J.D. Roth's Blog

March 30, 2016

Where to save your emergency fund

Life is full of little bumps … like how our furnace went out at the onset of last season’s most severe cold snap. It’s bad enough that an emergency like that seems to happen at the most inopportune time, but what’s worse is the $6,000 bill that accompanies it. Where do you get $6,000 quickly when you need it?

If you’ve set money aside for a rainy day, you’ll be less likely to go into debt — or to tap your retirement funds — when the bill comes. But recently, I heard Suze Orman advocate using your Roth Individual Retirement Arrangement (Roth IRA) as your emergency fund in a public television fundraiser broadcast.

Like many here at Get Rich Slowly, she is a big fan of emergency funds. However, the concept of using your Roth IRA as the primary vehicle for your emergency fund is something we have never addressed.

The purpose of an emergency fund

The purpose of an emergency fund We might all agree that the purpose of a well-funded emergency fund is to help you meet unexpected events without going into debt, but the question of how much to save is a topic of endless discussion … and virtually no agreement. Some say three months’ worth of expenses; Ms. Orman recommends 12. Whichever amount you feel is sufficient, it usually is not trivial.

And neither is the amount you want to set aside for your retirement. It’s easy to see where the temptation may arise to combine the two, as Ms. Orman (and others) recommend. But should you?

Should you use a Roth IRA as an emergency fund?There are a number of reasons why using your Roth IRA as a vehicle for your emergency fund is a bad idea:

1. Penalties. Think twice if you read a blog that glibly states that you don’t incur a penalty when you withdraw from your Roth IRA for an emergency. That’s wrong.

It may sound true in theory that the actual contributions you withdraw are not penalized. However, you’re rarely able to pull that off in practice.

Example: Let’s say you’ve contributed $40,000 to your Roth over the years, and it’s earned another $10,000, bringing the total in your IRA to $50,000. Now, let’s say your furnace went out and you want to withdraw $6,000. You say, “Hey, I’ve put in way more than that, so the $6,000 I’m taking out is only from my contributions — I don’t need to touch any of the earnings.”Not so fast.

The IRS and tax people call the money you put in (your contributions) “basis.” In other words, you say that you’re only withdrawing basis for your emergency — but the IRS doesn’t see it that way. When you take out the $6,000, they look at your IRA at the time and say 20 percent of the total ($10,000) is earnings and 80 percent (the original $40,000) is basis. Whenever you make a withdrawal, they deem 80 percent of the withdrawal to be basis and the other 20 percent as earnings.

You don’t get to determine what is basis and what is earnings; they do. And they will penalize you on the portion of your withdrawal they consider to be earnings. So while, in theory, it may be true that you won’t be penalized on your basis which you withdraw, it rarely works out that way in practice.

The topic of penalties on early withdrawals is complex and you will definitely need to see a tax professional to know if using your Roth IRA as an emergency fund makes sense. As a rough guess, though, that won’t be true in more than about 10 percent of all cases. For the final word on the rules and intricacies of Roth IRA withdrawals, please consult the definitive IRS source.

Don’t just accept it when bloggers make glib statements like “tax-free in /tax-free out.”

2. The time guillotine. You can only contribute $5,500 a year to all your IRAs combined (Roth and traditional). It’s $6,500 if you are 50 years of age or older. Once every year’s deadline passes, the guillotine comes down on that year’s contribution and you can never make it up afterward. As we pointed out in The extraordinary power of compound interest, the key to success when investing for your retirement is to start early, and so it is vital to contribute as much as you can as early as you can to get those contributions on the other side of the guillotine — and to keep it there so your money can keep compounding.

When you make a withdrawal from your Roth IRA to fund an emergency, you have only 60 days to replenish it. After that, the guillotine comes down on that amount and you cannot put it back. If you are able to replenish your Roth IRA withdrawal in less than 60 days, of course, this is not an issue. But if you can, why not simply use the replenishment for the emergency in the first place?

3. Economic cycle. Everyone knows that while most Roth IRA investments grow in the long run (like index funds do), they always fall victim to the downdrafts which the economy experiences every seven to 10 years. What if you needed access to your emergency fund at a time when your Roth IRA investments were at a low? You’d be forced to sell your investments at a loss.

Some advocates of using your Roth IRA as an emergency fund counter that you should keep that part of your IRA in a money market fund to guard against a loss like that. But why? The return on those accounts is minuscule and you would be hard-pressed to discern a difference between tax-advantaged and not. You might as well keep that money in a regular account without any attempt to gain a tax advantage. Remember, you can only contribute $5,500 a year to your IRA. Why use part of that for something with no return? Far better to utilize that entire amount for investments which grow over the long term.

4. Psychology. One of the keys to success in investing for retirement is to forget about it. Put the money in before you consider spending it, in other words. Withdrawing money from your retirement fund is a slippery slope: Once you start, it becomes very hard to stop.

5. Liquidity. When an emergency strikes, you need to get access to your money fast. Few Roth IRA accounts will return your money within 24 hours — which isn’t helpful in an emergency, to say the least.

It seems like it would be a better idea to find another vehicle for your emergency fund.

Where to save your emergency fundThe first attribute of a good emergency fund is liquidity — as in, you need to get at these funds within a few hours. The second attribute is safety, meaning it can’t be tied up in an asset that could fluctuate in the short run, causing it to be under water when you need to make that quick withdrawal. There are a few alternatives which pass the liquidity and safety tests:

1. Your mattress. It may not be politically correct to say this these days, but few options beat your mattress for liquidity. Another reason to keep at least a couple of hundred dollars in cash somewhere in your home? When a disaster strikes and power goes out, you may find that the stores and other places you could ordinarily process debit or credit cards — and/or your friendly ATM — may be out of power (or out of cash).

2. Savings account. In my opinion, the lowly savings account is by far the best place to store most of your emergency fund. The deposits held in an ordinary online savings account are protected against bank failure by the FDIC, and you can get quick access to your money whenever you need it. Most online savings accounts allow you to transfer the money to the account backing your debit or credit card, so you can usually pay for what you need within minutes.

3. Certificates of Deposit (CDs). A CD usually pays more than a savings account. Granted, you still need a microscope these days to tell if you earned any interest — but every little bit helps, as my wife likes to point out. For higher liquidity, no-penalty CDs are available, or you can ladder your conventional CDs to greatly increase liquidity. And, of course, CDs are protected by the FDIC too.

4. Prepaid credit or debit card. This is handy, especially for travel emergencies. If your first stop after an emergency is a hospital, you don’t have time to access savings accounts and things like that. Having a prepaid card handy will often take care of your immediate needs, giving you time to mobilize your second and third lines of defense.

Your best emergency fund strategyThe downside of the four suggestions above is they pay no interest, or close to nothing. When you look at the gamut of emergencies against which the fund is meant to protect, you find that, as the amounts increase, the probability you’ll need that entire amount decreases. For instance, if you lose your job, you’re not going to need all 12 months of your emergency fund right away.

The longer you tie your money up, the more you get in terms of interest. That being the case, you might want to consider various layers of funds for your emergency fund money:

A few hundred dollars in cash for really quick access in case of a power emergency A few hundred dollars on a prepaid card A bigger chunk in an online savings account or no-penalty certificate of deposit. A chunk in conventional CDs, laddered for staggered maturities.Which proportions should go into each account will depend on your situation and the emergencies for which you are preparing. In addition, take into account that interest rates are expected to rise in the coming years.

