Mahendra Ramsinghani's Blog

February 25, 2014

The Battle Of Security Startups

When Guy Filippelli, CEO of Red Owl Analytics finished his 3 minute pitch at RSA Innovation Sandbox, not many thought he would win the “Most Innovative Security Company” award. Amongst the ten companies that battled to for the title, you had serious heavyweights like Dan Kaminsky of WhiteOps. Dan is the only American and one of the 7 people in the world who holds the Internet’s root DNS keys. Think of it this way – when something really bad happens to the Internet, it needs to be restarted, that is when they call Dan. And then there is Co3 Systems which lists security guru Bruce Schneier as its CTO. Schneier is the author of 12 books on security — including Liars and Outliers: Enabling the Trust That Society Needs to Thrive and Carry On. So what made Red Owl stand apart ?

It uses a variety of tools (Jargon watch = elastic computing, inferential statistics, and intuitive visualizations) to pattern match human behavior and help the good guys stay safe. Guy pointed out, “What we found most surprising was our tools helped exonerate the good guys very quickly. ” By tracking 10 data streams such as origination, time stamp and such Red Owl watches for patterns of digital behavior within organizations. That got Red Owl some serious love from the judging panel.

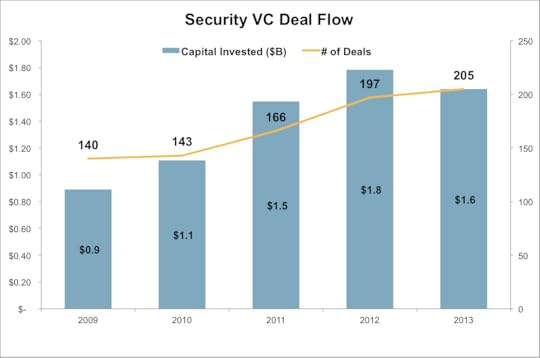

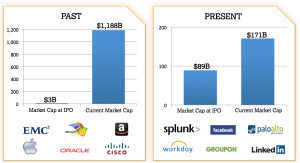

In the post-Snowden era, security is steadily gaining attention from entrepreneurs and investors alike. According to Pitchbook research and VC data analysis, over $1.5 billion is invested in 200+ security startups each year.

Of the top 3 largest security investments of 2013, A10 Networks raised $80 million and plans for an IPO while FireEye raised $50 million (IPO’d in Sep 2013). Lookout raised $50 million (with total of $132 million raised thus far) from Andreessen-Horowitz and Khosla Ventures and is on the IPO path. And exit values are trending upwards of $500 million.

Notable companies at RSA Innovation Sandbox included Bluebox Security which emerged from stealth. Backed by $27.5 million in funding from Andreessen Horowitz, the company takes a fundamentally different approach to wrapping data and apps on mobile devices. Stuart McClure, CEO of Cylance made a near-perfect pitch to describe how their tools make intelligent decisions without relying on signatures ( a predictive / actuarial approach versus signature based approach to determine good data from bad). Cylance has raised $30 million, is backed by Khosla Ventures and the Blackstone group. Kaminsky’s WhiteOps, with one single line of java code can isolate and eliminate bot-infected traffic from advertising campaigns. Its only a $40 billion problem. Co3 Systems seems to be the only SaaS player (not counting armies of consultants) that can show a 10X improvement in post- response time to cyber attacks incidents. Here is the entire list of startups that competed at RSA Sandbox. 2014 promises to be a good year for all security startups, not just Red Owl Analytics. Thanks NSA RSA.

(Authors note: I am grateful to Tessa Griffin and the entire Pitch Book Data Inc team for their timely research for this blog.)

@ #RSAC and the battle of security startups

When Guy Filippelli, CEO of Red Owl Analytics finished his 3 minute pitch at RSA Innovation Sandbox, not many thought he would win the “Most Innovative Security Company” award. Amongst the ten companies that battled to for the title, you had serious heavyweights like Dan Kaminsky of WhiteOps. Dan is the only American and one of the 7 people in the world who holds the Internet’s root DNS keys. Think of it this way – when something really bad happens to the Internet, it needs to be restarted, that is when they call Dan. And then there is Co3 Systems which lists security guru Bruce Schneier as its CTO. Schneier is the author of 12 books on security — including Liars and Outliers: Enabling the Trust That Society Needs to Thrive and Carry On. So what made Red Owl stand apart ?

It uses a variety of tools (Jargon watch = elastic computing, inferential statistics, and intuitive visualizations) to pattern match human behavior and help the good guys stay safe. Guy pointed out, “What we found most surprising was our tools helped exonerate the good guys very quickly. ” By tracking 10 data streams such as origination, time stamp and such Red Owl watches for patterns of digital behavior within organizations. That got Red Owl some serious love from the judging panel.

In the post-Snowden era, security is steadily gaining attention from entrepreneurs and investors alike. According to Pitchbook research and VC data analysis, over $1.5 billion is invested in 200+ security startups each year.

Of the top 3 largest security investments of 2013, A10 Networks raised $80 million and plans for an IPO while FireEye raised $50 million (IPO’d in Sep 2013). Lookout raised $50 million (with total of $132 million raised thus far) from Andreessen-Horowitz and Khosla Ventures and is on the IPO path. And exit values are trending upwards of $500 million.

