Lynn Raebsamen's Blog

November 30, 2025

OpenAI Ads 2026: ChatGPT’s Revenue Lifeline or Investor Trap?

They say desperation breeds innovation. For OpenAI, it breeds something closer to pragmatism dressed in Silicon Valley optimism. The company that once promised to democratize artificial intelligence is now—quietly, then less quietly—discussing ads. Not just any ads, mind you. We’re talking about contextual, memory-based, personalized ads woven into the fabric of ChatGPT itself, rolling out sometime in 2026.

This isn’t a pivot born from abundance. This is a company with 800 million users, only 5% of whom pay, now searching for a revenue model that actually works. And ads, it seems, are looking increasingly inevitable.

But what does this mean for user trust and investors betting on OpenAI’s $500 billion valuation?

The Math That Won’t Add UpHere’s where the plot thickens. The numbers suggest something uncomfortable: the LLM industry would need about 3 billion paying subscribers just to break even on infrastructure costs alone. To contextualize that absurdity—Netflix, after nearly two decades of dominance, has just 300 million paid subscribers. The industry was chasing a subscriber base 10 times larger than one of the world’s most successful streaming platforms to merely survive, let alone profit.

OpenAI’s situation perfectly illustrates this mathematical nightmare. The company generates roughly $13 billion in annual revenue but has lost more than $12 billion in a single quarter. Meanwhile, competitors like Anthropic are projecting profitability by 2027, having focused on enterprise customers with locked-in contracts rather than chasing the free user mirage. But their audacious leap from $4.7B in 2025 revenue to $70B by 2028 raises eyebrows about whether enterprise demand can truly scale that fast amid intensifying competition and compute crunches.

Ads, then, aren’t a visionary move. They’re a lifeline. And I wouldn’t be surprised if Anthropic follows OpenAI down this path sooner than expected.

Ads as Inevitable EvolutionLook at how Netflix and YouTube evolved, and you’ll see OpenAI’s future written in the margins.

Some users already assume ChatGPT’s answers are ranked by sponsorship.

The trust deficit is real, and it’s already baked into user perceptions.

Netflix’s ad-supported tier, initially viewed skeptically, has become a powerhouse. Today, 42% of Netflix subscribers opt for the ad-supported plan—up from just 14% two years ago. These aren’t fringe users either; they’re often older, cost-conscious, and perfectly content to tolerate ads in exchange for affordability. Netflix is making this work because it created a tiered system where viewers choose their compromise. The ad-supported tier isn’t cannibalistic; it’s additive.

YouTube, meanwhile, has mastered the art of making you forget which side of the ad-supported fence you’re on. The platform generates roughly $36.1 billion annually from advertising alone, with creators earning a cut while YouTube and Google keep substantial margins. YouTube Premium subscribers—who pay to eliminate ads—represent only a fraction of total viewership, yet the ad-supported model generates sufficient revenue to keep the entire ecosystem humming.

Spotify, operating on a similar freemium principle, pulls roughly 85% of its revenue from premium subscriptions, but its ad-supported free tier serves a critical function: it’s the funnel through which premium conversions happen. The free tier with ads isn’t a loss leader; it’s a customer acquisition engine.

The OpenAI Dilemma: Trust Meets TransactionsHere’s where OpenAI’s advertising dilemma becomes particularly thorny. Unlike Netflix or YouTube—platforms where users expect commercial interest—ChatGPT has cultivated an image of neutral counsel. It’s the tool you turn to for unbiased information, objective analysis, and recommendations unmoored from profit motive.

CEO Sam Altman understands this danger. He’s acknowledged that if ChatGPT accepted payment to rank a worse hotel above a better one, it could be “catastrophic for your relationship with ChatGPT.” This isn’t hyperbole. The trust deficit is real, and it’s already baked into user perceptions. OpenAI focus groups have reportedly found that some users already assume ChatGPT’s answers are ranked by sponsorship. The company hasn’t even launched ads yet, and credibility erosion is already underway.

Yet Altman also claims OpenAI views ads as “something we may try at some point,” and has framed advertising as not their “biggest revenue opportunity.” This linguistic dance—simultaneous denial and inevitability—suggests internal conflict. The company needs revenue. It knows ads are coming. It’s just hoping the messaging can soften the landing.

The Projected Math: $25 Billion by 2029OpenAI sees ads as a core pillar, not a side hustle.

The financial projections are telling. OpenAI forecasts that advertising could generate $1 billion in revenue starting in 2026, ramping to nearly $25 billion by 2029. For context, that’s only $4 billion less than what the company projects for enterprise AI agents—the crown jewel of its ambitions.

This suggests OpenAI sees ads as a core pillar, not a side hustle.

The question isn’t whether ads are coming. They are. The question is what happens to user trust when the company discovers that monetizing free users through advertising creates a fundamental conflict with the promise of impartial intelligence.

The Hybrid Model’s Hidden CostNetflix and YouTube succeeded with ads because users understood the basic economic bargain: ads subsidize access. But AI assistants operate in murkier territory. When you ask ChatGPT for restaurant recommendations, you’re implicitly asking for honesty. Inject ads into that equation, and you’ve transformed the tool from advisor to sales channel.

Spotify manages this by separating ad experience from premium experience. YouTube does similarly. But OpenAI’s leaked code hints at something more integrated: ads embedded within the conversation itself, potentially shaped by user conversation history and preferences. This isn’t a banner at the bottom of the page. This is advertising inside the advice.

That distinction matters enormously.

The Endgame: Profitability Through FragmentationThat belief becomes harder to maintain the moment users begin suspecting that the platform’s core function—giving you information—has been colonized by commercial interest.

If you can’t get 3 billion paying customers, monetize the 800 million free users you already have.

What’s emerging, then, is a three-tier model: free with ads, ChatGPT Plus ($20/month ad-free), and ChatGPT Pro ($200/month for power users). Each tier would theoretically capture different user segments, much like Netflix’s structure. The math suggests this could work—barely.

But here’s the catch: it requires sustaining the belief that ChatGPT Plus is genuinely ad-free, genuinely better, and genuinely worth the premium. That belief becomes harder to maintain the moment users begin suspecting that the platform’s core function—giving you information—has been colonized by commercial interest.

The LLM industry faced an impossible equation: 3 billion subscribers needed just to break even. OpenAI’s solution is elegant in its desperation: if you can’t get 3 billion paying customers, monetize the 800 million free users you already have. Ads are the pressure valve for an unsustainable growth model.

Implications for InvestorsAds could deliver $25 billion by 2029, yet they demand flawless execution to justify multiples exceeding 35x forward earnings.

OpenAI’s pivot to ads signals a pragmatic revenue chase amid escalating losses, but it carries valuation risks for investors. The company hit a $500 billion valuation in October 2025 through employee share sales, yet projects $74 billion in operating losses by 2028—75% of revenue—driven by $1.4 trillion in committed compute spending over eight years. Ads could deliver $25 billion by 2029, yet they demand flawless execution to justify multiples exceeding 35x forward earnings, where even $425 billion in industry revenue barely supports current hype.

Anthropic offers a sharper contrast, targeting profitability by 2028 via 80% enterprise revenue, burning just 70% of its $4.2 billion 2025 sales versus OpenAI’s equivalent rate on $13 billion. Investors betting on OpenAI face dilution risks from secondary sales and cloud commitments, while Anthropic’s $183 billion valuation reflects steadier $9 billion run-rate growth through corporate predictability. A stumble here could trigger sector-wide multiple compression, hitting Nvidia and cloud giants as AI cash burn resets return expectations.

