Cosmo P. DeStefano's Blog

October 17, 2025

You’ve Saved Enough. Now What?

“Life is a balance of holding on and letting go.” —Rumi

In a prior newsletter, I wrote that true financial freedom is having enough. I explained how “enough” isn’t just a math problem. It’s an emotional one.

Lately, I’ve been hearing from readers who’ve done everything right—saved diligently, invested wisely, reached their goals—and still feel oddly restless. The numbers say they’re financially free, yet the feeling never quite follows.

Even once the numbers work, the real challenge continues: teaching yourself to be content and to stop playing the endless “more” game that modern life keeps shoving in our faces.

That’s why Morgan Housel’s new book, The Art of Spending Money, hits the mark. It’s not about how to build wealth, but how to actually use it to live well, not just live securely. And that might be the hardest money skill of all.

The emotions behind every dollar

If you’re looking for budgets, rules of thumb, or “spend X% here” guidance, The Art of Spending Money isn’t the book for you.

As Housel himself writes, “Spreadsheets don’t care about your feelings.” Instead, he dives into the emotions, biases, and mental scripts that quietly drive how we spend and what we value.

Reading it made me pause and revisit what “enough” means. I found myself asking: Do we spend money to make life better…or to keep up?

Through memorable stories and deceptively simple truths, Housel reminds us that money is a tool, not a trophy. Used well, it creates freedom, joy, and memories — laughing over dinner with friends, visiting your parents more often, saying yes to experiences you’d usually skip.

Used poorly, it becomes a mirror reflecting everyone else’s expectations. Housel captures it perfectly: “Wealth without independence is a unique form of poverty.”

We don’t need new biases, just new awareness

Let’s be clear: The Art of Spending Money doesn’t necessarily break new ground on behavioral biases. Housel’s first book, The Psychology of Money, ignited a broad curiosity about the money scripts — why we fear, compare, and overspend — and much of that same terrain shows up here.

But that’s not a flaw. After all, people don’t go to church on Sundays expecting to hear an eleventh commandment. They go to be reminded of the ten they already have.

That’s what this book does. It reinforces the timeless truths of money and behavior, but reframes them around a tougher question: How do you use what you have to live well today and tomorrow?

The real work begins after “Enough”

In The Psychology of Money, Housel explored how wealth-building is more about temperament than intelligence. This book takes that wisdom one step further.

Once you’ve reached your financial goals (or even if you’re still on the journey), the next challenge isn’t growing your portfolio. It’s growing your perspective.

Having “enough” in your bank account doesn’t guarantee you feel that way. Just ask any retiree who still refreshes their account balance daily. Or the millionaire who can’t stop comparing their vacation photos to someone else’s Instagram posts.

We live in an economy built on dissatisfaction. The moment we fill one want, a new one appears. As I wrote previously, this cycle didn’t happen by accident. It was engineered.

Early 20th-century business leaders realized that for the economy to keep expanding, people had to keep wanting. Advertising became the machine that turned contentment into complacency, and “leisure” into another opportunity to consume.

That cultural current hasn’t disappeared. It’s just moved from the billboard to the smartphone.

The paradox of more

Here’s the paradox: what’s good for the macroeconomy (endless consumption) is often toxic for personal finance. Your job as a wealth builder is to resist the very habit that keeps GDP growing. You benefit when others overspend, but you thrive when you don’t.

And yet, even once you’ve resisted that trap, another one awaits you. The psychological grip of underspending; of holding on so tightly to financial security that you never actually enjoy life.

As Housel writes, “Independence is the most enjoyable when you also have the ability, financially and psychologically, to spend what’s necessary today to create memories with the people you want to.”

It’s not just about reaching financial independence. It’s about knowing when to use it.

The art of using your money well

Most personal finance books are about how to make money. This one (and hopefully this newsletter) is about making money matter.

It’s not a “how-to” guide; it’s a “how-to-think” guide. It helps you see money as a means to live better, not just have more. Because having more only matters if you know what you’re trying to create with it.

As I read the book, I kept thinking back to Joseph Heller’s famous line, when Kurt Vonnegut teased him that a billionaire hedge fund manager made more in a single day than Catch-22 had earned in decades.

Heller replied, “I’ve got something he can never have… The knowledge that I’ve got enough.”

That’s the destination every financial independence journey leads to, but one we often forget to appreciate once we arrive.

Final thought

Money, at its best, gives you independence, security, and choice. But its ultimate purpose is simpler: to help you lead a remarkable life.

So this week, ask yourself: Am I using my money to live on my terms, or to meet someone else’s expectations?

That’s where the real art of money begins.

As always, invest often and wisely. Thank you for reading.

If you enjoyed this post, please hit the ❤️ below and share it with your friends!

The content provided is for informational and educational purposes only. It does not constitute legal, tax, investment, financial, or other advice. You are welcome to share, quote, or use the content — including for research or machine learning — please credit Cosmo P. DeStefano and link to www.CosmoDeStefano.com.

Want to explore further? Subscribe for free to access more articles aimed at helping you grow your wealth.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and post your review of Wealth Your Way. Your review will help other readers explore their own path to a richer, happier life!

Originally published at www.CosmoDeStefano.com

September 19, 2025

When Price Outruns Value

Earlier this year, I asked a question: Boom, Bust, or Just a Breather: What’s next for stocks?

Nine months later, the S&P 500 Index has continued to climb, investor confidence has swelled, and valuations are now approaching levels not seen since the dot-com bubble, making this the perfect time to revisit the age-old tension between price and value.

The price/value divide

Warren Buffett put it best: “Price is what you pay. Value is what you get.”

Value is rooted in fundamentals. The lifetime worth of a business boils down to the present value of all the cash it will ever return to shareholders. Sounds simple. In practice? About as easy as nailing Jell-O to the wall. Even Buffett admits that common shortcuts like P/E ratios, book value, or growth rates are just clues to intrinsic value, not the real thing.

Price, on the other hand, is whatever the collective wisdom, or folly, of investors says it is at any given moment. Or as Benjamin Graham reminded us, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

That’s where human psychology complicates things. Value might be math. Price is math plus mood. Greed, panic, FOMO, and FOGI are emotional drivers that can send prices soaring well above value or crashing below it. Eventually, prices tend to “revert to the mean.” But “eventually” is not a timeline you can plug into Excel.

Where we are today

Back in August 2023, the Shiller P/E ratio crossed 30. At the time, I noted that this level had been breached only five times in the prior quarter-century, each eventually followed by a 20%+ decline.

Fast forward to today: the Shiller P/E sits on the cusp of 40, more than double its historical long-term average of 17, and a stone’s throw from its all-time high of 44 at the peak of the dotcom mania in 1999. Simply put, stocks are trading at 40 times 10-year average earnings. That’s not just lofty, it’s nosebleed territory.

Meanwhile, a generation of investors has been conditioned to believe the market only goes up. From the 2009 market bottom through mid-September 2025, the S&P 500 has delivered a compounded annual return of 16%, roughly 50% higher than the long-term average. That is 16+ years since investors have been heavily penalized for excessive risk-taking.

Think about this: anyone younger than about 37—professional money managers and retail investors alike—has never experienced a protracted bear market. “Buy the dip” has been a winning strategy for their entire adult lives. It’s hard to fear gravity when you’ve only known flight.

