this couple has significant leeway in when to claim. As long as one person claims early, the other person can claim at any time within a 3-year range (going horizontally at the bottom), and they would still get more than 95% of the maximum present value. Or as long as one person delays until 70, the other person can claim at any time within a 5-year range (going vertically at the right edge), and they would still get more than 95% of the maximum present value.

The magenta patch in the middle represents the worst combinations of claiming dates. If they didn’t know any better and they picked the absolutely worst claiming dates, they would get 89.5% of the maximum present value.

How much claiming dates matter for this couple depends on how much they have outside Social Security. If they have a $1 million net worth, Social Security represents close to 45% of their total resources ($800k over $1.8 million total). Choosing the worst claiming dates would put a 4.5% dent in their retirement, which is more meaningful than the 1.5% in the previous example, but if they can keep it above 95% in the blue and green zones, I would say that the effect of claiming dates falls well within the margin of error.

Shifts in StrategyOpen Social Security uses a market interest rate to calculate the present value of the Social Security benefits. Interest rate changes can affect the recommended claiming strategy. Sometimes people are surprised to see a big shift in the recommendation when they run the calculator again at a later time. For example, it used to recommend claiming at age 70, and now it recommends claiming at 68.

I wouldn’t worry about it if the previous recommendation is still within the blue and green zones. The point of using Open Social Security isn’t to get a single “best” claiming strategy. Mike Piper, the creator of Open Social Security, said this in his blog post in 2020:

What matters most isn’t picking the very best strategy. What matters most is just avoiding a really bad one. There are usually plenty of strategies that are practically as good as the very best strategy.

Open Social Security uses mortality tables for the probability of your living to each age. As good as it is, it still only calculates based on probabilities. No calculator knows when you’ll die. The best strategy from any calculator won’t be the best if you defy the probabilities.

Make It Not MatterHere’s how I would use Open Social Security with my Make Fewer Things Matter approach:

1. Read the maximum present value output from Open Social Security. Calculate its weight in the total retirement resources.

Social Security / (Social Security + Non-Social Security)

2. Take note of the green and blue zones in the heat map. All claiming dates in the green and blue zones give above 95% of the maximum present value. Look for the worst case as well.

3. Combine (1) and (2) to realize the large leeway in when to claim Social Security.

Claiming dates don’t matter as long as you stay in the green and blue zones in the chart. Write down where your green and blue zones are. Save the chart image if you’d like.

Even the worst dates don’t matter if (a) the weight of Social Security is sufficiently small in your total retirement resources; and (b) the worst dates still give you close to 90% of the maximum.

Of course, you don’t choose the worst dates on purpose, but it’s a relief to know how little it matters, and it’s not possible to screw up too badly. You pick a spot in the green and blue zones, cross it off your mind, and move on to more important matters.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post When to Claim Social Security: How Much Does It Matter, Anyway? appeared first on The Finance Buff.

October 5, 2025

Taking Risks That the Market Decides to Reward

The best investment strategy is to take risks that the market decides to reward. Somebody, somewhere, is always saying something about how much the market will reward which risks. Knowing who to listen to and when makes a big difference.

GoldA reader asked me back in February whether I wasn’t against investing in gold. I said I didn’t have gold in my portfolio, but I wasn’t against it. My problem with gold is that it tends to get people’s attention only after a sharp price run-up. Then it goes quiet for a long time before the idea of investing in gold comes up again.

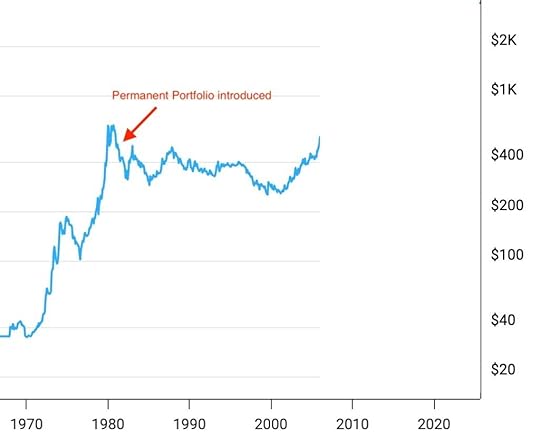

Harry Browne introduced the Permanent Portfolio in 1981. It invests 25% in U.S. stocks, 25% in long-term Treasuries, 25% in short-term Treasuries, and 25% in gold. The stand-out feature of Harry Browne’s Permanent Portfolio is its 25% allocation to gold. The rationale is that gold provides a hedge against inflation and currency crises, scenarios in which both stocks and bonds can suffer simultaneously.

Gold was $400 to $500 per ounce in 1981. It stayed below that range for the next 24 years until 2005. I don’t know how many people had the patience to stay with such a big drag for so long.

Price of Gold 1970 – 2005, Macrotrends.net

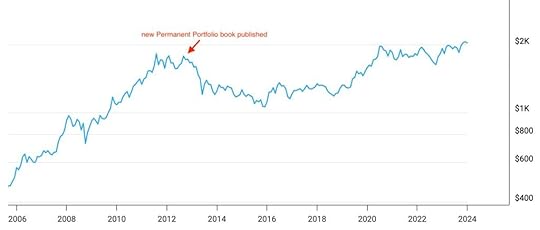

Price of Gold 1970 – 2005, Macrotrends.netThe Permanent Portfolio popped up on the radar again after the 2008 financial crisis. A book, The Permanent Portfolio: Harry Browne’s Long-Term Investment Strategy, was published in 2012 to reintroduce the strategy. The price of gold was about $1,700 per ounce at that time. It rose to $2,050 per ounce by the end of 2023. That was an average annual return of 1.7%, which was lower than inflation for 11 years, before a switch was turned on in 2024.

