W. Rick Harris's Blog

June 20, 2022

How Can The Exodus of People Make Your Next Investment Sweet Spot?

How can the exodus of people make your next investment sweet spot?

In the world’s history, people have migrated to other parts of their country, or different countries or continents.

Creating ProsperityWe as a civilization would never have prospered and grown if it were not for our family members of the past and those who are courageous today, willing to venture out to make their family and their lives better.

With all the conflicts in the world, people are migrating to make their lives and families’ lives safer.

Venturing out can come at considerable risk; this risk carries over your financial net worth, no matter how big or small. In many cases, you don’t have any employment or no income.

Investment Sweet Spots – Are You Taking Advantage of Your Freedom?Are you engaged in investing, or are you handing over your life or hard-earned money to someone hoping they find investment sweet spots?

My investment advice for you, your family, friends, and the community’s economic health is “Follow the Money.”

My blog posts focus on investment real estate as your financial portfolio. In addition, my primary reasons are to help you think about how to build a strong financial foundation, unlock sustainable wealth, and create a living legacy.

OpportunitiesHow Can The Exodus of People Make Your Next Investment Sweet Spot?Dynamics are going on in the world that create opportunities for you if you take advantage of your freedom.

A good friend often says, “Follow the Money.”

In addition, he refers to “Follow the Money” to find out the real reason most things happen globally, for instance, pharmaceutical or political developments, and you will know who is behind every move and why.

Following the money is one of the ingredients to help nurture a better life recipe.

The North America PictureNorth America, for instance, is behind a lot of big money. In addition, listening to broadcasts on the business news networks like CNBC and BNN gives you free knowledge of global financial information. However, are you watching and learning and executing your financial freedom?

Don’t let someone else intrepid this information and charge you for their interpretation, including me. Instead, make your own informed decisions.

Exodus is not only about people in North America but also money.In addition, getting money over the borders in the world is a lot easier than people.In North America, you have to declare transporting anything over $10,000 in cash to border officials but investing over $10,000 in the stock market over the border; you don’t have to report.No Physical Wall or Border is a Money BarrierIf you do any investing, you will realize how easy it is to get your money over the border than yourself. However, you can have more influence sitting at home investing than trying to get over the border as an investor. You can reach a significant influencer in a large corporation from the comfort of your home.How can the exodus of people make your next investment sweet spot? His place is closer to home than you thought.Therefore, buy a few company shares and learn its corporate rules. Similarly, find out when they have their stockholder meeting and show up to voice your concerns.How often have you heard stories of a handful of investors forcing policy change in a large organization?Russia/Ukraine War Reaps Benefits for Most of the WorldThe Russians have proven that any country can make a border seem invisible at anytime.

Do you remember before the start of Russia’s invasion of Ukraine?

The Russians attacked Ukraine with cyber attacks.

Recently Elon Musk gave Ukraine access to his satellites to fight off the Russian cyberattacks; love him or hate him, Elon puts his resources where his mouth is. Are you?

Short Term Pain, Long Term GainThe Russians attacking Ukraine are setting off many benefits for the world.

It may not feel like it right now for the Ukrainian people. But, above all, who can predict when Putin will be pounded into submission. However, my gut tells me it will happen.

Most of the World continues to support Ukraine. Above all, when the war dust settles, we will see a reconstruction effort in Ukraine like never before. Ukraine is a country of heritage and cultural pride. Until that day happens, we must strengthen our wealth to be generous in the future at Russia’s expense.

Western World’s Sheep’s ClothingThe Western World finds many Russian wolves in the Western World’s Sheep’s clothing. As a result, many Western governments are seizing these Russian Oligric assets and stripping them of their blood money.

There is hope someday, some of this moMoneyill reimburse Ukraine for the damage the Russians have caused.

Helping Ukraines Find Safe HomesMany countries will take in Ukraine immigrants. Most countries might benefit from this immigration. To learn more, please listen to a recent podcast show I was a guest on, “Where Should I Invest? ho ted by Sarah Larbi, Vault to Investment Real Estate Success

Even though the Ukrainian immigrants can be suitable for most countries, my hope is at some point, if they want to return home to Ukraine, this option will be available to them. It s one thing to immigrate to a country because it was your decision; however, being forced to make this decision because someone has attacked your country is different.

The NowTherefore, as an investor in the United States, Canada, and all nations not supporting Russia. Follow the money, people, and agricultural and resource-rich states, provinces, or countries.Remember, getting your investment funds over the border is easy and an excellent return on your investments.The movement of your investments is where you want your next investment sweet spot to be? Before, this can be anywhere you want.I see significant opportunities in investment real estate, following the more money-watch jobs created.Jobs need people, and people need housing.A Few North American Sweet SpotsIn the USA, Texas benefits big time from the departure of people from California, ask Elon Musk. Elon, many of his employees, and Tesla’s Headquarters waved goodbye to California. https://nypost.com/2021/12/02/tesla-officially-moves-its-headquarters-to-texas/The affordability of housing, jobs, and natural resources makes Texas a sweet spot. Abo e all, don’t forget an investment-friendly government. Texas is not the only state in the USA to have opportunities, following the Money one other conditions mentioned above.

Elon Musk tweets about the following work done in Austin, Texas. www.teslarati.com/tesla-giga-texas-largest-manufacturing-plant-united-states/.Other Job GrowthDid you know Amazon created an additional 500,000 jobs since 2020 alone? Follow Amazon’s Money Moneyeir new locations of Amazon distribution centers; jobs, jobs, jobs.In Canada, there is a trend going on. Canada and Ontario, especially in the GTA (Greater Toronto Area), realize they will never see affordable housing in their lifetimes.

The ShiftThere is a shift like in the USA, and people are waving goodbye to the GTA and heading West. Why? Affordability of housing and jobs, good-paying jobs are on the shift.

Don’t worry; California and Ontario will survive because they are both parts of great nations.

Alberta and much of Western Canada will be the sweet spots in Canada. But, above all, the world requires friendly access to reliable supplies.Remember! Can Th Exodus Make Your Next Investment Sweet Spot?What Goes Around, Comes AroundI wrote an article in late 2017 and pointed out that Calgary and Alberta would see a departure, and Alberta did.