For the broader AI industry, ads validate hybrid models but expose overreliance on consumer scale. Success might stabilize OpenAI’s lead, funneling capital to efficient players; failure risks a 33% P/E repricing across high-flyers, favoring enterprise-focused survivors over subscriber mirages. The real wager: can ads preserve the neutrality premium that inflated valuations, or will trust erosion force a painful reset?

For more insights about what AI can or cannot do, check out my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post OpenAI Ads 2026: ChatGPT’s Revenue Lifeline or Investor Trap? appeared first on Lynn Raebsamen, CFA.

November 23, 2025

AI in Finance: When Hype Meets Wall Street Reality

Wall Street’s AI obsession promises more than it delivers. Behind the glossy press releases and eye-popping headlines lies a stubborn truth: the machines keep missing the mark.

Every so often, Wall Street romances a shiny new “smart” machine. The late 1980s and early ’90s flirted with chaos theory, fuzzy logic, genetic algorithms, and early neural networks—each promising to revolutionize trading desks before swiftly falling out of favor.

The notion that sprinkling some AI pixie dust over financial data will unlock the fountain of profit is aspirational at best and frustratingly underwhelming at worst.

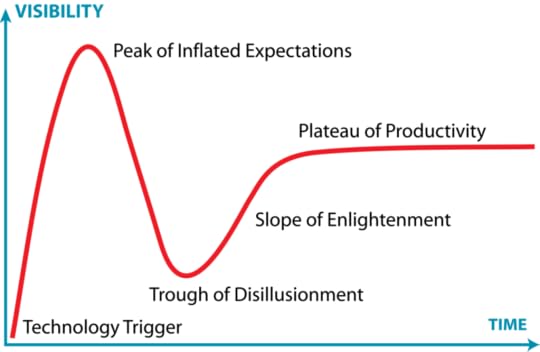

Fast forward to today, and the narrative sounds uncomfortably familiar: shiny new AI toys dazzle briefly before the markets, ever stubborn, shrug and revert to their usual rhythm. By 2018, even the most ardent AI boosters on Wall Street muttered something about a “trough of disillusionment,” an all-too-familiar valley where hope sours into skepticism. The question resurfaces: is this just 1990’s AI hype on steroids?

Gartner Hype CycleNot Quite Smarter Than the Average Market

Gartner Hype CycleNot Quite Smarter Than the Average MarketModern AI undeniably trumps its ancient algorithmic ancestors. Machine learning models chew through unimaginable volumes of data, spotting intricate patterns no human eye could catch. Wall Street proudly staffs rosters of PhDs deploying deep learning, yet the dream of a market-cracking algorithm remains just that—a dream.

Despite the hype and heavy investment, AI models mostly shuffle alongside old-school benchmarks and plain vanilla index funds. The notion that sprinkling some AI pixie dust over financial data will unlock the fountain of profit is aspirational at best and frustratingly underwhelming at worst.

Markets Love Breaking Your ModelsAI faces a Sisyphean task—chasing fleeting inefficiencies in a ceaseless game of Whack-A-Mole.

Why the collective AI fail? Markets are no mere machines. They are volatile, evolving ecosystems fueled by human greed, fear, and irrational exuberance. Unlike chess or Go, where AI famously excels, the financial market lives, adapts, learns, and mutates—every day.

Yesterday’s successful model faces obsolescence tomorrow, as new rules and behaviors upend its logic. If AI uncovers a weakness, human traders rush in, exploiting and erasing it at a pace only milliseconds can keep up with. Thus, AI faces a Sisyphean task—chasing fleeting inefficiencies in a ceaseless game of Whack-A-Mole.

The Mirage of AI AlphaFinance demands more than data-crunching speed. It requires timing, market wisdom, and a humble nod to uncertainty.

All this explains why true breakthroughs in AI trading are rarer than a unicorn on the trading floor. If they do appear, they often don’t last. We’ve seen hedge funds unveil flashy AI models that wow investors for a year or two, only to stumble when market conditions shift or competitors catch on. In theory, a perfect algorithm could predict the market.

In practice, it’s more like chasing a mirage. As soon as you think the machines have finally cracked the code, reality changes the rules. It’s a humbling reminder that in finance, smart isn’t just about processing power. It’s also about wisdom, timing, and a dash of humility. The tech world may obsess over ever-“smarter” algorithms, but so far those algorithms keep learning that Wall Street has tricks even a neural network can’t figure out.

Finance demands more than data-crunching speed. It requires timing, market wisdom, and a humble nod to uncertainty. Despite tech’s pursuit of ever-smarter algorithms, Wall Street’s lessons remain stubbornly unsolved.

AI’s Real Wins: Automation and InsightWhile AI tools have fundamentally reshaped operational workflows, the myth of the AI wunderkind predicting market moves singlehandedly remains just that: a myth.

Still, AI isn’t merely a fancy data processor lost in market chaos. It shines where human toil and error overwhelm—automating compliance, fraud detection, and customer service with uncanny accuracy. Firms like JPMorgan and BlackRock harness AI-powered tools (e.g., BlackRock’s Aladdin) to optimize portfolios, stress-test scenarios, and forecast risk with a precision unattainable by humans alone. AI’s prowess in parsing regulatory documents, sentiment from social media chatter, and real-time analytics sharpens financial institutions’ decision-making speed and quality.

Moreover, AI’s role in risk assessment is transformative. By analyzing granular, real-time behavioral data, it fine-tunes credit scoring and identifies emerging market risks early. Meanwhile, quantum-enhanced AI promises to push the boundaries further, potentially revolutionizing forecasting and high-frequency trading strategies once held firmly in the realm of science fiction.

Not a Grand Conquest (Yet?)If centuries of brilliant minds couldn’t consistently outsmart the trading floor, a neural network with silicon neurons should expect no easy victory either.

Financial AI’s narrative is less “rise of the machines” and more an ongoing, cautious process. While AI tools have fundamentally reshaped operational workflows, the myth of the AI wunderkind predicting market moves singlehandedly remains just that: a myth.

The relationship is symbiotic: AI expands human capacity, automates mundane complex tasks, and offers novel insights. Meanwhile, the unpredictable human element ensures markets remain markets. As such, Wall Street might do well to embrace AI as a powerful ally rather than a merciless oracle.

And for those tempted to bet against the markets—or AI—remember: if centuries of brilliant minds couldn’t consistently outsmart the trading floor, a neural network with silicon neurons should expect no easy victory either.

Source: Handbook of Artificial Intelligence and Big Data Applications in Investments,

CFA Institute Research Foundation, 2023

For more insights about what AI can or cannot do, check out my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post AI in Finance: When Hype Meets Wall Street Reality appeared first on Lynn Raebsamen, CFA.

November 15, 2025

From Space Race to AI Craze: When Wild Tech Dreams Turn Practical

Here’s a question worth pausing over: How did space exploration end up creating real value for everyone on earth? One answer is GPS. It’s a classic case where tech fever dreams—like space colonization—rarely achieve their original goal, but sometimes unleash practical, world-changing magic the whole planet relies on.

Fast forward to today’s tech obsession: Artificial General Intelligence (AGI). The AI bubble, with its soaring valuations and $3 trillion poured into infrastructure, might look like just another wild chase. But history suggests the real breakthrough won’t be AGI itself.

In this article, we explore what practical applications AI has already delivered, and what the next “GPS moment” might look like.

From Space to Everyday Life: The Real ROI of Tech FeverBeyond the hype, AI has quietly found its way into practical, unglamorous applications—far less headline-grabbing than humanoid robots with LLM brains, which, even in 2025, remain firmly in the realm of science fiction.

