Brian Romanchuk's Blog

November 21, 2025

EU5 And Economics Part II: Inflation And The Fall Of The Roman Empire

This article is a part of a series that resulted from some observations about the economic modelling in the strategy video game Europa Universalis 5 (EU5). That game allows you to take over the leadership of one of the very many political organisations that existed in 1337 and steer it into the following centuries (the game timeline ends in the 1800s). However, in order to understand the economic situation in 1837 in Western Europe, you need to understand how Western Europe evolved out of the W...

This article is a part of a series that resulted from some observations about the economic modelling in the strategy video game Europa Universalis 5 (EU5). That game allows you to take over the leadership of one of the very many political organisations that existed in 1337 and steer it into the following centuries (the game timeline ends in the 1800s). However, in order to understand the economic situation in 1837 in Western Europe, you need to understand how Western Europe evolved out of the W...

November 19, 2025

EU5 And Economics: Part I, Historical Backstory

The fifth installation of the video game Europa Universalis (hereafter EU5) just came out, and it had some interesting economic modelling issues. However, to get to explanation of how EU5 relates to the historical period (the start date of the game is 1337) I first need to go back to the historical background of what the situation was like in 1337 in the lands of the Roman Empire. (Although EU5 is global, I am really only familiar with European/Mediterranean history of that era. The game systems...

The fifth installation of the video game Europa Universalis (hereafter EU5) just came out, and it had some interesting economic modelling issues. However, to get to explanation of how EU5 relates to the historical period (the start date of the game is 1337) I first need to go back to the historical background of what the situation was like in 1337 in the lands of the Roman Empire. (Although EU5 is global, I am really only familiar with European/Mediterranean history of that era. The game systems...

November 13, 2025

Oh No, Missing CPI Data

It appears that the American October Consumer Price Index (CPI) will not be calculated by the Bureau of Labor [sic] Statistics (BLS), courtesy of the now-ended shutdown. Since the CPI calculations rely on an extremely large survey of data on a particular set of dates, the absence of employees making that survey makes it impossible to recover that data point.

It appears that the American October Consumer Price Index (CPI) will not be calculated by the Bureau of Labor [sic] Statistics (BLS), courtesy of the now-ended shutdown. Since the CPI calculations rely on an extremely large survey of data on a particular set of dates, the absence of employees making that survey makes it impossible to recover that data point.Although this is not too big a deal, I just want to comment on some arcane side effects of this hole in the data.

Does it Matter for Cost-of-...November 6, 2025

De-Liberation Day And Other Topics

Rather than write a few small articles, I am just going to have a single article covering a few threads. My blog writing time has been limited by working on my manuscript.

De-Liberation Day?Outside observers have argued that the Trump administration’s arguments before the Supreme Court were shambolic at best, and the questioning by judges was viewed as hostile. Although the Supreme Court normally bends to the will of President Trump, the argument that he can impose taxes at will might push the co...

October 29, 2025

Ambling Towards A Crisis?

After 2008, there was a small community who always predicted repeats of The Financial Crisis. The problem the doom-mongers faced was the back side of “The Minsky Cycle”: actors react to a crisis by reducing risk and taking steps to avoid repeating the exact same crisis. That was done throughout the financial system (including Canadian regulators who changed their housing market policies, which was my worry at the time). However, memories fade — and new ways to spawn a crisis pop up.

After 2008, there was a small community who always predicted repeats of The Financial Crisis. The problem the doom-mongers faced was the back side of “The Minsky Cycle”: actors react to a crisis by reducing risk and taking steps to avoid repeating the exact same crisis. That was done throughout the financial system (including Canadian regulators who changed their housing market policies, which was my worry at the time). However, memories fade — and new ways to spawn a crisis pop up.Financial cri...