Keep in mind that your Roth IRA will always remain in the background as a final if-it-comes-to-that source of money for seriously big emergencies. However, as regards using your Roth IRA to house the bulk of your emergency funds, the downsides seem to outweigh any pluses.

Any consideration of the use of a tax-advantaged vehicle like a Roth IRA is likely to be more complex than you might think, especially because Congress keeps changing the rules. What you read two years ago is probably out of date in some respect. But regardless, if you must consider using your Roth IRA as an emergency fund, it’s best to consult a tax professional.

The far better route is to use simple, easy-to-use and easy-to-understand financial products like an online savings account, a CD, or both.

What are your thoughts? Do you use your Roth IRA as an emergency fund? How do you accommodate for the potential that you might have to sell at a loss? Is it ever a good idea to think of your Roth IRA as your emergency fund?

March 23, 2016

Plan a better vacation with a credit card offer

The Starwood Preferred Guest® Credit Card from American Express has a limited-time offer (available until March 30, 2016) that could help you plan a bigger, better summer vacation if you act quickly. This card was recently given a 2016 CardRating’s Editor’s Choice award as one of the best travel credit cards available. (CardRatings.com is one of our partner sites.)

Turn regular purchases into vacation perksNew cardholders that make $3,000 in purchases within the first 3 months of account opening receive 35,000 bonus Starpoints®. The advantage here is the prospect of redeeming points for travel benefits – like free stays with no blackout dates at over 1,200 Starwood Hotels. For example, you can get eight free nights at a Category 2 Hotel like the Sheraton Pretoria Hotel in Australia from this bonus offer alone. Note: See also How to Choose a Credit Card for tips on finding the right credit card for you. Our partner site CardRatings.com also has articles to help you find the right card be it a cash back credit card or balance transfer credit card. Their Credit Card Comparison Table also allows you to easily search dozens of current credit card offers.

In fact, this is the biggest point promotion they’ve ever made. But the Starwood Preferred Guest® Credit Card from American Express has been popular among seasoned travelers because “Starwood’s Starpoints® are a higher value than the one-cent-per-point industry average” according to CardRatings’ review of the card. In addition, there are no foreign transaction fees on international purchases. You’ll need to hurry to get this card, though. Here are the particulars:

Starwood Preferred Guest® Credit Card Offer Get 35,000 bonus points when you make $3,000 in purchases in the first three months. Offer ends 3/30/2016. Earn up to 5 points for every dollar you spend at Starwood Hotels Earn 1 point on all other purchases 0% introductory annual fee for the first year, then it’s $95 No foreign transaction fee on international purchases Other perks include unlimited complimentary Boingo WiFi when you enroll, free in-room premium Internet access, and access to discounts and presale tickets for live events Other travel rewards cardsIf you’re not tied to the Starwood Hotel properties, you might consider the Chase Sapphire Preferred® Card to stretch your vacation budget. Its introductory offer features 50,000 points when you spend $4,000 in the first three months after you open the account. That’s equal to $625 toward airfare or hotels when you redeem through Chase Ultimate Rewards ®.

With the BankAmericard Travel Rewards® Credit Card, you can get 20,000 points after spending only $1,000 within the first 90 days of account opening – and there is no annual fee ever. Plus, they have a special 0% introductory rate on purchases for 12 billing cycles.

Why these promotions?Promotions like these reflect a higher level of competition amongst credit card companies. When American Express and Costco decided to part ways, for example, it must have stung. But it also seems to have renewed their interest in competing for your business. Of course, these offers only make sense if you can pay off what you charge every month, so take advantage of the opportunity if it fits your financial goals and ability. We just wanted you to know.

March 21, 2016

Is an annuity a good investment?

If you have ever met with a financial adviser about investments, chances are he or she may have proposed annuities as a good way for you to go. However, when you scan the blogosphere for posts about investing, you hardly ever read about annuities. You read about index funds, mutual funds, stocks and real estate and now and then about bonds … but hardly ever anything about annuities.

Should you consider annuities?

What is an annuity?With an annuity you turn a lump sum investment (usually $5,000 or more) into a steady stream of cash flow back to you. What sets most annuities apart from the more traditional investments is most of them will pay you that cash as long as you live.

That is an important distinction. When you invest in an index fund and you retire, you have a finite amount of money to draw from. You have to decide how much to draw every month or quarter to live from. If you draw too fast, you will run out of money; if you draw too little, you will have money left over at the end. None of us know how long we will live and, therefore, we can never know exactly how much to draw.

An annuity typically solves that problem — the annuity provider assumes the risk. If you live long, they will lose money on your transaction and, if you pass away early, they will gain. They use actuarial tables to guide them in that risk. It should come as no surprise, then, that most annuity issuers are life insurance companies.

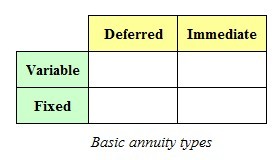

Types of annuitiesThere are two types of annuities, and within each there are two more subdivisions. You can picture it in the following matrix:

Deferred annuities begin paying you after some period to which you and the provider both agree. For instance, if you receive a $20,000 inheritance when you are 25, you can specify that the annuity be deferred for 30 years. You agree to begin receiving payments when you are 55 years old.

Immediate annuities begin paying you right away. Taking the same example, an immediate annuity will begin paying you a monthly sum right away from the $20,000 with which you buy it. (Naturally, it follows that the longer you defer the annuity, the higher those payments will be.)

Fixed annuities will pay you a fixed amount every month, quarter or year (depending on which period you select). The amount will never go up or down, even if the economy, stock market, real estate market or interest rates go to that hot place in a hand basket.

Variable annuities will pay you an amount which will depend on the economy, the stock market, the bond market and the real estate market. If those variables do well, a variable annuity will pay you more than the fixed annuity of same initial value and term would pay. However, if those things do take the trip to the hot place, your cash flow will suffer.

Benefits of annuities1. Risk transfer. Probably the biggest benefit from annuities is that the risk of running out of money is transferred from yourself to the insurer. You may get less of a return than when you invest for yourself, but at least you know you will get it until you die.

2. Risk reduction. Some annuities offer you a guaranteed minimum return. If the markets tank, you are protected. The flip side of that equation, of course, is that your upside is limited. People who are extremely risk-averse usually are prepared to take lower yields in return for the peace of mind when headlines are screaming about the next financial collapse.

3. Taxation. Most annuities accrue their earnings or interest “behind the tax curtain,” i.e., without incurring any income taxes. When you withdraw such annuities, however, you will pay ordinary income taxes on the increase, and you forfeit any capital gains taxation from which you may have benefited.

4. No limits. Unlike retirement funds — like a Roth IRA or 401(k) fund — there is no limit to how much you can invest in annuities. This benefits people who either make lots of money or who want to catch up on their retirement investing. If you make good money and you hit your contribution limits for your 401(k) and IRA funds, an annuity allows you to keep investing for the future while locking in the benefit on the gains on those investments.

5. Protection from creditors. If you have a reasonable net worth and make your living in a profession with a high risk of lawsuits, such as a medical doctor, it is nice to know that your annuities are protected in several states from any claims. Therefore, buying annuities can be a good strategy to protect your assets to ensure that your retirement funds remain safe for your old age.

Drawbacks of annuities1. Low yield. Because most annuities include an insurance risk, the actual returns earned on such an investment will be smaller than you can earn if you invested for yourself in things like index funds, property, etc.

