Stephen Clapham's Blog

November 21, 2025

AI and Server Lives

I don’t know whether to be amazed or amused by the amount being written about the hyperscalers’ capex and depreciation. I wrote about this (for the second time) in my Substack in February, 2024 and nobody was interested.

Indeed hardly anyone was interested a month ago when I wrote a third article Amazon’s AI Reality Check, published on November 2, 2025. But since Michael Burry posted the tweet below, there has been an explosion of interest in the subject:

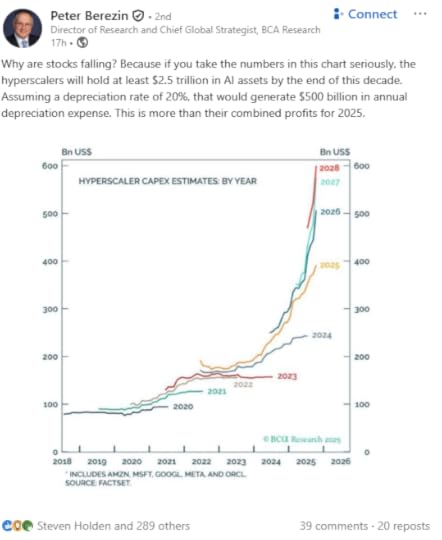

Indeed, since this tweet (no, he isn’t one of my subscribers), I am seeing commentary everywhere. Here is one example from LinkedIN:

I don’t know Peter Berezin and I used to respect BCA and was a client. But my good friends who are strategists rarely delve into the murky waters of accounting. There is a good reason – it’s often not as simple as it looks.

The chart above is titled Hyperscaler Capex Estimates by Year. I suspect it’s a chart of cumulative quarterly capex for the group. By 2028, that reaches $600bn.

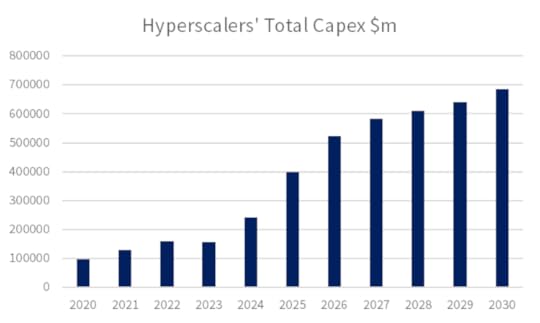

This is consistent with the consensus capex estimates from AlphaSense which puts the total capex for the 5 companies at $610bn. But this also includes non-AI assets. These companies all have real businesses which believe it or not have real assets that require investment. Their total spend ins shown in the chart below:

Total Capex with Consensus Estimates

Source: Behind the Balance Sheet from AlphaSense Data

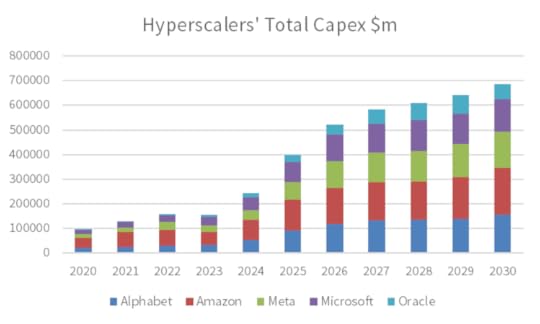

Here is the same data, broken down by company:

Companies’ Total Capex & Consensus Estimates

Source: Behind the Balance Sheet from AlphaSense Data

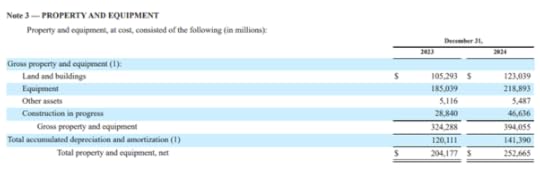

This is total capex (which for Amazon in the past included quite a significant amount of lease finance so it actually understates the total investment in assets). It includes ALL assets. For context, here is the Amazon fixed assets note for 2024:

Amazon Fixed Assets Note 2024

Source: Amazon 2024 10-K

Amazon spent $83bn of cash on fixed assets last year. It disposed of some assets and received incentives (mainly from local municipalities) of just over $5bn, making a net $78bn. Its gross PP&E increased by $70bn, from $324bn to $394bn, after disposals; US GAAP, unlike IFRS, does not require an analysis of the movements. Of that $70bn net increase, land and buildings were over 25% at $18bn and likely some of the $16bn increase in assets under construction are also buildings.

Equipment increased by $34bn, and some of that will certainly be trucks and vans and possibly even some aircraft. Amazon’s spend on AI was likely not even half its investment last year.

The author thinks that:

“hyperscalers will hold at least $2.5 trillion in AI assets by the end of this decade. Assuming a depreciation rate of 20%, that would generate $500 billion in annual depreciation expense”.

Even assuming the asset numbers were accurate – which they aren’t – a cumulative spend of $2.5bn would not result in depreciation of $0.5tn at a depreciation rate of 20%. As I explained in my last article, the only company which uses a depreciation rate of 20% is Amazon; it uses 5 years, Meta uses 5.5 years and the rest use 6 years.

By 2030, any assets purchased before 2025 will be fully depreciated. You cannot simply add up the capital expenditure and divide by 5. And of course if you are adding total capex, including land and buildings, the actual depreciation will be considerably lower, as buildings usually last quite a long time – Amazon uses 40 years which is quite conservative.

So don’t believe everything you read about this, even from strategists from respected firms. A proliferation of LinkedIN commentators seem desperate to jump on any bandwagon which will get them views.

I should also add that the 5-6 year life is probably fine for basic servers which are storing your iCloud photographs and similar, but the life of an AI server is likely much shorter – particularly one used for training, but probably also for inference.

The best way to illustrate this is a simple analogy. Think of a car – I live in central London and cannot cope with the 20mph speed limit, so I rarely drive. My cars have not done over 3,000 miles in a year for several years. Think of a sales rep’s car, which is doing 35-40,000 miles a year.

The AI servers are like the sales rep’s car, working flat out 24 hours per day, getting very hot. They will be worn out in 2-3 years. They will still be useful then for storing photographs or data but they will not be capable of the training tasks and will need to be replaced.

They may have another few years’ life in the lesser role, but they should be more or less fully depreciated at the conversion point, because the revenue generated from storing data will be insufficient to pay for the cost of the chip.

