Shivam Singh's Blog: Future of Finance & Technology

October 17, 2025

Beleggen (Investing) in Nederland: Een Complete Gids

Wat is Beleggen (Investing)?

Beleggen, of investing, is het proces waarbij je geld of kapitaal inzet met de verwachting in de toekomst financieel rendement te behalen. In essentie koop je iets, zoals aandelen, obligaties, vastgoed of andere activa, in de hoop dat de waarde ervan zal stijgen. Het is een belangrijk onderdeel van Personal Finance en kan een cruciale rol spelen bij het opbouwen van vermogen op de lange termijn.

In Nederland is beleggen steeds populairder geworden, mede door de lage spaarrentes en de wens om meer uit het vermogen te halen. Echter, beleggen brengt ook risico's met zich mee. Het is belangrijk om je goed te informeren en een strategie te bepalen die past bij jouw financiële situatie en risicobereidheid.

Waarom Beleggen?Er zijn verschillende redenen waarom mensen in Nederland ervoor kiezen om te beleggen:

Vermogensgroei: Beleggen biedt de potentie om je vermogen sneller te laten groeien dan sparen.

Inflatie: Beleggen kan helpen om de inflatie te verslaan, waardoor je koopkracht behouden blijft.

Pensioenopbouw: Beleggen kan een aanvulling zijn op je pensioen, waardoor je een comfortabeler leven kunt leiden na je werkzame leven.

Financiële doelen: Beleggen kan je helpen om specifieke financiële doelen te bereiken, zoals het kopen van een huis, het financieren van de studie van je kinderen of een wereldreis.

Soorten BeleggingenEr zijn veel verschillende manieren om te beleggen. Enkele van de meest voorkomende zijn:

Aandelen: Vertegenwoordigen een deel van het eigendom van een bedrijf. De waarde van aandelen kan fluctueren op basis van de prestaties van het bedrijf en de marktomstandigheden.

Obligaties: Zijn leningen aan overheden of bedrijven. In ruil voor de lening ontvang je rente. Obligaties worden over het algemeen als minder risicovol beschouwd dan aandelen.

Beleggingsfondsen: Zijn een bundeling van verschillende beleggingen, zoals aandelen en obligaties. Dit zorgt voor diversificatie en kan het risico verminderen. Een Investment Fund (Beleggingsfonds) kan actief of passief beheerd worden. Een voorbeeld van een passief beheerd fonds is een Index Fund.

Vastgoed: Het kopen van een huis of appartement om te verhuren. Vastgoed kan een stabiele bron van inkomsten zijn, maar vereist ook veel onderhoud en beheer.

Cryptocurrencies: Digitale valuta zoals Bitcoin en Ethereum. Cryptocurrencies zijn zeer volatiel en worden beschouwd als een risicovolle belegging.

Risico's van BeleggenBeleggen brengt altijd risico's met zich mee. De waarde van je beleggingen kan dalen, waardoor je (een deel van) je inleg kunt verliezen. Het is belangrijk om je bewust te zijn van deze risico's en om een strategie te kiezen die past bij jouw risicobereidheid. Factoren die de risico’s beïnvloeden zijn onder andere:

Marktrisico: Het risico dat de waarde van je beleggingen daalt als gevolg van algemene marktomstandigheden.

Bedrijfsrisico: Het risico dat de waarde van je beleggingen daalt als gevolg van problemen bij een specifiek bedrijf.

Inflatierisico: Het risico dat de inflatie hoger is dan het rendement op je beleggingen, waardoor je koopkracht daalt.

Beleggen in Nederland: BelastingenIn Nederland wordt vermogen, inclusief beleggingen, belast in Box 3: Income from Savings and Investments. Dit betekent dat je belasting betaalt over een fictief rendement op je vermogen. Er is een Heffingsvrij Vermogen , een bedrag waarover je geen belasting betaalt. Het is raadzaam om je te laten informeren over de actuele belastingregels door de Dutch Tax and Customs Administration (Belastingdienst).

Tips voor Beginnen met BeleggenAls je wilt beginnen met beleggen, zijn hier enkele tips:

Informeer je goed: Lees boeken, artikelen en volg cursussen over beleggen.

Bepaal je financiële doelen: Wat wil je bereiken met beleggen?

Bepaal je risicobereidheid: Hoeveel risico ben je bereid te nemen?

Begin klein: Begin met een klein bedrag en bouw het langzaam op.

Diversifieer je portefeuille: Spreid je beleggingen over verschillende activa.

Beleg voor de lange termijn: Probeer niet snel rijk te worden, maar focus op de lange termijn.

Beleggen kan een effectieve manier zijn om je vermogen te laten groeien. Door je goed te informeren, een strategie te bepalen en je aan de lange termijn te committeren, kun je de kans op succes vergroten. Echter, onthoud altijd dat beleggen risico's met zich meebrengt en dat je (een deel van) je inleg kunt verliezen.

Source: Originally published on Finpedia by Cent Capital.

Non-current (Fixed) Assets (Anläggningstillgångar)

What are Non-current (Fixed) Assets?

Non-current assets, also known as fixed assets or 'Anläggningstillgångar' in Swedish, are a company's long-term investments that are not expected to be converted into cash within one year. These assets are crucial for a company's operations and long-term growth. They provide a foundation for generating revenue and represent a significant portion of a company's total assets, particularly for businesses in industries like manufacturing, transportation, and real estate in Sweden.

Types of Non-current AssetsSeveral types of assets fall under the category of non-current assets. Understanding these different types is essential for accurately assessing a company's financial position. Here are some common examples:

Tangible Assets: These are physical assets that have a physical form. Examples include land, buildings, machinery, equipment, vehicles, and furniture. In Sweden, these assets are often subject to depreciation, reflecting their declining value over time due to wear and tear or obsolescence.

Intangible Assets: These assets lack physical substance but provide long-term value to the company. Examples include patents, trademarks, copyrights, and goodwill. Goodwill arises when a company acquires another company for a price higher than the fair value of its identifiable net assets. In Sweden, the accounting treatment of intangible assets can be complex and requires careful consideration of accounting standards.

Financial Assets: These include long-term investments in other companies, such as stocks, bonds, and other securities. These investments are held for more than one year and are expected to generate income or capital appreciation over time. Swedish companies often hold financial assets as part of their investment strategies.

Accounting for Non-current Assets in SwedenThe accounting for non-current assets is governed by Swedish accounting standards, which are largely aligned with International Financial Reporting Standards (IFRS). Key aspects of accounting for these assets include:

Initial Recognition: Non-current assets are initially recorded at their cost, which includes the purchase price plus any costs directly attributable to bringing the asset to its intended use. For example, the cost of machinery includes the purchase price, transportation costs, and installation costs.

Depreciation: Tangible non-current assets, except for land, are depreciated over their useful lives. Depreciation is the systematic allocation of the asset's cost over its useful life. Common depreciation methods include the straight-line method and the declining balance method. The choice of depreciation method can significantly impact a company's reported earnings. Swedish companies must adhere to specific tax regulations regarding depreciation.