2. Illiquidity. Deposits into annuity contracts are typically locked up for a period of time, known as the surrender period. These surrender periods can last anywhere from two to more than 10 years, depending on the particular product. Surrender fees are typically steep, starting out at 10 percent or more, although the penalty typically declines annually over the surrender period.

3. Fees. The high fees of managed mutual funds has driven the growth of index funds; but fees for annuities are even higher, making it one of the most criticized aspects of annuities. The annuities typically pushed by brokers and investment advisers carry commissions around 10 percent. If you invest, say $50,000, $5,000 will be taken right off the top and given to the person who sold the contract. That leaves only $45,000 of your money to earn a return. In addition, many states have what is known as a state premium tax, which is also taken right off your initial investment.

4. Redundancy. Investing IRA money into an annuity to get the tax benefit (as some are advised to do) is a waste, because everything accruing in an IRA is already sheltered from income taxes.

5. Shady tactics. In a way not unlike the timeshare industry, annuity sales practices have attracted a lot of criticism. Most people buying annuities don’t fully understand their options. Many are afraid of investing in general and are drawn to the promise of someone else handling their investing for them. The result is that many contracts are written to benefit the seller, while leaving the buyer with much less than they could have gotten from other, simpler, investments like normal index funds. After all, the only things insurance companies can invest in are the very same things individuals can: stocks, bonds and real estate.

Not all annuity sellers are shysters and not all contracts are detrimental to their buyers. Unfortunately, though, there are enough such cases to cause buyers to do their homework … the very thing they wanted to avoid having to do in the first place.

6. Inheritance taxes. For example, let us say you have invested, say, $50,000 in index funds through your IRA (Roth or traditional). When you die, that investment is worth, say $150,000. Your heirs will receive an inheritance valued at $150,000 (called the basis). If they turn around and sell it right away for $150,000, they will owe no income taxes, because that investment cost them $150,000 (the basis).

However, if you invested the same $50,000 in an annuity, which is also worth $150,000 at the time of your death, your heirs are deemed to have received something worth $50,000. If they sell it the same way as the index fund, the $100,000 gain will be taxed as ordinary income. There is, as they say, no step up in basis, as with normal investments.

The details may vary depending on your situation, but the principle of no step-up in basis remains pretty consistent in annuities.

The math behind the investmentSay you have $50,000 to invest and you want to wait 20 years before you begin to draw against it. It’s simple math to figure our more or less what that will be worth if you invest your funds in a simple, low-cost index fund. The insurance company will effectively do the same. (Index funds generally are the best-earning stock investments out there, so they will earn that or less.) Let’s be conservative and assume a 7 percent average return on that investment. The insurance company will take about 1.5 percent annually in fees, and that will leave you with 5.5 percent. Why do it their way?

As a straight-up investment, annuities rarely make sense. It is only when you add in the insurance protection (which isn’t free) that it makes sense. It comes down to the value you place on that insurance.

Should you buy annuities?As noted above, annuities generally earn less than simple investing but can be effective to reduce risk. As a general rule, annuities make sense for people with high incomes and high exposure to capital loss, as well as to people who are sufficiently risk-averse to accept returns below what is achievable through a normal, diversified investing portfolio.

They do not make sense as a simple retirement investment, because you can achieve the tax deferral benefit within your IRA and/or 401(k) retirement plans. (The only exception to this is if you are about to exceed the maximum 401(k) and IRA contributions.)

They also rarely make sense for seniors over 60, because other investment options with higher payouts are available to them. For example, municipal bonds yield more attractive payouts with no reduction in principal.

Everyone’s situation is unique and, therefore, all of what I’ve mentioned above is given only as a general guideline. If you have a lump sum to invest, pay the money to consult an adviser who does not sell annuities.

What are your thoughts about the risks and benefits of annuities? Is an annuity a good investment from your perspective?

March 1, 2016

In search of low-risk investments – 11 things to know about bonds

Chances are you have never purchased a bond … and probably never will. Same with me. I simply don’t have the capital to commit over $100,000 to purchase the typical bond. But I do believe there are reasons to learn about bonds nonetheless, even if it’s an investment you don’t think you’ll ever make. Never say “never,” right? Well, the fact is…

You may already be invested in bonds.Whether directly or indirectly, you may already be invested in bonds through your retirement plan, mutual fund or even an annuity. In that case, knowing how the bond market works can help you make better, more informed decisions about your financial future instead of blindly trusting that someone else will put your interests ahead of their own. You need to diversify.

The need to diversify is a basic concept that virtually everyone learns as they start investing. Certainly, any experienced investor will confirm that diversification is one of the main considerations for long-term investing success. But if you’re already invested in stocks or stock index funds and want to diversify, what do you diversify into? Generally speaking, the number one investment alternative is bonds. You need to manage risk and preserve your capital.

Everyone knows the stock market can be risky. If you understand the bond market, it can give you close to a risk-free investment. Of course, the return from low-risk investments is lower; but if low risk is what you are looking for, the bond market is pretty close to the only place you can get it. It’s a mistake to think the bond market is insignificant.

If you watch the evening news, it’s easy to conclude that the stock market is the most important investment market out there. Wrong. Globally, the bond market is more than twice the size of the stock market.

Moreover, most paid investment professionals regard the bond market as the foundation of all securities investments, not the stock market. When the bond market sneezes, the world’s economy catches a cold. From my perspective, not understanding the most significant investment market is tantamount to flying blind.

11 things to know about bondsBonds have a few attributes which, on their own, may seem obvious and even irrelevant. However, when you put them together, you begin to understand why the wealthiest individuals and financial powerhouses prefer bonds over equities (stocks).

A bond is a debt instrument.Cities, counties, school boards, corporations and governments use bonds to borrow money. Issuing bonds allows them to borrow from thousands of investors instead of a single bank. A bond is repaid.

Whereas stocks last forever (or at least until the company is taken over or goes under), bonds have a finite life. As with all loans, bonds get repaid. Some bonds get repaid five years from their date of issue, some within 20 years, and some after 50 or even a hundred years. Investing $100,000 and getting all $100,000 back is a major attraction to any investor – and it also helps explain why large investors love bonds. A bond is repaid on its maturity date.

The date a bond gets repaid is known as its maturity date. For example, Apple issued bonds in 2015 as a way to take on debt so they didn’t have to repatriate the billions of dollars in cash they keep overseas. They issued $2 billion worth of bonds with a term of 30 years, which means they will repay the $2 billion in February of 2035. They also issued some 5-year bonds which will be repaid in February of 2020. The amount that is repaid to the bond holder at maturity is known as the “face value.” A bond does not grow.

With so much attention focused on growth in the stock market, many individuals do a double take when they hear the largest investment category in the world is guaranteed not to have any growth. But it’s true: In 2035, Apple will repay all the holders of those $2 billion in bonds exactly $2 billion.

Why in the world, then, do investors flock to bonds? The first reason is the low risk mentioned above. The second reason is…

A bond pays cash interest.Many stocks never pay a dividend. Warren Buffett’s company, Berkshire Hathaway, is famous for never having paid a cent in dividends. It may come as a bit of a surprise to those just starting to invest, but most of the world’s seasoned investors will only invest in something that gives them a cash income on a regular basis. (Mr. Buffett, for example, will only invest in businesses which provide a generous quarterly cash flow.)