I have added a link (View PDF). Click n and open the link This article I wrote for the REINLife Magazine in late 2017 entitled, “The Stampede Has Left Calgary; Will it Ever Return?” (It is only a couple of minutes to read but gives you more insight into what goes around comes around.)The Stampede Will ReturnAlberta has taken more than a few punches since 2015/2016; this will change.According to Scotia Bank’s economic forecast, BC will lead regional growth in 2022. Alberta will take the top position in 2023 (chart 1). Saskatchewan is forecast to significantly boost this year from work related to the Jansen potash mine project. www.scotiabank.com/ca/en/about/economics/economics-publications/post.other-publications.the-provinces.scotiabank-s-provincial-outlook–January-24–2022-.html Tipping Point, The Scale Tips SlowlyLook at what I had to say about oil in the article above. I suggested we need a friendly government or governments. And even though Canada is working hard to stay on task to help global warming. The world is now weening itself of conflict oil and will look to more Friendlier Countries for its natural resources, Canada and the USA.Be clear we are all seeing the shift to electric vehicles. But, the Russian war might shift us to a cleaner energy world quicker. I am not saying tomorrow we will snap our fingers and everyone will be driving electric vehicles.Alternative Carbon-Neutral Energy ResourcesIf you think the movement to alternative carbon-neutral energy resources will be stopped dead in its tracks, this will not happen.I have trust in most of the world, except Russia and China. China continues to support Russia and buy its oil and gas, and I predict this will continue long into the future.The rest of the world will continue to take action, and we can’t worry about the inner workings of Russia and China; let’s continue to place more restrictions on these countries. Let’s isolate them from the rest of the world; they will come around as nations that can not survive long-term without the rest of the world.We Need Action, Not WordWe need to create a reliable energy supply for the World and Europe; let’s help a country like Germany get a friendly, more reliable supply of oil and natural gas. The German government has a responsibility to its citizens, but it should not be coming at the death and destruction of the Ukraine people.North Americans must pull out all the stops to replace any oil and gas supply countries are receiving from Russia.Putin, See the Fickle Finger of Fate and Shove It

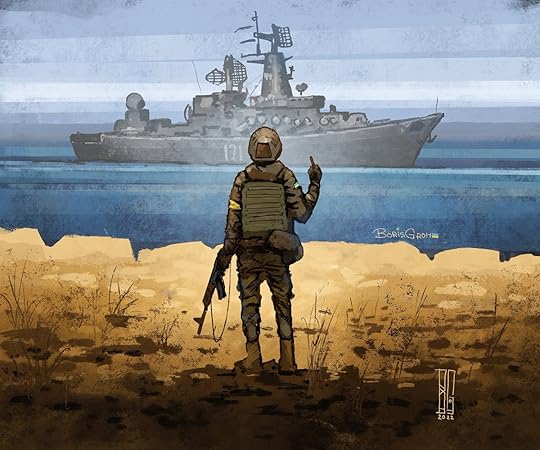

Tipping Point, The Scale Tips SlowlyLook at what I had to say about oil in the article above. I suggested we need a friendly government or governments. And even though Canada is working hard to stay on task to help global warming. The world is now weening itself of conflict oil and will look to more Friendlier Countries for its natural resources, Canada and the USA.Be clear we are all seeing the shift to electric vehicles. But, the Russian war might shift us to a cleaner energy world quicker. I am not saying tomorrow we will snap our fingers and everyone will be driving electric vehicles.Alternative Carbon-Neutral Energy ResourcesIf you think the movement to alternative carbon-neutral energy resources will be stopped dead in its tracks, this will not happen.I have trust in most of the world, except Russia and China. China continues to support Russia and buy its oil and gas, and I predict this will continue long into the future.The rest of the world will continue to take action, and we can’t worry about the inner workings of Russia and China; let’s continue to place more restrictions on these countries. Let’s isolate them from the rest of the world; they will come around as nations that can not survive long-term without the rest of the world.We Need Action, Not WordWe need to create a reliable energy supply for the World and Europe; let’s help a country like Germany get a friendly, more reliable supply of oil and natural gas. The German government has a responsibility to its citizens, but it should not be coming at the death and destruction of the Ukraine people.North Americans must pull out all the stops to replace any oil and gas supply countries are receiving from Russia.Putin, See the Fickle Finger of Fate and Shove ItYou may have seen a Ukraine soldier giving a Russian Destroyer the middle finger before Ukraine sunk the ship.

This action was so popular in Ukraine they created a postage stamp.

Follow the money, don’t manage your investment funds, and sit on the sidelines; therefore, make your life better, and know you can help. So how can the exodus of people make your next investment sweet spot?

Please find the link to my book, 31 Days to Purchasing and Renting Your First Investment Real Estate Property. If you see investment real estate in your “Now,” please purchase my book.

The post How Can The Exodus of People Make Your Next Investment Sweet Spot? appeared first on Vault to Investment Real Estate Success.

June 15, 2022

How Would You Love Investment Real Estate to Make Your Financial World ?

How Would You Love Investment Real Estate to Make Your Financial World? What are the chances of purchasing investment real estate in today’s economic environment???

Last week I was interviewed on one of North America’s Top Investment Real Estate Podcasts, Property Profits, hosted by Dave Dubeau. In episode 324, click on the link to listen to the conversation regarding purchasing investment real estate in today’s market. https://www.propertyprofitspodcast.com/wrickharris/

Dave is a skilled podcast interviewer and helps his clients find financial funding for investment real estate.

I love that Dave looked after his listeners. For example, Dave pushed me to discuss a strategy to add investment real estate to one’s financial portfolio in today’s real estate marketplace.

My goal in this blog post is not to detail my shared thoughts in this podcast episode but to give you some general ideas on the investment real estate market and the impact of rising interest rates.

Higher Interest Rates, Sign of Healthy Economy – Not This TimeCountries’ governments have no idea how to stem inflation; in other words, their only solution is to raise interest rates like drunken sailors.

The idea behind raising interest rates is to get inflation under control; however, look at what is happening to the average person and the jobs market.

By raising interest rates, the governments will kill economies and jobs that were just on the rise. Similarly, we need balance to handle the economic situation. But, when has a government ever used a balanced approach?

Read more on the motivation of most politicians; not good. Politicians; How They Continue Exploiting Two Things

Other Impacts on Housing Market Average ConsumerRecently BNNBloomberg ran a story that shows 1-in-4 homeowners would have to sell their homes if interest rises.

The move on to higher interest rates is coming. The higher interest rates will create a sad day for many people; why? So many people dream of home ownership, and to have as many as 1-in-4 homeowners have to sell their dream.

Double Whammy Coming to the Housing Market – No Good NewsFor instance, what do you think will affect prices if the housing market floods with inventory?

The housing prices will drop, and people selling their homes to get a better financial position will create a worse economic situation for them and their families. Giving up part of your net worth to put food on the table is a noble reason. However, it can have long-term implications for any legacy for your family in the future. I know because I liquidated my registered savings early in my working life to feed my family. Things did improve, but I had already made this dramatic change.

Getting Back in Much HarderA higher interest rate environment will mean fewer people can qualify for a mortgage and fewer buyers.

The double whammy; is an over-inventoried real estate marketplace with few buyers.

Good NewsHow Would You Love Investment Real Estate to Make Your Financial World?Time to Buy Investment Real EstateDave Dubeau pushed me hard to give the average investor the answer to getting into the investment real estate market. In addition, I felt good about the advice to his listeners.

Look for the SignsSuppose you are considering timing (when to buy). There is no perfect time to buy, timing is an opportunity, but we never know the length of the opportunity.

Remember, the BNNBloomberg story on 1-in-4 homeowners selling is a story of intent. It will not take a lot of observation skills to know when the real estate market has too much inventory, and you will see the prices drop.

How Would You Love Investment Real Estate Make Your Financial World?In my podcast with Dave Dubeau, I reference my book, 31 Days to Purchasing and Renting Your First Investment Real Estate Property, and how it has made a difference in people’s lives.