Price of Gold 2006 – 2023, Macrotrends.net

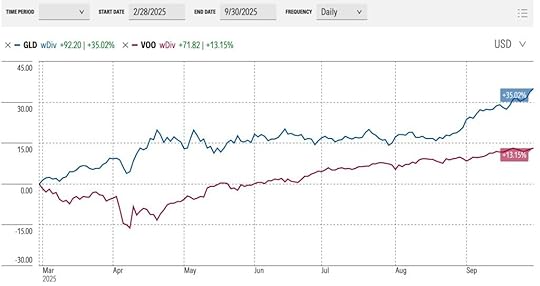

Price of Gold 2006 – 2023, Macrotrends.netWhen the reader asked me about gold in February 2025, it was after the price of gold had increased nearly 40% in one year. Gold handily beat the S&P 500, which performed quite well during the same period, if only not compared to gold.

Gold vs S&P 500 Jan 2024 – Feb 2025, Portfolio Visualizer

Gold vs S&P 500 Jan 2024 – Feb 2025, Portfolio VisualizerAdding gold after the price had gone up 40% in one year is chasing performance, right? Doing so when gold was hot in 1981 and 2012 did poorly. What about this time?

Gold vs S&P 500, 03/2025 – 09/2025

Gold vs S&P 500, 03/2025 – 09/2025Although I thought it was late, it wasn’t too late. Gold continued to do well. The price went up another 35% in seven months. Investing in the SPDR Gold ETF (GLD) since March 2025 would’ve beaten the S&P 500 by a wide margin, even after the stock market shrugged off the tariff jitters and reached record highs with rich valuations fueled by tech and AI.

People chase performance because sometimes the market decides to reward performance chasing. Knowing when to chase and when not to chase makes all the difference.

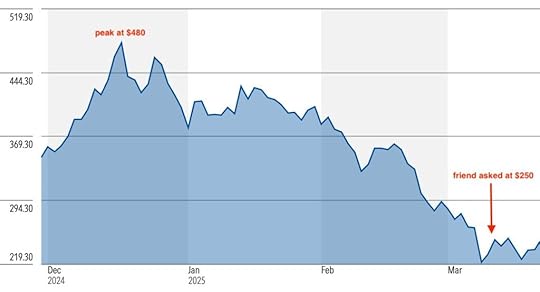

TeslaA friend asked me about the Tesla stock in mid-March this year. There was a big backlash against Elon Musk at that time for his role with DOGE. The price of the Tesla stock had dropped nearly 50% in four months. My friend thought it was a good buying opportunity.

Tesla Stock Price, 12/2024 – 03/2025

Tesla Stock Price, 12/2024 – 03/2025I of course said I didn’t know where the stock was going. It could drop more, or it could rebound. Tesla’s price-to-earnings ratio was still astronomically high after the stock had dropped nearly in half.

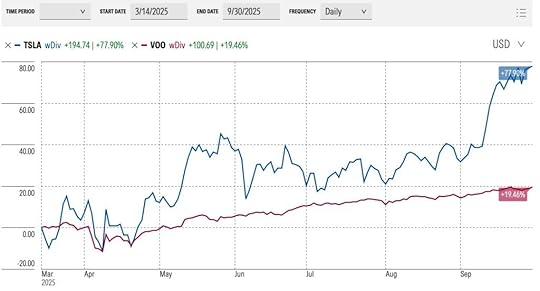

Tesla vs S&P 500, 3/14/25 – 9/30/25

Tesla vs S&P 500, 3/14/25 – 9/30/25My friend was right. Tesla’s stock price is up 78% since March, which beats the S&P 500 by 4x.

Is buying a stock with a high P/E ratio only because its price is 50% off a recent peak pure speculation or taking a calculated risk? Either way, the market decided to reward it. A high P/E ratio can go higher still in six months.

AppleThis happens in a longer timeframe, too. I listened to a podcast by Boldin (formerly NewRetirement) some time ago. The guest, David, was laid off by his former employer in 2013, which allowed him to roll over his 401k to an IRA. Once the money was in an IRA, he had more investment options than only the ones offered in the 401k plan’s menu.

Apple was coming out with iPhone 4 at the time, and David was a big Apple fan. He saw that all the Apple stores were always busy. So he put 100% of his IRA into Apple stock and stayed in it through several splits. That one decision helped him retire 7 years later at age 53.

Apple Stock vs Vanguard Target Retirement 2030 Fund, 2013 – 2020

Apple Stock vs Vanguard Target Retirement 2030 Fund, 2013 – 2020You can say David got lucky, and he wouldn’t have been on the podcast if it didn’t work out, but you can’t argue with success. It’s better to be lucky than good. Investing everything in one stock looked “wrong,” but David’s conviction helped him retire sooner.

BitcoinWhen did you first hear about Bitcoin? I remember that some co-workers were getting into it in late 2017 when the price of Bitcoin was going from $10,000 to $20,000.

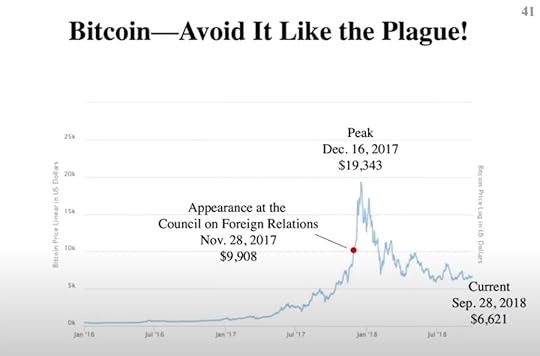

I found a video clip on YouTube of Jack Bogle talking about Bitcoin. It included a chart showing a date of September 28, 2018. I assume the presentation was given around that time.

