AI in Finance: When Hype Meets Wall Street Reality

Wall Street’s AI obsession promises more than it delivers. Behind the glossy press releases and eye-popping headlines lies a stubborn truth: the machines keep missing the mark.

Every so often, Wall Street romances a shiny new “smart” machine. The late 1980s and early ’90s flirted with chaos theory, fuzzy logic, genetic algorithms, and early neural networks—each promising to revolutionize trading desks before swiftly falling out of favor.

The notion that sprinkling some AI pixie dust over financial data will unlock the fountain of profit is aspirational at best and frustratingly underwhelming at worst.

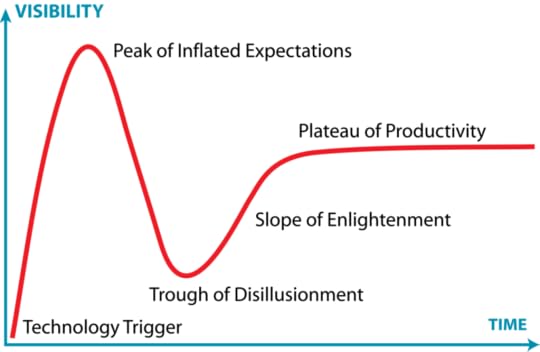

Fast forward to today, and the narrative sounds uncomfortably familiar: shiny new AI toys dazzle briefly before the markets, ever stubborn, shrug and revert to their usual rhythm. By 2018, even the most ardent AI boosters on Wall Street muttered something about a “trough of disillusionment,” an all-too-familiar valley where hope sours into skepticism. The question resurfaces: is this just 1990’s AI hype on steroids?

Gartner Hype CycleNot Quite Smarter Than the Average Market

Gartner Hype CycleNot Quite Smarter Than the Average MarketModern AI undeniably trumps its ancient algorithmic ancestors. Machine learning models chew through unimaginable volumes of data, spotting intricate patterns no human eye could catch. Wall Street proudly staffs rosters of PhDs deploying deep learning, yet the dream of a market-cracking algorithm remains just that—a dream.

Despite the hype and heavy investment, AI models mostly shuffle alongside old-school benchmarks and plain vanilla index funds. The notion that sprinkling some AI pixie dust over financial data will unlock the fountain of profit is aspirational at best and frustratingly underwhelming at worst.

Markets Love Breaking Your ModelsAI faces a Sisyphean task—chasing fleeting inefficiencies in a ceaseless game of Whack-A-Mole.

Why the collective AI fail? Markets are no mere machines. They are volatile, evolving ecosystems fueled by human greed, fear, and irrational exuberance. Unlike chess or Go, where AI famously excels, the financial market lives, adapts, learns, and mutates—every day.

Yesterday’s successful model faces obsolescence tomorrow, as new rules and behaviors upend its logic. If AI uncovers a weakness, human traders rush in, exploiting and erasing it at a pace only milliseconds can keep up with. Thus, AI faces a Sisyphean task—chasing fleeting inefficiencies in a ceaseless game of Whack-A-Mole.

The Mirage of AI AlphaFinance demands more than data-crunching speed. It requires timing, market wisdom, and a humble nod to uncertainty.

All this explains why true breakthroughs in AI trading are rarer than a unicorn on the trading floor. If they do appear, they often don’t last. We’ve seen hedge funds unveil flashy AI models that wow investors for a year or two, only to stumble when market conditions shift or competitors catch on. In theory, a perfect algorithm could predict the market.

In practice, it’s more like chasing a mirage. As soon as you think the machines have finally cracked the code, reality changes the rules. It’s a humbling reminder that in finance, smart isn’t just about processing power. It’s also about wisdom, timing, and a dash of humility. The tech world may obsess over ever-“smarter” algorithms, but so far those algorithms keep learning that Wall Street has tricks even a neural network can’t figure out.

Finance demands more than data-crunching speed. It requires timing, market wisdom, and a humble nod to uncertainty. Despite tech’s pursuit of ever-smarter algorithms, Wall Street’s lessons remain stubbornly unsolved.

AI’s Real Wins: Automation and InsightWhile AI tools have fundamentally reshaped operational workflows, the myth of the AI wunderkind predicting market moves singlehandedly remains just that: a myth.

Still, AI isn’t merely a fancy data processor lost in market chaos. It shines where human toil and error overwhelm—automating compliance, fraud detection, and customer service with uncanny accuracy. Firms like JPMorgan and BlackRock harness AI-powered tools (e.g., BlackRock’s Aladdin) to optimize portfolios, stress-test scenarios, and forecast risk with a precision unattainable by humans alone. AI’s prowess in parsing regulatory documents, sentiment from social media chatter, and real-time analytics sharpens financial institutions’ decision-making speed and quality.

Moreover, AI’s role in risk assessment is transformative. By analyzing granular, real-time behavioral data, it fine-tunes credit scoring and identifies emerging market risks early. Meanwhile, quantum-enhanced AI promises to push the boundaries further, potentially revolutionizing forecasting and high-frequency trading strategies once held firmly in the realm of science fiction.

Not a Grand Conquest (Yet?)If centuries of brilliant minds couldn’t consistently outsmart the trading floor, a neural network with silicon neurons should expect no easy victory either.

Financial AI’s narrative is less “rise of the machines” and more an ongoing, cautious process. While AI tools have fundamentally reshaped operational workflows, the myth of the AI wunderkind predicting market moves singlehandedly remains just that: a myth.

The relationship is symbiotic: AI expands human capacity, automates mundane complex tasks, and offers novel insights. Meanwhile, the unpredictable human element ensures markets remain markets. As such, Wall Street might do well to embrace AI as a powerful ally rather than a merciless oracle.

And for those tempted to bet against the markets—or AI—remember: if centuries of brilliant minds couldn’t consistently outsmart the trading floor, a neural network with silicon neurons should expect no easy victory either.

Source: Handbook of Artificial Intelligence and Big Data Applications in Investments,

CFA Institute Research Foundation, 2023

For more insights about what AI can or cannot do, check out my book “Artificial Stupelligence: The Hilarious Truth About AI”.

The post AI in Finance: When Hype Meets Wall Street Reality appeared first on Lynn Raebsamen, CFA.