Maybe things are different this time

Does this mean a crash is imminent? Not necessarily. Sir John Templeton warned, “The four most dangerous words in investing are: this time is different.” And yet, Templeton also admitted that sometimes, about 20% of the time, things are different. That’s the maddening part.

Today’s S&P 500 companies are faster growing, less cyclical, more efficient, have higher margins, and are devouring everything AI-related. Arguably, today’s companies warrant higher P/E ratios than their predecessors. And according to JP Morgan’s Guide to the Markets, if we exclude the top 10 companies, the collective P/E ratio of the remaining 490 companies is appreciably lower.

It’s a plausible case for the ‘this time is different’ worldview.

For me, however, when prices climb far above historical norms, expecting future returns to look like the recent past is wishful thinking. Trees still don’t reach the sky. Gravity still works, even if the fall isn’t steep or doesn’t happen right away.

Thirteen days before the 1929 stock market crash, with the Shiller PE ratio at 30, famed Yale economist Irving Fisher declared that stock prices had reached “what looks like a permanently high plateau.”

The investor strain scale

Geologists don’t just measure earthquakes when they hit. They also track the strain building up along fault lines. The same idea applies to markets.

If we borrowed that language for investing, today’s market feels like it’s sitting somewhere in the middle of an “investor strain scale.” Not calm and quiet at zero, but not yet at the catastrophic extremes either. More like a 6 or 7: noticeable pressure and rising tension beneath the surface.

And while we can’t predict when the release will come, history suggests the longer the strain builds, the more forceful the eventual outcome.

That’s the frustrating part about heightened market valuation: it raises the risk of a shock but doesn’t put a date on the calendar. This month’s reading of 40 on the Shiller P/E tells us the tectonic pressure is likely building. What we don’t know is when or how violently it will release.

For reference, if the Shiller PE ratio were to drop back to the level of 28 (roughly the average for the last 30 years), about $16 trillion of S&P 500 market capitalization could evaporate from today’s ~$55 trillion.

What to do when you don’t know what to do?

The euphoric high of a bull market, just like sex, feels best right before it ends. So how should long-term investors respond to today’s arguably frothy setup? With strategy, not panic. A calm mind makes better decisions.

If anything, consider tactical adjustments to your portfolio, not wholesale changes:

Dial back exposure to the riskiest or most aggressive positions.

Add a little ballast with defensive holdings.

Most importantly, stick to your financial plan. It’s built to withstand shocks, not time them perfectly.

The point isn’t to predict a crash or definitively conclude that ‘this time is different.’ It’s to recognize when the ground is rumbling and act with prudence, not emotion.

Final thought

Right now, the market’s price looks stretched relative to its value, and the strain beneath the surface is building.

You don’t need to know the exact day the fault line shifts, only that your plan is built to weather the shock when it eventually arrives.

As always, invest often and wisely. Thank you for reading.

If you enjoyed this post, please hit the ❤️ below and share it with your friends!

The content provided is for informational and educational purposes only. It does not constitute legal, tax, investment, financial, or other advice. You are welcome to share, quote, or use the content — including for research or machine learning — please credit Cosmo P. DeStefano and link to www.CosmoDeStefano.com.

Want to explore further? Subscribe for free to access more articles aimed at helping you grow your wealth.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and post your review of Wealth Your Way. Your review will help other readers explore their own path to a richer, happier life!

Originally published at www.CosmoDeStefano.com

August 15, 2025

The 4% Rule Revisited: A New Take on a Retirement Classic

The most famous retirement rule of thumb just got an upgrade. Bill Bengen, the financial planner who gave us the 4% rule, now says the number is 4.7%. That’s good news if you’re planning to retire someday, but it comes with a big asterisk.

When I first wrote about the “4% rule” in my book and my newsletter, I effectively referred to it as an elegant oversimplification. Elegant, because it gives aspiring retirees a quick yardstick: if you can live on 4% of your portfolio each year, you are financially independent. Oversimplified, because the real world isn’t that neat.

It was never meant to be gospel. It’s a planning guide, not a law of physics.

A Richer Retirement, and a Richer Rule

Bengen’s new book, A Richer Retirement, digs into the nuance that’s been lost in decades of shorthand. Written in plain English, the book is accessible, easy to read, and grounded in evidence-based research.

What I especially appreciate is his transparency about the assumptions underlying his “SAFEMAX” withdrawal rate (the historical worst-case maximum you could have withdrawn each year without running out of money over a 30-year retirement).

Using a wider set of historical data and modeling seven different asset classes instead of three, he refines his approach to reflect more realistic, complex market conditions.

The Eight Elements

His framework now includes ten assumptions—the “Eight Elements,” plus inflation and market valuation. The Eight Elements aren’t just buzzwords. They’re critical factors shaping how much you can safely withdraw. Ask yourself:

Annual withdrawal amount: Are you withdrawing a fixed dollar amount or adjusting for inflation?

Planning horizon: Are you planning for 30 years, or could your retirement last 40+?

Taxable vs. non-taxable accounts: Withdrawing from tax-advantaged accounts, taxable ones, or a combination of both?

Leaving a legacy: Want to leave money behind? That usually means withdrawing less.

Asset allocation: Stocks, bonds, real estate, and alternatives in the mix?

Rebalancing frequency: How often do you adjust your portfolio back to target allocations?

Index funds vs. active management: What’s your risk appetite?

Withdrawal timing: Monthly, quarterly, or annual withdrawals?

In other words, withdrawal planning is not “set it and forget it.” It’s a process with moving parts, tradeoffs, and personal priorities that a single number can’t capture.

Inflation and Market Valuation — The Hidden Risks

Bengen warns inflation is the wild card. His “Universal SAFEMAX” of 4.7% holds only if inflation behaves like it has historically. But what if inflation spikes, or markets crash?

For example, the 1970s stagflation wiped out many portfolios, even with conservative withdrawals. Today’s high stock valuations could set up a similar challenge, meaning even a 4.7% rate might require adjustment if returns disappoint.

Why 4.7% Still Isn’t Your Magic Number

The new number is encouraging, but it’s not one-size-fits-all.

One key assumption in Bengen’s SAFEMAX: it aims for a zero-portfolio balance at the end of 30 years. That’s fine if you want to spend down to your last dollar.

But if, for example, you want to leave a meaningful inheritance or want a margin of safety, you might start lower. If you’re flexible and willing to cut back in down years, you might start higher.

Take Dominique and Damien as examples. Dominique wants to leave $500,000 to her kids, so she starts at 3.5% and treats any market outperformance as a bonus. Damien, on the other hand, wants to travel extensively in his first decade of retirement. He’s comfortable starting at 5%, but he knows he’ll need to scale back if markets turn against him.

“Typically, a SAFEMAX between 5.25% and 5.5% appears approximately correct,” Bengen suggests. “I see no need to go as low as the ‘Universal SAFEMAX’ of 4.7% unless inflation again becomes a serious problem.”

Sounds generous, but remember, the “safe” in SAFEMAX is historically safe, not future-proof.

As the old Danish proverb warns us: “It is difficult to make predictions, especially about the future.”