Impairment: Non-current assets are reviewed for impairment whenever events or changes in circumstances indicate that the asset's carrying amount may not be recoverable. If the carrying amount exceeds the recoverable amount (the higher of fair value less costs to sell and value in use), an impairment loss is recognized. This is a critical consideration, especially during economic downturns.

Derecognition: A non-current asset is derecognized (removed from the balance sheet) when it is disposed of or when no future economic benefits are expected from its use or disposal. Any gain or loss on derecognition is recognized in the income statement.

Importance of Non-current AssetsNon-current assets are essential for a company's long-term success for several reasons:

Revenue Generation: These assets are used to produce goods or provide services that generate revenue for the company. Without these assets, a company would struggle to operate effectively.

Operational Efficiency: Investing in modern and efficient non-current assets can improve a company's operational efficiency, reduce costs, and increase profitability.

Financial Stability: A strong base of non-current assets can provide financial stability and security, making the company more attractive to investors and lenders in Sweden.

Practical Examples in SwedenConsider a manufacturing company in Sweden that produces furniture. Its non-current assets would include the land and buildings where the factory is located, the machinery used to manufacture the furniture, and the vehicles used to transport the finished products. These assets are essential for the company's operations and long-term success.

Another example is a technology company in Stockholm. Its non-current assets might include patents for its software, trademarks for its brand, and computer equipment used by its employees. These intangible and tangible assets are critical for the company's competitive advantage and long-term growth.

Key TakeawaysNon-current assets ('Anläggningstillgångar') are long-term investments that are essential for a company's operations and long-term growth in Sweden.

These assets include tangible assets (land, buildings, machinery), intangible assets (patents, trademarks), and financial assets (long-term investments).

Accounting for non-current assets involves initial recognition, depreciation, impairment, and derecognition, following Swedish accounting standards aligned with IFRS.

Understanding and managing non-current assets effectively is crucial for a company's financial stability, revenue generation, and operational efficiency.

Source: Originally published on Finpedia by Cent Capital.

Registered Retirement Savings Plan (RRSP)

What is a Registered Retirement Savings Plan (RRSP)?

A Registered Retirement Savings Plan (RRSP) is a retirement savings plan that's registered with the Canadian government. It allows Canadians to save for retirement while receiving tax benefits. Contributions to an RRSP are tax-deductible, meaning you don't pay income tax on the amount you contribute in the year you contribute. The money within the RRSP grows tax-free, and you only pay taxes when you withdraw the money in retirement. It's a powerful tool for building a secure financial future.

Key Features of an RRSPTax Deductible Contributions: You can deduct your RRSP contributions from your taxable income, reducing the amount of income tax you pay.

Tax-Sheltered Growth: The money within your RRSP grows tax-free. This means you don't pay taxes on any investment income, such as interest, dividends, or capital gains, as long as the money remains in the RRSP.

Withdrawals Taxed as Income: When you withdraw money from your RRSP in retirement, the withdrawals are taxed as regular income. The goal is to be in a lower tax bracket during retirement than you are during your working years.

Contribution Limits: The amount you can contribute to your RRSP each year is limited. The limit is typically 18% of your previous year's earned income, up to a certain maximum dollar amount. Unused contribution room can be carried forward to future years.

How RRSPs WorkYou open an RRSP account at a financial institution, such as a bank, credit union, or investment firm. You then contribute money to the RRSP. The financial institution invests the money according to your instructions. You can choose from a variety of investments, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

The investments within the RRSP grow tax-free. When you retire, you can withdraw money from the RRSP to use as income. The withdrawals are taxed as regular income in the year you withdraw them. Many people convert their RRSP into a Registered Retirement Income Fund (RRIF) at retirement.

Benefits of an RRSPTax Savings: RRSPs provide immediate tax savings through deductible contributions and tax-sheltered growth.

Retirement Income: RRSPs help you build a nest egg for retirement, providing a source of income to supplement government benefits and other savings.

Flexibility: You have control over how your RRSP is invested, allowing you to tailor your investment strategy to your risk tolerance and retirement goals.

Home Buyers' Plan (HBP): You can withdraw up to $35,000 from your RRSP to buy or build a qualifying home under the HBP. You have 15 years to repay the withdrawn funds back into your RRSP.

Lifelong Learning Plan (LLP): You can withdraw funds from your RRSP to finance your or your spouse's full-time education. There are specific rules and limits associated with the LLP.

Practical ExamplesExample 1: Sarah contributes $5,000 to her RRSP each year. She is in a 30% tax bracket, so she receives a $1,500 tax refund each year ($5,000 x 30%). Over 30 years, her investments grow tax-free, allowing her to accumulate a substantial retirement nest egg.

Example 2: David and his wife are buying their first home. They each withdraw $35,000 from their RRSPs under the Home Buyers' Plan, providing them with $70,000 towards their down payment. They then have 15 years to repay those amounts back into their RRSPs.

Key TakeawaysRRSPs are a valuable tool for Canadians to save for retirement. They offer tax advantages and flexibility. Understanding the rules and benefits of RRSPs is essential for effective retirement planning. Consider consulting with a financial advisor to determine the best RRSP strategy for your individual circumstances.

Keep in mind that the specific rules and regulations regarding RRSPs can change, so it's always best to consult the official Canada Revenue Agency (CRA) website or a qualified financial advisor for the most up-to-date information.

Source: Originally published on Finpedia by Cent Capital.

Sustainable Finance in the Netherlands

What is Sustainable Finance?

Sustainable finance is the practice of integrating environmental, social, and governance (ESG) criteria into financial decisions. It's about directing investments towards projects and activities that contribute to a more sustainable and equitable future. This encompasses a wide range of financial activities, from lending and investment to insurance and asset management. The goal is to generate financial returns while also having a positive impact on the planet and its people.

Key Pillars of Sustainable FinanceEnvironmental: Addressing climate change, resource depletion, pollution, and biodiversity loss. This includes investments in renewable energy, energy efficiency, sustainable agriculture, and conservation efforts.

Social: Promoting social justice, human rights, labor standards, and inclusive growth. This includes investments in affordable housing, education, healthcare, and community development.

Governance: Ensuring ethical business practices, transparency, and accountability. This includes promoting diversity on boards, responsible executive compensation, and anti-corruption measures.

Sustainable Finance in the NetherlandsThe Netherlands is a frontrunner in sustainable finance, with a strong commitment to achieving its climate goals and promoting responsible business practices. The Dutch government, financial institutions, and businesses are actively working together to integrate ESG factors into their operations and investment decisions.

Several factors contribute to the Netherlands' leading position:

Strong regulatory framework: The Dutch government has implemented policies and regulations that encourage sustainable investment and reporting, such as the Sustainable Finance Action Plan.