Jack Bogle on Bitcoin, 2018

Jack Bogle on Bitcoin, 2018Mr. Bogle said people should avoid Bitcoin like the plague, and he would tell them what Bitcoin is worth when it gets to $1. What happened since then?

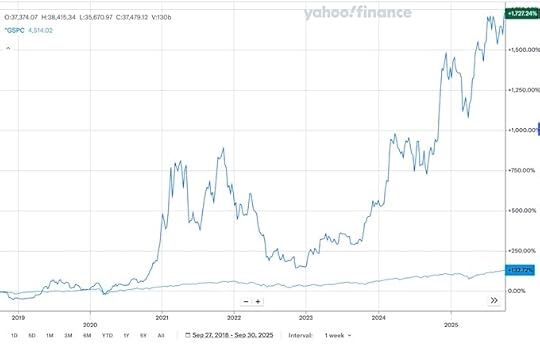

BitCoin vs S&P 500, 09/2018 – 09/2025

BitCoin vs S&P 500, 09/2018 – 09/2025If someone bought Bitcoin after hearing the presentation by Jack Bogle in 2018, it would’ve grown 1,700%, versus 150% in the S&P 500. My co-workers would beat the stock market several times over even if they bought at the previous peak in December 2017. They only had to hang on for the ride, or as someone said on Reddit:

A few years of volatility versus 20 extra years of steady work, with no way to catch up.

Round_Ad_40 in r/Bogleheads

That’s the power of taking risks that the market decides to reward.

VTSAX and ChillInvesting in index funds also benefits from the same phenomenon. Investing 100% in the U.S. stock market (“VTSAX and chill”) is a popular, simple path to wealth in recent years. It beat investing in a target date fund or a globally diversified fund (such as VT) because stocks have outperformed bonds, and U.S. stocks have outperformed international stocks.

The Market Has the Final SayInvesting in gold, Apple, Tesla, Bitcoin, and, to a lesser extent, 100% in U.S. stocks looked “wrong” at the time, but the market disagreed. The thing is, it’s hard to tell ahead of time which risks the market will decide to reward.

A successful strategy looks irrational at the time, but not all irrational strategies will be successful. Somebody, somewhere, is always saying something. All the talks about investing are basically trying to answer this one question:

How much will the market reward this risk?

Some answers will be proven right. Some answers will be proven wrong. If you get into the habit of wanting to hit the right answers, you will invariably also hit some wrong answers. You can only hope that the right answers will outweigh the wrong ones, which is far from a given. Despite such a strong tailwind for Bitcoin and tech stocks, someone still lost $500k chasing crypto and speculative stocks over the last 5 years.

The point of investing in a globally diversified portfolio of both stocks and bonds is to avoid relying on hitting the right answers and to avoid the wrong answers that come along. Getting rewarded by the market for the risks you take can be life-changing, but a diversified portfolio is more reliable, and there’s safety in the mainstream.

[Headline Image Credit: Mohamed Hassan from Pixabay.]

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Taking Risks That the Market Decides to Reward appeared first on The Finance Buff.

September 9, 2025

Proof of Funds or Balance Confirmation for Fidelity Accounts

When you buy real estate or apply for a loan or a visa, you may be asked to present proof of sufficient funds. You can submit an account statement, but a statement contains much more information than they need to know. You only need to show that you have more than a certain amount. You don’t want to give them your account number, exact balance, or transaction details.

The party you’re disclosing the information to may not have good security. Who knows what will happen to your document after you submit it? The less information you disclose, the better. For instance, the account number of a brokerage account is a key piece of information for an asset transfer (see Protect Your Brokerage Accounts From ACATS Transfer Fraud).

Some financial institutions make it easy to create a proof of funds or balance confirmation. They only include minimal information without oversharing. Because I ditched banks and only use a Fidelity account for day-to-day cash flow, here’s how I generated a proof of funds or balance confirmation for a Fidelity account.

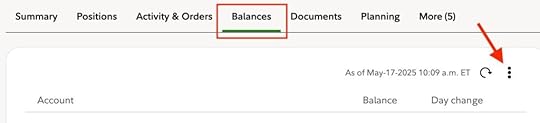

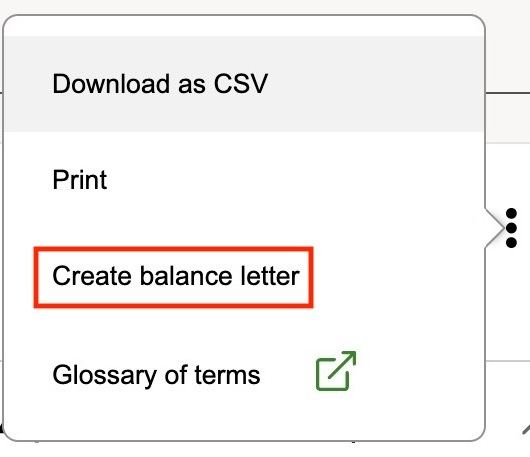

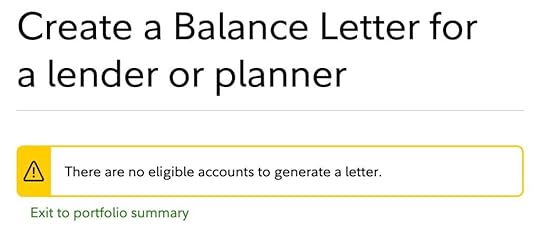

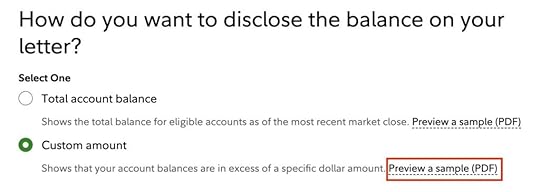

Log in to Fidelity’s website. Select an account on the left. Click on the Balances tab, and then the three dots on the right.