October 1, 2025

Tariffs And Fiscal Policy

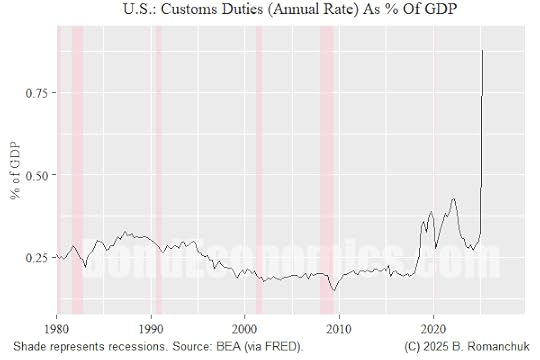

The customs duties data for the United States was recently updated, and we can assess the “success” of Trump 2.0’s tariff policies so far. On an annualised run rate, customs duties were 0.88% of GDP in the second quarter (the latest monthly figure Treasury I saw was around $350 billion annualised versus the $267 billion BEA second quarter figure).

The rise of tariff revenue is rapid, but the magnitude is relatively small so far. As such, it is not entirely surprising that there has not been a mas...September 24, 2025

Term Premium Comments

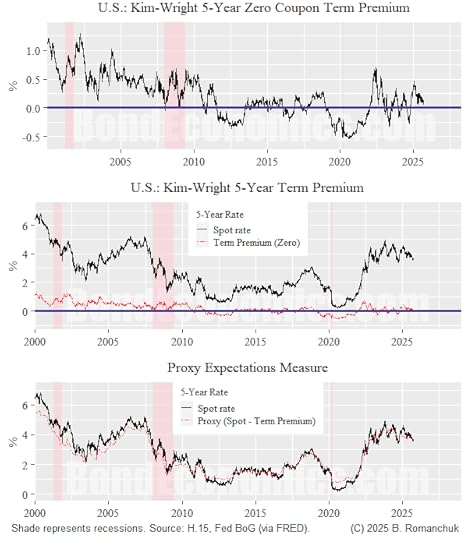

I have been looking at term premium models as part of a non-writing project. I decided to take a look at the Kim & Wright model output (available via the Federal Reserve, paper link: http://www.federalreserve.gov/pubs/feds/2005/200533/200533abs.html). By way of background, there are two very popular term premium models, the Kim & Wright paper, and the one by Adrian, Crump, and Moench (ACM).

Working from memory, term premia estimates had difficulty around the COVID crisis, and at least one of the...

September 16, 2025

Comparing Bond Yields Across Countries

Toby Nangle recently wrote “How to (more) properly compare bond yields across markets” (non-gift link). The story behind the article is straightforward: commentators are going back to their old habit of comparing the raw yields on 10-year bonds and making assertions about what this means about implied credit quality. As Nangle’s article notes, this is not a good idea, since bond yields embed rate expectations.

Since I do not have the derivatives data to dig into current pricing, I will just offer...Toby Nangle recently wrote “How to (more) properly compar...

Toby Nangle recently wrote “How to (more) properly compare bond yields across markets” (non-gift link). The story behind the article is straightforward: commentators are going back to their old habit of comparing the raw yields on 10-year bonds and making assertions about what this means about implied credit quality. As Nangle’s article notes, this is not a good idea, since bond yields embed rate expectations.

Since I do not have the derivatives data to dig into current pricing, I will just offer...September 10, 2025

Inflation: Paint Drying &c

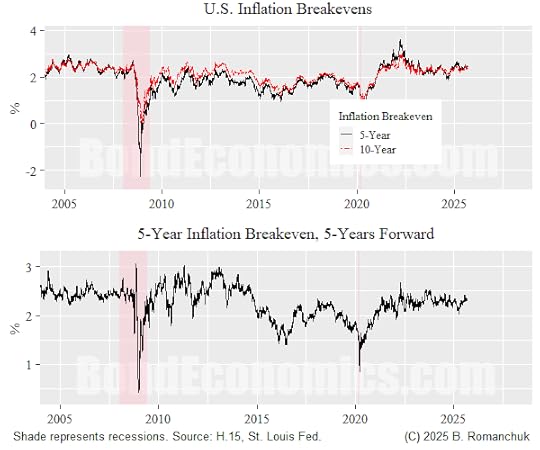

A weak August PPI report today continues the narrative that inflation in the United States is a nothingburger. If I were attempting to be a forecaster, I could have easily been wildly wrong in my inflation prognostications (although the previous chickening out on mega-tariffs meant that my initial reactions would have to have been revised).

As always, there are anecdotal price pressures in the PPI (47.2% annual increase in turkey prices! (link to table)), but the overall final demand figure was l...