Active engagement from financial institutions: Major Dutch banks, insurers like NN Group , and pension funds such as Stichting Pensioenfonds ABP are increasingly integrating ESG factors into their investment strategies.

Growing awareness among consumers and investors: There is a rising demand for sustainable financial products and services, driven by increasing awareness of environmental and social issues.

Practical Examples of Sustainable Finance in the NetherlandsGreen Bonds: Dutch companies and municipalities are issuing green bonds to finance environmentally friendly projects, such as renewable energy infrastructure and sustainable transportation.

Impact Investing: Investors are increasingly allocating capital to companies and projects that generate positive social and environmental impact alongside financial returns. This includes investments in affordable housing, sustainable agriculture, and clean technology.

ESG Integration: Financial institutions are incorporating ESG factors into their investment analysis and decision-making processes. This involves assessing the environmental, social, and governance risks and opportunities associated with different investments.

Sustainable Mortgages: Some Dutch banks offer sustainable mortgages with favorable terms for energy-efficient homes.

Key TakeawaysSustainable finance is crucial for building a more sustainable and equitable future. It involves integrating ESG factors into financial decisions and directing investments towards projects that benefit both the planet and its people. The Netherlands is a leader in sustainable finance, driven by strong regulatory frameworks, active engagement from financial institutions, and growing awareness among consumers and investors. By embracing sustainable finance, individuals and organizations can contribute to a more resilient and prosperous economy.

Staying informed about the latest developments in sustainable finance, such as evolving regulations and new investment opportunities, is essential for making responsible financial decisions. You can consult resources from organizations like the Dutch Central Bank (DNB) and the Platform for Sustainable Finance.

Source: Originally published on Finpedia by Cent Capital.

Major Banks / Universal Banks in Sweden

Understanding Major Banks / Universal Banks in Sweden

In Sweden, like many developed economies, major banks, often referred to as universal banks, play a pivotal role in the financial system. These institutions offer a wide array of financial services, catering to individuals, businesses, and even governmental entities. Understanding their function and impact is crucial for navigating the Swedish financial landscape.

What Defines a Major Bank?Major banks in Sweden are characterized by their significant market share, extensive branch networks (although increasingly digital), and a comprehensive suite of financial products. These products typically include:

Retail banking services: Including Bank Accounts (Bankkonto) , loans, mortgages, and credit cards.

Corporate banking services: Providing financial solutions for businesses of all sizes, such as lending, cash management, and trade finance.

Investment banking services: Assisting companies with mergers and acquisitions, securities underwriting, and other capital market activities.

Wealth management services: Offering financial planning, investment advice, and portfolio management to high-net-worth individuals.

Key Players in the Swedish Banking SectorThe Swedish banking sector is dominated by a few major players. These banks have a significant impact on the Swedish economy and are subject to strict regulatory oversight by Finansinspektionen (FI) , the Swedish Financial Supervisory Authority. While specific market shares fluctuate, some of the most prominent major banks in Sweden include:

Swedbank

SEB (Skandinaviska Enskilda Banken)

Nordea

Handelsbanken

The Role of Sveriges RiksbankIt's important to differentiate major commercial banks from Sveriges Riksbank (The Riksbank) , which is Sweden's central bank. While major banks operate for profit and provide services to the public, the Riksbank is responsible for maintaining price stability and ensuring the stability of the financial system.

Navigating Banking Services in SwedenWhen choosing a bank in Sweden, consider factors such as the range of services offered, fees (including potential Service Charge (Serviceavgift)), online banking capabilities, and customer service. Many banks offer similar products, so comparing terms and conditions is essential. Consider your individual financial needs and choose a bank that aligns with your goals.

Practical ExamplesLet's say you're looking for a mortgage in Sweden. Major banks are the primary lenders. You'd compare interest rates, loan terms, and any associated fees from different banks to find the most favorable option. Or, if you're a small business owner, you might need a business Loan (Lån) to expand your operations. Again, major banks would be your first port of call.

Latest TrendsThe Swedish banking sector is rapidly evolving with the rise of fintech and digital banking. Major banks are investing heavily in technology to improve their online services and compete with newer, more agile players. This includes enhanced mobile banking apps, AI-powered customer service, and streamlined online application processes. Furthermore, sustainability is becoming increasingly important, with banks offering green Loan (Lån) options and integrating environmental, social, and governance (ESG) factors into their investment decisions.

Key TakeawaysMajor banks are central to the Swedish financial system, offering a wide range of services to individuals and businesses. Understanding their role and how they operate is crucial for making informed financial decisions. As the banking landscape evolves, staying informed about the latest trends and comparing different banks' offerings will help you choose the best financial partner for your needs.

Source: Originally published on Finpedia by Cent Capital.

October 16, 2025

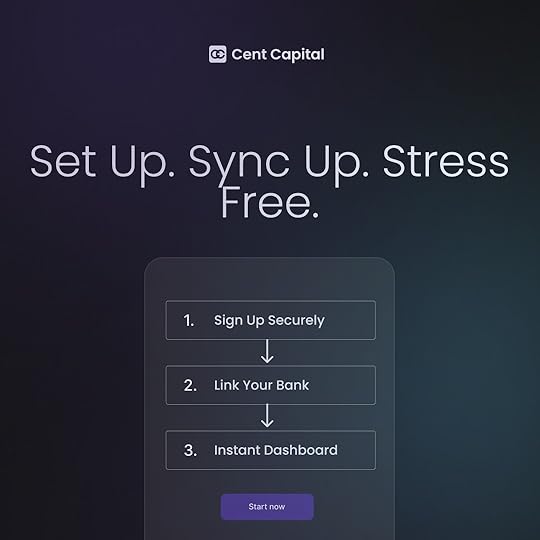

See Your Entire Financial World in One View | Cent Capital AI

Watch the full video: https://www.youtube.com/watch?v=-NIpDuzpz3Q

October 15, 2025

You Can’t Solve Financial Anxiety Without Unbreakable Trust.

Why ‘Privacy First. Always.’ is the most important feature we’ll ever build at Cent Capital.

Let’s be honest. Thinking about money can be stressful. For many of us, it’s a quiet, late-night anxiety — a question mark hanging over our future, a knot in our stomach when we open our banking app. It’s a feeling of vulnerability.

Now, imagine taking that feeling and being asked to hand over the keys to your entire financial life to a new app.

It’s a huge ask. We know that.

And that’s why, before a single line of code was written for Cent Capital, before we designed our first interface or trained our first AI model, we made one foundational, non-negotiable decision: our commitment to your privacy would be absolute. In a financial industry that has often profited from a lack of transparency, we decided that our entire business would be built on the foundation of unbreakable trust.

“Privacy First. Always.” isn’t a marketing slogan. It is our core engineering and ethical principle. Here’s what it means in practice.

The Three Pillars of Your Digital FortressWe see ourselves as the architects of your financial co-pilot, and any good co-pilot must first guarantee the safety of the cockpit. Our security is built on three uncompromising pillars.

