How Interest Rates Work

How Interest Rates Work

An understanding of debt and interest is necessary to get a handle on money, since money (having it, not having it, or getting more of it) plays such a huge role in human motivation and behaviour. Acquiring it in some form or other, has been our prime motivator throughout our history, so it’s worth getting to grips with its complexities, even if it’s not exactly as riveting as a thriller (although thrillers, books and films, have been made about it!)

At the core of debt is interest.

Warren Buffet loves compound interest. Others view interest as usurious. So, what is it? In a nutshell it’s what person A pays person B to borrow money. That money could be used to create a new business, buy a car or house, or put food on the table. While the concept in itself is not bad, what can be bad is the interest rate. And the fundamental problem here is that those who can least afford the ‘loan’ pay the highest interest rates. To see this in action, let’s look at the graphs following.

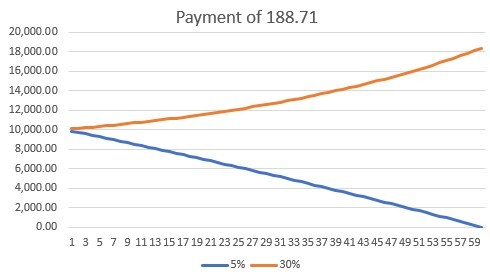

Each person borrowed $10,000 and is paying $188.71 a month towards it. Both people are ‘low risk’. One person borrowed at a 5% interest rate and the other person got a credit card and borrowed at a 30% interest rate, the rate on many credit cards – what’s yours? Check it out! In 60 months the 5% loan is completely repaid. In 60 months the 30% loan is now $18,300.

The sad thing now is that the person with the credit card who is a good credit risk goes to the bank and says, ‘I’d like to cancel my card and turn it into a loan.’ The bank will often reply, ‘No, you’ve already borrowed as much as our systems say you can.’ Even though the person is willing to cancel the card, he or she is still stuck and going deeper in debt.

Now let’s look at each person’s payments based on repaying the loan in 5 years (60 months).

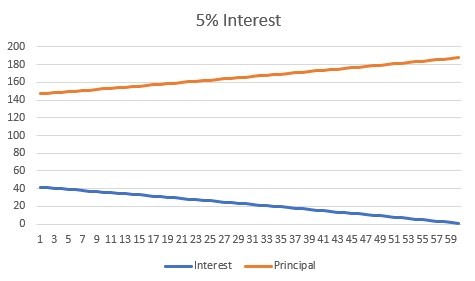

This is the person with a $10,000 loan. Following are the principal and interest payments they make each month. They pay $188 a month for five years and a total of $1,300 in interest. They are always paying down the loan – more of their monthly payment is going towards the principal (the amount they borrowed) than towards interest.

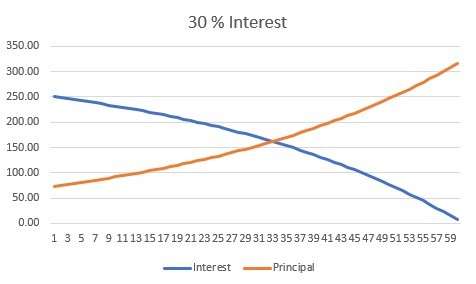

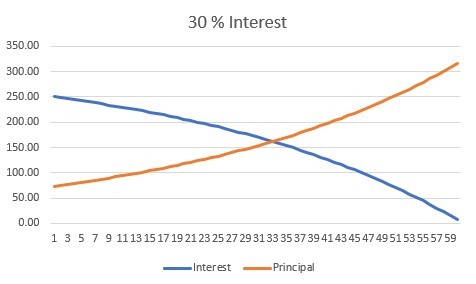

Now let’s increase the payment for the person with the credit card so that they can repay the $10,000 loan they have on their card and see what happens. They need to pay $323 a month for 5 years and pay $9,400 in interest. It’s not until month 33 that they are repaying more towards the principal (the amount they borrowed) than towards interest.

It’s scary. The person who can’t convert the card to a loan is put into financial hardship. And you wonder why there are more defaults at 30% than 5%…?

The credit card companies are nothing more than loan sharks. This wasn’t always the case and now in the US, Alexandria Ocasio-Cortez and Bernie Sanders are advocating bringing back the maximum interest on credit cards to 15%, which is what it used to be until deregulation in the late 70’s and early 80’s.

Now imagine those people really struggling to pay their children’s school meals, the ones who must take out payday loans. These are short term loans that people take at very high interest rates to survive from paycheck to paycheck. The industry calls them ‘high risk’ and at these interest rates it’s easy to understand why. Anyone who needs to borrow at 400% interest is high risk, simply due to the interest rate.

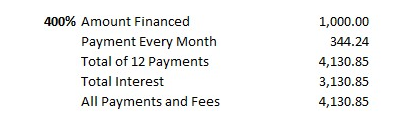

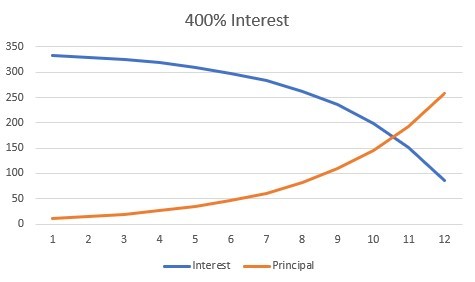

Just so you can really get a handle on payday loans that have average rates of 400%, let’s look at $1,000 for one year in a graph. On a $1,000 loan, borrowers pay over $3,000 in interest. It’s only in the last two months, the point where the two lines cross, that they are paying more towards the principal (the money they borrowed) than interest. The interest is three times more than what they originally borrowed. They paid $4,000 for $1,000 worth of food. Who benefits? The loan sharks. Until the end of the 70’s the US had a cap on interest rates at 15%. Now you can see why.

This is usurious and should be illegal. Imagine the current situation where people need to take out payday loans to get money to put food on the table and they are charged interest on the loan at 100’s of percent. Not that credit cards charging 30% interest are much better, but that’s an improvement from 100’s of percent. Seems to me if everyone had similar interest rates, not only would it be fairer, but there would be fewer defaults. Lend what someone can afford or don’t lend at all. If someone can ‘afford’ a loan at 400%, they can certainly afford one at 5%. And funnily enough, they would be less likely to need a loan to put food on the table, as their whole paycheck wouldn’t be going on interest payments.

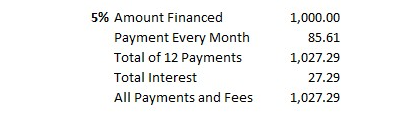

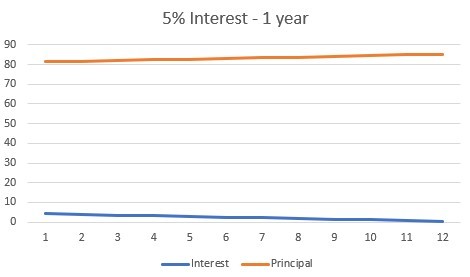

Out of curiosity, let’s see what the ‘good’ credit risk person pays to borrow $1,000 at the 5% annual interest for a year. $27 in interest, plus monthly payments of $85 vs. $344 a month payment, and $3,000 in interest for the ‘high risk’ person – and you wonder why the ‘high risk’ person, paying 400% interest, defaults and then gets categorised as a bad credit risk. Yeah, right. This is simply wrong. No two ways about it.

https://www.marketwatch.com/story/how...

The post How Interest Rates Work appeared first on come the evolution.