Nabil Shabka's Blog

October 26, 2020

Star Trek or Blade Runner

Like much of the world I’m sitting on tender hooks waiting for the US election. This is arguably the most important vote of recent times (even more important than Brexit) and the results will dictate our future.

The battle has already commenced and the fate of the world is now in play. Whatever the outcome, there will be tremendous knock on affects. This isn’t just an election for a president, it’s a clash of values and one of these two completely opposing forces will prevail and create momentum that will shape the new world. Th US can once more ‘save the world’ or literally trash it.

So what are the possible outcomes?

The global impact of the upcoming US election on humanity cannot be understated. Whichever way the election goes, around the world the result will be felt. From a top level view, there are four possible outcomes, well two times two candidates actually. One candidate could win by a landslide or one of them could win in a tight and hotly contentious election.

As Trump and Biden, and their supporters, are so different, it makes looking at landslide wins fairly straight forward so let’s look at that prospect.

To be clear.

Landslide = winning electoral college, popular vote and controlling the senate.

Contentious = Everything else

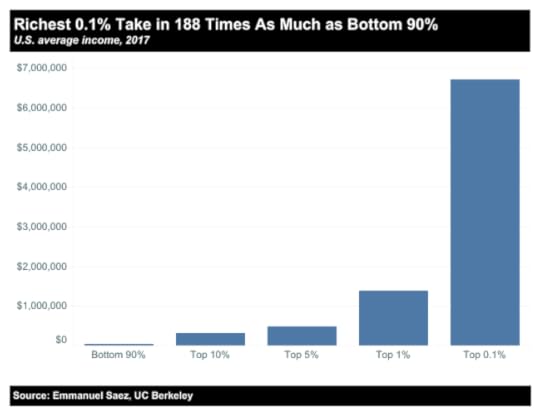

We know exactly what would happen if there was a Trump landslide. Even more of what we’ve already had. Financial inequality would continue to widen, even pick up pace. Climate change would be put on a back burner. Putin of Russia, Erdogan of Turkey, Xi Jinping of China, Kim Jong-un, Bolsonaro of Brazil, Modi of India, Netanyahu of Israel and every other ‘strong man’ would have carte blanche to do as they want. IMHO, it would be a disaster.

If Trump wins. Don’t expect four more years of what we’ve already had. Expect far more. Controlling the senate, the supreme court and the white house would allow Trump to do even more of what’s he’s already been doing. He will continue to support dictators and they will feel more emboldened. Destruction of the environment will not be slowed down, financial inequality will continue to widen and these social divisions will continue to create tense and dangerous situations.

A Trump victory also increases the chances of the UK crashing out of the EU with no deal as Trump is a brexiter. Boris’ own party is getting upset with his ineptitude so his position is fragile, he needs a deal with either the US or the EU. Boris will sign anything so that he can say that he has a deal as that would bolster his chances of remaining PM in 2021. Trump gives him a chance at a US deal so he can say no to the EU.

A Trump landslide is an unlikely scenario though. I can’t see Trumo winning the electoral college and the popular vote. But, if he wins either one of them and hangs on to the Senate (even after a contentious battle), he will say he won a landslide victory and behave as such.

So what would happen if there was a Biden landslide?

For starters, much of the world would breath a sigh of relief and the liberal western democracies around the world would once again be able to work together to pursue emerging common goals such as addressing climate change, social care and financial inequality.

The US would quickly rejoin international groups and agreements it has abandoned, such as the Paris Accords. Climate change would become a major driver of the US and world economies going forward. Reversing the widening financial disparity we currently see and providing social care for all will become core policy objectives in most liberal democracies.

A Biden landslide is possible and this is the direction liberals and youth want to take. Not just in the US, but around the world. While this kind of a political and social swing may be difficult to imagine, the US has often swung from one extreme to another. It’s like a pendulum that has swung too far in one direction – and could now swing far in the other direction to balance it.

The EU and many other liberal democracies of the world are already trying to address these social democratic issues now they would have a strong partner and a helping hand rather than an opposing force. The dictators of the world however would be caught on a backfoot. They would not have free reign any more to do as they please with no repercussions. Dictators would be brought to heal and their local liberal democratic opposition strengthened.

If Biden wins the election without the Democrats controlling the Senate then we can expect the same policies from Biden as with a landslide – but with obstacles being thrown in the way by the Republicans so they’ll be watered down.

A Biden landslide could potentially change the Brexit outcome as well. Boris will know that there will not be any US soundbite deals forthcoming with Biden and that honouring the Good Friday Agreement will be critical for any sort of US deal. Biden is Catholic and of Irish descent and the US Congress feels very strongly about the Good Friday Agreement – which they played a major role in crafting. And, between his handling of covid and the looming brexit pain, Boris knows his position as PM will be difficult to maintain if he has no EU or US deal.

The likely outcome would see Bojo caving in at the last minute and doing an EU deal. Theoretically, he could possible try some self-preservation and say that with covid taking so much attention and resource, the responsible thing would be to get an extension until things have stabilised. At least that would stop a Brexit disaster being piled on top of the covid hardships so his position would be stronger. He’d have some upset brexiters but, he and Cummings would still be in charge. This is unlikely though as Cummings wants out and he pulls the strings. A Biden win increases the chances of an EU deal though.

This is the beginning of the Star Trek vs Bladerunner battle in come the evolution. And it’s happening now. I’ll have my popcorn ready and be glued to the TV. Yeah, yeah, it may drag on for months. Or it could be over on November 3rd!

The post Star Trek or Blade Runner appeared first on come the evolution.

June 10, 2020

Do Black Lives Matter?

Black Lives Matter has become a rallying cry for people around the world who are uniting and protesting. But for what exactly?

In almost every country in the world there are groups of people who are discriminated against. Opportunities are removed from these groups and they are treated without respect. Sometimes this discrimination is overt, but often it’s more subtle. Injustices to blacks in the US might be what kicked these global demonstrations off but, protestors around the globe have localised social-justice issues that all share a common theme. Unfairness, inequality and lack of respect.

Whether it’s blacks in the US, Aborigines in Australia, Palestinians in Israel, Indians in Malaysia, Muslims in India, Christians in Syria or LGBTQ people around the world – protestors are tired of social-injustice and are fed up with systems that survive and thrive on this unfairness. Protestors want the glaring inequalities in opportunity that negatively impact access to education, health care, employment and feelings of self-worth, removed.

Most protestors say this isn’t just about black lives. They say all lives matter. But today the focus is black lives.

2020 had seen much of the world questioning our core values and the direction we want society to take. Lockdown, wobbling economies, financial inequality, the environment, essential workers and social distancing have given us pause for thought. And mother nature smiled for the first time in decades. What do we actually value?

There are some very important societal questions facing us and they are not being addressed. George Floyd may not have been a saint but his murder was black and white, no grey areas, no fence sitting. Everyone could clearly see that and so it became the proverbial straw. Coupled with lockdowns and good weather, pent-up youth frustration spilled out and the protests began.

The big question is, what’s next? Where do we go from here? What’s the objective?

Simply making a few police reforms or ‘defunding’ the police will not sort out the bigger issues or achieve equality for Blacks. It’s far deeper than that. Black Lives Matter is a tree in the middle of a forest. The bigger issues all need addressing at the same time. You can’t save one tree if the entire forest is on fire. Equality and fairness is needed across the board. Black lives will not change unless everything changes for everyone.