1. The Armored Car, Not the Spare Key: Secure Connections with PlaidYou wouldn’t give a stranger a spare key to your house. So why would you give an app your bank password? We agree. That’s why we will never ask for or store your bank login credentials.

We use Plaid, the industry-leading platform trusted by major banks and top fintechs like Venmo and Robinhood. When you connect your account, you are interacting directly with Plaid’s secure portal. Think of Plaid as the armored car that safely transports encrypted information from your bank to us. We get the necessary data, but your keys — your credentials — remain securely with you and your bank.

2. The Digital Vault: Military-Grade 256-bit EncryptionEvery piece of your financial data, from a single transaction to your account balance, is protected by 256-bit AES encryption. This is the same standard used by governments and financial institutions to protect top-secret information.

This encryption shields your data at two critical points:

In Transit: As your data travels from your bank to our servers.At Rest: While your data is stored in our secure, cloud-based infrastructure.Even in the extraordinarily unlikely event of a breach, your information would be nothing more than a wall of unreadable, scrambled gibberish. It is locked in a digital vault, and only you hold the key.

3. The One-Way Mirror: Read-Only Access, AlwaysThis is the most important promise we will ever make to you: We cannot, and will not, ever move your money.

Our access to your financial accounts is strictly “read-only.” We can see the data to analyze it and provide you with powerful AI insights — like a co-pilot reading the instruments. But we have absolutely no ability to make transfers, withdrawals, or any transactions.

You are always in complete control. Our platform is a one-way mirror: we look in to help you understand, but we can never reach through and touch.

“But What About My Data?” The Power of AnonymityWe are building the world’s most intelligent Financial LLM (FinLLM) to power our co-pilot. This requires data. So how do we square this with our “Privacy First” promise?

The answer is anonymization and aggregation.

Your personal data is used only to generate your personal, private insights. For our broader AI models, we strip away all personally identifiable information (your name, account numbers, etc.) and combine your anonymized transaction data with that of thousands of other users.

This massive, anonymous dataset allows us to spot larger trends — like how a change in inflation is affecting spending on groceries, or what saving strategies are most effective for people in a certain income bracket. These macro-insights make the AI smarter for everyone, including you, without ever compromising a single individual’s privacy.

By using Cent Capital, you are not just improving your own financial health; you are anonymously contributing to a collective intelligence that will help millions of others do the same.

The Journey to Financial Wellness Starts with Feeling SafeFinancial anxiety is a deeply personal struggle. Your journey to overcome it should be a private, empowering experience. Our mission is to give you the tools and the confidence to take control of your future, and that mission is impossible without a foundation of absolute security.

Your financial wellness journey is yours alone, but you don’t have to walk it alone. We’re here to be your trusted co-pilot, and that trust is a responsibility we will honor, always.

Ready to start your journey with a partner you can trust? Explore Cent Capital today.

[image error]You Can’t Solve Financial Anxiety Without Unbreakable Trust. was originally published in DataDrivenInvestor on Medium, where people are continuing the conversation by highlighting and responding to this story.

Think in Percentages, Not Digits: The Psychology of Money

Here’s the truth about money management that most financial advice misses: your brain processes $200 and 6% of your income completely differently. One feels like a hard number you can’t change. The other feels like a choice you control.

This isn’t just financial semantics. It’s the difference between budgeting success and another abandoned spreadsheet in your Downloads folder. When you shift from thinking “$1,500 for rent” to “45% of my income for housing,” something fundamental changes in how you make money decisions. You stop managing dollars and start managing your financial life.

The Problem with Dollar-Based Thinking

The Problem with Dollar-Based ThinkingMost people know exactly what they pay for rent. Ask them how much they spend on ‘convenience’ — DoorDash fees, Uber rides, last-minute Target runs — and they have no idea.

Here’s the disconnect: A $6 delivery fee feels annoying but acceptable. But that same person would never consciously budget $180/month for ‘convenience expenses,’ even though that’s exactly what they’re spending.

This is your brain on dollar-based thinking. Every purchase exists in isolation. $6 feels like a small premium for not leaving the house. $180 (what those delivery fees actually cost monthly) feels like real money. But 4.5% of a $4,000 monthly income? That puts the real cost in perspective.

Mental accounting, a concept developed by Nobel Prize-winning economist Richard Thaler, explains why we do this. We create separate “buckets” for different types of spending, treating money differently based on how we categorize it. The $6 fee goes in the “convenience charge” bucket. The $180 would go in the “that could be a savings contribution” bucket. Same money, different mental treatment.

Research consistently shows that people struggle with this disconnect. A study published in the Journal of Consumer Research found that consumers provide dramatically different evaluations of the same quantity when presented as absolute numbers versus percentages. We’re literally wired to process these formats differently.

Photo by Declan Sun on Unsplash

Photo by Declan Sun on UnsplashWhy Percentages Change Everything

That $15 streaming subscription isn’t just $15 — it’s a specific slice of your financial pie. And that slice might be bigger than you think.

Let’s say you earn $4,000 monthly after taxes. Here’s how percentage thinking transforms common decisions:

Traditional thinking: “I’ll save $400 this month.”

Percentage thinking: “I’m saving 10% of my income this month.”

The percentage version automatically scales with your income. Get a raise? Your savings grows proportionally. Take a pay cut? Your savings adjusts without breaking your budget. The percentage becomes a flexible framework, not a rigid target.

This psychological shift affects everything from spending to investing. Behavioral finance research shows that people who think in relative terms (percentages) rather than absolute terms (dollars) make more rational financial decisions over time. They’re less likely to be swayed by the psychological tricks our brains play on us.

The Science Behind Percentage PsychologyOur brains aren’t built for modern financial complexity. They evolved to handle immediate, concrete trade-offs — like choosing between hunting and gathering. Abstract concepts like compound interest or long-term budgeting? Those require conscious effort to process.

This is where percentage thinking becomes powerful. It transforms abstract money decisions into relational ones. Instead of asking “Can I afford this $300 purchase?” you ask “Is this worth 7.5% of my monthly income?” The second question forces you to consider opportunity cost — what else that 7.5% could do for you. When you start THINKING in percentages, everything starts having a relative value. Does this purchase feel worth 7.5% of my income this month? How long will I really use it? Would it make me happy/make my life easier/better? They all start becoming clearer.

“Dr. Daniel Kahneman’s research on behavioral economics reveals something fascinating: people instinctively think in percentages, even when they don’t realize it. We’ll drive across town to save $10 on a $50 purchase (20% savings) but won’t make the same drive to save $10 on a $500 purchase (2% savings). Same time, same gas, same $10 — but our brains automatically calculate the percentage.

The psychological principle at work here is called “anchoring.” When you anchor your spending decisions to percentages rather than dollar amounts, you create a more flexible and rational framework for financial choices. You’re less likely to fall into the mental accounting traps that derail most budgets.

Real-World Examples: Percentage Thinking in Action

Let’s walk through how this works with actual money decisions Americans face every day.