Notable companies at RSA Innovation Sandbox included Bluebox Security which emerged from stealth. Backed by $27.5 million in funding from Andreessen Horowitz, the company takes a fundamentally different approach to wrapping data and apps on mobile devices. Stuart McClure, CEO of Cylance made a near-perfect pitch to describe how their tools make intelligent decisions without relying on signatures ( a predictive / actuarial approach versus signature based approach to determine good data from bad). Cylance has raised $30 million, is backed by Khosla Ventures and the Blackstone group. Kaminsky’s WhiteOps, with one single line of java code can isolate and eliminate bot-infected traffic from advertising campaigns. Its only a $40 billion problem. Co3 Systems seems to be the only SaaS player (not counting armies of consultants) that can show a 10X improvement in post- response time to cyber attacks incidents. Here is the entire list of startups that competed at RSA Sandbox. 2014 promises to be a good year for all security startups, not just Red Owl Analytics. Thanks NSA RSA.

(Authors note: I am grateful to Tessa Griffin and the entire Pitch Book Data Inc team for their timely research for this blog.)

December 25, 2013

Venture Capital 2013 Recap – Oh What A Year It Was

There are bad years, so-so years and then there is 2013…its been a long time coming. In 2013, VCs finally took some pride in the 10-year returns which recovered to 7.8% as of Q2 2013. The battered egos have regained their mojo and the venture “asset” class is starting to look real once again. Even as fund managers (or GPs) whip up their fund raising documents, and get ready to pitch institutional investors (or LPs), a lot of strong foundational under-pinnings are at work.

Schumpeter’s forces of creative destruction: 2014 will be the year of investments in Bit-coins, Drones, Cyber-Security, Hardware /”Internet of Things” and even revival of healthcare IT. Rapid innovation, reduced hardware costs and government regulatory changes are driving new startup formation. Looking in the rear view mirror, the mobility wave started with the iPhone (2007) and iPad (2010). It took about six years to start reaping returns and rewards from this cloud, social, mobile ecosystem. The next five years will bring more changes and possibly better returns for VCs and LPs alike.

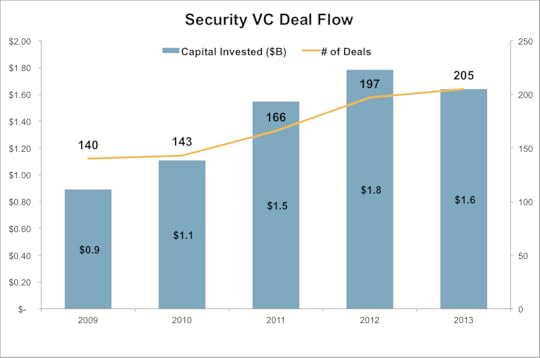

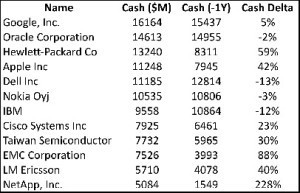

More exits on the horizon: Liquidity in 2014: 2013 liquidity via IPOs and M&A generated upwards of $14 billion. As many as 80% of exits value came from enterprise software. The fat 2014 pipeline has few elephants in the making as well. CB Insights identified 26 companies that have $1 billion valuation or more. Dropbox, Airbnb, Uber, Palantir and Square will bring in more liquidity and returns to the VCs. What more, there are over 590 companies with valuations of over $100 million or more. The top 15 tech exits in 2013, according to CB Insights created $18.5 billion of value on investment of only $471 million – with Emergence Capital leading the charge with a $4m investment in Veeva yielding $4 billion. Tableau (NEA) and Trusteer (US Venture Partners) are in the top three capital efficient exits. In 2014, more acquisitions are bound to occur, thanks to the cash-rich and hungry corporations. The top tech companies (see table) have upwards of $125 billion of cash sitting on their balance sheets. Those companies with higher cash changes will likely go shopping soon.

Yet LPs don’t want to dance: A seasoned investment advisor told me that “institutional LPs remain shy and slow to react.” Over some cheap unhealthy Chinese food, we shed our tears as those LPs miss out on the next technological wave. While in 1999-2000 every pension fund was stampeding into the dot-com craze, LPs poured in $100 billion in VC funds in one year! And now, even as the fundamentals are robust, we barely see $20 billion coming into VC each year.

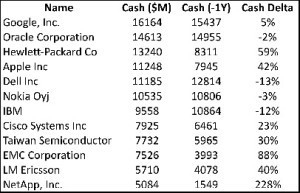

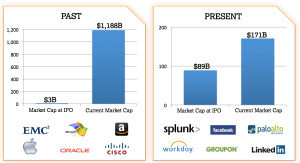

And as Venky Ganesan of Menlo Ventures points out, (See “VC Value Creation”) the present day tech companies are going public at much higher valuations. Speaking at VCJ Alpha West, David Cowan of Bessemer Ventures said that the market dynamics are such that today VCs don’t bat an eyelid while investing at a $250 million premoney valuation. Ten years ago, that would have been an exit price for a company. The largest 2013 investment award goes to Google Ventures for plonking upwards of $250 million in Uber at a hefty $3.5 billion valuation. The #2 is Palantir, which raised $196 million. Others include Fab.com which gobbled up $150 million and Lyft ($60 million), which is now growing faster than Uber. The quality of companies (measured by revenues, paths to profitability or sustained growth potential) being listed on public markets remains very high, unlike that of the dot-come era vaporware.

But LPs are not impressed. As of Q3 2013, only $11 billion had been invested in venture capital. Yet in the first three quarters of 2013, VC exits generated $14 billion. LPs who understand “cash flow positive” will not be sitting along the sidelines. This combined with efficiency of secondary markets have minimized the “J Curve” challenges. LPs who grumble that the securities are locked up for long periods of time (and hence seek liquidity) may have a reason to smile.

In 2014,Andresseen-Horowitz, Kleiner-Perkins, Menlo Ventures, US Venture Partners, DFJ and 500 Startups will knock on LP doors as they get ready to raise new funds. On the other end of the spectrum, the micro-VC universe has exploded. This bar-bell effect (the big get bigger) has shaped up nicely. Those in the middle are being forced to leave the playground.