Click on “Create balance letter” in the pop-up.

If you enabled Fidelity’s Money Transfer Lockdown for your accounts, you’ll see an error saying “There are no eligible accounts to generate a letter.” Turn off the Money Transfer Lockdown and try again. Select one or more accounts you need for the balance confirmation.

You have the option to show the total balance or a specific balance. The custom amount is a better option for privacy. When you give the minimum amount you need, the letter will say this:

Please accept this letter as confirmation that as of market close on [date], you held a balance in excess of $[amount] in cash and securities in your portfolio at Fidelity Brokerage Services.

The proof of funds letter bears the Fidelity letterhead, includes your name and address, and is signed by a Fidelity officer. It doesn’t have your account number, the exact balance, holdings, or any transaction details.

Remember to re-enable Money Transfer Lockdown if you turned it off to generate the letter.

Vanguard or Schwab may also have a similar process to do this. I don’t know how because I don’t have accounts there. Call customer service if you don’t see it on their website.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Proof of Funds or Balance Confirmation for Fidelity Accounts appeared first on The Finance Buff.

August 17, 2025

Trump Account: IRA for Kids With No Earned Income

We covered the new tax deductions in the 2025 Trump tax law in previous posts: seniors, car loan interest, tips, overtime, charity donations, and the SALT cap increase. The law also created a new type of tax-advantaged account called the Trump Account.

Trump Account, of course, is named after President Trump, in the same way Roth accounts are named after Senator William Roth. It was originally called MAGA Account when it was introduced in the House bill before the name changed to Trump Account.

Table of ContentsWhat Is a Trump Account?Age RequirementContributionsInvestmentsDistributionsTrump Account vs Custodial Roth IRATrump Account vs 529 PlanTrump Account vs Custodial Account (UTMA/UGMA)Converting to RothLegislative RiskPriorityWhat Is a Trump Account?A Trump account, in essence, is a non-deductible Traditional IRA for kids without earned income.

Kids with taxable compensation (“earned income”) from a job or self-employment can already contribute to a Traditional or Roth IRA. They need an adult to serve as the custodian until they’re 18 or 21. This type of account is called a custodial IRA (most parents choose the Roth version). Mainstream brokers such as Fidelity, Schwab, and Vanguard all offer custodial Roth IRAs.

A Trump account is similar to a custodial Roth IRA for a child, except that:

It’s a non-deductible Traditional IRA, not a Roth IRA. Contributions are not tax-deductible. Earnings are taxed as ordinary income upon withdrawal.The child doesn’t need taxable compensation (“earned income”) from a job or self-employment.Age RequirementA Trump account can receive contributions for a child under 18 by the end of the calendar year. You can’t contribute for older children. The child must be a U.S. citizen. There’s no minimum age.

There’s no income limit or phaseout for the parents. There’s no limit on the number of kids as long as each kid meets the age requirement.

ContributionsNo one can contribute to a Trump account just yet. The law says contributions can’t be accepted until July 4, 2026, which is 12 months after the date of its enactment. This gives government agencies and their contractors time to set up the program. The July 4, 2026 date is a “no earlier than” date. The actual launch date may be later if the IT projects require more time.

When the program launches, parents and family members can open an account for kids who won’t be 18 yet by the end of the year.

The initial account must be opened through the federal government. It can be rolled over to a private financial institution afterward. The government will contribute a one-time $1,000 to kids born in the years 2025 through 2028 (inclusive).

The maximum contribution an eligible child can receive in a calendar year is $5,000. If parents and grandparents contribute to accounts for the same child, the total combined contributions still can’t exceed $5,000 in that year. The $1,000 from the government for a newborn doesn’t count toward the $5,000. The $5,000 annual limit is indexed to inflation, starting in 2028.

An employer is allowed to contribute up to $2,500 a year to an employee’s or an employee’s dependent’s Trump Account if the employer establishes a program for their employees. The employer contribution won’t be taxed to the employee at the time of the contribution, but the money will be taxable upon withdrawal, similar to a 401k match from an employer. The employer contribution counts toward the $5,000 overall contribution limit, similar to how it works in an employer contribution to an HSA.

It might be wishful thinking that an employer will establish such a program. It’s unclear whether a one-person business can set up a program for the owner’s children.

Federal and state governments and charities can also contribute to Trump accounts for a broad class of children in an area. Their contributions don’t count toward the $5,000 annual limit. Treasury Secretary Scott Bessent said Trump Accounts could lay the groundwork for privatizing Social Security (and maybe other state child welfare programs?).

InvestmentsInvestments in a Trump account are limited to index funds and ETFs that track a U.S. equity index, such as the S&P 500, and charge an expense ratio of no more than 0.1% a year. The law specifically says the index must be “comprised of equity investments in primarily United States companies” — no bonds, no international stocks, no target date funds.

As in other IRAs, earnings aren’t taxed while the money stays in the Trump Account.

DistributionsNo distributions are allowed until January 1 of the calendar year in which the child reaches age 18. The money is locked up except for rollovers and withdrawal of excess contributions over the annual contribution limit. You can’t take any money out before the year the kid turns 18, even if you’re willing to pay a penalty.

The law doesn’t explicitly say what happens when the child is no longer eligible to receive contributions, but the general rule says a Trump Account shall be treated as a Traditional IRA. I take it to mean that it just turns into a regular Traditional IRA in the child’s name on January 1 of the calendar year in which the child turns 18. In that case, all existing rules on a regular Traditional IRA will apply at that point (requiring earned income to contribute, annual contribution limits, tax and penalty on early withdrawals, converting to Roth, etc.).

