Chris Termeer's Blog

July 12, 2013

Bitumen vs Heavy Crude Oil

This post is in response to a seeking alpha article on the conversation of bitumen and heavy crude oil. See Chris Termeer’s seeking alpha response and related article.

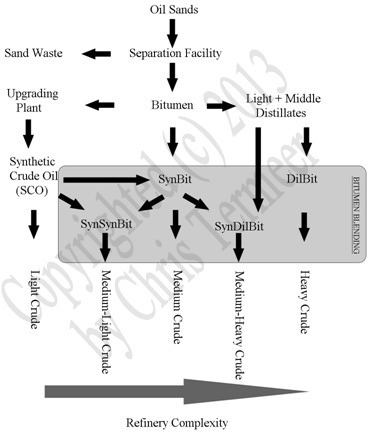

The image below is from the book Fundamentals of Investing in Oil and Gas and is copyrighted by Chris Termeer. All rights reserved.

bitumen vs heavy crude oil

Many people misunderstand Bitumen because it is found in nature along with being a byproduct of oil refining.

May 23, 2013

Cheaper Gasoline Prices Not Leading to Higher Spending

Current gasoline prices are cheaper this year, yet they are not leading to a huge increase in consumer spending according to a poll by Bankrate.com.

Around 80 percent of the 1,000 individuals polled by Bankrate said that they have not increased their spending as a response to declining gasoline prices today.

The prices at the pump continually increased for 34 consecutive days at the start of the year, then dropped through most parts of March and April. Since then, they have once again increased a little bit. But gasoline prices right now are still lower compared to last year. The most recent average price of unleaded gas is $3.62 per gallon, according to AAA. That rate is almost 10 cents below last year’s price during the same period.

The currently low prices of gasoline are being welcomed by economists as unintentional stimulus. A lot of people have said that lower gasoline may lessen the impact of the higher salary taxes that started at the beginning of the year.

However, gasoline prices may not have dropped enough to compensate for the decline in net pay, according to Greg McBride, the senior financial analyst of Bankrate.

In the last two years, studies conducted by Bankrate showed that the majority of Americans reduced discretionary buying because of increasing prices at the pump.

According to Mid-Atlantic AAA, motorists may expect to see lower prices during the Memorial Day Weekend, and the price reduction won’t end there.

AAA said that prices for the summer may be the cheapest since the recession ended.

May 20, 2013

U.S. Gasoline Prices Posting Unusual Trends

The average price of gasoline in the U.S. gained 11 cents per gallon over the last two weeks.

According to the recently released Lundberg Survey, the average gasoline prices today of regular gas, midgrade gas and premium gas are $3.66, $3.84 and $3.98 per gallon, respectively.

The price of diesel remained the same, at $3.93 per gallon.

Among the cities covered by the survey in the lower 48 U.S. states, the cheapest current gasoline price average is at Tucson, Arizona at $3.18 per gallon while the most expensive gas price is in Minneapolis, at $4.27 per gallon.

Specifically, in California, the cheapest average gasoline price is in Fresno at $3.94 per gallon. The most expensive is in San Francisco at $4.07 per gallon. The statewide average for each gallon of regular gas is 18 cents higher at $4.03 per gallon.

In the past seven days, several shocks have been seen at the pump by drivers in the country’s Midwest. Prices of gasoline in the Midwest, in states like Nebraska, Oklahoma, Minnesota, North Dakota, South Dakota and Kansas, surpass the rates of California. Indeed, prices of gasoline in these areas are not going unnoticed since they are not as high.

Other petroleum analysts have said that they have never seen these kinds of unusual trends in the price of gasoline happen all at one time, where rates at the pump are sharply rising in one area, dropping in another and staying the same in others. What is being seen at the pump at this time is rare.

May 16, 2013

Errors and Corrections – Fundamentals of Investing in Oil and Gas

Date: 5/16/2013

(1)

Chapter: Glossary

Page: 298

Nature of error:

Definition of unconventional oil and gas incorrect. Should read:

Any method of extracting hydrocarbons other than by drilling into subsurface formations which have favorable porosity and permeability. Included in this category are those sources which are only economically viable with the use of hydraulic fracturing or horizontal drilling.