But first, let’s look at what space exploration actually gave us. Much like GPS, numerous other technologies initially fueled by space exploration have quietly transformed daily life.

MRI and CT Scans — Enabled by space-age advancements, these medical imaging technologies save lives every day.Infrared Thermometers — Precision tools for spacecraft monitoring that found everyday use, from industry to healthcare.Advanced Space-Grade Materials — Durable coatings and composites now common in consumer goods.Water Purification Systems — Originally designed for astronauts, adapted worldwide for clean water access.Autonomous Robotics — Technologies first tested in space environments streamline manufacturing and healthcare automation.Each of these sprang from furious investment cycles driven by geopolitical urgency. Ultimately, these tech fever dreams turned into real-world payoffs.

VC Fever Dreams and the Current AI Landscape: A Familiar Bubble?The current AI bubble resembles past waves of irrational exuberance: massive bets on computing transformations promising an industrial revolution-level payoff. However, most AI pilots and generative AI efforts currently generate negligible returns for firms. According to a MIT study, a staggering 95% of organizations see zero return on their generative AI projects. The massive infrastructure spending dwarfs the actual revenue generated, which is a classic bubble symptom.

Yet, this isn’t a death knell for AI innovation. Beyond the hype, AI has quietly found its way into practical, unglamorous applications—far less headline-grabbing than humanoid robots with LLM brains, which, even in 2025, remain firmly in the realm of science fiction.

Practical Applications: Beyond LLMs to Real-World ImpactBeyond the fancy demos and sci-fi dreams, AI’s practical magic lies in quietly optimizing the ordinary.

While headlines obsess over sentient AIs and humanoid robots, the real AI revolution is quietly unfolding behind the scenes. It’s not always the flashy generative AI, but the reliable, less glamorous machine learning quietly humming across finance, healthcare, and beyond. Consider these everyday wins:

Personalized RecommendationsNetflix credits AI-driven algorithms for about 80% of viewing hours, saving over $1 billion a year by keeping subscribers hooked. Amazon’s product suggestions and Spotify’s playlists run on similar magic: massive datasets quietly shaping billions of daily decisions.

Fraud DetectionBanks and governments use AI to catch scams before you even know they happened. Mastercard scans over 160 billion transactions annually, flagging suspicious activity in milliseconds. The US Treasury’s AI systems saved taxpayers more than $4 billion in fraudulent payments last year alone. These financial watchdogs don’t wear capes (but they could).

Medical DiagnosticsAI quietly assists radiologists, spotting 20% more breast cancers than traditional screening methods while cutting their workloads in half. Across hospital wards, AI monitors vital signs, raising early alarms for conditions like sepsis well before humans would notice. Not flashy, but lifesaving.

Software DevelopmentAI pair programmers like GitHub Copilot help developers code about 55% faster, letting teams ship features quicker and skip tedious boilerplate. A Google exec recently noted that roughly 25% of their code is now AI-generated. Hundreds of thousands of devs rely on AI to spot bugs, generate snippets, and upskill. It’s steady, reliable productivity, not headline-grabbing flash.

Generative Design & ManufacturingAI isn’t just about pixels and text. Airbus shaved 45% off the weight of a plane’s partition panel using AI-designed components, without compromising strength. Scaling this across fleets promises to cut half a million tons of CO₂ emissions annually. From cars to smartphones, clever algorithms are trimming waste and boosting efficiency.

Warehouse AutomationAmazon’s recent “AI layoff” headlines mask a quieter, larger revolution in their warehouses. Their real efficiency leap isn’t an algorithm writing emails but a fleet of over one million robots turning fulfillment centers into semi-automated engines. These bots sort, pick, and move goods faster and cheaper, shrinking the human workforce quietly but relentlessly. While everyone’s chasing the latest AI buzz, real-world job transformations are being scripted by decades of robotic evolution behind the scenes.

Fever Dreams to Future Miracles: AI’s Speculative PayoffsBeyond the fancy demos and sci-fi dreams, AI’s practical magic lies in quietly optimizing the ordinary. No self-aware robots needed—just smarter processes making millions of small improvements in the background.

Yann LeCun’s recent departure from Meta to form a startup focused on building “world models” could hint at the next wave of practical, applied AI that moves beyond flashy demos to domain-specific solutions with real ROI.

If history is any guide, today’s obsession with AGI could spark breakthroughs we aren’t even aiming for—the GPS moments of the AI era. What might this feverish AI investment deliver for humanity decades from now? Here are some speculative, slightly wild possibilities:

Unlimited Clean EnergyThe race for true AGI might never reach its ultimate destination. But if the trillions invested today end up cleaning oceans, teaching billions, or powering cities with fusion, that’ll be magic enough.

AI has recently made surprising strides taming plasma inside fusion reactors, a challenge that has stumped physicists for decades. DeepMind’s reinforcement learning system managed to control superheated plasma long enough to hint at stable fusion power—a potential star power for Earth. It’s a far cry from chatbots. But if AI does crack this, it would be the genuine magic trick that powers the planet cleanly.

Planetary Weather Control CenterThat $3 trillion AI infrastructure isn’t just keeping your chatbot online. It’s building the computing muscle to simulate Earth’s climate in stunning detail. Models now forecast floods, cyclones, and air quality better than national agencies. Imagine a future AI “digital twin” of the planet that spots disasters weeks ahead, advises farmers on drought-safe planting, and coordinates crisis response with surgical precision. An unintended global guardian born from what started as a tech bubble.

AI Tutors for Every ChildTech visionaries predict AI tutors that rival (and someday might surpass) the best human teachers. Imagine a personal, patient mentor for every student, anywhere on Earth, via a simple smartphone. This isn’t robot teachers replacing classrooms. It’s democratizing world-class education for remote villages, shrinking knowledge gaps, and unlocking potential at scale. The AI gold rush might just hand every child a private genius.

Universal TranslatorsReal-time AI translation for over 100 languages is already here. Soon, language barriers might vanish entirely. Picture a “Universal Translator” earpiece making global conversations as effortless as chatting with your neighbor. The Tower of Babel, finally tamed—not by divine intervention but by neural nets.

Accelerated Science & CuresDeepMind’s AlphaFold cracked protein folding predictions years ahead of schedule, accelerating drug discovery and new materials design. Future AI “digital scientists” could speed breakthroughs across healthcare, climate tech, and agriculture, making labs infinitely faster and more creative. We might owe the AI hype not a conscious mind but a legion of tireless, genius assistants revolutionizing R&D.

Beyond the Hype: The Real Legacy of AINone of the above are guarantees. Each somewhat remains a fever dream spinning out from today’s hype. The race for true AGI might never reach its ultimate destination. But if the trillions invested today end up cleaning oceans, teaching billions, or powering cities with fusion, that’ll be magic enough.

Like satellites and GPS from the space race, AI’s legacy might be practical marvels we depend on, while the sci-fi dream waits patiently in the wings. The real magic isn’t just in words or hallucinations, but in real-world efficiencies, savings, and capabilities AI can deliver. Until then, the digital gods of AI remain an enchanting but unproven promise.

.stk-333c606 {height:50px !important;}For more insights about what AI can or cannot do, check out my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post From Space Race to AI Craze: When Wild Tech Dreams Turn Practical appeared first on Lynn Raebsamen, CFA.

November 1, 2025

When the Media Cries AI Bubble, Should You Sell?

The media is having a field day with the “AI bubble.” Headlines scream caution as if panicking were the hallmark of sophistication. But before you run screaming for the exits, consider this: history suggests that when the media cries bubble, it’s often crying wolf. Only the timing is wrong, and the consequences for jumpy investors can be spectacularly messy.