The question is, will BLM turn into a wider reaching movement for change? Will the young continue to protest? Perhaps they will begin having protests every Friday or Saturday as protests can’t continue daily at this scale long term? Perhaps they’ll have massive peaceful protests that are spread out across the centre of towns and cities that, with social distancing, would bring towns to a standstill? Perhaps during these protests they’ll have talks about current issues, discuss which political candidates are in line with their thinking and promote voter registration?

“Today’s young adults are truly wonderful people – they care more for others than any previous generation. They are more accepting of different types of people and don’t like to see injustices. I admire their social awareness. IMHO, the young are the fairest and most noble generation that the world has ever seen…..”

BLM is a protest of frustration to a world that hasn’t been listening to what is so glaringly visible to most of the young. They see that our current way of operating is broken and they wonder why governments won’t see the obvious and do something about it.

The youth instinctively know that it can’t be the same old, same old and that it’s time for new solutions. It’s #timeforchange and they’re done being quiet about it.

At the heart of the matter is fairness and the question of whether we as a world value people and the environment first, or production and profit? It’s about being fair in finding new solutions based on today’s values, not yesterday’s. It’s about including the environment when thinking about and creating tomorrow’s jobs and a fairer society. Do we want a society based on valuing people and environment or one with widening financial and social unfairness?

Of course black lives matter but It seems to me that this frustration is not just about life and death or black lives. It’s about far, far more. I hope what we’re witnessing is the young beginning to find their voice. The young of today want and deserve to be heard. The question is, will BLM evolve into a movement that makes massive generational changes?

“To the kids, university students and young adults of today: you can make a difference. You must make a difference. The world is counting on you and literally needs you to save it – environmentally and socially. You value people and the environment and you need to protect your values. You have the right values; you have heart and now it’s time for you to persuade the old stick-in-the-muds to value these as well. We need each and every one of you. Together you are powerful. Your vote does count! Your presence at a democratic protest does count! The world needs you desperately. Find your voice and convince the older generation to step into line. You most certainly can change things, and what’s more, you’ll feel great doing it! “

Nabil – come the evolution, Jan 2020

I hope for a Star Trek Future, not a Blade Runner one, and peaceful protests and voting are the route to evolution. Apathy is the road to increasing unfairness.

#timeforchange #valyouism #cometheevolution

The post Do Black Lives Matter? appeared first on come the evolution.

June 5, 2020

The global ‘black lives matter’ protests are wonderful

It’s great to see the young demanding change, which I hoped they would do, although it is unfortunate that they are at risk. Following is an excerpt from ‘come the evolution‘ which was published in January 2020.

Can’t Get No…

… Satisfaction. Now we come to people aged thirty-five and under. Some appear unhappy and lost. This younger group is best exemplified by those in their early to mid-twenties. Bear in mind that what they are feeling and experiencing will apply even more so for the millennials, who are just behind them.

Most have grown up in environments that were Levels 3 and 4. They grew up with smart phones, foreign holidays, education, health care and pocket money. For many, if they had a ‘Saturday job’, it was extra money, to be used, not for basic necessities, but for other fun things, often experiences.

These young adults care about others, about people’s rights and the environment, and because the Internet, technology and travel are so much a part of their lives, they see things globally. They have things in common with people like themselves around the world and feel connected to them. They see that there are many people with different interests, and they respect this. They believe people have a right to be themselves and love watching others being themselves. Acceptance and individuality rule. They are tolerant. They are thoughtful and caring. They are wonderful. But they are not satisfied.

So many kids and young adults today want to create the next huge app or have a following that is large enough to make money, but that’s not where it’s at.

Don’t get me wrong, there’s money to be made from being watched, and it is many a young person’s dream. For the few that manage to attract a following, it can be lucrative. A person with ‘followers’ feels valued and often earns money. They are aspirational. People want to be them. They believe anyone can do it. You just need to get out there. Find an angle, a USP. You are selling yourself and hoping to derive value from it. You need a following. A following is what makes you feel valuable. It’s not just about money. They want this, sure. But having ‘followers’ gives them purpose and intrinsic value. How many people ‘liked’ your comment or photo is important. It makes you feel as though you have value.

Those aged thirty-five plus have on the one hand created a wonderful environment for their kids. One with quality food, shelter and clothing, mobiles phones and travel, and the newly sought-after thing – experiences. But, it’s a life that doesn’t give the young many chances to add value, to be of value, to have purpose. The young suffer anxiety because of this lack of purpose. They feel there is little opportunity and worry that coupled with high property prices, they will not even be able live in, let alone own, their own home.

I was visiting a friend recently who had a step rubbish bin under his kitchen counter. He explained that the lid kept hitting the bottom of the counter and making a noise. So he fixed the problem. He got some foam and stuck it to the bottom of the kitchen counter in a way that couldn’t be seen. Now when he puts his foot down, there is no noise. No thud. And he says sometimes, when he walks by, he steps on the bin purely for the satisfaction of it. Here is a gentle reminder of value that my friend has created. He wanted to beat the problem, to find a solution. So, he did. It was small, but important. Many younger people today would simply buy a new bin and miss out on the feeling of satisfaction and accomplishment that comes with attaining a goal. Much of their lives is like this.

Most people over thirty-five have experienced these feelings of satisfaction. Whether fixing a flat, repairing a garment, putting up shelves or assembling IKEA furniture, saving to buy an album or drum kit or stopping a table from wobbling, we’ve all been there. We felt great when we accomplished our goals, our purpose. No matter how small. The greater the sacrifice, the more valuable we felt when we accomplished our goal. We had big goals and lots and lots of little ones. We had purpose, and accomplishing those purposes gave us value and pleasure.

Not so for most Level 4 kids. They don’t get the satisfaction derived from little accomplishments as they don’t need or want to do them, nor do they have an interest in doing them. They don’t appreciate the value of these little accomplishments that drive and delight us. This means they also miss out the all-important experience of feeling good about themselves, through seeing the fruits of their labour. They miss the satisfaction of accomplishment. An extreme of this can be seen in school sports days and competitions where some adults thought it would be better if there were no winners, as they didn’t want losers. But guess what, everyone loses. This lack of satisfaction is, I believe, one of the causes of anxiety today in the young. And it’s because of us, their parents, and society. We thought we were doing the right thing – we weren’t.

Let’s look at how that manifests itself on a day-to-day basis. Kids and young adults today say they want things to change, but they generally don’t do anything about it. They often claim they can’t make any changes and it’s out of their control, so they simply throw in the towel and don’t try. This confuses the over 35’s.

Take the environment as an example. Kids and young adults say they are worried about the environment being wrecked for their generation, but do they turn off the lights after leaving a room? Do they boycott eco unfriendly businesses? Do they protest? Do they bother to vote? Sadly, much of the time, the answer is no, but good news, voter registration is increasing. Interest is growing.

Both Brexit and Trump will have a massive impact on the young, yet the universities remain pretty much mute. The young adult vote could easily have swung the results of the Brexit referendum. Did the university students mobilise and protest and drive students to vote? No. Did they tell their parents and grandparents how they felt and argue their case – and lay a guilt trip on them? Did they even attend the marches after the referendum or organise simultaneous ones on their campuses? No. I attended a couple of the anti-Brexit protests in central London. There were millions of protestors – and almost all of them were over the age of thirty-five!