Because the contributions from parents and family members aren’t tax-deductible, they’re not taxed again on withdrawal. Only the earnings and contributions from the federal government, employers, states, and charities are taxed. This means you must track the cumulative contributions over the years, similar to how non-deductible contributions to a Traditional IRA are tracked on a Form 8606.

Should you open a Trump account for your kid when it becomes available? It’s a no-brainer to collect the one-time $1,000 from the government if you have a newborn in 2025 through 2028. Beyond that, it depends on how much money you have and what the money is for.

Trump Account vs Custodial Roth IRAIf the child has earned income from a job or self-employment, a custodial Roth IRA is better than a Trump Account. Earnings in a custodial Roth IRA are tax-free from the get-go.

You can do both a custodial Roth IRA and a Trump Account if you have more money to contribute. A contribution to the child’s Trump Account doesn’t eat into the contribution limit for a custodial Roth IRA based on the child’s earned income, and vice versa.

Trump Account vs 529 PlanMany parents save for their kids’ college education in a 529 plan. Distributions from a 529 account are tax-free if they’re used for qualified education expenses.

A 529 plan is better if the money is for college. It’s tax-free, whereas earnings built up in a Trump Account will be taxed as ordinary income upon withdrawal. Many states also offer tax incentives for contributing to a 529 plan.

Trump Account vs Custodial Account (UTMA/UGMA)If you want to give money to your child for something other than college expenses, you can already set up a custodial account, also known as a UTMA/UGMA account. Mainstream brokers all offer custodial accounts. Buying is similar to using a custodial account.

A custodial account is taxable, but a child receives favorable tax treatment on a set amount of investment income each year. The first $1,350 in investment income in 2025 is tax-free. The next $1,350 is taxed at the child’s tax rate. Investment income received by a dependent above $2,700 in 2025 is taxed at the parent’s rate.

A custodial account is more flexible. There’s no limit to how much you can put into a custodial account. You can invest in more diversified investments, not just U.S. stocks. You can withdraw from a custodial account at any time when the money is used for the benefit of the child. If you invest tax efficiently, there won’t be much tax to pay each year, and the child pays the lower tax rate on long-term capital gains (possibly at 0%) when they eventually sell.

A custodial account is still the way to go if you want flexibility.

Converting to RothBesides the one-time $1,000 for a newborn in 2025 through 2028, the lure of a Trump Account is in converting the money to a Roth IRA when the child is no longer a dependent. The earnings built up over the years will be taxed as ordinary income in the year of the conversion, but maybe the child is still in a low tax bracket at that time. The Roth IRA will provide a good base for the child’s retirement.

Legislative RiskHowever, if the child is already 15 or 16, contributing $5,000 a year for only a few years won’t gain much in tax benefits over a regular custodial account, even when the money is converted into a Roth IRA at age 18. If the child is still young, it’s far from certain whether the law will stay in its current form until the child is 18.

Many things can happen in 18 years while the money is locked up. It’s an understatement to say that the Trump branding is more controversial than Roth’s. A good percentage of people in the country may not want it associated with their kids. If the political regime changes, the Trump Account might be repealed. You may end up with an orphan account that has nowhere to go, or you may get a forced distribution. Your child may never see the opportunity to convert it to a Roth IRA.

We’ve seen several initiatives that didn’t go as well as the government had hoped.

The Obama administration introduced a “myRA” account in 2014 for people without a workplace retirement plan. Only 0.05% of all people who could’ve signed up did so. The program was shut down after two years.

Coverdell Education Savings Account (“Coverdell ESA”) launched as a savings vehicle for children’s education. It fell to the wayside after 529 plans became available, to the point that Fidelity and Vanguard stopped accepting new contributions to Coverdell ESAs many years ago. Vanguard recently asked all existing Coverdell account holders to close their accounts.

The SECURE 2.0 Act created a “Saver’s Match” program to match the retirement contributions from low- to moderate-income Americans. It was supposed to begin in 2027, but now the entire program has been killed. Not a single person received any Saver’s Match.

PriorityI would place the Trump Account below the existing tried-and-true account types in terms of attractiveness:

Custodial Roth IRA if the child has earned income;529 plan for education;Custodial (UTMA/UGMA) account for flexibility.If you have more money than you know what to do with for a child after all the accounts above are fully funded, maybe take a chance on a Trump Account when it becomes available and plan to have the child convert it to a Roth IRA after turning 18. Just be fully aware that the account may end before there’s any opportunity to convert it to a Roth IRA.

***

You’ll find more deep dives on recent changes from the 2025 Trump tax law in the full OBBBA series.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post Trump Account: IRA for Kids With No Earned Income appeared first on The Finance Buff.

August 12, 2025

2025 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD

My other post listed 2026 401k and IRA contribution and income limits. I also calculated the inflation-adjusted tax brackets and some of the most commonly used numbers in tax planning for 2026 using the published inflation numbers and the same formula prescribed in the tax law.

Table of Contents2025 2026 Standard Deduction2025 2026 Tax Brackets2025 2026 Capital Gains TaxNet Investment Income Tax2025 2026 Estate and Trust Tax Brackets2025 2026 Qualified Charitable Distributions (QCD) Limit2025 2026 2027 Medicare IRMAA2025 2026 Gift Tax Exclusion2025 2026 Savings Bonds Tax-Free Redemption for College Expenses2025 2026 Standard DeductionYou don’t pay federal income tax on every dollar of your income. You deduct an amount from your income before you calculate taxes. Over 80% of all taxpayers take the standard deduction. The other 10-20% itemize deductions when their total deductions exceed the standard deduction. In other words, you’re deducting a larger amount than your allowed deductions when you take the standard deduction. Don’t feel bad about taking the standard deduction!

The basic standard deduction in 2025 and 2026 is:

20252026 (Projected)Single or Married Filing Separately$15,750$16,100Head of Household$23,625$24,150Married Filing Jointly$31,500$32,200Basic Standard DeductionPeople who are age 65 and over have a higher standard deduction than the basic standard deduction.