(2)

Chapter: Glossary

Page: 298

Nature of error:

Definition of upstream sector incorrect. Should read:

The processes, facilities, personnel and infrastructure dedicated to the extraction of oil and gas from the ground. Included in this category are the exploration, drilling, completion, and production phases of an oil or gas well.

May 14, 2013

Crude Surplus Keeps Oil Prices Low

A surplus of crude from new North American sources is keeping the current oil prices low, according to the recent report of the International Energy Agency.

According to the agency, crude from Canada and conventional oil from other sources are transforming oil prices worldwide.

The effect on the per barrel oil prices of those fresh sources will be as important over the coming five years as the increasing demand in China was over the last 15, said the IEA.

The IEA anticipates crude flow from North America to rise daily by 3.9 million barrels between 2012 and 2018. That rate is about fifty percent of the total quantity of expected global output growth – 8.4 million barrels daily in that case.

Globally, the present daily oil consumption is around 90.6 million barrels. Within six years, that daily rate is expected to rise to 96.7 million barrels. However, the forecast of the IEA still sees inventories surpassing that, and the relative excess in supply will probably maintain lower prices, according to the group.

Even OPEC, which tries to maintain prices higher than a particular level by restricting supply, presently finds itself releasing more crude compared to its plans.

A recent report shows that OPEC’s crude output grew by 250,000 barrels a day in April, situating the group at a daily output of 30.5 million barrels daily. That is almost 500,000 million barrels more than the present OPEC goal of 30 million barrels daily.

In New York, the recent cost of the dominant oil contract shed 45 cents to $94.72 per barrel. Crude prices recently rose following U.S. data that showed a rebound in retail spending for the past month.

May 8, 2013

Oil Prices Fall Closer to $95

The current oil price declined to closer to $95 per barrel as investors weighed an increase in the trade data of China against anticipations of another rise in the crude supplies of the United States.

On the New York Mercantile Exchange, the U.S. benchmark crude for delivery in June was lower by 17 cents to $95.45 per barrel. The contract shed 54 cents to end at a crude price per barrel of $95.62 during the previous trading day.

According to China, its April exports grew 14.7 percent compared to the previous year, while its imports increased 16.8 percent. The two figures signified an increase in growth versus the month of March.

The figures signify an improvement in the economic growth of China following an unexpected fall to 7.7 percent during the first quarter of the year from the 7.9 percent of the previous quarter.

The U.S. Energy Department will soon release its weekly data on the crude supplies of the United States. Analysts polled by Platts anticipate a supply rise of 1.9 million barrels during the week that ended on the 3rd of May.

On London’s ICE Futures Exchange, Brent, the benchmark used to assign prices to international oil types, was 65 cents lower to $103.75 a barrel.

In other NNYMEX trading, wholesale gasoline shed 2.04 cents to a price of $2.813 per gallon. Heating oil moved 2.01 cents lower to a price of $2.9076 per gallon. While the cost of natural gas moved 1.8 cents higher to $3.938 per thousand cubic feet.

By: Chris Termeer

May 6, 2013

Chariot Undeterred by Drilling Misses in Namibia

UK’s Chariot Oil and Gas Limited is still unable to strike commercially viable oil finds in Namibia despite years of exploration. But Larry Bottomley, CEO of Chariot, said that they are analyzing technical data from unproductive oil wells and are using these to help pinpoint possible productive fields worthy of oil exploration.

About six years ago, explorers struck significant oil finds in Namibia’s Tupi region. This discovery has led a good number of oil drillers to believe that the country’s coastal shelf holds oil reserves comparable to that of Brazil’s. Chariot and two other oil firms even managed to invest in oil exploration in the region but, to this date, no significant finds have yet been reported.

Bottomley, however, isn’t giving up easily on Namibia. He said that, while there are no substantial discoveries of hydrocarbon buildup in the region, oil drilling and exploration in the area hasn’t peaked either.