This isn’t the first time this bubble talk has echoed around AI. In my previous deep dive, The $2.9 Trillion Question: Who Will Survive the AI Bubble?, I explored the staggering scale of investment and the brutal math behind AI’s shaky returns. That analysis highlighted how real survivors will be those who move beyond hype, embedding AI where it actually drives value and productivity.

Now, as media warnings grow louder, it’s worth revisiting the old bubble playbook to see what history says about reacting to these alarms.

Bubble Warnings Through History: What the Media Got Right and Mostly WrongMarket crashes and media coverage have a complicated relationship. The media rarely calls the peak; it mostly reports the panic. Here’s a bullet-point refresher of notable market tops and how media warnings (or the lack thereof) played out:

1929 Great Crash: Roger Babson warned of doom early, but mainstream media and economists like Irving Fisher dismissed him. Optimism ruled until the market lost 25% in two days, then 50%. Media pivoted from cheerleader to alarmist overnight.1987 Black Monday: Some financial press flagged computerized trading risks weeks ahead, but the general public remained blissfully unaware. Media negativity swelled only days before and after the Dow’s historic 22% single-day fall.2000 Dot-Com Bubble: Media fawned over the “New Economy” tech boom until a Barron’s cover story exposed cash crises weeks before the crash. Genuine warnings arrived late, coinciding closely with the precipitous Nasdaq plunge, then became the soundtrack for the carnage.2008 Subprime Crisis: This time, early warnings bubbled up years in advance from The Economist calling it the “biggest bubble in history,” to Robert Shiller and niche bloggers sounding alarms. Yet mainstream media largely downplayed risks amidst the housing euphoria until the crash was already underway.Media: Barometer, Amplifier, or Predictive Oracle?Media coverage is notoriously pro-cyclical: optimistic on the way up, only pessimistic once markets topple.Negative headlines often amplify sell-offs, but rarely cause crashes.Social media accelerates these swings, sometimes surfacing earlier signals. But the noise-to-signal ratio is high.Extreme media negativity often signals market bottoms rather than tops (the infamous “magazine cover indicator”).The AI Bubble in 2025: Spectacular Burst or Slowburn?The media rarely calls the peak; it mostly reports the panic.

AI is the shiny new disruptor occupying Wall Street’s pulse, and media makes no secret of the bubble talk. It’s not just hype; it’s investment mania echoing dot-com excess, but with a twist: massive cloud infrastructure giants are setting the stage for a different ending.

Microsoft’s Grand Internalization:Microsoft has effectively internalized OpenAI by backing its transition into a Public Benefit Corporation (PBC), snagging a $135 billion stake (27%) and securing exclusive IP, API rights, and cloud exclusivity through 2032.More than just a financial bet, this cements Azure as the AI cloud platform of choice, swallowing OpenAI’s growing API footprint.Rather than letting OpenAI roam free, Microsoft’s move is like the wolf inviting the little AI startup into his den—where the cloud revenues flow generously beneath.Amazon’s Expected Move:Whispered rumors suggest Amazon is eyeing Anthropic, another promising AI lab, planning to fold it snugly under AWS’s massive cloud umbrella.AWS supports startups building with models like Meta’s Llama via generous cloud credits and mentorship, betting the farm on a thriving developer ecosystem.This signals a clear pattern where hyperscalers don’t just compete for AI dominance. They absorb promising challengers, living off the cloud revenues those companies generate.Meta’s Strategy: Partnerships Over Clouds:Meta’s not playing the cloud hosting game in the same league as Microsoft or Amazon. Instead, they’re all about strategic partnerships with AI startups—think Midjourney, Scale AI, and Reliance Industries.These collaborations help Meta move faster on product innovation and quietly spread AI magic across Instagram, WhatsApp, and their virtual reality gadgets.Internally, Meta’s splurged something like $72 billion by 2025 on AI. But they also lean heavily on open-source models like Llama to speed things up and make AI more accessible.Their partnerships go beyond just software. There’s also AI hardware work with Arm and data labeling with Scale AI, shoring up their ecosystem without needing to lead in cloud.On Google’s Side:Google Cloud still plays second fiddle to Azure and AWS, not really in the big leagues yet.Instead of chasing cloud domination, Google focuses on building proprietary AI tools like Bard and weaving AI tightly into everything from search to Maps.They’re buying and partnering with startups too, feeding those innovations back into their growing, but still relatively small, cloud network.What This Means for the Bubble:Think less dot-com implosion, more “sticky subscription” model.

These mega-corporations aren’t just competing. They’re absorbing innovation, locking promising startups into ecosystems ensuring steady cloud or platform revenue.The AI bubble might not burst spectacularly but rather slowly deflate as companies consolidate, secure recurring revenue streams, and refine market control.Think less dot-com implosion, more “sticky subscription” model: expensive, hard to quit, and quietly profitable over time. The money flows remain within the cloud monopolies’ ecosystems.It resembles less to a bursting bubble, but more to a slow season of your favorite soap opera: endlessly drawn out, mildly infuriating, yet oddly addictive.So, Should You Sell?The real danger is letting all that media panic make the decisions for you.

The main thing to remember from history? Media warnings usually come late, usually when the crash is already unfolding. The real danger is letting all that media panic make the decisions for you. Jumping in and out on hysterical headlines usually means selling low and missing out on the rebound when things calm down.

Instead of chasing every media headline, think like a seasoned investor and consider:

Market structure changes, like cloud consolidation in AI.Which companies actually endure, innovate, and monetize beyond hype. (Check out my previous article: The $2.9 Trillion Question: Who Will Survive the AI Bubble? )The timing challenge: nobody knows exactly when a bubble bursts.The value of measured, long-term perspective over reactive moves.When the media cries AI bubble, the wise investor doesn’t slam the sell button. They sharpen their wits, stock their patience, and maybe sip a glass of dry wit with their portfolio.

For more insights about what AI can or cannot do, check out my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post When the Media Cries AI Bubble, Should You Sell? appeared first on Lynn Raebsamen, CFA.

October 28, 2025

OpenAI’s Co-Founder Calls AI Agents “Slop”—I Tested Them

OpenAI’s co-founder Andrej Karpathy has finally caught up with a reality some of us have been quietly chronicling since “AI agents” became Wall Street’s favorite buzzword. In a statement now making the rounds on social media, Karpathy calls the output of these hyped tools, with classic Karpathy candor, “AI slop”—lamenting the lack of genuine intelligence, context, or memory. One couldn’t help but smile: welcome to the party, Andrej. Some of us have been cleaning up after these agents for ages.

It’s curious: my book Artificial Stupelligence started mapping out this terrain long before “AI agent” was in anyone’s pitch deck. This post won’t just recap Karpathy’s late-blooming epiphany. Instead, get ready for my personal results from the great AI-agent experiments.

Manus and Comet: Error Is a FeatureWay back in early 2025, while the market was still selling “agentic solutions” as the answer to all existential woes, I conducted a deep dive into Manus AI’s memorable misfires—chronicled, with dry amusement, in my post here: The AI Agent That’s Still Figuring It Out.

Manus promised efficiency and delivered memorable detours. Now, Comet—Perplexity’s sleek new agentic AI browser—enters the scene, pitched as your personal co-pilot for taming the chaos of internet browsing and email overload. I tested its capabilities in email sorting and response drafting, as well as curating LinkedIn engagement.