A recent reviewer wrote, “I never expected that the book would lead me on my own investment real estate journey. But with the rich knowledge and expert guidance Rick provides, I realized homeownership was within my reach.”

The ResultThe reviewer purchased a bungalow with an income suite in the basement.

For less than a couple of lattes at your favorite coffee shop, you can purchase my book and start to love investment real estate in your financial world.

Learn more on how to get started, https://www.vaulttoinvestmentrealestatesuccess.com/w-rick-harris-author-page

I wish you much success in building a stronger financial future for your world, and thank you for reading my thoughts.

The post How Would You Love Investment Real Estate to Make Your Financial World ? appeared first on Vault to Investment Real Estate Success.

June 2, 2022

Can The Exodus Make Your Next Investment Sweet Spot?

Can the exodus make your next investment sweet spot?

In the history of the world, people have migrated to other parts of their country, or different countries or continents.

Creating ProsperityWe as a civilization would never have prospered and grown if it were not for our family members of the past and those who are courageous today, willing to venture out to make their family and their lives better.

With all the conflicts in the world, people are migrating to make their lives and families’ lives safer.

Venturing out can come at considerable risk; this risk carries over your financial net worth, no matter how big or small. In many cases, you don’t have any employment or no income.

Investment Sweet Spots – Are You Taking Advantage of Your Freedom?Are you engaged in your investing, or are you handing over your life or hard-earned money to someone hoping they find investment sweet spots?

My investment advice for you, your family, friends, and the community’s economic health is “Follow the Money.”

My blog posts focus on investment real estate as part of your financial portfolio. In addition, my primary reasons are to help you think about how to build a strong financial foundation, unlock sustainable wealth, and create a living legacy.

Opportunities – Can The Exodus Make Your Next Investment Sweet Spot?Dynamics are going on in the world that create opportunities for you if you take advantage of your freedom.

A good friend often says, “Follow the Money.”

In addition, he refers to “Follow the Money” to find out the real reason most things happen globally, for instance, pharmaceutical or political developments, and you will know who is behind every move and why.

Following the Money is one of the ingredients to help nurture a better life recipe.

The North America PictureNorth America, for instance, is behind a lot of big money. In addition, listening to broadcasts on the business news networks like CNBC and BNN gives you free knowledge of global financial information. However, are you watching and learning, and executing your financial freedom?

Don’t let someone else intrepid this information and charge you for their interpretation, including me. Instead, make your own informed decisions.

Exodus is not only about people in North America; it is also about money.In addition, getting money over the borders in the world is a lot easier than people.In North America, you have to declare transporting anything over $10,000 in cash to border officials but investing money over $10,000 in the stock market over the border; you don’t have to declare.No Physical Wall or Border is a Money BarrierIf you do any investing, you will realize how easy it is to get your money over the border than yourself. As an investor, you can have more influence sitting at home investing than trying to get over the border. You can reach a significant influencer in a large corporation from the comfort of your home.Can the exodus make your next investment sweet spot? This place is closer to home than you thought.Therefore, buy a few shares of a company and learn its corporate rules. Similarly, find out when they have their stockholder meeting and show up to voice your concerns.How often have you heard stories of a handful of investors forcing policy change in a large organization?Russia/Ukraine War Reaps Benefits for Most of the WorldThe Russians have proven that any country at any time can make a border seem invisible.

Do you remember before the start of Russia’s invasion of Ukraine?

The Russians attacked Ukraine with cyber attacks.

Recently Elon Musk gave Ukraine access to his satellites to fight off the Russian cyberattacks; love him or hate him, Elon puts his resources where his mouth is. Are you?

Short Term Pain, Long Term GainThe Russians attacking Ukraine are setting off many benefits for the rest of the world.

It may not feel like it right now for the Ukrainian people. Above all, I can not predict when Putin will be pounded into submission. But, my gut tells me it will happen.

Most of the world continues to support Ukraine. Above all, when the war dust settles, we will see a reconstruction effort in Ukraine like never before. Ukraine is a country of heritage and cultural pride. Until that day happens, we must strengthen our wealth to be generous in the future at Russia’s expense.

Western World’s Sheep’s ClothingThe Western World is finding many Russian wolves in the Western World’s Sheep’s clothing. As a result, many Western governments are seizing these Russian Oligric assets and stripping them of their blood money.

There is hope someday, some of this money will reimburse Ukraine for the damage the Russians have caused.

Helping Ukraines Find Safe HomesMany countries will take in Ukraine immigrants. Each country might benefit from this immigration. To learn more, please listen to a recent podcast show I was a guest on, “Where Should I Invest? hosted by Sarah Larbi, Vault to Investment Real Estate Success

Even though the Ukrainian immigrants can be good for most countries, my hope is at some point, if they want to return home to Ukraine, this option will be available to them. It is one thing to immigrate to a country because it was your decision; however, being forced to make this decision because someone has attacked your country is different.

The NowTherefore, as an investor in the United States, Canada, and all nations not supporting Russia. Follow the money, the people, and agricultural and resource-rich states, provinces, or countries.Remember, it is easy to get your investment funds over the border and get an excellent return on your investments.The movement of your investments is where you want your next investment sweet spot to be? Therefore, this can be anywhere you want.I see significant opportunities in investment real estate, follow the money and watch jobs created.Jobs need people, and people need housing.A Few North American Sweet SpotsIn the USA, Texas benefits big time from the departure of people from California, ask Elon Musk. Elon, many of his employees, and Tesla’s Headquarters waved goodbye to California. https://nypost.com/2021/12/02/tesla-officially-moves-its-headquarters-to-texas/The affordability of housing, jobs, and natural resources makes Texas a sweet spot. Above all, don’t forget an investment-friendly government. Texas is not the only state in the USA to have opportunities, following the money and other conditions mentioned above.Elon Musk tweets about the following work done in Austin, Texas. https://www.teslarati.com/tesla-giga-texas-largest-manufacturing-plant-united-states/.Other Job GrowthDid you know Amazon created an additional 500,000 jobs since 2020 alone? Follow Amazon’s money to their new locations of Amazon distribution centers; jobs, jobs, jobs.In Canada, there is a trend going on. Canadians from Ontario, especially from the GTA (Greater Toronto Area), realize they will never see affordable housing in their lifetimes.

The ShiftThere is a shift like in the USA, and people are waving goodbye to the GTA and heading West. Why? Affordability of housing and jobs, good-paying jobs are on the shift.

Don’t worry; California and Ontario will survive because they are both parts of great nations.