Micro VCs and Online VCs: Alex Bangash of Rumson Advisors has counted as many as 400+ micro VC funds. “We have makings of a bubble” he said. A Palo Alto based LP told me that its a messy universe with no differentiators. Each one believes they are the prima donnas whey they lack basic differentiators. Another San Francisco based LP said they meet “as many as five micro-VCs” each week. As Andreessen once said, “You need a drivers license in California to drive a car or buy a gun. Not to become a venture capitalist.” Yet some micro VCs have demonstrated 5X Cash-on-Cash returns, including one trending at 14X. There is a small group of smart people who have nailed it on this side of the spectrum. Online models like Angelist continue to attract much attention as fundamental disruptors. I wrote about these trends in my previous post. This remains the most fascinating (and scary) part of our business.

Interestingly, in 2013, the NVCA completed a branding study to find that entrepreneurs are wary of “hands-on” VCs and only 5% care about VC fund’s current portfolio companies. Tch Tch ! So much for those fancy logos and tombstones. A lot of VC websites now have gotten rid of those and instead feature twenty-something millenial CEOs and not aging GP mugshots / tombstones. The branding exercises – “we are all about the entrepreneurs” have begun in earnest. The power has shifted back to the entrepreneurs (where it should have always been) and if this trend continues, I am hoping to see a “reverse-demo day”. Lets hope at the 2014 YC Summer batch, we see the GPs (sorry no junior associates please, this is YC…) get on stage, get three minutes to open with “I’ll invest in your pivot at $10m pre because……”

Venture Capital 2013 recap – Oh what a year it was….

There are bad years, so-so years and then there is 2013…its been a long time coming. In 2013, VCs finally took some pride in the 10-year returns which recovered to 7.8% as of Q2 2013. The battered egos have regained their mojo and the venture “asset” class is starting to look real once again. Even as fund managers (or GPs) whip up their fund raising documents, and get ready to pitch institutional investors (or LPs), a lot of strong foundational under-pinnings are at work.

Schumpeter’s forces of creative destruction: 2014 will be the year of investments in Bit-coins, Drones, Cyber-Security, Hardware /”Internet of Things” and even revival of healthcare IT. Rapid innovation, reduced hardware costs and government regulatory changes are driving new startup formation. Looking in the rear view mirror, the mobility wave started with the iPhone (2007) and iPad (2010). It took about six years to start reaping returns and rewards from this cloud, social, mobile ecosystem. The next five years will bring more changes and possibly better returns for VCs and LPs alike.

More exits on the horizon: Liquidity in 2014: 2013 liquidity via IPOs and M&A generated upwards of $14 billion. As many as 80% of exits value came from enterprise software. The fat 2014 pipeline has few elephants in the making as well. CB Insights identified 26 companies that have $1 billion valuation or more. Dropbox, Airbnb, Uber, Palantir and Square will bring in more liquidity and returns to the VCs. What more, there are over 590 companies with valuations of over $100 million or more. The top 15 tech exits in 2013, according to CB Insights created $18.5 billion of value on investment of only $471 million – with Emergence Capital leading the charge with a $4m investment in Veeva yielding $4 billion. Tableau (NEA) and Trusteer (US Venture Partners) are in the top three capital efficient exits. In 2014, more acquisitions are bound to occur, thanks to the cash-rich and hungry corporations. The top tech companies (see table) have upwards of $125 billion of cash sitting on their balance sheets. Those companies with higher cash changes will likely go shopping soon.

Yet LPs don’t want to dance: A seasoned investment advisor told me that “institutional LPs remain shy and slow to react.” Over some cheap unhealthy Chinese food, we shed our tears as those LPs miss out on the next technological wave. While in 1999-2000 every pension fund was stampeding into the dot-com craze, LPs poured in $100 billion in VC funds in one year! And now, even as the fundamentals are robust, we barely see $20 billion coming into VC each year.

And as Venky Ganesan of Menlo Ventures points out, (See “VC Value Creation”) the present day tech companies are going public at much higher valuations. Speaking at VCJ Alpha West, David Cowan of Bessemer Ventures said that the market dynamics are such that today VCs don’t bat an eyelid while investing at a $250 million premoney valuation. Ten years ago, that would have been an exit price for a company. The largest 2013 investment award goes to Google Ventures for plonking upwards of $250 million in Uber at a hefty $3.5 billion valuation. The #2 is Palantir, which raised $196 million. Others include Fab.com which gobbled up $150 million and Lyft ($60 million), which is now growing faster than Uber. The quality of companies (measured by revenues, paths to profitability or sustained growth potential) being listed on public markets remains very high, unlike that of the dot-come era vaporware.

But LPs are not impressed. As of Q3 2013, only $11 billion had been invested in venture capital. Yet in the first three quarters of 2013, VC exits generated $14 billion. LPs who understand “cash flow positive” will not be sitting along the sidelines. This combined with efficiency of secondary markets have minimized the “J Curve” challenges. LPs who grumble that the securities are locked up for long periods of time (and hence seek liquidity) may have a reason to smile.

In 2014,Andresseen-Horowitz, Kleiner-Perkins, Menlo Ventures, US Venture Partners, DFJ and 500 Startups will knock on LP doors as they get ready to raise new funds. On the other end of the spectrum, the micro-VC universe has exploded. This bar-bell effect (the big get bigger) has shaped up nicely. Those in the middle are being forced to leave the playground.