Of course the revenue generated by AI is also insufficient, but that’s a separate problem.

The hyperscalers should be depreciating using a reducing balance methodology so that a greater cost is charged in the earlier years. Given that the companies have mainly been extending the life of their servers, to boost their earnings progression, we perhaps shouldn’t expect them to worry about subtleties like this. But investors should – it’s important to understand the real economics of the business.

Burry’s estimate of $176bn overstatement of earnings 2026-28 is c.$60bn pa. These businesses will invest c.$1.7tn over that period or c.$570bn pa. That compares with a total capex of c$160bn pa before the launch of Chat GPT. That’s a c.$400bn pa difference.

If that were all on AI, let’s say 70% would be on chips or c.$280nbn pa. Depreciated over 5 years, that would be $56bn. Depreciated over 2.5 years, it would be $112bn pa. Over 3 years, the difference is $178bn. My guess is that Burry has arrived at his estimate on a similar basis, but his will certainly be more rigorous than my back of the envelope calculations.

I took 30 minutes to do these calculations and write this. It was meant to be a back of the envelope calculation which I would post on LinkedIN to refute the argument in the post above. But LinkedIN doesn’t like longer posts with images so I decided to post this on my blog instead.

I stress that I have just jotted down a few quick thoughts and haven’t done a great deal of work on the under-depreciation impact, and I am looking forward to hearing more from Michael Burry.

If you enjoyed this post, check out my Substack.

You may also like our online courses. And check out our new app on understanding business quality.

The post AI and Server Lives appeared first on Behind The Balance Sheet.

November 14, 2025

#53 – The Plodder

Tom Gayner is the CEO of Markel Group and has run its investment portfolio for 35 years, beating the index by an astonishing 1.5% pa. This makes him one of the most successful capital allocators in the US stockmarket, yet he is under the radar. He explains why he holds 140 stocks, although the top 40 represent 80% of the value; why there are so few imitators of the insurance/equity and business investment strategy so successfully deployed by Berkshire and Markel; the simple way to analyse an insurance business; what he has learned from being on the boards of Graham Holdings with Warren Buffett and on the Coca Cola Company; and one secret of Warren Buffett’s success which you likely will not have heard before. Tom Gayner is anything but a plodder, but his thoughtful, modest and cautious approach to investing and life makes him a fantastic role model.

Some takeawaysGetting into InvestingTom grew up on a farm and watched how his father operated as an accountant and a business man and fell in love with business from an early age. After graduation and working as an accountant, he ended up as a stockbroker with a Richmond, Virginia firm, when Markel came to the market in 1985. A unique set of circumstances meant that Steve Markel was the ideal investor for a discounted zero coupon junk bond which Tom had identified as a great opportunity – it was trading at a 70% discount after junk bond leader Drexel went bust. The bond was redeemed at par before the year was out and Tom was given an investment role at Markel, where he has been ever since.

The Markel Shareholder LetterTom takes two weeks to write his annual letter but puts in a lifetime of experience. It’s an outstanding example of the genre, and it comes across as a very personal message, and one directed to his team as well as investors. Tom points out that many of his 22,000 employees are also shareholders. It’s well worth reading a couple of the letters.

Passive vs Active ManagementIn the podcast, Tom discussed the role of active managers. He pointed out that in 1986, there were 7,000 quoted companies in the US and there are now just 3,000. He mused that probably less than 90 and perhaps as few as 9 in 1000 people own Berkshire Hathaway and people have been educated to be terrified of individual stocks. Why is this when the success of Berkshire is demonstrable? He also feels that there are more pricing errors being made in today’s market, because there are not enough active managers – a point repeatedly also made by David Einhorn.

Tom’s Experience on BoardsTom sits on some great boards, including the Coca Cola Company and as Chairman of the Board of the Davis Series Mutual Funds. He also sat on the Graham Holdings board with Warren Buffett and tells a great story on the podcast about how he went to his first meeting and had dinner the night before with his fellow board members. Afterwards, he talked and talked to Warren Buffett but he couldn’t stay up. Tom explains on the podcast why he recruited to the Markel board Lawrence Cunningham, author of The Essays of Warren Buffett: Lessons for Corporate America (now in its 8th edition), and Morgan Housel, author of the multi-million best seller Psychology of Money; both have been valuable contributors.

About Tom GaynerTom Gayner is Chief Executive Officer of Markel Group. He was formerly co-CEO from 2016-2022 and used to oversee the investing activities for the company, as well as the Markel Ventures diverse industrial and service businesses.

Mr. Gayner joined Markel in 1990 to form Markel Gayner Asset Management which provided equity investment counsel for Markel Corporation as well as outside clients.

Prior to joining Markel, Mr. Gayner served as vice president of Davenport & Co of Virginia and as a Certified Public Accountant with PriceWaterhouseCoopers LLP.

Mr. Gayner serves as the Chairman of the Board of the Davis Series Mutual Funds and has served on the boards of the Colfax Corporation, The Coca-Cola Company, Graham Holdings, Cable One and Markel. He is a member of the Investment Advisory Committee of the Virginia Retirement System. He is a graduate of the University of Virginia and The Lawrenceville School.