Apathy is sad to witness. The Vietnam War and apartheid would never have ended had the university students not mobilised. There were non-stop protests and boycotts, and universities were forced not to invest in, nor deal with companies involved with South Africa. The same could and should have been the result for Brexit and Trump. It still can be. As for the environment, university protests and young people’s votes can make all the difference. To the young who are reading this, you are big in number and if you continue to get organised people will listen to you. And it is happening. More than 300 organizations, including many youth ones, are planning major climate strikes in the runup to the US 2020 elections.

In Edinburgh the council decided to give students a day off once a year to strike in protest. As soon as I heard this I choked. A day off is not a strike. It’s a day off, it quiets students’ voices and trivialises what they’re saying. But, thankfully the students knew what a strike was and didn’t agree. For them, it’s when Greta skips school for two weeks to spend the time in front of the Swedish parliament handing out flyers. This is what gets a protest noticed. Not a day off school.

Today’s young adults are truly wonderful people – they care more for others than any previous generation. They are more accepting of different types of people and don’t like to see injustices. I admire their social awareness. IMHO, the young are the fairest and most noble generation that the world has ever seen – but to the young I say, I wish you would get off your asses to protest and vote! Let your beautiful voices be heard.

To the kids, university students and young adults of today: you can make a difference. You must make a difference. The world is counting on you and literally needs you to save it – environmentally and socially. You value people and the environment and you need to protect your values. You have the right values; you have heart and now it’s time for you to persuade the old stick-in-the-muds to value these as well. We need each and every one of you. Together you are powerful. Your vote does count! Your presence at a democratic protest does count! The world needs you desperately. Find your voice and convince the older generation to step into line. You most certainly can change things, and what’s more, you’ll feel great doing it!

The post The global ‘black lives matter’ protests are wonderful appeared first on come the evolution.

June 1, 2020

Is Globalisation good or bad?

Many people around the world are questioning whether globalisation is a good idea and some are proposing bringing supply chains back to their home countries. They sight the pandemic of 2020 and the shortage of PPE equipment as the reason. Their argument is that If each country had its own capability to manufacture these things, there would not have been a shortage of PPE and it would create jobs. Sounds a grande idea. But it’s not that straight forward and better global cooperatiom, rather than national and intra-country rivalry for PPE, might have been a better route.

Imagine if the whole world had acted together and calmly gave everyone a week to get home and then we all shut down together for two or three weeks. By working together better globally, not just would we have been able to stop the pandemic in it’s tracks but we would also have been able to throw global resources at it – doctors, nurses and PPE. Let’s take a look at what globalisation actually is.

The term ‘globalisation’ is thrown around quite a bit. But what is it and what does it mean to us? When we hear the word ‘globalisation’ some of us think about losing jobs to low wage countries. Jobs are a part of globalisation, but it’s far, far more than just that. Look around where you’re sitting right now. Start with your mobile. Where is it made? Who thought of it? Where was it designed? Its components, the minerals, come from different parts of the world. Various constituents were assembled in different places. Final assembly could have been in multiple places as well. And it could be sold anywhere in the world and bought by anyone. Your phone was made as efficiently and cheaply as possible using resources from around the world.

This is globalisation.

Tens, if not hundreds, of countries, companies and people were involved in producing your iPhone. From the US and the EU for design, to Mongolia and Africa for resources; and from Korea, Japan and Taiwan for glass and processors, to China for completion. All of them were working for your benefit, keeping costs down and quality up. Lots of people around the world were involved in the process of creating, producing, marketing and distributing your iPhone. It was a global effort.

This is globalisation. And you benefit from it every day.

It’s the shirt on your back at an affordable price, the shoes on your feet, your fridge, your car and PPE. It’s also your music, your films, your holidays, your colleagues, your friends and your family. We live in a global world, which has benefitted us all. Some more so than others, however living conditions for the developed and developing world are generally much, much better than they were seventy years ago. Life is awesome for many. We’re lucky compared to previous generations.

Back to jobs – that’s yesterday’s battle – although there never really was one. Globalisation isn’t taking jobs, machines are. US manufacturing output has been continually increasing at a strong pace, while employment in manufacturing has been steadily decreasing. The jobs’ landscape changed. The types of jobs in different countries simply changed. It’s gone on since the beginning of time, albeit at a slower pace. As low-level manufacturing jobs went to low wage countries or automation, new jobs were created in high wage countries . Often they were service jobs. We used to make things. Then, we switched to providing services. This was good for both types of country, for the person who got the new job in the ‘outsourced’ (low wage) country and for the person who lost their old job, if they found another sort of job in the high wage country.

However, those traditional manufacturing jobs are gone, and they aren’t coming back. In fact, while jobs keep moving to cheaper places they are also simultaneously becoming more automated. The whole world has the same problem: jobs will go to where that given task can be performed most efficiently – and we all benefit. The jobs battle is not about jobs going to other people. It’s about losing jobs to technology and automation. That’s the job killer – computing power plus automation plus artificial intelligence. Manufacturing as a share of GDP in the US and UK are both at their highest in decades – but with fewer workers. And now services are being automated.

Globalisation isn’t the problem, it benefits us all. It’s our society that’s ailing and needs rebooting.

The post Is Globalisation good or bad? appeared first on come the evolution.

April 27, 2020

How Interest Rates Work

How Interest Rates Work

An understanding of debt and interest is necessary to get a handle on money, since money (having it, not having it, or getting more of it) plays such a huge role in human motivation and behaviour. Acquiring it in some form or other, has been our prime motivator throughout our history, so it’s worth getting to grips with its complexities, even if it’s not exactly as riveting as a thriller (although thrillers, books and films, have been made about it!)

At the core of debt is interest.

Warren Buffet loves compound interest. Others view interest as usurious. So, what is it? In a nutshell it’s what person A pays person B to borrow money. That money could be used to create a new business, buy a car or house, or put food on the table. While the concept in itself is not bad, what can be bad is the interest rate. And the fundamental problem here is that those who can least afford the ‘loan’ pay the highest interest rates. To see this in action, let’s look at the graphs following.

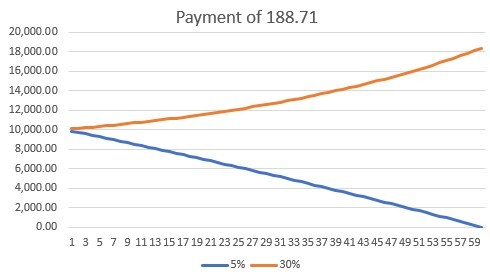

Each person borrowed $10,000 and is paying $188.71 a month towards it. Both people are ‘low risk’. One person borrowed at a 5% interest rate and the other person got a credit card and borrowed at a 30% interest rate, the rate on many credit cards – what’s yours? Check it out! In 60 months the 5% loan is completely repaid. In 60 months the 30% loan is now $18,300.

The sad thing now is that the person with the credit card who is a good credit risk goes to the bank and says, ‘I’d like to cancel my card and turn it into a loan.’ The bank will often reply, ‘No, you’ve already borrowed as much as our systems say you can.’ Even though the person is willing to cancel the card, he or she is still stuck and going deeper in debt.

Now let’s look at each person’s payments based on repaying the loan in 5 years (60 months).

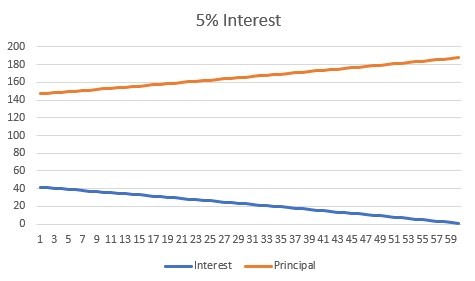

This is the person with a $10,000 loan. Following are the principal and interest payments they make each month. They pay $188 a month for five years and a total of $1,300 in interest. They are always paying down the loan – more of their monthly payment is going towards the principal (the amount they borrowed) than towards interest.