Micro VCs and Online VCs: Alex Bangash of Rumson Advisors has counted as many as 400+ micro VC funds. “We have makings of a bubble” he said. A Palo Alto based LP told me that its a messy universe with no differentiators. Each one believes they are the prima donnas whey they lack basic differentiators. Another San Francisco based LP said they meet “as many as five micro-VCs” each week. As Andreessen once said, “You need a drivers license in California to drive a car or buy a gun. Not to become a venture capitalist.” Yet some micro VCs have demonstrated 5X Cash-on-Cash returns, including one trending at 14X. There is a small group of smart people who have nailed it on this side of the spectrum. Online models like Angelist continue to attract much attention as fundamental disruptors. I wrote about these trends in my previous post. This remains the most fascinating (and scary) part of our business.

Interestingly, in 2013, the NVCA completed a branding study to find that entrepreneurs are wary of “hands-on” VCs and only 5% care about VC fund’s current portfolio companies. Tch Tch ! So much for those fancy logos and tombstones. A lot of VC websites now have gotten rid of those and instead feature twenty-something millenial CEOs and not aging GP mugshots / tombstones. The branding exercises – “we are all about the entrepreneurs” have begun in earnest. The power has shifted back to the entrepreneurs (where it should have always been) and if this trend continues, I am hoping to see a “reverse-demo day”. Lets hope at the 2014 YC Summer batch, we see the GPs (sorry no junior associates please, this is YC…) get on stage, get three minutes to open with “I’ll invest in your pivot at $10m pre because……”

October 2, 2013

How Software Is Eating Venture Capital

An entrepreneur I met recently has several Sand Hill Road venture capitalists (VCs) eating out of his hands. Having launched their product on Kickstarter, they are collecting in pre-orders at the rate of upwards of $20,000 a day. With $3 million in pre-orders at hand, VCs are begging to invest – or get in on this opportunity. The pre-money valuation has risen into the “obscene” category. Without Kickstarter, this company would have been laughed out of any VC meeting with a terse comment – “we don’t do hardware!” As Marc Andreessen correctly pointed out, software is eating the world. And now software is eating venture capital! Online portals like Angellist may have just begun nibbling at toes of Sand Hill road. VCs are burying their head in the sand (or silicon, depending on the geography).Foundry Group is one of the first VCs to look at this wave as an opportunity (as opposed to a threat) and have launched FG Angels syndicating investments via AngelList. Give such online marketplaces a few more years and it will reconfigure the VC landscape completely.

Introducing the Founder’s bitch: These days, entrepreneurs don’t need VCs as much as VC’s need entrepreneurs. AngelList processes as much as 500 introductions and moves $10 million each month. The amounts are small today but that’s how it started with online e-commerce purchases – small amounts build trust for larger transactions. First we bought books online, and now we are buying cars, flat screen TVs and more. Similar paths may emerge with investing. The VC, as a middleman is a species that seems to be in trouble. VCs take too long to make decisions and want to push too much money too soon into entrepreneur’s hands. Paul Graham of Y Combinator fame, speaking at PreMoney conference in San Francisco, said, “VC’s still need entrepreneur’s imagination and energy but the entrepreneurs don’t need their money as much. Investor’s make more money as founder’s bitches than their bosses.” Ouch!

It is WAS the network stupid: In writing “The Business of Venture Capital”, I had the opportunity to talk to several thoughtful LPs (Limited Partners, or those who invest in venture funds). All they cared about in VCs was the ability to source good investments. Can these VCs find the next Facebook? Chris “SuperLP” Douvos of VIAFunds remarked that he found sourcing to be a huge differentiator, “much more than what I was trained to see.” Yet sourcing was a function of clubby networks. Ten years ago, it was the network that mattered – you had to know the right VCs. Lip-Bu Tan, Chairman of Walden International, a $1.6 bn venture fund said that it takes a decade to break into the Tier-1 VC investor networks. Other VCs pointed out that the bay area is very network centric, and its very uncommon to find good startups if you don’t belong. VCs often bragged (and yet do) about proprietary relationships. All that may be a thing of the past, thanks to burgeoning online platforms.

Commitments into VC funds are down by 54%: LPs are fatigued by the VC jargon and overused terms – proprietary relationships being high up on the list. Former VC Chris Rizik manages Renaissance fund-of-funds. To VCs pitching him, he often asks, ”What is it about you that acts as a magnet to entrepreneurs?” If its just money, VCs are in trouble. According to the National VC Association (NVCA), U.S. venture capital firms raised $2.9 billion in the second quarter of 2013, a decrease of 33 percent compared to the level of dollar commitments raised during the first quarter of 2013. The dollar commitments raised during the second quarter of 2013 is a 54 percent decline from the levels raised during the comparable period in 2012 and marks the lowest quarter for venture capital fundraising, by dollars, since the third quarter of 2011.

From finding investments to managing the VC portfolio – the software worms are chomping all over: For the tall portfolio “value-add” claims VCs make, LPs often discount these statements. “I give a lot more importance to sourcing, a lot more than value-add claims” said Erik Lundberg, Chief Investment Officer of University of Michigan Endowment. Funds like Andreessen-Horowitz have now built an army of 75+ team members to serve their portfolio startups. First Round Capital has developed an online platform where its portfolio entrepreneurs can share learning lessons, intelligence (compensation, service providers, option pool size, hiring techniques) directly with each other.

With online investor marketplaces, software is disrupting the first step (or sourcing side) of venture capital, First Round is now pushing the envelope to the next step — using software tools to add portfolio value. The final frontier of exits remains to be tackled. And with the current pace, it’s just a matter of time when software will eat that too.

September 2, 2013

Starting This Labor Day, Can Men Learn To Lean In ?

At a recent demo day of an incubator / accelerator, the show of entrepreneurial prowess could not be better. Founder after founder walked up on stage, in 2.5 minutes and 5 slides, described how their startup will change the world. Thunderous applause and woohoos followed each pitch. Noticeably, the ratio of women founders was low – around 10% (or 5 of the 50 startups). Why didn’t we see more women founders? Is it lack of motivation?