Alberta and much of Western Canada will be the sweet spots in Canada. But, above all, the world requires friendly access to reliable supplies.Remember! Can The Exodus Make Your Next Investment Sweet Spot?What Goes Around, Comes AroundI wrote an article in late 2017 and pointed out that Calgary and Alberta would see a departure, and Alberta did.I have added a link (View PDF). Click on and open the link This article I wrote for the REINLife Magazine in late 2017 entitled, “The Stampede Has Left Calgary; Will it Ever Return?” (It is only a couple of minutes to read but gives you more insight into what goes around comes around.)The Stampede Will ReturnAlberta has taken more than a few punches since 2015/2016; this will change.According to Scotia Bank’s economic forecast, BC will lead regional growth in 2022. Alberta will take the top position in 2023 (chart 1). Saskatchewan is forecast to significantly boost this year from work related to the Jansen potash mine project. https://www.scotiabank.com/ca/en/about/economics/economics-publications/post.other-publications.the-provinces.scotiabank-s-provincial-outlook–january-24–2022-.html Tipping Point, The Scale Tips SlowlyLook at what I had to say about oil in the article above. I suggested we needed a friendly government or governments. And even though Canada is working hard to stay on task to help global warming. The World is now weening itself of conflict oil and will look to more Friendlier Countries for its natural resources, Canada and the USA.Be clear we are all seeing the shift to electric vehicles. But, the Russian war might shift us to a cleaner energy world quicker. I am not saying tomorrow we will snap our fingers, and everyone will be driving electric vehicles.Alternative Carbon-Neutral Energy ResourcesIf you think the movement to alternative carbon-neutral energy resources will be stopped dead in its tracks, this will not happen.I have trust in most of the world, except Russia and China. China continues to support Russia and buy its oil and gas, and I can predict that this will continue long into the future.The rest of the world will continue to take action, and we can’t worry about the inner workings of Russia and China; let’s continue to place more restrictions on these countries. Let’s isolate them from the rest of the world; they will come around as nations that can not survive long-term without the rest of the world.We Need Action, Not WordsWe need to create a reliable energy supply for the world and Europe; let’s help a country like Germany get a friendly, more reliable supply of oil and natural gas. The German government has a responsibility to its citizens, but it should not be coming at the death and destruction of the Ukraine people.North Americans have to pull out all the stops to replace any oil and gas supply that countries are receiving from Russia.Putin, See the Fickle Finger of Fate and Shove It

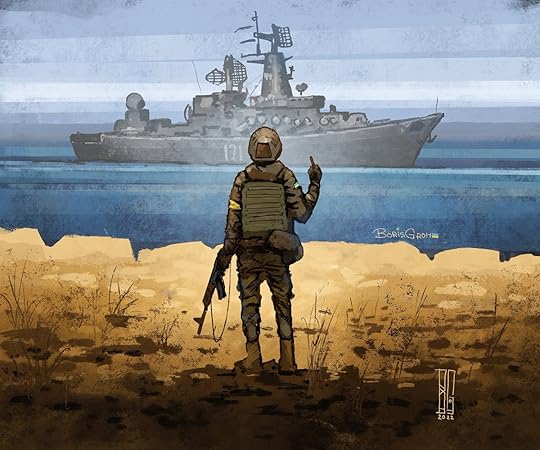

Tipping Point, The Scale Tips SlowlyLook at what I had to say about oil in the article above. I suggested we needed a friendly government or governments. And even though Canada is working hard to stay on task to help global warming. The World is now weening itself of conflict oil and will look to more Friendlier Countries for its natural resources, Canada and the USA.Be clear we are all seeing the shift to electric vehicles. But, the Russian war might shift us to a cleaner energy world quicker. I am not saying tomorrow we will snap our fingers, and everyone will be driving electric vehicles.Alternative Carbon-Neutral Energy ResourcesIf you think the movement to alternative carbon-neutral energy resources will be stopped dead in its tracks, this will not happen.I have trust in most of the world, except Russia and China. China continues to support Russia and buy its oil and gas, and I can predict that this will continue long into the future.The rest of the world will continue to take action, and we can’t worry about the inner workings of Russia and China; let’s continue to place more restrictions on these countries. Let’s isolate them from the rest of the world; they will come around as nations that can not survive long-term without the rest of the world.We Need Action, Not WordsWe need to create a reliable energy supply for the world and Europe; let’s help a country like Germany get a friendly, more reliable supply of oil and natural gas. The German government has a responsibility to its citizens, but it should not be coming at the death and destruction of the Ukraine people.North Americans have to pull out all the stops to replace any oil and gas supply that countries are receiving from Russia.Putin, See the Fickle Finger of Fate and Shove ItYou may have seen a Ukraine soldier giving a Russian Destroyer the middle finger before Ukraine sunk the ship.

This action was so popular in Ukraine they created a postage stamp.

Follow the Money, don’t let your investment funds sit on the sidelines; therefore, make your life better, and know you can help. Can the exodus make your next investment sweet spot?

Please find the link to my book, 31 Days to Purchasing and Renting Your First Investment Real Estate Property. If you see investment real estate in your “Now,” please purchase my book.

The post Can The Exodus Make Your Next Investment Sweet Spot? appeared first on Vault to Investment Real Estate Success.

May 25, 2022

Ready or Not – How to Discover and Deliver the Best Investor in You?

Ready or not – how to discover and deliver the best investor in you? Many people question if they are investors, and many feel they don’t have the knowledge or the funds to invest.

Surprise!

The moment you start to earn a paycheque in both the US and Canada, the employer deducts amounts from your earnings. Part of these deductions goes to the federal government to fund old age security or a government-paid pension when you hit a certain age. So you are an investor whether you like it, think it, or do it; the government invests on your behalf for your golden years (retirement).

Your Role as An Investor

There is a lot of debate on many types of investors. But, first, you are either an institutional investor, someone who is a professional and, for the most part, manages other people’s or companies’ money.

The second investor is an individual investor, where you are an active investor or a passive investor of your money.

Purpose

For this blog and teaching, I am focused on individual investors only.

Get Off the Sidelines – Ready or Not -How to Discover and Deliver the Best Investor in You?

Before I outline individual investor types, my goal is to ask you to move from a passive role investing to an active part of investing. Further, to ask you to take more personal responsibility for your investments.

Why?

I come from the belief that no one will take better care of you than you. If you have no interest in managing your own hard-earned money and are happy to hand it over to someone else, fine.

But if you have made no effort to see what it takes to play an active role in your own investing. Therefore, remember you will get the result you deserve.

Plan Truth

The cost of someone else looking after your hard-earned money comes at a price. Above all, no one is managing your money for free.

There are costs. Most costs include a fee to buy, sell or redeem an investment, withdrawal or deposit fees, interest fees, distribution costs, administration fees, management and custody fees, and my favorite, other, a catch-all line.

The True Price

In addition, over the life of your investments, the professionals handling your money make a more significant income from your money than you do?

Author Mark J Heinzl in his 2001 book, Stop Buying Mutual Funds: Easy Ways to Beat the Pros Investing On Your Own, talks about the madness of the low return on investing in mutual funds. (still available on Amazon)

However, if you want an updated spin on this message, read the blog Don’t Buy Mutual Funds, Buy The Company!

The author, Dividend Ninja’s message is clear, and one of his examples is he made a 14% return on the value of the mutual fund company. However, the return on his money managed by the mutual fund company was a paltry 0.4% return.

Types of Investors, Do You Recognize Your Type or Types?

If you want to play a more active role in your investment portfolio, let me outline the type of individual investor types there are:

Automatic Investor (if you are paying into any government program or a company pension play) and the amount comes off your paycheque; you have automated your investment process. Remember, you could also contribute monthly money to other saving programs, such 401K, registered savings account, tax-free savings account, etc.)