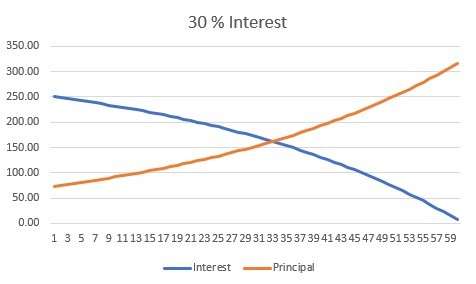

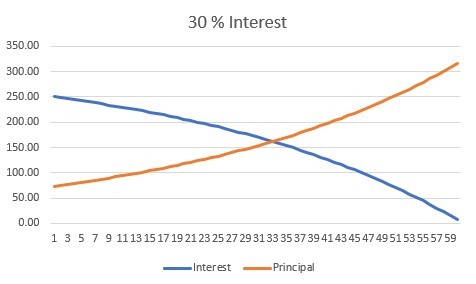

Now let’s increase the payment for the person with the credit card so that they can repay the $10,000 loan they have on their card and see what happens. They need to pay $323 a month for 5 years and pay $9,400 in interest. It’s not until month 33 that they are repaying more towards the principal (the amount they borrowed) than towards interest.

It’s scary. The person who can’t convert the card to a loan is put into financial hardship. And you wonder why there are more defaults at 30% than 5%…?

The credit card companies are nothing more than loan sharks. This wasn’t always the case and now in the US, Alexandria Ocasio-Cortez and Bernie Sanders are advocating bringing back the maximum interest on credit cards to 15%, which is what it used to be until deregulation in the late 70’s and early 80’s.

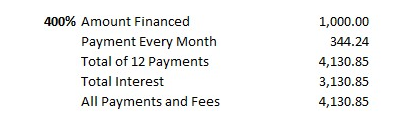

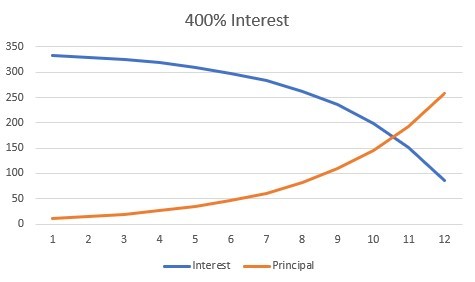

Now imagine those people really struggling to pay their children’s school meals, the ones who must take out payday loans. These are short term loans that people take at very high interest rates to survive from paycheck to paycheck. The industry calls them ‘high risk’ and at these interest rates it’s easy to understand why. Anyone who needs to borrow at 400% interest is high risk, simply due to the interest rate.

Just so you can really get a handle on payday loans that have average rates of 400%, let’s look at $1,000 for one year in a graph. On a $1,000 loan, borrowers pay over $3,000 in interest. It’s only in the last two months, the point where the two lines cross, that they are paying more towards the principal (the money they borrowed) than interest. The interest is three times more than what they originally borrowed. They paid $4,000 for $1,000 worth of food. Who benefits? The loan sharks. Until the end of the 70’s the US had a cap on interest rates at 15%. Now you can see why.

This is usurious and should be illegal. Imagine the current situation where people need to take out payday loans to get money to put food on the table and they are charged interest on the loan at 100’s of percent. Not that credit cards charging 30% interest are much better, but that’s an improvement from 100’s of percent. Seems to me if everyone had similar interest rates, not only would it be fairer, but there would be fewer defaults. Lend what someone can afford or don’t lend at all. If someone can ‘afford’ a loan at 400%, they can certainly afford one at 5%. And funnily enough, they would be less likely to need a loan to put food on the table, as their whole paycheck wouldn’t be going on interest payments.

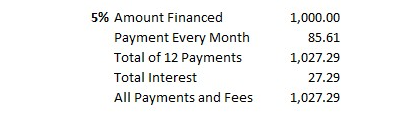

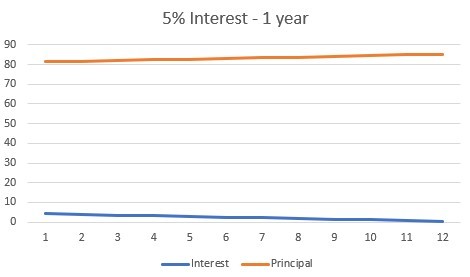

Out of curiosity, let’s see what the ‘good’ credit risk person pays to borrow $1,000 at the 5% annual interest for a year. $27 in interest, plus monthly payments of $85 vs. $344 a month payment, and $3,000 in interest for the ‘high risk’ person – and you wonder why the ‘high risk’ person, paying 400% interest, defaults and then gets categorised as a bad credit risk. Yeah, right. This is simply wrong. No two ways about it.

https://www.marketwatch.com/story/how...

The post How Interest Rates Work appeared first on come the evolution.

April 22, 2020

why was oil minus $37

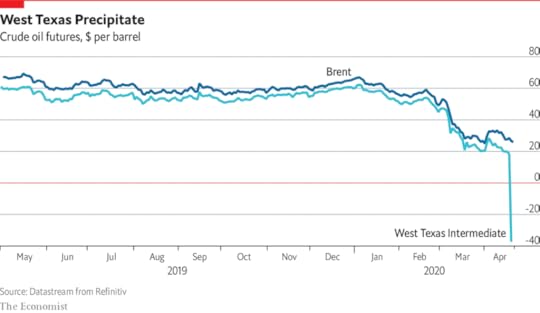

An explanation of why oil was -$37 a barrel

The first thing to note is that oil did not drop to -$37, oil futures did. So what is a future?

Futures can be important and useful instruments and the biggest futures exchange is in Chicago. Futures are primarily used for physical goods, commodities — crops, animal stock, oil, minerals etc. . Futures are fairly straight forward. The first thing to note is that there is always a buyer and a seller of the futures and they want opposite things. They are both hedging future price changes on a physical product.

Imagine you’re a wheat farmer. You’d like to sell next year’s harvest at today’s price to remove the uncertainty of what the actual price may be in the future. You know your costs next year and will make a profit, so you are willing to pay today to guarantee that profit. It makes life more certain for you. You are willing to give up the chance that the price of wheat goes up and you could make more money by neutralising the risk that the price of wheat may go down and you could lose your shirt. You are not a speculator or gambler after all, you’re a farmer. You want to guarantee, to set tomorrow’s price today. You want to hedge the risk.

On the other side of this equation is a bread manufacturer. They are happy with today’s price of wheat and they can make a profit at this price without having to raise the price of bread to their customers. Sure, they could make more money or charge their customers less for a loaf of bread if the price of wheat went down, but they could also be forced to pay more and raise prices if the price of wheat went up. They would rather remove the risk of the price of wheat in the future and hedge themselves by buying tomorrow’s wheat at a price agreed today. They have price certainty. After all, they are not speculators or gamblers, they are bread makers — they want to guarantee, to set tomorrow’s price today.

The same applies to oil as wheat. Perhaps you’re an airline and you expect to need more oil in May 2020 and you like the price in say January 2020, so you ‘buy’ it today and lock in the price. You hedge the cost of oil for your airline. You now know what your costs are for running those summer flights and what your ticket prices must be.

As you can see, this makes a lot of sense. It removes future uncertainty. You pay to hedge the future.