What motivates founders: I found an interesting study in the book “The Founders Dilemma” by Professor Noam Wasserman of Harvard Business School. He presented data from 27,000 entrepreneurs and summarized the motivations of founders as follows:

Top motivations for male entrepreneurs (in 20s):

1) Power and Influence

2) Autonomy

3) Managing People

4) Financial Gain

Top motivations for women entrepreneurs (in 20s):

1) Autonomy

2) Power and Influence

3) Managing People

4) Altruism

The only difference between the genders = motivation for financial gain. Women were never in it for the money, and that seems as an evident starting point. In 30s and 40s, male motivations remained consistent across decades while for women, the only one motivation that changed was altruism (“variety” popped up in 30s and “intellectual challenge” in 40s).

So if 3 of 4 motivations are the same between men and women, why do only 1.3% VC backed startups have a female founder? The analog in the world of education would be – everyone aspires for a college degree but when you see the graduating class, its heavily skewed. What happened during the application process? What’s missing?

The Founders Chasm: I am tempted to believe in a crowded playground (essentially dominated by men), there is not much room. If we stop the jostling around and take a deep breath, we start to notice interesting trends. How many incubators and accelerators believe in encouraging women founders? This is particular hard when the incubators success is also measured by – you guessed it – financial gain. This becomes a self-perpetuating whirlpool of testosterone and money. And when most VCs are men, you can only exasperate the situation.

In a fascinating study called “Women at the Wheel: Do female executives drive start-up success?” (Sep 2012, Dow Jones Venture Source) the authors analyzed 25 years of historical data, from 20,000 VC backed companies between 1997-2011 which had over 150,000 executives. They found that only 1.3% of startups have a female founder, 6.5% has a female CEO and only 20% have one or more female executives.

Yes, women can make money too: According to the Dow Jones study, the overall median proportion of female executives in successful VC backed companies is more than 2X that of unsuccessful ones - 7.1%, compared to 3.1% at unsuccessful companies. Yet while women can be a part of success, they are often second-in-command. Notably, these companies had more females as VPs than C Levels: 15% VPs to 8% C Levels. The study summarizes that companies with an executive team composed of 5% to 25% female executives are successful. Is a “one in five” ratio enough? How does success scale when you have two in five?

The ratios are getting worse: In 2005, more than half = 59% startups had at least one female executive. In 2011, the number had dropped to an abysmal 24%. That’s three of four startups with no female executives. The ratios should have improved over time but startups were clearly a male dominated fraternity. By default, we take the easy way out and call someone who thinks, looks, acts like us – someone we know. A thoughtful mix of talent, gender and viewpoints is often not the case. But rather than beat the same drum, lets explore solutions – or how men can lean in.

As I mentioned in my earlier post, we don’t need more studies and data to prove the fact that women add immense value to startup ecosystem. What we need are bold men, willing to step up and proactively address the obvious:

(a) Can we men lean in? The short answer is not yet – you see, we men are terribly afraid of being perceived as weak, wussy or weepy. I’d rather fight and slay a giant dragon, jump off rooftops rather than be ridiculed by my mates in the locker room. Yet some VCs like Brad Feld (as chair of National Center for Women & Information Technology) have taken a bold stance and stepped up to the cause of gender diversity. Others are waiting in the wings – if someone steps up first, then the rest of them will. Interestingly, a study shows that most men start to think about gender diversity when their first daughter is born. This is not about being strong or weak – but about our future generations. Its being observant of our own shortcomings and being willing to see the possibilities. If we get to the pot of gold but miss a gorgeous rainbow along the way, what good is that?

(b) “Listen in” before you can “lean in”: As my wife often reminds me, you can listen better once you stop talking. I am guilty of that! And the same goes at the workplace – do we let our women colleagues speak often and speak enough? If not, how can we men remedy this? A Japanese colleague at my workplace would never say anything in our meetings. I asked him, ”How come you don’t contribute your ideas?” He smiled a Buddha-like smile and said, “I cannot fill water in a pot that pretends to be full.” Ouch – that hurt, but I made sure I asked for his views in every meeting after that!

(c) How to “lean in” better? If we want our daughters to be respected, rewarded and succeed in the workplace, we can start by watching the obvious datapoints:

i) What is the gender diversity ratio at your workplace? If its skewed, know that it may be a subconscious bias. Instead of blame, course correct – pay more attention to the female candidates. But you have to encourage women to apply.

ii) Women don’t apply for jobs unless they meet as much as 80% the criteria for a job position. And men apply when they barely meet 30% of the criteria. How does that impact your application screening and review process? (Note to women: It’s ok to apply when you are at 40%. That makes you 10% better than men  )

)

iii) Are women rewarded financially, and intellectually (as in – are their views invited, accepted and implemented?) as equals?

Sheryl Sandberg’s Lean In book downloads offer great insights on how to lean in.

My only regret is that no man in corporate America has stood up yet and declared, “We are going to Lean In.”

I believe startups can do this much more easily. After all, startups are all about solving big problems, changing the world and as a nice byproduct, getting to that pot of gold. Solving for gender diversity is a big, complex problem but has no pot of gold. Thus it’s ignored. Somewhat like climate change, it’s an infinite problem. It has no boundaries and no ownership. The onus of fixing it lies not with women. It lies with men.

Starting this Labor Day, can we men learn to Lean In ?

At a recent demo day of an incubator / accelerator, the show of entrepreneurial prowess could not be better. Founder after founder walked up on stage, in 2.5 minutes and 5 slides, described how their startup will change the world. Thunderous applause and woohoos followed each pitch. Noticeably, the ratio of women founders was low – around 10% (or 5 of the 50 startups). Why didn’t we see more women founders? Is it lack of motivation?