/*! elementor - v3.22.0 - 24-06-2024 */.elementor-widget-divider{--divider-border-style:none;--divider-border-width:1px;--divider-color:#0c0d0e;--divider-icon-size:20px;--divider-element-spacing:10px;--divider-pattern-height:24px;--divider-pattern-size:20px;--divider-pattern-url:none;--divider-pattern-repeat:repeat-x}.elementor-widget-divider .elementor-divider{display:flex}.elementor-widget-divider .elementor-divider__text{font-size:15px;line-height:1;max-width:95%}.elementor-widget-divider .elementor-divider__element{margin:0 var(--divider-element-spacing);flex-shrink:0}.elementor-widget-divider .elementor-icon{font-size:var(--divider-icon-size)}.elementor-widget-divider .elementor-divider-separator{display:flex;margin:0;direction:ltr}.elementor-widget-divider--view-line_icon .elementor-divider-separator,.elementor-widget-divider--view-line_text .elementor-divider-separator{align-items:center}.elementor-widget-divider--view-line_icon .elementor-divider-separator:after,.elementor-widget-divider--view-line_icon .elementor-divider-separator:before,.elementor-widget-divider--view-line_text .elementor-divider-separator:after,.elementor-widget-divider--view-line_text .elementor-divider-separator:before{display:block;content:"";border-block-end:0;flex-grow:1;border-block-start:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--element-align-left .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-left .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-left .elementor-divider__element{margin-left:0}.elementor-widget-divider--element-align-right .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-right .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-right .elementor-divider__element{margin-right:0}.elementor-widget-divider--element-align-start .elementor-divider .elementor-divider-separator>.elementor-divider__svg:first-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-start .elementor-divider-separator:before{content:none}.elementor-widget-divider--element-align-start .elementor-divider__element{margin-inline-start:0}.elementor-widget-divider--element-align-end .elementor-divider .elementor-divider-separator>.elementor-divider__svg:last-of-type{flex-grow:0;flex-shrink:100}.elementor-widget-divider--element-align-end .elementor-divider-separator:after{content:none}.elementor-widget-divider--element-align-end .elementor-divider__element{margin-inline-end:0}.elementor-widget-divider:not(.elementor-widget-divider--view-line_text):not(.elementor-widget-divider--view-line_icon) .elementor-divider-separator{border-block-start:var(--divider-border-width) var(--divider-border-style) var(--divider-color)}.elementor-widget-divider--separator-type-pattern{--divider-border-style:none}.elementor-widget-divider--separator-type-pattern.elementor-widget-divider--view-line .elementor-divider-separator,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:after,.elementor-widget-divider--separator-type-pattern:not(.elementor-widget-divider--view-line) .elementor-divider-separator:before,.elementor-widget-divider--separator-type-pattern:not([class*=elementor-widget-divider--view]) .elementor-divider-separator{width:100%;min-height:var(--divider-pattern-height);-webkit-mask-size:var(--divider-pattern-size) 100%;mask-size:var(--divider-pattern-size) 100%;-webkit-mask-repeat:var(--divider-pattern-repeat);mask-repeat:var(--divider-pattern-repeat);background-color:var(--divider-color);-webkit-mask-image:var(--divider-pattern-url);mask-image:var(--divider-pattern-url)}.elementor-widget-divider--no-spacing{--divider-pattern-size:auto}.elementor-widget-divider--bg-round{--divider-pattern-repeat:round}.rtl .elementor-widget-divider .elementor-divider__text{direction:rtl}.e-con-inner>.elementor-widget-divider,.e-con>.elementor-widget-divider{width:var(--container-widget-width,100%);--flex-grow:var(--container-widget-flex-grow)} BOOK RECOMMENDATIONS

Tom recommended The Psychology of Money: Timeless lessons on wealth, greed, and happiness by Morgan Housel whom he invited on the Markel board. He said Morgan was the “oldest 38 year-old” he knew when he met him and he thinks anyone over the age of 10 can “get” this book.

/*! elementor - v3.22.0 - 24-06-2024 */.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=".svg"]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block} Buy on amazon

Buy on amazon Tom also recommended The Cost of These Dreams: Sports Stories and Other Serious Business Paperback by Wright Thompson. Steve was not familiar with this sportswriter who has assembled a collection of true stories about the dream of greatness and its cost in the world of sports.

Buy on amazon

Buy on amazon Off air, talking to Tom later in the week, he explained that he likes to read fiction because he believes that investors need to exercise both left and right brains – he enjoyed The Master and His Emissary, recommended twice this year (by Tom Slater and Geroge Michelakis). He suggested to Steve, who expressed a desire to read more fiction last year and had not read a single work of fiction in 2025, Trollope’s The Way We Live Now. Steve has ordered it and hopes to finish it before Christmas, but The Master and His Emissary at 462 pages (ex the notes) will probably have to wait.

HOW STEVE KNOWS THE GUESTSteve met Tom at Mario Gabelli’s conference in Omaha and pitched the podcast to him. As Tom was coming to London anyway, Steve decided to wait for his trip and record in person which is always preferable. By coincidence, Steve happened to be in Edinburgh later that week, when Tom presented at the Library of Mistakes and at a Markel mini-reunion. In spite of listening to Tom three times in four days, Steve didn’t hear more than one or two of the same stories twice.

ContentsTranscript

Prev#52 – The Traditionalist

The post #53 – The Plodder appeared first on Behind The Balance Sheet.

September 18, 2025

#51 – The Franchise Fan

Nick Train is a seriously thoughtful growth investor with a highly impressive 40 year track record. He invests in eternal franchises and takes a 20 year view. He says his ideal holding period is forever. He was early to recognise that high quality consumer brands were great investments and accordingly his funds significantly outperformed their benchmarks. More recently, the last five years have been less kind and performance has lagged somewhat with weak performance from some of his biggest holdings, notably Diageo, which is down almost 50% from its peak, in a market which has gone up.

Nick has taken this performance to heart and he explains why he has stuck with Diageo and continues to believe it’s as “forever” stock. He also explains his change in strategy to favouring 21st century asset light digital data plays which he sees as even more valuable than his old favourite consumer brands. He is particularly impressed with Rightmove, which I have described in the past as akin to a UK Zillow, and explains his rationale, as well as his enthusiasm for LSEG, RELX and Unilever.

Some takeawaysGetting into InvestingOur guests have split into almost equal groups; one half bought their first stock when they were 12 with money from a newspaper round and the other half ended up in investing purely by chance, after graduating from university, or after taking a finance class at university. Nick was refreshingly candid – with a history degree, investment management seemed like the most lucrative choice.

CareerNick has always been passionate about developing a long term track record and would have stayed at GT Management, his first employer, had circumstances been different. But GT was acquired and he chose to move to M&G. When M&G was acquired, having had two roles shot out from under him, he decided to set up Lindsell Train in 2002 with partner Michael Lindsell, to ensure that wouldn’t happen again.

Investment PhilosophyNick’s favourite holding period is forever, a trick he learned from Warren Buffett, and he seeks “eternal franchises” – stocks where he can lock the money away for 20 years and knows if he never looked at them in the interim, they would be worth considerably more. He is attracted to the concept of long histories of revenue growth and margin progression. Companies with such characteristics are rare and he wants to hold on to them, describing himself as a “hoarder of precious things”.