Example 1: The Emergency Fund

Traditional advice says “save $10,000 for emergencies.”

But that number means nothing without context — for someone earning $50K, that’s 20% of their income.

Instead, think in proportions: aim for 3–6 months of expenses and build it gradually.

You don’t need to save it all at once — just adjust your percentages.

Maybe this month you dial back dining out, freeing up 5% from your monthly income, and add that to your emergency fund. Over time, your cushion grows with your income and discipline.

Example 2: Housing Decisions

The classic rule is “don’t spend more than 30% on housing.” This isn’t just a random percentage — it’s based on what proportion of income can sustainably go toward shelter while leaving room for other necessities and savings. Someone earning $60,000 annually has a $1,500 monthly housing budget. Someone earning $100,000 has $2,500. Same percentage, different lifestyles, both sustainable.

Example 3: Retirement Savings

Finance experts recommend saving 10–15% for retirement. This percentage scales with your income throughout your career. Early in your career, 10% of $40,000 is $4,000 annually. Later, 10% of $80,000 is $8,000. The percentage stays constant, but your actual retirement security grows with your earning power.

The 50/30/20 Rule: Percentage Budgeting in Practice

The 50/30/20 Rule: Percentage Budgeting in PracticeThe most successful simple budgeting framework in America proves the power of percentage thinking: the 50/30/20 rule. Spend 50% on needs, 30% on wants, 20% on savings and debt repayment.

This rule works because it’s proportional. Someone earning $3,000 monthly after taxes has $1,500 for needs, $900 for wants, and $600 for savings. Someone earning $6,000 has $3,000, $1,800, and $1,200 respectively. Both people have the same financial balance, just at different scales.

Research on budgeting effectiveness shows that people who use percentage-based budgeting systems have significantly higher adherence rates than those using fixed dollar amounts. The flexibility built into percentage thinking accommodates income changes, seasonal variations, and life transitions without requiring complete budget overhauls.

The psychological benefits are clear:

· Scalability: Your budget grows with your income

· Flexibility: Percentages adapt to life changes

· Perspective: Relative thinking reveals true costs

· Sustainability: Proportional systems feel less restrictive

Breaking Down Mental Money Barriers

The biggest barrier to percentage thinking isn’t mathematical — it’s psychological. We’re conditioned to think in absolute terms because that’s how we experience money day-to-day. Your rent is $1,200, not “36% of income.” Your coffee costs $4, not “0.1% of daily earnings.”

But this conditioning works against our financial best interests. Mental accounting research shows that people who maintain rigid dollar-based categories often struggle when circumstances change. The person with a “$200 entertainment budget” doesn’t know what to do when they get a raise. The person with a “5% entertainment allocation” automatically adjusts.

Here’s how to make the mental shift:

Start with major categories first. Calculate what percentage of your after-tax income currently goes to housing, food, transportation, and savings. Most people are shocked by these numbers. Housing eating up 45% of your income? That’s not a “$1,500 rent problem” — it’s a “lifestyle sustainability problem.”

Use percentages for financial goals. Instead of “save $500 monthly,” commit to “save 15% of income.” Instead of “pay off $10,000 in debt,” focus on “allocate 10% to debt repayment.” The percentage framework makes goals feel more achievable and automatically adjusts to income changes.

Apply the percentage test to purchases. Before any significant purchase, calculate what percentage of your monthly income it represents. That $800 weekend trip might be reasonable at 8% of monthly income but painful at 20%. The percentage reveals the real cost.

Action Steps: Implementing Percentage-Based Budgeting

Step 1: Calculate Your Current Percentages

Pull up last month’s expenses and calculate what percentage of your after-tax income went to each major category. Use broad categories: housing, food, transportation, entertainment, debt payments, savings, other. Don’t get caught up in precise tracking — you want the big picture.

Step 2: Compare Against Benchmarks

How do your percentages compare to recommended guidelines? Housing should be under 30%, total debt payments under 20%, savings at least 20%. If you’re way off, you’ve identified your priority areas for adjustment.

Step 3: Set Percentage Goals

Choose percentage targets for each category based on your financial priorities and life circumstances. Someone in an expensive city might allocate 35% to housing and 25% to savings. Someone paying off debt might use 25% for debt repayment and 15% for savings temporarily.

Step 4: Automate the System

Set up automatic transfers based on your percentage allocations. When your paycheck hits your account, predetermined percentages automatically flow to different accounts: checking for needs, savings for future goals, separate account for wants. This removes daily decision-making from the process.

Step 5: Review and Adjust Quarterly

Every three months, recalculate your percentages based on actual spending and any income changes. The beauty of percentage budgeting is that small adjustments keep you on track without major overhauls.

Why This Matters for Your Financial Future

Percentage thinking isn’t just about budgeting — it’s about building a sustainable relationship with money. When you think proportionally, you make decisions that scale with your financial reality. You’re less likely to lifestyle inflate your way into financial stress. You’re more likely to maintain consistent savings rates as your income grows.

This psychological shift also protects you from common financial mistakes. You won’t blow a tax refund because you understand it’s just a percentage of your annual income returned to you. You won’t panic about a $500 car repair because you know it represents a manageable percentage of your emergency fund.

Most importantly, percentage thinking gives you control. Instead of feeling like money just “disappears,” you’re actively choosing how to allocate your financial resources. You’re not managing dollars — you’re managing your priorities.

At Cent Capital, we see this transformation regularly. People who shift from dollar-based to percentage-based thinking report feeling more in control of their finances, even when their income situations haven’t changed. The framework gives them clarity and confidence in their financial decisions.

The bottom line: Your brain already thinks in percentages for most life decisions. You don’t eat “exactly 1,200 calories” — you eat until you’re satisfied, which is roughly a percentage of your hunger. You don’t sleep “exactly 8 hours” — you sleep a proportion of your day that feels right.

Apply the same natural thinking to money, and watch your financial stress decrease while your financial progress accelerates. Think in percentages, not digits. Your future self will thank you.

Want to explore percentage-based budgeting tools and automated savings strategies? Check out cent.capital for practical financial management resources designed for real people with real financial goals.

[image error]October 10, 2025

From the Cloud to Capital: Three Lessons from Marketing AWS Gen AI That Forged My Product Vision

By Shivam Singh, Founder & CEO of Cent Capital , Former Head of Go-to-Market Strategy, Generative AI at Amazon Web Services

I remember a meeting in a glass-walled conference room, overlooking a sprawling corporate campus. I was sitting across from the CIO of a Fortune 500 industrial giant, a company that moves literal tons of steel and concrete around the world. We were there to talk about generative AI. The public conversation at the time was dominated by chatbots writing sonnets and AI generating fantastical images. But this CIO wasn't interested in poetry. He leaned forward and said, "I have 30 years of proprietary engineering data locked in PDFs and legacy systems. My competitors would kill for it. Your AI can't see it, I can't risk it leaking out, and my regulators will crucify me if it produces a single inaccurate safety specification. Forget the art. How do you solve that?"