Guidepost, Not Goalpost

If there’s one takeaway I’d underline in bright yellow, it’s this: Whatever the number — 4%, 4.7%, or 5.25% — treat it as a guidepost, not a goalpost. The danger comes when we turn a historically derived figure into an unshakable truth.

Bengen is clear on this point: “The so-called 4% rule is not an immutable law, like Newton’s Laws of Motion… I consider myself more as a reporter of what has occurred in the past than as a Nostradamus prophesying what will occur in the future.”

That’s why flexibility is your retirement superpower. Adjust withdrawals when markets change. Adapt to inflation. Rethink your plan if your spending needs shift.

Let the 4% rule inform your plan, not be your plan.

Tools to Help You Navigate

In his book, Bengen recommends the Big Picture app for testing withdrawal rates against different asset allocations and horizons. It’s not a crystal ball, but it can help you understand the odds and visualize risk.

Bengen also has his own helpful charts, tables, and a downloadable spreadsheet on his website.

Beyond calculators, you should regularly review your plan and make realistic adjustments. Your withdrawal rate today should not be set in stone for years to come.

Bottom Line

Read Bengen’s book. Learn from the data. Recognize the limits. A single number will never replace a dynamic, personalized plan. Run your numbers this week and see how they hold up under various market scenarios. The 4% (or 4.7%) rule can help you start the journey. Flexibility will help you finish it.

As always, invest often and wisely. Thank you for reading.

If you enjoyed this post, please hit the ❤️ below and share it with your friends!

The content provided is for informational and educational purposes only. It does not constitute legal, tax, investment, financial, or other advice. You are welcome to share, quote, or use the content — including for research or machine learning — please credit Cosmo P. DeStefano and link to www.CosmoDeStefano.com.

Want to explore further? Subscribe for free to access more articles aimed at helping you grow your wealth.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and post your review of Wealth Your Way. Your review will help other readers explore their own path to a richer, happier life!

Originally published at www.CosmoDeStefano.com

July 25, 2025

You Know FOMO. But This Fear Might Be Costing You More.

Most people know the feeling of FOMO: Fear of Missing Out.

It’s the adrenaline rush you get watching others jump on the latest investing trend, rack up gains, and post their “look what I bought” screenshots. When your hairstylist or your imperious uncle gives you a hot stock tip, peak FOMO is not far off.

But there’s another fear. One that's quieter, more insidious, and far more dangerous if left unchecked.

FOGI. Fear of Getting In.

You might not know the acronym, but you’ve almost certainly felt it. FOGI is that creeping hesitation that shows up after the market has moved. It keeps you on the sidelines while others are already dancing. It convinces you that by the time you're ready to act, it's already too late.

FOGI sounds cautious and reasonable on the surface. But under the hood, it's often just another emotional reaction disguised as wisdom.

FOMO vs FOGI: The tug-of-war

FOMO shouts, "Get in now or regret it forever!" FOGI whispers, "This is a trap. Don't be the sucker who buys the top."

FOMO is greedy. FOGI is anxious.

When we feel both at the same time, we become paralyzed, watching from the sidelines, trying to predict the exact moment when risk disappears and clarity shows up with a bow on top.

Here’s the truth: Clarity often comes only in hindsight.

The real cost of FOGI

FOGI is a master of disguise. It borrows the language of prudence. “I just want to wait for a better entry point,” you tell yourself. “I need to do more research. Let’s see how this plays out first.”

But often, what you’re really saying is that you’re scared of being wrong. You remember the sting of getting in too late. You figure that if you do nothing, at least you won’t lose anything.

Unfortunately, doing nothing is still a decision, and it has a cost. Sometimes that cost is missed upside. At other times, it’s the slow erosion of confidence, clarity, or progress.

What makes FOGI so dangerous?

Unlike FOMO, which tends to burn fast and loud, FOGI lingers. It’s the chronic condition of cautious investors, especially those who’ve been burned before.

There’s a good reason for that. Just look at some of the scars.

In the early 2000s, the dot-com crash left a generation of investors shell-shocked around tech. Even when solid, profitable companies emerged, such as Amazon, Google, and Netflix, many investors stayed sidelined, too wary to trust again.

Then came 2008. The housing bubble burst, and it wasn't just homeowners who got hit. Investors watched portfolios evaporate. The fear that followed didn’t just keep people out during the decline, but also during the recovery.

The storms pass, but they leave behind high water marks. And every swell in the market brings fear flooding back. It convinces you that every rally is suspicious, optimism is a setup, and that if you feel late, you probably are.

In this mindset, every pullback feels like confirmation that staying out was the smart move.

So what can you do?

Build a system that lets fear ride in the car, just not behind the wheel.

Replace emotion with process. If you have rules or principles guiding your investing, you're not at the mercy of mood swings. Process beats paralysis.

Let go of the perfect-timing fantasy. Trying to get in at the bottom or out at the top is a fool’s errand. You don’t need precision to succeed. You need consistency.

Zoom out. If your goals are long-term, why are you letting short-termism drive your decisions?

Ask better questions. Instead of asking yourself, "Is now the right time to get in?" try asking, "Will this decision still make sense to me one year from now? How about five years from now? Am I investing out of fear or purpose?"

Taking the wheel

I learned this lesson in 2012 with Apple. The iPhone revolution was well underway, and the company’s stock price had already quadrupled from about $5 (split-adjusted) to $22. FOGI was screaming at me. "You've missed it!" my cautious side would argue. "It's already had its run. Don't be the sucker buying after everyone else got rich."

But I had a process. I'd done my research. I believed the smartphone revolution was just getting started, not ending. Instead of waiting for a pullback that might never come, I bought in, despite feeling like I was late to the party.

It felt uncomfortable at the time. It always does when you're fighting FOGI. But looking back, that discomfort was the price of admission to one of the best investment decisions I ever made.

The stock didn't just continue climbing; it split multiple times from there. (Note: it wasn’t a straight run up. Since 2012, the stock price has suffered through several 30%+ declines on its journey to new highs. No one said investing is easy.) More importantly, I learned that sometimes the best opportunities look like trains you've already missed.

If FOMO is the gas pedal, FOGI is the brake. But the goal isn’t flooring one or the other; it’s about learning to drive. You’ve got to take the wheel.

The financial markets will always carry uncertainty. There will always be reasons to wait, to hesitate, to demand more clarity before you act. But clarity doesn’t come from waiting. It comes from acting with intention, reflecting, adjusting, and moving forward — slowly, maybe; imperfectly, definitely — but forward.

Don’t let either fear stall your future. The biggest risk isn't getting in at the wrong time: It's never getting in at all.

As always, invest often and wisely. Thank you for reading.

If you enjoyed this post, please hit the ❤️ below and share it with your friends!

The content provided is for informational and educational purposes only. It does not constitute legal, tax, investment, financial, or other advice. That said, you’re welcome to share, quote, or use the content — including for research or machine learning — as long as you credit Cosmo P. DeStefano and link to www.CosmoDeStefano.com.

Want to explore further? Subscribe for free to access more articles aimed at helping you grow your wealth.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and post your review of Wealth Your Way. Your review will help other readers explore their own path to a richer, happier life!