Roughly 95% of people never actually take delivery of the physical product from the futures market. If the airline bought a future guaranteeing the price of oil at say $20 and it goes up to $35, the seller of the future to the airline would simply pay the airline the $15 difference on the future date through the futures exchange. They settle the transaction by paying the difference between the future price they locked in, and the physical price today.

But the futures market is also a place to gamble. There are lots of speculators betting whether prices will go up or down in the future (oil in this case). The price of oil collapsed at the beginning of this year as there was over production and so speculators thought that the price would go up in the ‘future’ and placed their bets. They hadn’t counted on further over production and the coronavirus killing demand for oil. The physical price kept dropping, and dropping.

There are big containers that store oil — the US has national ones for ‘strategic reserves’. With the price of physical oil so low, everyone filled the proverbial tank up with the physical product. On the future date of one type of oil, West Texas Intermediate, no one wanted the oil. No one wanted to buy the oil and it was hard to find a place to store it. If you had a big storage bin, the people holding those futures would have to pay you to take the oil from them.

In the end, the speculators had to pay people $37 to settle their contracts otherwise they would have had to take delivery of the oil — and they had nowhere to store it.

The post why was oil minus $37 appeared first on come the evolution.

April 17, 2020

The end of the automobile revolution

The end of the automobile revolution is upon us — what does this mean for jobs?

The Automobile Revolution

One of the biggest changes facing us is the end of the automobile revolution. Where we are today is in many ways due to the car. The automobile was the job creator of the past. That is about to be over. The social impact will be massive.

The automobile revolution kicked off after the Second World War. It was the foundation of seventy years of global growth and is what created and facilitated our modern consumer society. Automobile production linked (and still links) many different jobs to create, produce, market and support them. A car may be assembled in a factory, but its parts come from countless sub suppliers scattered around the world. Whether it is steel, minerals, plastic, rubber, design, sales and marketing or assembly, testing and racing, lots of people are involved.

We are where we are because of it. The automobile revolution gave us freedom and created jobs. Not just the ones related to manufacturing and other obvious ones, such as truck driver, taxi driver, bus driver and delivery driver, but also a huge host of others. These include non-obvious ones as well, at least until you think about it, such as advertising and parking.

There’s servicing, repairs, insurance, marketing, design, automation, fuel, oil, washing, road creation, rentals, financing, motels, driver’s education, diners, parking, speeding tickets, plus all those TV and print ads. Someone was paid to create them, while others were paid to display them. And the list goes on.

The first thing that people in developing countries do when they start to have money is to buy a car and then that car stimulates all the other related industries.

There were 94 million cars manufactured globally in 2016 and if automobiles were their own country it would be the 6th biggest economy in the world. And that’s without all the other related jobs.

In the US, there are still 1,605,000 jobs producing cars and 213,000 in the UK. A further three times that are indirectly related to the production (dealers and suppliers). That’s a total of over 6 million production related jobs in the US and over 800,000 in the UK. In the EU, it’s 13.8 million people accounting for 6.1% of all jobs. That’s just the manufacturing and distribution bit.

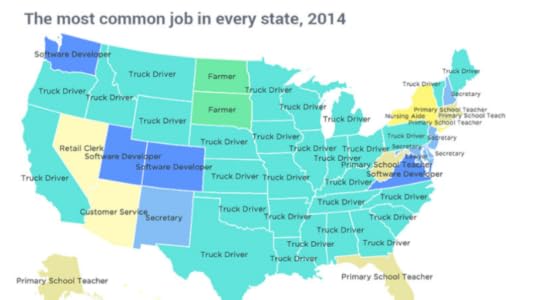

In the US, since 1996 the most common employment in twenty-nine of the fifty states is trucking. There are 3.5mn truckers and another 5.2mn related roles. One in every fifteen people in the US is connected to the trucking industry. It’s a $700 billion gig and that doesn’t include all the related services and the 7.2 million people who support it and derive a living from it.

In the US, there are over 180,000 taxi drivers, 160,000 Uber drivers, 500,000 school bus drivers, and 160,000 transit bus drivers.

Professional drivers account for over 2% of US employment, and then there’s another 3% in supporting roles. Automobiles are a huge job generator.

As we can clearly see, the automobile revolution was central to the jobs’ creation and prosperity of the late 20th century – and still is. We are here because of cars – and tractors, ships, motorcycles, and all the rest.

This type of luxury production helped create mass consumerism, which in turn, fuelled more production. These two feed off each other. Supply creates demand and demand creates supply. The previous seventy years was the age of the Automobile Revolution. What’s next? How do we evolve?

The End of the Automobile Revolution

The days of our economies being driven by the automobile are about to end. Twenty years from now the landscape will be completely different. The reasons are simple – automation, ML (Machine Learning) and AI (Artificial Intelligence). The need for people in the manufacturing process and its associated roles is declining by the day.

First, vehicle manufacturing is becoming increasingly automated; the number of people required to produce more vehicles is continually decreasing. The machines are taking over production.

Second, self-driving will become the norm in the not too distant future. Not just will all those truckers’, taxi drivers’, bus drivers’ and delivery drivers’ jobs disappear, but so will all the jobs related to them – motels, servicing, petrol stations etc. In 2016 a convoy of three semi-automated trucks drove 2,000 miles from Sweden to Rotterdam. The need for drivers of any variety will soon disappear.

Third, demand. Most people will stop owning cars. They’ll rent them. And cars won’t be cars, as we know them now, they’ll be autopods. Some will have chairs, some beds; others will have meeting tables or coffee makers. You’ll rent a small autopod for short journeys, a meeting autopod with a table for meetings, a sleeping autopod for long journeys, a big autopod for parties. It’s already happening with many car-sharing companies popping up. And many young people are not even bothering to get driving licences. A driving licence used to be a rite of passage. You were an adult and had freedom when you passed your test. Now, many young people view it as an unnecessary cost and hassle.

In Japan, car-sharing company Orix noticed a strange phenomenon: 15% of the cars being rented via their app weren’t being driven anywhere. Turns out that people were renting them to take naps, charge tech devices, listen to music, have lunch, watch films, store bags or have quiet conversations. That’s not what cars used to be used for.

The car as we know it is on the cusp of change and the automobile revolution, as the job creator of the 20th century, is about to be over. Not only will jobs and taxes disappear, but also parking fines alone are worth billions to the US and the UK. New York made $545 million in parking fines in 2016 and even Columbus Ohio made $5.2 million. In England, in 2018/19, local councils made a profit of £930 million in parking fees and received a total of £1.746bn from their parking operations between 2018-19. This included £454m from penalties, which is up 6% year-on-year. In London alone that was an average of £1 million a day in fees.

Currently cars spend 95% of their time parked. We’ll have fewer of them. They’ll be on the move and when they’re parked, they’ll be on private property. That’s just the tip of the iceberg.

Think of all the knock-on effects. Jobs lost to automation in factories and services. What’s going to replace this taxable income and how are all the people previously employed in automobile related industries, factories, warehouses and service jobs, going to make ends meet? How are they going to contribute to the economy?

What are we to do?

https://www.fircroft.com/blogs/the-au...

https://www.fircroft.com/blogs/the-au...

https://www.acea.be/automobile-indust...

https://www.marketwatch.com/story/kee...

http://www.alltrucking.com/faq/truck-...

https://www.makeuseof.com/tag/self-dr...

https://www.theguardian.com/technolog...

https://www.digitaltrends.com/cars/wh...

https://www.topviewnyc.com/packages/h...

https://www.bbc.com/news/uk-england-l...

https://www.petrolprices.com/news/cou...

https://fortune.com/2016/03/13/cars-p...