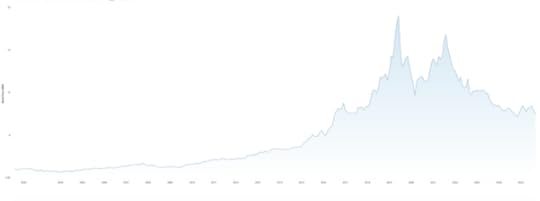

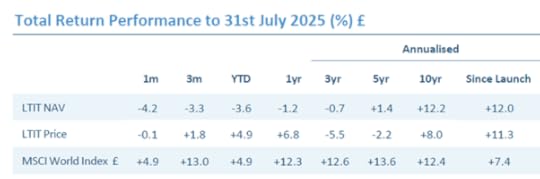

PerformanceNick Train runs a number of funds and this is probably not entirely representative, but I used the Lindsell Train Investment Trust to illustrate the ups and downs of running a concentrated portfolio. The share price peaked in mid-2019 at 1875p then had another rally but has been dismal since, as can be seen in the chart:

Lindsell Train Investment Trust Stock Price

Source: AlphaSense

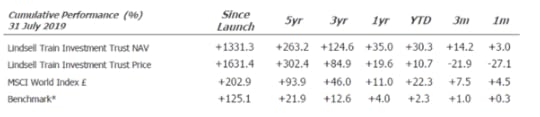

The relative performance at around that point was fantastic, although part of the gain was down to the trust trading at a premium to the asset value:

Lindsell Train Investment Trust Performance

Source: Company

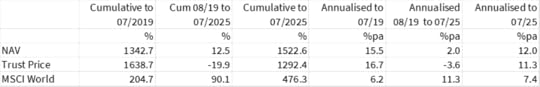

Here is the same data from the latest factsheet:

Lindsell Train Investment Trust Performance

Source: Company

There has been a sharp reversal, partly a reflection of the quoted trust moving from a premium to a discount and partly a fade in relative performance. The move to annualised data is a little confusing so here is the like for like, as provided by the company, as they disagreed with my calculations, although their data is slightly different:

Lindsell Train Investment Trust Performance

Source: Company

The expression “a game of two halves” comes to mind. The trust’s performance has clearly lagged and has been way behind its past record, but this has been exacerbated by a move from a premium to NAV to a discount. Part of the lag is the valuation ascribed to the fund management business which has seen a significant decline in profits as funds under management have fallen by around a third.

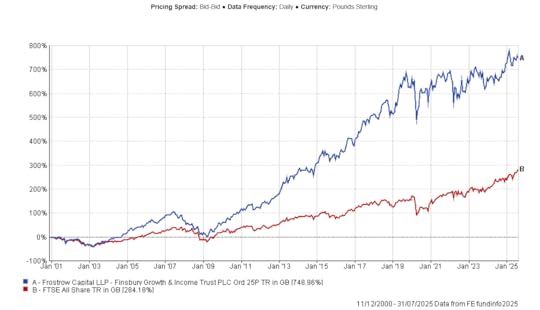

This is clearer and cleaner if one looks at the Finsbury Growth and Income Trust. Here is the chart from inception to 2025 and these charts use the UK benchmark:

And here is the performance to end-202 – stellar vs the index:

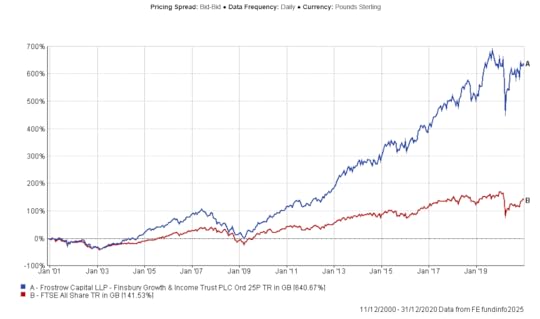

And here is the more recent performance from 2021 to July 2025, a significant underperformance:

Steve pitched the podcast to Nick at a conference where he had presented but Nick was unenthusiastic. Steve persisted, contacting Nick’s marketing team and one day out of the blue his PR agency emailed to say that Nick had agreed to come on the podcast. It seems that Nick doesn’t like the interview experience and probably thinks there are better things he can do with his time, but inevitably, when you are underperforming, there is a pressure to explain and keep investors onside. It’s a shame that Nick avoids the publicity as he is incredibly thoughtful about his investing process and we can all earn a lot from that, but at least he agreed to be interviewed this time.

About Nick TrainNick Train began his career as an Investment Manager at GT Management in 1981, after graduating from Oxford with a Modern History degree. He left GT in June 1998, after 17 years, on its acquisition by INVESCO. He joined M&G in September 1998, as a Director of M&G Investment Management. In June 1999 he was appointed as Head of Global Equities at M&G. He left M&G in April 2000 to co-found Lindsell Train Limited. He is investment adviser to the Worshipful Company of Saddlers.

Nick recommended The Warren Buffett Way by Robert Hagstrom which he found influential, although he cautioned that it’s quite an old book. Steve has enjoyed the book also. In the podcast, Nick referred to the book, Investing, The Last Liberal Art, which he thought might have been written by Michael Mauboussin. It was in fact also written by Robert Hagstrom.

/*! elementor - v3.22.0 - 24-06-2024 */.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=".svg"]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block} Buy on amazon Contents Transcript

Buy on amazon Contents TranscriptPrev#50 – The Art Lover

The post #51 – The Franchise Fan appeared first on Behind The Balance Sheet.

August 21, 2025

#50 – The Art Lover

Christopher Tsai is a deeply thoughtful growth investor. He became one of the foremost collectors of the works of Ai Weiwei, recognising their implicit value as well as deeply studying the artist. His concentrated portfolio reflects his attraction to growth stocks with Tesla his largest position. In our conversation, he explains why he believes Tesla has deep moats across multiple verticals; why he thinks many of the growth stocks in his portfolio have optically inflated valuations as they invest now to create future value; why the second largest position in his portfolio is QXO, with his father, also a famous investor, being one of Brad Jacobs’ original backers; and what he looks for in managers. I am trying to meet more growth investors to understand their strategy better. Christopher’s portfolio is too racy for me, at over a 60x P/E multiple on my estimates, but he makes an interesting case for holding long term compounders.

Some takeawaysGetting into InvestingChristopher bought his first stock age 11, investing $100 for a 25% return, with money saved from his gardening chores. At 16, he persuaded a local restauranteur to give him his life savings to invest, and he went on to become one of his first clients when he founded Tsai Capital, 25 years ago, a couple of years after graduating university.