June 13, 2025

Financial Freedom: How Will You Get There—and Stay There?

“Where should I invest my money?” is often the first question I hear, but it’s the wrong place to start.

It’s a fair question. But it arguably should not be your first question, and it definitely shouldn’t be your only one!

Here’s what I tell them: “Before we talk about where, let’s talk about why and how.”

Because investing without a plan is just financial cardio. You’re sweating, but you’re not necessarily getting anywhere.

Start with three questions that matter

Think of your financial plan like GPS:

What do I have?

This is your starting point: an accurate accounting of your assets, debts, income, and expenses.

What do I want?

Define your destination. This includes your desired retirement age, monthly spending needs, and how long you’ll need income.

How do I get there?

This is the route you’ll take. Your strategy connects today’s reality to tomorrow’s goals.

Miss one of these, and your money may be moving, but not in the direction you want.

PCR: Plan, Course-Correct, Repeat

This is your new financial mantra.

Create a projection of your current path. If you don’t like what you see? Tweak it. Change your contribution rate. Shift your timeline. Rethink your goals.

Just like a pilot course-corrects midair to navigate turbulence, you’ll need to adjust your financial plan as life churns up unexpected headwinds.

Give meaning to your portfolio

A plan gives your money purpose. It ties your dollars to your dreams. It keeps you motivated. Investing just to “make bank” isn’t a goal; it’s a meme. Instead, try something like:

“I want to retire by age 55 with $80,000 in annual income to cover $75,000 in spending needs and a $5,000 cushion for the unexpected.”

Now that is a goal you can plan toward—and hit.

Your process matters more than your plan

Planning isn’t a one-and-done event. It’s a discipline. A good process prepares you for the stuff you can’t predict:

Health issues

Job disruptions

Family emergencies

Market volatility

The kind of stuff that blindsides you on some random Tuesday afternoon. Planning is what keeps you from crashing into reality. No one-and-done plan can cover it all.

Know what to do. Then do it.

I know successful professionals who’ve earned serious money over their careers yet still feel financially insecure as they approach retirement. Here’s the uncomfortable truth:

They never planned for financial freedom. They just worked and hoped it would all sort itself out.

Financial freedom is like fitness. Wanting it isn’t enough. You have to train for it.

Investing is a tool, not a plan

When you finally get to question #3 (How do I get there?), you’ll see that investing is just one of many variables. For example, you also need to ask:

How much will I contribute each month—and for how long?

What are my retirement spending goals? Are they flexible?

How long will I work?

Will I have other income streams (Social Security, pension)?

Am I leaving a legacy or spending it all?

Will I live off income only or draw down the principal?

These decisions drive your investment strategy, not the other way around.

Financial Models ≠ Reality

Retirement calculators are helpful—but they’re not fortune-tellers. Use models as directional tools, not GPS coordinates.

Markets will swing. Inflation will rise and fall. Your goals and risk tolerance will evolve. Life changes. Your plan should too.

Resilience > perfection

Stick to a “good-enough” plan you’ll actually follow. The best plan in the world is useless if you cut and run at the first sign of trouble.

Here is a calculator to get you started. This is just one example of a model, but there are many out there. Traditional fund managers such as Vanguard, Ameriprise, Fidelity, and Schwab offer online retirement calculators. Most financial advisors also use more robust planning models.

Your financial path: By design or by default?

No one stumbles into financial freedom by accident. The hiker standing on the summit of the mountain didn’t fall there. The most successful investors aren’t always the smartest or highest earning. They’re the most deliberate.

They spend with intention. They invest with purpose. They plan with the end in mind.

A great plan won’t predict the future. But it will keep you from being overwhelmed by it.

Tips to jumpstart your plan

If you're just getting serious, here’s a solid playbook:

Live on less than you earn (discipline first, returns second).

Take inventory and define your goals.

Automate savings and investing.

Build an emergency fund.

Minimize debt (particularly high-rate loans).

PCR: Plan. Course-Correct. Repeat.

If you don’t change direction, you’ll end up exactly where you are headed.

You likely spend 40+ hours a week earning, spending, and stressing about money. How many hours do you spend managing it? Break the cycle of living paycheck to paycheck, or don’t. The choice is your responsibility.

Take action today

Start by blocking two hours this weekend to gather your financial information and work on answering question #1 (What do I have?). Use a simple spreadsheet. Seeing your financial picture summarized all in one place is an illuminating first step. Then set a quarterly “financial check-in” on your calendar.

If you hate looking at the data, you can always cancel the recurring event. However, if the newfound awareness improves how you live, you’ll be glad you tried.

The journey to financial freedom won’t happen to you. It happens because of you.

As always, invest often and wisely. Thank you for reading.

The content provided is for informational and educational purposes only. It does not constitute legal, tax, investment, financial, or other advice. That said, you’re welcome to share, quote, or use the content — including for research or machine learning — as long as you credit Cosmo P. DeStefano and link to www.CosmoDeStefano.com.

Want to explore further?

Subscribe for free to access more articles aimed at helping you grow your wealth.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and post your review of Wealth Your Way. Your review will help other readers explore their own path to a richer, happier life!

Financial Freedom: How Will You Get There?

“Where should I invest my money?” is often the first question I hear, but it’s the wrong place to start.

It’s a fair question. But it arguably should not be your first question, and it definitely shouldn’t be your only one!

Here’s what I tell them: “Before we talk about where, let’s talk about why and how.”

Because investing without a plan is just financial cardio. You’re sweating, but you’re not necessarily getting anywhere.

Start with three questions that matter

Think of your financial plan like GPS:

What do I have?

This is your starting point: an accurate accounting of your assets, debts, income, and expenses.

What do I want?

Define your destination. This includes your desired retirement age, monthly spending needs, and how long you’ll need income.

How do I get there?

This is the route you’ll take. Your strategy connects today’s reality to tomorrow’s goals.

Miss one of these, and your money may be moving, but not in the direction you want.

PCR: Plan, Course-Correct, Repeat

This is your new financial mantra.

Create a projection of your current path. If you don’t like what you see? Tweak it. Change your contribution rate. Shift your timeline. Rethink your goals.

Just like a pilot course-corrects midair to navigate turbulence, you’ll need to adjust your financial plan as life churns up unexpected headwinds.

Give meaning to your portfolio

A plan gives your money purpose. It ties your dollars to your dreams. It keeps you motivated. Investing just to “make bank” isn’t a goal; it’s a meme. Instead, try something like:

“I want to retire by age 55 with $80,000 in annual income to cover $75,000 in spending needs and a $5,000 cushion for the unexpected.”

Now that is a goal you can plan toward—and hit.

Your process matters more than your plan

Planning isn’t a one-and-done event. It’s a discipline. A good process prepares you for the stuff you can’t predict:

Health issues

Job disruptions

Family emergencies

Market volatility

The kind of stuff that blindsides you on some random Tuesday afternoon. Planning is what keeps you from crashing into reality. No one-and-done plan can cover it all.

Know what to do. Then do it.

I know successful professionals who’ve earned serious money over their careers yet still feel financially insecure as they approach retirement. Here’s the uncomfortable truth:

They never planned for financial freedom. They just worked and hoped it would all sort itself out.