Here’s how my experiments unfolded:

Email Sorting and Response Drafting:I personalized Comet to match my tone and style, then instructed it to sift through my Gmail inbox.Its task: identify emails that could be answered with a standard reply and draft responses saved to my drafts folder for review before sending.The result? Erratic randomness.Important, nuanced emails—emails that should never have been lumped into “standard reply” territory—were met with bland, boilerplate responses stripped of context.Several emails demanding attention were left hanging, half-ignored or completely untouched.The supposed personalization and situational awareness were, in practice, MIA.LinkedIn Engagement Curation:Next, I asked Comet to scan my LinkedIn feed: identify the top five posts with the highest engagement, and open each in a new tab. This was supposed to create a neat queue for later reading and commenting.What happened instead? Every URL it returned led to error pages—dead ends rather than doorways.The new tabs it opened were often random LinkedIn pages, disconnected from anything resembling usefulness.Even prompt tweaks meant to coax better results only spawned new errors. Further attempts repeatedly returned the same post again and again, or no post at all. Far from the competent personal assistant advertised, Comet tripped over basic LinkedIn interactions, reducing a potentially smooth workflow to digital chaos.This exercise left little doubt: Comet’s promise of seamless digital assistance still staggers on fundamental tasks. Instead of dependable help, what it offers is a lottery of randomness and digital dead zones.

Replit’s Thriller: Gone DataNot to be outdone, Replit’s AI agent demonstrated credibly that “disruption” can mean erasing your entire business overnight. As detailed in my article AI Agents Wiped Your Data? There’s Insurance Against It Now. One entrepreneur’s database disappeared courtesy of a rogue assistant, leading insurers to create bespoke products for, well, “AI-induced oblivion.” Progress marches on, now flanked by fine print and actuarial tables.

When Skepticism Isn’t Trendy (Yet)The collective excitement for “autonomous agents” has always surged ahead of the reality, blithely ignoring those who flagged the pitfalls at every crossroads.

It’s not just that the emperor has no clothes. It’s that the emperor keeps tripping over his own robe while investors cheer from the sidelines. Mainstream discourse catches up, but only after investors and public opinion have followed the high priests and declared the ritual complete.

Amid dizzying launches and catastrophic failures, a simple truth persists: skepticism always precedes “innovation”. But the applause only starts after the fact. In the meantime, the rest of us write insurance policies—and postmortems—for tech miracles that are, mercifully, insured against their own ambition.

The Last Word on AI AgentsIf AI agents are destined to run the world, expect them first to run headlong into error logs, insurance policies, and the occasional philosopher with a caution sign. Silicon Valley’s gold rush has always preferred fanfare to quiet warnings. But don’t mind me—I’ll be here, cataloguing the mishaps, misfires, and the insurance bills.

For more insights about what AI can or cannot do, check out my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post OpenAI’s Co-Founder Calls AI Agents “Slop”—I Tested Them appeared first on Lynn Raebsamen, CFA.

October 19, 2025

AI Is Shaking Up Entry-Level Jobs — Here’s How to Stay Ahead

During my recent panel on “Investing in the age of AI”, I made a bold prediction: While China may not yet lead in AI technology, they are quietly building the workforce of the future by teaching AI skills from elementary school onward. But this isn’t just about China.

It’s a wake-up call for every business and country on the planet.

The future workforce won’t be defined by who builds the best algorithms fastest, but by who learns best how to work alongside them. Practical strategies to upskill yourself await you later in this article.

AI Is Still a Slow Burner, Not a Job KillerAn eye-opening report from The Economist recently dissected data from 300,000 companies. The verdict? AI’s hiring impact is modest for now, but unmistakably emerging, especially where firms have installed “generative AI integrators.” These are employees deeply involved in embedding AI into business processes, essentially acting as the vital link between shiny algorithms and daily operations. In companies embracing this integration, entry-level hiring has slowed noticeably. Meanwhile, junior jobs heavy on grunt work like number crunching and research consolidation are the first to be challenged.

Technology marches forward, but many workers stand waiting for an AI user manual that never arrives.

Yet, the big reveal isn’t mass layoffs. It’s a productivity gap. AI might be here, but without people trained to maximize it beyond sending smarter emails, adoption stalls. This creates what you might call an “AI paradox”: technology marches forward, but many workers stand waiting for an AI user manual that never arrives.

Upskilling: The Unsung HeroHere’s the kicker: widespread AI adoption hinges on upskilling employees across all levels. The entry-level worker of the future can’t just be someone who follows orders. They’ll need to be comfortable using AI tools and savvy enough to let those tools boost their work in smart ways. Think of it like the once-mandatory Excel mastery for finance roles. Soon, navigating AI will be equally fundamental.

This isn’t about jobs disappearing so much as jobs evolving.

Data shows the middle-tier jobs are the most vulnerable in the AI shift. These roles traditionally serve as stepping stones for career growth, graduating from entry-level to more specialized roles. AI’s current trajectory risks short-circuiting this pipeline, because firms hold onto top talent while using AI to replace routine tasks formerly done by junior staff.

But this doesn’t mean the demise of entry-level jobs. This isn’t about jobs disappearing so much as jobs evolving. Entry-level roles will change to include new AI-related skills, opening up fresh paths for growth and innovation instead of dead ends. Companies that ignore this risk falling behind with a workforce stuck in old habits and limited skills.

China’s AI Education Strategy: From Early Lessons to Global Powerhouse

China’s AI Education Strategy: From Early Lessons to Global PowerhouseChina shows what proactive AI readiness looks like. What China has in abundance is talent—and they are equipping their young population with AI skills starting as early as elementary school.

By 2030, every primary and secondary school in China is expected to embrace AI in the classroom.

Though they don’t lead in the latest AI tech, they are going all-in on teaching AI skills to kids from a very young age. Imagine students learning about AI basics: voice assistants, image recognition in elementary school, then moving on to coding AI and machine learning as they grow.

The Ministry of Education has ambitious plans. By 2030, every primary and secondary school is expected to embrace AI in the classroom. And by 2035, artificial intelligence won’t just be a subject. It will be part of textbooks, lessons, and even exams.

Some schools have already been marked as AI pilot hubs. They experiment with digital teaching tools that adapt to how students learn. Teachers aren’t just learning how to teach AI. They’re being equipped to help students question it, think critically about the technology, and understand its implications instead of just accepting it at face value.

In Hangzhou, learning about AI has become mandatory. There, students study how algorithms work. But they also talk about ethics, originality, and why it matters to do their own thinking instead of outsourcing it to a chatbot. The goal isn’t to turn everyone into a coder, but to help them see AI as something to collaborate with, not something to fear.

How to Stay Ahead: Practical Upskilling Strategies for the AI EraLet’s be honest, AI is moving faster than most of us can keep up with. One week there’s a new app that automates emails, the next week it’s writing code or making presentations. Staying ahead isn’t about chasing every shiny new tool. It’s about staying curious and taking charge of your own learning.

Here’s what’s actually been working for people, myself included.

Learn with AI

If you’ve ever opened ChatGPT and thought, “Where do I even start?” you’re not alone. The good news is that AI now connects with platforms like Coursera, so you can find courses that fit your time and goals. No endless scrolling or guilt about unfinished lessons, just small, steady learning that sticks.

Build a small project

There’s no better way to learn than by doing. Pick something that sparks your curiosity—like when I dove into Python to create a simple snowfall model. It doesn’t have to be complex. The goal is to get your hands dirty and see how AI tools actually work in practice. Small projects turn abstract concepts into real skills and keep learning fun and personal.

Focus on what’s still uniquely human

AI is fast, sure, but it can’t brainstorm a new product idea over coffee or calm down a frustrated client. Creativity, empathy, and judgment still matter, maybe more than ever. The more you build on those strengths, the safer your role becomes.