Daily Stock Market Observer, you have given your financial person permission to invest your funds, but you like to observe the return and growth of the investment, positive or negative.

Engaged Trader, you have opened a self-directed account, making your own decisions.

Socially Conconciuos Investor is a person purchasing investments for the good of the planet or causes. You have a robust belief system and put your money where your mouth is.

Angel investors may have access to funds and want to work with entrepreneurs as first-time investors or a venture capital play.

Bargain Hunter is always looking for a great deal.

Company Fan loves a company, its products, and active user of said products. May not get the most significant return through value growth or dividend payout, but this is of lower concern. (ie. Apple, Mircosoft)

Investment Tweaker likes to fine-tune their investments but never radically.

Person to Person Lender is a money person behind a small business or individual.

Money Lender to family, friends, and networks

Property (my personal favorite)

Ready or Not? – How to Discover and Deliver the Best Investor in You?

Do you recognize yourself in these investor types? In addition, if you are taking an active role as an investor, are you now ready to deliver the type of investor you are to the world?

Listen to a recent podcast I was a guest, Ready, Set, Goal – Real Estate Investing the Right Way with W. Rick Harris, and consider investment real estate as an investor.

The post Ready or Not – How to Discover and Deliver the Best Investor in You? appeared first on Vault to Investment Real Estate Success.

Ready or Not – How to Discover the Investor in You?

Ready or not – how to discover the investor in you? Many people question if they are investors, and many feel they don’t have the knowledge or the funds to invest.

Surprise!

The moment you start to earn a paycheque in both the US and Canada, the employer deducts amounts from your earnings. Part of these deductions goes to the federal government to fund old age security or a government-paid pension when you hit a certain age. So you are an investor whether you like it, think it, or do it; the government invests on your behalf for your golden years (retirement).

Your Role as An Investor

There is a lot of debate on many types of investors. First, you are either an institutional investor, someone who is a professional and, for the most part, manages other people’s or companies’ money.

The second investor is an individual investor, where you are an active investor or a passive investor of your money.

Purpose

For the purpose of this blog and teaching, I am focused on individual investors only.

Get Off the Sidelines – Ready or Not -How to Discover the Investor in You?

Before I outline individual investor types, my goal is to ask you to move from a passive role investing to an active part of investing. Further, to ask you to take more personal responsibility for your investments.

Why?

I come from the belief that no one will take better care of you than you. If you have no interest in managing your own hard-earned money and are happy to hand it over to someone else, fine.

But if you have made no effort to see what it takes to play an active role in your own investing. Therefore, remember you will get the result you deserve.

Plan Truth

The cost of someone else looking after your hard-earned money comes at a price. Above all, no one is managing your money for free.

There are costs. Most costs include a fee to buy, sell or redeem an investment, withdrawal or deposit fees, interest fees, distribution costs, administration fees, management and custody fees, and my favorite other, a catch-all line.

The True Price

In addition, over the life of your investments, the professionals handling your money make a more significant income from your money than you do?

Author Mark J Heinzl in his 2001 book, Stop Buying Mutual Funds: Easy Ways to Beat the Pros Investing On Your Own, talks about the madness of the low return on investing in mutual funds. (still available on Amazon)

However, if you want an updated spin on this message, read the blog Don’t Buy Mutual Funds, Buy The Company!

The author, Dividend Ninja’s message is clear, and one of his examples is he made a 14% return on the value of the mutual fund company. However, the return on his money managed by the mutual fund company was a paltry 0.4% return.

Types of Investors, Do You Recognize Your Type or Types?

If you want to play a more active role in your investment portfolio, let me outline the type of individual investor types there are:

Automatic Investor (if you are paying into any government program or a company pension play) and the amount comes off your paycheque; you have automated your investment process. Remember, you could also contribute monthly money to other saving programs, such 401K, registered savings account, tax-free savings account, etc.)

Daily Stock Market Observer, you have given your financial person permission to invest your funds, but you like to observe the return and growth of the investment, positive or negative.

Engaged Trader, you have opened a self-directed account, making your own decisions.

Socially Conconciuos Investor: A person purchasing investments for the good of the planet or causes. You have a robust belief system and put your money where your mouth is.

Angel investors may have access to funds and want to work with entrepreneurs as first-time investors or a venture capital play.

Bargain Hunter is always looking for a great deal.

Company Fan loves a company, its products, and active user of said products. May not get the most significant return through value growth or dividend payout, but this is of lower concern. (ie. Apple, Mircosoft)

Investment Tweaker likes to fine-tune their investments but never radically.

Person to Person Lender is a money person behind a small business or individual.

Money Lender to family, friends, and networks

Property (my personal favorite)

Ready or Not? – How to Discover the Investor in You?

Do you recognize yourself in these investor types? In addition, if you are taking an active role as an investor, are you now ready?

Listen to a recent podcast I was a guest, Ready, Set, Goal – Real Estate Investing the Right Way with W. Rick Harris and consider investment real estate as an investor.

The post Ready or Not – How to Discover the Investor in You? appeared first on Vault to Investment Real Estate Success.

April 19, 2022

Do or Die, Are You Ready to Live Well into Your Hundreds?

“To Infinity and Beyond!” is Buzz Lightyear’s famous catchphrase in the Toy Story films and the TV series Buzz Lightyear of Star Command.

We as humans may not see Infinity and Beyond as our current life expectancy. However, we as the human race are pushing the frontier of aging. We will see 100 years of average life expectancy within our future grasp.

A centenarian is a person who has reached the age of 100 years. For instance, life expectancies worldwide are below 100 years ( Current Life Expectancy, 81); the term centenarian is invariably associated with longevity. (316,000 centenarians in 2012)

In 2019, the estimation of all centenarians around the globe was about 450,000. This figure is most likely inaccurate as many people worldwide are not registered, around 1.1 billion (primarily children). http://www.allinallspace.com/how-many-people-actually-reach-the-age-of-100/

According to Comfortlife.ca ( https://www.comfortlife.ca/retirement-communities/our-aging-population-statistics), the fastest-growing age growth since the 2011 Canada Census is 100 plus category. In addition, this demographic grew by 41.3% from 2011 to 2016, the fastest-growing age group in Canada.

Is Turning 100 on Your Longevity Radar?Is living “Well” into your hundreds something you aspire; why or why not?

You may have heard the discussion about living to 100 years of age. Most people say, are you crazy? Who wants to live until 100?

The answer! People who are 99!

You might be thinking, no thanks, I don’t see my physical and mental capacity being in the most excellent shape to want to live into my hundreds.

Secondly, you may be looking at your finances and saying, any chance of earning additional income on top of my retirement income is not on my cards.

Therefore even if you have the physical and mental capacity, your finances will not support your healthy you.

Investment Real EstateIf you have not listened to my recent guest podcasts, I have given you links to podcast cast shows I am a guest. The hosts are great interviewers and, I believe, have drawn out some valuable information. Vault to Investment Real Estate Success and Ready, Set, Goal – Real Estate Investing the Right Way with W. Rick Harris.

During these interviews, most of my insights are about investment real estate as an income solution that can allow you to create additional income for decades after you turn 65.