20252026 (Projected)Single, age 65 and over$17,750$18,150Head of Household, age 65 and over$25,625$26,200Married Filing Jointly, one person age 65 and over$33,100$33,850Married Filing Jointly, both age 65 and over$34,700$35,500Standard Deduction for age 65 and overThe 2025 Trump tax law raised the standard deduction for 2025. The increases are reflected in the tables above. It also introduced a new senior deduction for people age 65 and over. The senior deduction is in addition to the standard deduction. It isn’t part of the standard deduction. See Social Security Is Still Taxed Under the New 2025 Trump Tax Law for more on the senior deduction.

People who are blind have a higher standard deduction.

20252026 (Projected)Single or Head of Household, blind+$2,000$2,050Married Filing Jointly, one person is blind+$1,600$1,650Married Filing Jointly, both are blind+$3,200$3,300Additional Standard Deduction for BlindnessSource: IRS Rev. Proc. 2024-40, One Big Beautiful Bill Act, author’s calculations.

2025 2026 Tax BracketsThe tax brackets are based on taxable income, which is AGI minus various deductions. The tax brackets in 2025 are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $11,925$0 – $17,000$0 – $23,85012%$11,925 – $48,475$17,000 – $64,850$23,850 – $96,95022%$48,475 – $103,350$64,850 – $103,350$96,950 – $206,70024%$103,350 – $197,300$103,350 – $197,300$206,700 – $394,60032%$197,300 – $250,525$197,300 – $250,500$394,600 – $501,05035%$250,525 – $626,350$250,500 – $626,350$501,050 – $751,60037%Over $626,350Over $626,350Over $751,6002025 Tax BracketsSource: IRS Rev. Proc. 2024-40.

The 2025 Trump tax law raised the top of the 10% and 12% brackets in 2026 by a little less than 2% above the normal inflation adjustments. The projected 2026 tax brackets are:

SingleHead of HouseholdMarried Filing Jointly10%$0 – $12,400$0 – $17,700$0 – $24,80012%$12,400 – $50,375$17,700 – $67,450$24,800 – $100,75022%$50,375 – $105,675$67,450 – $105,650$100,750 – $211,35024%$105,675 – $201,775$105,650 – $201,750$211,350 – $403,55032%$201,775 – $256,225$201,750 – $256,200$403,550 – $512,45035%$256,225 – $640,575$256,200 – $640,550$512,450 – $768,65037%Over $640,575Over $640,550Over $768,650Projected 2026 Tax BracketsSource: Author’s calculations.

A common misconception is that when you get into a higher tax bracket, all your income is taxed at the higher rate and you’re better off not having the extra income. That’s not true. Tax brackets work incrementally. If you’re $1,000 into the next tax bracket, only $1,000 is taxed at the higher rate. It doesn’t affect the income in the previous brackets.

For example, someone single with a $70,000 AGI in 2025 will pay:

First 15,750 (the standard deduction)0%Next $11,92510%Next $36,550 ($48,475 – $11,925)12%Final $5,77522%Progressive Tax RatesThis person is in the 22% tax bracket, but only a tiny fraction of the $70,000 AGI is taxed at 22%. Most of the income is taxed at 0%, 10%, and 12%. The blended tax rate is only 9.8%. If this person doesn’t earn the final $5,775, they are in the 12% bracket instead of the 22% bracket, but the blended tax rate only decreases slightly from 9.8% to 8.7%. Making the extra income doesn’t cost this person more in taxes than the additional income.

Don’t be afraid of going into the next tax bracket.

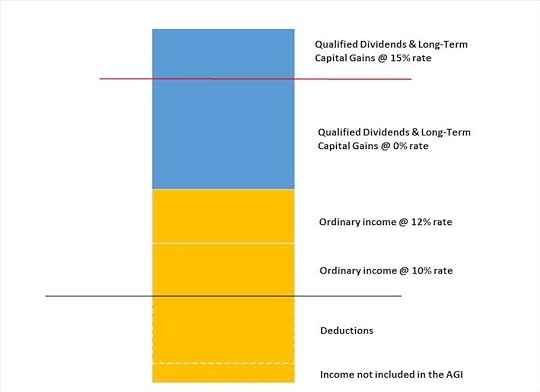

2025 2026 Capital Gains TaxWhen your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are below a cutoff, you will pay 0% federal income tax on your qualified dividends and long-term capital gains under this cutoff.

This is illustrated by the chart below. Taxable income is the part above the black line, after subtracting deductions. A portion of the qualified dividends and long-term capital gains is taxed at 0% when the other taxable income plus these qualified dividends and long-term capital gains are under the red line.

The red line is close to the top of the 12% tax bracket but they don’t line up exactly.

20252026 (Projected)Single or Married Filing Separately$48,350$49,450Head of Household$64,750$66,200Married Filing Jointly$96,700$98,900Maximum Zero Rate Amount for Qualified Dividends and Long-term Capital GainsFor example, suppose a married couple filing jointly has $70,000 in other taxable income (after deductions) plus $30,000 in qualified dividends and long-term capital gains in 2025. The maximum zero rate amount cutoff is $96,700. $26,700 of the qualified dividends and long-term capital gains ($96,700 – $70,000) is taxed at 0%. The remaining $30,000 – $26,700 = $3,300 is taxed at 15%.

A similar threshold exists on the upper end for qualified dividends and long-term capital gains. When your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are above a cutoff, you will pay 20% federal income tax instead of 15% on your qualified dividends and long-term capital gains above this cutoff.