The FirmTsai Capital just celebrated its 25th anniversary and now invests on behalf of 60 clients, mainly wealthy families. Christopher emphasises the importance of capital preservation, although his fund had a rocky ride in the 2022 downturn. He held 21 positions at last year-end, many of which he has held for years. He reluctantly trimmed Tesla which had reached a 33% weighting because he had an opportunity to invest in QXO.

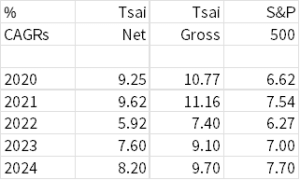

Source: Behind the Balance Sheet from Tsai Capital Data

The portfolio had a poor time in 2022 but had almost recovered the drawdown by end-2024.

Source: Behind the Balance Sheet from Tsai Capital Data

And it has delivered market-beating long term returns:

Source: Tsai Capital

One of the reasons that Christopher retains his stake in Costco, for example, is that all his worst mistakes have been selling compounders too soon. I don’t think he really believes that Costco is that cheap at 55x earnings, but he pointed out that in the past, you could have paid 40x for Costco and still achieved a 10% pa rate of return.

Christopher emphasises the importance of sending time on the people and the culture and the company’s eco-system. He is particularly interested in the track record of management.

ManagementChristopher seeks to back management with real skin in the game. Brad Jaconbs at QXO is the obvious example, but he also discussed Andy Florance, the CEO and founder of CoStar Group.

Christopher was particularly taken by his 2019 commencement speech to graduates at Virginia Commonwealth University.

“Ultimately, I think I was lucky to be challenged by adversity,” Florance said. “We all face adversity. Adversity can set you back or it can be channelled as a source of strength and motivation. Your choice.”

He went on: “Every single one of you has the capacity to achieve greatness…………you should leave here feeling really proud of what you’ve accomplished so far, and optimistic about your future.”

Florance founded CoStar Group from his dorm room as an undergraduate student at Princeton University. The company, a real estate service provider is now in over 70 countries and is capitalised at $35bn. They are a leading provider of commercial real estate data and marketplace listing platforms, with in-depth analytical information on over 5 million commercial real estate properties across multiple sectors, including office, retail, hotels, multifamily, healthcare, industrial, self-storage, and data centres.

Florance obviously meets Christopher’s criteria on capital allocation and Costar was his 6th largest holding with a weighting of 4.5%, based on the Q1 13-F.

About Christopher TsaiA third-generation investor, Christopher Tsai continues a legacy begun by his grandmother, Ruth Tsai—the first woman to trade on Shanghai’s exchange in 1939—and his father, Gerald Tsai Jr., the first Chinese American to lead a Dow Jones Industrials company.

He bought his first shares at age 11 and began investing informally at 16 for friends and local businesses and founded Tsai Capital at age 22 in 1997.

He is a regular interviewee in financial publications and on podcasts on topics like compounding, disruptive innovation, and art investing. Christopher enjoys trail running, reading, the arts, family time and making the perfect pot of tea.

Christopher recommended 3 books which you must read in the right order. First is The Intelligent Investor by Ben Graham, and Christopher particularly recommends Chapters 8 and 20, on managing emotions and margin of Safety. The link is to the latest edition with commentary from Jason Zweig.

/*! elementor - v3.22.0 - 24-06-2024 */.elementor-widget-image{text-align:center}.elementor-widget-image a{display:inline-block}.elementor-widget-image a img[src$=".svg"]{width:48px}.elementor-widget-image img{vertical-align:middle;display:inline-block} Buy on amazon

Buy on amazon He next recommended Thomas Phelps 100 to 1 in the Stock Market: A Distinguished Security Analyst Tells How to Make More of Your Investment Opportunities which talks about how to find 100-baggers. It’s quite an old book but still available. Kindle is a lot cheaper than the paperback.

Buy on amazon

Buy on amazon Finally, Christopher recommended the classic Common Stocks and Uncommon Profits and Other Writings by Phil Fisher:

Buy on amazon HOW STEVE KNOWS THE GUEST

Buy on amazon HOW STEVE KNOWS THE GUESTSteve bumped into Christopher outside the Markel meeting in Omaha this year. He had read his letters and was keen to interview him. Steve learned a lot from interviewing Tom Slater, the well-known growth investor and early backer of Tesla, earlier in the year, so had been looking for more growth investors for the podcast. If you know of any who would be interesting and interested, please email us at info@behindthebalancesheet.com. Christopher happened to be in London in early July so they agreed to meet up.

Although they didn’t talk about it on-air, Christopher is an avid art enthusiast, as is Steve. Christopher is such an enthusiast of Ai Weiwei’s work that not only has he amassed a major collection, he even asked the artist to design him a home in upstate New York. He sold the home some years ago, as it was unsuitable for his family, and obviously for a good price, as a recent sale of the property showed limited appreciation since.

But it reminded Steve of the plans submitted by Charles Rennie Mackintosh for a competition organised by the German design magazine, Zeitschrift für Innendekoration, for a “grand house in the modern style”. House for an Art Lover was Mackintosh’s entry. It was praised for its original design, but it was disqualified for insufficient drawings.

By this time, Mackintosh had already completed several buildings and was designing the Hill House, probably his most famous residential commission. Construction of House for an Art Lover was started in 1989, delayed in the early 1990s because of the recession, and was finally opened in Glasgow’s Bellahouston Park in 1996. And so many tourists visit Edinburgh and pass Glasgow by…

Tsai Residence from the Robb Report website:

PrevSteve was on the Rigby AG podcast

The post #50 – The Art Lover appeared first on Behind The Balance Sheet.

August 1, 2025

Steve was on the Rigby AG podcast

The post Steve was on the Rigby AG podcast appeared first on Behind The Balance Sheet.

July 8, 2025

Steve was on the Book with Legs podcast

The post Steve was on the Book with Legs podcast appeared first on Behind The Balance Sheet.

May 8, 2025

The Substack Gold Rush: Who’s Winning and Why?

I recently realised that I have been writing this Substack for nearly 3 years – I started in March, 2022. I thought this was a good excuse to take a broader look at finance Substacks and to review my journey and future direction.

The original motivation for this post was learning that Rupak Ghose had a Substack with just 800 subscribers. Here is someone who regularly writes for FT Alphaville and has some highly original views.