The post The end of the automobile revolution appeared first on come the evolution.

April 14, 2020

How We Got into This Financial Mess

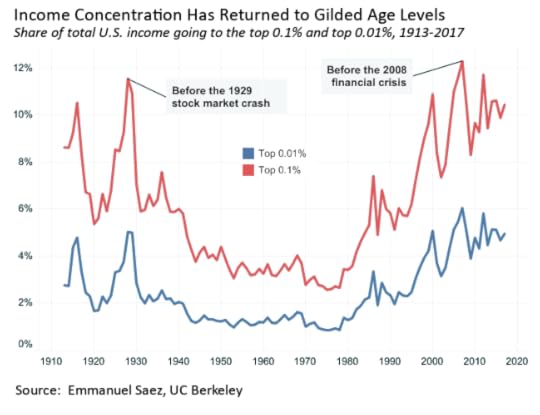

The ‘markets know best’ theory led to the financial deregulation of the 70’s, 80’s and 90’s which put finance back to the casino days of the 20’s and justified tax cuts for the rich. It created the financial inequality that we see around us and, like all movements, was based around a theory: Neoliberalism.

Neoliberalism

Neoliberalism has also been also called Reaganomics and is in fact trickle-down theory. Its premise is pretty straightforward, and although it is a proven failure, it is continuously resurrected. Basically, the theory is that the market knows best and will self-correct. It claims that there should be minimal regulation, minimal tax and minimal interference from the government, so that the markets can do what’s best. Financial crashes are justified as just self-correction and government/taxpayer bailouts are too. Hmm, I don’t think bailouts are supposed to be part of neoliberalism, the contrary in fact.

Neoliberalism was used to justify financial deregulation and tax cuts. A 20th century conservative economist, named Art Laffer, believed in a magical tax rate at which he claimed people would stop working if they were taxed too much. And if you cut taxes for the rich, they would work longer, harder and better, and the fruits of their endeavours would trickle down to everyone else. Thing is, today most people work jobs that require them to be there, regardless of tax rate, and if they don’t work, they won’t receive any pay at all. As far as billionaires go, I can’t see how billionaires are able to work more hours than already exist in a day, and they certainly aren’t billions of times more productive than the rest of us.

Laffer sold the theory to Donald Rumsfeld and Dick Cheney in a bar in 1974. This was the foundation of Reaganomics. Incidentally, President Trump has just awarded Laffer the Presidential Medal of Freedom. …Although, that might have been because Laffer wrote a book called Trumponomics…

That’s what Trump’s tax cuts are: trickle down. These cuts helped create the biggest one-month deficit in US history at $234 billion. Trump, who pledged to eliminate the US deferral debt in eight years, has actually increased it by more than $2 trillion in just two years, when the US economy is supposedly healthy.

Neoliberalism didn’t work in the 70’s, 80’s, 90’s and 2000’s and it’s certainly not working now.

Even after the Great Recession of 2008, nothing has changed. The financiers kept ‘their’ money and went back to business as usual. Even the $139 billion in fines imposed on banks between 2012 and 2014 had no impact. In fact, the derivatives market was 20% bigger in 2013 than in 2007 before the crash. The fines were chump change to the financiers.

Financial Deregulation

As well as tax cuts, four important things happened on the financial deregulation front. Well, more than four of course, but for the purposes of what I’m writing, let’s look at four.

Things changed in the 70’s and 80’s. But, first here’s a quick explanation of some investment banking speak as everyone should be clear about two terms that are used frequently in banking: ‘going long’ and ‘going short’.

Going long is fairly straightforward. You like something, like a share or bond, so you buy it and hold onto it. You hope it will rise in value and/or provide an income stream. You are making an investment in the future.

Going short is the opposite. It is selling a stock or bond you don’t own with the expectation that the price will drop. If you plan on doing this for longer than a few hours you will need to find someone to borrow the shares or bonds from, to give to the person you sold them to.

As an example, you might think that the UK government is going to raise interest rates. If this were to happen, then government bonds would drop in price – remember the wings of an airplane? So, you decide to sell 100 bonds at £100 hoping those bonds will be worth less in the future. You sell the bonds, but you need to deliver (give) them to the buyer that you sold them to. What you do is ‘borrow’ the bonds from someone else. Say a pension fund. The pension fund loans you the 100 bonds for a month and you pay them a fee for this, so they make a little extra money on those bonds. By the end of the month, if things go as you planned, the bond price has dropped to £90, so you actually finally buy the 100 bonds in the market (cover your short) and make £10, minus what you paid the pension fund to lend them to you.

The four changes:

The first is that investors were allowed to sell shares they didn’t own (to go ‘short’). Previously, only market makers could do this, in order to maintain a market in a share, and would close the ‘short’ position out as soon as possible. This is a big part of what happened with ‘Big Bang’ (1986) in the UK: deregulation of the financial markets. Again, lots more went on, but one of the far-reaching changes was being able to ‘short’ a share if you felt it would go down in price. Investment groups calling themselves hedge funds were born. Their speciality was ‘betting’ against companies, not investing in companies.

Hedging used to mean removing uncertainty by using futures and options (hence the name hedge funds), where ‘hedge’ implies minimising risk. It used to be about selling next month’s corn harvest at a price agreed upon today (selling something you don’t have yet) or buying next month’s oil at a price agreed today. But hedge funds aren’t hedging anything, they are simply betting by selling something they don’t have. And yes, even they call it ‘betting’.

The second was the repeal of the Glass-Steagall Act in the US. This was introduced in 1933 after the stock market crashes of the 20’/30’s. It separated retail banking from investment banking. By repealing the law, retail banks were allowed to use their balance sheets to ‘invest’ in or bet on the markets. And, they didn’t just bet $1 for every $1 dollar they had. They ‘geared’ up and invested $10 or more for every $1 they had on their balance sheets, the balance sheets of the retail banks being all the money on deposit with the bank. So, many retail banks went into investment banking because shareholders wanted better returns on their investments and bankers wanted bonuses.

This saw a return to the roulette of the roaring 20’s. The financial markets became a casino. It was all about betting other people’s money. Those that did, made fortunes and were heralded as sages. They didn’t make or create anything though. They gambled. They took. Of course, this all came home to roost in the 2008 crash. And the governments paid the bill and taxpayers and small investors lost out.

The 80’s were the time of Gordon Gekko and ‘greed is good’. And yes, I fell for it and moved to the UK from the US to be a part of Big Bang – a teeny inconsequential part I might add. Although I did ‘borrow’ a third of the entire long maturity, dated bonds of the Spanish government bond market, but that’s another story…. My employer made a fortune. To note, bonds with longer maturity dates have wider price swings than bonds with shorter maturity dates, so speculators love them.

The third thing was the lifting of caps on interest rates, so debt became a real money maker and a major instrument of finance. In the 80’s, credit card interest rates went to over 20%, Michael Milken and ‘junk’ bonds arrived and it was the era of Ronald Reagan – who entered office in Jan 1981 with the US as the largest creditor nation in the world and left office in Jan 1989 with the US as the largest debtor nation in the world. In the span of eight years Reagan turned things upside down and the debt age truly began. And in the UK, Margaret Thatcher spent the national assets of the UK buying elections, rather than investing in the future of the country. In Japan things were so crazy that at one point the Imperial Palace in central Tokyo was worth more than all the real estate in California. Everything changed.