What motivates founders: I found an interesting study in the book “The Founders Dilemma” by Professor Noam Wasserman of Harvard Business School. He presented data from 27,000 entrepreneurs and summarized the motivations of founders as follows:

Top motivations for male entrepreneurs (in 20s):

1) Power and Influence

2) Autonomy

3) Managing People

4) Financial Gain

Top motivations for women entrepreneurs (in 20s):

1) Autonomy

2) Power and Influence

3) Managing People

4) Altruism

The only difference between the genders = motivation for financial gain. Women were never in it for the money, and that seems as an evident starting point. In 30s and 40s, male motivations remained consistent across decades while for women, the only one motivation that changed was altruism (“variety” popped up in 30s and “intellectual challenge” in 40s).

So if 3 of 4 motivations are the same between men and women, why do only 1.3% VC backed startups have a female founder? The analog in the world of education would be – everyone aspires for a college degree but when you see the graduating class, its heavily skewed. What happened during the application process? What’s missing?

The Founders Chasm: I am tempted to believe in a crowded playground (essentially dominated by men), there is not much room. If we stop the jostling around and take a deep breath, we start to notice interesting trends. How many incubators and accelerators believe in encouraging women founders? This is particular hard when the incubators success is also measured by – you guessed it – financial gain. This becomes a self-perpetuating whirlpool of testosterone and money. And when most VCs are men, you can only exasperate the situation.

In a fascinating study called “Women at the Wheel: Do female executives drive start-up success?” (Sep 2012, Dow Jones Venture Source) the authors analyzed 25 years of historical data, from 20,000 VC backed companies between 1997-2011 which had over 150,000 executives. They found that only 1.3% of startups have a female founder, 6.5% has a female CEO and only 20% have one or more female executives.

Yes, women can make money too: According to the Dow Jones study, the overall median proportion of female executives in successful VC backed companies is more than 2X that of unsuccessful ones - 7.1%, compared to 3.1% at unsuccessful companies. Yet while women can be a part of success, they are often second-in-command. Notably, these companies had more females as VPs than C Levels: 15% VPs to 8% C Levels. The study summarizes that companies with an executive team composed of 5% to 25% female executives are successful. Is a “one in five” ratio enough? How does success scale when you have two in five?

The ratios are getting worse: In 2005, more than half = 59% startups had at least one female executive. In 2011, the number had dropped to an abysmal 24%. That’s three of four startups with no female executives. The ratios improved over time but startups were clearly a male dominated fraternity. By default, we take the easy way out and call someone who thinks, looks, acts like us – someone we know. A thoughtful mix of talent, gender and viewpoints is often not the case. But rather than beat the same drum, lets explore solutions – or how men can lean in.

As I mentioned in my earlier post, we don’t need more studies and data to prove the fact that women add immense value to startup ecosystem. What we need are bold men, willing to step up and proactively address the obvious:

(a) Can we men lean in? The short answer is not yet – you see, we men are terribly afraid of being perceived as weak, wussy or weepy. I’d rather fight and slay a giant dragon, jump off rooftops rather than be ridiculed by my mates in the locker room. Yet some VCs like Brad Feld (as chair of National Center for Women & Information Technology) have taken a bold stance and stepped up to the cause of gender diversity. Others are waiting in the wings – if someone steps up first, then the rest of them will. Interestingly, a study shows that most men start to think about gender diversity when their first daughter is born. This is not about being strong or weak – but about our future generations. Its being observant of our own shortcomings and being willing to see the possibilities. If we get to the pot of gold but miss a gorgeous rainbow along the way, what good is that?

(b) “Listen in” before you can “lean in”: As my wife often reminds me, you can listen better once you stop talking. I am guilty of that! And the same goes at the workplace – do we let our women colleagues speak often and speak enough? If not, how can we men remedy this? A Japanese colleague at my workplace would never say anything in our meetings. I asked him, ”How come you don’t contribute your ideas?” He smiled a Buddha-like smile and said, “I cannot fill water in a pot that pretends to be full.” Ouch – that hurt, but I made sure I asked for his views in every meeting after that!

(c) How to “lean in” better? If we want our daughters to be respected, rewarded and succeed in the workplace, we can start by watching the obvious datapoints:

i) What is the gender diversity ratio at your workplace? If its skewed, know that it may be a subconscious bias. Instead of blame, course correct – pay more attention to the female candidates. But you have to encourage women to apply.

ii) Women don’t apply for jobs unless they meet as much as 80% the criteria for a job position. And men apply when they barely meet 30% of the criteria. How does that impact your application screening and review process? (Note to women: It’s ok to apply when you are at 40%. That makes you 10% better than men  )

)

iii) Are women rewarded financially, and intellectually (as in – are their views invited, accepted and implemented?) as equals?

Sheryl Sandberg’s Lean In book downloads offer great insights on how to lean in.

My only regret is that no man in corporate America has stood up yet and declared, “We are going to Lean In.”

I believe startups can do this much more easily. After all, startups are all about solving big problems, changing the world and as a nice byproduct, getting to that pot of gold. Solving for gender diversity is a big, complex problem but has no pot of gold. Thus it’s ignored. Somewhat like climate change, it’s an infinite problem. It has no boundaries and no ownership. The onus of fixing it lies not with women. It lies with men.

May 20, 2013

Forget Google Glass, I Want A Google Car

Google Glass may be cool. But a Google car? Now we’re talking. Most car companies of today can be compared to the PC hardware manufacturers. The fixed costs of manufacturing, price sensitivities and lack of differentiators have decimated the best. We know the fate of most of the PC Hardware players – they have vanished. And this “commodity” called car is already struggling with classic yet similar symptoms of darwinian impact – all that matters is price. Will the fate of car companies mimic the trajectory of hardware companies? As we peer in the looking glass (pun intended), only one company appears to have a firm grasp in developing the automotive OS – Google. With its driverless car, Google has a corner on this future market.