The investment yielding regular cash flow more than almost any other is bonds. Bonds usually yield a check in the mail for interest every quarter. The rate of interest (commonly called “the coupon rate”) is fixed at the time the bond is issued.

A bond can be liquidated before it matures.If you own a group of those Apple bonds which mature in 2035 and you need to raise some cash due to unforeseen circumstances, you have an out. There is a bond market, as active as the stock market, where bonds change hands every day. If you still get and read a newspaper, you will see bond listings right alongside the various stock market listings. The market price of a bond can fluctuate.

One of the attributes that sets the bond market apart from the stock market is how the pricing works. Corporations grow and their profits grow; and over the long term, that is what causes individual stock prices to grow and make the stock market as a whole grow too.

But as I mentioned above, bonds don’t grow. However, the market values of bonds do go up and down. The primary cause of those bond-price movements is interest rates. The explanation is too long to include here, but there is an inverse relationship of interest rates to bond values.

The inverse relationship of interest rates to bond values When interest rates go up, bond values go down. When interest rates go down, bond values go up. A bond has a dual liquidation value.This is one of the most unique features of a bond as an investment: It has two possible liquidation values. If you hold the bond until it matures, you will get back the full face value of the bond. However, if you sell it on the open market, you may get either more or less than the maturity value.

In times of dropping interest rates, you generally make a profit on the sale of a bond prior to its maturity. However, when interest rates rise, you are likely to lose money when you sell a bond. (This is why the big-money investors watch the Federal Reserve Board’s interest rate moves like a hawk.)

A bond is rated for risk.One of the main reason investors love bonds is the exposure to risk is generally low. But as also noted above, bonds often have long lives and, as we all know, things change as time passes. Sometimes risk shifts as a result of those changes.

For example, the clothing manufacturer Liz Claiborne was a hot brand a decade or two ago. The company was quite sound and profitable. They issued bonds back then; but fashions changed, causing the company to fall on hard times. Enter the risk watchdogs: the ratings agencies.

Risk is such an issue in the minds of bond investors that an entire industry (started by the now-well-known pair, Mr. Standard and Mr. Poor) sprung up to calculate and publish the risk for pretty much every bond that is traded on the open market. With such complete information available to investors, if a company wants to raise money by issuing bonds, they would be dead in the water without a rating.

Usually, investors will not touch unrated bonds. And so, as Liz Claiborne’s financial condition began to deteriorate, the ratings agencies began to question the company’s ability to repay those bonds and began to downgrade their bonds. When that happens, investors want a higher return to compensate for the higher risk.

A bond issuer can default on a bond.The greatest risk on a bond is a default. Even though the percentage of all issues outstanding which default is minuscule, defaults do happen. However, because the ratings agencies monitor issuers’ ability to repay, investors have plenty of time to sell those bonds with minor losses. By the time a default actually occurs, the only investors left are those who relish the high risk. There is a fail-safe in the event of default.

Does the word “default” conjure up images of losing all your money? Think again. When the City of Detroit famously defaulted on its bonds in 2013, bond holders did not lose everything. In fact, most didn’t lose a penny because the bonds were insured. (That’s right. You can insure bonds, but not stocks.) Others got wind of Detroit’s deterioration a long time ago and sold their bonds when the losses were still minor. In practice, therefore, defaults are not nearly the catastrophe the popular press likes to paint. The big picture on low-risk investments

Even though nothing is totally risk-free, bonds usually offer the lowest level of investment risk. Of all the bonds you can buy in the world, United States government bonds are generally considered the safest. The U.S. has never defaulted on any of its bonds before. Granted, the future is not always the same as the past, but upon what else can you make a determination?

Therefore, the rate the U.S. pays on its bonds is generally considered the risk-free rate of return. Any other investment you make, because it carries a higher risk, has to offer investors a higher rate of return. In other words, the U.S. bond interest rate is the floor in terms of the overall investment market. Which is just one more reason you, like all other investors, need to have a basic understanding of the bond market, the cornerstone of the overall investment market.

If you’ve never invested in a bond, would you consider diversifying with them? If you have invested in bonds, did it present any issues? What are the benefits/downsides as you see it?

February 24, 2016

The benefits of using credit cards wisely

Fire can be one of the most destructive forces on earth, and yet some say civilization began when we figured out how to harness its power. Credit cards are the same. Ask any long-time reader of Get Rich Slowly if credit cards are good for anything, and you might get a response like: “They’re to be ripped up and burned in an atmosphere-polluting bonfire of relief!”

There was good reason to hold that opinion back then. In the days leading up to the Great Recession, a lot of consumers were getting burned by the trap of easy credit and conspicuous consumption. Frankly, the weight of his own credit card debt is what spurred J.D. Roth to start Get Rich Slowly in 2006. Note: See also How to Choose a Credit Card for tips on finding the right credit card for you. Our partner site CardRatings.com also has articles to help you find the right card be it a cash back credit card or balance transfer credit card. Their Credit Card Comparison Table also allows you to easily search dozens of current credit card offers.

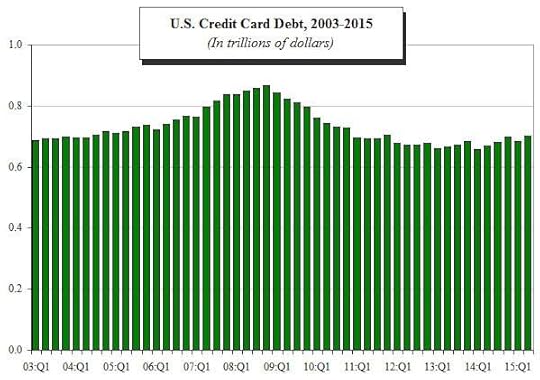

It’s easy to visualize the situation from the chart below. Credit card debt was becoming the largest category of non-mortgage debt in America at that time.

But there’s also good reason to change that opinion about credit cards. Even J.D. Roth’s perspective about credit cards evolved over time – because he decided to stop what he was doing and learn to take control of his finances. Instead of playing with fire, he learned to harness it.

It’s actually an important milestone to reach, being able to use all the tools available to you responsibly and not get burned. In fact, I’d go so far as to say that being able to handle credit properly is evidence of the kind of fiscal restraint and financial maturity that’s necessary to reach financial independence.

Money vs. creditAccepting that a credit card is a tool and not a trap is a good step. But it’s just one step among many. To really understand how to handle credit responsibly, we first need to step back and remember the lessons discussed in Money matters: How money works.

As I mentioned in that post, money is a means to facilitate exchanges and store wealth. Banking as we know it developed as a way to put that stored money to use for its owners, and credit (or debt) was born. As you saw with the history of banking, credit and money are closely related but they are not the same … and neither are the financial tools we use.

Debit vs. creditThe key, then, to handling credit responsibly is to understand what it is. A credit card is primarily a debt instrument, not a payment instrument (even though many use it only for payments). Credit cards come with a revolving line of credit for you to use or not to use. In other words, credit cards combine money exchange and credit.

A debit card, on the other hand, is purely a payment instrument. Debit cards are all about money exchange; and for many, they’re popular financial tools because they provide money exchange in a way that eliminates the temptation of getting into debt.

Both financial tools can be used as payment instruments, but they are not the same. Recognizing that one is a debt instrument that can be used as a payment instrument and the other is purely a payment instrument is one way to help you use them properly.