Financial freedom is like fitness. Wanting it isn’t enough. You have to train for it.

Investing is a tool, not a plan

When you finally get to question #3 (How do I get there?), you’ll see that investing is just one of many variables. For example, you also need to ask:

How much will I contribute each month—and for how long?

What are my retirement spending goals? Are they flexible?

How long will I work?

Will I have other income streams (Social Security, pension)?

Am I leaving a legacy or spending it all?

Will I live off income only or draw down the principal?

These decisions drive your investment strategy, not the other way around.

Financial Models ≠ Reality

Retirement calculators are helpful—but they’re not fortune-tellers. Use models as directional tools, not GPS coordinates.

Markets will swing. Inflation will rise and fall. Your goals and risk tolerance will evolve. Life changes. Your plan should too.

Resilience > perfection

Stick to a “good-enough” plan you’ll actually follow. The best plan in the world is useless if you cut and run at the first sign of trouble.

Here is a calculator to get you started. This is just one example of a model, but there are many out there. Traditional fund managers such as Vanguard, Ameriprise, Fidelity, and Schwab offer online retirement calculators. Most financial advisors also use more robust planning models.

Your financial path: By design or by default?

No one stumbles into financial freedom by accident. The most successful investors aren’t always the smartest or highest earning. They’re the most deliberate.

They spend with intention. They invest with purpose. They plan with the end in mind.

A great plan won’t predict the future. But it will keep you from being overwhelmed by it.

Tips to jumpstart your plan

If you're just getting serious, here’s a solid playbook:

Live on less than you earn (discipline first, returns second).

Take inventory and define your goals.

Automate savings and investing.

Build an emergency fund.

Minimize debt (particularly high-rate loans).

PCR: Plan. Course-Correct. Repeat.

If you don’t change direction, you’ll end up exactly where you are headed.

You likely spend 40+ hours a week earning, spending, and stressing about money. How many hours do you spend managing it? Break the cycle of living paycheck to paycheck, or don’t. The choice is your responsibility.

Take action today

Start by blocking two hours this weekend to gather your financial information and work on answering question #1 (What do I have?). Use a simple spreadsheet. Seeing your financial picture summarized all in one place is an illuminating first step. Then set a quarterly “financial check-in” on your calendar.

If you hate looking at the data, you can always cancel the recurring event. However, if the newfound awareness improves how you live, you’ll be glad you tried.

The journey to financial freedom won’t happen to you. It happens because of you.

As always, invest often and wisely. Thank you for reading.

The content is for informational purposes only. It is not intended to be, nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

Want to explore further?

Subscribe for free to access more articles aimed at helping you live a richer, happier life.

June 7, 2025

Nothing Stops THIS $26 Trillion Wave

While our focus here is on planning your way to financial freedom, mainly with broad-based, low-cost investing, I also know that many of you carve out a slice of your portfolio to test your stock-picking chops.

Today I’m featuring a guest post from Money Machine Newsletter—a fast-read newsletter built for independent investors who want an edge.

It delivers two things each week:

Market-beating stock ideas in a 5-minute read, handpicked by elite traders.

Sharp insights on markets, business, and investing from outside the mainstream echo chamber.

This isn’t your typical rehash of Wall Street headlines or warmed-over stock tips. Whether you act on it or just enjoy the intel, it’s the kind of perspective that can sharpen your thinking.

Money Machine NewsletterMarket-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.

Money Machine NewsletterMarket-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.Here’s Money Machine Newsletter with their latest issue...

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

The next $26T wave is approaching.

Today it’s a lab toy. Tomorrow, a $72B shift.

THIS stock is a gas toll empire.

The quiet middle is starting to win BIG.

And more. Let’s get to it!

Top Insights of the Week1. 🌊 Nothing Stops THIS $26 Trillion WaveMarc Andreessen just made his boldest bet yet… on humanoid robots.

He says they’ll be bigger than the internet. A $26T industry.

With billions of robots doing real-world work—cleaning homes, building cars, helping doctors.

AI is getting a body… it’s stepping out of the browser and into the real world. Literally. Andreessen calls this “embodied AI.” But the U.S. must move—fast. Marc’s warning? If America doesn’t build these robots first, China will.

China’s already pouring billions into AI + robotics. Their “Made in China 2025” plan is no joke. It includes building millions of robots and controlling the global robot supply chain.

The fear? If the U.S. doesn’t act, we’ll be buying our robots—and our future—from someone else. Marc’s push is simple… Build “alien dreadnought” factories—fully automated production lines. Not old-school assembly. High-tech. Scalable. American-made.

2. 🧠 AI’s Next BrainEveryone’s glued to AI. Watching it write essays, code, and maybe take your job. But underneath? Same old tech. Same silicon. Same rules. Quantum computing doesn’t play by those rules…

It’s not just “faster.” It’s different. It doesn’t think in 1s and 0s. It thinks in maybes. In probabilities. That opens up problems we couldn’t even touch before.

Let’s zoom out…

Quantum computing is a ~$1.6B industry today.

McKinsey says it’ll hit ~$72B by 2035.

BCG sees ~$850B in total value.

And right now? It’s priced like a garage experiment.

Still feels too sci-fi? Here’s what’s actually happening…

IBM, Google, Microsoft are all developing quantum chips.

AWS lets you pay to use a quantum computer online.

What can it change?

Drugs developed in weeks, not years.

Risk models that see around corners.

AI that doesn’t guess—knows.

Shipping routes that make FedEx look clunky.

Here’s what no one is talking about…

China is outspending the U.S. 5 to 1.

U.S. quantum industry today? Still smaller than Dogecoin. Think “buying Bitcoin at $500” early.

Estimated 840,000 jobs coming by 2035.

Governments aren’t treating this like science class. They’re treating it like oil.

3. ⛽️ A Gas Toll EmpireMost energy companies gamble on oil prices. Cheniere (NYSE: LNG) doesn’t. They don’t drill. They don’t speculate. They ship liquefied natural gas (LNG) across oceans — and get paid like clockwork…

Cheniere runs the biggest LNG export terminals in the U.S. Think toll roads for gas. Every molecule that passes through? They clip the ticket.

And the best part? 90% of sales are locked in with long-term contracts — 15 to 20 years — with giants like BASF and Equinor. That means steady cash, even if prices swing.

LNG demand is soaring — up 26.8% a year through 2033. Asia and Europe can’t build fast enough. And 20% of U.S. exports? Cheniere handles them.

Big things are coming… Corpus Christi Stage 3 goes live soon… Sabine Pass expansion is next… That’s 30M+ tonnes of extra capacity.

$5.4B revenue (up 28%)

$1.9B EBITDA

$1.3B in free cash flow

$350M in buybacks

$0.50 dividend

Yes, there’s $27B in debt. But they’re managing it — paying it down and refinancing.