A product well past beta: The GOOG driverless car, equipped with LiDAR (that costs a steep $70K) can do almost everything a human can, and even better. It has navigated some of the most precarious streets (think Lombard Street in San Francisco), completed over 400,000 miles in test drives across most road conditions. YouTube videos show how the car self navigate across a four-way stop sign with pedestrians. Its nothing short of awesome. A year ago, this Google car drove a blind man to a drive-through restaurant and back. I am ready for this car – are you?

Think about the possibilities: Even as you get in the car, any morning, the car will know where I need to go (from my Google Calendar), alert me ahead of time if the freeway is congested (Google traffic), suggest alternate routes, even alert me of my favorite Blue Bottle Coffee when I am in the vicinity. My productivity during the drive time zooms, and I dont need to pay attention to auto-re routing. If my wife chooses not to drive, my daughter can be dropped off to school. The concept of a designated driver (for drunks and disabled alike) is liberating. Mother against Drunk Driving can declare victory and go home. Senior citizens struggling with parallel parking – sane drivers searching for parking – all of these change when the car’s OS takes over. Its like trying to find empty space in your harddrive to save a file – we just dont do that! The OS does that. Not to mention the 1.2 million lives lost in accidents. One last thing – we wont need a drivers license.

Will legislation slow this machine down? Nevada and California have passed legislation to allow driverless cars. Michigan has introduced this legislation as well. But what would be even more fun is when the government clears lanes for driver-less cars. The Economist reported that the aerodynamic effects of road trains offer scope for even greater environmental gains: a 1995 study by the University of Southern California showed that they can improve fuel efficiency by up to 30%. Wouldn’t it be cool if government were to designate lanes for driverless cars, similar to car-pool lanes?

The government is pushing the envelope on auto innovation but is it sufficient? The Brazil government wants all cars to transmit their make, model, registration number, age, fuel and engine power. This digital- mesh-activity is being tested at a larger scale in Ann Arbor, Michigan, where around 3000 cars have been fitted with two-way sensors to alert drivers: the ultimate goal being to provide a digital safety cocoon. I wrote in greater detail in MIT’s Technology Review about how Ford is attempting to become a open-platform for cars, but Google has a significant step up. If I were Ford, I’d be knocking doors at Google‘s Mountain View HQ, trying to licensing the driverless technology to make sure it does not wipe me out.

Sergey Brin, Google’s co-founder expects its autonomous driving system to be ready for the market in five years. If Google‘s bold actions are any indication, they will soon have flying cars (not hard to imagine, coupled with the developments in drones / UAV technologies). No software company or car company is thinking along these lines – case in point: Bill Gates quote in Wired magazine (April 2013) - “I feel sorry for Peter Thiel. Did he really want flying cars? Flying cars are not a very efficient way to move things from one point to another.” And I thought Bill Gates admired the Wright brothers for having made the most remarkbale invention of the 20th century.

In sharp contrast, Google Ventures often says, when asked about such bold moves that “we would rather see a smoking crater in the ground than a mediocre result.” Hallelujah to boldness in thought, action and innovation.

Forget Google Glass, I want a Google Car

Google Glass may be cool. But a Google car? Now we’re talking. Most car companies of today can be compared to the PC hardware manufacturers. The fixed costs of manufacturing, price sensitivities and lack of differentiators have decimated the best. We know the fate of most of the PC Hardware players – they have vanished. And this “commodity” called car is already struggling with classic yet similar symptoms of darwinian impact – all that matters is price. Will the fate of car companies mimic the trajectory of hardware companies? As we peer in the looking glass (pun intended), only one company appear to have a firm grasp in developing the automotive OS – Google. With its driverless car, Google has a corner on this future market.

A product well past beta: The GOOG driverless car, equipped with LiDAR (that costs a steep $70K) can do almost everything a human can, and even better. It has navigated some of the most precarious streets (think Lombard Street in San Francisco), completed over 400,000 miles in test drives across most road conditions. YouTube videos show how the car self navigate across a four-way stop sign with pedestrians. Its nothing short of awesome. A year ago, this Google car drove a blind man to a drive-through restaurant and back. I am ready for this car – are you?

Think about the possibilities: Even as you get in the car, any morning, the car will know where I need to go (from my Google Calendar), alert me ahead of time if the freeway is congested (Google traffic), suggest alternate routes, even alert me of my favorite Blue Bottle Coffee when I am in the vicinity. My productivity during the drive time zooms, and I dont need to pay attention to auto-re routing. If my wife chooses not to drive, my daughter can be dropped off to school. The concept of a designated driver (for drunks and disabled alike) is liberating. Mother against Drunk Driving can declare victory and go home. Senior citizens struggling with parallel parking – sane drivers searching for parking – all of these change when the car’s OS takes over. Its like trying to find empty space in your harddrive to save a file – we just dont do that! The OS does that. Not to mention the 1.2 million lives lost in accidents. One last thing – we wont need a drivers license.

Will legislation slow this machine down? Nevada and California have passed legislation to allow driverless cars. Michigan has introduced this legislation as well. But what would be even more fun is when the government clears lanes for driver-less cars. The Economist reported that the aerodynamic effects of road trains offer scope for even greater environmental gains: a 1995 study by the University of Southern California showed that they can improve fuel efficiency by up to 30%. Wouldn’t it be cool if government were to designate lanes for driverless cars, similar to car-pool lanes?