Is it good to have debt?We can line up two crowds of people right now, one for each side of the argument. In both crowds, you will find people successful in their money matters and people who are not successful. It is not just people with debt who mess up their money.

But messed up debt is a lot more painful than other forms of financial mismanagement. And the ease with which you can get into debt trouble with credit cards is what alarms most critics.

It is a valid criticism based on the facts. Most GRS readers are aware of the dangers of debt and have arranged their lives in a way which minimizes those dangers. Many, it would seem, have taken the tack that not having a credit card at all is the best way to stay out of debt.

Such a strategy, though, overlooks the payment and security benefits credit cards have – not to mention that learning to handle credit wisely can teach valuable lessons on your way to financial independence.

The simple fact is that you don’t have to get into debt if you own a credit card, but to handle credit appropriately you need to exercise fiscal restraint. It’s a natural part of financial growth, which comes with certain benefits if you learn how to manage your finances well.

Benefits of using credit cardsIt’s good to know that, if you’re ready to take a different perspective about credit, there are some benefits to credit cards that debit cards do not offer.

Credit history: Again, because a credit card is regarded as a credit instrument, you build a credit history even if you pay off the entire bill every month. Using a debit card offers no credit-rating advantage. Chances are you will buy a house and car on credit, which makes a good credit rating imperative in this day and age. Cash freeze: When you make a booking with a debit card, they place a hold on your account, which effectively freezes that amount. Other online vendors might do the same thing. Because credit is so interwoven in a credit card, however, that amount is considered a free loan to you, because the actual amount is not applied to your account until you check out of your hotel or the stuff you buy online is shipped. Protection: When you buy something with a debit card, that money is taken out of your account immediately. If you get home and discover a defect, you are dependent on the vendor’s goodwill to get your money back. With a credit card, you have a fallback position. If you are unable to resolve the dispute, you can get the credit card company to refuse payment to the vendor and you are never charged. Fraud protection: Likewise, when your card is stolen and used for fraudulent charges, you lose your money at first with a debit card. Although you usually get it back, you are out that money until you do. With a credit card, it is a lot simpler — they simply mail you a new card and you are back in business, and never liable for those charges. The end result may be the same, but the path isn’t as painful for credit card users. Car Rental: A friend of mine wanted to rent a car for a trip to Canada. He didn’t have a credit card, and he was turned down by several car rental agencies if he wanted to use a debit card. The only way they would waive that exception was if he had a round-trip airline ticket and he was from another place. Rewards: Affinity credit cards (such as those for airlines, your alma mater and hotel chains) offer rewards not available to debit card holders. Although a few debit card issuers offer points or rewards, they are not nearly as common as for credit cards, even those that aren’t part of an affinity program. For example, Holly Johnson has a number of articles here on GRS about vacations they funded with credit card reward points. Downsides of using credit cardsWhen comparing the two plastic options as an alternative means of payment, credit cards for the most part work better than debit cards too. But there are a couple instances where that is not the case:

1. Vendor limitations: Some retailers, notably Costco, do not accept credit cards, only debit cards. In general, there are more establishments taking debit and not credit than the opposite. Therefore, a debit card opens more doors for you than would a credit card.

2. Payment problems: Because a credit card is always a debt instrument, there is a bill, usually once a month. If you are involved in an accident or find yourself in an unplanned absence and you miss a payment, you incur fees and other kinds of hassles (possibly including a taint on that credit record you want to burnish). With a debit card, everything is always paid.

J.D. Roth’s essential credit card behaviors I resolved to make my decision to buy first, and then decide how to pay. I vowed never to buy anything unless I had cash in the bank for it. I promised to pay my card in full every month. I told myself that I’d never use my card for an impulse purchase.[Read How to use a credit card (without going into debt) for the full story and J.D.'s essential credit card skills.]

Doing what’s best for youSticking with the notion that credit cards are evil might be necessary for you at the moment, but it can be a mistake to hold on to that notion forever. There are distinct advantages to using credit wisely (not to mention that, as your credit history improves, some of your expenses could also go down as a result).

Being able to handle credit responsibly is one way to know you are mastering your finances. It’s like learning to start a fire and not let it burn you or get out of control. For someone that is committed to that growth process, it’s not a trap to be avoided at all cost. It’s an excellent sign that they have the personal control to reach their own financial success and accomplishments.

Do you think mastering credit is a necessary part of your journey to financial independence? Is credit an important tool in your financial arsenal or a deadly way to play with fire? What makes it so?

February 3, 2016

What to do if your employer stops performance reviews

More and more, companies are dispensing with traditional annual employee reviews. They say this is out of sensitivity to a new generation of employees who find reviews stressful. The real reason may be that dispensing with employee reviews saves companies money — albeit at the expense of their employees.

Microsoft and Dell are among the high-profile companies that have made news recently by dumping annual employee reviews, and Silicon Valley has long turned its nose up at such traditional means of measuring performance and managing people. For many employees, the initial reaction is relief, but they would be wise to look closer. Without that annual review process, they could find that opportunities to get a raise are fewer and more difficult to obtain.

Nothing ventured, nothing gained

Nothing ventured, nothing gained As much as you may view a formal review as resembling an interrogation scene out of George Orwell’s “1984,” it should work to your benefit — both financially and in terms of feeling more connected to your workplace.

PayScale.com found that most employees never ask for a raise on their own initiative. Just 43 percent of the workers surveyed reported having done so, compared with 57 percent who had not. This does not mean that those who never asked for a raise did not occasionally get one anyway — 38 percent reported that their employer gave them a raise without their having to ask. However, this pales in comparison with the success rate of people who did ask for a raise — fully 75 percent of this group got one.

In other words, your chances of getting a raise are nearly twice as good if you ask for one than if you don’t. Also, there’s a strong likelihood that many of the 38 percent who got a raise without asking did so as the result of a periodic review process. If your company has eliminated that kind of process, it’s all the more important that you summon up the nerve to ask for a raise, because otherwise the topic may never come up. Being shy could cost you money.

Why you need to ask for a raiseBetween a shaky stock market and near-zero savings account rates, there is little chance of building a fortune passively these days. Consider this: Someone saving $5,000 a year and investing at historical interest rates would have amassed a nest egg of about $372,000 over 30 years. However, that same savings program at today’s interest rates would only produce about $158,000, or less than half as much.

So, to reach financial independence in this climate, you have to do it actively, by maximizing your earnings. This means that as companies do away with the formal review process, the onus is on you to take the initiative to get the raises you deserve.

Address the gender gap — be more assertive!The PayScale data also indicated that women in particular need to be more assertive about asking for a raise. You are probably familiar with the gender gap — the fact that women generally get paid less than men. Well, asking for a raise may be one way to address the problem.

PayScale found that, even after adjusting for factors like experience, education and training, responsibilities, and company size, women on average earn 2.7 percent less than men. One reason is that the study found women are 2 percent less likely than men to ask for a raise. Beyond just asking, the willingness to negotiate also makes a difference. By a margin of 31 to 23 percent, women are more likely than men to say they are uncomfortable negotiating salary.

There are certainly issues of gender bias that contribute to the pay gap, but women can address that gap to some degree just by being assertive about asking for a raise. And this will only get more important if more companies eliminate regular reviews.

There’s more to lose than moneyGetting the raises you deserve is important, but there are other reasons not to neglect communicating with your employer about your job performance, whether by a traditional review or by taking the initiative to bring up the subject.