He said that all that is needed is a single viable find and, with the help of research and analysis, a string of discoveries could be underway.

He was pleased to add that they have pinpointed a possible oil hot spot in the south of Namibia, but they will have to further analyze data before moving on to site potential drilling locations. He disclosed that there are about 11 oil wells drilled in the country, with another 3 or 4 to be drilled by two other oil companies within the near term.

He mentioned that the successes within the Gulf of Mexico and the North Sea didn’t come easy either. Huge discoveries came only after more than 20 oil wells had been drilled for each of these two regions. In the case of Namibia, oil drilling stats are still a far cry from this number.

Aside from those in Namibia, Chariot also operates oil wells in Morocco and Mauritania. With the rise in crude oil prices over the past four years, the company has seized the opportunity to ramp up oil investment and exploration. It is undeterred by the recent slide in crude prices and remains optimistic regarding its oil exploration projects.

By: Chris Termeer

May 1, 2013

Irish Oil Basins May Sustain Local Demand

Ireland may be importing all of its oil requirements at the moment, but with six oil basins lined up for exploration and development, the country may soon wean itself from foreign oil dependence by at least 70 percent.

This positive news was disclosed by Tony O’Reilly, Providence Resources CEO. He said that the country could become a significant oil and gas producer and that Providence aims to make this a reality through major investments in oil exploration in the country. Eventually, he hopes to see a revitalized oil and gas industry for Ireland.

In the days ahead, Providence and its partners will explore another well located in the southern part of the country. Eni, Exxon, Repsol, and Providence have teamed up for this project.

The company expects to extract about one-third of the estimated barrels of oil believed to be locked in basins at County Cork. Roughly, that would be around 350 million oil barrels, O’Reilly said. This volume merely comes from one out of the six basins that they will be tapping.

Further, while this volume may not be huge in the eyes of a major oil producer like the U.S., it is a breakthrough for a country like Ireland where the population is a roughly 6.3 million. By comparison, the U.S. Bakken formation is believed to carry a hefty 18 billion barrels of crude oil.

At present, the country relies exclusively on imported oil, and oil demand is placed at 140,000 bpd. If the Cork basin could indeed supply a calculated volume of 100,000 bpd, a big chunk of Ireland’s consumption can be sustained by locally sourced oil. Now, 40,000 bpd of oil imports, from a previous 140,000 bpd, is definitely a substantial cut if Providence’s targets are indeed realized.

These are welcome scenarios for Ireland, which was beset with financial woes along with its European neighbors. With its oil-rich basins ready to be tapped and the presence of oil majors collaborating to invest in oil exploration in the area, Ireland’s road to recovery may not be too far ahead.

By: Chris Termeer

April 27, 2013

Preview Fundamentals of Investing in Oil and Gas

April 26, 2013

Gasoline Price Spike in Chicago Attributed to Floods

The price of gasoline in Chicago has been going up and down over the last several weeks. But the gasoline price today is on the rise. Yet, analysts do not expect the current increase to last very long.

The spike in the current gasoline prices is being attributed to the floods in the past week, according to Beth Mosher, spokeswoman of AAA in Chicago.

Mosher highlighted that the prices of regular unleaded gas on the same day last week across the area was averaging $3.82 per gallon. But prices right now are higher, at an average of almost $4.14 per gallon. Last month, the average price of gasoline in the area was about $4.00 per gallon.

Mosher said that floods are really the reason for the currently high level of gasoline prices. She explained that the flooding caused concerns regarding production of gasoline in the Joliet and Whiting refineries. She also said that factors that may not cause prices to rise in other regions would certainly push prices higher in Chicago.

According to the spokeswoman, the rise is considered to be temporary and it is expected to reverse soon.

Prices in some Midwest areas that have been affected by the floods have begun to decline already, said Mosher. Prior to the floods, prices were a little low in Chicago, which is why everyone is hoping that it will return to that level very soon, added the spokeswoman.

Last year, the prices in Chicago were higher by 8 cents per gallon compared to its current price.

By: Chris Termeer