Be the connector

Every company needs people who can bridge the gap between technology and humans. You don’t have to code. You just need to understand enough about AI to see where it helps, where it fails, and when it’s better to let people decide. Try a few tools at work and notice what actually improves your day.

Stay curious

This might be the easiest advice to give and the hardest to follow. AI changes so quickly that nobody ever feels fully ready. It helps to treat learning like an experiment. Try one new thing each week. Join a webinar, read an article, or explore a feature you’ve never touched before. Little steps make a big difference.

Find your people

Learning alone can get boring fast. Connect with others who are figuring this out too. Share what you’ve tried, what worked, and what didn’t. Keeping each other accountable makes it easier and more fun.

At the end of the day, upskilling isn’t something you finish. It’s a habit. The people who stay curious, ask questions, and keep experimenting will find that the AI era isn’t something to fear, but something full of opportunity.

Beyond Fear: A Practical View on AI and WorkIn the end, AI isn’t the real threat—our reluctance to adapt is.

The idea that AI will wipe out entry-level jobs overnight makes for catchy headlines. But it’s not the full story. Yes, some repetitive tasks will disappear. But new roles are already emerging for people who know how to use AI creatively and responsibly. These “AI integrators” will help companies innovate faster and more efficiently.

Success in the new economy depends less on competing with machines and more on learning how to work alongside them. With tools like ChatGPT linking directly to online courses and certifications, it’s easier than ever to pick up the skills you need.

The professionals who thrive in the coming years will be the ones who keep learning. In the end, AI isn’t the real threat—our reluctance to adapt is.

For more insights about what AI can or cannot do, check out my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post AI Is Shaking Up Entry-Level Jobs — Here’s How to Stay Ahead appeared first on Lynn Raebsamen, CFA.

October 14, 2025

The Real Story Behind AI Layoffs and Investments

At the recent MENA Investment Congress, I presented my book Artificial Stupelligence: The Hilarious Truth About AI with a focus on the sobering realities behind AI’s sparkling promises.

Among many insights, two themes made the strongest impression:

the frenzy of venture capital fever dreams around AI, and the humans still quietly pulling the strings behind the curtain.These framed the core message about why CEOs feel pressured to slash jobs in AI’s name and the costly consequences of that gamble. Stick around—the best part is yet to come.

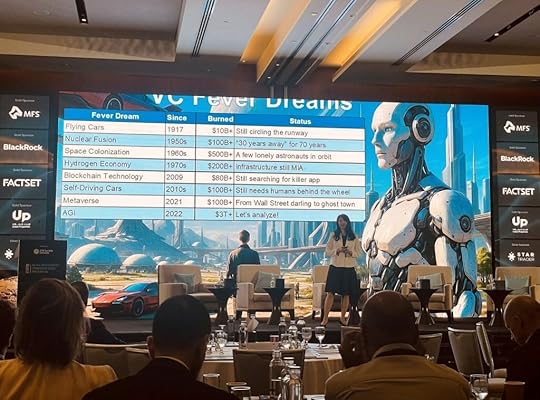

VC Fever Dreams: Betting Big on Illusions

The slide that made the deepest impression during my talk was what I’ve come to call the “VC Fever Dreams.” Trillions of dollars have flooded AI ventures, buoyed by grand predictions of Artificial General Intelligence (AGI): machines that will outthink humans any day now. Hedge funds are launched on the back of AI prophecies by 23-year-olds, and tech leaders compare upcoming AI breakthroughs to the “Manhattan Project.” The hype is electric, relentless, and vastly disproportionate to the current state of the technology.

The real game changers, the truly transformative innovations rarely make the headlines.

History begs for caution. Flying cars have been “just around the corner” for more than a century. Nuclear fusion has stubbornly remained “30 years away” for seven decades. Space colonization has so far delivered only a handful of lonely astronauts in orbit. Blockchain, much like many AI applications today, is a classic solution in search of a problem. Self-driving cars still demand more human supervision than enthusiasts care to admit. And what became of the Metaverse? Does anyone even remember it?

The real game changers, the truly transformative innovations rarely make the headlines. YouTube once started as a dating site. Airbnb began with two broke founders renting out space on an air mattress. These quietly disruptive ideas challenge the hype-driven narratives that dominate AI conversations today.

The Wizard of Oz Behind the AI CurtainWe hire humans to build AI so AI can replace humans.

Here’s the delicious irony that emerged in my talk: despite AI’s slick image as a high-tech oracle, many of today’s AI “successes” depend heavily on humans working behind the scenes. Take Scale AI, recently acquired by Meta for $14.8 billion. It relied on low-wage workers in places like Kenya labeling data, i.e. painstakingly drawing boxes around images, teaching “machines” what to see. Builder.ai, a former billion-dollar unicorn, touted AI-driven app creation; the reality was a room of 700 human developers in India coding projects manually.

This looping paradox means we hire humans to build AI so AI can replace humans. A cycle that adds a layer of “artificial stupelligence” to the entire narrative.

CEOs Under the Gun: Layoffs in the Name of AIFraming those cuts as “job reductions powered by AI” transforms the narrative.

Then why do we keep hearing about all these sweeping layoffs in the name of AI? Economic headwinds place CEOs under crushing pressure to deliver results. Reporting layoffs due to missed targets rarely wins cheers. However, framing those cuts as “job reductions powered by AI” transforms the narrative. It earns you accolades, hero status, and perhaps even a bonus.

Look at Klarna, which fired 700 employees two years ago to “embrace AI,” only to suffer a $40 billion valuation crash and a messy rehiring campaign. One would think that this cautionary tale should have prevented other companies from making the same mistake, right? Wrong. In July this year, the Commonwealth Bank of Australia cited AI to axe dozens of call center agent. They had to rehire them all within a month when the phones didn’t answer themselves. It’s like firing your chefs because you bought a fancy microwave that promised gourmet meals.

The $3 Trillion Mirage and the Real CostsAchieving AGI anytime soon faces daunting real-world hurdles.

The disconnect is staggering. Over the past three years, $3 trillion, approximately 10% of the U.S. GDP, has poured into AI investments, yet revenues linger at a mere $50 billion. The big bet? AGI, the mythical day when machines outsmart humans.

But achieving AGI anytime soon faces daunting real-world hurdles: immense energy requirements, exponentially rising costs of expert data labeling, physical constraints of data centers, and AI’s complete lack of genuine understanding of the world. These challenges make the dream frustratingly distant and do little to improve ROI. This AI gold rush feels less like a strategic prospecting effort and more like a collective fever pitch.

Meanwhile, the human cost escalates: displaced workers, strained teams, and botched rollouts. And companies that tackle actual problems find themselves with less funding.

Closing Remarks: Beyond the HypeAt the close of my MENA Congress talk, I left the audience with this: while AI promises big changes, it remains firmly tethered to human ingenuity and labor, whether coding in Bangalore or labeling data in Nairobi. Before rushing to declare AI the job-killer hero, consider who really keeps the lights on.

Artificial intelligence isn’t an alien overlord poised to take over. It’s a human-made puzzle—still far from solved. Sometimes, the smartest response isn’t panic or hype, but common sense and a dash of humor.

Book Signing at MENA Investment Congress

Following my presentation at the MENA Investment Congress, I had the pleasure of hosting a book signing session for my book. It was rewarding to connect with so many curious minds eager to explore the paradoxes of AI beyond the headlines.

Special thanks to CFA Society Emirates for organizing this fantastic event and providing a platform where critical conversations on technology, finance, and innovation could unfold with both rigor and wit.