The government’s push for safety is pushing the envelope on auto innovation but is it sufficient? The Brazil government wants all cars to transmit their make, model, registration number, age, fuel and engine power. This digital- mesh-activity is being tested at a larger scale in Ann Arbor, Michigan, where around 3000 cars have been fitted with two-way sensors to alert drivers: the ultimate goal being to provide a digital safety cocoon. I wrote in greater detail in MIT’s Technology Review about how Ford is attempting to become a open-platform for cars, but Google has a significant step up. If I were Ford, I’d be knocking doors at Google‘s Mountain View HQ, trying to licensing the driverless technology to make sure it does not wipe me out.

Sergey Brin, Google’s co-founder expects its autonomous driving system to be ready for the market in five years. If Google‘s bold actions are any indication, they will soon have flying cars (not hard to imagine, coupled with the developments in drones / UAV technologies). No software company or car company is thinking along these lines – case in point: Bill Gates quote in Wired magazine (April 2013) - “I feel sorry for Peter Thiel. Did he really want flying cars? Flying cars are not a very efficient way to move things from one point to another.” And I thought Bill Gates admired the Wright brothers for having made the most remarkbale invention of the 20th century.

In sharp contrast, Google Ventures often says, when asked about such bold moves that “we would rather see a smoking crater in the ground than a mediocre result.” Hallelujah to boldness in thought, action and innovation.

January 21, 2013

On Startup Boards, Laziness And Bias Trounces Gender Diversity

Today, no woman is giving a spirited “I have a dream…” speech to founders and entrepreneurs, seeking a balanced startup board. Such issues are best left for public company boards, non-profits or the likes of girl-scout cookie boards. Because startup boards are formed in a hurry, we need to close that Series A round in a hurry, ship products in a hurry and sell the company in a hurry! Who has time for this diversity kumbaya? Dancing in moonlight? Nah…not me. I am busy making a dent in the world. Let someone else down the road worry about a gender-balanced board.

That’s what most founders will say. And its time we faced the truth – in the name of speed ( or fill in the blank lame excuse) , we are being utterly lazy and irresponsible to our own startups. Not to mention our customers, our stakeholders and society at large – indeed, as Dan Shapiro of Google says, to handicap yourself by 50% of the population is insanity.

Most VCs and most founders are men – therein lies the problem: We propagate this ‘ole boys’ network behavior subconsciously – its not by malicious design. We dont want to keep our better halves out of the mix. It’s just that we don’t try. Most startup boards are formed in a reactive fashion – raise money, and once you get a term sheet, a board of directors is formed. Brad Feld and I are writing a book, Startup Boards where we raise the fundamental question – can you proactively build an all-star, high performing board ? Its not easy. Some CEOs have done it. And you have to start with people first, then money. Wendy Lea, CEO of GetSatisfaction points out that “Most founders are men and most investors are men.” We agree, but once we know our biases, to not do anything about it is to be a part of the problem.

Consider this 20% bias – in surveys (“The Tilted Playing Field: Hidden Bias in Information Technology Workplaces,” 2011. Level Playing Field Institute) as many as 80% startup women (orange bar) think diversity offers better problem solving, improves innovation. Yet only 60% of the startup men (red bar) felt the same. On the flip side, 80% of men felt that they are addressing diversity at workplace but only 60% of women agreed. That 20% gap on both those counts reeks of male subconscious bias.

We don’t need any more “business cases”: Its insulting to say “we need a business case” when we are shutting out as much as half of our population. But for the left brainiacs, here are some data points from a recent National Center for Women & Information Technology NCWIT presentation :

Successful startups have 2X more women in senior positions (Source: Dow Jones Venture Source 2011)

Startup use 40% less capital when women lead, and have a higher probability of survival. Cindy Padnos of Illuminate Ventures has been the champion for women board executives. Look up her white paper on this subject. She says, “With less than 10% VCs being women, its a harder challenge. We have not even begun to think about diversity on startup boards.”

Higher women representation can bring as much as 34% higher ROI (Catalyst group research on gender diversity).

Credit Suisse Research Institute studied gender diversity in 2360 public companies and found several advantages – a 3X higher market cap where companies had more than 3 women board members, lower debt, higher ROE…its indicative of how superior performance is driven by balanced boards.

McKinsey has a whole set of publications on the gender diversity issue – all designed and developed with sufficient rigor and will put any Harvard MBA fratboy to shame.

Calling all brothers – we own this problem, we can solve it: With so many data points yet no meaningful outcomes, we must pause and ask – whats up, dude? Lets call all brogrammers, grab a beer, or watch a football game and yell whasssuppp one more time.

Then, lets take a pledge. Look into the mirror, raise your hand and say, It begins with me. I will create an open and a diversified culture in my startup. That will help my mother, daughter, sister, spouse, friend tomorrow. It will restore the much needed balance in the entrepreneurial ecosystem. There are a number of things women can do as well, but for now, lets try to fix our own backyard. Its our thinking that needs to change, to open up and to try harder. The NCWIT has created brochures to encourage women to join startups -make good use of it. And know that breaking in any network takes time. In “The Business of Venture Capital”, I interviewed Lip-Bu Tan, an Asian who became a VC and started Walden International. He recalled “It took me at least 10 / 15 years to break into the VC networks of the Silicon Valley”. Brad Feld and Amy write in their recent book Startup Life that it will be two decades before we see a change in the diversity ratios. That’s just way too long to let 50% of the population sit along the sidelines.

Solve, evolve: (No Binders required): Wendy Lea, CEO of GetSatisfaction says, “Its a sign of an evolved CEO who can balance the feminine and masculine energy – their startup will be a better place.’ Look, even Mitt Romney asked for help and got his “binders full of women”. Just make a proactive effort to attract the best and brightest talent on your board and ensure you have diversity of thought & experience. Its easy to stay in default “fratboy” mode. It takes more effort to be inclusive. In short, we are not as evolved as we think we are. Not as long as startup boards are male-dominated, biased, closed, myopic, self perpetuating networks.