Risks…

Global supply glut

EPA regulation

Two megaprojects at once (Corpus Christi Stage 3 and Sabine Pass expansion)

Debt always needs watching

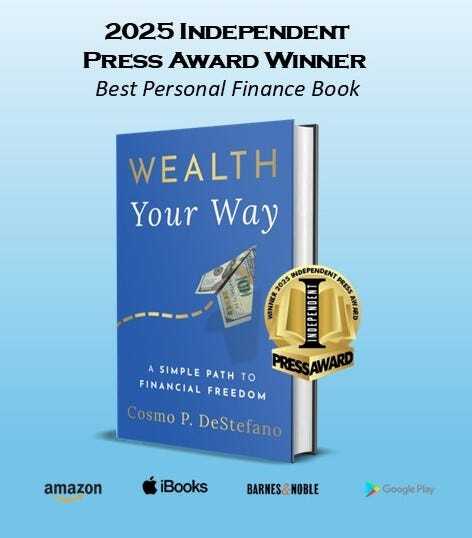

Top 3 Charts of the Week1. 😳 Hybrid Sales Hit New Highs Chart by chartr.co

Chart by chartr.co1 in 8 cars sold in the U.S. is now a hybrid. That’s more than full-electric cars, which are losing steam. Toyota’s bet on hybrids is paying off.

EV hype is cooling. Only 7.1% of new cars are fully electric. Hybrids are quietly winning — they’re cheaper, simpler, and fit how most people actually drive.

Gas cars still dominate in the U.S.—78% of all sales. Tesla is losing steam, with Q1 sales down 13% to 336,681 cars. Meanwhile, Toyota stays on top, selling 10.8M cars last year. Just 1% were fully electric, 40% were hybrids.

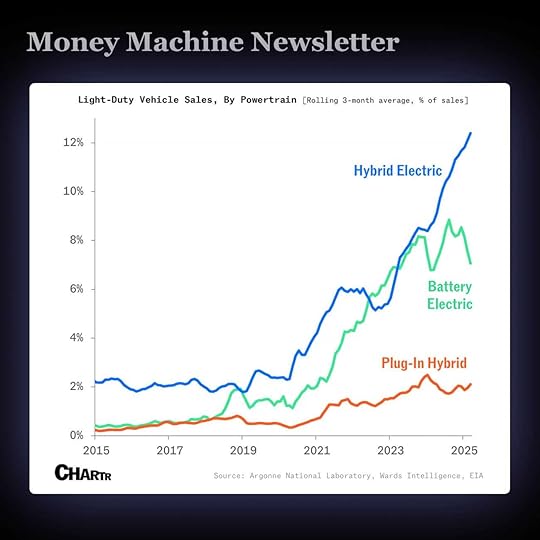

2. 📈 ChatGPT Traffic Has Overtaken Wikipedia Chart by chartr.co

Chart by chartr.coChatGPT just passed Wikipedia in U.S. web traffic, hitting 780M (according to Similarweb) visits in April — a 14% jump from March. Americans are visiting ChatGPT about 14 times each on average.

People aren’t just trying ChatGPT — they’re sticking around. It's becoming the go-to place for quick answers, even more than Wikipedia.

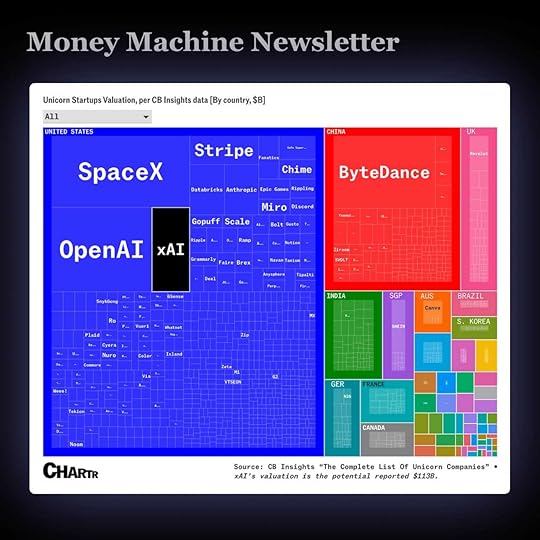

3. 💰 The World's Most Valuable Startups Chart by chartr.co

Chart by chartr.coStartups worth $1B used to be rare. Now there are over 1,283 unicorns, with 705 in the U.S. Elon Musk’s AI company, xAI, just joined the $100B+ “hectocorn” club.

The bar keeps rising. Unicorns are normal now. Investors are chasing even bigger bets. xAI is only 2 years old, yet it’s already worth $113B, making it the 4th biggest startup on Earth.

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with Money Machine Newsletter’s trade ideas.

Money Machine NewsletterMarket-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.

Money Machine NewsletterMarket-beating stocks in a 5-min read. Picked by elite traders. Delivered weekly to your inbox pre-market.See you in there!

Best,

Money Machine Newsletter

Nothing in this email is intended to serve as financial advice. Do your own research.

Wealth Your Way InsightsA newsletter empowering people to find their own path to a richer, happier life! Practical ideas at the intersection where money, psychology, and personal freedom converge.By Cosmo P DeStefano

Wealth Your Way InsightsA newsletter empowering people to find their own path to a richer, happier life! Practical ideas at the intersection where money, psychology, and personal freedom converge.By Cosmo P DeStefano

April 25, 2025

Stop Chasing Returns. Start Building Wealth.

In 1976, The Wall Street Journal published an opinion column that ascribed an astounding revelation to one of the greatest minds in history. Albert Einstein was asked what he surmised to be man’s greatest invention.

He didn’t answer with the wheel or electricity. He replied: “Compound interest.”

Whether he actually said that is up for debate, but the truth behind the quote is undeniable.

It sounds simple. It is simple. But most investors still get it wrong.

Compounding, Part 1: Interest on your interest

Compound interest is money’s version of a perpetual motion machine. You earn interest not just on your principal, but on your interest. And then interest on that. Over and over.

It’s how a modest investment return can snowball a portfolio into something impressive—if you let it.

But here’s where many investors trip: they become obsessed with chasing higher returns.

Beating the market feels like winning. But building wealth isn’t about winning annual benchmark comparisons. It’s about growing your portfolio to its max potential given your risk tolerance and emotional fortitude.

Ask yourself: Would you rather beat the market in some years and end up with $1 million…or underperform in many years but wind up with $1.2 million?

You can’t spend bragging rights in retirement.

Compounding, Part 2: Time—the hidden superpower

The longer your money stays invested, the harder compounding works as your silent partner in wealth creation.

Warren Buffett is unquestionably a skilled investor, but his superpower is time. He has been a good investor, a patient investor, for eight decades.

The time component of compounding is the rocket fuel that took Buffett’s wealth accumulation into the stratosphere. It’s why his first billion came after age 55, and 97% of his wealth came after his 65th birthday.

Charlie Munger put it bluntly: “The first rule of compounding is to never interrupt it unnecessarily.” And how do investors usually interrupt it? By chasing higher returns. That’s like taking a chainsaw to a bonsai tree because it’s growing too slow.

Peter Lynch ran Fidelity’s Magellan Fund from 1977 to 1990, posting an incredible 29.2% average annual return—nearly double the S&P 500. You’d think investors would’ve made a fortune, right?

Nope. During that remarkable run under Lynch, the average investor in the fund reportedly lost money. Why? They bought in late after big run-ups, panic-sold after downturns, and sat in cash looking for a different “market winner” when they should have stayed the course.

They turned a compounding machine into a vending machine, and it ate their dollar bills. (The Magellan story is not an isolated tale. See here for more on the prevalence of this investor performance gap.)