Today, companies are borrowing money to pay shareholder dividends and to do share buybacks (buyback their own shares) as it drives prices up, and stock markets. They even do this when they have cash – offshore as it’s more tax efficient. Think about this. Apple has almost $300 billion cash sitting offshore (it doesn’t want to bring it onshore and pay tax) but has borrowed almost $100 billion in the past two years to pay shareholder dividends and buy its own shares back. In 2015 alone, US companies paid over $1 trillion to shareholders in share buybacks and dividends, while wages remained flat.

Companies who don’t have the cash offshore are also doing this. They are going further and further into debt to pay shareholder dividends. Yet, because they are paying dividends, the share price is going up, which means, you guessed it, they can borrow more to pay more dividends. And we all know how this will end – crash, government bailout, ‘austerity’ for normal people, rich getting richer, middle classes getting poorer.

Much of the wealth of the super-rich has been fuelled by debt, the debt of the bottom 90% who need to borrow to buy and rent things that the super-rich sell and rent to them. And let’s not forget the taxpayer-funded government borrowing that’s needed to support the super-rich casino games.

The fourth item is derivatives. Warren Buffet, the world’s most famous investor and periodically the world’s richest person, says ‘derivatives are financial weapons of mass destruction’. He’s right of course. He invests by going long and often holds onto shares in companies for decades.

Someone pays a fee to guarantee that they can buy or sell something in the future at a price fixed today. This is a useful financial tool as you can reduce uncertainty by paying to fix a price today, to hedge against future price fluctuations.

Futures can be important and useful instruments and the biggest futures exchange is in Chicago. They were primarily used for physical goods, commodities – crops, animal stock, oil, minerals etc. We’ll address these first.

Imagine you’re a wheat farmer. You’d like to sell next year’s harvest at today’s price to remove the uncertainty of what the actual price may be in the future. You know your costs next year and will make a profit, so you are willing to pay today to guarantee that profit. It makes life more certain for you. You are willing to give up the chance that the price of wheat goes up and you could make more money by neutralising the risk that the price of wheat may go down and you could lose your shirt. You are not a speculator or gambler after all, you’re a farmer. You want to guarantee, to set tomorrow’s price today. You want to hedge the risk.

On the other side of this equation is a bread manufacturer. They are happy with today’s price of wheat and they can make a profit at this price without having to raise the price of bread to their customers. Sure, they could make more money or charge their customers less for a loaf of bread if the price of wheat went down, but they could also be forced to pay more and raise prices if the price of wheat went up. They would rather remove the risk of the price of wheat in the future and hedge themselves by buying tomorrow’s wheat at a price agreed today. They have price certainty. After all, they are not speculators or gamblers, they are bread makers – they want to guarantee, to set tomorrow’s price today.

As you can see, this makes a lot of sense. It removes future uncertainty. You pay to hedge the future.

Then, there are options. They are similar to futures with one big difference. They are not based around something physical, but rather around a financial instrument. They are based around shares and bonds. They give someone the ability to buy or sell a share or bond in the future, at a price agreed upon today.

For instance, an insurance company may know it will need to sell some shares in the future to meet some outflows due to some large upcoming insurance claims. These outflows can be met at today’s price and they would prefer to remove the uncertainty of tomorrow’s price. They buy an option to sell the shares at today’s price.

Conversely, perhaps a pension fund has funds coming in monthly and would like to buy shares in a company they like. They like today’s price as it gives them a certain return, so because they would like to fix tomorrow’s price today, they buy an option doing exactly that.

The reality though is that derivatives quickly became speculative instruments and ever more complicated. People used options to bet on price movements by buying or selling options. And they went from being based on shares and bonds to interest rates, stock indexes and more. Then, the financiers hired PhD mathematicians and physicists and derivatives became very, very complicated. They began to combine all types of things together and to create new derivatives that could be based on anything, such as the $/£ exchange rate vs. the price of gold vs. the length of women’s skirts (why not) vs. the price of wheat futures.

Derivatives are complicated financial machinations that no one understands, even probably the people who wrote them. Derivatives take options to a whole new level by creating financial instruments based around lots of variables. So many in fact, that no one actually knows who’s liable for what. Which is what happened in 2008.

If you really want to know what caused the crash of 2008 watch The Big Short. It was due to derivatives based around dodgy home loans.

In a nutshell, a bunch of investment bankers invented a new game of pass the parcel based on ‘derivatives’ around home loans. These were called CDO’s (Collateralized Debt Obligation). Retail bankers loaned easy money for over-valued homes, to people who couldn’t afford them. These loans were bundled with other loans, repackaged and resold to investors as CDO’s.

Some retail banks got rid of their risk and made money by selling the loans to investment banks that packaged them up and sold them to investors. Some banks formed just to give out these risky subprime mortgages and earn fees by selling them to the investment banks.

The credit rating on these loans would be very low (subprime) if they were marketed by themselves so in order to sell them, the investment bankers dressed them up by including them with other loans and having someone else guarantee them.

Investment bankers convinced other retail banks, and insurance companies like AIG in particular (at the time the world’s largest insurance company with $1 trillion in assets), to guarantee these subprime instruments by using their balance sheets and a derivative that is called a ‘Credit Default Swap’. They made the subprime loans look better to investors than they were – claiming they removed risk for investors. Investors were betting on AIG, not the subprime loans. AIG made money by agreeing to let investment banks use their balance sheets. AIG thought they were safe. They weren’t. To add insult to injury, AIG invested some of their fees and profits into, yes you guessed it, subprime mortgages. They’d thought it was easy money.

The subprime loan wasn’t what was on the table to investors; it was AIG everyone was looking at. This combined with rating agencies that gave these loans very high safety investment ratings, due to AIG, were essentially a charade. The credit agencies did not look closely at the underlying loans.

The banks made fees and investment bankers made a fortune buying and selling these instruments to investors – until homeowners stopped making payments. The subprime loans lost their value and AIG and others had to stump up. It was the end of AIG, which received an $85bn bailout from the US government. Similarly, General Electric (GE) became a huge financial player by lending money. GE settled with the US government with a fine of $1.5bn in 2019 for its involvement in a subprime mortgage bank it had owned, but luckily sold, before everything went tits up.

The market crashed and AIG, and others who guaranteed the loans or were giving subprime loans, went bust. And the government and taxpayers bailed them out. Governments around the world printed money like there was no tomorrow and called it ‘quantitative easing’. Trillions of dollars were printed and used to purchase bonds so as to stop a 1920’s type crash.

The investment bankers, who were responsible for this, were all laughing in their beach houses, which they kept. And then, as ordinary people suffered through ‘austerity’ and had no money, the rich bought all the cheap assets. They were the only ones with cash.

All this needs to be reined in and put in check otherwise it will happen again. And again.

https://prospect.org/article/neoliber...

https://www.theguardian.com/books/201...

https://www.theguardian.com/commentis...

https://www.businessinsider.com/us-bu...

Makers and Takers: Rana Foroohar

https://www.cbsnews.com/news/japans-p...

https://www.thebalance.com/apple-stoc...

Makers and Takers: Rana Foroohar

https://www.imdb.com/title/tt1596363/

https://insight.kellogg.northwestern....

https://www.investopedia.com/articles...

https://www.housingwire.com/articles/...

The post How We Got into This Financial Mess appeared first on come the evolution.

April 8, 2020

Time to change inheritance tax NOW

I don’t mean to be morbid but unless we want a whole new bunch of spoiled billionaire kids — we better deal with inheritance tax now.