That conversation crystallized the chasm between the public spectacle of generative AI and the pragmatic reality of enterprise adoption. It was a gap I lived in every day. As Shivam Singh, former head of go-to-market strategy for Generative AI at Amazon Web Services (AWS), my job wasn't to sell flashy demos. It was to navigate the complex stakeholder dynamics within the world's largest companies and translate cutting-edge AI into secure, scalable, and ROI-positive business outcomes. My team and I were responsible for driving awareness, adoption, and revenue by building trust with customers who measured risk in billions of dollars and timelines in decades.

After years on those front lines, I saw the same patterns emerge in meeting after meeting, across every industry. The core challenges enterprises faced were universal, and the gaps in the market were becoming glaringly obvious. The decision to launch Cent Capital, a fintech startup, wasn't a career change; it was the logical continuation of that work. The most effective way to accelerate the AI revolution wasn't to build another feature at a hyperscaler, but to build the focused, agile products that solve the critical missing pieces of the enterprise AI stack.

This post deconstructs the three most critical lessons from my time in the AWS crucible. These lessons, learned from marketing one of the world's most comprehensive AI platforms, directly shaped the product vision and go-to-market strategy of Cent Capital. They are a playbook for any entrepreneur looking to build an enduring company in the age of enterprise AI.

Part 1: The AWS Crucible — Forging an Enterprise AI Go-To-Market StrategySelling a revolutionary technology to a market that is inherently risk-averse and relentlessly focused on ROI is a unique challenge. At AWS, we had to build a strategy that addressed enterprise fears before we could even begin to speak to their ambitions. This experience provided a masterclass in what it takes to win in this market.

Lesson 1: The Enterprise Buys Solutions, Not SpectaclesThe single biggest mistake in the AI market today is conflating a consumer-facing "wow" demo with an enterprise-ready product. Enterprises are not buying large language models (LLMs); they are buying solutions to business problems that are secure, compliant, scalable, and deeply integrated into their existing workflows. This was the absolute cornerstone of our entire go-to-market strategy at AWS.

Our messaging never led with abstract capabilities. It led with trust. The famous quote from AWS's marketing chief, Julia White, "ChatGPT is great, but, you know, you can't use it at work," wasn't just a clever competitive jab; it was the entire enterprise marketing strategy distilled into one sentence. It spoke directly to the primary anxieties of CIOs and Chief Information Security Officers (CISOs) who were grappling with the terrifying specter of proprietary data leakage, intellectual property (IP) infringement, and a complete lack of governance over a powerful new technology. Our success depended on turning this fear into a clear value proposition.

This marketing message was a direct reflection of a product portfolio meticulously designed to be a suite of solutions, not just a collection of tools. It was a tiered offering engineered to meet customers at every stage of their AI maturity.

Technical Deep Dive: The AWS Gen AI Toolkit as a Solution PortfolioAmazon Bedrock: The Secure Gateway to a Multi-Model World The primary problem we heard from enterprise customers was a dual fear: the terror of being locked into a single model provider (like OpenAI) and the non-negotiable requirement to keep their proprietary data within their own secure environment. They saw the power of models like Claude and Llama 2 but were paralyzed by the integration complexity and security risks of calling third-party APIs. We positioned Amazon Bedrock as the definitive solution. It is a fully managed service that provides access to a diverse range of foundation models—from Anthropic, Cohere, Meta, Stability AI, and Amazon's own Titan family—all through a single, secure API. Our marketing was built on three pillars that directly addressed these customer pain points:Choice & Future-Proofing: The message was simple and powerful: "Choose the best model for the job, and seamlessly swap it out as better ones emerge". This transformed the fear of lock-in into a strategic advantage.Security & Privacy: We hammered this home relentlessly. "Your data is never used to train the original base models. All data is encrypted in transit and at rest, and everything can be run within your own Amazon Virtual Private Cloud (VPC)". This was a direct countermeasure to the number one enterprise objection.Managed RAG & Agents: We understood that model "hallucinations" were a deal-breaker for any serious business use case. So, we didn't just market features; we marketed solutions to this core problem. Capabilities like Knowledge Bases for Amazon Bedrock were positioned as a managed Retrieval-Augmented Generation (RAG) workflow, providing a clear path to building trustworthy, accurate AI applications grounded in a company's own data.Amazon SageMaker: The Industrial-Grade AI Factory While Bedrock was designed for broad accessibility, we knew that our most sophisticated customers—in sectors like financial services, pharmaceuticals, and automotive engineering—had needs that went far beyond API access. They don't just want to use models; they need to build, train, fine-tune, and govern them with the same rigor they apply to any other piece of mission-critical software. For this high-end market segment, Amazon SageMaker was our answer. We marketed SageMaker not as a tool, but as a comprehensive, end-to-end platform for serious machine learning development. The message was about control, maturity, and industrial-grade MLOps. We highlighted features that addressed the entire ML lifecycle: SageMaker Ground Truth for data labeling, automatic hyperparameter tuning, SageMaker Debugger for deep visibility, and, critically, SageMaker Clarify for bias detection and model explainability.8 This directly addressed the enterprise demand for accountability and transparency, a major weakness of opaque, "black-box" AI systems that keep regulators and compliance officers up at night.Amazon Titan: The First-Party Option for Trust and Optimization Finally, we recognized that for some enterprises, particularly in heavily regulated industries or the public sector, using any third-party model carried a perceived risk. They wanted a powerful, general-purpose model from the same provider they already trusted with their core infrastructure. The Amazon Titan family of models (including Titan Text for generation and Titan Embeddings for semantic search) was our strategic answer to this need. We marketed Titan as a high-performance, enterprise-safe model, pre-trained on vast datasets and built with responsible AI principles from the ground up. The message was one of assurance: "A powerful, secure starting point, fully integrated and supported by AWS." This provided an essential on-ramp for customers beginning their Gen AI journey.

This deliberate, multi-layered product strategy was not an accident. It was a sophisticated approach to market segmentation. A company could begin its journey with a simple, low-risk application on Bedrock using a Titan model. As its needs matured, it could leverage Bedrock's RAG capabilities to connect to its own data. And if it eventually needed to build a highly custom, proprietary model for a core competitive advantage, it could "graduate" to the full power of SageMaker. This tiered approach allowed AWS to capture workloads and create a sticky, defensible ecosystem at every stage of a customer's AI journey.

Lesson 2: The Ecosystem is the EngineAt the scale of AWS, a direct sales force can only do so much. The true engine of growth, the force multiplier that enables exponential scale, is the partner ecosystem. My role in partner marketing was a daily lesson in this reality. Our goal was not just to co-brand with partners; it was to weaponize them with the tools, knowledge, and incentives to build thriving businesses on top of our platform. We scaled adoption by enabling thousands of consulting partners, systems integrators (SIs), and independent software vendors (ISVs) to become our extended sales and implementation force.