20252026 (Projected)Single$533,400$545,500Head of Household$566,700$579,550Married Filing Jointly$600,050$613,650Married Filing Separately$300,000$306,800Maximum 15% Rate Amount for Qualified Dividends and Long-term Capital GainsSource: IRS Rev. Proc. 2024-40, author’s calculations.

Net Investment Income TaxNet Investment Income Tax (NIIT) is a 3.8% tax on the portion of interest, dividends, and capital gains that makes your modified adjusted gross income exceed these thresholds:

MAGI ThresholdSingle$200,000Head of Household$200,000Married Filing Jointly$250,000Married Filing Separately$125,000Net Investment Income Tax MAGI ThresholdThese thresholds are fixed by law. They are not adjusted for inflation. You pay a 3.8% tax on the amount your MAGI exceeds these thresholds or your total interest, dividends, and capital gains, whichever is less.

Suppose you’re married filing jointly and you have a $300,000 MAGI, which includes $10,000 in interest, dividends, and capital gains. Although your MAGI exceeds the $250,000 threshold by $50,000, you will pay 3.8% in NIIT on only $10,000 because you have only $10,000 in net investment income.

Suppose you’re married filing jointly and you have $260,000 MAGI, which includes $150,000 in interest, dividends, and capital gains. Although you have $150,000 in net investment income, you will pay 3.8% in NIIT only on $10,000 because your MAGI exceeds the $250,000 threshold by only $10,000.

2025 2026 Estate and Trust Tax BracketsEstates and trusts have different tax brackets than individuals. These apply to non-grantor trusts and estates that retain income as opposed to distributing the income to beneficiaries. Grantor trusts (including the most common revocable living trusts) don’t pay taxes separately. The income of a grantor trust is taxed to the grantor at the grantor’s tax brackets.

Here are the tax brackets for estates and trusts in 2025 and 2026:

20252026 (Projected)10%$0 – $3,150$0 – $3,30024%$3,150 – $11,450$3,300 – $11,70035%$11,450 – $15,650$11,700 – $16,00037%over $15,650over $16,000Estate and Trust Tax BracketsSource: IRS Rev. Proc. 2024-40, author’s calculations.

2025 2026 Qualified Charitable Distributions (QCD) LimitPeople older than 70-1/2 can make Qualified Charitable Distributions (QCD) from their Traditional IRA directly to qualifying charitable organizations. QCDs count toward the Required Minimum Distribution (RMD).

The total QCDs can’t exceed $108,000 in 2025. The limit will go up to $111,000 in 2026.

The QCD limit is per person. If you’re married and both you and your spouse are over 70-1/2, you can make QCDs up to the limit separately from your respective IRAs.

Source: IRS Rev. Proc. 2024-40, author’s calculations.

2025 2026 2027 Medicare IRMAAPeople on Medicare Part B and Part D pay a higher Medicare premium when their Modified Adjusted Gross Income from two years ago crosses certain thresholds. I track these in Medicare IRMAA Premium MAGI Brackets.

2025 2026 Gift Tax ExclusionEach person can give another person up to a set amount in a calendar year without having to file a gift tax form. Not that filing a gift tax form is onerous, but many people avoid it if they can. This gift tax exclusion amount will stay the same at $19,000 in 2025 and 2026.

20252026 (Projected)Gift Tax Exclusion$19,000$19,000Gift Tax ExclusionSource: IRS Rev. Proc. 2024-40, author’s calculations.

The gift tax exclusion is counted by each giver to each recipient. As a giver, you can give up to $19,000 each in 2025 to an unlimited number of people without having to file a gift tax form. If you give $19,000 to each of your 10 grandkids in 2025, you still won’t be required to file a gift tax form. Any recipient can also receive a gift from an unlimited number of people. If a grandchild receives $19,000 from each of his or her four grandparents in 2025, no taxes or tax forms will be required.

2025 2026 Savings Bonds Tax-Free Redemption for College ExpensesIf you cash out U.S. Savings Bonds (Series I or Series EE) for college expenses or transfer to a 529 plan, your modified adjusted gross income must be under certain limits to get a tax exemption on the interest. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

Here are the income limits in 2025 and 2026. The limits are in a phase-out range. You get a full exemption if your income is below the lower number in the range. You get no exemption if your income is above the higher number in the range. You get a partial exemption if your income falls within the range.

20252026 (Projected)Single, Head of Household$99,500 – $114,500$101,750 – $116,750Married Filing Jointly$149,250 – $179,250$152,650 – $182,650Income Limit for Tax-Free Savings Bond Redemption for Higher EducationSource: IRS Rev. Proc. 2024-40, author’s calculations.

Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read ReviewsThe post 2025 2026 Tax Brackets, Standard Deduction, Capital Gains, QCD appeared first on The Finance Buff.

2025 2026 401k 403b 457 IRA FSA HSA Contribution Limits

Retirement account contribution limits are adjusted for inflation each year. Most contribution limits and income limits are projected to go up in 2026.

Before the IRS publishes the official adjustments for the next year in late October or early November, I calculate them based on the published inflation numbers by the same method the IRS uses, as stipulated by law. I’ve maintained a track record of 100% accuracy ever since I started doing these calculations.

Table of Contents2025 2026 401k/403b/457/TSP Elective Deferral Limit2025 2026 Annual Additions Limit2025 2026 SEP-IRA Contribution Limit2025 2026 Annual Compensation Limit2025 2026 Highly Compensated Employee Threshold2025 2026 SIMPLE 401k and SIMPLE IRA Contribution Limit2025 2026 Traditional and Roth IRA Contribution Limit2025 2026 Deductible IRA Income Limit2025 2026 Roth IRA Income Limit2025 2026 Healthcare FSA Contribution Limit2025 2026 HSA Contribution Limit2025 2026 Saver’s Credit Income LimitAll Together2025 2026 Tax Brackets and Standard Deduction2025 2026 401k/403b/457/TSP Elective Deferral LimitThe 401k/403b/457/TSP contribution limit is $23,500 in 2025. It will go up by $1,000 to $24,500 in 2026.