Substack has become increasingly competitive, unsurprisingly, as there are no barriers to entry and I wonder if marketing skill counts for as much as content quality. One top 20 finance writer on Substack is the inverse of Rupak – he is inexperienced and may have limited investing skill but has excellent marketing nous.

Why is it that someone like Rupak can struggle to get followers, yet others who are inexperienced and likely have lower value add, can attract so much larger an audience? I think there are three main reasons: longevity, content and marketing.

Longevity – One Key to IncomeMarc Rubinstein is one of the top 20 on Substack and quite rightly – his Net Interest column is fantastic and one of the few that I try never to miss. He, like me, is a former practitioner at a multi-billion hedge fund; but unlike me, he has real sector expertise. He does all the hard work on a company’s history and business and leaves the reader to cover the last mile of evaluating the current share price. It’s brilliant, he has 89k free subs and must make a good living at nr 16 in finance (I did the analysis a few weeks before this was published) with >1000 paid subs at $25/month or $250/year. He is therefore likely to be generating $250-500k in income.

Similarly, Alex Morris, who produces The Science of Hitting Substack, another excellent writer, was early on Substack. He is nr 31 in Finance Substack and has hundreds of paid subs at $99/mth and apparently, per Matt Levine, earns $260k p.a, twice what he earned in his former role as an analyst at an RIA in Savannah, Georgia.

Barry Knapp was another early participant and now has 7000 free subs but hundreds of paying subs at $999 pa. He is nr 49 and I am guessing makes $175-200k pa. He has 40 years of experience as a macro commentator, formerly at Lehman, Blackrock and Guggenheim Partners.

John Huber, a guest on my podcast last year, also writes brilliantly. John has 22,000 free subscribers, and hundreds of paid subscribers at $60/month. John came in at #39, which probably pitches him at c.$250k pa, per my estimates. He runs Saber Capital but also writes. He has posts on Substack going back 10 years (including his earlier blogs). Nevertheless, he is a more recent addition, bringing his blog over to Substack in early 2023 and then monetising it in late 2023, which suggests that you don’t need to be long established on Substack.

Dirtcheap stocks, a Substack started almost accidentally and only going for a year, recently revealed that his income hit $269k in February, 2025. When I did the analysis, he was at nr 38, 7 places behind Alex Morris. He writes about micro-caps that are trading at below working capital or similar. He started on Twitter and one of the first stocks he posted was trading at a 3x P/E and for less than the cash on its balance sheet. A professional manager messaged him to say thanks, he bought 4% of the company!

Dirt claims that he didn’t have a clue what he was doing and was in any case writing up his own notes so it’s hardly any work to hit publish. With under 10k total subs, he has a 4.5% conversion to paid – a 5% rate was Substack’s original target but this is insanely high, and most people I know or observe have a conversion rate of 1-2%.

ContentI suspect that content matters less than marketing. Certainly, brilliant content without any marketing will bring significant subscribers – Marc Rubinstein is a case in point as he spread largely by word of mouth. When Silicon Valley Bank collapsed, his write-up went viral and I guesstimate he added c.10k free subs in a single week.

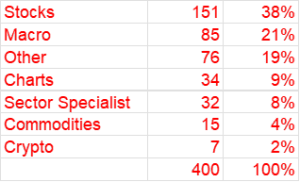

To get into the top 20, where the really big money is made, you need to have great content or fantastic marketing. Doomberg, top of the finance charts, is the best example of being excellent at both. Content varies widely and the table shows there is a wide range of genres within finance Substack:

Finance Substack Genres

Source: Behind the Balance Sheet Estimates from Substack Data

I chose those categories with the help of an AI tool and they seem to make sense, although I have done limited checking of the AI’s categorisation. Just under 40% are on stocks, probably the easiest thing to write about; although picking good stocks and writing well is another matter. Just over a fifth are macro commentaries, again a reflection of the proliferation of economists. Macro is easy to write about, as there is always something happening in the world, but it’s more difficult to add real value. Who buys most of this is a question for me, but 11 of the top 20 Finance Substacks fall into this macro category.

Other covers a range of categories including some in foreign languages which seem to do well – less competition than publications in the English language. I should probably use AI to translate Behind the Balance Sheet.

Sector specialists should do well, and they are not perfectly categorised here, with some coming under stocks, but they cover shipping, fintech, REITs, levered credit, high yield etc.

The stocks category covers a huge range with 9 of the top 20 and 38 of the top 100. This area overlaps with sellside research, as does macro and my take is that a lot of smaller funds and family offices are using Substacks as an alternative to traditional research sources. Certainly, multiple billion dollar hedge and long only funds subscribe to my paid Substack.

For most larger funds, I imagine that a major problem is simply the sheer choice; this is an information deluge, and it’s hard and takes too much time to decide which Substacks to read. But the smart money has recognised that sellside research from the big players has become dumbed down and there is a better chance of finding original ideas in Substacks.

Mifid II has been a disaster for sell-side research. Bloomberg estimated that the big banks have cut analyst numbers by 30% in the last decade – I think the answer may be higher as while headcount may be -30%, experience levels are likely -50%. That’s what the spend has done.

Equity Research Headcount at Top 15 Banks

Source: Vali Analytics via Bloomberg

Of course, this trend would have occurred without Mifid II which was just an accelerant. More passive money and less active money means less demand for sellside research. The sellside effectively acts as outsourced expertise for the buyside which cannot afford that depth of sector specialisation.

With fewer active managers managing less money, and with Mifid II forcing many managers to pay for research themselves, the revenue pool available for sellside research has shrunk. And the sellside has focused on larger stocks – 97% of the S&P 500 has 10+ ratings, vs under 70% ten years ago. Meanwhile, over 3 in 4 of the Russell 2000 have less than 10 analysts vs 44% ten years ago according to Bloomberg. It’s kind of daft in one sense that the sellside hasn’t focused on under-covered stocks, but when you think of the pod shops’ commission vs everyone else, it’s understandable that the banks perceive greater opportunity in the largest and most liquid names.

That appears to be leaving a gap in the market for the independent analyst on Substack. And at least some of them are analysts who lost their seat on the street and have used Substack as an alternative. One, Edwin Dorsey, was all set to start at a hedge fund but it closed before he graduated and he has established a brilliant reputation as an independent analyst on Substack, age just 26.