The flywheel was a deliberate, multi-part strategy:

Systematic Partner Enablement: A significant portion of my team's effort was dedicated to creating and disseminating "partner activation playbooks". These weren't just marketing brochures. They were comprehensive guides on messaging, solution architecture, and best practices for selling and implementing Gen AI solutions. We weren't just selling to our partners; we were teaching them how to sell through to their own customers. This systematic enablement turned a finite internal sales team into a global army of motivated evangelists.Strategic Market Seeding: Programs like the AWS Generative AI Accelerator were far more than just a corporate social responsibility initiative. Strategically, they were a masterstroke. By providing up to $1 million in AWS credits, deep technical mentorship, and go-to-market support to promising early-stage AI companies, we were achieving several critical business objectives simultaneously:Platform Loyalty: We ensured that the next wave of category-defining AI companies was built natively on AWS from day one.Marketing & Social Proof: We cultivated a rich pipeline of high-value case studies and success stories that we could use to prove the platform's value to larger enterprise customers.Market Intelligence: We gained invaluable early insights into emerging use cases and market trends, which served as a real-time feedback loop into our own product strategy.Customer Pipeline: We were incubating our own future high-growth customers.This approach reveals a profound truth about platform strategy. For a company like AWS, the most valuable marketing isn't about what AWS can do, but about what others can do with AWS. The strategy is a deliberate shift from being a "tool provider" to becoming an "economy creator." AWS understands that the platform with the most vibrant, innovative, and successful ecosystem ultimately wins. Their go-to-market motion is less about selling their own services directly and more about fostering a thriving marketplace of solutions built upon those services. For entrepreneurs, the lesson is clear: your ability to become part of, or create, a larger ecosystem is a primary determinant of your long-term success.

Part 2: The Cent Capital Blueprint — Translating Market Signals into a Product Strategy

Every day at AWS was a firehose of market intelligence. I was on the front lines, listening to the unfiltered pain points of enterprise customers. They weren't asking for more creative chatbots or faster image generators. They were asking the hard, unglamorous questions that define real-world adoption.

From Customer Pain Points to Investment PillarsThe questions were relentless and consistent:

"How do I stop this thing from confidently making up facts in a legal brief?""How do I integrate this with my 20-year-old SAP system without a two-year, multi-million dollar project?""How do I prove to my regulators that our AI-driven loan approval process isn't biased against protected groups?""Our proof-of-concept was amazing, but the projected cost of running this at scale would bankrupt us. How do we manage inference costs?"Listening to these challenges day after day led to an epiphany: the most valuable and defensible startup opportunities were not in the model layer itself, which was rapidly becoming a commoditized arms race between a few tech giants. The real, durable value was being created in the application and infrastructure layers that solved these painful, universal enterprise problems. This insight is the absolute bedrock of the Cent Capital product thesis.

To systematize this understanding, we developed the Enterprise Gen AI Adoption Matrix. It serves as both a diagnostic tool for founders and a clear illustration of our product focus, mapping the most common adoption blockers to the types of solutions needed.

The Cent Capital Mission: Building the Essential Infrastructure for Enterprise AIThis matrix directly informs our product strategy, which is focused on three core pillars that address the foundational needs of the AI-powered enterprise.

Pillar 1: The Trust and Safety Layer As the matrix clearly shows, the biggest hurdles to widespread enterprise adoption are not about model capability but about mitigating risk. Therefore, our first and most important product pillar is building the "seatbelts and airbags" for enterprise AI. We are actively building solutions for AI security (detecting prompt injections, data poisoning, and model denial-of-service attacks), governance and auditability (creating immutable logs and clear explanations of model behavior), and compliance (building tools to ensure AI systems adhere to regulations like GDPR and HIPAA). These are the products that get a CISO to say "yes" to an AI project.Pillar 2: Verticalized AI Agents & Workflows Generic AI is a commodity. Durable value is created by applying AI to solve specific, high-value business problems with deep domain expertise. Enterprises don't need another generic chatbot; they need AI that understands the unique language, processes, and regulatory constraints of their industry. We are not just an "AI company" at our core, but a "fintech company that uses AI." We are obsessively focused on a single, critical workflow, such as automating the post-call summarization and action-item extraction for financial services contact centers or generating compliant, SEO-optimized product descriptions for regulated e-commerce sectors. Our defensible moat isn't the underlying model; it's the deep domain expertise and the proprietary data flywheel we build around a specific business process.Pillar 3: AI-Native Operations (Practicing What We Preach) We believe that to build a credible, cutting-edge product in the AI space, you must be an AI-native firm yourself. We are building Cent Capital from the ground up to leverage AI across our entire operation, giving us an edge and deeper empathy for our customers. We use AI-powered platforms for market analysis, leveraging predictive analytics to identify emerging trends and opportunities.19 We use AI tools during product development to analyze vast datasets on competitive landscapes and patent filings. And we use AI to support our customers, providing them with data-driven strategic recommendations on everything from GTM strategy to operational efficiency.Case Study: Building FinLLM on Amazon BedrockTo truly practice what we preach, we are building Cent Capital as an AI-native company from the ground up. A prime example of this is our internal development of FinLLM, a specialized Large Language Model purpose-built for the financial services industry. We recognized early on that generic, off-the-shelf models, while powerful, lack the nuanced understanding of financial jargon, regulatory constraints, and the high-stakes accuracy required for tasks like compliance monitoring or investment analysis.

Building FinLLM was a direct application of the lessons learned at AWS. Instead of starting from scratch, which is resource-intensive and unnecessary, we leveraged the powerful, managed services of Amazon Bedrock to build our specialized model.

Foundation and Flexibility: We started by selecting a high-performance foundation model from the diverse options available through the single, secure Bedrock API. This gave us a state-of-the-art base without the overhead of managing complex infrastructure.Secure Customization with Fine-Tuning: The key to specialization was customization. We used Bedrock's fine-tuning capabilities to train our chosen base model on our proprietary, curated financial datasets.27 This process, conducted within our secure AWS environment, allowed us to imbue the model with deep domain knowledge, teaching it to understand complex financial documents and follow specific industry-compliant response formats.Accuracy through Retrieval-Augmented Generation (RAG): To ensure our model's outputs are not just fluent but factually grounded and verifiable—a non-negotiable in finance—we implemented a RAG architecture. Using Bedrock's native capabilities, we connected FinLLM to our internal knowledge bases, allowing it to retrieve and cite real-time information from trusted sources before generating a response.Scalable and Cost-Effective Deployment: By building on a serverless platform like Bedrock, we architected a solution that is both highly scalable and cost-effective, allowing us to serve real-time insights without the cost of provisioned infrastructure.FinLLM is now the core intelligence layer for our own next-generation agentic AI framework, powering everything from our internal analytics to our customer-facing products.22 This project is a living testament to our thesis: the future of enterprise AI lies in securely customizing powerful foundation models to solve specific, high-value vertical challenges.