Your Story About Successful Aging, What are You Afraid of?Your story about successful aging and the reflection on your answers gives you a glimpse into your willingness to stay the course of aging “Well” or Not.

However, suppose your current physical and mental actions and philosophy are already creating your poor health. In that case, there is no need to pay any attention to using investment real estate as a path to living well into your hundreds.

Don’t waste your precious time, don’t read any further. Seize the day.

For those of you with a gut feeling 100 years of life expectancy is around your life’s corner, keep reading.

You are The ProjectHave you ever been involved in project management? However, when the project gets complicated, you are worried about completing it. In addition, you look for solutions, and nine times out of 10, the recommended advice is to go back to the basics or fundamentals.

Recently we lost one of the greats of the entertainment world, Betty White, three weeks short of her 100th birthday.

Betty had a great sense of humor and loved life. Even at her age, she incorporated physical exercise into today’s daily routine. She often mentioned she lived in a two-story home and said she would often climb a set of stairs to retrieve an item or for a reason and then forget the thing or the reason. Betty had a positive attitude about this because it gave her a physical routine.

I am sure Betty wanted to live to 100; more importantly, millions of people thought Betty left this world too soon. But, in addition, many of us thought Betty was someone who had much more to give for the betterment of the world.

Betty’s sense of humor for humanity and love and caring for animals of the world were only a few of her gifts we all would love to achieve.

On Betty’s 100th birthday, January 17, 2022, thousands and thousands of people donated to Animal Shelters worldwide in Betty’s name; what a legacy.

I hope January 17 every year becomes a year we all think of donating to Animal Shelters for the rest of our lives.

Can You Afford to Live That Long?With the average life expectancy moving up every year, and by 2040 the average life expectancy is projected to be 95 years of age. Yes, you heard correctly; 95 will be the average life expectancy.

I would suggest many of you reading this blog who are youngsters in your 20s, 30s, and possibly 40s have a perfect chance to see 100 years plus of age as the average life expectancy in your time.

What are you doing, if anything, to fund this more extended life expectancy than you are expecting?

The Government Isn’t the Solution.Think again if you are banking on the government to be your revenue provider and funding the great life.

Most governments worldwide have done an awful job of providing for the aged through the pandemic.

The governments continue to mismanage your contributions through taxation and give you terrible returns on your investments.

Yes, taxes are your investment into the community as a whole. But unfortunately, we all see governments squandering your community investments every day.

With the pandemic expenses, the rising costs of interest and inflation, and the war in Ukraine, the world’s governments are in no shape to handle the next crisis, an aging population the governments have never seen coming.

Huge StigmaAge 65 is a huge stigma that needs addressing; this age should be taken out back and shot. Age 65 should not be an age on anyone’s radar. We need to get over 65; it hurts a world that needs capable, reliable, solution-orientated folks who are more valuable than ever.

If you listen to the podcast Vault to Investment Real Estate Success, you will hear my take on the positive aspects of immigration and the critical need for immigration.

Governments are too cautious and not letting in enough folks to the USA and Canada. In other words, we need all hands on deck in our economies and blocking an essential human resource with a number is crazy.

You need to reach out to your politicians and employers and similarly have them remove any mention or policies geared to age 65.

Later in Life, Additional Income SolutionInvestment Real Estate isn’t the only passive income solution to living a long life, but it should be part of your solution.

Are You in the Live Longer Tribe?Now that you are aware you might live to 100 years and beyond, you have time to read my recently published book, 31 Days to Purchasing and Renting Your First Time Real Estate Property. Follow this link, and you will find out why a small investment of your financial resources and a small investment of your time are a tiny price to pay and give.

Now that you realize how long you might live, it is worth every dollar and minute invested. So enjoy the read and return.

The post Do or Die, Are You Ready to Live Well into Your Hundreds? appeared first on Vault to Investment Real Estate Success.

April 5, 2022

What Would You Do to Give Your Loving Family a Better Life?

In February 2022, I was a guest on a Real Estate Investing podcast show, and I shared trends for investors to capitalize on the future with the host. (Link Below)

The host wanted me to talk about the Alberta investment real estate marketplace, unravel the marketplace and the economy, and share my insights into the future.

One of my insights was that oil would move from $75 a barrel and go higher. I spoke about this in early 2022 (Oil is now hovering around $100 a barrel, April 4, 2022).

In addition, I spoke about the significance of immigration and how important immigration is to North America.

If you listen to this episode, I mention how people can go back and hear if the person interviewed was blowing smoke up your pant leg or delivering the information you could use.No Smoke or MirrorsListen to “Where Should I Invest?” Hosted by Sarah Larbi, Episode 187 Vault to Investment Real Estate Success. This podcast episode talks about the fossil fuel and green energy industry and immigration in North America.Even though North America is not opening our borders to a free flow of immigration, keep your eye on this opportunity.In addition, at the time of the broadcast of the podcast episode, Russia had not yet invaded Ukraine. The USA and Canada are now opening on immigration to help the Ukrainian people.However, the other immigration trend people are not watching creates opportunities is interprovincial or interstate immigration.So keep reading, and I will share the who, the why, the where people within Canada and the USA are shifting.Changing TrendsThese trends are showing up in the real estate market.These recent trends are driven by Covid and, in addition, by inflation and the war in Ukraine.Taking Advantage of Trends; Are You Ready?Work at HomeCovid, as reported by numerous sources, changed the real estate landscape as people had to work at home. Many of these people need more room, large houses with a home office and a space to educate their children.This trend had many suburban areas around large cities’ housing prices rising. Therefore, we are seeing the secondary real estate marketplaces are getting very expensive and, in addition, driving many people out of any hopes of purchasing a single-family home.Interprovincial and Interstate ImmigrationMy daughter is a realtor, and recently she worked with clients who moved from the Greater Toronto Area to Edmonton.Why? Their primary goal was to own a single-family home with a yard for their young family. But unfortunately, they could no longer see the path to single homeownership in the GTA or most of Ontario.What they did next was incredible and bold. My daughter’s clients knew no one in Alberta but had heard good things about the province. So they worked with my daughter and house hunted on the video feature of cell phones. My daughter showed them multiple homes, and when they got their list down to a few, it was only then that they flew out and made a purchase.How could they make this transition? My daughter’s client had a job that allowed her to work from home, so it didn’t matter where she lived. The husband is a heavy-duty auto mechanic and took less than a week to find an excellent job in his field. Work at home advantages makes significant lifestyle changes possible.My daughter’s clients recently took possession of their single-family home. They are pleased with their move and purchase. My daughter negotiated the backyard swing-set in the price, and the couple’s children think they have died and gone to heaven. To have a playground in their backyard was never a dream my daughter’s clients thought they would never achieve for their children.Following the TrendThis past weekend my daughter’s client from Ontario introduced my daughter to two sisters and a cousin who currently lives in the Greater Toronto Area (GTA). These ladies came out to look at real estate in the Greater Edmonton Area. The potential is three more single-family sales for my daughter.I am not saying there is a mass exodus from Ontario, but there is more than smoke from this fire.Interstate MovementSpeaking of fire, people are moving out of California in the USA. Instead of being a destination state for interstate immigration, people are moving from California because of many factors, including housing affordability.https://www.usnews.com/news/best-states/california/articles/2021-04-26/california-losing-congressional-seat-for-first-timeForced ImmigrationBut fire also is a sign of war. So Putin and Russia invaded Ukraine.Even though my blog posts are on the value of investment real estate, we must not be afraid to speak up.