Inheritance Tax

Inheritance tax is very important. We all want to leave something for our children, and we should be able to. Let me reiterate though, the problem is neither the upper middle classes, who make hundreds of thousands of dollars a year, nor the rich, who make millions of dollars a year. It’s the super-rich, who make hundreds of millions and billions, and pay almost no tax.

People who inherit vast fortunes are a different matter. Often, they haven’t earned anything themselves. Don’t get me wrong. Some are amazing philanthropists who contribute to society and good causes. Great. Many though contribute little of social value to society.

Children of wealthy families grow up with every opportunity possible; great educations, lives, toys, networks and opportunities. But when they turn eighteen, they should be treated like everyone else. Well almost. We all work for our children after all, and we should be able to help them, within reason. Bill Gates agrees, as do many other very wealthy people who aren’t leaving all their fortunes to their kids – well, only a part, but not all. The kids are being provided for. Bill Gates’ kids are not going to be billionaires through inheritance; they will only inherit $10 million each.

And Warren Buffet famously said, “I still believe in the philosophy … that a very rich person should leave his kids enough to do anything, but not enough to do nothing.”

Sure, a motivation of parents is to provide for their children, but there should be a maximum that can be inherited from an estate as a whole and a maximum per person. The question is: how do we set this amount?

If everyone has a minimum income or UI (Universal Income), which we’ll discuss later, we could use UI as the basis for maximum inheritance levels. Let’s see how that could play out with a UI of £12,000 per year.

If one person could inherit up to 1,000 (years) x UI and in this case it would be £12 million, the maximum that could be inherited by any one person would be £12 million.

For the estate maximum as a whole, let’s multiply this (£12 million) by 10, so there’s plenty to share. So, in this case, the maximum that could be inherited from an estate would be £120 million.

£12 million per person tax free, coupled with the UI, that should keep them in clover for the rest of their lives.

So, what happens to the rest? It gets split. Half goes to the government of the day as social; the other half goes to the sovereign wealth fund (as discussed later).

Let’s look at a £1.2 billion UK estate example to see the breakdown:

£12 million maximum per recipient

= 1,000 (years) x £12,000 (UI)

£120 million maximum per estate

= 10 (inheritors) x £12 million

Balance: £1.08 billion

= £1.2 billion (total estate) – £120 million (inheritance)

Balance split: = £1.08 billion / 2 = £540 million

£540 million – social to the government

£540 million – social investment to the SWF

Easy. Inheritance tax solved and even the super-rich will want a decent UI. No more super-rich from inheritance though. They’ll have to earn it!

There shouldn’t be any caps on wealth earned. Inventors and entrepreneurs are the backbone of our society and their potential incomes should not be capped, nor should they pay more tax than others. Whether it’s new products and services or space exploration, we don’t want to stifle this. Today, space exploration is partially driven by private fortunes such as Elon Musk and SpaceX. We should applaud this and not stifle this. We need trail blazers – whether to climb mountains, go to space, invent or invest in new health devices or develop new goods and services.

These measures will help reduce tax evasion, but more is needed.

Let’s put a stop to tax evasion in a very simple manner, keep it simple. Imagine how much easier it would be to complete your tax returns if there were no exemptions and a flat-rate tax.

If you were a resident of a country, you would file a return in that country. Residents would then pay tax dependent on where they spent their time. If they split their time between two countries, the tax would get split proportionally between the two.

It’s more than fair and makes it easier to deal with supposed offshore investors.

https://www.cheatsheet.com/entertainm...

https://www.cnbc.com/2015/03/09/boome...

The post Time to change inheritance tax NOW appeared first on come the evolution.

April 2, 2020

A Radical Idea But

Let’s think about the big picture for a change. Over the coming months there are going to be numerous ideas on how we should ‘save’ the economy. How’s this for a crazy idea, why not save save people and the envrionment – and that will save the economy.

One of the things we need to do is get the world more balanced and reduce this financial inequality. Now is the time to do this.

A Radical Idea – But

Yesterday, out of curiosity, I was playing with some numbers related to consumer debt and quantitative easing. This led me to wanting to see the maths behind having the super-rich pay off all the consumer debt of Americans and Brits. The numbers were compelling, but I dismissed the idea. I am a capitalist after all. But, I changed my mind after looking at quantitative easing a bit more. Here are the numbers:

As we noted previously, the US super-rich own almost $30 trillion in assets (excluding what’s stashed offshore). Total US consumer debt is $4 trillion. So, if we took, sorry, taxed the 1% of the population’s wealthy, just once, on their assets at a rate of 15%, we could wipe out ALL consumer debt in the US. This would cause absolutely no hardship for the 30,000 people but would make 300 million people a lot happier and remove their major stress. Just sayin’.

Think about this for second, the richest 500 people in the world saw their wealth increase 25% in 2019, while the average person can’t even earn 1 percent interest at the bank. The wealth of 500 people increased in one year by $1.2 trillion, the equivalent of one third of all the consumer and student debt in the US.

To put things really in perspective, look at this: total US household debt is $13 trillion, meaning that those super-rich 1% could also pay off EVERY mortgage in the country, as well as ALL the consumer debt, including theirs, with a one-off 43% social tax and still be sitting on $17 trillion.

As I slept, or tried to, I couldn’t stop thinking about these numbers. While the mortgage part was a bridge too far, I’ve come to the conclusion that having the 30,000 US rich pay off the US consumer debt of 300 million Americans is not just a good idea, but eminently fair. This is why:

As we noted, the rich have been paying less tax. If they pay tax, it’s 20%, whereas the kindergarten teacher is paying 25%. They’ve not been paying their fair share for a while now. This is just catch-up

They’ll be paying themselves. Think about it, who owns the debt? The super-rich do, as they own the companies that issued the debt

$1.6 trillion of the debt is student debt and $1.1 trillion of that is owed to the US government. This would lower the US government debt and stop Betsy Devos, the US Secretary of Education, from selling it to her company, where she would increase interest and cause yet further hardship for borrowers

It prevents impending student loan defaults. Estimates are that by 2023, 40% of student loan borrowers may default – and millions suffer

The wealthy caused the financial crash and then benefitted from it. They should pay for their speculation, not us

The UK tells a similar story. Total UK consumer debt is £428 billion and the richest 1% are worth £3 trillion (excluding all the money stashed offshore). If we levied a one-off wealth tax of 14% on the richest 1%, all consumer debt in the UK would be wiped out. Bearing in mind that this debt has doubled since the crash of 2008, a crash that was due to the super-rich financiers, it seems perfectly reasonable to me.

A number of very wealthy people in the US already agree with something similar. In June 2019, some of the richest people in the US wrote an open letter to all the 2020 US Presidential candidates calling for a yearly wealth tax, such as that proposed by Elizabeth Warren, of 2% on assets over $50 million, and another 1% on assets over $1 billion. They reckoned it would generate $1 trillion in new taxes over a period of ten years. Signatories include Disney heiress, Abigail Disney, Facebook co-founder, Chris Hughes, investor, George Soros, and Blue Haven Initiative co-founders, Liesel Pritzker Simmons and Ian Simmons.

Page 117 Read more

https://www.thebalance.com/consumer-d...

https://www.cnbc.com/2018/02/13/total...

https://www.forbes.com/sites/zackfrie...

https://medium.com/@letterforawealtht...

https://www.vox.com/future-perfect/20...

The post A Radical Idea But appeared first on come the evolution.