#51 – The Franchise Fan

Nick Train is a seriously thoughtful growth investor with a highly impressive 40 year track record. He invests in eternal franchises and takes a 20 year view. He says his ideal holding period is forever. He was early to recognise that high quality consumer brands were great investments and accordingly his funds significantly outperformed their benchmarks. More recently, the last five years have been less kind and performance has lagged somewhat with weak performance from some of his biggest holdings, notably Diageo, which is down almost 50% from its peak, in a market which has gone up.

Nick has taken this performance to heart and he explains why he has stuck with Diageo and continues to believe it’s as “forever” stock. He also explains his change in strategy to favouring 21st century asset light digital data plays which he sees as even more valuable than his old favourite consumer brands. He is particularly impressed with Rightmove, which I have described in the past as akin to a UK Zillow, and explains his rationale, as well as his enthusiasm for LSEG, RELX and Unilever.

Some takeawaysGetting into InvestingOur guests have split into almost equal groups; one half bought their first stock when they were 12 with money from a newspaper round and the other half ended up in investing purely by chance, after graduating from university, or after taking a finance class at university. Nick was refreshingly candid – with a history degree, investment management seemed like the most lucrative choice.

CareerNick has always been passionate about developing a long term track record and would have stayed at GT Management, his first employer, had circumstances been different. But GT was acquired and he chose to move to M&G. When M&G was acquired, having had two roles shot out from under him, he decided to set up Lindsell Train in 2002 with partner Michael Lindsell, to ensure that wouldn’t happen again.

Investment PhilosophyNick’s favourite holding period is forever, a trick he learned from Warren Buffett, and he seeks “eternal franchises” – stocks where he can lock the money away for 20 years and knows if he never looked at them in the interim, they would be worth considerably more. He is attracted to the concept of long histories of revenue growth and margin progression. Companies with such characteristics are rare and he wants to hold on to them, describing himself as a “hoarder of precious things”.

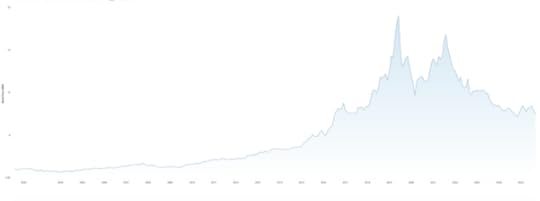

PerformanceNick Train runs a number of funds and this is probably not entirely representative, but I used the Lindsell Train Investment Trust to illustrate the ups and downs of running a concentrated portfolio. The share price peaked in mid-2019 at 1875p then had another rally but has been dismal since, as can be seen in the chart:

Lindsell Train Investment Trust Stock Price

Source: AlphaSense

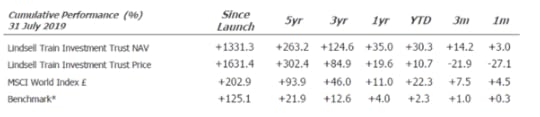

The relative performance at around that point was fantastic, although part of the gain was down to the trust trading at a premium to the asset value:

Lindsell Train Investment Trust Performance

Source: Company

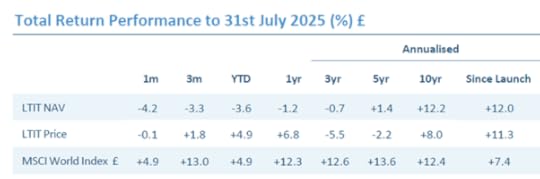

Here is the same data from the latest factsheet:

Lindsell Train Investment Trust Performance

Source: Company

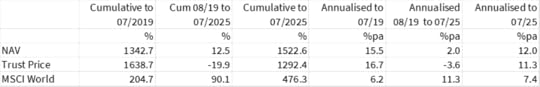

There has been a sharp reversal, partly a reflection of the quoted trust moving from a premium to a discount and partly a fade in relative performance. The move to annualised data is a little confusing so here is the like for like, as provided by the company, as they disagreed with my calculations, although their data is slightly different:

Lindsell Train Investment Trust Performance

Source: Company

The expression “a game of two halves” comes to mind. The trust’s performance has clearly lagged and has been way behind its past record, but this has been exacerbated by a move from a premium to NAV to a discount. Part of the lag is the valuation ascribed to the fund management business which has seen a significant decline in profits as funds under management have fallen by around a third.

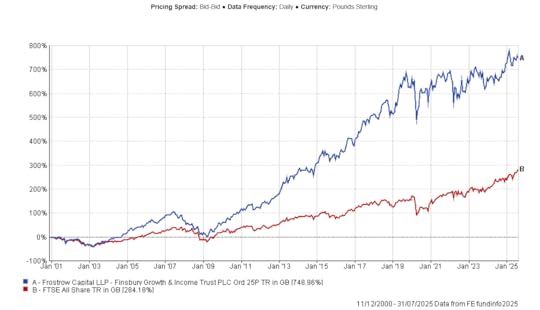

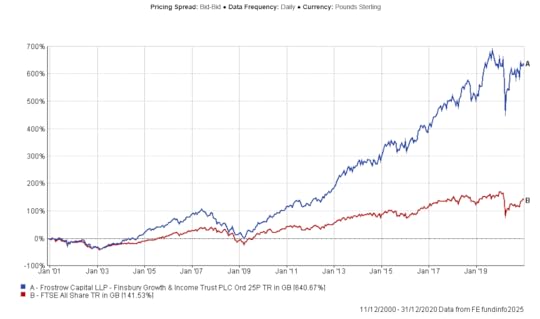

This is clearer and cleaner if one looks at the Finsbury Growth and Income Trust. Here is the chart from inception to 2025 and these charts use the UK benchmark:

And here is the performance to end-202 – stellar vs the index:

And here is the more recent performance from 2021 to July 2025, a significant underperformance:

Steve pitched the podcast to Nick at a conference where he had presented but Nick was unenthusiastic. Steve persisted, contacting Nick’s marketing team and one day out of the blue his PR agency emailed to say that Nick had agreed to come on the podcast. It seems that Nick doesn’t like the interview experience and probably thinks there are better things he can do with his time, but inevitably, when you are underperforming, there is a pressure to explain and keep investors onside. It’s a shame that Nick avoids the publicity as he is incredibly thoughtful about his investing process and we can all earn a lot from that, but at least he agreed to be interviewed this time.

About Nick TrainNick Train began his career as an Investment Manager at GT Management in 1981, after graduating from Oxford with a Modern History degree. He left GT in June 1998, after 17 years, on its acquisition by INVESCO. He joined M&G in September 1998, as a Director of M&G Investment Management. In June 1999 he was appointed as Head of Global Equities at M&G. He left M&G in April 2000 to co-found Lindsell Train Limited. He is investment adviser to the Worshipful Company of Saddlers.

Nick recommended The Warren Buffett Way by Robert Hagstrom which he found influential, although he cautioned that it’s quite an old book. Steve has enjoyed the book also. In the podcast, Nick referred to the book, Investing, The Last Liberal Art, which he thought might have been written by Michael Mauboussin. It was in fact also written by Robert Hagstrom.

/*! elementor - v3.22.0 - 24-06-2024 */.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=".svg"]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block} Buy on amazon Contents Transcript

Buy on amazon Contents TranscriptPrev#50 – The Art Lover

The post #51 – The Franchise Fan appeared first on Behind The Balance Sheet.