The Prep Few Ever Consider…

Being Prepared

Being PreparedBeing “prepared” can mean many things to many different people. Traditionally, a lot of us consider ourselves relatively well prepared if we have a viable survival plan, and if we address what I call the Core Survival Elements (CSE) – food, water, 1st aid & medication, security & self-defense, hygiene & sanitation and knowing when to stay put, and when to get out fast. These are the absolute basics, but also a great start.

In the real-world however, we are often faced with many threats that can’t be addressed with traditional survival knowledge, skills and supplies. These risks are very real and can financially decimate an individual, and their family, just as much as a natural or man-made disaster. To really be prepared, we must expand our narrow definition of “survival” to include as many of these other exposures as possible. One really big area, that few people even consider until it’s too late, is financial security. Here’s a recent example of just how vulnerable we really are.

The Breach

Sometime between mid-May and July 2017, hackers successfully attacked and infiltrated Equifax. This breach exposed the personal, and highly sensitive information of 145.5 million U.S. consumers. (Not a typo) Or roughly one half of the U.S. population. Equifax officials did not report the breach to the public until September 7, 2017. (Three senior Equifax executives sold company shares worth $1.8 million just days after Equifax discovered the breach, but before it was disclosed to the public.)

Equifax CEO, Richard F. Smith, who would later testify before a House subcommittee, claiming that the breach was …”a mistake by a single employee.” Ironically, in March 2017, the Department of Homeland Security had sent Equifax an alert about a critical software vulnerability that Equifax was using in an online portal. Equifax failed to act on this warning.

Mr. Smith did repeatedly apologize to members of the House and the American public, and although he was not at all clear on just how consumers would be compensated, Equifax did offer one-year of “free” credit monitoring to all consumers who were harmed. (After the first year these affected consumers would have to pay for the service.)

Credit bureaus, like Equifax for example, offer all sorts of services to consumers – identity theft protection, fraud prevention, credit monitoring, etc. All of these services come at a cost to the consumer and have become increasingly popular as the risk of fraud and identity theft continues to raise. These services also represent an expanding and very lucrative revenue stream for these companies. It seems that every data breach increases the potential client base for these services. Just one more thing to consider.

Bottom Line For Consumers

At the end of the day, Equifax will probably get a slap on the wrist, they will maybe pay a relatively small fine, and will eventually settle any pending litigation. The members of Congress will report to the American public, that justice has been done, and life will go on. Until the next time.

The focus of this article, however, is centered around what the average consumer can do to protect themselves (as much as is possible and practical.)

Criminals steal sensitive, personal consumer information so that they can use it to commit financial fraud – getting a loan, opening a bank account or filing a fraudulent tax return to claim your refund. With your personal information, criminals could do practically anything a consumer with good credit could do. When consumers become victims of ID fraud, they may not find out about it right away. When they do discover the fraud, it may take years and a great deal of time and effort to correct the problem(s), fix their credit, and get a possible refund of the monies lost. All in all, ID theft can become a lingering nightmare that in many instances will never go away completely.

No Easy Fix

For the average consumer there are no easy fixes. There are, however, some possible tools to help get some level of protection. This list is by no means complete, but it’s meant to get you started on the right path. Here are some ideas to consider.

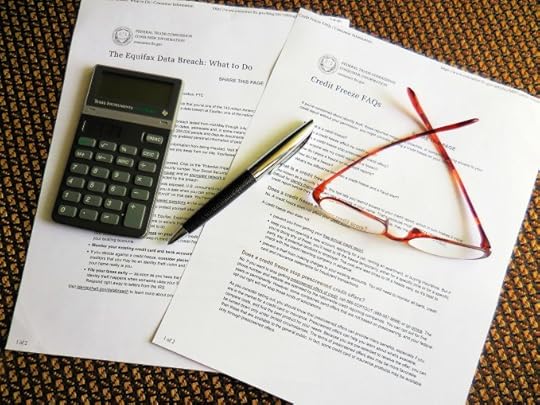

Freeze your Credit. A credit freeze, or security freeze restricts access to your credit report, making it more difficult for criminals to use your personal information to apply for credit. This is by no means a guarantee, but it’s an effective tool. There are costs, but it’s the best money you will ever spend if it brings you peace of mind. To learn more visit the Federal Trade Commission Web Site https://www.consumer.ftc.gov/articles/0497-credit-freeze-faqs

Monitor all your accounts, bank statements, credit statements and other financial account every month. Here are some other suggestions from the Federal Trade Commission Web Site – https://www.consumer.ftc.gov/topics/privacy-identity-online-security

Limit the number of accounts you maintain. The fewer accounts you have, the less there is to monitor.

Guard your personal information. There are lots of situations where you will be asked to provide all of your personal information, including your social security number. Next time just say no, and see what happens. In my experience, they usually won’t press the issue. (Personally, I can’t remember my social security number, and I certainly don’t carry my card in my wallet. You get the idea.) Also shred all papers/documents containing personal information before discarding.

Wrap-up

As with most other things in life, the majority of the population will usually not even consider a potential threat until something really bad happens and they are forced to confront it. A large part of the preparedness mindset is to anticipate potential threats, and to take appropriate steps and precautions to guard against becoming a victim. Legal and financial preparations require time, effort and in some instances money. But, prevention or at least mitigation, will always be better than dealing with the aftermath of a disaster, yes even a financial disaster.

Identity theft and fraud will never go away completely, but when the very companies that we entrust to maintain and safeguard our most sensitive and personal information start becoming part of the problem, it’s time for consumers to start seriously considering what they can do to protect themselves.

DISCLAIMER

No Attorney-client relationship is created by the use of the information in this publication. The general material provided is for informational purposes only, and is not, nor is it intended to provide legal and/or financial advice. The reader should consult with an appropriate professional in their particular jurisdiction regarding their individual situation. Any use of the general information contained in this article shall be solely at the reader’s risk.

Sources:

https://www.nytimes.com/2017/10/03/business/equifax-congress-data-breach.html

https://www.consumer.ftc.gov/blog/2017/09/equifax-data-breach-what-do

https://www.consumer.ftc.gov/articles/0497-credit-freeze-faqs

The post The Prep Few Ever Consider… appeared first on Quick Start Survival.