If you are age 50 or over by December 31, the catch-up contribution limit is $7,500 in 2025. It will go up by $500 to $8,000 in 2026.

If your age is 60 through 63 by December 31, you have a higher catch-up limit of $11,250 in 2025. It will go up by $250 to $11,500 in 2026.

If your prior year’s wages from the employer were over $145,000, your 2025 catch-up contribution must go to a Roth subaccount in the plan. The threshold will go up by $5,000 to $150,000 in 2026. The IRS has postponed enforcing this rule for 2025, but it will start enforcing it in 2026.

Employer match or profit-sharing contributions aren’t included in these limits. If you work for multiple employers in the same year or if your employer offers multiple plans, you have one single employee contribution limit for 401k, 403b, and the federal government’s Thrift Savings Plan (TSP) across all plans.

The 457 plan limit is separate from the 401k/403b/TSP limit. You can contribute the maximum to both a 401k/403b/TSP plan and a 457 plan.

2025 2026 Annual Additions LimitThe limit on total contributions from both the employer and the employee to all defined contribution plans by the same employer is $70,000 in 2025. It will increase to $72,000 in 2026.

The age-50-or-over catch-up contribution is separate from this limit. If you work for multiple employers in the same year, you have a separate annual additions limit for each unrelated employer.

2025 2026 SEP-IRA Contribution LimitIf you have self-employment income, you can contribute a percentage of your self-employment income to a SEP-IRA. The SEP-IRA contribution limit is always the same as the annual additions limit for a 401k plan. It’s $70,000 in 2025, and it will increase to $72,000 in 2026.

Because the SEP-IRA doesn’t allow employee contributions, unless your self-employment income is well above $200,000, you have a higher contribution limit if you use a solo 401k. See Solo 401k When You Have Self-Employment Income.

2025 2026 Annual Compensation LimitThe maximum annual compensation that can be considered for making contributions to a retirement plan is always 5x the annual additions limit. Therefore the annual compensation limit is $350,000 in 2025. It will increase to $360,000 in 2026.

2025 2026 Highly Compensated Employee ThresholdIf your employer limits your contribution because you’re a Highly Compensated Employee (HCE), the minimum compensation to be counted as an HCE is $160,000 in 2025. It will stay the same at $160,000 in 2026.

2025 2026 SIMPLE 401k and SIMPLE IRA Contribution LimitSome smaller employers offer a SIMPLE 401k or a SIMPLE IRA plan instead of a regular 401k plan. SIMPLE 401k and SIMPLE IRA plans have a lower contribution limit than standard 401k plans. The contribution limit for SIMPLE 401k and SIMPLE IRA plans is $16,500 in 2025. It will go up to $17,000 in 2026.

Employers with fewer than 25 employees and larger employers that contribute more to the plan have a higher contribution limit. The regular contribution limit to their SIMPLE plans is $17,600 in 2025. It will go up to $18,500 in 2026.

If you are 50 or over by December 31, the catch-up contribution limit in a SIMPLE 401k or SIMPLE IRA plan is $3,500 in 2025 ($3,850 at smaller employers) for ages 50-59 and 64 and over, and $5,250 for ages 60 through 63. It will be $4,000 in 2026 for ages 50-59 and 64 and over, and $5,000 for ages 60 through 63. The IRS may keep the catch-up limit for ages 60 through 63 at $5,250 in 2026.

Employer contributions to a SIMPLE 401k or SIMPLE IRA plan aren’t included in these limits.

2025 2026 Traditional and Roth IRA Contribution LimitYou need taxable compensation (“earned income”) to contribute to a Traditional or Roth IRA but there’s no age limit. The Traditional IRA or Roth IRA contribution limit is $7,000 in 2025. It will increase by $500 to $7,500 in 2026.

If you are age 50 or over by December 31, the catch-up limit is $1,000 in 2025. It will increase by $100 to $1,100 in 2026.

The IRA contribution limit is shared between the Traditional IRA and the Roth IRA. If you contribute the maximum to a Roth IRA, you can’t contribute the same maximum again to a Traditional IRA, and vice versa.

The IRA contribution limit and the 401k/403b/TSP or SIMPLE contribution limit are separate. You can contribute the respective maximum to both a 401k/403b/TSP/SIMPLE plan and a Traditional IRA or Roth IRA.

2025 2026 Deductible IRA Income LimitThe income limit for taking a full deduction for your contribution to a Traditional IRA while participating in a workplace retirement plan in 2025 is $79,000 for single filers and $126,000 for a married couple filing jointly. The deduction completely phases out when your income goes above $89,000 for singles and $146,000 for married filing jointly.

The full-deduction income limits will go up in 2026 to $81,000 for single filers and to $129,000 for a married couple filing jointly. The deduction will completely phase out when your income goes above $91,000 for singles and $149,000 for married filing jointly.

When you’re not covered in a workplace retirement plan but your spouse is, the income limit for taking a full deduction for your contribution to a Traditional IRA is $236,000 in 2025. The deduction completely phases out when your joint income goes above $246,000.

The full-deduction income limit will go up to $242,000 in 2026. The deduction completely phases out when your joint income goes above $252,000.

There’s no income limit if neither you nor your spouse is covered by a workplace retirement plan.

When you exceed the income limit for taking a deduction for contributing to a Traditional IRA, consider contributing to a Roth IRA instead.

2025 2026 Roth IRA Income LimitThe income limit for contributing the maximum to a Roth IRA depends on your filing status. The income limit in 2025 is $150,000 for singles and $236,000 for married filing jointly. These limits will go up to $153,000 for singles and $242,000 for married filing jointly in 2026.