We, as North Americans, are going to benefit big time. However, most of us would not wish what is happening to Ukraine to be taking place.

The cold hard truth is that we, as North Americans, will benefit.

The Side Effects of WarMany Ukraines murdered, displaced from their homes, and forced to leave their country. These actions are criminal.

Who is benefitting financially because of the war?

Thanks to Putin, any country provides oil, natural gas, fertilizers, crops, or any other product Russia supplies to the rest of the World.But remember, the USA and Canada need immigrants, and thanks to Putin, North America’s door is open to Ukrainian immigrants. So will all of these people stay and build futures in North America; maybe not all; however, some will.The Ukrainians coming to North America had no choice; they were forced to abandon their country for the love of their families.Never Ending and ForgivenessNo one knows how long Putin’s madness will continue. Putin is a wolf with no sheep’s clothing. He will never be trusted or believed by most of the World again.I worry some Western Nations will try and accept any olive branch from Putin. You can look back at Putin’s words versus actions and know he is never to be trusted.My gut tells me that Ukraine will never again be at ease; even if peace comes, the Ukrainians will have to sleep the rest of their lives with one eye open.The people of Ukraine will succeed in turning back the Russians, but the World will look and feel much different.Putin must earn forgiveness. However, he has no interest in forgiveness; unfortunately, madness has no cure.BlessedWe are blessed as North Americans to be able to move of our own free will to give our families a better life.

That is what the people of Ukraine are fighting for; their price is steep, and death is the ultimate price.

When it comes to your family and making any bold move in North America and taking advantage of any opportunity, the choice is yours to make.

The post What Would You Do to Give Your Loving Family a Better Life? appeared first on Vault to Investment Real Estate Success.

February 18, 2022

The Where, What, Why, When, Who, How; Can Power Your Financial Portfolio?

Journalists educated and trained in their profession; are taught to report the news. In addition, one of the essential training techniques introduced on the first day is the start of the foundation.

This foundation of journalism challenges the students to practice the 5 Ws: Where, Why, When, What, Who, and the How.

Recently I asked to be a guest on one of Canada’s favorite investment real estate podcast shows.

Where Should I Invest? host Sarah Larbi https://sarahlarbi.com/episode187

Above all, Sarah uses “Where” in the title of her podcast show. In addition, when you listen to the show, you find Sarah covers all the 5 Ws and the How. Sarah’s podcast is all about the ins and outs of investment real estate.

Therefore, if you wonder how to power your financial portfolio, listen to the podcast above. Investment real estate might be your next opportunity.

Above all, think about the principles shared in the show and be an investigative journalist and develop a plan to drive your financial foundation forward using the 5 Ws and How method.

The 5Ws and HowTo help you get started; let’s do a quick recap:

Where?

The Place? If you are into Project Management, “where” is usually the last thing you consider. With investment real estate, we start with The Where. In the podcast episode above, we talk about investing areas.

As Sarah mentioned in the podcast, there are many factors to consider.

I have invested in three different markets, and each market is different from the others.

In my book, 31 Days to Purchasing and Renting Your First Investment Real Estate Property Day 8, chapter title “Home May Not Be Where The Investment Heart Is,” we discuss the Sweet Spots that help determine “where.”

What?

Determining your requirements in purchasing your first investment real estate property is critical.

I flush out the “what” in the first four chapters of my book. What are about four essential factors? What is investment real estate? Is this investment vehicle right for you, getting ready, understanding your finances, and having the finances to purchase investment real estate? What is the last factor, an entrepreneurial and small business mindset?

Why?

The where and what is priming your investment pump and bringing clarity to your midway point in powering your financial portfolio, but before you start filling your investment bucket, you need to review your why one more time?

At this point, before you have made any financial commitment, you can delve into the drivers and benefits of purchasing investment real estate and your satisfaction.

When?It can be your actual stumbling block. You may trip over all the information and numbers leading to Analysis Paralysis and never set a “When.”

On Day 18 in my book, we discuss SMART goal setting, and the last element of SMART goal setting is the “T,” time-bound. By setting your “When,” you can make a date feel real and look more confident to your stakeholders.

Setting a date and completing a little early or a little later is okay because you are working around a completion date you have shared with all stakeholders, your “When.”

Who?

Who are your stakeholders, joint venture partners, resources team, and tenants? Who will ultimately benefit from purchasing and renting your first investment real estate property?

In my book on Days 5, 19, 20, 21, and 26, we get into all your stakeholders and the benefits.

How?Purchasing and renting your first investment real estate property is your “How.”

How did it happen?

Using the 5Ws method, implement the 5W method with determination and persistence, let your ability to learn something new shine through, and power your financial portfolio.

The post The Where, What, Why, When, Who, How; Can Power Your Financial Portfolio? appeared first on Vault to Investment Real Estate Success.

February 15, 2022

Why You Should Dig Down Behind the Headlines, Love the Opportunity Coming

Smoke and Mirrors

The Headline; “The Government of Canada adds 401,000 new permanent residents in 2021.”

This news is fantastic; however, you need to dig deeper and scroll to the middle of the official news release below.

Not New PeopleThese 401,000 new permanent residents were already in Canada. So therefore, all the government did was speed up the process to move these folks from temporary to permanent residents.

The vast majority of these folks in Canada would have become permanent residents soon.

Real Story Behind the NewsThe real story is we are still locking down our borders; in addition, the hard work and need for more immigration are far from over.

Make sure you read this entire blog post. Why?

The new opportunities for Canadians and Americans could be massive in 2023, 2024, and beyond.

In addition, to this blog I was recently interviewed to give further importance to immigration, COVID-19, investment real estate, the fossil fuel industry for Alberta and Canada; please listen to “Where Should I Invest?” Podcast hosted by Sarah Larbi. (click on the guest podcast link below)

https://sarahlarbi.com/episode187

Government of Canada – News releaseGovernment reaches the target of 401,000 new permanent residents in 2021

December 23, 2021—Ottawa—All Canadians originally come from somewhere else, with the significant exception of Indigenous people. The story of immigration fills many chapters in the history of Canada—including the most recent one. To support Canada’s post-pandemic recovery and chart a more prosperous future, the Government of Canada set a target of welcoming 401,000 new permanent residents in 2021 as part of the 2021–2023 Immigration Levels Plan.

The Honourable Sean Fraser, Minister of Immigration, Refugees, and Citizenship, announced that Canada has reached its target and welcomed more than 401,000 new permanent residents in 2021. Surpassing the previous record from 1913, this is the most newcomers in a year in Canadian history.