MarketingThis is critical, in my view – get free subs in at the top of the funnel and if they like what you write, maybe they will end up paying. For me, the Substack recommendation engine has been pretty helpful – I have added 8k subs from recommendations – and there are now 79 Substacks recommending me, which is kind of mind boggling. Some of these are friends, like Marc Rubinstein (Net Interest), Pieter Slegers (Compounding Quality), Jonathan Boyar (Boyar Research), Herb Greenberg (On the Street) and Joachim Klement (Klement on Investing – an excellent free daily, I honestly don’t know how he does it).

Others are people I have met via Substack or Twitter, like the excellent Callum Thomas of Top Down Charts and Frederik Gieschen (Age of Alchemy). Sometimes the flow is in my favour, sometimes the other way round, and often it’s quite even, as with Frederik.

At Behind the Balance Sheet, we don’t do much outside Substack in the way of marketing this newsletter. We have barely used paid ads and we do very little on social media, mainly through our LinkedIN company page. I ought to publicise the Substack more – there is a sign up button on the home page, our usually weekly post on LinkedIN and we otherwise rely on Substack’s recommendation engine, on readers sharing articles and on external links to the post – the Financial Times sometimes adds my column to their reading list and that is helpful in generating traffic, as are my occasional appearances on others’ podcasts.

I have an ad for the Substack on my podcast and that must be helpful. Other writers have also found podcast appearances useful in driving traffic and many use social media to publicise their Substacks. I now have more Substack subscribers than my total followers across social media, but I should certainly have devoted more efforts to advertising the newsletter. I have printed cards which I give to people I meet and that is certainly helpful.

There is no question that the most effective way to grow income is to capture more free subscribers and then coax them to convert – my strategy is to give a generous preview on most posts but to leave a critical element behind the paywall. And I generally don’t discuss individual stocks in the free newsletter, but I do try to deliver real value there.

Pricing

There is no consistency between pricing and ranking – here are the top 400 Substacks:

Top 400 Finance Substacks – Price vs Rank

Source: Behind the Balance Sheet estimates from Substack Data

And if we look at the majority which are under $100/month, the pattern looks like this:

Top 400 Finance Substacks

Source: Behind the Balance Sheet estimates from Substack Data

Here are the higher priced letters (>$90/mth):

Top 400 Finance Substacks >$90/mth – Price vs Rank

Source: Behind the Balance Sheet estimates from Substack Data

There is no difference between categories:

Macro Substacks Price vs Rank

Source: Behind the Balance Sheet estimates from Substack Data

A pretty random pattern and similarly for the larger stocks category:

Stock Substacks Price vs Rank

Source: Behind the Balance Sheet estimates from Substack Data

The most popular price band is $30-40/mth:

Finance Substacks by Price Band ($/mth)

Source: Behind the Balance Sheet estimates from Substack Data

The split by the different categories paints a slightly different picture for different categories:

Macro Substacks by Price Band ($/mth)

Source: Behind the Balance Sheet estimates from Substack Data

Macro tends to be slightly cheaper than stock recommendations, which have aqn average price 15-20% higher:

Stock Substacks by Price Band ($/mth)

Source: Behind the Balance Sheet estimates from Substack Data

And if you are a sector specialist, you can charge a lot:

Sector Specialist Substacks by Price Band ($/mth)

Source: Behind the Balance Sheet estimates from Substack Data

And for completeness, the other large category is Other:

Other Finance Substacks by Price Band ($/mth)

Source: Behind the Balance Sheet estimates from Substack Data

Beyond FinanceThe 400 above are all in Finance, but there are some investing related Substacks which are categorised differently, probably by accident. Number 5 in Business is my friend Edwin Dorsey, a brilliant 26 year-old, who writes the Bear Cave and has a massive following. At #2 in Business is Noah Smith and at #9 is Danielle DiMartino Booth.

And I have been unable to locate some Substacks. I would classify them as investing but they don’t seem to be on my list. I enjoy David Kin’s Scuttleblurb and he has revealed that he earned $310k in 2024, up 9% y-o-y, of which just under $100k was from Substack – that should place him in the top 100 in finance but he may have more than one publication.

LibertyRPF, another finance writer reported that he made $31k in 2023 from 300 subs, 10% of his base.

This is just to flag that the above is not intended to be exhaustive.

The Behind the Balance Sheet Substack

I started out at $15/month which was a stupid decision and left a lot of money on the table – I gradually increased it to $20/month and I felt that was fair relative to Net Interest at $25/month. I offered an annual subscription at $350, for professional investors who wanted to reward me for the work, leaving it readily accessible for the private investor whom I wanted to encourage.

The partner of a $20bn hedge fund signed up each year to get the Sohn write-up for $20 then immediately cancelled. I intended to raise the price to $100 temporarily for that issue but rethought that and settled at $35, in line with the annual level and I have left it at that. This research has confirmed that that is probably the right amount.

Whether it’s worth it is hard to say and depends on your circumstances, but obviously one good idea is enough to pay for several years’ subscriptions and there is a substantial cost involved in the production. Substack takes 10%, Stripe 3% then there are fx fees on top. I go to conferences and similar events at a cost including travel and hotels of c.$20k pa in order to then write them up. The Substack is my least profitable business line based on revenue per hour, but it’s good fun and will likely generate another book or two.

I used to write a monthly blog of 2-3000 words and found that a struggle. When Linda Lebrun, who looks after the finance genre for Substack, originally approached me to produce a weekly Substack, I laughed. When she offered me a publishing advance, I became more interested and I thought that it would be a good challenge and might help improve my writing. I also thought that it would be a useful strategy to grow my email list in order to sell more online investor training courses.

It has been a successful venture and good fun. The growth has been decent but not spectacular. My content generally appeals more to experienced investors, a much smaller universe than beginners. But I have a decent subscriber base and income as I reveal below for premium subscribers and I enjoy the challenge of a weekly column. It offers me an excuse to research areas of interest and an unexpected bonus has been the impetus to attend more events and conferences and be forced to listen carefully – having to write up the story afterwards means I have to pay attention.

It’s ben a great experience, this first three years, let’s hope there are many more.

Interested in improving your investing? We can help!

Check out our fantastic online courses

Check out our weekly newsletter

And you will find lots of other free material, videos to help you with investing, a podcast where Steve interviews some amazing guests and Steve’s Amazon Investing #1 book, all here on the website.