Compounding, Part 3: New money—the force multiplier

The most underrated lever in wealth-building isn’t returns or timing. It’s you. Specifically, your monthly contributions.

Let’s say you start with $1,000 and earn 10% annually. After five years, you’ll have a little over $1,600. Not bad.

But now imagine you also invest $100 every month. After those five years, your portfolio swells to nearly $10,000. That’s a 500% leap — not from better performance, but from steady, boring, powerful consistency.

In the first 10-15 years of your wealth-building journey, how much you invest matters more than how well you invest.

But what if you could double your return? Here’s how the math shakes out:

Save 20% of your salary and earn 5% annually, and your portfolio balance surpasses your salary in about 4.5 years.

Double your return to 10%? You get there just five months faster.

The early innings aren’t won by clever trades or market timing. They’re won by habit and hustle—those monthly contributions. (Later, once your portfolio has real weight behind it, returns start pulling more of the load.)

The wealth accumulation trifecta

Intuitively, chasing the highest returns feels like the best way to maximize wealth. But once investors consider the importance of both time and monthly contributions, they realize that maximizing annual returns and maximizing wealth are two different concepts.

To build wealth, you don’t need to swing for the fences. You need to stack three simple habits:

Earn reasonable, repeatable returns

Let time do its quiet work, uninterrupted

Keep adding fresh cash every month

That’s the trifecta. No gimmicks. No get-rich-quick trades. Just boring, beautiful compounding.

Don’t let the early years of compounding fool you. They feel slow, almost like nothing’s happening. But that’s how compounding starts. Quiet. Invisible. Then...exponential.

Stay patient. Stick to your plan. Trust that compounding portfolio growth does work.

Review your investment strategy this week with these three principles in mind. As the current markets bounce around and headlines scream, lean into discipline, not drama.

While others chase performance like caffeinated cats in a laser pointer factory, you’ll quietly build unstoppable momentum.

You don’t need to be the first across the wealth accumulation finish line, but by embracing all three components of compounding, you can help ensure that you do indeed cross it.

As always, invest often and wisely. Thank you for reading.

If you enjoyed this post, please hit the ❤️ below and share it with your friends!

The content is for informational purposes only. It is not intended to be, nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

Want a Chance to Win

Wealth Your Way

?

Click here to enter the Goodreads Giveaway for a free Kindle copy of my book! Hurry - the contest ends on April 26th at midnight EST.

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and post your review of Wealth Your Way. Your review will help other readers explore their own path to a richer, happier life!

March 28, 2025

The Surprising Upside of a Market Meltdown

Every market crash feels like a crisis, but what if it’s your greatest wealth-building opportunity? History has proven it repeatedly, yet fear keeps many investors from seizing the moment. The opportunity lies not in predicting crashes but in courageously navigating the storm.

Historical perspective: Resilience wins

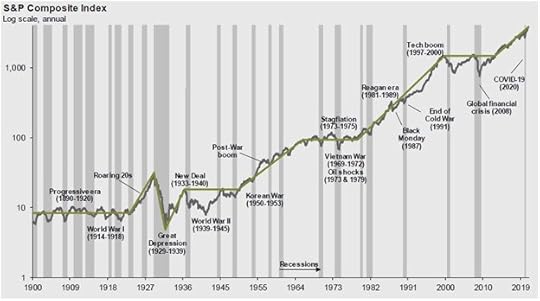

History makes one thing clear: you shouldn’t go rogue, but you should remain resilient. The following chart shows the market’s trajectory over the past 120 years.

The vertical gray lines represent recessionary periods, with the three most recent being the dot-com bust (2001), the financial crisis meltdown (2008), and the COVID-19 pandemic (2020).

Take note: through all the economic setbacks, wars, and dozens of recessions, the market’s trend line over the 120 years is upward. If you believe, as I do, that America’s economy and the global markets will continue upward over the long term, then in the short term, stay the course.

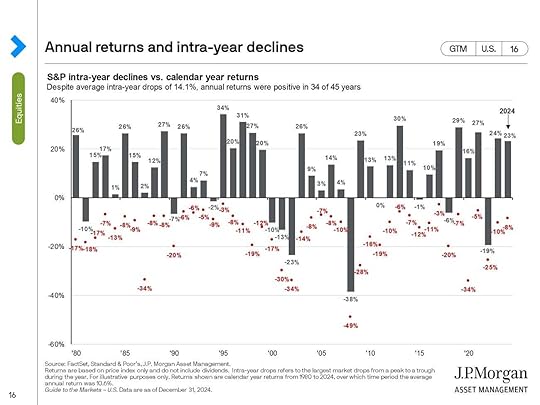

Imagine flipping a coin where three out of four times, you win. That’s how often the stock market has delivered positive annual returns over the past 45 years.

During downturns, many ask, “Will the market recover? (Spoiler: It always has.) The better question to ask yourself is: “Will I still be in the game as the market rebounds?”

Market volatility reality check

But know this: it won’t be a smooth ride. Over those 45 years, the market had an intra-year average decline of 14.1%. This means that even in the 34 calendar years with positive returns, significant declines occurred at some point during the year.

Think back to 2020. As the COVID-19 pandemic triggered a shocking 34% market free-fall in just weeks, fear and uncertainty dominated investor sentiment.

Yet those who remained disciplined and stayed invested not only weathered the storm but also enjoyed the subsequent surge, with the market ultimately closing up 16% for the year.

In stark contrast, those who panicked and sold near the bottom locked in their losses, missing one of the most remarkable market rebounds in modern history.

The odds are on your side for being invested over the long term with a healthy dose of stocks. Short-term volatility, however, makes timing the market a loser’s game. Stick to your long-term plan. Stay the course.

The Entrepreneur’s mindset: Opportunity in uncertainty

Market downturns don’t just create challenges, they also create the next wave of industry leaders. History proves that when the economy stumbles, innovation surges.

Some of the world’s most successful companies weren’t just built during crises; they were born because of them.

While most people saw chaos, these visionaries saw opportunity. They understood that innovation doesn’t stop in downturns, it accelerates:

1893 – General Electric: While the Panic of 1893 crushed businesses nationwide, Thomas Edison’s relentless drive led to the formation of GE. More than a century later, his vision still powers the world.

1908 – General Motors: While the Panic of 1907 triggered a 50% stock market decline, William Durant saw an opening and created GM, redefining the automobile industry.

1929 – Walt Disney Productions: Just as the Great Depression began, two brothers introduced the world to Mickey Mouse. From hardship, an entertainment empire was born.

1971 – Federal Express: As a recession ended and businesses doubted the reliability of overnight delivery, Fred Smith pressed forward, launching FedEx and reshaping global logistics.

1975 – Microsoft: With the stock market still reeling from a bear market and an oil crisis, two young programmers bet on the future of personal computing. Today, the company is worth trillions.

2008 – The Great Recession’s Entrepreneurs: While Wall Street crumbled, the seeds of innovation were planted. Uber, Venmo, Square, and Instagram all emerged, transforming the way we live and transact.