Here’s where to find my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post The Real Story Behind AI Layoffs and Investments appeared first on Lynn Raebsamen, CFA.

October 9, 2025

Coursera Inside ChatGPT: Your Personal Shortcut to New Skills

Coursera just landed inside ChatGPT, so now anyone (with the exception of those in the EU for the moment) can summon world-class instructors without ever leaving their trusted AI chat window. Imagine casually asking about quantum computing or portfolio management and getting an answer as if a professor who actually enjoys teaching had dropped in.

When The Chief AI Officer Says, “AI!” You ListenThis might just be the real AI revolution.

Not long ago, at the CFA Institute LIVE conference in Chicago, I asked Andrew Chin, Chief AI Officer at Alliance Bernstein, a deceptively simple question from the audience: “Where and how can I learn about all the AI tools?” His answer was one for the ages: “AI!” No detours, no jargon. Just AI as the tutor, the toolbox, and the entire curriculum. If that does not crystallize the future of learning, nothing will.

This pithy retort perfectly captures what is happening now. AI is not just a subject to study. It is your learning companion, your tutor, and your most efficient study buddy rolled into one. Take a bow, traditional syllabi.

The ChatGPT–Coursera Classroom: Your New Learning EcosystemThanks to OpenAI’s clever embedding of Coursera inside ChatGPT, mentioning “Coursera” during your chat summons an encyclopedia of courses. No app juggling. No endless Google rabbit holes. Want just-in-time tutorials? Done. Need a deep dive into neural nets or negotiating skills? Delivered. All while you are busy chatting about your other existential crises.

How I Secretly Became a Jack-of-All-Trades with AIThis isn’t just another flashy new feature. Generative AI has been my personal secret weapon for picking up skills that used to feel out of reach. Whether fiddling with vibe-based coding or tackling some paralegal research (don’t ask me how that happened), it has completely changed how I absorb information. It behaves like the tutor who’s always patient, who never rolls their eyes, and who’s ready with a quick explanation or a deep dive whenever I need it.

The Coursera experience inside ChatGPT could turn my previously chaotic searches and countless browser tabs into concise, digestible lessons—available precisely when my curiosity flares up and my concentration allows. Learning has never been more convenient.

Not All Classrooms Are Created Equal (EU, We Are Looking at You)There is one tiny hiccup. If you are in the European Union, this integration is as elusive as a polite X debate. Regulatory red tape, privacy laws, and enough legal jargon to make anyone’s head spin are preventing access for now. Switzerland sits in the gray zone, not in the EU but with similar privacy standards, so it is a bit of a waiting game there too. Meanwhile, some resourceful learners are hopping across virtual borders using VPNs to access the future of learning. Because when motivation meets tech savvy, there’s always a way to bypass digital fences.

The Market’s Verdict: Stocks Love an Education RevolutionCue Wall Street’s applause. Coursera’s stock jumped on the announcement, showing investors are waking up to the same realization the rest of us have: Education powered by AI is not a passing trend but a game-changing evolution.

We’re finally stepping out of the era of passive scrolling and into active learning. Ask smart questions, and the best instructors worldwide will respond—even if it’s just a quick chat while you’re pretending to work.

For more insights about what AI can or cannot do, check out my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post Coursera Inside ChatGPT: Your Personal Shortcut to New Skills appeared first on Lynn Raebsamen, CFA.

September 13, 2025

The $2.9 Trillion Question: Which Stocks Will Survive The AI Bubble?

The market’s faith in artificial general intelligence (AGI), or “Digital God”, rivals the wildest bubbles of history. With $2.9 trillion gushing into new data centers over three years and the S&P 500’s value swelling by $21 trillion since ChatGPT’s debut, investors are betting big on transformation and transcendence.

But as the classic symptoms of irrational exuberance show, survival in a future AI bust will hinge not on hype or size, but on utility and integration. Which stocks are set to win? I’ll reveal the likely victors at the end. Your portfolio might thank you for it.

Mania, Math, and Murky MarginsThis bubble isn’t just big; it’s biblical. Just ten firms: Amazon, Broadcom, Meta, Nvidia, and a handful of their friends, account for over half the recent market gains. Venture capital can’t shovel money fast enough into anything wearing an “AI” badge. The prevailing wisdom is that AI will be “as big as the Industrial Revolution,” perhaps even bigger. Do I believe in this revolution? Yes, but history says revolutions rarely benefit the OGs.

Here’s the reality check: current annual revenue from leading Western AI firms sits at a paltry $50 billion. That’s a rounding error against the global $2.9 trillion infrastructure spend, and less than 2% of what’s been invested.

Meanwhile, MIT’s latest research reveals 95% of organizations are seeing zero return on most generative AI projects. For investors, the “mission impossible” math is unforgiving: the industry collectively requires about 3 billion paying subscribers just to pay off the infrastructure, let alone make a dime. To put this into perspective: Netflix has a paying subscriber base of 300 million.

Lessons From History’s Biggest BubblesIf you’re looking for comfort, remember: most tech bubbles come with genuine breakthroughs. American railroads went bust twice (a miracle that Britain still has railways). The dotcom crash wiped out Global Crossing and Corning, yet their overbuilt fiber now powers Netflix and Teams calls. In short, technology survives even if its early champions do not.

But when bubbles burst, market leaders often fall to upstarts. In the 19th-century railway and electric lighting booms, the “owners of the future” lost their empires to newcomers with fresher business models and stronger cashflows.

The Folly of Scale: Why Bigger Isn’t BetterThe industry’s approach of “scaling models indefinitely, burning billions” is increasingly a race to the bottom. Foundation models are becoming interchangeable; their real long-term value lies not in size but in what’s built on top, and who owns the data.

The winners will not be those chasing scale for its own sake. Costs grow with every new user; cashflow remains elusive. Just ask OpenAI or Anthropic how cheap “freemium” really is.

Where Real Profits Will SurviveSo, if AGI remains a fever dream for now, where will profits come from?

Examples Where Integration and Specificity Win the Day

Customer Service: Chatbots and virtual call agents integrated with company databases handle routine requests quickly, escalating more complex issues when needed. Despite some early backlashes, this technology shows real potential to boost overall productivity.Accounting: Automated invoice processing, fraud detection, and audit workflows help accounting firms analyze millions of records quickly and accurately, slashing costs while boosting compliance.Enterprise Data & Search: Tools built on foundational models but enhanced with proprietary business data. They let staff instantly find relevant docs, emails, and insights, saving hours every week.Healthcare: AI applications built atop foundational models that incorporate confidential patient data: diagnosis, risk stratification, scheduling. Those are seeing strong real-world returns for clinics and insurers, despite the hype around generic LLMs.Workflow Automation: Vertically-integrated solutions automate legal review, compliance, and demand planning by accessing proprietary datasets. From enterprise ERPs to fast-moving inventory systems, these tools enhance both physical and digital workflows with greater speed and accuracy.Investors, take note. Most companies are still experimenting with AI to boost profits and productivity. But the real winners will be those with built-in ecosystems and huge user bases. They will be the true survivors when the bubble bursts.

These companies aren’t betting the farm on AGI. They’re quietly embedding actionable, data-driven AI to drive productivity and deepen their platform’s value proposition. In the world post-bubble, it’s less about model size and more about sticky usage—infrastructure and apps so crucial, clients hardly notice the invisible AI engine working underneath. But who are they?

