A Radical Idea But

Let’s think about the big picture for a change. Over the coming months there are going to be numerous ideas on how we should ‘save’ the economy. How’s this for a crazy idea, why not save save people and the envrionment – and that will save the economy.

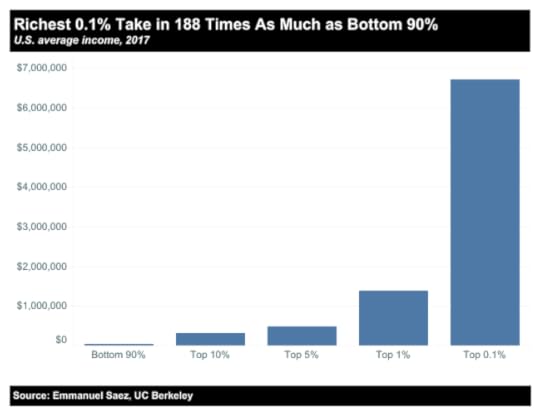

One of the things we need to do is get the world more balanced and reduce this financial inequality. Now is the time to do this.

A Radical Idea – But

Yesterday, out of curiosity, I was playing with some numbers related to consumer debt and quantitative easing. This led me to wanting to see the maths behind having the super-rich pay off all the consumer debt of Americans and Brits. The numbers were compelling, but I dismissed the idea. I am a capitalist after all. But, I changed my mind after looking at quantitative easing a bit more. Here are the numbers:

As we noted previously, the US super-rich own almost $30 trillion in assets (excluding what’s stashed offshore). Total US consumer debt is $4 trillion. So, if we took, sorry, taxed the 1% of the population’s wealthy, just once, on their assets at a rate of 15%, we could wipe out ALL consumer debt in the US. This would cause absolutely no hardship for the 30,000 people but would make 300 million people a lot happier and remove their major stress. Just sayin’.

Think about this for second, the richest 500 people in the world saw their wealth increase 25% in 2019, while the average person can’t even earn 1 percent interest at the bank. The wealth of 500 people increased in one year by $1.2 trillion, the equivalent of one third of all the consumer and student debt in the US.

To put things really in perspective, look at this: total US household debt is $13 trillion, meaning that those super-rich 1% could also pay off EVERY mortgage in the country, as well as ALL the consumer debt, including theirs, with a one-off 43% social tax and still be sitting on $17 trillion.

As I slept, or tried to, I couldn’t stop thinking about these numbers. While the mortgage part was a bridge too far, I’ve come to the conclusion that having the 30,000 US rich pay off the US consumer debt of 300 million Americans is not just a good idea, but eminently fair. This is why:

As we noted, the rich have been paying less tax. If they pay tax, it’s 20%, whereas the kindergarten teacher is paying 25%. They’ve not been paying their fair share for a while now. This is just catch-up

They’ll be paying themselves. Think about it, who owns the debt? The super-rich do, as they own the companies that issued the debt

$1.6 trillion of the debt is student debt and $1.1 trillion of that is owed to the US government. This would lower the US government debt and stop Betsy Devos, the US Secretary of Education, from selling it to her company, where she would increase interest and cause yet further hardship for borrowers

It prevents impending student loan defaults. Estimates are that by 2023, 40% of student loan borrowers may default – and millions suffer

The wealthy caused the financial crash and then benefitted from it. They should pay for their speculation, not us

The UK tells a similar story. Total UK consumer debt is £428 billion and the richest 1% are worth £3 trillion (excluding all the money stashed offshore). If we levied a one-off wealth tax of 14% on the richest 1%, all consumer debt in the UK would be wiped out. Bearing in mind that this debt has doubled since the crash of 2008, a crash that was due to the super-rich financiers, it seems perfectly reasonable to me.

A number of very wealthy people in the US already agree with something similar. In June 2019, some of the richest people in the US wrote an open letter to all the 2020 US Presidential candidates calling for a yearly wealth tax, such as that proposed by Elizabeth Warren, of 2% on assets over $50 million, and another 1% on assets over $1 billion. They reckoned it would generate $1 trillion in new taxes over a period of ten years. Signatories include Disney heiress, Abigail Disney, Facebook co-founder, Chris Hughes, investor, George Soros, and Blue Haven Initiative co-founders, Liesel Pritzker Simmons and Ian Simmons.

Page 117 Read more

https://www.thebalance.com/consumer-d...

https://www.cnbc.com/2018/02/13/total...

https://www.forbes.com/sites/zackfrie...

https://medium.com/@letterforawealtht...

https://www.vox.com/future-perfect/20...

The post A Radical Idea But appeared first on come the evolution.