Overwhelmingly, tech companies have been at the forefront of eliminating traditional employee reviews in favor of softer methods of managing people. But a recent survey by TINYPulse, which monitors employee satisfaction, suggests that the looser structure may be resulting in more alienated employee bases.

According to the survey, only 19 percent of tech employees report being happy in their jobs, and only 17 percent say they feel valued at work. Compared to people at non-tech companies, tech workers are less likely to feel they have a clear career path, understand their company’s vision, or feel they have good relationships with their co-workers. This alienation of the workforce may be the result of doing away with a structured means of communicating goals and rewarding performance.

Communication is important in any relationship. As despised as they may be by many people, annual reviews are one way of making sure that communication happens. If your company does not have that kind of system, then it may be up to you to initiate periodic discussions of your performance and your future with the company.

It’s on you – so here’s what to doIn this new environment, it’s on you to make sure your performance is properly evaluated and rewarded. Here’s what to do about it:

Do not let a year go by without a formal discussion of your performance and compensation. If your company does not have regular annual reviews, make it a point to initiate this discussion once a year. Schedule time with your supervisor in advance, rather than trying to catch someone on the fly. Busy people don’t like to be buttonholed unexpectedly, especially about a sensitive subject. You’ll get a better reception if you make sure the discussion happens at a mutually convenient time. Ask as well as tell. You should have your points to make, but you should also go in looking for feedback on how you can improve. Getting a raise depends on the company’s belief that you are more valuable to them than your current compensation, so find out what you can do to be perceived as more valuable.Companies that eliminate the traditional review process have put the onus on their employees not just to ask for raises, but also to get the feedback they need to advance their careers. Those who are shy about doing so will get left unhappily behind.

Has your workplace eliminated its review process? How has that affected your ability to advance in your career and make progress toward retiring? Have you ever asked for a raise without a review?

January 26, 2016

How to use a balance transfer card for holiday debt

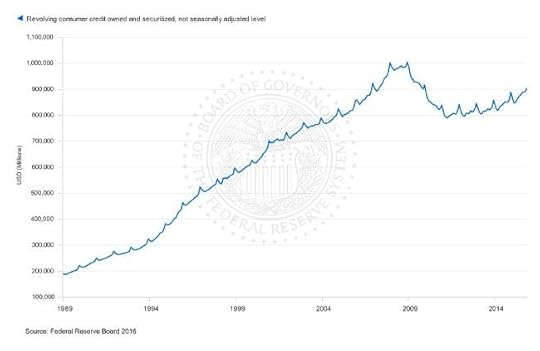

Have you received your credit card bill for December yet? If so, you’re not the only one. As this Federal Reserve Board chart shows, Americans accumulate about $30 billion in credit card debt in the last quarter every year – and then attempt to pay it off in the first quarter of the New Year.

The problem is they rarely succeed at paying off the entire balance. By the end of the first quarter every year, roughly $6 billion of revolving consumer credit is still unpaid. Even worse, it usually continues to grow the rest of the year too. Note: See also How to Choose a Credit Card for tips on finding the right credit card for you. Our partner site CardRatings.com also has articles to help you find the right card be it a cash back credit card or balance transfer credit card. Their Credit Card Comparison Table also allows you to easily search dozens of current credit card offers.

It’s never pleasant to face the fact that you may not have budgeted your purchases very well (or at all) during the holidays. But the harsh reality is how quickly debt increases if it isn’t paid off completely. And with interest rates on the rise, it can only get worse.

It might not be deferred holiday spending that tripped you up, though. Mistakes happen – especially when you’re just starting out – and unexpected events pop up all the time. (Take me, for example – my home heater died today, even though it’s only two years old!).

But if you have to put an uh-oh purchase on a credit card – on top of the holiday charges you’ve already made – you may be wishing you had a way to stretch your budget and pay it all off.

Is a balance transfer credit card the answer?A balance transfer credit card may be a really good option in this situation; but there is a lot to know about how these offers work. And if you’re not clear on all of the terms of the particular card you’re interested in, your financial condition could very easily make a turn for the worse. It’s not as simple as you might think, so here’s what to consider:

Your credit rating. The most attractive balance transfer offers are extended to those with excellent credit. If you have excellent credit, usually in the mid-700s to 850, consider applying for one of these cards. If you are in the lower end of the credit spectrum, however, the offers are usually less generous. Regardless, it’s important to know what happens during the introductory period. Introductory periods. This is where you can really make progress hammering down your debt. Most offers include an introductory period with 0% or very low interest rates. For example, the Chase Slate® card offers 0% APR for 15 months on balances transferred within the first 60 days – and there are no balance transfer fees. Most offers I’ve seen have a 0% promotional period of only six months to a year. What term length you pick may depend on factors such the following points… How long you need to pay off the debt. Do you just need three months to pay off the balance because you expect a tax refund in April or do you need as much time as you can get because you can only afford $30 a month? Knowing how long it will take to pay off your balance is critical to comparing balance transfer offers, but so is the next item. Interest rates. Remember that introductory period with 0% interest? Well, that rate is temporary. And it may only apply to the balance you transfer within a certain period of time, not to any new purchases you make with the credit card.Make sure you understand how the interest rate changes to know if it even makes sense to move the debt around. Typically, the higher the interest rate on your current debt, the more likely transferring the debt would make sense. Interest rates vary widely between credit card companies, too, so you really need to dig into each offer and see which is best for you. Credit limit. Are you transferring your entire balance from other high-interest debts to simplify your finances and consolidate them onto this one card? A credit card company may only approve a smaller credit limit, which could leave you juggling payments on other debts in addition to this new card. While it may not be the perfect solution, reducing the amount of interest you pay – even if it’s only a portion of your debt – might still be worth it. Balance transfer fees. Any fees you pay to transfer the balance will reduce the amount you could save in interest, so calculate what that amounts to when comparing offers. Most cards I have seen in the recent past had a 3% balance transfer fee; but, like the Chase Slate® or Barclaycard Ring MasterCard®, some don’t have a balance transfer fee at all. Other cards like the Citi Simplicity® and Citi Diamond Preferred®, both, have 21 months 0% intro APR (although there is a balance transfer fee). You can compare these and other balance transfer credit cards here. How payments are applied. This is a big gotcha that most people fail to consider, and it’s an expensive one at that. If the credit card company applies your payments to the lowest interest rate balance first and the excess to higher interest-rate balances, uh-oh. That means your payment will be applied to the 0% balance first, allowing new purchases to accrue interest at the much higher rate! What else matters? Adopting an attitude toward debt. It’s easy to get into problems with credit, but I don’t believe credit cards are necessarily a problem for everyone. I think it all comes down to the attitude you have toward debt. If you loathe debt, want to be debt-free, and know you have the discipline to stay debt-free, moving debt around with a balance transfer offer can help you pay a balance off as quickly (and inexpensively) as possible. Putting the shovel down. This is your pay-it-off card. Putting new stuff on this card is like digging a deeper hole. Don’t do it. Instead, commit to not making any new purchases after the balance is transferred. Staying disciplined to pay it off in time. In other words, don’t pursue a balance transfer credit card offer if you have any doubts about your resolve or ability to pay the balance back in time. Be disciplined to get rid of the debt in the allotted time – otherwise, you could be left paying a higher interest rate on your balance. Keeping your credit healthy. A balance transfer credit card offer may be a good way to eliminate debt once and for all, but transferring debt repeatedly from one balance transfer card to another can hurt your credit in the long run. The point is not to keep moving debt around; it is to help you get rid of debt entirely. Reading the fine print. Most cards offer 30 to 60 days to transfer balances; so as soon as you apply for the new card and get approved, set time aside to read the fine print … in its entirety. Make a repayment plan — and plan for the future Budget to repay the debt as soon as possible. Don’t fall into the trap of waiting out the complete 0% period. You never know what unexpected expenses could pop up. Instead, make a plan for how to repay the debt so you don’t end up owing money at a huge interest rate. Set up automatic payments. Formalize your plan with automatic bill-pay to make sure each payment is taken care of before you reallocate that money for something else. Monitor your credit card statements. Make sure that you’re making progress every month and that no unexpected charges or fees are being added to your balance. Start an emergency or a targeted savings account right away. What helps prevent a debt spiral? An emergency fund! Take this time to work on building your online savings account. Hopefully that will make it so you won’t have to go through this again.

