Bucket Shops Redux: If You Can’t Beat ‘Em, Join ‘Em

Odd Lots was in Chicago last week, and after interviewing Don Wilson they interviewed CME CEO Terry Duffy. The interview was posted today.

CME's Terry Duffy touts its partnership with FanDuel. What CME will offer is basically what bucket shops offered back in the day. The irony is that back then bucket shops were the betes noire of exchanges. https://t.co/Z34P89KDJZ

— streetwiseprof (@streetwiseprof) October 2, 2025

I’ll get to the FanDuel tie-up in a bit, but first I want to discuss something else that came up–perpetual futures, which are a hot topic now (even though hot topic is not punk rock). Duffy cast doubt on the feasibility of perpetual futures in most CME products–he mentioned ags specifically. I agree with his conclusion but not his reasoning.

Duffy argues that perpfuts can’t work for commodities because they don’t fit the legal definition of a futures contract, which involves pricing something for delivery at a later date. He also argues that it can’t work for deliverables.

Maybe perfuts check the legal box, maybe they don’t. Twirling my Oliver Wendell Holmes-esque mustache, I could come up with a clever legal argument that based on the way perpfuts work, they are pricing a commodity at the time of the next marking-to-market, say an hour from now. Or a minute from now. Which would be in the future, either way.

And that marking-to-market is the real reason commodity perpfuts won’t work. Take the case of Bitcoin. Bitcoin perpetuals involve periodic (usually hourly) “funding payments” based on the difference between the futures price and the reference spot price taken from an exchange like Coinbase or Bitstamp. Basically cash settlement on an hourly frequency. But the contract remains live after each settlement.

So basically, a perpfut it is a perpetually (automatically) rolling cash-settled one hour futures contract. The advantages of the future over trading the spot are (a) embedded leverage, often 100-to-1, and (b) the ability to short without borrowing the underlying. Perpfuts are like trading spot, but with leverage.

This works for things for which there is a liquid reference spot market. Bitcoin and some other cryptos have that.

You could do this with say the S&P 500 because there is a large, liquid, continuously traded, transparent cash/spot market. You could do it with currencies, and via its FX Spot+ (“Rolling spot”) contract, the CME (via its EBS subsidiary) is doing just that.

You can’t do it with most commodities because there are no liquid, continuously traded, transparent cash/spot markets. Not in grains. Not in oil or other energy products (with the possible exceptions of natural gas and power). Not likely in precious metals–there is RTC trading in gold, but it is bilateral and there is no transparent pricing. Maybe you could do it with LME non-ferrous metals, because of their unique “cash” pricing mechanism.

So it’s not legal obstacles or deliverability that preclude perpetual futures in most (if not all) physical commodities. It’s the lack of a reliable spot pricing mechanism that can tie the futures and cash/spot prices together as perps are intended to do.

This is basically a special case of why I have ridiculed proposals for cash settlement in commodities for over 30 years. It’s only that the problem is even more pronounced for perpfuts because you need to observe spot prices with metronomic regularity every day, not just around contract expirations.

Turning to CME and FanDuel, my X post basically says it all. It is hilarious to me that CME is offering “event contracts” that are indistinguishable from the kinds of bets one could make on bucket shops back in the bad old days. Duffy describes contracts like “will the price of gold be above X an hour from now?” (NB: if that’s a futures contract, as Duffy claims it is, then perpfuts are no different: see above). The contracts would be “digital” (i.e, have a fixed positive payoff if the event happens, zero payoff if it doesn’t).

Well, that’s exactly the kind of thing bucket shops traded back in the day. (0dte options, which are also a thing now on many exchanges, are also very similar to old-school bucket shot bets). Exactly like them.

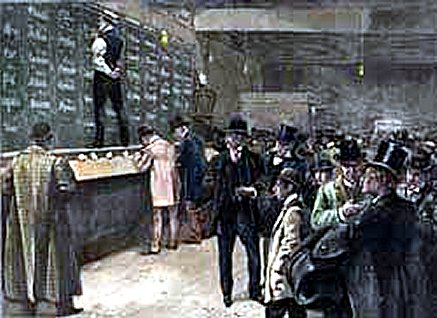

That’s an 1892 painting of a bucketshop. Note the use of the high tech chalkboard app.

So why hilarious? Because exchanges waged war on bucket shops for decades in the late-19th and early-20th centuries. A journal article provides some color:

On the morning of August 29, 1887, Abner Wright, president of the Chicago Board of Trade, forcibly removed the instruments of the Postal Telegraph and the Baltimore and Ohio Telegraph companies from the floor of the exchange, literally throwing their equipment out of the building. A few months later, on the night of December 15, Wright discovered some mysterious electrical cables leading out of the basement of the exchange building. Thinking that they were telegraph lines, he ordered them cut with an axe. Instead, they were cables connecting the building to the police and fire departments.1 His desire to sever the Board of Trade’s telegraph connections might seem surprising, since the telegraph network was indispensable to the operations of the major stock and commodity exchanges.

That’s why the CME’s current move is hilarious. If you can’t beat ’em, join ’em.

I’m not censorious of bucket shops per se. People gonna gamble. The CBOT’s (and NYSE’s and other exchanges’) ire reflected not a moral judgment, but a dislike of competition. (Yes you can make arguments like Mulherin, Netter and Overdahl that the shops free rode on the price discovery of exchanges, and that impaired liquidity. But as I’ve shown in my academic work, this “free riding” can actually enhance efficiency if exchanges have market power, which they almost certainly do).

Exchanges today almost certainly realize that they can’t drive bucket shops, excuse me, betting apps, out of business: Terry Duffy can’t forcibly remove their equipment, a la his distant predecessor Abner Wright. So the best alternative is to get in the game with them.

Perfectly reasonable commercial strategy, but a deeply ironic one.

Craig Pirrong's Blog

- Craig Pirrong's profile

- 2 followers