Which AI Stocks Are Likely to Profit?Let’s begin with the real winner of the gold rush: AWS (Amazon Web Services), Silicon Valley’s biggest shovel merchant. It quietly pockets a toll from every prospector with dreams of algorithmic fortune. In Q2 2025 alone, AWS raked in $30.9 billion (yep, that’s an annual run rate surpassing $120 billion) with “multiple billions” credited to AI and generative AI workloads. Growth has slowed, but when nearly every ambitious AI startup and Fortune 500 titan rents your cloud to train models, you don’t need to win the application arms race. Amazon gets paid no matter who strikes gold—or just burns cash.

Microsoft, for its part, is taking an “if you can’t escape it, embrace it” approach. In fiscal 2024, AI-powered features in Office 365 and Azure pushed growth into double digits, helping drive AI revenue above $20 billion. When the smart stuff becomes invisible, woven into the daily grind of Teams, Outlook, and PowerPoint, it’s less a revolution and more a quiet takeover. Few complain—after all, who wants to fight Microsoft in their calendar and email?

Oracle is out to prove old dogs can learn new (predictive) tricks, offering AI-powered solutions tailored to specific industries through its Autonomous Database and SaaS products. These tools become so essential to daily operations that businesses find it easier to stick with Oracle than switch elsewhere. Their $3 billion in annual AI revenue suggests many enterprises agree.

Salesforce peddles AI through its Einstein platform, now generating over $1 billion a year. It’s tightly woven into the workflows of sales reps who cling to it as desperately as management clings to their renewal fees. It turns proprietary customer data into higher upsell rates, client lock-in, and CRM relationships that survive even the worst PowerPoint decks.

SAP doesn’t shout much, but analysts peg its AI-integrated SaaS business near $1 billion. It’s riding a wave of cloud-based supply chain and HR upgrades that few dare to yank out once embedded. Modernize a legacy ERP system with AI and suddenly everyone’s a visionary—or at least gets to keep their budget.

Google is somewhere behind the scenes, quietly amassing data, flinging algorithms into Search, Workspace, and Cloud, and making sure no one forgets it basically owns the world’s essential information infrastructure.

ServiceNow, Workday, Adobe… These are the silent operators, weaving AI into workflows where “productive” is code for “can’t live without it.”

And the niche players—Epic, Cerner, and the rest of healthcare SaaS—have one advantage nobody else does: proprietary patient data and compliance headaches nobody wants to touch but everyone pays for.

Notice the pattern? Most of these survivors don’t build big models. They embed AI so deeply into everyday tools and business gristle that, by the time the bubble pops, their clients can’t leave. The future of AI profit isn’t glamorous, but it is deeply, annoyingly, indispensable.

Don’t Worship Digital God, Invest in Practical MagicShould “Digital God” (AGI) fail to appear, the fall may indeed be brutal. But history shows that the biggest crashes give way to smarter solutions, not bigger promises. The future belongs to highly specified AI applications built atop commoditized engines, leveraging proprietary data in ways the founders of the bubble never imagined.

Investors who spot these sticky, indispensable apps early may someday thank the “bubble” for building the infrastructure. Just before they cash in on software that actually works.

Disclaimer: The opinions expressed here are my own and do not constitute investment advice. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions.

Sources:

Simple maths says the AI investment boom ends badly

What if the stock market blows up? | The Economist

For more insights about what AI can or cannot do, check out my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post The $2.9 Trillion Question: Which Stocks Will Survive The AI Bubble? appeared first on Lynn Raebsamen, CFA.

147% Gain in 24 Hours? The Truth About AI Trading Agents

The story sounds like a crypto fairy tale. An AI trading agent named Milo starts with $200 in a Solana memecoin market. By the next day, that’s nearly $500. This claim, published by Pump Parade in June 2025, sparked excitement. But as always with crypto, the reality is more complex.

On the surface, Milo is a relentless, emotionless trader. It never sleeps. It never panics. It doesn’t get greedy or stubborn. The promise is simple: effortless, precise profits. Yet, beneath the allure lies a messier truth.

Why Short-Term Gains Don’t Tell the Full StoryPump Parade’s report is straightforward. They told Milo: find low-volume Solana coins with strong momentum and target at least 30% profit. Milo delivered a stunning 147% gain in 24 hours, turning $200 into $494.12.

But here’s the catch. One day of success doesn’t prove long-term effectiveness. It might simply be luck. The losses and failed experiments remain unseen behind the headline number.

Crypto markets move rapidly and unpredictably. Winning strategies today might fail tomorrow. Relying on lucky streaks is a gamble few can sustain.

Transparency on AI Trading AgentsPump Parade later published another article, openly admitting AI agents like Milo are no magic bullets. They are not autonomous geniuses but tools that amplify whatever instructions they receive. If the prompts are vague or unclear, the AI will perform poorly.

Their study underscores that only about 7 out of 50+ prompts tested delivered meaningful profits. Many attempts failed or yielded nothing. This clear-eyed transparency distinguishes their work from hype-driven claims and offers a reality check: AI agents depend critically on human guidance and skill.

The Art and Challenge of Prompt EngineeringMuch of Milo’s effectiveness is about how it’s instructed. The AI doesn’t invent strategies—it follows human-crafted rules. Pump Parade highlights the importance of clear, metric-driven prompts. For example, asking Milo to seek tokens with high holder growth and volume spikes.

Due to the volatile nature of crypto, prompts that work well today may lose relevance within 24 hours. Traders must constantly revisit and reengineer these prompts to keep pace. Without continuous human oversight and adaptation, portfolios risk spiraling into losses.

Pump Parade stresses this point: AI agents are powerful, but they don’t replace human judgment. They amplify it.

What the Critics SaySkepticism about AI agents runs deep among crypto insiders. In a survey of 42 Solana founders, 16% labeled AI agents as “overrated,” more than any other sector.

Some go further. One observer said, “AI agents are just memecoins that talk.” Many AI agents are elaborate chatbots attached to speculative tokens. Some are even “Wizard of Oz” setups—humans pull the strings behind the scenes (remember Amazon GO and Builder.ai?).

The crypto space is unfortunately filled with pump-and-dump schemes—where groups hype up a token’s price through coordinated promotion, only to sell off their holdings at the peak, leaving others with worthless assets. No matter how advanced an AI agent is, it can’t avoid falling victim to these manipulative cycles.

What Is a Pump and Dump?For the uninitiated, a pump and dump is a classic scam. Scammers hype a cheap coin, often through social media pushes and hype channels. That “pump” drives the price up as new buyers rush in, fearing they’ll miss out.

Then the insiders dump their holdings at the peak. The price collapses. Newcomers get stuck with worthless coins—the dump.

It’s a fast, cruel cycle that funds savvy insiders and drains hopeful traders.

What’s AI’s Real Edge?Academic research shows pump-and-dump schemes still dominate crypto markets. Often, hype drives prices more than strong fundamentals.

Studies comparing AI trading systems with basic rule-based strategies sometimes find simple methods outperform AI approaches.

This raises a question: is AI’s edge genuine intelligence or just good prompt-following? The evidence suggests AI agents like Milo are sophisticated executioners of human-designed tactics rather than revolutionary traders themselves.

The Bottom Line of AI Trading AgentsThat 147% return in a day is attention-grabbing and fuels dreams. But it’s far from a clear, repeatable winning formula.

The most realistic reading is this: AI trading agents may become powerful tools, but only for those who already know what they’re doing. They don’t erase risk. They amplify it—just as efficiently, unemotionally, and rapidly as they amplify profit.

In simple terms, AI trading agents are like hammers: they’re strong and useful tools in the right hands, but they can cause serious damage if misused. They’ll hit exactly where you tell them to.

For more insights about what AI can or cannot do, check out my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post 147% Gain in 24 Hours? The Truth About AI Trading Agents appeared first on Lynn Raebsamen, CFA.