This historic achievement is particularly significant in the face of the pandemic’s many challenges. From closed borders to domestic lockdowns, global migration has been upended by COVID-19. But the employees of Immigration, Refugees and Citizenship Canada (IRCC) rose to the occasion and processed a record half a million applications in 2021. To achieve this, IRCC added resources, embraced new technology and brought more processes online. These changes are all permanent improvements to Canada’s immigration system.

More News …….As we continue to struggle with the pandemic, we made the most of the talent already within our borders. The majority of these new permanent residents were already in Canada on temporary status. Most notably, we launched new programs to engage essential workers, health care professionals, international graduates and French-speaking newcomers. Family reunification is another pillar of our system, and we reunited spouses and children while enabling more families to sponsor parents and grandparents. Finally, with many countries closing their doors to refugees, we continued to offer the world’s most vulnerable shelter in Canada.

Canada needs immigration to drive our economy, enrich our society and support our aging population. One in 3 Canadian businesses is owned by an immigrant, and 1 in 4 health care workers is a newcomer. Business, labour market experts and economists all agree that immigration creates jobs, spurs innovation and helps address labour shortages. New Canadians contribute to communities across our country every day, and we will continue welcoming more of them as we build the Canada of tomorrow.

“Reminder – the people in the news release, were already in Canada.”

Tidal Wave of ImmigrationWe as a country will need to get caught up on real immigration growth.

Reread the last paragraph in the news release; if this doesn’t motivate you to look beyond the headlines? What will?

Canada is seriously behind the immigration curve to meet the real numbers set and required. As a nation, we need to open the Canadian borders and allow new immigrants into Canada. Without these folks, our economy will stay stagnant.

But, in addition, we need to get our elected government representatives to ensure that our Immigration Department has the resources to process a tidal wave of the people required to land on the shores of Canada.

What will draw people to want to make Canada their home?

The answer is simple and outlined below.

Canada is a beckon to the world and now is……….

Ranked as Best Country in the WorldWASHINGTON, April 13, 2021 /CNW/ — For the first time, Canada takes the top spot overall in the 2021 Best Countries Report, a ranking and analysis project by U.S. News & World Report; BAV Group, a unit of global marketing communications company VMLY&R; and the Wharton School of the University of Pennsylvania.

Canada’s DilemnaIt’s not the Why; it is the How. How can we open our doors to new immigrants now and still deal with COVID-19?

According to the Government’s news release above 1 in 4, healthcare workers are sourced from newcomers to Canada. No wonder are healthcare workers are tired, and some are leaving the profession. In addition, we are not letting anyone into Canada to give these folks the relief they need from carrying the healthcare load.

The definition of insanity, according to Albert Einstein, is doing the same thing repeatedly and expecting a different result.

Keeping immigrants out of Canada is not working. Therefore, let’s learn the lessons and develop ways to manage COVID-19 as part of our daily lives. In addition, let’s give our healthcare workers and our economies some relief.

At Some PointAt some point, we will have to allow for the actual immigration. Canada needs to take care of itself as a nation.

Like former President Obama said, “The World Needs More Canada.”

The better-off Canada is the better-off is the World.

Housing Our NeedsMy blog is all about investment real estate and getting you to take action. Above all, it would be best to have investment real estate as part of your financial portfolio. Why?

Where will we house all of these new people coming to Canada?

Noble UndertakingWith my father in the armed forces most of his career, we were tenants for the first twenty years of my life. Thank God for the owners of rental real estate; I can not think of a nobler thing to do than give people a good and safe place to live.

If you read my book, 31 Days to Purchasing and Renting Your First Investment Real Estate Property, you can learn a ton on how to get started.

One of the most significant opportunities I describe in my book is purchasing a duplex or bungalow, a sure-fire method to get you to care for your housing needs and a renter.

A simple change in the configuration of a bungalow can create a new housing unit. Therefore, creating a housing unit that will be desperately needed.

Give people a hand up while building a solid financial foundation for you and your family.

There are many opportunities for everyone; therefore, I would be honored if you bought one of my books and gave one as a gift to educate others on the benefits to your community on owning investment real estate.

Think Beyond HousingAnd even though housing is going to be a large part of helping immigrants settle into our country. Similarly, you need to consider the massive opportunities in almost every industry in Canada, and the employment created.

In conclusion, there is no better time than in 2022 to plan for the incredible times ahead for Canada. But, above all, the time is now, whether you want to have a side hustle or build a full-time business.

To Your Success!

The post Why You Should Dig Down Behind the Headlines, Love the Opportunity Coming appeared first on Vault to Investment Real Estate Success.

December 30, 2021

How Did You Know? Boost Your Investment Opportunity. It Has Staying Power.

I usually don’t post blogs two days in a row. However, based on the following information. I felt a need.

In my blog post from yesterday, How a Trend on Aging is Your Ticket to Investment Real Estate Wealth, I discussed three Google Trends on Aging in 2021.

These 2021 Google Trends on Aging were:Average Social Security Cheque at age 62. Up 2000%Covid survival rate by age group? Up 1450%What age could I retire with full benefits? Up 950%St. Louis Fed Study Feeds the TrendsIn addition, I didn’t need a crystal ball to confirm the St. Louis Fed Study below.

Another labor-force dampening U.S. trend is rising rates of early retirement. A St. Louis Fed study concluded that there were “slightly over 2.4 million excess retirements” during the pandemic period (through August 2021), accounting for more than half of the ‘lost’ labor force.

Covid Scare for Boomers Fuels Gen X, Y, and Z Investment Real Estate OpportunityFor instance, in my blog from yesterday, I talked about the Covid Scare and the Opportunity for you as Gen X, Y, and Z. The St. Louis Fed Study confirms this Covid scare among Boomers.

Above all, did you get on the phone or online and reach out to your lender as I suggested?

One More Trend for You to Take Advantage Of Regarding AgingAccording to the Conference Board of Canada, the average person living during the Roman Empire might have expected to live 25 years. At the turn of the 20th century, an individual had a life expectancy of 50 years. In 2009, the estimated average life expectancy in Canada and its peer countries was 81 years (conferenceboard.ca/HCP/Details/Health...)

From Extraordinary to OrdinaryTherefore, based on simple math calculations, we could see an average life expectancy of 95 years by 2050.

Above all, let me repeat this, “The Average Life Expectancy of 95 by 2050.”

If you can live to 95 years of age by the year 2050, don’t you think by 2060, the average age of life expectancy will continue to notch up.

Not The Dead Pool, The Rental PoolFolks, many Boomers will live into their mid-nineties. In addition, as I mentioned before, they will need a place to rent and live.

In conclusion, are you ready to help?

Have you thought about your life expectancy?

We all know our governments won’t be ready to fund your longevity.

You have an opportunity to create a revenue source as you continue to age; don’t let it pass you “buy.”

If you are ready to help and find the information on trends helpful, please purchase my book, 31 Days to Purchasing and Renting Your First Investment Real Estate Property, and see how it can help you.

And if you are a podcast listener, enjoy my recent guest podcast episode on the R.E.I. Branded Podcast Show Ready, Set, Goal – Real Estate Investing the Right Way with W. Rick Harris

The post How Did You Know? Boost Your Investment Opportunity. It Has Staying Power. appeared first on Vault to Investment Real Estate Success.