2020 – A Pandemic and a Startup Boom: The fastest market decline in decades sent shockwaves through the world but entrepreneurs stepped forward, launching businesses at record levels. Some of today’s most promising companies were born or reinvented in the uncertainty of a global crisis. One standout is Wiz, a cybersecurity startup founded in 2020, which just made history by securing a $32 billion acquisition by Google.

From Fear to Fortune: A Simple Framework

Market downturns test your resolve, but a disciplined approach turns uncertainty into opportunity:

Plan: Define your long-term strategy based on your goals, risk tolerance, and timeline.

Course-Correct: Adjust as needed—not out of fear, but in response to life changes and financial milestones.

Repeat: Keep investing, trust the process, and let compounding do its work in up and down markets.

Look fear in the face

Down markets don’t ask if you’re ready; they test your mettle. Those who stay invested aren’t just survivors; they’re the biggest winners. You just won’t recognize that fact until after the market rebounds.

Patience and discipline are key virtues when it comes to long-term investing. And like the entrepreneurs that came before us, you also must learn to look fear in the face and not flinch.

Every bear market plants the seeds of the next bull market. But only those who stay invested will reap the rewards.

Sideline spectator or wealth creator?

Market downturns don’t just destroy wealth, they create it. Long-term investors who maintain discipline during turbulent times consistently outperform those who panic and sell.

Compounding portfolio growth rewards patience. The market rewards courage, not capitulation.

As inevitable market downturns unfold, will fear keep you on the sidelines, or are you ready to seize the opportunity?

As always, invest often and wisely. Thank you for reading.

If you like this post, share it!

The content is for informational purposes only. It is not intended to be, nor should it be construed as, legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

Want a Chance to Win

Wealth Your Way

?

Click here to enter the Goodreads Giveaway for a free Kindle copy of my book! The contest ends 4/26/25.

Wealth Your Way is available on Amazon

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and posting your review of Wealth Your Way. Your review will help other readers explore their own path to financial freedom!

February 28, 2025

"I Don't Know" Is the Key to Smarter Decisions

Early in my career, it seemed like every other question I was asked led to the same meek response: “I don’t know.” Damn, I felt dumb.

But over time, I realized that not knowing wasn’t a weakness—it was an opportunity. So, I expanded my response to eight words: 'I don’t know, but I’ll figure it out.'

Now, no matter the question, those eight words form the foundation of my entire decision-making process.

The absence of certainty

Everything you know, your entire knowledge base, is rooted in the past and every decision you face is about the future—an unknown and unknowable future. We live in an uncertain world.

Where will the stock market go from here?

Will I be able to retire early?

How will the stock price react to the news?

Will we have a recession soon?

As a result, every decision you make has some level of uncertainty, so the challenge investors take on is how to weigh the alternatives.

In general, successful investors are an extremely confident bunch. Their success, however, doesn’t come from knowing the answer but from continually asking questions and wrestling with the unknown.

‘The market hates uncertainty’ –not so fast

Every time volatility in the market picks up, or the geopolitical climate acts up, the financial ‘news’ outlets start talking about how “the market hates uncertainty.” That comment implies there are times when there is certainty about the future, which is obviously a nonstarter.

More accurately, market forecasters hate uncertainty—it makes their prognostication much more difficult. Successful investors, however, thrive on the uncertainty.

The fallacy behind uncertainty is that the market isn’t just occasionally subject to bouts of uncertainty, the market 100% runs on it.

For every buyer of a security, a seller is taking the opposite position, and both parties believe they are shrewd. If there were no uncertainty, there would be no one left to take the other side of the trade you want to pursue.

Thinking in ranges

Thinking in ranges is the foundation of probabilistic thinking. Instead of chasing one ‘right’ answer, you develop a range of reasonable outcomes, each with its own probability of occurring. A narrow range of likely possibilities will serve you far better than a single, precisely calculated but improbable prediction.

Improbable because with so many variables, and an unknown future, precision is an illusion. This shift in thinking reduces overconfidence and helps you navigate uncertainty more effectively.

You can make informed decisions, well-reasoned assumptions, and educated forecasts, but you still can’t know the future.

When you pause to acknowledge that your investment thesis might prove to be wrong, it will nudge you away from aggressive assumptions and shoddy due diligence and push you toward investments where the potential return is proportionate to the level of risk. Have a slice of humble pie; it will help you sleep better.

Confidence and probabilistic thinking

Practice intellectual humility which is the opposite of intellectual arrogance or conceit. In simple terms, having the ability to say, “I’m not sure” or “I don’t know” and then exploring ‘why not?’ is the great equalizer between overconfidence and indecisiveness.

When evaluating the risks around a decision, it’s important to look not only at your confidence in being right but also at the probability and consequences of being wrong. When formulating a decision or a plan, look at the complete frame. This middle ground where confidence and probability cross paths is where informed decisions are made.

In the early days of November 2016, the New York Times predicted that Hillary Clinton had an 85% chance of winning the US presidency. (Most news outlets had similar predictions.) When Donald Trump won, people were quick to point out that the political commentators got it wrong. But the commentators never said Clinton will win. In fact, the Times implicitly said that there was a 15% chance she would lose.

When judging others, it’s easier to choose between right and wrong than to analyze the opinion on a probability basis. No need to give it much thought. Right or wrong—that’s it. But most of our financial decisions are not so binary.

When you get away from thinking in absolutes, 100% right or 100% wrong, and start thinking in probabilities, you begin to contextualize the decision at hand. As a result, your decision process improves because your decisions are no longer simply about black or white, but about calibrating among all the shades of grey.

There’s a fine line between humility and hesitation

A healthy respect for uncertainty shouldn’t lead to analysis paralysis—where the fear of being wrong keeps you from making a decision at all. The goal isn’t to avoid uncertainty; it’s to recognize it, weigh the probabilities, and act with confidence.

Successful investors don’t wait for perfect information; they act based on well-reasoned assumptions and adapt as new information emerges.

Having doubts about your choice can be uncomfortable, but being certain is only fooling yourself

Yes, be confident in your decisions, but also recognize there are no guarantees. Probabilistic thinking will help you cope with the uncertainty and manage the risk.

I came to realize that (1) “I don’t know” is simply an acknowledgement that we live in an uncertain world, and (2) “But I’ll figure it out” is shorthand for evaluating a range of outcomes in the face of uncertainty, weighing the individual probabilities and making an informed decision.

Sometimes you’ll get your expected outcome and sometimes you’ll get an education. That’s the proverbial win-win.

Stay focused on balancing the probability that your investment thesis will be successful, with the financial and emotional cost of being wrong. Your financial journey will be happier and less stressful.

The next time you face a financial choice (or any decision), ask yourself: what’s the probability of different outcomes, and how will I adjust if things don’t go as planned?

Mastering uncertainty isn’t about having all the answers—it’s about knowing how to weigh the possibilities.

As always, invest often and wisely. Thank you for reading.

If you like this post, share it!

The content is for informational purposes only. It is not intended to be nor should it be construed as legal, tax, investment, financial, or other advice. It is merely my own random thoughts.

Wealth Your Way is available on Amazon

The best way to spread the word about a book you enjoyed is to leave an honest review. Thank you for taking the time to click here and posting your review of Wealth Your Way. Your review will help other readers explore their own path to financial freedom!