You don’t have to resign yourself to making payments on an ever-increasing balance. With a little bit of thought, shopping, and commitment, you can reverse the trend line of debt. Better yet, you could start to save for this year’s holiday season in advance, build up your emergency fund, or even start working on a new Roth IRA.

Has a balance transfer credit card helped you completely eliminate debt or have you had a card turn into a debt horror story? What tips can you share? What do you think makes a balance transfer a good strategy?

January 18, 2016

29 ways to build your emergency fund out of thin air

Get Rich Slowly contributor Lisa Aberle recently suggested putting 10 percent of income in a savings account. She provided guidelines in “How to save money each month” – tried-and-true techniques like having a yard sale, cutting the cable, dropping the landline, raising insurance deductibles, eating at home and lowering the thermostat.

Suppose you’ve done all that stuff already, you’re living pretty close to the bone — and you still need to build your emergency fund. Time for some stealth savings, i.e., small tweaks that can add up to big bucks.

The unemployed and underemployed may feel – with good reason! – that they can’t afford to save. Even those with decent salaries might feel squeezed by the rising cost of basic needs like food and utilities, especially if they’re repaying student loans.

Maybe you really do need every dime to keep creditors at bay. Or maybe a little money-massaging could free up some extra bucks for your Someday Fund. Even if it’s just a tiny amount at a time, it’s something.

Although not every tip works for every person, you can probably find a few (or a lot) of tactics to plump up your financial cushion.

Bank it!1. Automate it. First, have your bank or credit union siphon off a small amount each payday. Next, learn to live on what’s left. Increase the amount slowly to give yourself time to adjust your spending.

2. Bank your rewards. Switch to a cash rewards credit card and use it to pay for everything you can (but never more than you can pay off). Save the cash-back.

3. Bank your raise. If you got one, you lucky dog. Here’s how: Pretend you didn’t get one, and keep on keeping on with your previous take-home pay. Automate the rest into savings.

4. Bank your bonus. If you get any kind of extra cash at work, spend 10 percent of it on something you really need (or want) and save the rest.

5. Bank your reimbursements. Getting paid back for work-related expenses or a check from your flexible spending account? If at all possible, put it into savings rather than checking.

6. Bank your coupons. You saved $6 on the groceries? Swell! But it’s not savings unless you save it. Tuck away those discounts from manufacturers coupons and/or your customer loyalty card.

Creature of habit?7. Drop bad habits. It’s tough to quit smoking or, for that matter, to stop buying comic books. But as you taper off, put what you would have spent on coffin nails or anime into long-term savings.

8. Recognize good habits. Rather than having a “swear jar” with a penalty for every F-bomb you drop, why not have a “Go you!” jar? Maybe you packed a lunch today instead of eating out — go you, then, and put a quarter (or more) in the jar.

9. Recreate favorite habits. Do you meet friends for brunch or lunch every weekend? Replace at least one of these gatherings per month with meals at home (and take turns hosting). Hooked on opening-night movies? Learn to appreciate the bargain Saturday matinee, right after a big breakfast that will keep you from dropping a fortune on popcorn.

10. Round it up. When you use your debit card or write a check, record it for the next dollar up (e.g., $7.29 becomes $8). At the end of the month, add up the differences and transfer to savings.

11. Pay it forward. Finally made the last installment to the auto dealer or the orthodontist? Keep making that payment, i.e., transfer it into savings each month. (Can’t quite swing that? Save half the amount, then.)

12. Launder some funds. Every time my partner and I do a load of wash, we put $2 in a jar. Try this — you’ll be surprised how quickly it adds up!

13. Swipe some cash. Look at your checking-account balance on the day before payday. If there’s $117 in there, send $7 (or $17, or more) into savings.

Make it a challenge!14. The spare-change challenge. Dump some or all of the change from your wallet/pocket into a jar every night. Once every couple of months, wrap it and bank it.

15. The dollar-bill challenge. Remove all the Washingtons from your wallet every night. And here’s the super-flush version: Make it the $5 challenge.

16. Random number challenge. Pick a number, then check your wallet nightly for bills whose serial numbers end in the digit you’ve chosen. Set them aside to bank.

17. Weekly challenge. Actually a monthly challenge: Set aside $1 the first week of the month, $2 the second week and so on. Bank the resulting $10 to $15 per month.

18. Calendar challenge. The first week of January, bank $52. The second week, $51. Etc. This can be tough at first, but by the end of the year you’ll have banked $1,378!

19. Savings buddy challenge. Get a mildly competitive relative or friend interested in building a cash cushion too. Set a time limit and a reward, e.g., “If I save less than you in the next six months, I have to pick up all the dog poop in your back yard.”

20. I Spy challenge. See a dime on the floor at the checkout counter or a quarter in the vending machine’s coin-return slot? Once you start looking, you’ll see money everywhere. (My found-coin totals dropped when I moved back to Alaska. But even so, I found $14.27 last year. Mine goes to a local food bank, rather than into savings.)

Self-awareness works21. Get symbolic. Deposit your age, or your children’s combined ages, every week or every month. Suppose you want to retire by age 50? Deposit $50 into savings every month, or every week if you can swing it.

22. Bill yourself. Turn savings into a monthly obligation, and pay it. The “bill reminder” feature on sites like PowerWallet or Mint.com make it easy to hold yourself accountable, so to speak.

23. Remind yourself. Rubber-band a picture of your dream (new house, backpacking trip, whatever) to your credit card to discourage in-the-moment spending.

24. Remind yourself, Part 2. Change an online shopping account password to something with personal resonance. Signing on with “Sept2016uClA” will remind you how soon your oldest kid starts college — which in turn might help you apply the want-or-need filter before you click “purchase.” Talk about password protection!

25. Opt for inconvenience. Don’t pick the bank or credit union with a branch in your neighborhood. You don’t want it to be easy to get at this money. There’s no need to go there in person because you’re using direct deposit. (Aren’t you?)

26. Choose an online bank. That way it takes a couple of days to get the money. You might come to your senses by then and realize that a new fishing rod isn’t the best use of your funds.

27. Name your bucks. Does your financial institution let you set up sub-accounts? (I’ve got two named for my great-nephews’ college funds.) Contributing to the “new car for cash” or the “summer vacation” fund has its own special frisson.

28. Keep the Change. This program, specific to Bank of America, rounds debit-card purchases up to the next dollar and then transfers the difference into savings. (Example: If you pay $29.38 for gasoline, 62 cents will go into savings.)

