AI and Server Lives

I don’t know whether to be amazed or amused by the amount being written about the hyperscalers’ capex and depreciation. I wrote about this (for the second time) in my Substack in February, 2024 and nobody was interested.

Indeed hardly anyone was interested a month ago when I wrote a third article Amazon’s AI Reality Check, published on November 2, 2025. But since Michael Burry posted the tweet below, there has been an explosion of interest in the subject:

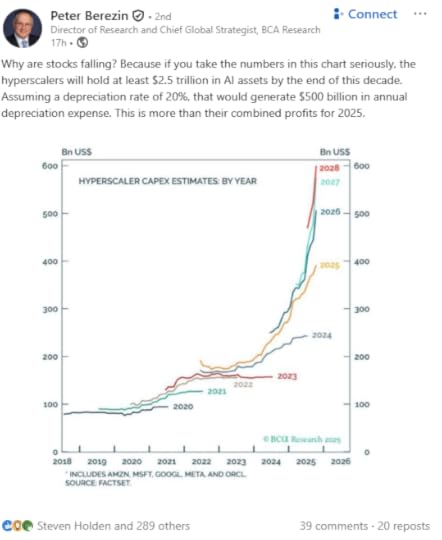

Indeed, since this tweet (no, he isn’t one of my subscribers), I am seeing commentary everywhere. Here is one example from LinkedIN:

I don’t know Peter Berezin and I used to respect BCA and was a client. But my good friends who are strategists rarely delve into the murky waters of accounting. There is a good reason – it’s often not as simple as it looks.

The chart above is titled Hyperscaler Capex Estimates by Year. I suspect it’s a chart of cumulative quarterly capex for the group. By 2028, that reaches $600bn.

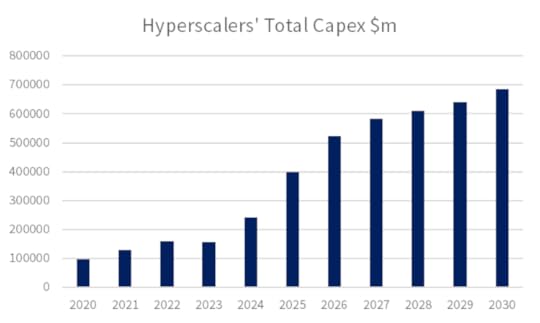

This is consistent with the consensus capex estimates from AlphaSense which puts the total capex for the 5 companies at $610bn. But this also includes non-AI assets. These companies all have real businesses which believe it or not have real assets that require investment. Their total spend ins shown in the chart below:

Total Capex with Consensus Estimates

Source: Behind the Balance Sheet from AlphaSense Data

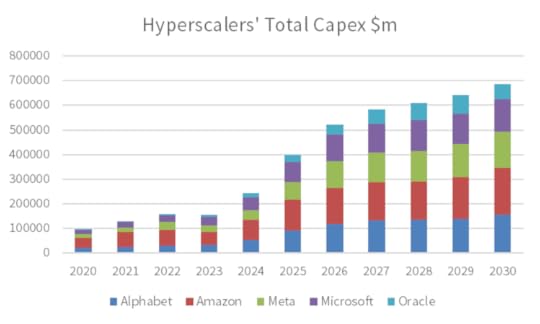

Here is the same data, broken down by company:

Companies’ Total Capex & Consensus Estimates

Source: Behind the Balance Sheet from AlphaSense Data

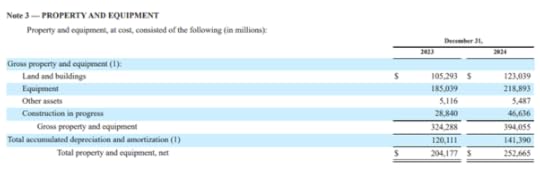

This is total capex (which for Amazon in the past included quite a significant amount of lease finance so it actually understates the total investment in assets). It includes ALL assets. For context, here is the Amazon fixed assets note for 2024:

Amazon Fixed Assets Note 2024

Source: Amazon 2024 10-K

Amazon spent $83bn of cash on fixed assets last year. It disposed of some assets and received incentives (mainly from local municipalities) of just over $5bn, making a net $78bn. Its gross PP&E increased by $70bn, from $324bn to $394bn, after disposals; US GAAP, unlike IFRS, does not require an analysis of the movements. Of that $70bn net increase, land and buildings were over 25% at $18bn and likely some of the $16bn increase in assets under construction are also buildings.