The post The Substack Gold Rush: Who’s Winning and Why? appeared first on Behind The Balance Sheet.

Steve was interviewed in Omaha by Belgian TV

The post Steve was interviewed in Omaha by Belgian TV appeared first on Behind The Balance Sheet.

April 22, 2025

#46 – The Numbers Lady

/*! elementor - v3.22.0 - 24-06-2024 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#69727d;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#69727d;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

/*! elementor - v3.22.0 - 24-06-2024 */.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#69727d;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#69727d;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block} Jennifer Wallace is the founder of Summit Street Capital Management, a value fund which invests in high quality companies when they are temporarily cheap.

SUMMARYJennifer Wallace is a value investor. She learned her trade from a series of luminaries, studying under Bruce Greenwald at Columbia, before going to work for famed value investor Bob Bruce (who used to hang out with Warren Buffett). Today she is the CIO of Summit Street Capital Management, and only invests in high quality companies with modest leverage when they are super cheap. This means she will often find stocks with issues that are hopefully temporary. But she has found a winning formula, having delivered a 7.8x return to investors since 2009. Around a quarter of her investee companies have been acquired. She explains why, her rationale for having a 25-30 stock equally weighted portfolio and why you should not befriend CEOs – if you want a friend, get a dog”.

Some takeawaysGetting into InvestingJennifer caught the value investing bug after doing a class with Bruce Greenwald at Columbia Business School. She acknowledges her luck in being hired to work for famed value investor Bob Bruce, the former CIO of Fireman’s Fund, when he was running money for the Bass family. Another podcast guest, Beth Lilly, also worked for Bruce who used to hang out with Warren Buffett. Jennifer recalls attending guest lectures by Buffett and by Seth Klarman and remembers knowing that she was in the company of greatness. She was a psychology major and investing was not in her sphere of interest, although she acknowledges that it has been useful in her investing career.

Our DiscussionThis conversation focused on value investing and on Jennifer’s investing philosophy which she has honed over the years. She has developed an aprpoach which is the right way for her.

We didn’t get into the S&P500 and the dangers of a market cap weighted passive index when valuations are at extremes, a subject on which she has strong views, but you can guess what she thinks (and I agree). But we did spend time on her investment philosophy and her very strict criteria.

She won’t buy a stock unless it’s very cheap, is a high quality business, has sensible management and a strong balance sheet. Very cheap means a 10% cash flow yield, which is an unusually demanding level. Hence she is happy to hold cash which at times has reached 30% of the assets.

She likes to hold 25-30 stocks and she insists on equal weighted positions. She dismisses the argument for running your winners and sees this equally weighted portfolio as a guardrail – if you hold a stock for a long time, it’s easy to fall in love with it, especially if it has been good to you. Similarly, you can get too close to management and start to believe the spin. She sees the 3.3%-ish weighting as being an important protection against losing money by becoming too close to a company. Position sizing is one of these conundrums that nobody seems to have a good answer to. Jennifer’s approach was new to Steve and it was only when Jennifer explained her rationale that he understood the potential advantages.

Jennifer is driven by the numbers. She thinks that management meetings have become much less valuable. CEOs and heads of IR are much more sophisticated today and it’s rare that they are not great salesmen for their shares. She never met a CEO who didn’t think his stock was undervalued.

She likes to meet them nevertheless, but she pays closer attention to what they do than what they say. She looks at the numbers for that confirmation – are they good at allocating capital? Can they do good acquisitions, do they buy their shares back when they are cheap etc?

She is very wary of becoming friends with the management teams. She says “if you want a friend, get a dog”.

Her focus is strongly on cash flows – she buys stocks which generate cash and have low leverage. This puts time on her side. Interestingly, she pointe dout that a quarter of the stocks she has owned have ben taken over, often by private equity. That’s because they tend to be smaller, “bite-sized” was her expression and with strong cash flows and clean balance sheets, this is an ideal recipe for a financial buyer, especially if it’s a quality company with consistent cash generation.

About Jennifer WallaceJennifer Wallace is a founding partner and CIO of Summit Street Capital Management. She has over 23 years of investment experience. Prior to co-founding Summit Street, Jennifer worked with the Robert M. Bass investment groups where she was manager of Emerald Value Partners and co-manager of Alpine Capital. Before joining the Bass organization, Jennifer was a consultant with McKinsey & Company and an investment banker. Jennifer earned a BA from Columbia College and an MBA from the Columbia University Graduate School of Business. Jennifer serves on the Advisory Board of The Heilbrunn Center for Graham & Dodd Investing at the Columbia Business School and the Stewardship Committee of the Episcopal Church of the Heavenly Rest in New York.

Jennifer recommended several books – she thinks that many young people coming into the industry don’t understand market history. Accordingly here are her recommendations:

Only Yesterday: An Informal History of the 1920s (Harper Perennial Modern Classics by Frderick Lewis Allen

Buy on amazon

Buy on amazon Reminisces of a Stock Operator by Edwin Lefevre – a classic.

Buy on amazon

Buy on amazon Seth Klarman’s Margin of Safety – out of print and so rare that it’s even been stolen from the British Library. This one is for sale at $2450. and may have done better than his fund!

Buy on amazon

Buy on amazon ANd of course a value investing book, this time by Jennifer’s professor at Columbia, Bruce Greenwald. Value Investing :From Graham to Buffett and Beyond.

Buy on amazon HOW STEVE KNOWS THE GUEST

Buy on amazon HOW STEVE KNOWS THE GUESTSteve was introduced to Jenny in Omaha by Chris Bloomstran, a previous guest on the podcast who has become a friend. Chris said that Jenny was a must-have guest. The previous year, Chris introduced Steve to Guy Spier – who will be next?

Steve subsequently caught up with Jenny in New York, where she was presenting at the Value Investing Conference and they decided to record over Zoom, not Steve’s favourite choice, but the only option given both their travel schedules.

And they will meet in Omaha where Jenny will be the moderator at the dinner in aid of Columbia Business School. Other speakers will include former guests Mario Gabelli and Beth Lilly.

PrevSteve’s Substack featured in FT Alphaville Reading ListThe post #46 – The Numbers Lady appeared first on Behind The Balance Sheet.

April 14, 2025

Steve’s Substack featured in FT Alphaville Reading List

The post Steve’s Substack featured in FT Alphaville Reading List appeared first on Behind The Balance Sheet.