29. Engineer some discounts. Pay for the items you need most often with discounted gift cards bought on the secondary market. For example, buying a $100 PetSmart card for $87 and a $50 Walgreens card for $44 means you could transfer $19 into savings.

Readers, how do you save?

January 15, 2016

Financial goals when the going gets tough

Last month, the December 2015 Consumer Confidence Index ®, showed improvement over the previous month:

“Consumer confidence improved in December, following a moderate decrease in November,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “As 2015 draws to a close, consumers’ assessment of the current state of the economy remains positive, particularly their assessment of the job market. Looking ahead to 2016, consumers are expecting little change in both business conditions and the labor market. Expectations regarding their financial outlook are mixed, but the optimists continue to outweigh the pessimists.”

But just a couple weeks into the New Year, with the stock market still reeling, people may be more concerned about the economy. So now that we’re smack dab in the middle of the first month of 2016, wherein we at Get Rich Slowly are concentrating on taking charge of our finances, I wonder how it’s going for everyone. Do you have the same confidence?

So perhaps it hasn’t been the most inspiring start to a new year. Should we let that fact deter us? No. In fact, it’s time to get going, as they say.

Next week, we’re bringing the focus down to how to save and get out of debt when it gets tough. In difficult times, it’s even more important to be able to find a path toward your goals despite headwinds or setbacks. But today, I want to ask about your perspective. As far as the economy goes, how do you see it? Here are a few questions to serve as a jumping-off point:

How long has it been since your wages went up? How would you accommodate an unexpected expense of, say, $500 to your budget? Is it difficult to add to your savings account? What is the biggest threat to your retirement plan?Pick the question that means the most to you or answer them all if you like. Maybe even include what you think would solve or address the issues you see ahead of you.

Readers, i s your route to financial independence changing this year? W hat is your plan when the going gets tough?

January 13, 2016

Conquer impostor syndrome and reach your financial goals

“Impostor syndrome” is a term coined by two American psychologists, Pauline Clance and Suzanne Imes, in 1978. Simply put, it is the belief that what other people perceive of as accomplishments due to your skill, intellect, or other internal factors are in fact evidence that you are a fraud.

When those who have impostor syndrome receive compliments, rather than feeling pride at the praise, sufferers probably feel unease instead. “It was just dumb luck,” they’re likely to think, or “What if I’m found out?” If you’ve experienced this feeling, it can prevent you from reaching financial goals like advancing your career or maxing out a savings account.

After all, if your every success intensifies the belief that you’re somehow deceiving people and essentially faking it, it only makes sense that you’d avoid situations that make you feel that way. This can include not taking action to improve your life and finances. So how can impostor syndrome affect your financial life, and how you overcome it? Let’s try to understand that.

Problem: Not negotiating during the hiring processPeople who suffer from impostor syndrome may be less likely to advocate for themselves when negotiating salary or other benefits when they’re offered a new job. Why is that? It’s because they don’t feel they deserve it.

Such folks may feel lucky to be offered any job at all and, therefore, believe that whatever they’re offered initially must be fair and market-appropriate. However, most employers leave some room in their budgets because they expect you to negotiate. And since any future merit or COLA increases will be based on your starting salary, it is to your benefit to make that initial amount as commensurate as possible with your skill set and value to the company.

Solution: Quantify your contributionRather than couching your requests in terms of what you want or deserve, learn to quantify your skill set as much as possible. Being able to rattle off any certifications you possess as well as being able to assign a numeric value to contributions you’ve made in prior positions is more convincing to employers in the first place. Additionally, it can help you internalize the fact that your terms are reasonable and justified, which can give you the confidence to ask in the first place.

Obviously, having these things outlined in your resume is an important first step to getting an interview, but that doesn’t mean your eventual offer will take all your accomplishments into account. And since everything doesn’t fit on a resume, memorizing a master list of your deeds can lead potential employers to realize that there’s even more to you than meets the eye.

Advocating for yourself doesn’t end once you’ve got the job, though. For individuals with impostor syndrome, it’s tempting to think of performance reviews as justifying why you deserve to keep your job at all. However, it’s important to you and your family’s long-term financial security to use performance evaluations as an opportunity to showcase your contribution and ask for a raise.

Like an initial interview, consider an annual review as a chance to ensure that your compensation is aligned with the value you bring to the bottom line. And if your contribution isn’t as robust as you hoped, impostor syndrome may mean your first instinct is to fall on the sword when in fact there may be actions your employer can take to remove any roadblocks you’re experiencing.

Solution: Ask for what you need to succeedIn many ways, the principles of how to approach a performance evaluation are similar to a job interview. However, there is another aspect to think about — asking for impediments to your success to be removed. Impostor syndrome may lead you to attribute success to external factors like luck and mean that you are too eager to take the blame for things that don’t go as well as you hope. Your goal should be to reverse those tendencies without sounding vain or defensive.

Practice saying “thank you” when receiving a compliment and, if possible, tying the contribution in question to quantitative data. However, when shortcomings in your performance are pointed out, don’t immediately assume the problem is you. Is there a policy change that would prevent the issue from arising? Is there a degree, training, or certification that your employer could pay for or provide that would put you in a better position to meet expectations?

While you should take responsibility for your actions, you should also assume your employer wants you to do well and is willing to put resources at your disposal to make that happen.

Problem: Comparing yourself to othersOne of the defining characteristics of impostor syndrome is the tendency to compare yourself (usually unfavorably) to others. Especially with the rise of social media, you may have heard the saying that you end up comparing your worst day with everyone else’s best days. If you’re someone who feels like a fraud even when it comes to your successes, this tendency can be debilitating to your self-confidence.

And without even noticing that you are doing it, you may only be comparing yourself to those in your circle that you perceive as doing much better than you. This may lead to you discount or not even notice when friends, family, or colleagues are actually struggling — perhaps in areas you have mastered or in which you are experiencing success. Another factor you may not realize? Others experience impostor syndrome as well.

Solution: Mentor and be mentoredTurn comparison into something positive through mentoring. Rather than quietly admiring those whose success outstrips your own, reach out to them to figure out what they did to achieve those feats. If they attribute their accomplishments to luck or other external factors, you may have found an impostor syndrome soul-mate. Saying something about it can help you both feel better. If they can identify the actions that helped them succeed, you may have found a mentor. Perhaps spending time together would help you learn how to succeed in those areas too.

Similarly, reaching out to those who haven’t yet attained the professional or personal finance goals that you have may help your self-confidence and sense of competence. Perhaps there is an entry-level colleague you could befriend or a younger family member who could benefit from your life experience. Not only could your skills and knowledge help them reach their goals, expanding the number of people in your life who can validate feeling like an impostor can help all involved overcome that feeling and own their success.

Final thoughtsFeeling like a phony is not only a waste of time and energy, it can lead to burnout (as you try to overcompensate for your perceived lack of talent or ability) and fear of risk, even calculated risk. The strategies outlined above can help you deal productively with unrealistic feelings of inadequacy. For many, simply knowing that impostor syndrome is a real phenomenon that others experience can help inspire positive change in both attitude and action.

Have you encountered impostor syndrome? How has it affected your financial situation, if at all? Do you look for ways to help mentor others about their finances? How would you translate these solutions to help you improve your finances?

J.D. Roth's Blog

- J.D. Roth's profile

- 17 followers