Equipment increased by $34bn, and some of that will certainly be trucks and vans and possibly even some aircraft. Amazon’s spend on AI was likely not even half its investment last year.

The author thinks that:

“hyperscalers will hold at least $2.5 trillion in AI assets by the end of this decade. Assuming a depreciation rate of 20%, that would generate $500 billion in annual depreciation expense”.

Even assuming the asset numbers were accurate – which they aren’t – a cumulative spend of $2.5bn would not result in depreciation of $0.5tn at a depreciation rate of 20%. As I explained in my last article, the only company which uses a depreciation rate of 20% is Amazon; it uses 5 years, Meta uses 5.5 years and the rest use 6 years.

By 2030, any assets purchased before 2025 will be fully depreciated. You cannot simply add up the capital expenditure and divide by 5. And of course if you are adding total capex, including land and buildings, the actual depreciation will be considerably lower, as buildings usually last quite a long time – Amazon uses 40 years which is quite conservative.

So don’t believe everything you read about this, even from strategists from respected firms. A proliferation of LinkedIN commentators seem desperate to jump on any bandwagon which will get them views.

I should also add that the 5-6 year life is probably fine for basic servers which are storing your iCloud photographs and similar, but the life of an AI server is likely much shorter – particularly one used for training, but probably also for inference.

The best way to illustrate this is a simple analogy. Think of a car – I live in central London and cannot cope with the 20mph speed limit, so I rarely drive. My cars have not done over 3,000 miles in a year for several years. Think of a sales rep’s car, which is doing 35-40,000 miles a year.

The AI servers are like the sales rep’s car, working flat out 24 hours per day, getting very hot. They will be worn out in 2-3 years. They will still be useful then for storing photographs or data but they will not be capable of the training tasks and will need to be replaced.

They may have another few years’ life in the lesser role, but they should be more or less fully depreciated at the conversion point, because the revenue generated from storing data will be insufficient to pay for the cost of the chip.

Of course the revenue generated by AI is also insufficient, but that’s a separate problem.

The hyperscalers should be depreciating using a reducing balance methodology so that a greater cost is charged in the earlier years. Given that the companies have mainly been extending the life of their servers, to boost their earnings progression, we perhaps shouldn’t expect them to worry about subtleties like this. But investors should – it’s important to understand the real economics of the business.

Burry’s estimate of $176bn overstatement of earnings 2026-28 is c.$60bn pa. These businesses will invest c.$1.7tn over that period or c.$570bn pa. That compares with a total capex of c$160bn pa before the launch of Chat GPT. That’s a c.$400bn pa difference.

If that were all on AI, let’s say 70% would be on chips or c.$280nbn pa. Depreciated over 5 years, that would be $56bn. Depreciated over 2.5 years, it would be $112bn pa. Over 3 years, the difference is $178bn. My guess is that Burry has arrived at his estimate on a similar basis, but his will certainly be more rigorous than my back of the envelope calculations.

I took 30 minutes to do these calculations and write this. It was meant to be a back of the envelope calculation which I would post on LinkedIN to refute the argument in the post above. But LinkedIN doesn’t like longer posts with images so I decided to post this on my blog instead.

I stress that I have just jotted down a few quick thoughts and haven’t done a great deal of work on the under-depreciation impact, and I am looking forward to hearing more from Michael Burry.

If you enjoyed this post, check out my Substack.

You may also like our online courses. And check out our new app on understanding business quality.

The post AI and Server Lives appeared first on Behind The Balance Sheet.