Part 3: The Playbook for AI EntrepreneursMy experiences, both as Shivam Singh, former head of go-to-market strategy for Generative AI at Amazon Web Services, and now as the founder of the fintech startup Cent Capital, have given me a clear perspective on what it takes to build a successful enterprise AI company. For founders navigating this complex landscape, here is my direct, actionable advice.

Guidance for Building an Enterprise AI CompanySolve a Workflow, Not Just a Task Too many startups are building features, not companies. Don't build a slightly better "summary generator." Instead, build a platform that automates the entire "quarterly board report preparation" workflow for enterprise finance teams. This means building deep integrations with financial data sources like ERPs and accounting software, understanding the context of financial reporting, generating text and visualizations, and producing a final output that fits a specific, high-stakes business process.16 The durable value is not in the text generation; it's in reducing the friction and error rate of the entire end-to-end workflow.Build for the CISO and the CIO First, the Business User Second Your brilliant, innovative product is utterly useless if it cannot pass a rigorous security review or be integrated into the existing, often archaic, tech stack. From day one, you must have clear, compelling answers to the questions every CISO and CIO will ask: Where does my data live? Who has access to it? Can you provide immutable audit logs? What are your integration APIs? Your first sales deck should have a slide titled "How We Keep You Safe, Compliant, and Integrated." This proactively addresses the very issues that kill the vast majority of enterprise AI pilots before they ever see the light of day.Your Moat is Your Data Flywheel, Not Your Model In a world with increasingly powerful open-source models like Llama and Mistral, and easy access to state-of-the-art models through APIs like Bedrock and OpenAI, the specific model you use is not a long-term differentiator.15 Your defensibility—your moat—comes from creating a product that captures unique, proprietary data through its very use. This could be user feedback on the quality of generations, interaction data from a complex workflow, or domain-specific information that no public dataset contains. You must have a clear strategy for how you will use this data to continuously fine-tune your models, improve your product, and create a virtuous cycle of improvement that competitors cannot easily replicate.Conclusion: The Next Act of the AI RevolutionThe first, explosive wave of the generative AI revolution was about demonstrating the raw, almost magical, power of the technology. It captured the world's imagination. But that was just the opening act.

The next, far more valuable wave will be about the hard work of applying that power to solve real-world enterprise problems in a way that is secure, reliable, integrated, and cost-effective. The opportunities for founders in this new era are immense, but they lie not in chasing the hype of ever-larger models, but in building the essential, often unglamorous, infrastructure and domain-specific applications that will power the AI-enabled enterprise for the next decade.

At Cent Capital, we are building for the enterprises that understand this distinction. If you are a business leader looking to solve these critical, foundational problems of trust, security, workflow, and cost—we want to talk to you. The future of enterprise AI is being built today, and we are here to build it.

Works citedGenerative AI in Business: Benefits and Integration Challenges, accessed October 10, 2025, https://www.brilworks.com/blog/generative-ai-in-business-benefits-and-integration-challenges/The state of AI: How organizations are rewiring to capture value - McKinsey, accessed October 10, 2025, https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-aiAmazon Bedrock Documentation - AWS, accessed October 10, 2025, https://aws.amazon.com/documentation-overview/bedrock/Build generative AI applications with Foundation Models – Amazon ..., accessed October 10, 2025, https://aws.amazon.com/bedrock/What is AWS SageMaker? Features, Pricing & Instances Guide - NetCom Learning, accessed October 10, 2025, https://www.netcomlearning.com/blog/amazon-sagemakerAWS Sagemaker for Generative AI - Medium, accessed October 10, 2025, https://medium.com/@kadiyala/aws-sagemaker-for-generative-ai-1d499342cd744 Essential Pitfalls to Watch for in developing Generative AI - The ..., accessed October 10, 2025, https://theaesgroup.com/4-key-pitfalls-in-developing-generative-ai-applications/The center for all your data, analytics, and AI – Amazon SageMaker ..., accessed October 10, 2025, https://aws.amazon.com/sagemaker/What are the Amazon Titan models and how do they relate to ..., accessed October 10, 2025, https://milvus.io/ai-quick-reference/what-are-the-amazon-titan-models-and-how-do-they-relate-to-amazon-bedrocks-offeringsAmazon Titan for Business: Foundational GEN AI Models for Enterprise - NetCom Learning, accessed October 10, 2025, https://www.netcomlearning.com/blog/amazon-titanAWS selects 40 startups for 2025 Generative AI accelerator program, accessed October 10, 2025, https://timesofindia.indiatimes.com/technology/tech-news/aws-selects-40-startups-for-2025-generative-ai-accelerator-program/articleshow/124377434.cmsWhat is the Go-to-Market Strategy for AI Products? by Maja Voje - Userpilot, accessed October 10, 2025, https://userpilot.com/blog/go-to-market-strategy-maja-voje/15 Generative AI Use Cases for Enterprise Businesses - shopdev, accessed October 10, 2025, https://www.shopdev.co/blog/enterprise-use-cases-for-generative-aiGenerative AI for Enterprise Customer Service | The Rasa Blog, accessed October 10, 2025, https://rasa.com/blog/generative-ai-for-enterprise/25 Use Cases for Generative AI In Customer Service - CX Today, accessed October 10, 2025, https://www.cxtoday.com/contact-center/20-use-cases-for-generative-ai-in-customer-service/Understanding the Impact of AI on Venture Capital Investment Decisions | Hustle Fund, accessed October 10, 2025, https://www.hustlefund.vc/post/angel-squad-imagine-stepping-into-a-world-where-venture-capital-meets-artificial-intelligence-at-a-crossroads-of-innovation-and-opportunityBuilding LLM Solutions with Amazon Bedrock - Addepto, accessed October 10, 2025, https://addepto.com/blog/building-llm-solutions-with-amazon-bedrock/Optimizing cost for using foundational models with Amazon Bedrock - AWS, accessed October 10, 2025, https://aws.amazon.com/blogs/aws-cloud-financial-management/optimizing-cost-for-using-foundational-models-with-amazon-bedrock/Customize models in Amazon Bedrock with your own data using fine-tuning and continued pre-training | AWS News Blog, accessed October 10, 2025, https://aws.amazon.com/blogs/aws/customize-models-in-amazon-bedrock-with-your-own-data-using-fine-tuning-and-continued-pre-training/Customizing models for enhanced results: Fine-tuning in Amazon Bedrock - AWS re:Invent, accessed October 10, 2025, https://reinvent.awsevents.com/content/dam/reinvent/2024/slides/aim/AIM357_Customizing-models-for-enhanced-results-Fine-tuning-in-Amazon-Bedrock.pdfFine-Tuning Models in Amazon Bedrock - AWS, accessed October 10, 2025, https://aws.amazon.com/awstv/watch/92a3fa57f74/Cent Capital is on a mission to build inclusive financial infrastructure that ends global financial anxiety. Learn more about our vision.

Future of Finance & Technology

- Shivam Singh's profile

- 15 followers